Charts of the Week: UAE GDP for Q1 this year was released, reaffirming the impact of the Covid19 outbreak on the economy. In Saudi Arabia, July inflation numbers reflect the tripling of VAT: this increase will likely be sustained through the rest of the year. Kuwait’s fiscal quagmire highlights the need for urgent reforms including phasing out subsidies and introducing VAT and excise taxes. Lastly, read our take on global trade movements as WTO early indicators point to a record drop in Q2.

- Annual decline in UAE GDP in Q1 2020

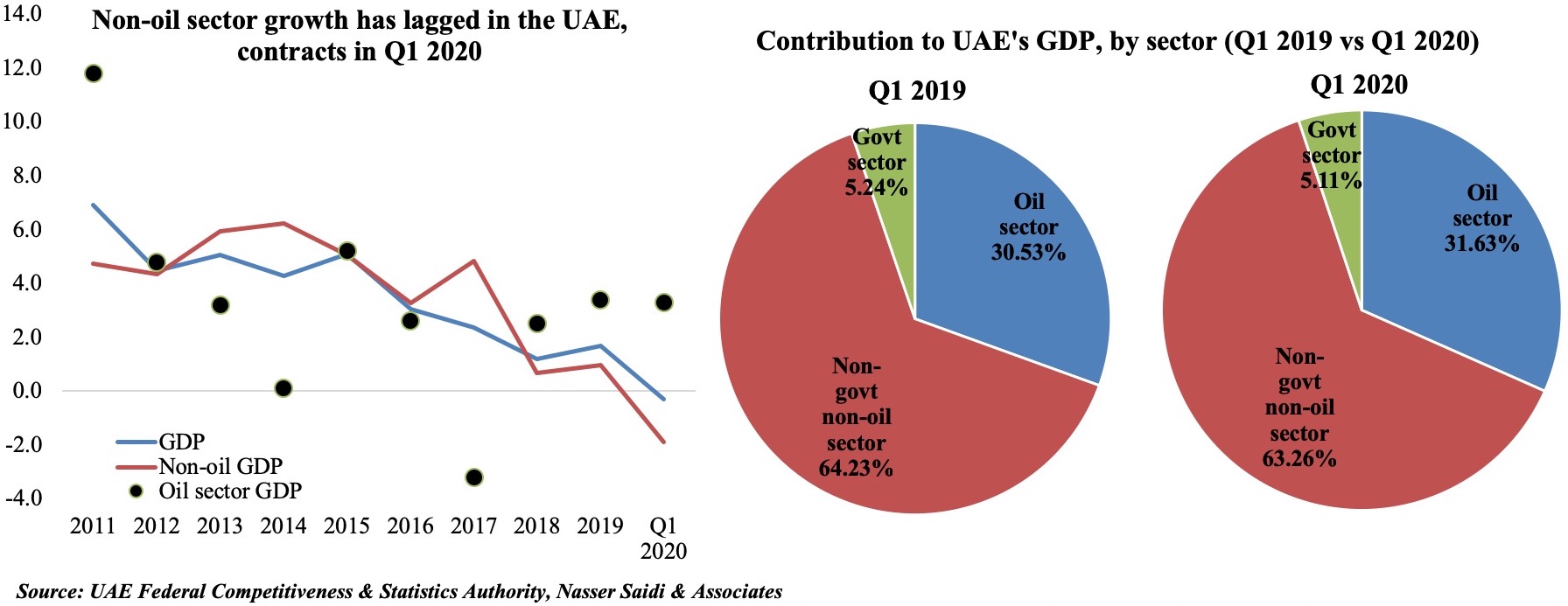

UAE GDP contracted by 0.3% yoy in Q1 this year, with non-oil GDP declining at a faster 1.9% pace. Oil sector remained the saving grace, rising by 3.3% during the quarter. The Q1 numbers were dragged down by the Covid19 outbreak: together the trade, transport and hospitality sectors had contributed just over 1/5th of GDP in 2019.

Q2 will show a larger GDP decline given the relatively widespread lockdown measures, work from home policies and/or job losses/ salary cuts, expats’ repatriation and subsequent reduction in economic activity (as can be gauged from the high-frequency mobility indicators). While various policy initiatives would have supported the private sector businesses during the 3-month period (including deferred loan payments), the slow pace of recovery will weigh on businesses cash flows and profitability. This could spill over into the banking sector if there are potential credit losses resulting from firm closures/ insolvencies/ bankruptcies.

How can the government support directly? One, support firms on the brink of liquidation with out-of-court settlements and developing corporate debt restructuring rules to prevent. Two, speed up payment of arrears from public sector: this could prevent viable businesses from going under.

- Saudi inflation picks up in Jul, as VAT triples to 15%

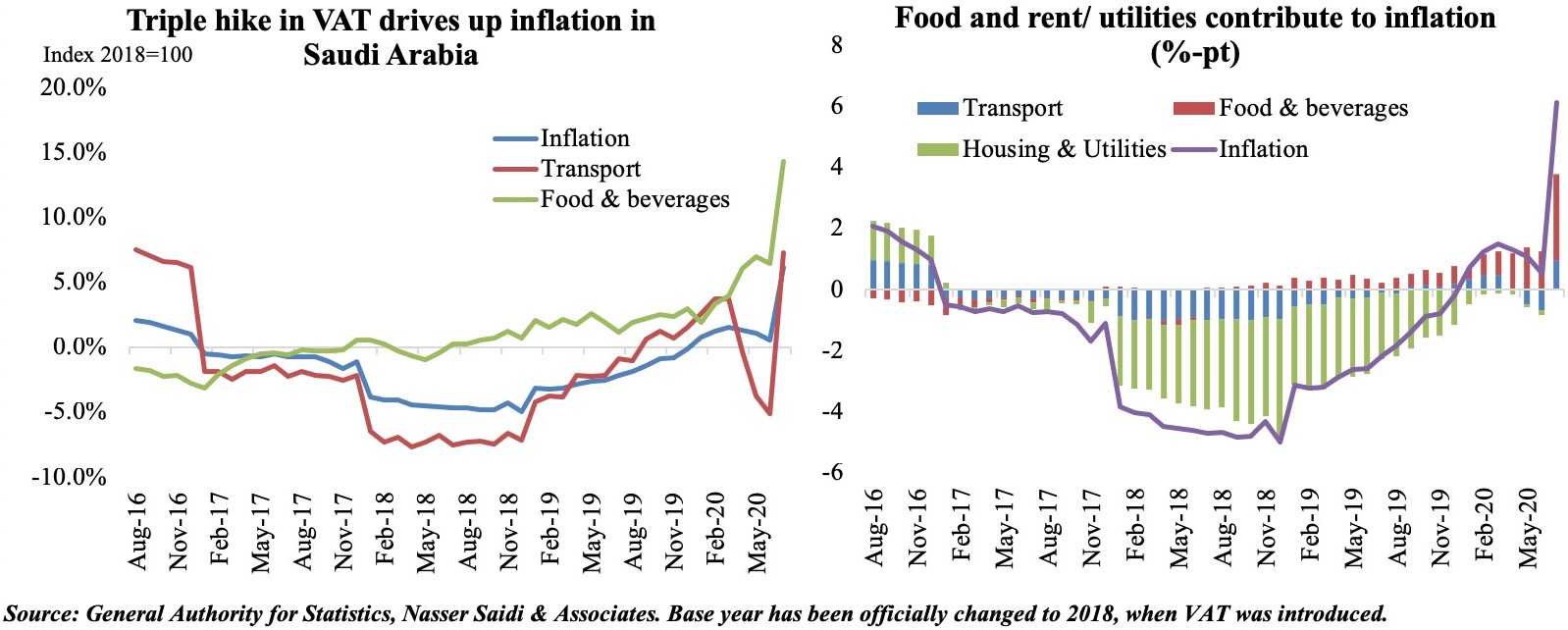

Headline inflation in Saudi Arabia picked up by 6.1% yoy in Jul this year, following a 0.5% rise in Jun. Food, communication and transport costs have picked up compared to a year ago, with the former surging 14.3% (the highest rate since 2008). A similar pickup was seen when VAT was introduced in 2018. The figure below however, charts the latest GaStat data, where the base year has been revised to 2018.

The effect of VAT will appear through the rest of the year, though some sectors like education are exempt from VAT. Household spending will be negatively impacted by the VAT hike (consumers had already frontloaded spending, as per SAMA data), in addition to reduced spending power (pay cuts, removal of cost of living allowances etc.) thereby subduing private sector activity as well for the rest of the year.

- Kuwait fiscal quagmire

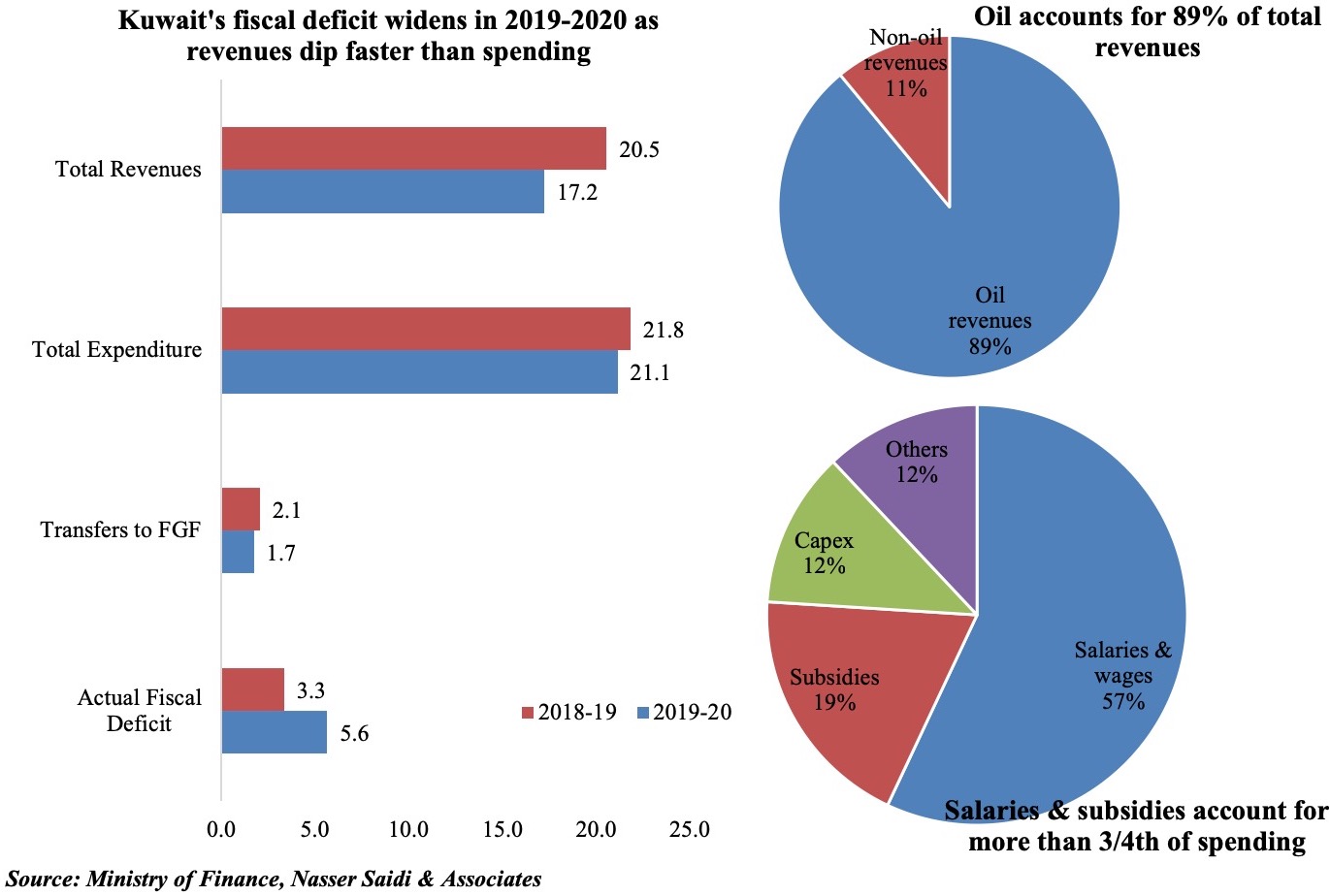

Kuwait’s fiscal situation has been in the limelight for 2 weeks now. Initially, it was the release of its 2019-20 fiscal data: revenues declined by a faster 16.2% yoy vs spending’s 3.2% drop, causing fiscal deficit (after transfers to the Future Generations Fund) to expand by 68.6% to KWD 5.64bn. The finance now ministry expects budget deficit to widen to KWD 14bn (USD 46bn) in the 2020-21 fiscal year, from a previous estimate of KWD 7.7bn.

Last week saw the finance minister stating that the country has just KWD 2bn (USD 6.6bn) worth of liquidity in its Treasury – which is not enough to cover state salaries beyond Oct. Liquidity in the General Reserve Fund decreased from KWD 5bn in the start of the 2020-2021 fiscal year, with the government withdrawing KWD 4bn in less than 100 days. In spite of this revelation, the Parliament returned the public debt law – which would allow the government to borrow KWD 20bn over 30 years – back to the finance committee for review. The Ministry of Finance is now preparing to transfer KWD 2.05bn in liquid cash to the General Reserve Fund.

Approval of the law that makes transfers to the Future Generations Fund dependent on budget surplus will provide comfort (estimated to save under KWD 1bn this fiscal year), but the nation needs to address its financing challenges. Going forward, an approval of the public debt law is necessary for the nation to tap international bond markets – to support refinancing of maturing debt, as well as reduce drawdowns from the General Reserve Fund. GCC sovereigns have been active players this year: issuances surged by 40% yoy to USD 42.3bn in H1 this year (Source: Markaz), and Abu Dhabi has started marketing a USD denominated 3-tranche bond offering this morning.

Kuwait has a long road ahead in improving its fiscal stance: it is yet to introduce VAT and excise taxes and subsidies (electricity, water and fuel) – at almost 7.5% of GDP – need to be phased out. Though the government approved a cut in state entities budget this year by at least 20%, the public wage bill needs to be reduced (accounts for roughly 1/3rd of budget) and directed towards more efficient public investment.

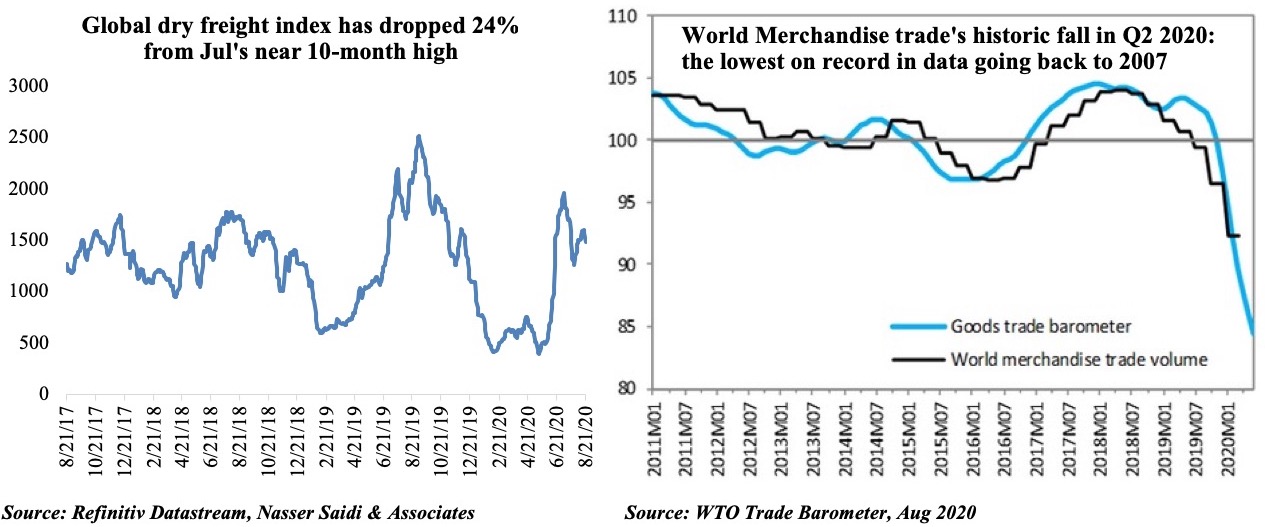

- Trade dips in Q2, Baltic Dry index drops after a near 10-month high in Jul

The WTO’s latest goods trade barometer shows a significant dip in Q2 this year (official trade volume data is not yet available): this is the lowest on record in data going back to 2007. This tracks the behaviour of multiple proxy indicators: be it the still-declining container shipping or air freight data while the export orders sub-component (within PMI) has started to recover from historic lows. The Baltic Dry Index – a composite index of the cost of shipping major raw materials – had inched close to a 10-month high in early Jul, raising hopes for a steady recovery; it has since then resumed to dip, but remains much higher than the numbers seen during the lockdown.

Global economic uncertainty still remains high, with second waves of Covid19 appearing in both Asia and Europe (while numbers of US, Brazil and India continue to surge). Trade recovery will depend on how fast consumer demand recovers: in China, there is a domestic-demand led recovery (versus export-led growth previously), while work from home policies have driven demand for semi-conductor exports from many Asian nations (e.g. latest Taiwan export data); Aug’s flash PMI for Eurozone shows a decline in new export orders (including intra-EU trade) in spite of a pickup in the overall index. Our call remains that a V-shaped recovery is less plausible in the current scenario.

Powered by: