Markets

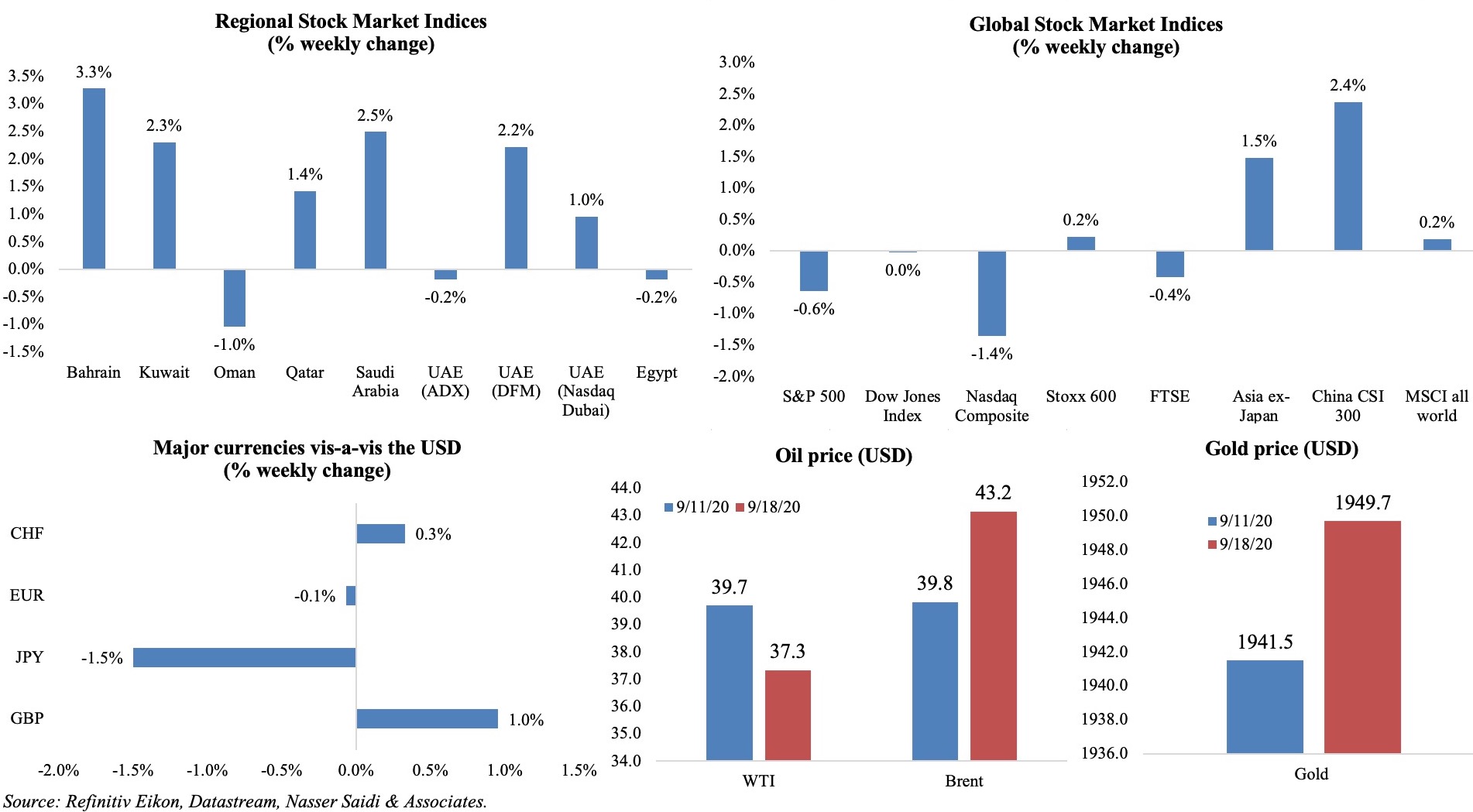

In a week dominated by central bank meetings and resurgence in Covid19 cases, stock markets closed mostly down. In the US, Fed statements and lack of progress on a potential relief package kept investors concerned, while in the UK it was the BoE announcement alongside higher chances of new lockdowns and the Brexit drama. Asia bucked the trend, as Chinese stocks gained; the MSCI world index posted its first weekly gain in 3 weeks. Regional markets, with the exception of Oman and Abu Dhabi, rose last week. The CNY had its best week in 10 months after economic indicators signaled a recovery. Oil was mixed: it had gained earlier in the week as Saudi Arabia pressed OPEC counterparts to meet output quotas. A weaker dollar supported the gold price record a second consecutive weekly gain.

Weekly % changes for last week (17-18 Sep) from 10th Sep (regional) and 11th Sep (international).

Global Developments

US/Americas:

- The Fed signaled that it would hold interest rates between 0-25% until at least end-2023 i.e. until maximum employment is reached, and inflation rises to 2% and remains on track to “moderately exceed 2% for some time.”

- US industrial production slowed in Aug, rising by just 0.4% mom, after pickups of 3.5% and 6.1% in Jul and Jun respectively. The dip was largely due to a 3.7% drop in auto factory production while mining fell by 2.5%. IP is still 7.3% below where it was pre-Covid19 in Feb. Capacity utilization was up marginally, to 71.4% from 71.1% in Jul.

- Retail sales spending in the US eased in Aug, up 0.6% mom (Jul: 0.9%), as federal aid ended. Sales picked up in food and drink (4.7%), clothing (2.9%) and furniture (2.1%), while spending at department and grocery stores fell by 2.3% and 1.6% respectively. Core retail sales fell by 0.1% (Jul: +0.9%).

- Housing starts fell by 5.1% in Aug to a seasonally adjusted annual rate of 1.416mn units, pulled down by a 22.7% fall in starts for multi-family housing. Building permits declined by 0.9% mom to 1.47mn in Aug, after hitting a 6-month high of 1.483mn in Jul.

- The Michigan consumer sentiment index increased to a 6-month high of 78.9 in Sep, but remains about 22 points away from the pre-pandemic high. Its index of consumer expectations also touched a 6-month high of 73.5 (Aug: 68.5)

- Initial jobless claims dropped to 860k in the week ended Sep 11, from an upwardly revised 893k the week before, making it the 26th straight week that unemployment claims remained above a pre-pandemic record. Continuing claims fell by 916k to a seasonally adjusted 12.63mn in the week ended Sep 5 – the lowest level since Apr 4.

Europe:

- German ZEW economic sentiment increased to 77.4 in Sep (Aug: 71.5) and the current situation reading improved as well (-66.2 from -81.3 in Aug), thereby improving overall outlook. The ZEW economic sentiment for the wider EU also picked up, by 9.9 points to 73.9 in Sep; while outlook improved, it was to a lesser extent than for Germany.

- German producer price index declined by 1.2% yoy in Aug, registering the 7th consecutive month of decline. Prices dropped thanks to lower energy prices (-3.9%) as well as prices of intermediate goods (-2%). Excluding energy, producer prices fell 0.4% in Aug, the same pace as in Jul. In mom terms, producer prices remained unchanged.

- Industrial production in the eurozone eased to 4.1% mom in Jul, after a 9.5% surge in Jun. Growth was supported by increases in France (3.8%) and Germany (+2.4%), with capital goods (5.3%) and durable consumer goods (4.7%) ticking up. In yoy terms, IP was down by 7.7% after Jun’s 12% drop.

- Inflation in the eurozone stood at -0.4% mom in Aug (Jul: -0.4%), thanks to a drop in prices of energy and industrial goods. Core inflation also fell in Aug, to -0.6% from the previous month’s -0.5%.

- The Bank of England kept interest rates at 0.1% and decided not to increase its asset purchase programme, while stating that economic outlook remains “unusually uncertain”.

- Inflation in the UK fell to 0.2% yoy in Aug, the lowest rate since Dec 2015, thanks to a temporary VAT cut and as prices in restaurants and cafes fell by 2.6% yoy (the first ever negative since records began). Core CPI eased to 0.9% yoy from 1.8% the month before.

- UK’s ILO unemployment rate inched up to 4.1% in the 3 months to Jul from 3.9% before. The average earnings excluding bonus rose 0.2% vs a 0.2% drop in the previous reading.

- Retail sales in UK picked up for the 4th straight month, up by 0.8% mom in Aug, supported by increased sales of DIY goods; sales are now 4% higher than in Feb (pre-pandemic) and higher by 2.8% yoy – the fastest annual rise since Oct 2019.

Asia Pacific:

- China’s FDI increased by 2.6% yoy in Jan-Aug vs 0.5% for the Jan-Jul period; investment in the high-tech service sector surged 28.2%. Fixed asset investment dropped by 0.3% ytd (till Aug), an improvement from the 1.6% drop in the months till Jul.

- Industrial production in China grew by 5.6% in Aug (Jul: 4.8%) – the best growth number reported since Dec 2019. Retail sales moved to a positive 0.5% growth in Aug – the first growth in the retail sector this year – after a drop of 1.1% the month before.

- The Bank of Japan left monetary policy unchanged, but upgraded its economic assessment, revealing that economy has started to pick up but remained in “a severe situation” due to the impact of the coronavirus pandemic at home and abroad.

- Inflation in Japan (excluding fresh food) fell by 0.4% yoy in Aug, largely due to a 32% drop in the cost of hotel accommodations. Core-core inflation (excluding both energy and fresh food) fell 0.1%, the lowest since Mar 2017.

- Industrial production in Japan climbed by 8.7% mom in Jul, following a 1.9% gain the month before, thanks to motor vehicle output (+38.4%). In yoy terms though, IP dipped by 15.5% yoy (Jun: -18.2%). Capacity utilization improved to 9.6% from Jun’s 6.2% rise.

- Japan’s exports and imports continued to fall in Aug, though at a slower pace: exports were down for the 21st consecutive month (-14.8% yoy vs Jul’s -19.2%) on fewer shipments of cars and mineral fuels while imports dropped by 20.8% (22.3%). Exports to China, Japan’s largest trading partner, rose 5.1% yoy in Aug, helped by a sharp increase in shipments of semiconductors.

- Retail inflation in India eased to 6.69% in Aug (Jul: 6.73%), as food costs slowed (9.05% from Jul’s 9.27%) – but stayed above the outer band of RBI’s inflation target. WPI inflation stood at a 5-month high of16% in Jul, recovering from the previous month’s drop of 0.58%.

- Unemployment in Singapore stood at 8% in Q2: resident unemployment hiked up to 3.8% and among citizens to 4%, but remained below past recessionary highs.

Bottom line: After back-to-back central bank meetings last week, this week China is likely to hold interest rates steady, its economic indicators have been showing a relatively stronger recovery compared to its global counterparts (partly as the virus affected the nation first). With rising daily infections in some European nations, calls for a second lockdown are getting stronger; Israel and parts of Madrid are already in lockdown. However, there are some signs of “relative” recovery: WTO’s services trade barometer shows resilience in some sectors, as well as a pickup in container traffic.

Regional Developments

- Bahrain will pay the electricity, water and municipal fees bills for its citizens for three months, while also encouraging banks to postpone loan repayments for those affected by the pandemic until end of this year in a way that “does not affect banks’ liquidity and financial solvency”. Separately, BHD 17 mn (USD 45mn) was disbursed to eligible citizens benefiting from government subsidies on Sep 15.

- Bahrain-origin exports grew by 2% yoy to BHD 190mn (USD 501.1mn) in Aug; Saudi Arabia, US and Oman were the top 3 destinations, together accounting for 45.8% of total value.

- The central bank of Bahrain reported a nearly 8-fold surge in electronic real-time fund transfers for 2 months in a row.

- Bahrain introduced amendments to some provisions of the corporate law, issued by decree 21 of 2001, with an aim towards consolidating minority investor rights, allowing the establishment of non-profit companies and providing legal tools for mergers and acquisitions.

- The King Fahd Causeway linking Bahrain and Saudi Arabia has reopened, with PCR tests required either at the causeway or results from one conducted 72 hours before travel.

- S&P warned that there is likely to be a deterioration in asset quality indicators in Bahrain, though it will remain “broadly manageable” in light of the central bank policies to support the economy during Covid19.

- The central bank of Egypt revealed that postponement of credit installments (in place for past 6 months) ended on Sep 15th. Banks have been asked to review existing credit facilities, and even provide an option to restructure clients’ debts as per customers’ ability to pay.

- Egypt signed three agreements worth USD 885mn with Arab funds to finance the Sinai Peninsula Development Program. The funds will support structural reforms, raise efficiency of the government’s management of public finance and help combat the Covid19 outbreak.

- Egypt is planning to invest EGP 60.6bn (~8.2% of total investments) into the development of petroleum, natural gas & mineral resources sector during the current fiscal year 2020-21.

- While Egypt invested EGP 100bn in the educational sector in the past 6 years, a further EGP 40bn is needed to create 73k new classes to resolve overcrowding in public schools.

- Jordan’s PM disclosed that the Jordan Investment Commission had received 139 new investment applications since the outbreak of Covid-19.

- The Independent Election Commission in Jordan has assigned Oct 6-8 as the days for individuals to register to run for the elections to be held on Nov 10th.

- In-class education in Jordan’s schools has been suspended for 2 weeks from Thurs, in addition to closure of mosques, churches and popular markets, in a bid to contain the Covid19 surge.

- Boursa Kuwait made its public debut last week, about 3 months before the bourse’s inclusion in the MSCI Emerging Markets Index, trading at 10X its offer price on its initial day.

- Land border crossings between Saudi Arabia and Kuwait have been reopened, with a PCR certificate necessary for movement between the two nations. A 14-day mandatory home quarantine is also prescribed.

- Lebanon’s PM designate is still in discussions to form a new government after failing to do so within the Sep 15 deadline; talks stalled after the PM proposed that 4 key ministries – Interior, Defence, Finance and Foreign – be rotated among the main religious sects.

- UNICEF launched a cash grant program for Beirut blast victims – a one-off transfer of LBP 840,000 for eligible household members living in priority areas – with an aim of reaching around 80k children and vulnerable individuals.

- Oman and India are in talks to establish an “air bubble”, revealed the CEO of SalamAir.

- Inflation in Saudi Arabia surged by 6.2% yoy in Aug, rising for the second consecutive month after VAT was raised to 15%. Food, tobacco and transport costs were up by 13.5%, 13% and 8.2% respectively. Month-on-month inflation was subdued at 0.2%.

- Saudi Arabia’s crude oil exports rebounded in Jul to 5.73mn barrels per day (bpd) from Jun’s record low 4.98mn bpd.

- Saudi ports reported a 12% increase in containers to 664k in Aug; transshipments grew by 21% to 225k containers.

- International flights resumed in Saudi Arabia last week (Sep 15th): entry is permitted to GCC citizens as well as non-Saudi passengers holding a valid visa, including exit and re-entry, residency permit (iqama), and visit visas to and from the country. Total lifting of the travel suspension (i.e. completely open borders) will be announced 30 days before Jan 1st

- At a closed-door OPEC+ meeting, the possibility of holding an extraordinary meeting in Oct was discussed in case oil markets weakened further. The meeting also called for compliance to OPEC+ cuts in light of overproduction in some nations (Iraq, Nigeria and UAE).

- Abu Dhabi and Dubai ranked 42 (up 14 spots) and 43 (+2) among 109 cities in IMD’s 2020 Smart City Index; Riyadh climbed 18 places to 53. Survey responses covered 5 key areas: health and safety, mobility, activities, opportunities and governance. Singapore, Helsinki, Zurich, Auckland and Oslo rounded the top 5 in the list.

UAE Focus

- A new law provides Abu Dhabi Accountability Authority the power to closely monitor, in real time, financial activities and spending in both government bodies and GREs – a significant move from being able to just review the financial results of such entities previously.

- The normalization of UAE-Israel ties is estimated to bring business deals worth USD 300-550mn. Multiple deals have already been announced: ENBD signed agreements with Israel’s biggest lenders; DMCC’s Dubai Diamond Exchange and the Israel Diamond Exchange signed a deal to boost trade; DP World and Dubai Customs agreed to form trade links with Israel. Separately, it was disclosed by the UAE minister of economy that discussions are ongoing to include some Palestinian areas as part of the bilateral economic agreements.

- Inflation in Dubai declined by 3.69% yoy and 0.32% mom in Aug, as housing and utilities costs fell by 5.72% yoy alongside a drop of 13% and 15% respectively in transportation and entertainment costs; food and beverage prices were up by 2.81%.

- The UAE central bank governor reiterated commitment towards Financial Action Task Force (FATF) standards: he cited the launch of the smart tool “Fawri Tick” to monitor terrorism financing as well as making the registration of hawala providers mandatory with the central bank as 2 instances to strengthen oversight.

- A senior official at the Abu Dhabi Islamic Bank disclosed that overall loan activity in the region is down by 20-25% compared to a year ago, though there was a significant uptick in GRE deals.

- The Abu Dhabi Investment Authority disclosed, in an SEC filing, a05% stake in US LNG producer Cheniere Energy; value of the stake is around USD 615mn.

- The expansion of Khalifa Port Logistics, South Quay and Abu Dhabi Terminals is on track to be completed next year, disclosed Abu Dhabi Ports. The Ports also plan to halve its emissions with the use of a solar-panelled steel and aluminium container to allow in-row cooling, renewable energy and efficient space allocation.

- Dubai reduced carbon emissions by 22% last year, cutting more than 14mn tonnes of emissions.

Media Review

Shaping the Trend of Our Time

https://www.unenvironment.org/news-and-stories/story/shaping-trends-our-time

Did Trump’s tariffs benefit American workers and national security?

https://www.brookings.edu/policy2020/votervital/did-trumps-tariffs-benefit-american-workers-and-national-security

The Rise of Covidnomics

https://www.project-syndicate.org/commentary/covid19-policies-medicine-economics-human-behavior-by-kaushik-basu-2020-09

Dubai May Be as Indebted as South Africa If S&P Proves Right

https://www.bloomberg.com/amp/news/articles/2020-09-17/dubai-may-be-as-indebted-as-south-africa-if-dissenters-are-right

Lebanon’s monetary meltdown tests the limits of central banking | PIIE

https://www.piie.com/publications/policy-briefs/lebanons-monetary-meltdown-tests-limits-central-banking

US & the Middle East: strongmen contemplate post-Trump era | FT

https://www.ft.com/content/132ad76d-0ad4-4cf8-9dc7-acd1797c9e6d

World Bank’s Human Capital Index 2020

https://openknowledge.worldbank.org/handle/10986/34432