Download a PDF copy of this week’s insight piece here.

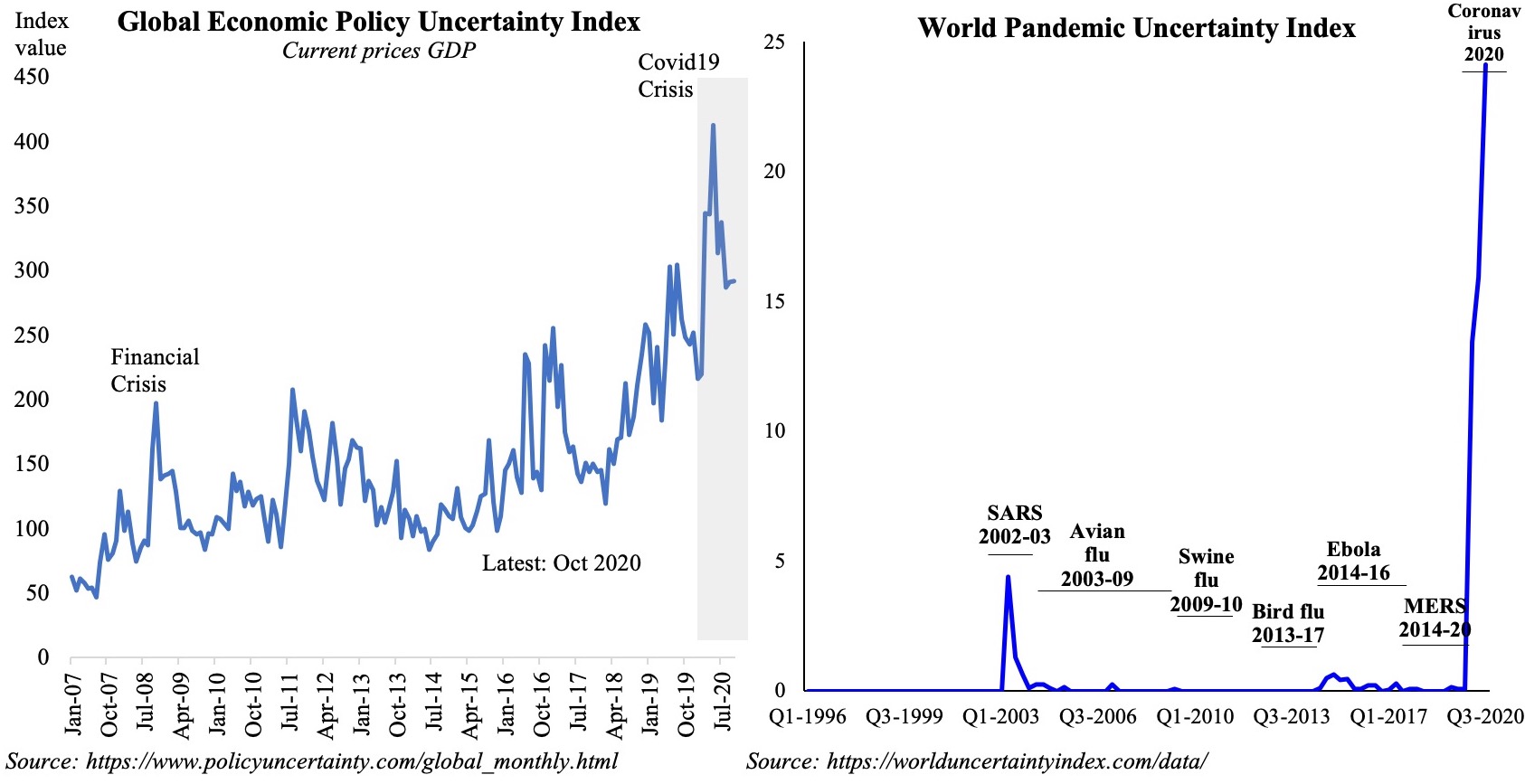

Chart 1: Uncertainty in the time of Covid19

Both Economic Policy Uncertainty and Pandemic Uncertainty indices touched record-highs during the Covid19 crisis. Even with vaccines being rolled out, a new strain of Covid19 in UK has led to stricter lockdown measures, border closures and travel bans.

Policy Uncertainty has been severely high this year, when compared to the global financial crisis or Brexit referendum or the US-China trade war phase. With fiscal and monetary responses continuing to support economies, care should be taken to ease the withdrawal of support in the future.

Countries need to be prepared for a phase of unemployment and wave of business closures when exiting the crisis.

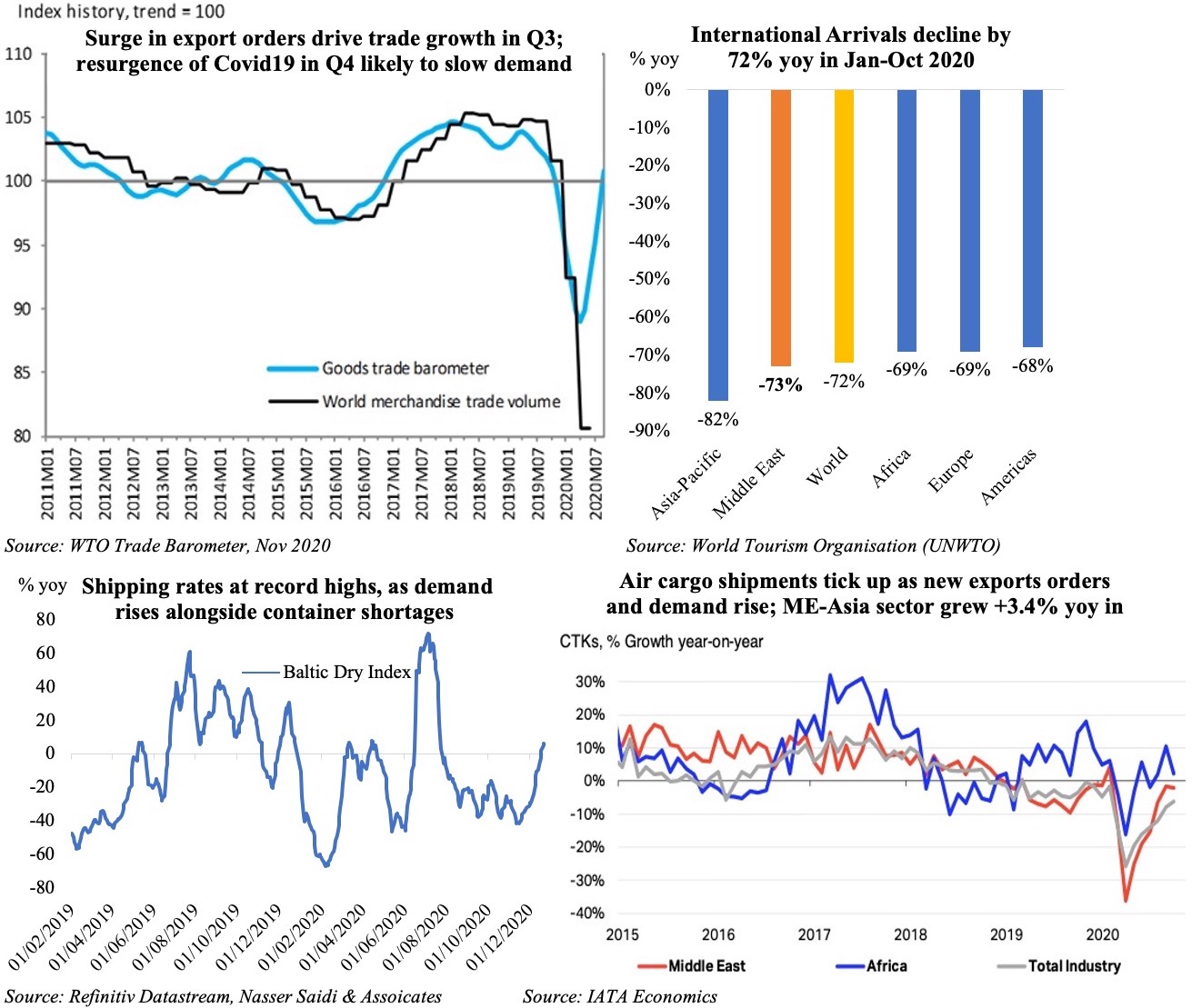

Chart 2: Trade bounced back in Q3, but will the current surge lead to another drop? Tourist Arrivals remain dismal

Trade growth recovered in Q3; but recent surge in cases, a new strain and related closures will likely result in lower demand & dip in trade in Q4.

Meanwhile, thanks to the recovery in new export orders, both shipping & cargo indicators are turning positive.

As international air travel as not picked up, air cargo has suffered, thereby directing demand towards shipping. However, as the holiday season got underway towards end-2020, demand ticked up, but container shortages are leading to higher shipping rates.

Tourism remains unlikely to recover to near pre-pandemic levels till vaccines reach a substantial proportion of global population. Prior to the recent surge in cases, domestic tourism (& therefore air travel) had picked up in Europe and Americas.

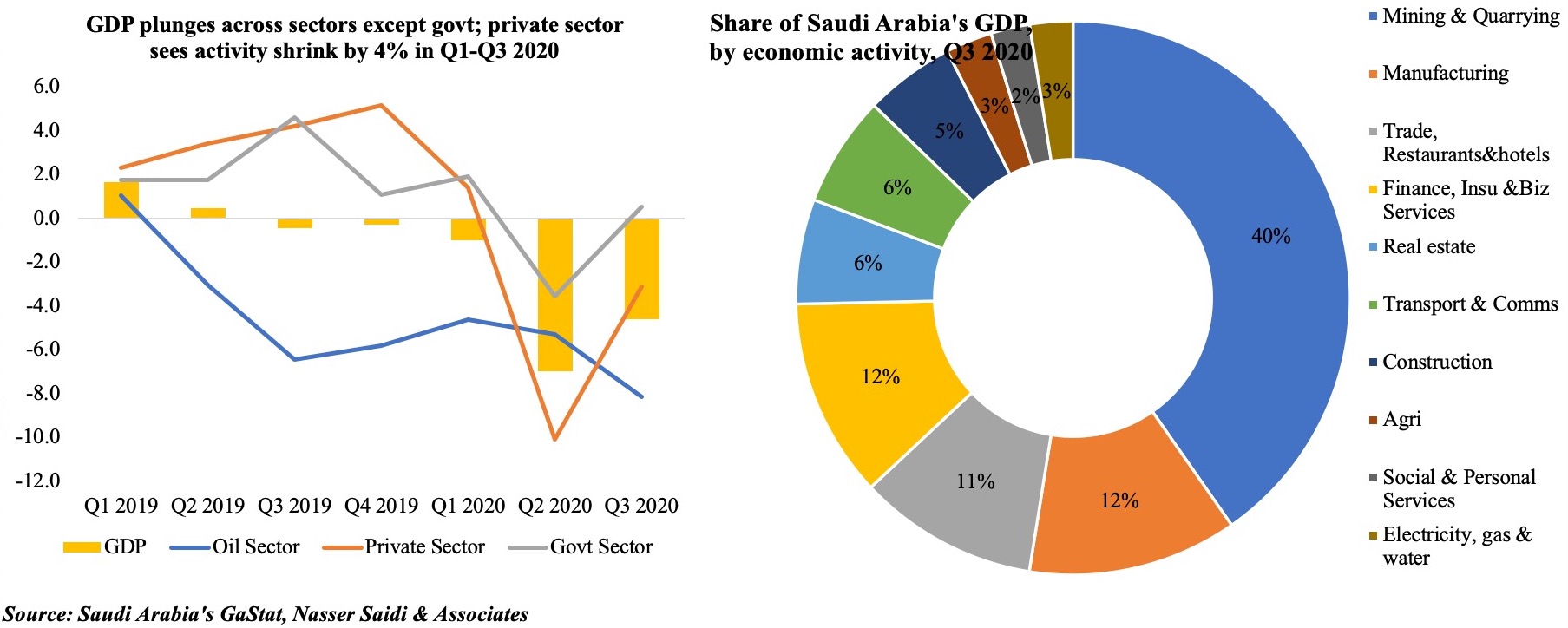

Chart 3: Saudi Arabia’s GDP shows recovery in Q3; private sector growth declines by 4% ytd

Saudi Arabia’s GDP declined by 4.3% in Q3, rebounding from Q2’s 7% plunge, with declines across oil and non-oil sectors (-8.2% and -2.1% respectively). Within the non-oil sector, most sectors posted declines in Q3 ranging from manufacturing (-10.1%) to trade, restaurants & hotels (-5.2%) while finance, insurance & real estate edged up (+1.1%). Share of GDP by economic activity shows that oil sector continues to dominate (40% of overall GDP), followed by manufacturing (12%) and trade & hospitality (11%).

Signs of recovery are evident: PMI for KSA is the strongest in the region, with output and export orders all increasing. The latest reading for employment also increased for the first time since Jan. Credit to the private sector, cement sales and PoS transactions have all been rising. Allocation of funds towards the public health system and social spending in the 2021 budget underscores the government’s commitment to support the economy as vaccines are rolled out next year. The reduction in Covid19 health concerns and uncertainty will encourage increased consumption and investment by the private sector, helping to boost growth. Similarly, roll out of vaccines will help restore the flow of non-religious tourism and the Hajj which are important contributors to the economy.

Powered by:

Weekly Insights 23 Dec 2020: V or W-shaped recovery? Surge in Covid19 cases & new strain to dampen growth in Q4

23 December, 2020

read 3 minutes

Read Next

publication

Subdued Inflation, Faster Credit Growth, Growing GCC Trade Integration: Weekly Insights 30 Jan 2026

Saudi monetary stats. Inflation in Oman & Qatar. Saudi and Oman trade stats. Oman fiscal

31 January, 2026

publication

Rising Geopolitical Risk, Growth Pockets and Policy Pauses: Weekly Economic Commentary 26 Jan 2026

Download a PDF copy of the weekly economic commentary here. Markets Geopolitical issues were high

26 January, 2026

publication

Countering Global Fragmentation: Trade Expansion & Economic Resilience in the GCC, Weekly Insights 23 Jan 2026

UAE CEPAs. Oman GDP. GCC US Treasury holdings. Global Growth & Risks. Global Trade &

24 January, 2026