Markets

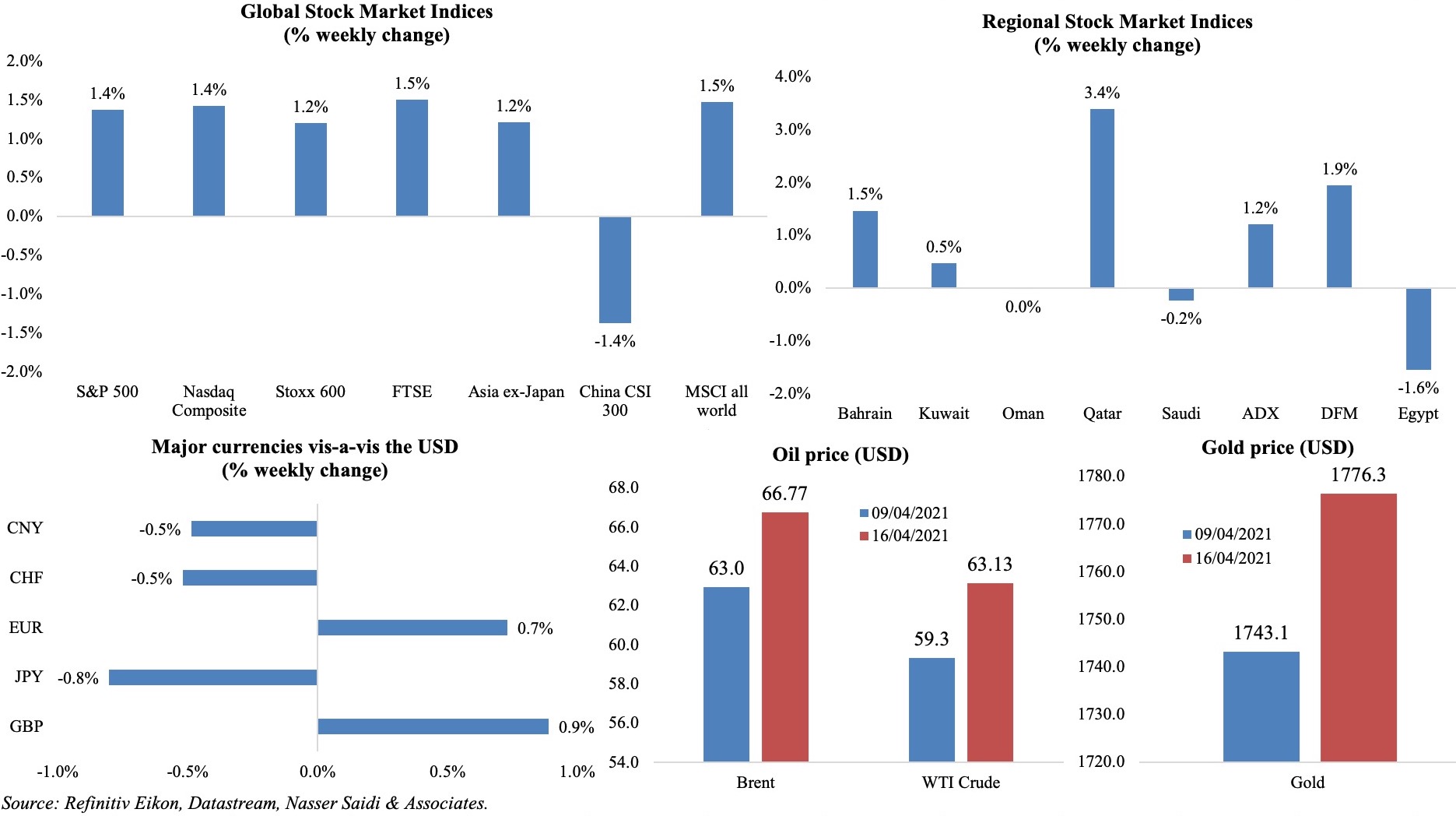

Capital market euphoria continues into another week, this time on strong economic data: Wall Street’s S&P 500 and Nasdaq as well as DAX and Stoxx600 climbed to new highs, FTSE crossed 7000 points to its highest since Feb 2020 and the MSCI All-World index touched an all-time peak. In the region, Qatar was the biggest gainer, after its announcement of allowing 100% foreign ownership of listed companies. Among currencies, both GBP and EUR gained with the dollar at a 4-week low; both oil and gold prices increased from the week before.

Weekly % changes for last week (15-16 Apr) from 8 Apr (regional) and 9 Apr (international).

Global Developments

US/Americas:

- Inflation in the US ticked up by 0.6% mom and 2.6% yoy in Mar (Feb: 0.4% mom and 1.7% yoy). The mom rise was the fastest pace since 2012, largely driven by petrol prices. Core inflation was up by 0.3% mom and 1.6% yoy (from 0.1% mom and 1.3% yoy).

- US industrial production rebounded by 1.4% mom in Mar – the highest since Jul 2020 – partly reversing the decline of 2.6% in Feb (related to severe weather conditions). Capacity utilization improved to 74.4% in Mar from 73.4% the month before.

- “National economic activity accelerated to a moderate pace from late Feb to early Apr”, according to the Fed’s Beige book. Stimulus cheques and related improvements in consumer spending alongside an increase in hiring supported the move. Separately, the NFIB Business Optimism Index increased to a 4-month high of 98.2 in Mar (Feb: 95.8), though “finding qualified labour” was identified as a critical issue. The Michigan consumer sentiment index meanwhile improved to 86.5 in Apr (Mar: 84.9), the highest reading since Mar 2020.

- Retail sales in the US increased by 9.8% mom in Mar (Feb: -2.7%), recording the largest gain in 10 months, supported by the stimulus cheques and vaccination drives. Level of sales is now1% above its pre-pandemic level and pushed to a record high. The rebound was led by sales at clothing stores (+18.3%), motor vehicles (+15.1%) and higher spending at restaurants and bars (+13.4%).

- Housing starts surged by 19.4% mom and 37% yoy to a nearly 15-year high of 1.739mn in Mar. Building permits increased by 2.7% mom to 1.766mn in Mar. The stock of housing under construction rose 0.8% to a rate of 1.306mn units, the highest since Sep 2006.

- Initial jobless claims fell to 576k in the week ended Apr 3, touching the lowest since Mar 2020, from the upwardly revised 769k the prior week, with the 4-week average slipping down to 683k. Continuing claims inched up to 3.731mn in the week ended Apr 3 compared to the previous week’s 3.727mn.

Europe:

- Industrial production in the eurozone declined by 1% mom and 1.6% yoy in Feb (Jan: 0.8% mom and 0.1% yoy): this was the largest dip since Apr’s record low, as many nations remained under strict restrictions. Drops were across the board: capital goods (-1.9%), energy (-1.2%), durables (-1.1%), non-durables (-0.1%).

- German ZEW economic sentiment fell 5.9 points to 70.7 in Apr, recording the first drop since Nov 2020. The current situation reading improved to -48.8 (Mar: -61), roughly the same level as in Mar 2020.

- The ZEW economic sentiment for the eurozone declined to 66.3 in Apr (Mar: 74) while indicator for the current economic situation climbed 4.3 points to -65.5.

- Harmonised index of consumer prices in Germany grew by 2% yoy and 0.5% mom in Mar.

- Wholesale price index in Germany increased by 4.4% yoy in Mar (Feb: 2.3% yoy), the highest uptick since Apr 2017; in mom terms, prices grew by 1.7% (Feb: 1.4%).

- Retail sales in the eurozone were up by 3% mom in Feb, partially reversing the 5.2% dip in Jan. Sales of non-food products rose by 6.8% and fuel by 3.7%. Overall sales fell by 2.9% yoy in Feb, following the 5.2% drop in Jan.

- UK’s GDP increased by 0.4% mom in Feb (Jan: -2.2%), as government restrictions remained unchanged. Overall, Feb’s level is 7.8% below that seen in Feb 2020 and is 3.1% below levels in Oct 2020, the initial recovery peak. Construction sector grew by 1.6% in Feb 2021, driven by growth in both new work and repair and maintenance.

- UK’s industrial production increased by 1% mom in Feb, supported by the 1.3% yoy uptick in manufacturing output. In yoy terms, IP and manufacturing declined by 3.5% and 4.2% respectively.

Asia Pacific:

- GDP in China increased by 18.3% yoy and 0.6% qoq in Q1 (Q4: 6.5% and 2.6% qoq) – fastest growth since quarterly records began in 1992. GDP grew just 2.3% last year, its weakest expansion in 44 years, but is the only major economy to have grown during the pandemic.

- China’s exports grew by 30.6% yoy in Mar and imports surged by 38.1%, causing trade surplus to shrink to USD 13.8bn (Feb: USD 103.25bn).

- China’s new yuan loans expanded to CNY 2.73trn in Mar (Feb: CNY 1.36trn), pushing bank lending in Q1 to a record high of CNY 7.67trn surpassing the previous high of CNY 7.1trn in Q1 2020. Money supply in China grew by 9.4% yoy in Mar (Feb: 10.1%).

- Industrial production in China increased by 14.1% yoy in Mar, easing from Feb’s 35.1% reading.

- FDI into China grew by 43.8% yoy in Q1 – the highest quarterly growth rate since Q2 2008. During Q1, a total of 10,263 new foreign-invested companies were established in the country, up 47.8% yoy. Fixed asset investment increased by 25.6% yoy till Mar this year, slowing from the 35% rise in Jan-Feb.

- China’s retail sales surged by 34.2% yoy following Feb’s 33.8% rise, causing Q1 to tick up by 33.9%.

- Japan’s machinery orders unexpectedly fell for the second consecutive month by 8.5% in Feb, (Jan: -4.5%); core machinery orders slipped by 7.1% in Feb after Jan’s 1.5% rise. Separately, machine tool orders increased by 65% yoy in Mar (Feb: 36.7%).

- Industrial output in India fell by 3.6% yoy in Feb (Jan: -0.9%). Manufacturing shrank by 3.7%, following Jan’s 1.3% drop. Cumulative industrial output for Apr-Feb fell by 11.3%.

- Wholesale price index in India jumped to an 8-year high of 7.39% yoy in Mar (Feb: 4.17%), driven by fuel (2-year high of 10.3%), manufactured products (8-year high of 7.3%) and metals. Separately, retail inflation rose to a four-month high of 5.52% in Mar.

- India’s trade deficit touched USD 13.93bn in Mar, following Feb’s USD 14.11bn deficit. Exports grew by 60.29% yoy to USD 34.45bn and imports accelerated by 53.74%.

- Singapore’s GDP grew by 2% qoq and 0.2% yoy in Q1 (Q4: 15.9% qoq and -2.4% yoy), the first yoy expansion since the Covid19 outbreak, as per the preliminary estimates released by the Ministry of Trade and Industry. Growth is supported by strong manufacturing (+7.5% yoy) while the construction sector shrank (-20.2%), as did wholesale and retail trade as well as transportation and storage trade (-4.1%).

Bottomline: The IEA expects world oil demand estimate to rise by 5.7m barrels per day in 2021, up from a decline in demand last year by 8.7mn bpd. However, surging Covid numbers in Europe, India (where infections have risen about 16 times over the past 2 months) and Brazil are likely to temper this optimism and an Iran deal could potentially bring an additional 2mn bpd to the market. China’s GDP for Q1 was below market expectations, but it still remains a major engine for global growth; its policymakers’ focus has shifted though to signs of overheating, leverage across the real estate sector and reining in steel production. Looking ahead this week, the ECB meets and is unlikely to spring any surprises (given Lagarde’s view that the economy is still “in crutches”). Inflation pressures are rising across many nations but is likely transitory for the time being.

Regional Developments

- The IMF’s latest Regional Economic Outlook report forecasts real GDP for the Middle East and North Africa (MENA) region to grow by 4% this year (up 0.9 percentage points from the projection in Oct 2020) after having slumped by 3.4% in 2020 (vs an estimate of a 5% drop in the Oct 2020 edition). Growth outcomes and prospects will still be centred on how the pandemic progresses in the region amid the pace of vaccination rollouts.

- The value of mergers and acquisitions in the MENA region grew by 19% yoy to USD 17.1bn in Q1 2021, according to Refinitiv. Egypt was the main recipient of M&A activity, with USD 3bn of investment, closely followed by Oman and Qatar. Debt issuances spiked by 61% yoy to USD 34.8bn – the best start to the year since 1980 – with Saudi and UAE the most active issuer nations (USD 12.3bn and USD 7.5bn in bond proceeds).

- Start-ups in MENA recorded venture capital investment of more than USD 1bn last year, according to MAGNiTT. While Bahrain saw a tripling of capital deployment in start-ups, UAE accounted for the maximum share in terms of total funding and number of deals followed by Egypt and Saudi Arabia.

- The Bahrain Bourse expects two new IPOs this year, a logistics firm and an oil company, disclosed the CEO to Asharq Business.

- Results of the 2020 FDI Survey showed a 3.3% rise in FDI volume into Bahrain to BHD 11.9bn (USD 31.3bn). Foreign investment from Luxembourg accounted for6%, (or BHD 248.2mn) of the total, followed by the Cayman Islands (BHD 93.3mn) and India (BHD 68.6mn), according to the survey.

- Fitch Ratings affirmed Bahrain’s long-term foreign-currency Issuer Default Rating at ‘B+’ with a stable outlook, citing the nation’s strong backing from partners in the GCC, high GDP per capita and also human development indicators.

- With more than 60 international oil and gas companies operating in Egypt, the oil and gas sector contributed 24% of Egypt’s GDP in 2020, revealed a senior government minister.

- Egypt reported a balance of payments surplus of USD 1.5bn in H2 2020, following a deficit of USD 9bn in H1 and compared to a surplus USD 410.9mn in H2 2019. Current account deficit meanwhile widened by 66.9% to USD 7.6bn in H2 2020.

- Egypt’s external debt grew by 14.7% yoy to USD 129.2bn in 2020; external debt stood at USD 125.3bn in Sep 2020.

- The total financial position of Egypt’s banks increased by 1.94% mom to EGP 7.158trn in Jan 2021. Bank capital was about EGP 174.774bn in Jan, while reserves stood at EGP 327.6bn.

- In a bid to support bond trading and expand its investor base, Egypt’s Financial Regulatory Authority decided to exclude 10% of each private placement bond issuance from the minimum subscription requirement.

- Remittances into Egypt declined by 4.15% yoy to USD 2.54bn in Jan 2021. While for the full year 2020, remittances had increased by 10.5% to USD 29.6bn, it grew by 10.6% yoy to USD 18.1bn during the period Jul 2020-Jan 2021.

- Occupancy rate at Egypt’s hotels (which are restricted to half capacity given Covid19 regulations) ranged between 40-45% in Q1, according to a tourism ministry official.

- Egypt’s cement sales surged by 22% mom and 15% yoy to 4.99mn tonnes (including exports) in Mar this year. Excess capacity amounted to 26%, the lowest since 2018.

- An Iraqi official disclosed that about 80% of the infrastructure required to connect Iraq’s electricity grid to the GCC Grid via Kuwait has been completed. Iraq already signed an agreement with Jordan last year to link their power grids.

- Jordan’s public debt jumped by 10.6% yoy to JOD 26.5bn (USD 37.4bn) in 2020: this is equivalent to at 85.4% of GDP, up from 75.8% a year earlier.

- Inflation in Jordan edged up by 0.07% yoy in Q1 this year; in Mar alone, inflation ticked up by 0.16% yoy and 0.29% mom.

- Jordan achieved all the targets that were set in the second review under the IMF’s USD 1.3bn Extended Fund Facility arrangement and has maintained the pace of reforms.

- As a result of the Covid19 pandemic, the clothing sector in Jordan recorded JOD 200mn in losses, given the closure of 700 firms in the sector and about 1600 persons laid off, revealed the President of the Textile and Readymade Clothes Syndicate.

- The IMF called for “strong fiscal consolidation” in Kuwait and stated that “structural reforms would be needed to preserve fiscal buffers and strengthen growth”.

- Kuwait’s central bank called for local banks to appoint Kuwaitis in “leadership positions”.

- Inflation in Lebanon surged to an annual 155.4% in Feb: this is the 8th consecutive month of triple-digit increases. The uptick was across all categories: prices at restaurants and hotels soared by 618%, clothing and footwear were up by 612%, in addition to furnishings and household equipment (609%) and food and non-alcoholic beverages (417%) among others.

- Lebanon’s central bank governor stated that the BDL’s subsidy program has kept inflation in recent months at 84%, emphasizing that it would have exceeded 275% otherwise. The governor also called on the government to roll out a new plan to ration subsidies and end waste.

- Oman started implementing a 5% VAT on most goods and services, starting last Fri. About 488 basic commodities have been exempt from VAT; it was also disclosed that departing tourists could claim a VAT refund on personal purchases provided the value of these goods are not less than OMR 25 (not inclusive of VAT).

- Qatar approved a draft law to allow foreign investors to fully own companies listed on the exchange. This pushed the stock market up by 2.8% on Thursday – its biggest intra-day gain since last Apr – with banks leading the gains.

- Qatar will maintain central bank liquidity support for local banks, and exemptions from utilities fees for sectors affected by the pandemic will be extended till end-Sep.

- In a bid to host a Covid-free event, Qatar’s foreign minister disclosed that programs are under development to provide vaccination to all attendees of World Cup 2022.

- According to a senior official at Bahrain’s Sustainable Energy Authority, the GCC nations which are now connected to the GCC Power Grid, are in next stage talks to extend and connect the link with Arab countries (talks with Egypt are in progress), following which the third phase would be to link up with the European power grid (providing surplus power to Europe during winter).

Saudi Arabia Focus

- Inflation in Saudi Arabia eased to 4.9% in Mar (Feb: 5.2%): food and transport prices increased by 10.2% and 10.5% respectively. Separately, wholesale price index rose by 8.7% yoy and 0.8% mom in Mar, largely due to the 14.6% uptick in prices of metal products, machinery and equipment.

- Saudi exports to China and Japan together accounted for 27.7% of total value of exports in 2020. Exports to these two nations dropped by 35% yoy last year, in part because of the decline in value of oil exports.

- The Saudi central bank is encouraging consolidation in the insurance sector: three insurance mergers happened in a short period of nearly a year, with the most recent one being of Aljazira Takaful and Solidarity.

- Saudi Aramco reassured in a bourse filing to Tadawul that the recent sale of its 49% stake in Aramco Oil Pipelines Company will not impede its crude production.

- The value of point-of-sale transactions in Saudi Arabia declined by 11.7% in the week ending Apr 10 to about SAR 10bn (USD 2.6bn) – ahead of the start of Ramadan. The food and beverage sector accounted for 17.4% of total sales.

- Starting from Apr 12th, Saudi Arabia reduced the maximum period of subsidized housing finance to 20 years from 25 years for new applications. The program provides a real estate loan with up to 100%, for those whose salary is SAR 14k or less, with a guarantee (on the amount of the profit margin) of up to SR500k of the financing amount.

- Home completions in Saudi Arabia increased by 4% yoy to almost 345k last year; new housing finance provided to Saudi families increased to 295,590 contracts with a value exceeding SAR 44bn (USD 72bn).

- In a bid to boost Saudization in the industrial sector, 50% of the wage will be provided for hiring, training and qualifying Saudi citizens to take up jobs in industrial firms (capped at SAR 3,000).

- Saudi Arabia’s first wind project, the 400MW utility-scale Dumat Al Jandal project, is 50% complete and first power from the wind farm project is expected within “the coming weeks”. When the project is completed by 2022, it will be able to power upto 70k homes annually.

- Saudi Arabia disclosed that it had contributed more than USD 713bn to support global efforts to address the Covid19 pandemic.

- Sudan will receive USD 400mn from Saudi Arabia and UAE to fund agricultural production inputs for this year.

UAE Focus![]()

- Dubai’s PMI nudged up by 0.1 point to 51 in Mar, as output expanded, and the new orders sub-index rose slightly to above 50. Impact of global supply shortages were evident: a reduction in input availability led to the sharpest rise in prices since Nov 2018. Travel and tourism stayed below-50 while construction sector saw major improvements as projects were allowed to restart.

- Foreign trade in Dubai touched AED 1.182trn (USD 321.8bn) in 2020: exports increased by 8% to AED 167bn while imports and re-exports fell by 13.8% and 21.7% respectively. Trade with its largest trade partners China and India declined by 5.3% and 34% to AED 142bn and AED 89bn respectively.

- The deadline for UAE’s Federal Tax Authority to issue a decision to reduce or exempt administrative fines is amended to 40 working days (from 20 previously) from the date of receiving the order.

- Without specifying a value, Mubadala’s CEO stated that a record amount had been invested by the company last year (it had invested USD 18.5bn in 2019 and USD 19.1bn in 2018). He also revealed that Emirates Global Aluminium is “well-placed” for an IPO and a decision would be made shortly regarding this move.

- Dubai Customs announced that 5mn transactions were completed in Q1: this was double the number completed in Q1 2019 and 20% yoy.

- US will proceed with its USD 23bn weapon sales to the UAE, with the spokesperson stating that the US will “continue reviewing details and consulting with Emirati officials” related to the use of the weapons.

- Dubai attracted FDI inflows worth AED 7bn (USD 6.73bn) in 2020, supporting 455 projects and creating an estimated 18,325 new jobs on the back of inbound FDI, according to FT’s fDI Markets.

- The Sharjah Electricity, Water and Gas Authority extended payment periods for utility bills: those with bills AED 1k or lower can pay one month within billing date without penalties where those with bills above AED 1k will have a 15-day grace period instead.

- Zand, the first fully independent digital bank in the UAE, is awaiting final regulatory approval and will be “launched immediately” for retail and corporate clients, revealed the bank’s chairman (Emaar Properties founder and former chairman Mohamed Alabbar).

Media Review

IMF Middle East & Central Asia Regional Economic Outlook: Arising from the Pandemic: Building Forward Better

https://www.imf.org/en/Publications/REO/MECA/Issues/2021/04/11/regional-economic-outlook-middle-east-central-asia

A Commonsense Corporate Tax

https://www.project-syndicate.org/commentary/corporate-tax-reform-destination-based-cash-flow-tax-by-alan-auerbach-2021-04

NFT prices are plummeting. What could this mean for the art world?

https://edition.cnn.com/style/article/nft-bubble-burst-prices-art-world-tan/index.html

https://news.artnet.com/market/nft-market-1957770

Coinbase: supersize listing rests on bitcoin price

https://www.ft.com/content/b740dba6-f2fc-457a-a0a0-067f0754d1b3

https://www.ft.com/content/abb1504f-b5f4-4d93-bdf6-ed992a03b0e8