Markets

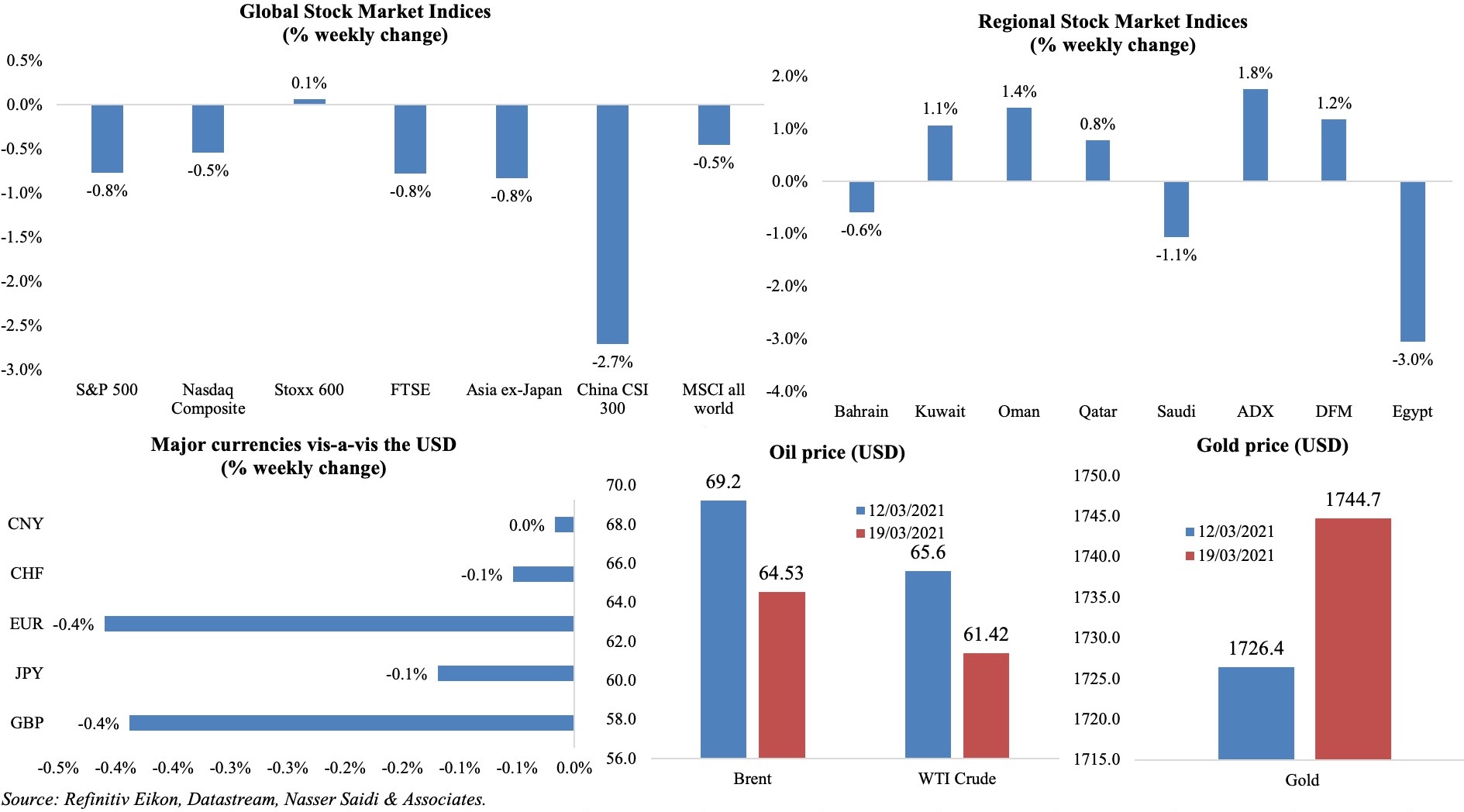

Equity markets across the globe were mostly down last week (as the rise in bond yields to 14-month highs exerted pressure); European markets concerned about fresh lockdowns and vaccination pace, while the rough start to high-level US-China talks also weighed on investor sentiment; MSCI world stocks fell from 1-month highs. Regional markets were mixed, with Saudi pulled down by its banking stocks and Egypt ending the week lower pressured by Eastern Company (the country’s top cigarette maker, dropping by 10% – its biggest intraday fall since Nov). Among currencies, the dollar advanced against major currencies (it is up 2% year-to-date) while oil prices tumbled, erasing 4 weeks of gains on weaker demand fears.

Weekly % changes for last week (18-19 Mar) from 11 Mar (regional) and 12 Mar (international).

Global Developments

US/Americas:

- The Fed kept interest rates unchanged, quashed inflation concerns and maintained a dovish stance. The Fed expects recovery to progress much quicker, forecasting growth of 6.5% this year, up from its prediction of 4.2% in Dec; unemployment rate is estimated to decline from over 6% today to 3.5% in 202

- Industrial production decreased by 2.2% mom in Feb, following 4 consecutive months of gains including Jan’s 1.1% rise, largely due to the severe cold weather spell and input shortages (e.g. semiconductors). Manufacturing fell by 3.1% mom, largely due to the 8.3% plunge in motor vehicles and parts. Capacity utilization slipped to 73.8% from Jan’s 75.5%.

- Retail sales in the US dropped by 3% mom in Feb (Jan: 7.6%), also affected by the unusually cold weather spell: motor vehicle sales were down by 4.2%, clothing sales lower by 2.8% and even online sales plunged by 5.4%. Excluding autos, retail sales fell by 2.7% from +8.3% the month before.

- Building permits tumbled by 10.8% mom to a seasonally adjusted annual rate of 1.682mn in Feb, following Jan’s 15-year high. Housing starts slipped by 10.3% mom and 9.3% yoy to 1.421mn – the lowest level since last Aug. The 30-year fixed-rate mortgage rose to an eight-month high of 3.05%.

- Initial jobless claims unexpectedly increased to 770k in the week ended Mar 13, rising from an upwardly revised 725k the prior week, with the 4-week average slowing to 746.3k. Continuing claims fell to 4.124mn in the week ended Mar 6 (vs the previous week’s 4.144mn).

Europe:

- Inflation in the eurozone remained stable at 0.9% yoy in Feb, while core inflation eased to 1.1% (Jan: 1.4%). The highest contribution to inflation came from food, alcohol and tobacco (1.3%), followed by services (1.2%) and non-energy industrial goods (1%), while energy prices remained lower (-1.7%).

- Germany’s producer price index inched up by 0.7% mom and 1.9% yoy in Feb, with energy prices up by 3.7% yoy and 1.3% mom. Prices of intermediate goods increased by 3.8% vs Feb 2020 – the highest yoy price rise since Nov 2017.

- German ZEW survey showed an upturn in economic sentiment to 76.6 in Mar (Feb: 71.2) while the current situation also turned more positive (-62 from -67.2 in Feb). In the eurozone’s ZEW survey, economic sentiment increased to 74 in Mar, from Feb’s 69.6 – this was almost 20 points higher than in Dec 2020.

- Labour cost in the euro area and EU increased by 3% and 3.3% respectively in Q4 (Q3: 1.6% and 1.8%). In both areas, the non-wage component moderated growth in hourly labour costs, due to the government’s tax reliefs and subsidies.

- The Bank of England kept interest rates unchanged at a record low 0.1% and left unchanged the size of its GBP 895bn bond-buying programme. While positive that the country’s vaccination drive was likely to speed up recovery, the apex bank still stated that “the extent to which that news changed the medium-term outlook was less clear”.

- Public sector borrowing in the UK touched GBP 19.1bn (USD 26.6bn) this Feb – the highest ever for Feb – bringing the 11-month total to GBP 279bn. Net debt climbed to GBP 2.13trn, to 97.5% of GDP, the highest level since the early 1960s.

Asia Pacific:

- China’s fixed asset investment surged by 35% yoy to CNY 4.52trn in Jan-Feb (2020: 2.9%); public and private investment were up by 32.9% and 36.4% yoy respectively. In Jan-Feb 2020, fixed asset investment had plunged by a record 24.5%.

- Industrial production in China accelerated by 35.1% yoy in Jan-Feb (Dec: 7.3%), partly due to the last year’s low base. Retail sales surged by 33.8% yoy, following Dec’s 4.6% increase and the 20.5% plunge during the same period a year ago. Also, urban unemployment rose to 5.5% in Feb, up from 5.2% in Dec.

- The Bank of Japan kept overnight interest rates on hold at -0.1% and will continue to peg 10-year bond yields at “around zero” though it will be allowed to fluctuate by ±0.25% versus ±0.2% previously. The bank launched a scheme to subsidise bank profits and removed a pledge to buy equities at an annual pace of JPY 6trn, in its quest towards a more “sustainable” policy.

- Inflation in Japan inched up by 0.2% yoy in Feb (Jan: 0.1%), mainly due to an uptick in energy prices. Excluding fresh food, prices fell by 0.4% (Jan: -0.6%).

- Japan’s core machinery orders fell by 4.5% mom in Jan – the first drop in 4 months – after posting a 5.2% uptick in Dec.

- The final estimates of industrial production in Japan showed a decline of 5.2% yoy in Jan versus initial estimates of -5.3% and Dec’s -2.6%.

- Exports from Japan declined by 4.5% yoy in Feb (Jan: 6.4%), as exports to the US declined by 14% (due to lower automobile, airplane parts and motors exports) while exports to China rose by 3.4%. Imports grew by 11.8% (Jan: -9.5%), the first annual gain in 22 months, bringing the trade surplus to JPY 217.4bn (USD 2bn).

- Wholesale price inflation in India ticked up to a 27-month high of 4.17% yoy in Feb (Jan: 2.03%), with food and fuel inflation at 1.36% and 0.58% yoy after months of softening. Core inflation rose further to a series high 5.5% in Feb.

- India’s trade deficit widened to USD 12.62bn in Feb as exports grew marginally by 0.67% while imports were up by 7% (oil imports declined 16.63%). For the period Arp-Feb, exports contracted by 12.33% and imports fell by 23.1%.

Bottom line: An ‘exponential’ resurgence in Covid19 cases (in India, Europe) has brought back lockdown measures; the slow pace of vaccination given delivery delays and fears over possible side effects are throwing a spanner into the revival of demand. Last week’s central bank meetings saw the Fed’s dovish stance on the one hand, while emerging markets, on the other, were not afraid to tackle inflationary pressures head on: Brazil, Turkey (the central bank governor was sacked after the hike) and Russia all hiked interest rates last week.

Regional Developments

- Contracts awarded by the Bahrain Tender Board declined by 14.6% yoy to BHD 1.6bn (USD 4.1bn) last year from 1688 tenders (-2.4%); the construction and engineering industry topped the charts, with 317 tenders worth USD 7mn.

- Payments through Bahrain’s Electronic Fund Transfer System (EFTS) surged by 292% yoy to over BHD 16bn (USD 42.4bn) last year. Transactions via the national electronic wallet, BenefitPay, increased by 794% in volume with total value above BHD 3bn (+539%) in 2020.

- A finance ministry official disclosed that Bahrain has set up a new office for debt management (its current government debt constitutes around 118% of GDP) and a ministerial committee was also formed to reduce spending and increase revenues.

- The Bahrain Bourse listed new government development bonds issued by the central bank. The BHD 200mn issue, with March 14 as its start date, will mature in six years and has an annual fixed return of 4% on these securities.

- A total of 5k Bahrainis joined 2465 companies in the private sector this year under the umbrella of the National Employment Programme 2.0. The program aims to find jobs for 25k Bahrainis this year and train 10k.

- Egypt’s central bank left rates on hold at the meeting last Thursday: overnight lending rate was left at 9.25% and the overnight deposit rate at 8.25% for a third consecutive time. The apex bank set a domestic inflation target of 7% (±2 ppts) on average until Q4 2022.

- Egypt central bank’s new mortgage finance initiative supports low- and middle-income earners have access to mortgage loans at a rate of 3% with a 30-year repayment period. Low- (middle-) income people with a maximum monthly income of EGP 4000 (EGP 10000) for individuals and EGP 6000 (EGP 16000) for families can get a mortgage to buy a house with a maximum value of EGP 350k (EGP 1mn).

- Expenditures in the fiscal year 2021-22 is expected to rise by 9% yoy in Egypt, according to the finance minister; overall budget deficit will be lowered to 6.6% of GDP while a primary surplus is expected, of around 1.5% of GDP.

- Egypt’s president increased the minimum wage for public sector employees to EGP 2400 (USD 152) in the fiscal year 2021-22; furthermore, two bonuses were approved (cost of EGP 7.5bn) and value of pensions were hiked by 13% (total cost of around EGP 31bn).

- Bilateral trade between Egypt & France grew by 20% yoy to USD 3bn in 2020; this is expected to grow further by 10-15% this year.

- Egypt’s food exports to Kenya grew by 111% between 2014 and 2020 totaling USD 419mn during the period. Food exports stood at a record high USD 89mn in 2019, before dropping to USD 73mn in Covid19 hit 2020.

- Remittances into Egypt increased by 10.5% yoy to USD 29.6bn in 2020, after the final quarter saw a 7% yoy uptick in inflows to USD 7.5bn. Separately, Egypt’s foreign exchange reserves increased by USD 100mn to USD 2bn in Feb.

- A USD 50mn financing agreement between Egypt and the Arab Fund for Economic and Social Development to support MSMEs, signed in Jan, was approved last week. The funds will be put towards offering new vacancies, lowering the unemployment rate and raising production.

- Hotel occupancy in Egypt is forecast to be between 35-62% this year, according to Colliers.

- Egypt petroleum ministry disclosed plans to produce 7.2bn cubic feet of natural gas per day in 2021-22; compares to production levels of around 6.6bn cubic feet per day in 2020.

- Iraq will allow the trade ministry to procure strategic commodities – part of the rationing programme – through direct purchase agreements.

- Iraq’s Budget Law for 2021 will include a privatisation programme for some state-owned assets. A financial advisor to the government revealed that more than 100 such assets were idle since 2003 and that salaries and wages of 450k unemployed workers were still being paid.

- Jordan is scheduled to receive 10.2mn doses of Covid19 vaccines this year, disclosed the PM’s office.

- Trade deficit narrowed by 16.5% yoy to JOD 6.438bn in Jordan last year, as exports dropped by 4.5% while imports inched up by 1%.

- Jordan’s first Green Climate Fund project approved: the USD 33.2mn project is to build climate resilience in the country via better water management practices.

- Revenues from Jordan’s free zones grew by 6% yoy to JOD 19.768mn in 2020, as the number of registered firms ticked up by 7% to 2806 and the number of investors in the free zones grew by 5%.

- The Lebanese pound touched a record high of 15k vis-à-vis the dollar on the black market on Tuesday last week. So, on Friday, the Central Bank decided to launch its own electronic currency exchange platform to register all transactions along with the commercial banks and licensed exchange dealers.

- Another meeting is scheduled between Lebanon’s President and PM designate on Monday, following Thursday’s meeting. The PM designate stated that the only way forward, to “prevent the collapse”, was forming a government that could re-engage with the IMF.

- Lebanon’s government and the Central Bank agreed in principle to disburse the World Bank’s USD 246mn cash assistance to poor families in USD instead of

- VAT will be introduced in Oman from Apr 16, according to the Oman News Agency. VAT is estimated to contribute 1.5% towards GDP, raising OMR 400mn per year.

- Oman is aiming to provide 250k doses of Covid19 vaccine by end-Mar and over 5 mn doses by end of this year, disclose a health ministry official.

- Total electricity produced in Oman ticked down by 2% yoy to 37,961.6 GW per hour at end-Dec 2020 while water production increased by 6.4%.

- Reuters reported that Qatar’s trade minister will chair the board of the Qatar Financial Centre in a restructuring approved by the council of ministers.

- China’s crude oil imports from Oman and UAE surged by 30% yoy to 7.78mn tonnes and 61% to 5.25mn tonnes respectively in the two months of Jan-Feb 2021.

- The e-commerce market in the region is estimated to grow by more than 1/3-rd to an estimated USD 30bn this year, from 2020’s USD 22bn, according to a Wamda-MIT report. Saudi Arabia, Egypt and UAE form 80% of the region’s overall e-commerce market.

Saudi Arabia Focus

- Saudi Arabia’s GDP declined by 3.9% yoy in Q4 last year, with oil sector contracting by 8.5% and non-oil by 0.8%. Overall GDP declined by 4.1% in 2020, driven by substantial drops in both oil and non-oil sector acivity (at -6.7% and -2.3% respectively). By economic activity, mining and quarrying sector accounted for 44% of overall GDP in 2020 (growing by 0.8% yoy) though the finance insurance and business services (share of 6.1%) grew the fastest, up by 1.3%.

- Saudi Arabia approved the Private Sector Participation (PSP) law, aimed to increase private sector activity while reducing government’s capital spending and distributing risk between the private and public sector. About 16 sectors have been identified for privatization including education (target of 60 schools), utilities, health and transportation.

- Inflation in Saudi Arabia eased to 5.2% yoy in Feb (Jan: 5.7%), the lowest rate since Jun: food and beverage prices were up by 11.2% yoy – an 8-month low – while transport prices increased by 9.8%.

- Saudi wholesale price index increased by 7.3% yoy and 1.5% mom in Feb, driven by higher prices of metal products, machinery, and equipment (+9% yoy).

- Saudi Arabia’s Kafalah programme issued USD 3.3bn in loan guarantees last year, responding to 5720 requests. In Q4 alone, the number of loan guarantees were up by 106% yoy, with total expenditure north of USD 900mn.

- Saudi Customs disclosed that no customs duty would be imposed on travelers’ new personal belongings worth less than SAR 3000 (USD 800) and the threshold for personal shipments is SAR 1000.

- The Saudi Industrial Development Fund (SIDF) approved 212 loans, amounting to USD 4.5bn, to 201 companies last year across various sectors like industry, mining, energy, and logistic services. About 84% of total loans were dedicated to SMEs.

- Crude oil exports from Saudi Arabia rose to 6.582mn barrels per day (bpd) in Jan from Dec’s 6.495mn bpd, according to JODI. Separately, the energy minister revealed the nation’s aim to reduce domestic consumption of liquid hydrocarbons by 1mn bpd for use “in a better way”. This would also increase Aramco’s long-term spare capacity from levels of around 5mn bpd to 2mn bpd historically.

- A “Made in Saudi” program will be launched from Mar 28th, to encourage the use of local products. Such initiatives are aimed at boosting non-oil exports contribution to 50% by 2030.

- Saudi Arabia raised SAR 67bn (USD 2.04bn) this month through the sale of Sharia-compliant bonds, as part of the government’s domestic sukuk programme. The first tranche of SAR 2.71bn matures in 2028 and the second SAR 4.96bn tranche will mature in 2031.

- Saudi Tourism has launched a new initiative called “Tourism Shapers” to support the learning and development of local travel trade partners in the tourism private sector. The “Your Future is in Tourism” campaign aims to create 100k jobs for citizens in the tourism sector this year, and 1mn jobs by the end of 2030.

- Saudi Arabia launched a digital version of the Muqeem, or resident, ID for foreign workers last week, giving access to a variety of e-services.

- Saudi Arabian Airlines (Saudia) signed a financing agreement worth SAR2bn (USD 3bn) to cover its aircraft financing requirements until mid-2024, to fund the purchases of 73 aircrafts it had ordered previously.

- SIPRI data disclosed that while the US accounted for 37% of global arms sales for the period 2016-2020, half of its sales were to the Middle East, with Saudi Arabia alone accounting for 24% of total US arms exports.

UAE Focus![]()

- UAE disbursed more than 7mn Covid19 vaccine doses: 56% of the residents and a much higher 72%+ of senior citizens and those with chronic diseases have received the vaccine.

- The UAE central bank estimates economic growth of 2.5% in 2021, up from last year’s 5.8% dip, with non-oil GDP rising at a faster 3.6% alongside flat oil GDP growth. Next year, growth is forecast at an overall 3.5%, thanks to “continued fiscal spending growth, healthy banks’ credit growth, strong improvement in employment and recovered business sentiment”.

- UAE’s banking system has returned to pre-Covid19 levels, according to the central bank governor. The amount drawn from Targeted Economic Support Scheme (Tess) has declined to AED 22bn from about AED 44bn announced in Q2 last year. More than 325k+ persons have benefitted from Tess and about 175k persons supported by loan deferrals.

- Fund transfers amongst UAE banks totaled AED 745.27bn in Jan 2021. Separately, 771mn cheques worth AED 82.22bn were circulated in Jan, accounting for 8.3% of last year’s total.

- Dubai government announced an additional AED 500mn stimulus package, bringing the total in the emirate to AED 6.8bn. The stimulus initiatives which will be valid till end-2021 includes advertising permit fee exemption for all companies registered with the Dubai Municipality for three months; 6-month licence extension for nurseries, clinics and healthcare professionals; 50% rent reduction for nurseries from the Knowledge Fund Establishment; licence renewal exemption for all nurseries in Dubai; and taxi concession fees reduction.

- Inflation in Dubai declined for the 27th consecutive month, falling by 4.5% yoy and 0.42% mom in Feb 2021. Housing and utilities costs fell by 9.14% while prices of clothing and footwear decreased by 2.57% and food and beverages dropped by 0.43%.

- Dubai dissolved the tribunal for real estate cheque disputes – which had an exclusive jurisdiction to settle complaints related to dishonoured cheques, which were issued by a property purchaser and made payable to a real estate developer, or those cheques issued by those with usufruct rights or with long-term leasehold rights. Another tribunal was set up to resolve disputes between heirs involved in the sale of inherited properties. Once the latter is in operation, other entities like the DIFC Courts cannot deal with such cases.

- Dubai’s weekly property sales surged to AED 5.7bn (USD 1.5bn) in the week ending Mar 18th – the highest this month, up 18.8% from the previous week and 26% from Mar’s 1st

- The Dubai Multi Commodities Centre (DMCC) will establish a regulatory framework for businesses offering, issuing, listing, and trading crypto assets. Bespoke licenses will be issued by the DMCC Crypto Centre to businesses dealing with crypto assets while SCA will issue approvals for crypto-related businesses looking to set up in the free zone.

Media Review

Covid19 cases are on the rise again

https://www.economist.com/graphic-detail/2021/03/19/covid-19-cases-are-rising-again-in-much-of-the-world

The ECB’s economy-wide climate stress test

https://www.ecb.europa.eu/press/blog/date/2021/html/ecb.blog210318%7E3bbc68ffc5.en.html

Who Is Making Sure the A.I. Machines Aren’t Racist?

https://www.nytimes.com/2021/03/15/technology/artificial-intelligence-google-bias.html

At the pandemic’s first anniversary, is Asia back to full health?

https://blogs.imf.org/2021/03/17/the-future-of-asia-what-a-difference-a-year-can-make/

Credit-Rating Agencies Could Derail Economic Recovery

https://www.project-syndicate.org/commentary/credit-rating-agencies-could-derail-economic-recovery-by-jayati-ghosh-2021-03