Download a PDF copy of this week’s insight piece here.

1. As cases continue to surge in India, pace of global recovery comes into question

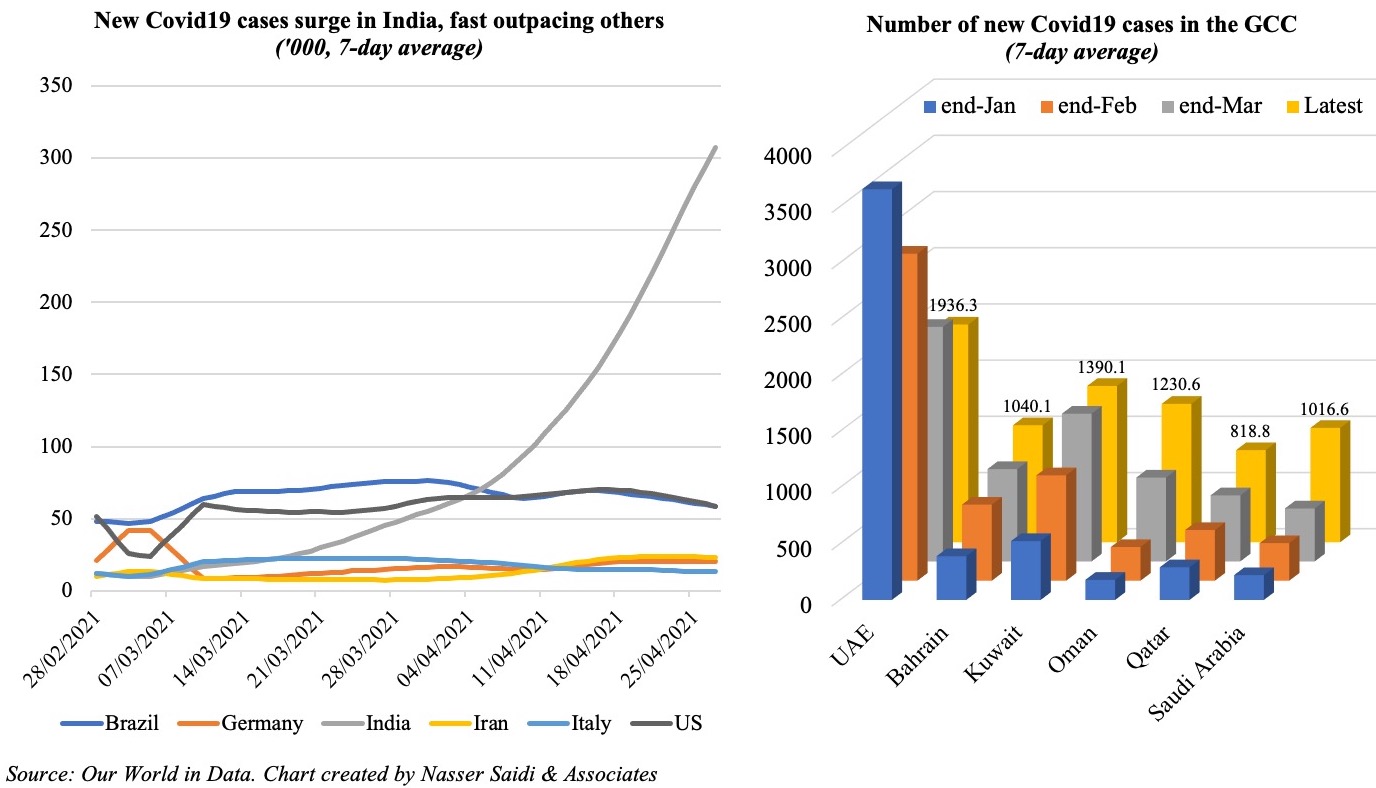

- India reported the highest-ever single day cases on Wednesday, at 379,257 & continues to account for almost half the rise in global Covid19 cases. Concerns about the accuracy of these statistics notwithstanding, it is worrisome that more than 20% of tests are coming positive and that the crumbling healthcare infrastructure (in many states) is leading to around 3k deaths per day!

- Given India’s linkages with the global economy (trade, labour & investment flows), it is not surprising that emergency supplies are coming in from across the globe to contain the spread; US relaxed its previous ban on exports of raw materials for vaccines.

- Meanwhile, GCC nations (except the UAE) have seen a steady uptick in cases from the beginning of this year; UAE’s numbers though are still the highest among the lot. In terms of new cases per million, Bahrain stands the highest (611) and Saudi Arabia the least (29), with Kuwait (326), Qatar (284), Oman (241) and the UAE (196) in between.

2. India-UAE links: Trade & Investment

- UAE has developed strong links with Asia, and especially India, over time. A prolonged slowdown in the Indian economy is likely to spillover into UAE’s growth.

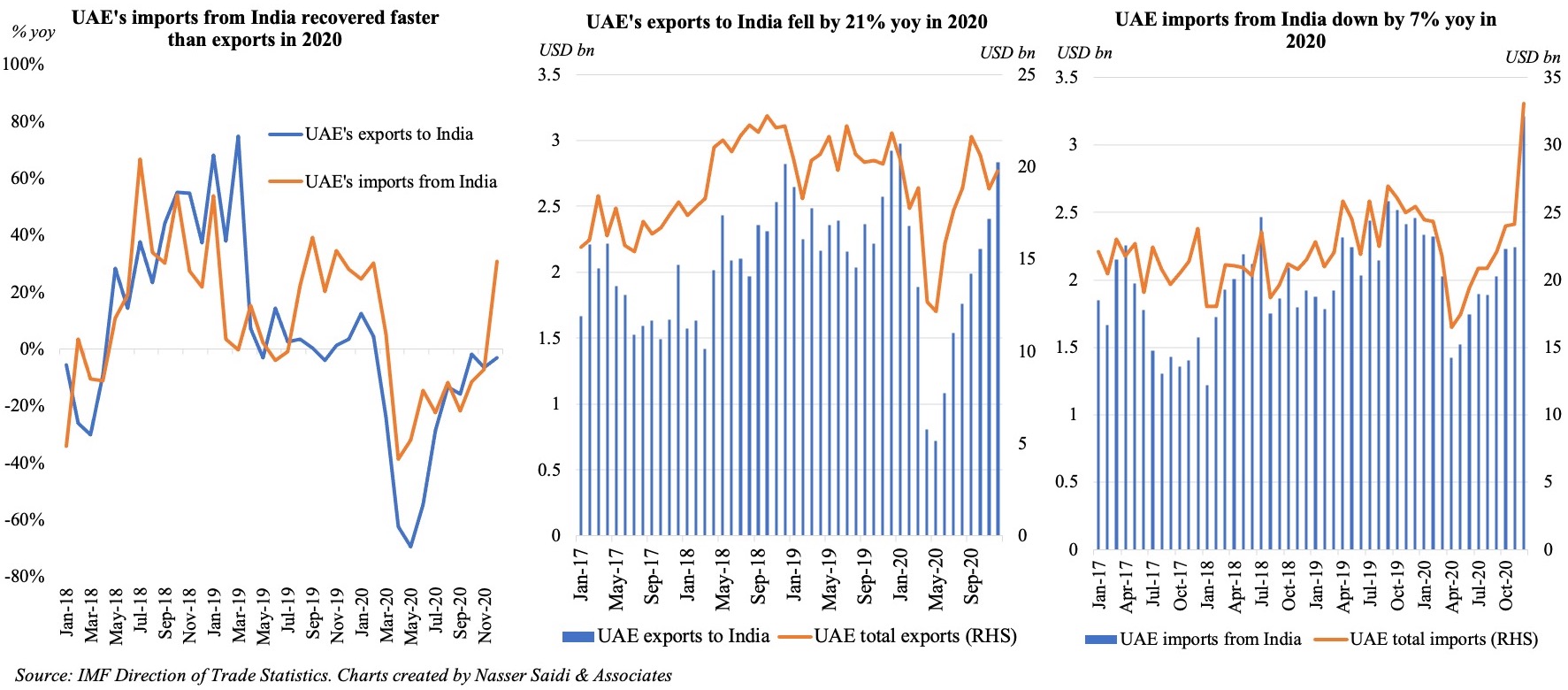

- First off, trade links: bilateral trade was around USD 60bn in 2019, though the Covid19 pandemic saw a decline in trade to USD 41.9bn (-30% yoy). Imports from India recovered much faster than exports into the country after the slump during lockdowns last year. India was the UAE’s second-largest trading partner (after China) during pre-Covid times.

- While oil is a key traded commodity – about 8% of India’s oil imports are from the UAE – exports of precious metals, stones and jewelry remain significant. Indian food imports also have a significant part to play in UAE’s food consumption.

- A slowdown in India would hence affect trade significantly: oil demand will decline with lower mobility; higher cases would lead to lower economic activity – i.e. negative impact on industrial production lowers exports of textiles, machinery products, lower levels of agricultural production implies less food imports from the country.

- Official figures for Indian investment in UAE are not available: the Indian Embassy estimates it at around USD 85bn.

3. India-UAE links: Tourism

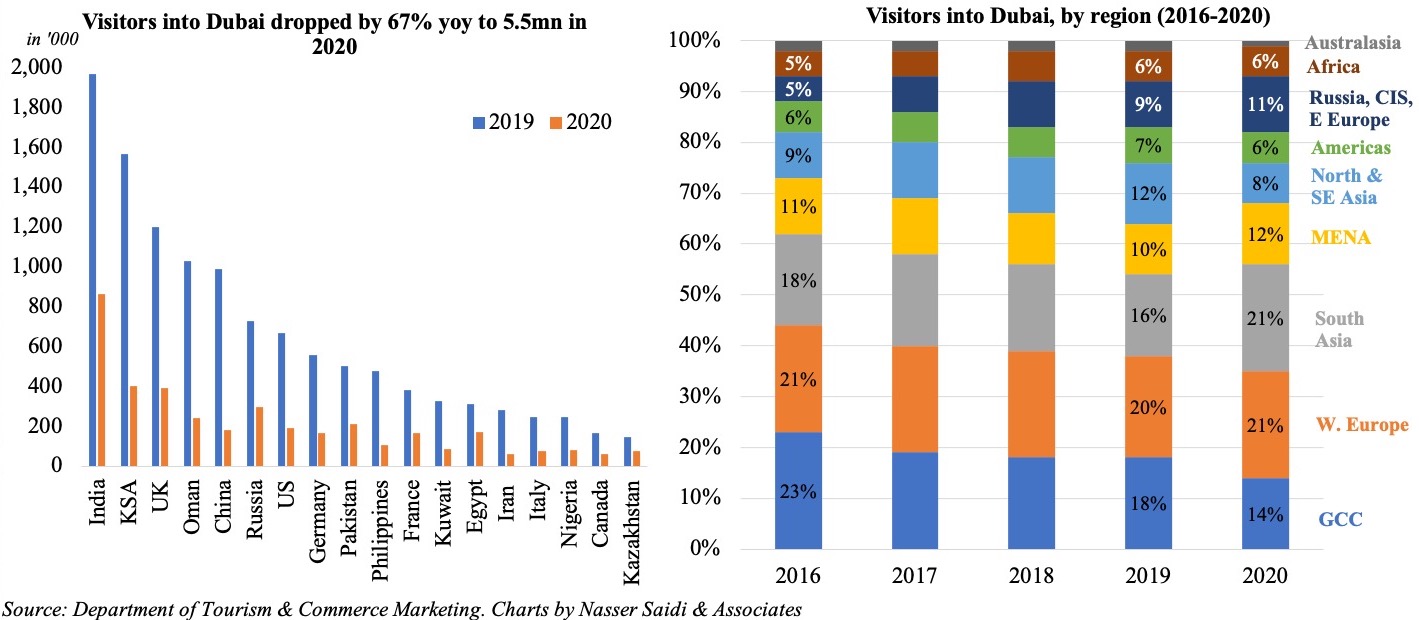

- Prior to the Covid19 epidemic, India was the largest source market for visitors into Dubai, attracting 1.97mn visitors out of a total 16.73mn.

- Covid19 cut short most tourist travel for a significantly large part of the year, resulting in a 67% decline in tourists into Dubai. India was still the largest source market for Dubai in 2020 – attracting 865k persons (-56% yoy) and South Asia retained its top spot as the largest source of visitors (21% of total).

- Flights to the Indian sub-continent have been suspended since Apr 25 for 10 days, and given the exponential rise in cases in India, an extension seems likely – about 300 commercial flights operated weekly in what is one of the busiest international travel corridors. Newspaper reports suggest an uptick in enquiries for private jets to ferry stranded residents (similar to the lockdowns last year). Cargo operations are carrying on uninterrupted.

4. India-UAE links: Remittances

- The UAE-India migration corridor is one of the largest in Asia: it stood at close to 3.5mn migrants in 2019. (Source: UN World Migration Report 2020). Indians account for around one-third of UAE’s total population.

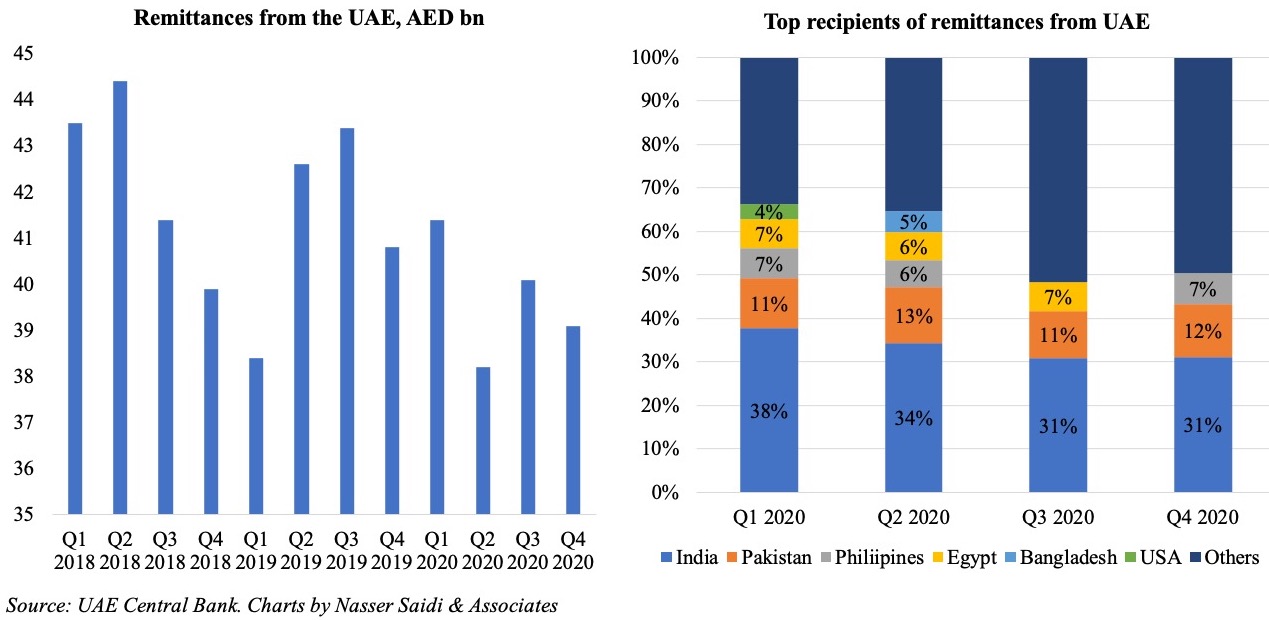

- In 2020, total remittances from the UAE touched a total of USD 43.2bn (-4% yoy). While Q1 saw a 7.8% uptick in remittances, Q2 saw the sharpest drop of 10.3%.

- Remittances to India accounted for 33.5% of its total remittances last year – maintaining its spot as the largest recipient of remittances from the UAE.

- As India goes into lockdown, it is possible that UAE will see an increase in remittances to the country as financial support for families in need. A weaker Indian rupee would further suport this pattern.

5. The economic case for vaccination

- The discovery of vaccines for Covid19 had brought a sense of consumer and business optimism. However, with vaccine distributions underway, its pace is less than heartening in many nations.

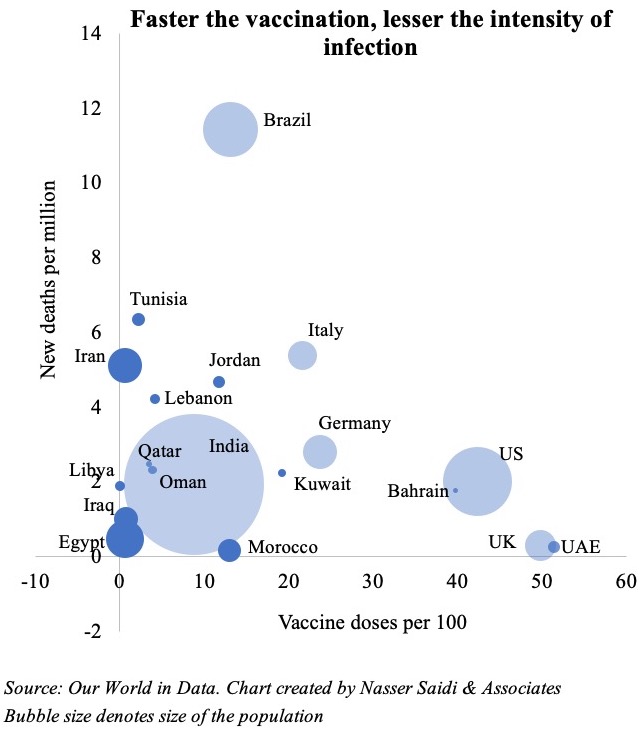

- Israel and UAE have topped the lists in terms of vaccination rates. There is confirming evidence from Israel of reduced transmissions as a result of the inoculations.

- As the chart on the right (focusing on MENA nations) shows, there is a negative correlation between vaccination and infection rates. Anecdotal evidence also suggests that an infection after the first dose of vaccine is much less likely to require hospitalization.

- Unfortunately for India, the pace of vaccination has been very slow. Less than 10% of the nation’s residents received the vaccine, in spite of it being home to the world’s largest vaccine manufacturer (the Serum Institute).

- The rapid pace of India’s infections also calls into question its vaccine production and distribution channels: the Serum Institute has not fulfilled its commitment to supply the AstraZeneca vaccine globally (to UK, EU and Covax), but is also planning to sell the vaccine to state governments and private hospitals in the country (at higher rates).

- In the MENA region, new deaths per million are low in the UAE (the leader in vaccine doses per 100 persons) while Iran has a long way to go. If Israel’s results are to be emulated, a coordinated effort should be underway to accelerate the pace of vaccination, resulting in faster return to higher economic activity.