Download a PDF copy of this week’s economic commentary here.

Markets

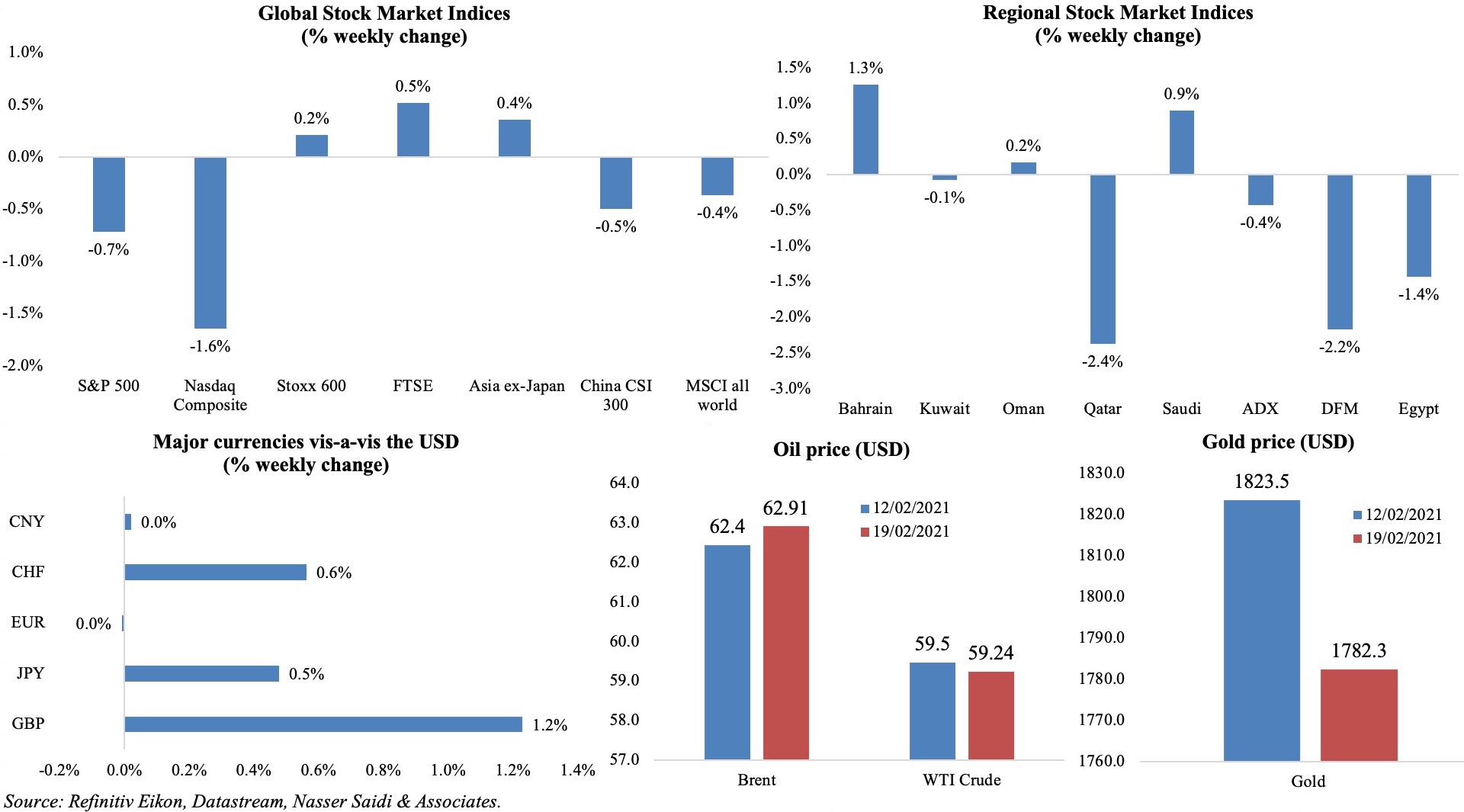

Global equity markets were muted, as the fear of inflation debate continues to gain ground; Japanese stocks rose to a 30-year high during the week while Saudi Arabia’s stock market crossed the 9,000 mark for the first time since Jul 2019. The GBP hit USD 1.40, a near three-year high, given the pace of its vaccination program amid lockdown while the Turkish lira continues to rally (+6% in 2021). Brent oil price topped USD 65 (given the deep freeze in Texas) and saw some profit-taking, gold price fell and copper price surged to its highest in more than 9 years while Bitcoin hit a market cap of USD 1trn on Fri (chart on global asset performance: tmsnrt.rs/2yaDPgn).

Weekly % changes for last week (18-19 Feb) from 11 Feb (regional) and 12 Feb (international).

Global Developments

US/Americas:

- US industrial production inched up by 0.9% mom in Jan, rising for the 4th consecutive month, after Dec’s uptick of 1.3%. Capacity utilization increased to 75.6% from 74.9% in Dec.

- Retail sales in the US increased by 5.3% mom in Jan (Dec: -1%), the most in seven months, thanks in part to the stimulus cheques of up to USD 600. Excluding autos, retail sales grew by 5.9% mom, while sales at non-store retailers (including e-commerce) surged by 11%.

- US PPI inched up by 1.3% mom in Jan (Dec: 0.3%), recording the largest advance since the index began in Dec 2009. Excluding food and energy, PPI grew by 0.8% from 0.5% in Dec.

- Building permits in the US surged by 10.4% yoy to a seasonally adjusted 1.881mn in Jan this year: this was the strongest gain since May 2006, thanks to a jump in permits for buildings with 5 units or more (+28% to 557k). Housing starts declined by 6% to 1.58mn.

- Existing home sales inched up by 0.6% mom to 6.69mn units in Jan; lack of supply continues with just a 1.9-month supply available at the current sales pace (versus a 3 month supply a year ago). This has been pushing prices higher, with the median price of an existing home sold in Jan at $303,900, up1%% yoy.

- Markit manufacturing flash PMI slowed down to 58.5 in Feb (Jan: 59.2) while services business activity reading improved by 0.6 points to 58.9 – the highest reading since Mar 2015.

- Initial jobless claims increased to 861k in the week ended Feb 12 from an upwardly revised 848k the prior week, with the 4-week average slowing to 833.25k. Continuing claims slowed to 4.494mn in the week ended Feb 5 from 4.56mn the week before.

Europe:

- GDP in the eurozone declined by 0.6% qoq and 5% yoy in Q4, upwardly revised vs preliminary estimates (-0.7% qoq and -5.1%) though worse compared to Q3’s rebound of 12.4% qoq. Overall, the first estimate for GDP in 2020 stood at a 6.8% decline.

- German ZEW survey showed an upward surge in economic sentiment to 71.2 in Feb (Jan: 61.8), largely due to expectations of a recovery in consumption and retail trade in line with the vaccine rollout while the current situation reading was more subdued, slipping to -67.2 from the previous month’s -66.4. The ZEW economic sentiment in the eurozone jumped to 69.6 in Feb (Jan: 58.3). Additionally, inflation expectations also increased sharply.

- The flash Markit manufacturing PMI in Germany inched up to 60.6 in Feb, following Jan’s 57.1 reading. However, services slipped to 45.9 from 46.7 in Jan given the continued containment measures. The survey results also showed average charges for goods and services rising at the quickest rate since Aug 2019.

- Eurozone’s flash manufacturing PMI increased to a 36-month high of 57.7 in Feb (Jan: 50.8) while services PMI, in contrast, fell to 44.7 (Jan: 45.4). Composite PMI remained below-50 for the 4th consecutive month, though nudging up to 48.1 in Feb (Jan: 47.8).

- Employment in the eurozone increased by 0.3% qoq in Q4, easing from Q3’s 1% rise.

- Trade surplus in the eurozone widened to EUR 29.2bn in Dec (Nov: EUR 25.7bn): exports to the rest of the world grew by 2.3% yoy – the first increase in exports since Feb 20 and intra-EU trade inched up by 0.9% to EUR 148.7bn. For the full year 2020, exports declined by 9.2% and imports by 10.8%.

- Industrial production in the eurozone slipped by 1.6% mom and 0.8% yoy in Dec (Nov: 2.6% mom and -0.6% yoy), with production of capital goods and non-durable consumer goods down by 3.1% and 0.6% respectively.

- Inflation in the UK rose by 0.7% yoy in Jan (Dec: 0.6%), with price rising across many categories including furniture, transport, hotels and food. PPI core output and retail price index both inched up by 1.4% yoy (Dec: +1.1% and +1.2% respectively).

- The impact of UK’s third lockdown was visible in the Jan retail sales numbers: it plunged by 5.9% yoy and 8.2% mom, following Dec’s positive readings of 3.1% yoy and 0.4% mom respectively. Clothing sales were down 35% mom, household goods sales dropped almost 20% while online spending accounted for a record 35.2% of sales.

- UK manufacturing PMI ticked up to 54.9 in Feb, following Jan’s 54.1 reading, thanks to an improvement in new order growth. Services PMI stabilized to 49.7 from 39.5 in Jan though temporary closures lead to weaker sales volumes.

Asia Pacific:

- Japan GDP grew at an annualized 12.7% in Q4 (Q3: 22.7%): growth was up by 0.2% yoy and 3% qoq (Q3: 1.2% and 5.3%). Q4 growth was supported by domestic demand (+2%), private consumption (+2.2%) and net exports (+1%). GDP declined by 4.8% in full year 2020, the first contraction since the 2009 global financial crisis when growth plunged by 5.7%.

- Final data on industrial production in Japan showed a drop by 1% mom and 2.6% yoy in Dec (Nov: -3.2% yoy).

- Exports from Japan grew by 6.4% yoy in Jan (Dec: 2%), posting the sharpest growth since Oct 2018, led by an increase in exports to China (+37.5%) and Asia (+19.4%). Imports declined for the 21st month in a row by 9.5% yoy (Dec: -11.6%), thereby moving the trade balance into a deficit of JPY 323.9bn from a surplus JPY 749.6bn the month before.

- Japan’s core machinery orders unexpectedly increased by 5.2% mom and 11.8% yoy in Dec (Nov: 1.5% mom and -11.3%).

- Inflation in Japan declined by 0.6% yoy in Jan (Dec: -1.2%). Excluding energy and food, prices were up by 0.1%, after 3 straight months of decline including Dec’s 0.4% drop.

- Japan’s composite PMI inched up to 47.6 in Feb (Jan: 47.1), thanks to a stabilisation in new export orders (after 26 months of sub-50 readings) and an expansion in employment levels.

- India’s WPI inflation rose to an 11-month high in Jan, up 2.03% following Dec’s 2.3% uptick.

- Trade deficit in India narrowed to USD 14.54bn in Jan (Dec: USD 14.75bn), as exports (+6.16%) grew faster vis-à-vis imports (+2.03%).

- GDP in Singapore grew by 3.8% qoq in Q4 (Q3: 9%) though contracting 2.4% yoy from the previous quarter’s 5.8% dip. The economy contracted by 5.4% in 2020 – the first annual contraction since 2001.

Bottom line: The latest PMI numbers in Europe continue to highlight the diverging trends between the manufacturing sector and the lockdown-hit services sector; input prices are ticking up, bringing to the forefront discussions on inflationary pressures. Separately, the IIF revealed a record-high global debt of USD 281trn in 2020, which is expected to rise further in 2021. Government debt, which accounted for more than half the increase last year, topped 105% of GDP (2019: 88%). Debt was one of the key discussion points at the G7 Summit last week, where President Biden announced an extra USD 4bn for Covax (to aid vaccine delivery).

Regional Developments

- Bahrain is expected to grow at 3.3% this year (from an estimated 5.4% drop in 2020), according to the IMF, with the non-oil economy rising by a faster 3.9%. In 2020, while overall fiscal deficit increased to 18.2% of GDP, from 9% in 2019, public debt widened to 133% of GDP from 102% a year ago. The IMF called for Bahrain to address “large imbalances, put government debt on a firm downward path, and restore macroeconomic sustainability”. More: https://www.imf.org/en/News/Articles/2021/02/12/pr2138-bahrain-imf-staff-completes-2021-article-iv-mission-to-the-kingdom-of-bahrain

- Exports from Bahrain increased by 25% yoy to BHD 200mn in Jan while imports declined by 9%. Trade deficit narrowed by 27% to BHD 154mn. Top export partners were Saudi Arabia, UAE and Oman, together accounting for more than 45% of total exports.

- Stricter Covid19 containment measures will come into force from today (Feb 21) in Bahrain for 3 weeks: includes work from home policies for government entities, limitations on social gatherings, closure of gyms and sports halls as well as online schooling.

- Egypt’s fiscal deficit declined to 4.4% in the first seven months of the current fiscal year: a primary surplus of EGP 18.1bn (USD 1.16bn) was reported during the period, with an increase of 16% in revenues alongside an increase in expenditures of 12.4%.

- Unemployment rate in Egypt declined to2% in Q4 2020, down by 0.8% yoy and 0.1% qoq. The number of jobless citizens stood at 2.16mn in Q4, part of the overall workforce of 29.96mn persons. Male and female unemployment stood at 5.1% and 16.8% respectively in Q4 (Q3: 5.8% and 15.2%).

- Egypt’s Taaleem Management Services Company is planning its IPO and private placement for subscription offering 8mln shares likely in Mar, reported Al Borsa News.

- Bloomberg reported that Egypt is close to restarting its second LNG plant at the Damietta port. This will be the first shipment since 2012 and is thanks to the resolution of a long-standing dispute over supplies between the government and Union Fenosa Gas.

- Egypt launched the first international tender for petroleum and gas exploration for 2021 in 24 areas in Suez Gulf, western desert and East and West Mediterranean.

- Iraq plans to halve imports of refined products such as petroleum and gas oil by end-2021, with an aim to import no petrol or gas oil by end-2023.

- Crude oil exports from Iraq rose to 3.44mn barrels in the first 14 days of Feb, reported Bloomberg, up 4.4% from Jan and the highest figure on a full-monthly basis since May. If the same pace is maintained through the rest of the month, it may exceed the self-imposed production target of 3.6mn barrels a day.

- Reexports from UAE to Jordan increased by 19% according to preliminary figures for 2020. Trade in Covid19-related products grew by 10% and food products by 12%.

- Inflation in Kuwait increased by 2.1% in 2020, almost double 2019’s 1.1%. Prices were driven up by food costs (+4.9%) while housing costs remained flat.

- The Covid19 vaccination drive in Kuwait shows that 3.7 shots were administered per 100 people: however, only 18k expats were vaccinated compared to 119k Kuwaitis. The health minister stated that 850k citizens (who want to receive the vaccine) would be vaccinated within 3 months as long as supply is not disrupted.

- Kuwait’s central bank reportedly extended its Covid19 support measures until end-Jun.

- The Lebanese pound fell sharply on the black market last week Thurs, as the political uncertainty drags on unresolved, trading near its record low against the dollar.

- A board member of the Association of Banks in Lebanon disclosed that most banks will raise their capital by 20% before the Feb 28 deadline; banks that may not be able to retrieve 3% of their deposits from abroad are likely to have further discussions with BDL officials.

- Saudi Arabia will stop giving government contracts to firms that do not have their regional headquarters in the Kingdom from 2024. Regulations are expected to be drawn up this year.

- Inflation in Saudi Arabia increased to 5.7% yoy in Jan (Dec: 5.3%), given higher food (+12.3%), communication (+13.8%) and transportation (+9.6%) costs.

- Saudi Arabia’s PIF increased its investments in US stocks to about USD 12.8bn as of end-2020 (end-Q3 2020: USD 7.05bn) including more than USD 3bn in three gaming companies. Separately, the sovereign wealth fund plans to establish a major airline company, operating in both domestic and international routes, reported Saudi Gazette.

- Saudi Arabia’s General Authority for SMEs set up a Small and Medium Enterprises Bank – a digital lender, which will provide all of its products and services online – to bridge the financing gap for SMEs.

- Another digital only bank is in the offing in Saudi Arabia: Al Moammar Information Systems Company disclosed to Tadawul that it would be a founding shareholder in a new digital Shariah-compliant bank in the country, contributing SAR 25mn to the bank’s capital.

- The Saudi energy minister warned against “complacency”, urging fellow oil producers to be cautious ahead of the OPEC+ meeting as uncertainty remains high.

- Defence spending in the GCC is set to decline by nearly 10% to USD 6bn this year, and is likely to drop further to USD 89.4bn in 2022, according to global open-source defence intelligence agency Janes. In 2020, defense spending had increased b 5.4% to USD 100bn.

UAE Focus

- UAE has vaccinated over 40% of its population, according to a senior official; it was also disclosed that about half the elderly residents were also vaccinated. As of 20 Feb 2021, the UAE had administered a cumulative 56.15 vaccination doses per 100 people.

- Banks in the UAE returned around AED 14.47bn from the central bank stimulus provided since Mar 2020.

- Abu Dhabi banks invested AED 26.1bn (USD 1bn) in debt securities in 2020, according to central bank data. This accounted for 63.7% of their total balance in investment vehicles.

- Non-oil trade between the UAE and Africa accelerated by 10.3% yoy to USD 40.7bn in Jan-Sep 2020, stated the Minister of State for Foreign Trade ahead of a Forum launch.

- Real estate transactions in Abu Dhabi surged by 28% to AED 74bn (USD 20.14bn) in 2020 from 19k property deals. Of this, value of mortgage deals stood at AED 44bn from 11k transactions.

- Over 4,300 new licences for economic and commercial activities were issued in the first 15 days of Feb, according to the National Economic Register.

- UAE is considering price caps on food items, given the soaring food prices globally amid supply chain bottlenecks. The minister of food and water security stated that caps could be placed on products like chicken and milk and would apply to both local and imported goods.

- Dubai International Airport reported a 70% yoy decline in passenger traffic to 25.9mn last year; this includes Q1’s 17.8mn travelers. India remained the top destination country, with 4.3mn passengers, followed by UK (1.89mn), Pakistan (1.86mn) and Saudi Arabia (1.45mn). In spite of the pandemic, Dubai retained top spot globally in total number of passengers handled, ahead of Heathrow (-73% to 22.1mn).

- As part of its 2018-23 five-year plan, UAE’s Ministry of Energy and Infrastructure is in the process of implementing 129 development projects worth approximately AED 11.8bn.

- DMCC is home to more than 18k member companies, with 2,025 firms having joined in 2020 (given new incentives in light of Covid19); number of Chinese firms increased by 20%.

- Sharjah’s Electricity, Water and Gas Authority (SEWA) announced a 50% discount on the deposit amount of new consumption accounts for residential and commercial entities.

Media Review

In defense of concerns over the $1.9 trillion relief plan: Blanchard

https://www.piie.com/blogs/realtime-economic-issues-watch/defense-concerns-over-19-trillion-relief-plan

Biden’s climate-friendly energy revolution

https://www.economist.com/briefing/2021/02/20/joe-bidens-climate-friendly-energy-revolution

What the future holds for world trade, according to 8 global leaders

https://www.weforum.org/agenda/2021/02/global-trade-wto-ngozi-okonjo-iweala/

“Green bubble” warnings grow: FT

https://www.ft.com/content/0a3d0af8-7092-44c3-9c98-a513a22629be

Climate graphic of the week: Polar vortex sends Texas into deep freeze

https://www.ft.com/content/dc74a4fc-9b24-4e77-a8dd-c055f5e0c884

Powered by: