Markets

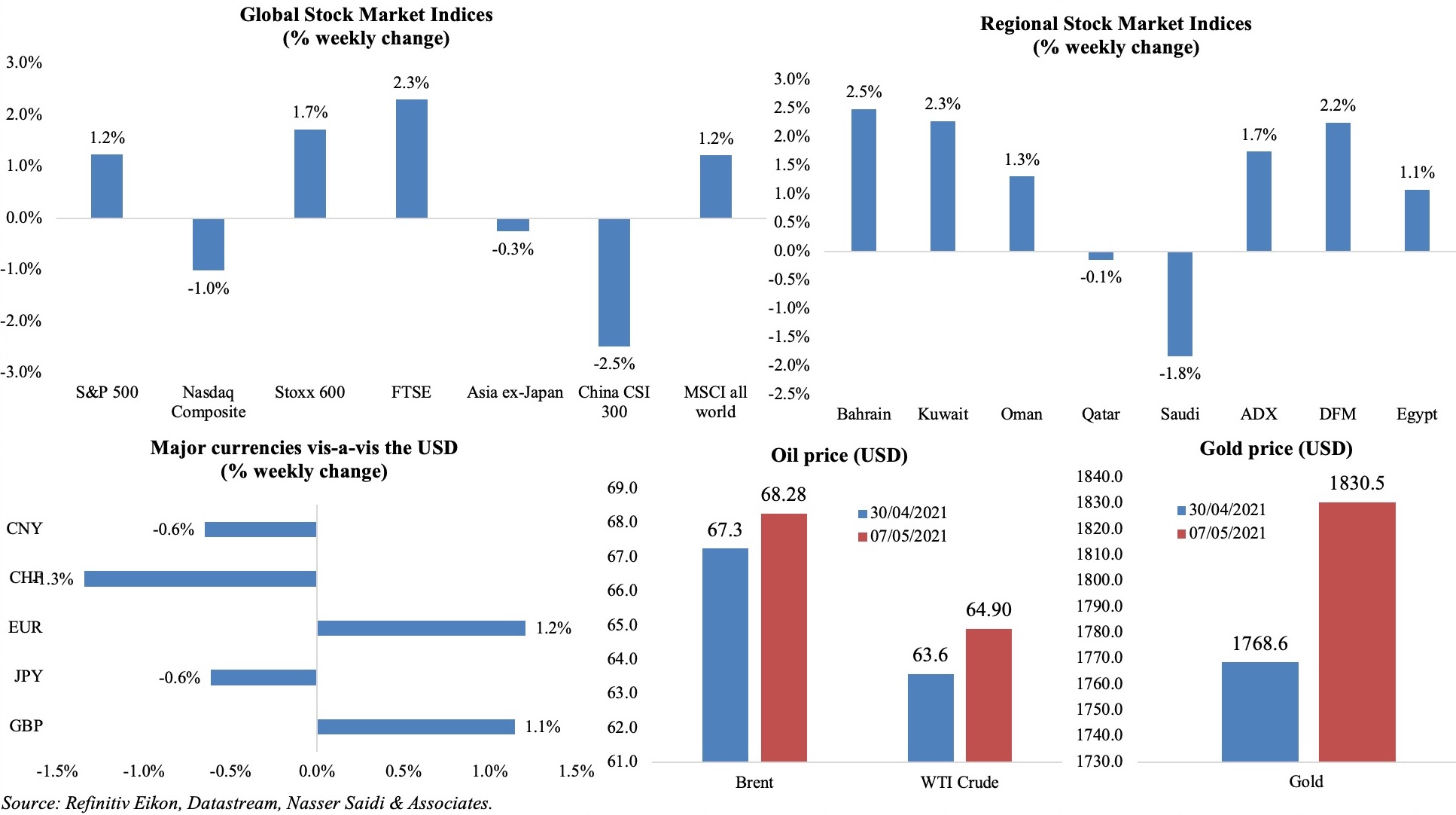

US equity markets closed at record highs on Fri, in spite of disappointing payrolls numbers, though the Nasdaq ended the week lower (the worst decline since early Mar); the optimism ran across Stoxx600 (led by utilities and tech shares) and the MSCI global equity markets benchmark index. Regional markets were mostly up; Saudi Arabia, where some weaker-than-expected earnings were reported, posted a 1.8% loss. Among major currencies, the pound and euro gained against the greenback. Oil prices were near 7-week highs, with Brent near the USD 70-mark as many countries proposed easing of restrictions thereby improving demand outlook. Gold price increased by around 3.5% from the week before, posting its best weekly gain since Nov 2020. Other commodities like palladium and copper continued to soar to record highs on worries over short supplies.

Weekly % changes for last week (6-7 May) from 29 Apr (regional) and 30 Apr (international).

Global Developments

US/Americas:

- Non-farm payrolls disappointed, rising by 266k in Apr, following Mar’s downwardly revised 770k. Leisure and hospitality industry saw the biggest hiring gain (+331k) while other services industries bore the most severe brunt: temporary help services (-114k), transportation/ warehousing (-74k), retail trade (15.3k). Average hourly earnings also slowed, rising by just 0.3% yoy compared to 4.2% the month prior. Unemployment rate increased to 6.1% in Apr (Mar: 6%), as labour force participation rates increased (to 61.7%, the best level since Aug, from 61.5%).

- Initial jobless claims declined to below the 500k mark, down to 498k in the week ended Apr 24. The 4-week average fell by 61k to 560k – the lowest level since Mar 2020. Continuing claims edged up to 3.69mn in the week ended Apr 17 from a revised 3.653mn the prior week.

- ADP employment report showed that an additional 742k jobs had been created in the private sector in Apr (Mar: 565k). The leisure & hospitality sector added the most – 237k jobs.

- Non-farm productivity increased by 5.4% in Q1 (Q4: -3.8%): output increased by 8.4%, much faster than hours worked (+2.9%) or wages (+5.1%) and unit labour costs fell by 0.3%. The level of output per hour is the highest ever recorded, and the yoy gain is the fastest since 2004.

- Factory orders in the US rebounded by 1.1% mom in Mar, following the 0.5% drop in Feb, supported by demand for machinery (+1.5%), metals (+1.6%) and fabricated metal products (+4%). Orders for non-defense capital goods, excluding aircraft, rose by 1.2%.

- ISM manufacturing PMI slipped to 60.7 in Apr (Mar: 60.6). The employment sub-index fell (to 55.1 from 59.6 the month before), as did new orders (64.3 from 68 in Mar) and the price gauge rose to a 13-year peak.

- ISM services PMI dropped to 62.7 in Apr, a full point below an all-time high reading in Mar, as new orders fell (63.2 from 67.2) while employment improved (58.8 from 57.2).

- Markit manufacturing PMI edged up to 60.5 in Apr (Mar: 59.1), with new order growth accelerating to a 11-year high while raw material shortages led to the fastest rise in cost burdens since Jul 2008.

- Trade deficit in the US widened to a record high of USD 74.4bn in Mar (Apr: USD 70.5bn). Deficit with China increased by 22% to USD 36.9bn, half the total trade deficit.

Europe:

- German factory orders increased by 3% mom in Mar (and 27.8% yoy), the largest increase in new orders since Oct 2020 – from a revised 1.4% uptick in Feb. The headline growth was supported by orders for consumer goods (+8.5%), while domestic and export orders ticked up by 4.9% and 1.5% respectively.

- Exports from Germany increased by 1.2% mom and imports by 6.5% in Mar, causing the trade balance to narrow to EUR 14.3bn (Feb: EUR 18.9bn). Exports grew by 16.1% yoy to a record high EUR 126.5bn, with sales to China and the EU countries surging by 37.9% and 21.2% respectively.

- German industrial production increased by 2.5% mom in Mar, supported by production of intermediate (1.2%) and consumer goods (2.9%), as well as energy output (2.4%) and construction (10.8%).

- Markit manufacturing PMI for Germany declined slightly to 66.2 in Apr (from Mar’s record high 66.6 reading), supported by strong growth in new orders and employment growth reached the quickest since Aug 2018. Services PMI retreated to below-50 in Apr (49.9 from Mar’s 51.5) and composite PMI also slipped to 55.8 (from Mar’s 37-month high of 57.3).

- Eurozone’s final manufacturing PMI reading stood at 62.9 in Apr, lower than flash estimate of 63.3 but higher than Mar’s 62.5 reading. Netherlands topped the list in terms of absolute PMI readings while Italy and Austria posted survey highs. Services PMI improved to 50.5 (Mar: 49.6), with divergences across countries – Spain gained, while Germany and Italy contracted. Composite PMI was up by 0.6 points to 53.8, thanks to a second consecutive monthly rise in new orders – the strongest recorded for over two-and-a-half years.

- Producer price index in the Eurozone climbed by 1.1% mom and 4.3% yoy in Mar, with prices higher across many categories including energy (+2% mom), intermediate products (+1.3%), non-durable consumer foods (+0.8%) and capital goods (+0.3%) among others.

- Retail sales in Germany surged by 7.7% mom and 11% yoy in Mar; compared to the pre-crisis month of Feb 2020, retail sales were up by 4.4% while the yoy gain was the strongest since records began in 1994.

- Eurozone’s retail sales increased by 2.7% mom and 12% yoy in Mar, thanks to non-food products excluding automotive fuel (4.6% mom, 25% yoy) and online sales (+37.2% yoy).

- The Bank of England kept its benchmark interest rate at an all-time low of 0.1%, but announced that it would slow QE purchases to GBP 3.4bn a week (from GBP 4.4bn), raised the growth forecast for this year to 7.25% (from 5% before) – the fastest annual growth since 1941 – and lowered peak jobless forecast to 5.4% (from 7.8%).

- UK’s manufacturing PMI grew to 60.9 in Apr, up 0.2 points from the flash estimate and higher than Mar’s 58.9. Sales growth was supported by easing of restrictions, and employment rose for the 4th consecutive month.

Asia Pacific:

- China’s exports surged by 32.3% yoy (and 9.5% mom) and imports by 43.1% to post a trade surplus of USD 42.85bn in Apr (Mar: USD 13.8bn). Exports grew as a result of higher demand for electronics and high-tech products.

- Services PMI in China rose to a 4-month high of 56.3 in Apr (Mar: 54.3), with new orders rising at the fastest rate since Nov 2020 and employment rising at the fastest in 5 months.

- Foreign exchange reserves in China inched up by USD 28.15bn to USD 3.198trn in Apr, largely due to the dollar’s decline against other major currencies held in the reserves, and to rises in global asset prices.

- Japan services PMI increased to 49.5 in Apr (Mar: 48.3), though remaining in contraction territory for the 15th straight month. New orders increased to the highest since Jan 2020 and employment rose for the 3rd consecutive month.

- India’s manufacturing PMI rose to 55.5 in Apr (Mar: 55.4), thanks to a pickup in demand in spite of the Covid19 cases surge. New export orders increased for the eighth consecutive month in Apr and at the fastest rate since Oct 2020.

- Singapore PMI inched up by 0.1 points to 50.9 in Apr, the highest reading since Dec 2018.

Bottomline: Global manufacturing PMI increased to 55.8 in Apr, the best since Apr 2010, with 21 out of 24 nations reporting improvements in business conditions. Expansion in output and new orders supported job creation though record supply chain delays are leading to production constraints while input costs rose at the fastest rate in a decade. Many EU nations are relaxing restrictions given improvements in the vaccination pace, while the UK’s green list announcement has led to a surge in bookings (a good sign for the travel/ tourism/ hospitality sector); many nations on UK’s “amber” list could move into green before the summer holidays begin. A similar surge in travel is expected in the US where President Biden set a new goal of vaccinating 70% of adults by Jul 4th. However, without widespread vaccination globally, the risks of new variants remain: in Africa, less than 1% of the population has been vaccinated and in Asia just 4.4%, while Covid is rampant in India.

Regional Developments

- The reopening of the King Fahd Causeway is expected to add up to USD 2.9bn to Bahrain’s economy this year, based on average spending recorded in 2019.

- Bahrain is in talks with international firms to invest in a petrochemical plant expected to cost USD2bn to build, reported Bloomberg, citing the oil minister. He also stated that they are also looking at selling energy assets (i.e. structuring infrastructure assets) to raise funding.

- PMI in Egypt fell to 47.7 in Apr (Mar: 48), the lowest reading since Jun 2020. New orders and employment declined, and input prices increased to a 19-month high on supply pressures.

- Egypt’s central bank kept rates on hold for a 4th consecutive meeting after the headline inflation number stabilized at 4.5% in Feb and Mar this year, edging up from Jan’s 4.3%.

- Gold reserves in Egypt increased by 4.9% mom to USD 4.128bn in Apr. Overall, net foreign reserves increased about USD 6mn (or 0.02% mom) to USD 343bn.

- S&P affirmed Egypt’s “B/B” sovereign credit rating in spite of its high external financing needs, given its foreign exchange reserves and access to domestic and external debt markets.

- Egypt announced new restrictions for a period of 2-weeks starting last Thursday, and including Eid holidays (May 12-16), during which time all gardens, parks and public beaches will be closed while all shops, malls, restaurants, cafes and cinemas would close at 9 p The country expects to receive another 4.9mn doses of vaccine from multiple sources this May.

- Iraq’s external debt ranges between USD 23-25bn, stated a financial advisor to the government; the remaining compensation to Kuwait is under USD 2bn.

- China is in talks with Iraq to revive the oil-for-projects deal that was temporarily halted due to the spread of Covid19. Bilateral trade between the two nations stood at USD 53.3bn in 2019, before falling to USD 30.2bn in the pandemic-affected 2020.

- Female economic participation rate in Jordan stood at 14.2% in 2020. One in seven women were economically active last year, versus one in 1.9 men in the 15+ age group.

- Political deadlock and lack of local expertise could delay the rollout of taxes in Kuwait by 3-4 years, reported the Al Rai newspaper, citing unnamed sources.

- Kuwait will not allow citizens who are not vaccinated to travel abroad from May 22, stated the information ministry. As of now, there is an existing ban on entry of non-Kuwaitis.

- Lebanon’s PMI inched up to 47.1 in Apr (Mar: 46.4), with the headline index deteriorating at the softest rate since Oct 2019. Output and new orders slowed at a lower pace while cost burdens rose in Apr.

- The LBP fell against the dollar on Fri after the meeting between Lebanese leaders and the French delegation seemed to have made little progress with regard to a new government.

- Given that the committee to review the USD 200mn emergency loan (approved in Mar) to finance fuel imports has yet to approve it, Lebanon is likely to go dark as cash for electricity runs out – as early as May 15, according to a member of parliament.

- Lebanon’s caretaker PM divulged that the cost for the subsidy card for nearly 750k Lebanese families would amount to USD 1.2bn annually. Who will finance this and whether there will be an inflationary impact following the gradual lifting of subsidies are unanswered questions for now. Currently, the subsidy program is costing USD 6bn a year.

- S&P is proposing, as part of its consultation exercise (that will last until May 14th), to “remove index constituents domiciled in Lebanon from the S&P Pan Arab Indices” and “to reclassify Lebanon from a frontier market to a stand-alone market, and consequently remove all constituents from S&P Frontier BMI and related sub-indices”.

- Oman’s budget deficit stood at OMR 751.4mn (USD 1.96bn) in Jan-Mar this year, with revenues down by 30.5% and net oil revenue down by 34.2% while spending fell by 2.7%, thanks to cost-saving efforts at various government units.

- More than 51k MSMEs are registered with Oman’s SME Development Authority as of end-Mar, denoting an increase of 17.2% yoy.

- According to Oman’s Ministry of Labour, 48,863 expats left the country by end-Mar, compared to around 70k persons that had registered to leave by end-Mar.

- Qatar’s PMI dropped to 52.1 in Apr (Mar:54.9), thanks to strong readings across the output, new orders and employment sub-components. Manufacturing, at 55.7, outperformed the other sectors: wholesale & retail (54.3), construction (53.8) and services (51.5).

- Further to the arrest of Qatar’s Minister of Finance over allegations of embezzlements and abuse of power, the Minister of Trade and Industry was entrusted with the finance minister’s duties as well.

- Total debt issuances in the MENA region accelerated by 61% yoy to USD 34.8bn in Q1 2021, according to Refinitiv data. Saudi Arabia and UAE were the most active issuer nations with USD 3bn and USD 7.5bn in bond proceeds, respectively.

Saudi Arabia Focus

- Saudi Arabia’s non-oil PMI increased to a 3-month high of 55.2 in Apr (Mar: 53.3), given an increase in output to 58.7 (thanks to improvements in new orders) and growth in export sales (thanks to demand from Asia). Employment increased at the fastest pace since Nov 2019.

- Budget deficit in Saudi Arabia declined to SAR 7.4bn (USD 1.97bn) in Q1 this year: oil revenues stood at SAR 117bn (-9% yoy), non-oil revenues posted a 39% yoy increase (thanks to a 75% rise in taxes) while expenditures slipped by 6% to SAR 212bn.

- Public debt in Saudi Arabia increased by 5.6% qoq to SAR 901.4bn (USD 240.4bn) in Q1 2021 – this was the fastest pace of growth since Q2 2020. Debt to GDP hence increased to 35.6% at end-Q1 from Q4’s 32.3%.

- Bilateral trade between Saudi Arabia and the US increased to SAR 75.6bn in 2020, according to the Saudi-American Business Council, with Saudi’s exports to the US touching SAR 33.7bn. US continues to be the second largest source of goods imported by Saudi Arabia.

- Money supply increased by 2.3% since end-2020 to its highest-ever level of SAR 2.199trn (USD 586.2bn) as of Apr 29th.

- A spending efficiency program, implemented as part of the Vision 2030 reform, resulted in savings of SAR 400bn (USD 106bn) over the last 4 years, disclosed Saudi Arabia’s minister of finance.

- Tadawul-listed companies can now own real estate in Makkah and Madinah, according to the approved amendment of Article 5 of the Law of Real Estate Ownership and Investment by non-Saudis, reported Umm Al-Qura newspaper.

- Investments in e-commerce in Saudi Arabia amounted to more than SAR 250mn in Q1 this year, according to Monsha’at; this amounted to 20% of total commercial deals. Sales increased by 26% yoy to more than SAR 22bn last year.

- According to the Saudi Central Bank, the insurance sector grew by 2.3% yoy in 2020, with written premiums rising to SAR 38.78bn. The report also stated that Saudization in the sector edged up by 1% to 75%.

- Occupancy rate at Makkah’s hotels during the holy month of Ramadan varied between 10-20% during the beginning of the month, rising to between 30-38% during the second half. Only 26 hotels were operating during this period, with average prices down by 55%.

- Saudi Arabia revealed that it had vaccinated nearly 29% of its population at a rate of 147,552 daily doses, and that every worker in the country will need to be vaccinated before returning to their workplace (no deadline has been given yet). Separately, starting May 17th, Saudi is preparing to receive foreign tourists and will allow vaccinated citizens to travel.

- A ministerial decision in Saudi Arabia will Saudize the first phase of educational jobs in private schools and international schools for boys and girls, in a bid to create 28k jobs over the coming 3 years.

- Recent changes to Saudi Arabia’s government: a new minister of economy and planning has been appointed; the Zakat and customs entities have been merged to create a Zakat, Tax, and Customs Authority.

UAE Focus![]()

- Non-oil private sector PMI in the UAE edged up to a 21-month high of 52.7 in Apr (Mar: 52.6), driven by new orders (growing at the fastest pace since Aug 2019, and mostly domestic demand) and an increase in new business inflows. Employment continued to fall for 3 months in a row.

- UAE overall and non-oil GDP declined by 6.1% and 6.2% respectively in 2020, according to FCSA data. Most major sectors posted a drop, with those directly affected by the pandemic more hard-hit: accommodation and food services activities (-6%), transportation and storage activities (-15.5%), wholesale and retail trade (-13.1%), construction and building activities (-10.4%) and financial and insurance (-3%). Manufacturing edged up by 0.2% yoy.

- Foreign non-oil trade through the Dubai Airport Free Zone reached AED 119bn (USD 32.4bn) in 2020 – accounting for 10% of Dubai’s non-oil foreign trade and 25% of total commercial activity via the free zones.

- Dubai’s property sales transactions hit a four-year high of AED 97bn in Apr: this is the highest value of monthly property transactions since Mar 2017, according to listings portal Property Finder. Demand for upscale properties have been surging too: a record-breaking 90 properties worth AED 10mn (USD 2.7mn) each were sold in Apr, following 84 such deals in Mar; this compares to a total of 54 in 2020. Another report, by ValuStrat, stated that Dubai registered the highest recorded number of home sales transactions in Q1 2021 since 2010.

- Dubai’s Tourism Chief disclosed that the emirate had welcomed 1.26mn visitors in Q1 this year, following the 67% yoy drop in visitors last year (to 5.5mn).

- Moody’s affirmed the Aa2 long-term issuer rating of the UAE Government and maintained outlook at stable.

- As the country prepares to welcome Expo delegates (from 173 nations and 24 international organizations), their country representatives have been encouraged to take up UAE’s offer of free vaccines. Vaccination will be mandatory for the Expo workforce, though it is being encouraged (and not enforced) for visitors and tourists.

Media Review

Fierce Foes, Iran and Saudi Arabia Secretly Explore Defusing Tensions

https://www.nytimes.com/2021/05/01/world/middleeast/Saudi-Iran-talks.html

Dubai luxury home market soars as world’s rich flee pandemic

https://apnews.com/article/dubai-europe-middle-east-travel-lifestyle-62331d53cd4b1790d2f6c56f8af2016b

IMF’s Concluding Statement of the 2021 Article IV Mission to Saudi Arabia

https://www.imf.org/en/News/Articles/2021/04/30/mcs050321-saudi-arabia-staff-concluding-statement-of-the-2021-article-iv-mission

Digital currencies that matter

https://www.economist.com/leaders/2021/05/08/the-digital-currencies-that-matter

Will the digital RMB change China? https://www.project-syndicate.org/commentary/china-digital-renminbi-banks-big-tech-by-shang-jin-wei-2021-05