Download a PDF copy of this week’s insight piece here.

Chart 1. Saudi Arabia’s Shareek investment package to jumpstart the economy

- The Shareek strategy (SAR 27trn stimulus over the coming decade) aims to jumpstart and shift expenditure patterns post-Covid by emphasizing investment vs consumption spending (incl.govt current spending), while implementing diversification. As proposed, the plan should be strongly supportive of non-oil growth, increase overall productivity growth and lead to job creation.

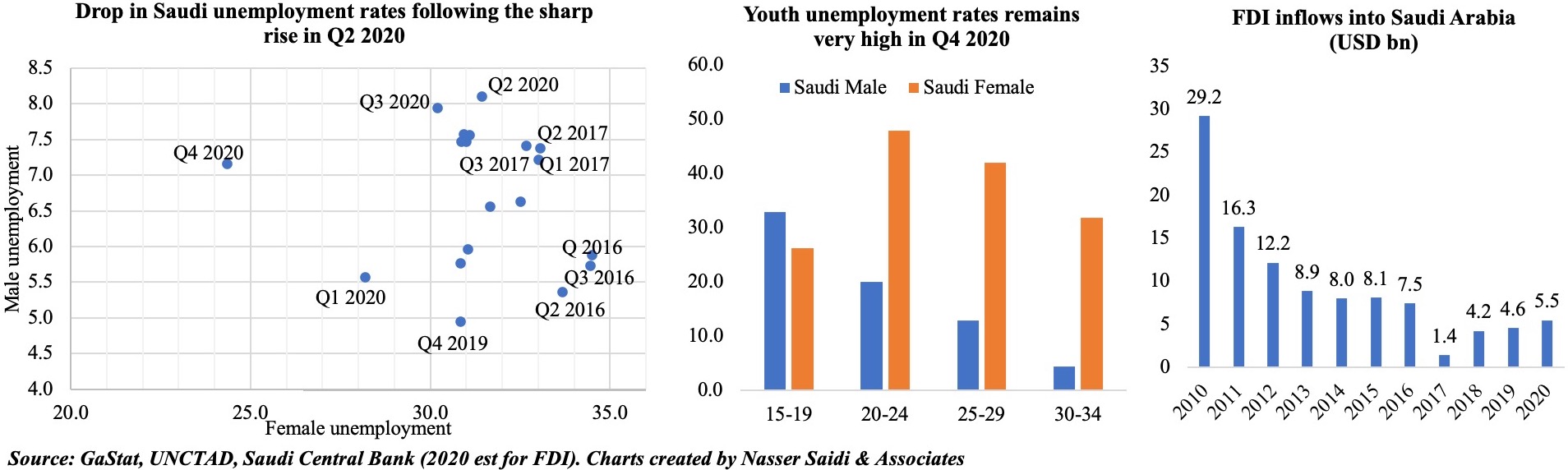

- Jobs are one of the biggest concerns for the country: female unemployment was running close to 50% for the 20-24 age group in Q3 & close to 20% for males in the same age group. It has come off highs earlier in 2020, but remains one of the highest in the region

- FDI has improved massively from the fall to USD 1.4bn (0.2% of GDP) in 2017; according to the Saudi Central Bank’s estimates, overall FDI reached USD 5.49bn in 2020 (+20% yoy, still below 1% of GDP).

- Saudi Arabia has been aggressively courting foreign investors: revamped over half of the 400 FDI regulations, introduced new laws (e.g. bankruptcy, PPP) and recently stated that presence of firms’ regional HQs in Saudi would become a necessary condition to bid for government contracts.

- FDI inflows would be directed away from oil & gas into more job creating & higher value-added sectors (e.g. renewable energy and clean tech, ‘clean’ petrochemicals, desert agriculture & AgriTech, digital economy). Potentially, this revival of investment and a successful program could attract back a fraction of Saudi private wealth held offshore (estimated at 56% of GDP).

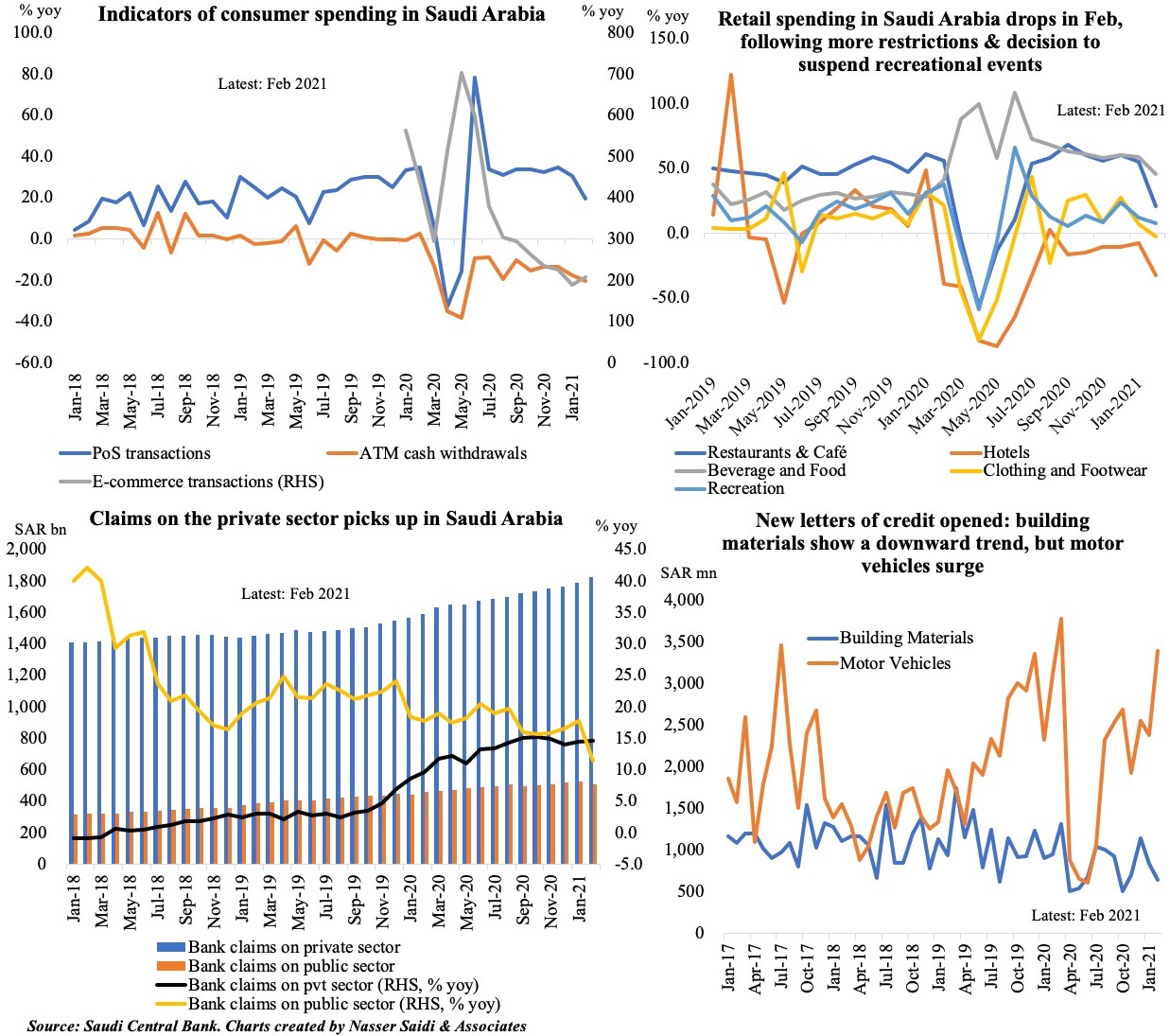

Chart 2. Monetary indicators in Saudi Arabia: PoS & e-commerce transactions and claims on the private sector rise in Feb

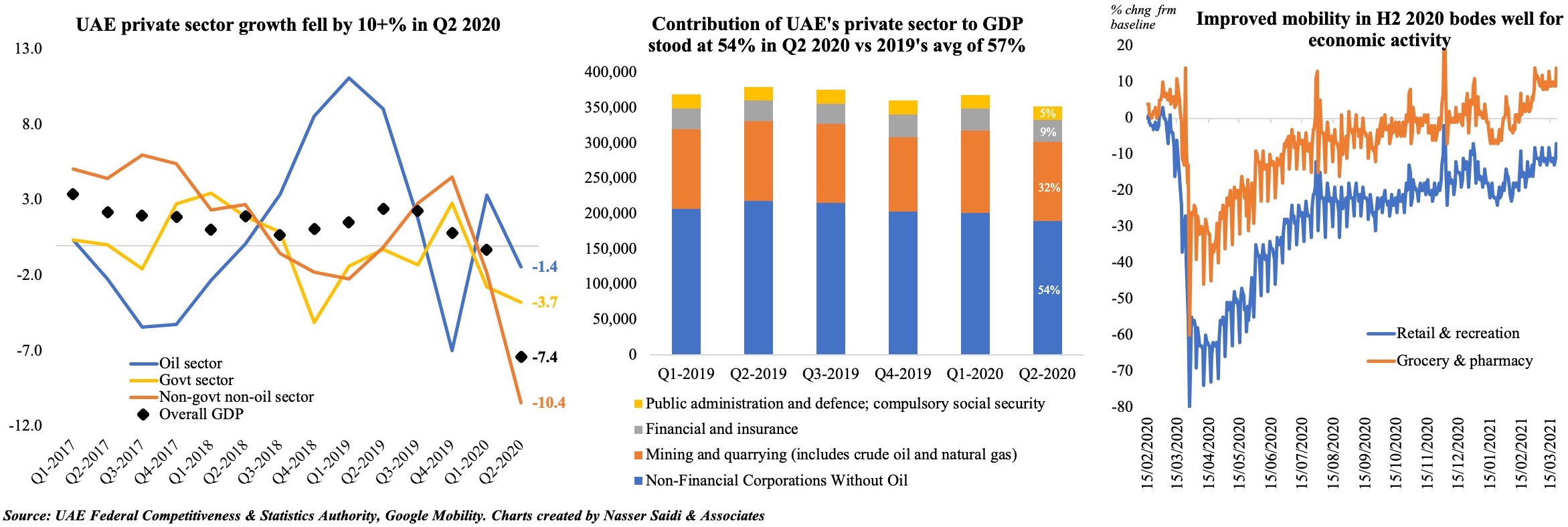

Chart 3. Overall GDP in UAE contracted by 7.4% yoy in Q2 2020; recovery expected in H2

- New data: Non-oil GDP fell by 9.9% in Q2 2020, following a 1.9% decline in the previous quarter. Finance and insurance was the lone sub-sector to post growth in Q2.

- Stringency was the highest and mobility lowest in Q2. Mobility data shows improved activity in H2 of 2020, which bodes well for GDP. UAE’s PMI, which averaged 50.2 in H2 2020 (vs 47.1 in Q2 and 47.5 in H1), also indicates a faster recovery in H2. Faster vaccination rollout and the Expo later this year will result in increased consumer and business confidence.

- With an aim to grow faster in the post-Covid world, the UAE has been proactively announcing reforms: with the latest industrial strategy (“Operation 300bn”), Dubai’s 5-year plan to increase trade to AED 2trn and its 2040 urban development plan alongside various incentives to attract high-skilled professionals (10-year visas, remote working visas, path to citizenship etc.)

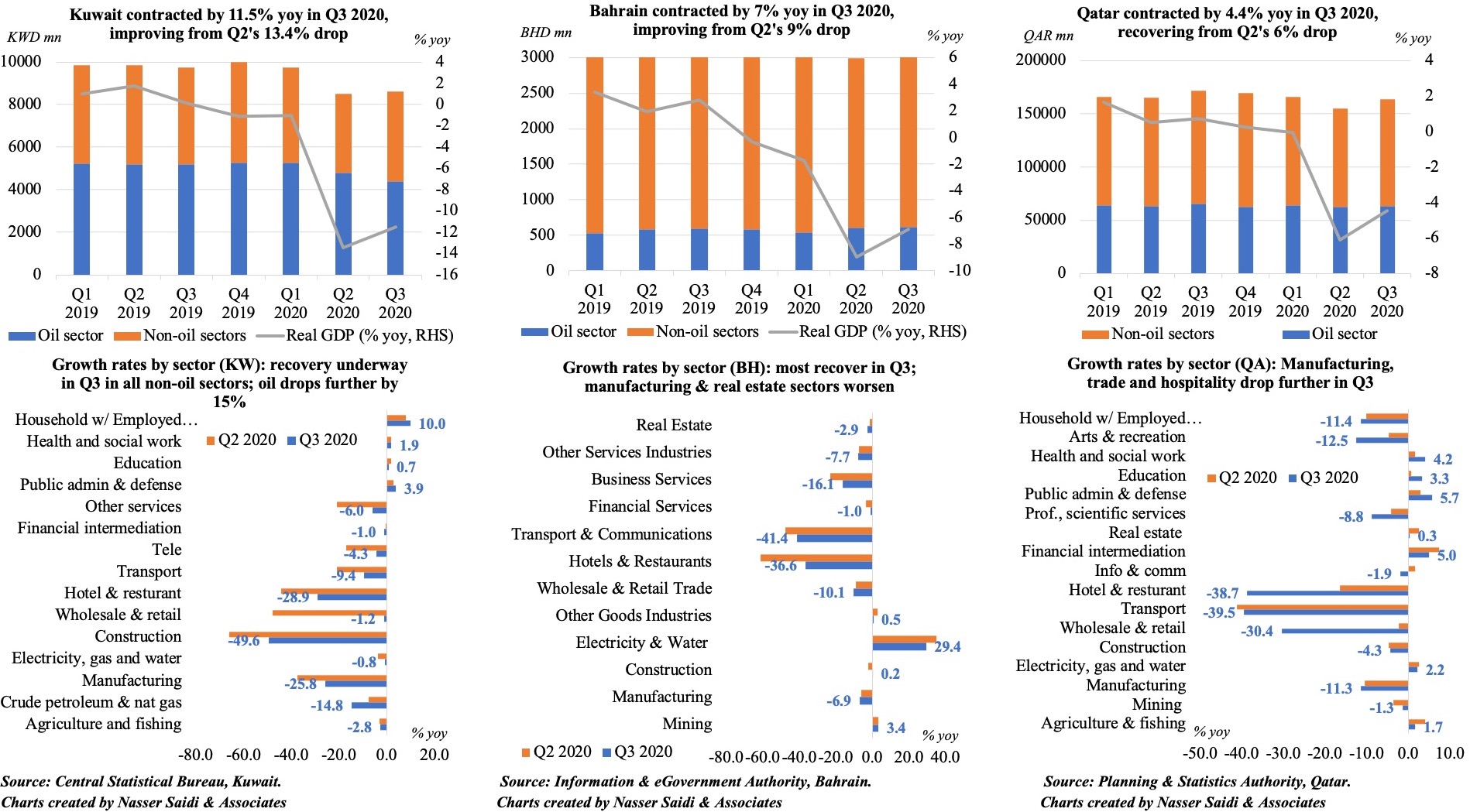

Chart 4. Q3 GDP data from other GCC nations suggest better quarters ahead for the UAE – the least restrictive of all

While overall % yoy GDP improved in Q3, some sectors (including oil, given OPEC+ cuts & others like trade, hospitality) contracted even more

Powered by: