Markets

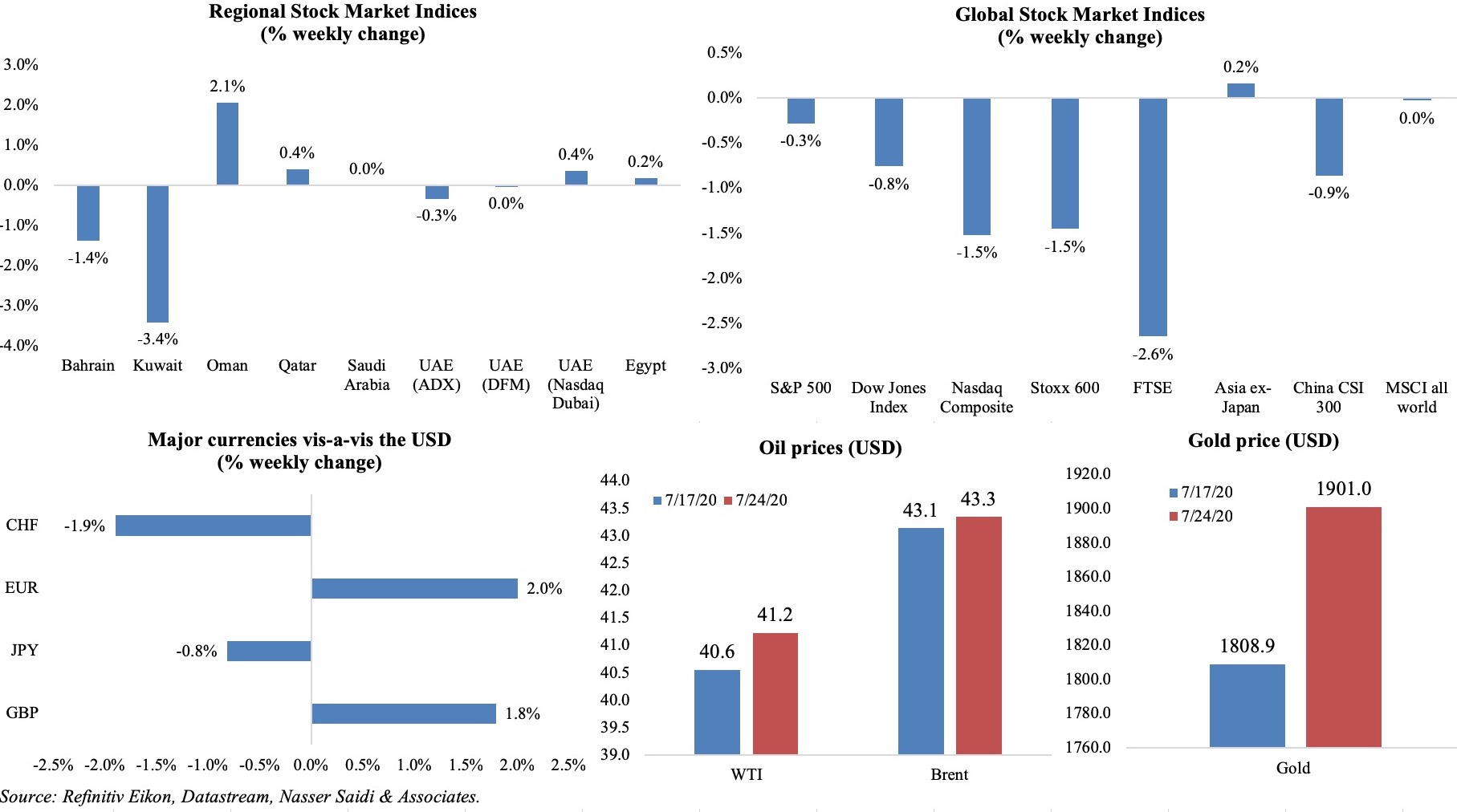

With rising US-China tensions (tit-for-tat orders to close consulates in Houston and Chengdu), stock markets across the globe dropped from their 5-month peaks on Fri, posting overall losses last week. Traditional safe haven assets continued their good run: gold hit its highest level since 2011 and closed 5.1% higher in the week; yield on five-year US Treasuries briefly dropped to a new record low of 0.25%; German bond yields also rose from two-month lows. Q2 corporate earnings disappointed across the region; market performance was mixed, with Oman posting the biggest gain (+2.1%) versus Kuwait’s dip of 3.4%. The euro touched a 21-month high vis-à-vis the dollar, while the Swiss franc touched a 4-month peak. Oil prices gained slightly, supported by a weaker dollar.

Weekly % changes for last week (23-24 Jul) from 16th Jul (regional) and 17th Jul (international).

Global Developments

US/Americas:

- Chicago Fed National Activity Index posted a new record high of 4.11 in Jun (May: 3.5 and Apr’s record low -17.89). The volatile index’s 3-month average stands at -3.49 in Jun.

- Markit manufacturing PMI improved to 51.3 in Jul (Jun: 49.8) – the first expansion since Feb – thanks to rise in both output and new orders. The flash services PMI inched up only to 49.6 from 47.9 in Jun.

- Existing home sales accelerated by 20.7% mom to 4.72mn in Jun, the highest gain on record, following three straight months of declines. Sales were down by 11.3% yoy. New home sales surged to a near 13-year high, rising by 13.8% mom and 6.9% yoy to a seasonally adjusted 776k units. The 30-year fixed mortgage rate is averaging 3.01%, close to a 49-year low.

- Initial jobless claims increased to 1.416mn in the week ended Jul 18, reversing the 15-week streak of declining initial claims. This also marks the 18th consecutive week with initial claims crossing the 1mn mark. Continuing claims decreased by 1.107mn to 16.197mn in the week ended Jul 11.

Europe:

- The EU’s recovery deal was approved after 5 days of discussions – the EU as a whole will borrow a total of EUR 750bn (for grants and loans) from the markets. This deal includes: (a) a EUR 1.1trn budget for the EU over the next 7 years; (b) EUR 360bn in low-interest loans for countries most hit by the pandemic; (c) EUR 390bn in grants to the worst affected nations. Hopes of the deal had sent Italy’s borrowing costs to their lowest since early-Mar and pushed the euro to a 19-week high.

- German manufacturing PMI moved out of the contraction zone, posting a reading of 50 in Jul. Services PMI also improved to 56.7 in Jul (Jun: 47.3) and composite PMI increased to 55.5 from the previous month’s reading of 47.

- Eurozone’s manufacturing PMI crossed the 50-mark, rising to 51.1 in Jul (Jun: 47.4). Services PMI rose to 55.1 (Jun: 48.3), supporting the composite PMI to touch 54.8 (48.5).

- German PPI remained unchanged month-on-month, missing market expectations, but fell by 1.8% yoy in Jun (May: -2.2%).

- Eurozone’s current account posted a surplus of EUR 7.95bn in May, almost halving from the month before, thanks to a big outflow of secondary income. In the 12-month period to May 2020, the current account recorded a surplus of EUR 264bn (2.2% of euro area GDP) vs 2.7% of GDP during the 12 months to May 2019.

- The interim UK manufacturing PMI (based on 85% of responses) rose to a 32-month high of 57.1 in Jul (Jun: 50.1) while services activity touched a 5-year high (56.6 from 47.1 in Jun), helping the composite index rise to 57.1 from 47.7.

- UK retail sales grew by 13.9% mom in Jun, with online sales accounting for GBP 3 out of every GBP 10 spent by consumers. The rebound is mixed: compared with Feb, the volume of food sales was 5.3% higher and non-store retailing grew by 53.6%, but non-food stores (including department stores and clothes shops) remained 15% lower.

Asia Pacific:

- The PBoC left its benchmark lending rate steady at 3.85% for the third straight month, after it was cut by a total of 46bps since last Aug.

- Japan’s exports fell by 26.2% yoy in Jun (May: -28.3%) while imports fell by a slower 14.4% (May: -26.2%), narrowing the trade deficit to JPY 268.8bn (May: JPY 833.4bn). Exports declined for the 19th consecutive month, also recording double-digit declines for 4 straight months, on plunging demand for cars and auto parts amid weak exports to China.

- Inflation in Japan inched up by 0.1% yoy in Jun, from a similar gain the month before. Excluding fresh food, inflation was flat while excluding both food and energy prices were up 0.4% (after the same rate of gain in May).

- Japan’s preliminary PMI increased to 42.6 in Jul (Jun: 40.1), posting the 15th straight month of contraction, as output and new orders continued to fall while business sentiment weakened.

- Korea’s Q2 GDP slipped by 2.9% yoy – the steepest decline since 1998 – and 3.3% qoq (Q1: 1.4% yoy and -1.3% mom). Exports were the biggest drag, declining by 13.6% yoy and 16.6% qoq in the quarter. Government spending rose 6% yoy and 1.0% qoq through advanced fiscal spending plus two supplementary budgets.

- Inflation in Singapore fell by 0.5% yoy in Jun (May: -0.8%) while core inflation dropped by 0.2% (May: -0.2%). Food inflation edged up by 2.3% in Jun, vs May’s 2.2%.

- Singapore industrial production unexpectedly fell by 6.7% yoy in Jun (May: -8.1%), with transport engineering recording the largest drop (-33.9%); excluding biomedical manufacturing, output grew by 2.1%.

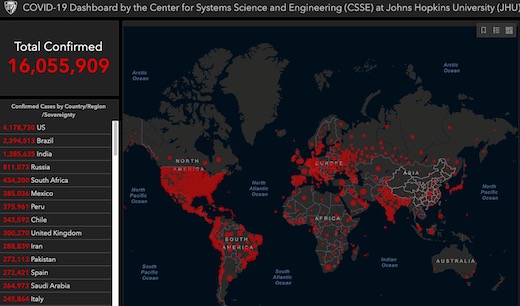

Bottom line: Global Covid19 confirmed cases have passed 16mn, with almost 40 nations reporting a record single-day rise in new infections. Large numbers of new infections are emerging: US crossed 4mn infections, Brazil and India surpassed the 1mn mark while South Africa – inching closer to 500k – rounds the top 5 confirmed cases along with Russia. In this backdrop, the IMF temporarily increased annual limits on access to resources in its General Resources Account and the Poverty Reduction and Growth Trust, after an “unprecedented number of member countries” sought financial support. There are some green shoots: as lockdowns eased and demand revives, Eurozone businesses reported the strongest growth in two years, with PMIs moving into expansion territory, a good start to H2. In Asia though, divergent patterns have emerged with trade-reliant Japan, Singapore and South Korea having gone into recession, while China has bounced back (supported by domestic demand).

Regional Developments

- The King Fahad Causeway partially opened to allow Saudis living in Bahrain to return; they will have to undergo a 10-day quarantine. The causeway had been closed since Mar.

- Bahrain completed a BHD 150mn Government Development Bond issuance via direct subscription through the primary market. Investors can trade the bonds in the secondary market after it is listed on Aug 9th.

- Bahrain accounted for 1.1% of the total personal wealth in Middle East and Africa last year, according to a recent BCG report. Millionaires accounted for 68.8% of Bahrain’s wealth, and this number is expected to rise by 1.1% annually.

- The validity of Bahraini Visits visas will be automatically extended for an additional three months till Oct 21.

- Egypt’s non-oil imports declined by 21.18% yoy to USD 23.35bn in Jan-May 2020, with food imports down 22.8% yoy to USD 4.553bn. Non-oil exports fell by 7.8% to USD 10.3bn.

- Budget deficit in Egypt widened to EGP 389.1bn (USD 24.36bn) in Jul 2019-May 2020, as the 2.2% rise in revenues was outpaced by the 6.8% growth in expenditures. Overall debt to GDP increased by 6.5% of GDP during this 11-month period.

- Egypt’s finance minister revealed that overdue export subsidies worth EGP 6bn had been disbursed to 1667 companies during the 2019-2020 fiscal year. For the current fiscal year, the government has allocated EGP 7bn to support exports.

- In a bid to end disputes between taxpayers and the Egyptian Tax Authority, the Central Bank of Egypt will remove the levy on taxpayers’ banks account, so long as they pay 1% of the disputed tax value.

- Tax relief in Egypt – waiving interest and late fees on taxes – has been extended till Dec.

- The Baghdad International Airport reopened for operations after its closure in Mar: there will be temperature checks at arrival while social distancing measures are enforced during passport control; incoming passengers are required to take a test 48-hours before boarding.

- Southern Iraqi exports in the first 20 days of Jul averaged 2.7mn barrels per day, unchanged from Jun’s official figures, implying that Iraq hasn’t met terms of its OPEC+ deal.

- The Central Bank of Jordan approved 3942 loan requests to the tune of JOD 380.8mn as part of the JOD 500mn SME support programme (for those businesses severely hit by the Covid19 outbreak).

- A circular issued by Jordan’s PM allows employers to reduce monthly salaries by up to 20% for Jul and Aug.

- Jordan’s airport will reopen in the first half of Aug, and flights will be open to “green” countries (i.e. where cases are similar to in Jordan).

- Jordan and Germany signed a EUR 34mn grant agreement to fund a School Construction Programme to upgrade the quality of primary education in the country.

- Kuwait plans to issue between KWD 4-5bn (USD 13-16bn) in public debt by end of the current fiscal year (i.e. Mar 2021), reported Reuters, subject to the approval of the debt law.

- Kuwait’s trade surplus with Japan narrowed by 46.3% yoy to JPY 18.1bn (USD 169mn) in Jun, thanks to the dive in exports. Exports to Japan dropped by 47% yoy – the third straight month of decline – while imports from Japan plummeted by 48.9% to JPY 6.1bn.

- Kuwait’s Health Ministry announced that all government-run hospitals would provide coronavirus diagnostic tests free of charge to both citizens and residents.

- Kuwait will enter the third phase of Covid19 restrictions starting Jul 28th: its nightly curfew hours will be shortened to 9pm to 3am, mosques will be opened, taxis will be allowed to operate, and hotels will be reopened.

- Kuwait’s expats who are stranded overseas will need new visas to return; furthermore, the decision on whether expats whose visas have expired while outside Kuwait (more than 40k) can be allowed back into the country will be taken this week. A study has recommended that 3 categories be banned from re-entering the country: marginal labourers, expats over 60 years of age and those sponsored by fake companies who have no actual jobs.

- With the aim to lower budgetary expenses this year, Kuwait Petroleum Corporation and its subsidiaries have begun to cancel “unimportant” tenders and contracts. It will also end the services of non-Kuwaitis under permanent and private contracts as well as subcontractors.

- Lebanon central bank’s 2018 audited accounts show assets arbitrarily inflated by over USD 6bn, reported FT. The government has since hired Alvarez & Marsal to conduct a forensic audit of the central bank. (More: https://www.ft.com/content/d2d63b9b-9669-4ec0-93e9-ed97cbeb9261)

- Oman’s Shura Council’s economic and finance committee has proposed linking VAT to economic growth, implementing VAT only if growth crosses 3% mark. It has also proposed excluding those who earn OMR 900 (USD 2,340) or less a month from the tax.

- China was the largest recipient of Oman crude in Jun, having received 94.28% of total Omani crude exports. Malaysia (2.63%), India (1.95%) and South Korea (1.14%) were others.

- The newly-established Oman Investment Authority restructured the boards of 15 companies it oversees; chairmen of five companies were replaced.

- Expat population in Oman has been declining steadily: it has dropped by 122k since Dec 2019 and by 55k in the past 3 months (Apr-Jun). Expat population stands at 1,589,883 in Jun.

- In a bid to limit the spread of Covid19, Oman will impose curfews (7pm to 6am) and travel bans for the upcoming Eid holidays, a “total lockdown” of all governorates.

- Oman issued an RfP to all prequalified bidders for the 1GW renewable energy project (‘Manah Solar I and ‘Manah Solar II IPPs); it will be the largest renewable energy venture of its kind once operational in the summer of 2023.

- Qatar has eased restrictions and will permit its citizens and permanent residency holders to travel outside the country and return anytime starting Aug 1st.

- Qatar Airways launched four international investment arbitrations seeking at least USD 5bn in compensation from Saudi Arabia, UAE, Egypt and Bahrain for blocking it from their airspace.

- Qatar Investment Authority has taken an undisclosed stake in the German bio-tech firm CureVac as part of a USD 126mn financing round.

- In a Bloomberg webinar, Saudi Arabia’s finance minister revealed privatization plans in sectors like healthcare and education (that weren’t targeted previously) to broaden its revenue base (raising an estimated SAR 50bn in the next 4-5 years). Levying income tax was an option under consideration, though unlikely to be introduced in the immediate future as it would require a “lot of preparation”. It was later clarified that “income tax issue is not under discussion”.

- Saudi Arabia’s oil exports dived by 65% yoy and non-oil exports shrank by 31.9% in May. Total exports declined by 57.9% yoy and 1.6% mom to SAR 36.506mn while imports dropped by 36.5% yoy and 9.3% mom to SAR 34.534mn.

- The value of foreign ownership on Saudi Tadawul inched up by 2.1% from the previous week to SAR 1.04bn in the week ended 16 Jul.

- The housing ministry Saudi Arabia is collaborating with 70 real estate developers to build more than 100k units across a number of projects; it targets building 200k residential units in the “near future”.

- Saudi Arabia’s land borders with Kuwait, Bahrain and the UAE opened last week: citizens, immediate family members and their domestic staff can enter the country without obtaining prior authorization.

- According to Moody’s, Middle East nations raised USD 46bn via Eurobond issuances in H1 2020, accounting for 34% of total emerging market activity. UAE topped with USD 15bn in issuances, followed by Saudi Arabia (USD 12bn), Qatar (USD 10bn) and Egypt (USD 5bn).

- S&P estimates that debt drawdowns and debt will be used to finance fiscal deficits in the oil-dependent GCC nations, with borrowing estimated at a record USD 100bn this year.

- The International Finance Corporation (IFC) invested USD 5.6bn to support the Middle East and sub-Saharan Africa region in Jul 2019-Jun 2020. Investments in sub-Saharan Africa region alone increased by 12.2% yoy to USD 4.6bn in the fiscal year 2020. IFC invested almost USD 2bn in short-term trade financing to support SMEs across the region.

UAE Focus

- The UAE government will waive residents’ fines on visas that expired before Mar 1st or on applications that were not processed during pandemic-related disruptions. These residents have till Aug 17th to leave the country without incurring a penalty.

- Non-oil foreign trade in Abu Dhabi touched AED 80.23bn (USD 21.84bn) in Jan-May 2020, according to Abu Dhabi Customs data. Saudi Arabia remained the top trade partner, clocking in AED 17.91bn during the period.

- Efficient government spending is necessary to tackle the economic fallout of Covid19, according to a senior UAE ministry of finance He also highlighted that residence laws will need to be reviewed due to “rapid loss of a skilled workforce” from temporary business closures.

- Abu Dhabi plans to launch a basic industries project – covering 4 major sectors food production, medical supplies, power generation and materials such as iron, aluminium and cement – to be “self-sufficient in the production of basic and consumer commodities”.

- UAE’s total value of trade in telecommunications services grew by 2.1% to around AED 29.4bn between 2017-2019, revealed the FCSA data.

- Capacity at UAE’s mosques will be increased to 50% from Aug 3rd, from the current 30%, while enforcing social distancing measures.

- All government employees in Sharjah returned to work last week, with mandatory measures in place like the use of face masks, gloves, and a ban on handshakes.

- UAE’s Fujairah, Ras Al Khaimah and Ajman emirates have announced free Covid19 tests for its citizens and residents.

- Office occupancy in Abu Dhabi remains subdued given the Covid19 pandemic, with vacancy in Abu Dhabi’s office market at 22.1% in Q2 2020, according to Knight Frank Middle East.

- Abu Dhabi DED is rolling out a remote work initiative, with its first phase involving 23.87% of total employee strength, and those specialized in the fields of inspection, supervision and customer service.

- UAE businesses recognize the need to make operational challenges to become more resilient, as per a global survey rolled out by HSBC. 50% of the 100 businesses surveyed in the UAE feel “strong overall” with the necessary adjustments, while only 5% identified themselves to be “significantly” challenged.

Media Review

COVID-19: A view from outside the industrialized world – Raghuram Rajan

https://bcf.princeton.edu/event-directory/covid19_33/

https://www.youtube.com/watch?v=jD1OjZpRtUk

The Open Secret to reopening the economy

https://www.project-syndicate.org/commentary/covid19-virus-will-decide-when-economy-can-reopen-by-anne-krueger-2020-07

Dominant Currencies and the Limits of Exchange Rate Flexibility

https://blogs.imf.org/2020/07/20/currencies-and-crisis-how-dominant-currencies-limit-the-impact-of-exchange-rate-flexibility/

China central bank to pause easing as economy recovers, wary of over-stimulus: sources

https://www.reuters.com/article/us-china-economy-policy/china-central-bank-to-pause-easing-as-economy-recovers-wary-of-over-stimulus-sources-idUSKCN24N0RH

The end of the Arab world’s oil age is nigh

https://www.economist.com/middle-east-and-africa/2020/07/18/the-end-of-the-arab-worlds-oil-age-is-nigh

Powered by: