Markets

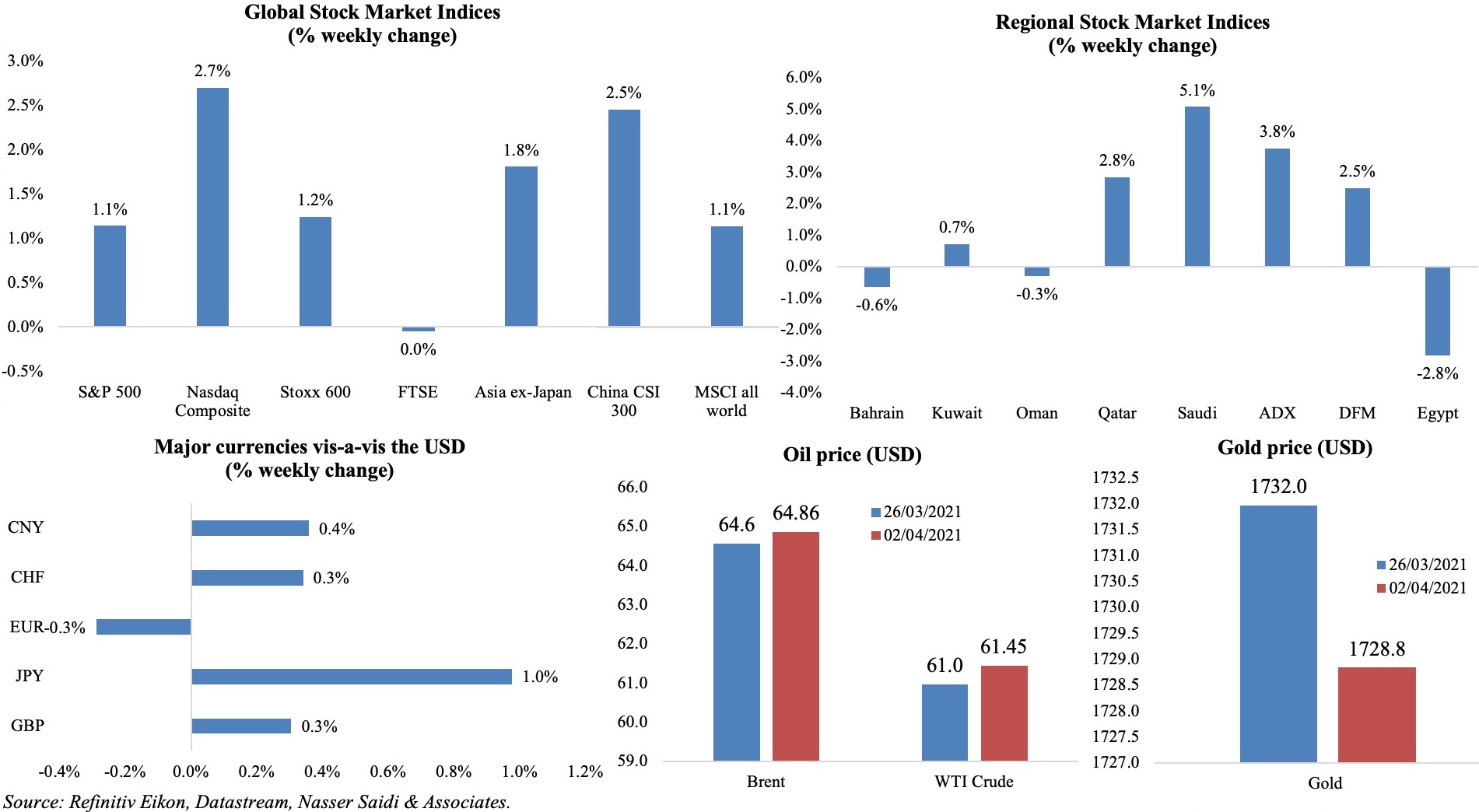

Equity markets had a good run last week, with the S&P closing above 4000 for the first time, on Biden’s infrastructure spending plans (markets were closed for Good Friday when the strong non-farm payrolls data were released); German DAX hit a record high, while Stoxx600 ended Q1 up 7.7%, posting the 4th straight quarter of gains. Nikkei hit a 2-week high while China’s CSI300 index closed at an almost 4-week high. Regional markets were mostly up: Saudi markets cheered the Shareek plan to galvanise domestic investment while Abu Dhabi closed Mar with a record high. The dollar gained for a 3rd consecutive week, remaining around its strongest level since Nov. Oil prices rallied after the OPEC+ decision to gradually raise oil production from May and Brent closed around USD 64 per barrel. Gold price eased to USD 1728.8 an ounce.

Weekly % changes for last week (1-2 Apr) from 25 Mar (regional) and 26 Mar (international).

Global Developments

US/Americas:

- Non-farm payrolls increased by 916k in Mar (Feb: 468k), thanks to gains in the leisure and hospitality sector (it is still down by 3.1mn or 18.5% since Feb 2020). Average hourly earnings slowed to 4.2% (Feb: +5.2%) and labour force participation rate inched up to 61.5% (61.4%). Unemployment rate fell to 6% in Mar from 6.2% the month before.

- S&P Case Shiller home prices increased by 11.2% yoy in Jan (Dec: 10.4%) – the largest annual gain in nearly 15 years.

- Pending home sales dropped for the second consecutive month by 10.6% mom in Feb (Jan: -2.4%). Inventories fell to a record low of 1.03mn units in Feb, down by 29.5% yoy, posting the largest-ever annual decline.

- Private sector in the US added a substantial 517k jobs in Mar (Feb: 176k) – the biggest gain in 6 months – with manufacturing sector adding 49k jobs.

- Chicago PMI increased by 6.8 points to 66.3 in Mar, the highest since Jul 2018: production saw the largest gain, while order backlogs saw the biggest drop.

- ISM manufacturing PMI increased to a 37-year high of 64.7 in Mar (Feb: 60.8), with new orders sub-index rising to 68 (Feb: 64.8), employment up to 59.6 (54.4) while prices paid by manufacturers hovered near its highest since Jul 20

- Markit manufacturing PMI inched up to 59.1 in Mar (Feb: 58.6), the highest since data collection began in May 2007. Demand improved and orders for consumer goods rose, but transportation delays, supplier shortages and Covid19 restrictions resulted in logistical problems.

- Initial jobless claims increased to 719k in the week ended Mar 27, rising from the downwardly revised 658k the prior week, with the 4-week average slowing to 719k. Continuing claims fell to 3.794mn in the week ended Mar 20 (vs the previous week’s 3.84mn).

Europe:

- Markit manufacturing PMI in Germany increased to an all-time high of 66.6 in Mar (Feb: 60.7), supported by a record growth in export orders, especially from Asia (China) and the US while workforce numbers expanded for the first time since Feb 2019.

- In the Eurozone, manufacturing PMI moved up to 62.5 (Feb: 57.9), with record increases in output, new orders and exports; many nations hit highest-ever PMI levels in Mar (Germany, Netherlands, Italy, France). Prices, however, were rising at the fastest rate in a decade.

- Germany’s harmonized index of consumer prices rose by 2% yoy (nearing a 2-year high) and 0.5% mom in Mar (Feb: 1.6% yoy and 0.6% mom).

- Retail sales in Germany increased by 1.2% mom in Feb, rebounding from Jan’ 6.5% drop. Compared to Feb 2020, sales were lower by 9%.

- Consumer price index in the eurozone increased by 1.3% yoy in Mar (Feb: 0.9%) to the highest level since the start of the pandemic. This uptick was due to rising fuel costs as well as the reversal of the VAT reduction in the start of 2021, but overall it remains below the ECB target of just under 2%. Core CPI edged down to 0.9% in Mar (Feb: 1.1%).

- Unemployment rate in Germany stayed put at 6% in Mar while jobless numbers dipped by 8k to 2.8m

- The Economic Sentiment Indicator rose in both EU (jumped 9 points to 100) and euro area (up 7.6 points to 101). Consumer confidence in the Eurozone stood at -10.8 in Mar – the highest since Feb 2020 – while the business climate improved to 0.3 from Feb’s -0.13 reading.

- GDP in the UK expanded by 1.3% qoq in Q4 from Q3’s 16.9%, marking improvements from the initial estimates of 1% and 16.1% respectively. Overall, GDP fell by 9.8% for the full year – recording the steepest fall since official records began.

- Manufacturing PMI in UK inched up to a decade-high 58.9 in Mar; business optimism was at a 7-year high, though overall constrained by weak export sales and supply-chain issues.

Asia Pacific:

- China’s official manufacturing PMI increased to 51.9 in Mar (Feb: 50.6): while output and new orders grew, export sales expanded (51.2 from Feb’s 48.8) and employment rose for the first time in 11 months (50.1). Caixin manufacturing PMI eased to 50.6 in Mar (Feb: 50.9): productions increased, but its rate of growth edged down to an 11-month low while the rate of cost inflation was the steepest recorded for 40 months. Non-manufacturing PMI improved to 56.3 in Mar (Feb: 51.4), with new orders and new export orders moving past the neutral 50-mark and confidence rising to a 10-month high.

- Unemployment rate in Japan stayed unchanged at 2.9% yoy in Feb. While the number of unemployed was flat at 2.03mn, employment rose by 30k to 66.97mn.

- Industrial output in Japan declined by 2.1% mom in Feb (Jan: 4.3%), as a result of the disruption from a strong earthquake (Feb 13); the auto sector output fell by 8.8% (also compounded by the global chip shortage).

- Japan’s Tankan large manufacturing index turned positive in Q1, moving up to +5 (Dec: -10). Among large manufacturers, the index stood at +4 while among large non-manufacturers it was -1 (Dec: -5).

- Japan’s retail trade fell by 1.5% yoy in Feb, following Jan’s 2.4% drop; sales at large retailers dropped by 4.7% (Jan: -7.2%). But, sales rose by 3.1% mom in Feb, the most since Jun 2020.

- India’s exports surged by 58% yoy to a record high USD 34bn in Mar; imports grew by 53% to USD 48.12bn, clocking the trade deficit at USD 14.1bn. In the 2020-21 fiscal year, exports contracted by 7.4% to USD 290bn while imports fell to USD 389bn (-18.1%).

Bottom line: Notwithstanding new Covid19 case highs and new restrictions/ lockdowns, the WTO forecasts volume of global merchandise trade to increase by 8% in 2021 (following 2020’s 5.3% drop). Global manufacturing PMI also rose to a 10-year high in Mar, with euro area, US and Taiwan leading the uptick; but overall conditions continue to be affected by supply chain disruptions and inflationary pressures. The IMF will release its World Economic Outlook report this week: an upward revision in growth rates is expected (in Jan, forecast was for 5.5% growth this year), thanks to additional policy support (fiscal, liquidity injection) and potential of a vaccine-supported recovery. Meanwhile, OPEC+ decided to increase output gradually from May-Jul (i.e. nearly 2 million barrels per day over the next three months) though Saudi Arabia has called for a “cautious stance”. We believe it is unlikely that oil demand will pick up to its pre-Covid19 pace soon: Covid19 variants, new waves and related lockdowns are likely to weaken demand; in spite of the fast pace of vaccinations in US, UK and other countries, a rebound in demand will be delayed till most nations achieve herd immunity.

Regional Developments

- The World Bank expects MENA region GDP to recover by 2.2% this year, following the 3.8% drop in 2020. In 2021, public debt is estimated to rise to 54% of GDP (2019: 46%) as a result of financing continuing budget deficits, while Covid19 induced losses will amount to USD 227bn.

- As Covid19 cases spike, GCC nations are imposing/ extending restrictions: Kuwait extended its partial curfew till Apr 22 (from 7pm to 5am as of Apr 8th). Oman will reduce in-person working in the government sector to 50% from Apr 4th. Both Oman and Qatar suspended in-person learning at public and private universities and schools.

- Bahrain’s King ratified the general state budget of BHD 7.182bn (USD 19bn) for the fiscal year 2021-22; this had previously been approved by both chambers of the National Assembly.

- Domestic liquidity in Bahrain increased by 11% yoy to BHD 2.9bn at end-2020, while money supply (M2) rose by 6.5% to BHD 12.8bn. Overall loans grew by 7% to BHD 10.4bn, with institutions and individuals accounting for 51.2% and 45.3% of the total respectively.

- Bahrain’s labour fund (Tamkeen) has disbursed more than BHD 54mn in financial support to over 16k businesses most affected by the Covid-19 crisis, disclosed its chief executive.

- Real estate transactions in Bahrain rebounded in H2 2020, with deals rising by 14% and 20% in Q3 and Q4 respectively; total transactions stood at USD 1.9bn in the full year 2020.

- Changes to Bahrain’s Bankruptcy Law were approved by the Shura Council. Amendments include extending the appeal period from 20 days to 30 days while also ensuring all parties are involved in the process equally.

- Bahrain will roll out its Wage Protection System – wherein workers’ wages will be regularly transferred directly to their bank accounts – in three phases starting from May.

- With Egypt’s Suez Canal blockage saga solved, the head of the Suez Canal Authority disclosed that losses and damages resulting from the blockage could amount to more than USD 1bn. Furthermore, a potential expansion of the shipping channel is being explored to prevent any recurrence of such disruptions. Refinitiv estimated the revenue loss per day at about USD 16mn for the canal, with cumulative revenue lost in the first 6 days greater than USD 95mn.

- Bilateral trade between Egypt and China grew by 10.34% yoy to USD 14.56bn in 2020. Exports from China increased by 11.83% to USD 13.64bn while Egypt’s exports to China dropped by 7.84%.

- Money supply in Egypt grew by 20.2% yoy in Feb to EGP 5.03trn (USD 321bn), according to the central bank.

- Egypt’s manufacturing and extractive industries index declined by 0.7% mom to 99.59 in Jan 2021. However, the manufacture of food products and computer, electronic and optical products picked up by 21.44% and 17.19% respectively, reflecting increasing demand.

- Remittances into Egypt stood at USD 24.4bn in 2020, representing 6.7% of GDP. The country was ranked 6th globally, by the World Bank, in terms of remittances received.

- A study on identifying Covid19’s impact on families in Egypt found that the percentage of those affected by the pandemic decreased to 26.9% in Q4 (vs. Q3’s 54.9%). In cases where incomes declined, it was attributed to salary cuts (34.4% of respondents), full closure of activity (32%) and precautionary measures (12.5%).

- Egypt received 500k tourists in Jan-Mar this year, thereby earning between USD 600-800mn in tourism revenues, according to the deputy tourism minister. Last year, revenues plunged by 70% as visitors fell to 3.5mn from 13.1 the year before.

- Egypt’s public and public business sector employed 760700 employees in 2020, down 3.9% yoy. About 87% of the employees were male and housing and construction accounted for the largest share of total workers (28.1% of the workforce).

- Last week, Egypt received 854,400 doses of the AstraZeneca vaccine as part of the 40mn doses set to receive via the global COVAX agreement.

- Iraq and Saudi Arabia signed five agreements covering financial, commercial, economic, cultural and media fields during a visit by the former’s PM to Riyadh. Saudi Arabia’s investments in Iraq are estimated to rise to SAR 10bn (USD 2.67bn) from SAR 2bn now. The two nations also agreed to establish a USD 3bn joint fund to promote investments in Iraq.

- Iraq approved an investment budget of USD 1.15bn to develop the Majnoon oilfield: this will raise output from the field to 450k barrels per day in 3 years, from the current 130k bpd.

- At least 3mn residential units need to be built in Iraq to support the nation’s growing population, which surpassed 40mn at end-2020. An approval to build 250k houses, with an initial allocation of USD 1bn, is still on hold as funds have not yet been released.

- Iraq customs exempted imports from Jordan from customs duties as of March 31st.

- Jordan’s government announced new Covid19 stimulus measures, valued at JOD 488mn (USD 632mn or 1.4% of GDP). This includes JOD 240mn injected into the market, expansion of social protection programmes by JOD 60mn, deferring installments owed to public credit funds until the end of the year and JOD10mn towards the industrial sector among others.

- GDP in Jordan fell by 1.6% yoy in 2020 (2019: +2.1%), with hotels and restaurants the worst hit sector (-8.8%), followed by transport, storage and communications (-5.7%), social and personal services (-4.1%) as well as the construction sector (-3%).

- Jordan’s National Aid Fund is transferring financial assistance to nearly 300,000 families as part of government’s regular assistance programmes. The beneficiaries, constituting 20% of families in Jordan, received an estimated JOD 50mn of financial support in March.

- Kuwait passed bills guaranteeing local bank loans for SMEs affected by the pandemic and also one deferring loan payments for citizens for 6 months.

- Public sector employees in Kuwait reached 420,800 in 2020, up 11.4% since 2016; about 77% of the employees are citizens. Expat workers in the public sector were from non-GCC Arab nations (42.6%), followed by Asia (38.7%) and GCC (7.4%).

- Lebanon’s central bank is scheduled to meet with the restructuring company Alvarez & Marsal on Apr 6 to discuss the forensic audit. The company had pulled out of the audit process in Nov last year, having not received the requested information.

- Lebanon’s subsidy program under pressure: with the central bank having only around USD 1bn in cash and USD 5.5bn in Eurobonds (valued at USD 650mn in the market), the government needs to finalise a plan to lift subsidies and issue prepaid cards for families-in-need (estimated at 800k). The cost of the subsidy program is around USD 500mn each month.

- The Parliament in Lebanon approved a USD 200mn loan for fuel imports for power generation.

- Daily average oil production in Oman marginally declined by 0.93% mom to 949,600 barrels per day in Feb; this compares to average output of 950.700 bpd in 2020. Oil output in Oman fell by 1.9% to 56.301mn barrels in Jan-Feb 2021 while oil exports fell by 3.8% yoy to 45.124mn barrels during the same period. While oil exports to China dropped (-6.8% to 38.374mn in Jan-Feb), oil exports to India increased almost 6-fold (to 5.69mn barrels).

- Oman’s oil & gas activities will be zero-rated for Value Added Tax only for the upstream and midstream segments. More clarity is needed on the applicability of VAT for the oil and gas sector, especially if downstream elements (i.e. refining and petrochemicals) will be standard rated at 5% VAT.

- Qatar’s GDP contracted by 3.9% yoy and 0.5% qoq in Q4 2020: activity in the transportation and storage sector plunged by 32.8% while construction dropped by nearly 5%.

- The World Bank approved an additional USD 9mn in funds to the Innovative Private Sector Development Project, to support startups and SMEs in Palestine. According to the World Bank, nearly half of all Palestinian firms are expected to witness a 50% drop in production and sales and lay off 24% of their employees due to the impact of Covid19. Separately, the World Bank will transfer funds worth USD 245mn to about one million Tunisians as part of the Social Protection Emergency Project.

Saudi Arabia Focus

- Saudi Arabia’s Shareek programme plans SAR 27trn worth domestic investments by 2030, including SAR 5trn from firms like Aramco and SABIC (expected to contribute 60% of the SAR 5bn), SAR 3trn from the Public Investment Fund and SAR 4trn under a new Saudi investment strategy. Job creation is a key goal, as well as raising the contribution of the private sector to GDP by 65% by 2030. If implemented successfully, this should be strongly supportive of non-oil growth and increase overall productivity growth.

- Companies like Aramco and SABIC agreed to reduce dividends and redirect funds to support the domestic capital spending plan. Though government revenues would decline given the diversion of dividends, the government can cut some of its investment programmes, in favour of investment programmes to be undertaken by Sabic, Aramco and other entities. This switch is likely to increase the efficiency of investment since SABIC, Aramco and other entities would aim to earn a market return on their investments. This would cut waste and inefficiencies, an overall gain to the economy. In return, “we’re going to give them subsidies, we’re going to change the laws as they wish and we’re going to do their wish list to make that happen”, stated the Crown Prince.

- The “Made in Saudi” initiative aims to create 1.3mn jobs in the mining and industrial sectors, raise non-oil exports to 50% of total (from 25% currently) and non-oil sector’s contribution to 65% (from 40%), revealed the minister of industry.

- FDI inflow into Saudi Arabia increased by 20.2% yoy to USD 5.5bn in 2020, according to the central bank. Separately, foreign reserve assets declined by 11.26% yoy to SAR 1.655trn (USD 441bn) in Deb – the lowest level in over a decade.

- Tadawul collected SAR 5.5bn (USD 1.46bn) in share sale proceeds last year, up 34% yoy (excluding the Aramco IPO), according to the chairman of the CMA. Debt sales surged by 65% to SAR 200bn.

- Foreign investor licenses issued in Saudi Arabia spiked by 52% qoq and 60% yoy to a record high 466 in Q4 2020. Industrial and manufacturing, logistics, retail, e-commerce, and ICT are among the leading industries that attracted FDI in Q4.

- Unemployment rate in Saudi Arabia declined to 7.4% in Q4 2020 (Q3: 8.5%). Unemployment rate among Saudi citizens declined to 12.6% (Q3: 14.9%). Female unemployment was running close to 50% for the 20-24 age group in Q3 and close to 20% for males in the same age group.

- The average monthly wage of Saudi employees grew by 5.7% qoq to SAR 10,540 in Q4 2020. Male employees saw wage increase of 5.6% to SAR 10,967 while women’s wages rose by 3.1% to SAR 8,951.

- The value of awarded contracts in Saudi Arabia jumped by 115% qoq to SAR 16bn (USD 4.3bn) in Q4, bringing the overall 2020 number to SAR 80bn.

- The mortgage market in Saudi Arabia remains strong: new housing contracts were up by 28% yoy to 26,800 in Feb, with their value at more than SAR 14bn (USD 3.7bn).

- Saudi Arabia will provide Yemen’s internationally recognised government with USD 422mn worth of petroleum products as the country struggles with a fuel shortage.

- Only vaccinated persons will be allowed to visit the holy cities of Makkah and Madina to perform Hajj and Umrah this year. However, those wishing to perform Umrah during Ramadan this year will not have to be vaccinated (as clarified on Twitter).

- Saudi Arabia plans to vaccinate all its residents before the end of the current year, disclosed the minister of commerce and acting minister of media.

UAE Focus![]()

- UAE will begin manufacturing the “Hayat-Vax” Covid19 vaccine as a joint project between UAE’s Group 42 and China’s Sinopharm CNBG. An initial capacity of 2mn doses per month is expected in cooperation with Julphar while a larger vaccine plant at Kizad (to become operational later this year) will aim to produce 200mn doses per annum.

- Dubai aims to boost the contribution of the creative and arts sector to overall GDP from 2.6% to 5% alongside a doubling of companies to 15k.

- Consumer confidence index in Dubai climbed to 145 points in Q1 2021 (Q4: 142, Q1 2020: 139) – the highest since Q2 2015, according to the Dubai Economy. Optimism was also strong as per McKinsey’s latest survey, which showed that 74% of UAE respondents were optimistic of a growth bounce back in 2-3 months to just as strong or stronger than pre-Covid levels (vs. 24% unsure and only 2% pessimistic).

- The Abu Dhabi Fund for Development, in its 2021 budget, allocated AED 735mn (USD 200mn) to the Abu Dhabi Export Office to support UAE’s exports via more financing as well as attracting buyers in target economies.

- Abu Dhabi’s ADNOC started trading futures contracts for Murban crude, its biggest oil grade, on an Abu Dhabi exchange from last week. Adnoc, which can produce about 2mn barrels of Murban crude a day, pledged to guarantee at least 1mn barrels of daily exports to support trading on the exchange.

- Petrol prices in the UAE have been increased for the second consecutive month in Apr: it increased by around 8% to AED 2.17 to 2.29 per litre (depending on the grade).

Media Review

WEF’s Global Gender Gap Report 2021

https://www.weforum.org/reports/global-gender-gap-report-2021

Ensuring a Stronger and Fairer Global Recovery

https://www.project-syndicate.org/commentary/policies-for-rapid-inclusive-sustainable-global-recovery-by-mohamed-a-el-erian-2021-04

How Europe has mishandled the pandemic

https://www.economist.com/leaders/2021/03/31/how-europe-has-mishandled-the-pandemic

Lebanon’s economic crisis: A tragedy in the making

https://www.mei.edu/publications/lebanons-economic-crisis-tragedy-making

Biden throws weight of US government behind clean energy

https://www.ft.com/content/33bcf3fc-bc44-4fe0-b1ff-4ec2dbb4168d