Markets

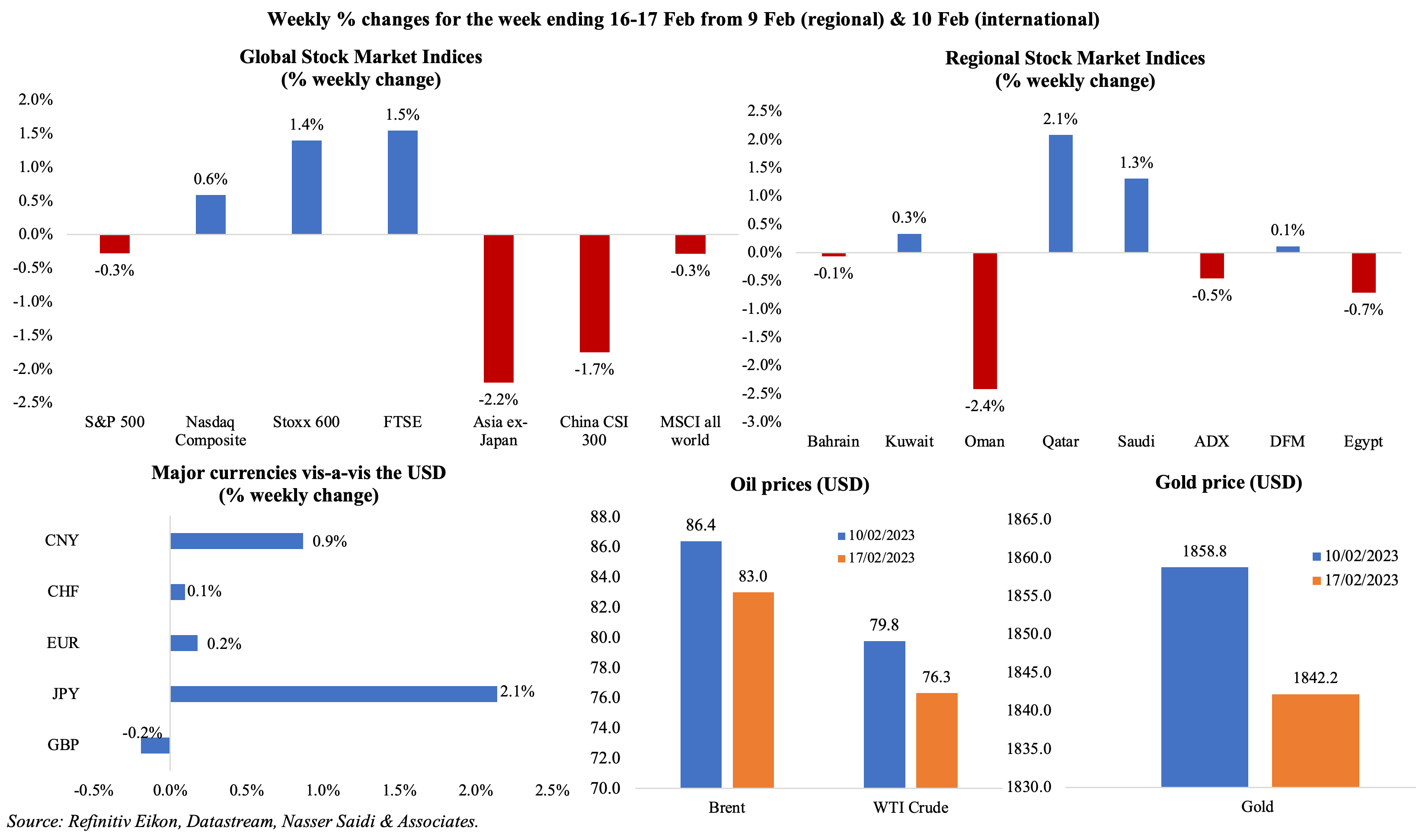

Global equity markets were mixed: hawkish comments from two Fed officials and recent signs of strength in the economy (higher retail sales, decline in claims along with a rise in PPI) indicate potential for more tightening policies to curb inflation; in Europe, Stoxx 600 had a strong week, and the FTSE 100 hit a record intra-day high. In the region, Abu Dhabi settled higher on Fri (though ending in the red for the week) after the ADNOC Gas IPO announcement while Qatar and Saudi were supported by gains in the banking and energy sectors. The dollar index touched a 6-week high before easing on Fri; the dollar touched a 6-week high of JPY 134.355 last week. Oil prices fell by around 4% on concerns about Fed hikes amid signs of sufficient supply while the price of European natural gas fell to an 18-month low of below EUR 50 per megawatt hour (vs a peak of more than EUR 300/ MWh in Aug 2022). Lastly, gold price was down by 0.9% for the week in the backdrop of a stronger dollar.

Global Developments

US/Americas:

- Inflation in the US eased slightly to 6.4% yoy in Jan (Dec: 6.5%). Prices rose by 0.5% mom, driven by energy prices (2% mom, reversing two months of declines) and rising apparel (0.8%) and food costs (0.5%). Core inflation eased to 5.6% from Dec’s 5.7% while remaining at an unchanged pace of 0.4% mom.

- Producer price index cooled to 6% yoy in Jan, slower than Dec’s 6.5% but was much higher than expectations; core producer price index eased slightly to 5.4% (Dec: 5.5%). The monthly producer price index was up by 0.7% – the largest increase since Jun 2022 – with energy costs up by 5% alongside a 1% drop in food prices.

- Industrial production in the US was flat in Jan (Dec: -1% mom) while in yoy terms it posted a 0.8% gain (Dec: 1.2% mom), the smallest since Mar 2021. Capacity utilisation eased to 78.3% (Dec: 78.4%).

- Retail sales in the US rebounded by 3% mom in Jan (Dec: -1.1%), recording one of the biggest monthly rises since Mar 2021. Receipts at auto dealers surged by 5.9; excluding autos, sales grew by 2.3% in Jan (Dec: -0.9%).

- NY Empire state manufacturing index improved to -5.8 in Feb (Jan: -32.9), as the decline of new orders eased (to -7.8 from -31.1 in Jan). Philadelphia Fed manufacturing survey worsened to -24.3 in Feb (Jan: -8.9), the lowest level since May 2020, as index for new orders remained negative and employment index decreased.

- US building permits inched up by 0.1% mom to 1.339mn in Jan. Single-family building permits fell 1.8% to a rate of 718k units while starts for housing projects with five units or more fell by a faster 5.4% to 457k units.

- Housing starts fell for a 5th consecutive month, by 4.5% mom to 1.309mn, the lowest level since Jun 2020 as a result of weakened demand due to higher mortgage rates. Starts declined 21.4% on a yoy basis.

- Initial jobless claims slipped by 1k to 194k in the week ended Feb 11th, remaining below 200k since mid-Jan, and the 4-week average inched up by 0.5k to 189.5k. Continuing jobless claims rose by 16k to 1.696mn in the week ended Feb 4th.

Europe:

- GDP in the eurozone increased by 0.1% qoq and 1.9% in Q4, in line with preliminary estimates, suggesting that the eurozone is avoiding a recession. The European Commission raised its growth forecast to 0.9% this year from 0.3%. Employment surprisingly expanded in Q4, rising by 0.4% qoq and 1.5% yoy to 165mn.

- Industrial production in the eurozone fell by 1.1% mom in Dec (Nov: 1.4%), with intermediate goods output falling the most (-2.8% vs Nov’s 0.5% gain) while energy output rebounded (+1.3% after 5 straight months of decline). In yoy terms, IP fell by 1.7%, the first decline since Jul 2022.

- Inflation in the UK eased to 10.1% in Jan (Dec: 10.5%), driven by a decline in petrol and diesel prices while food and beverages inflation soared by 16.7% yoy alongside a 10.8% uptick in restaurants and hotels costs. Producer price inflation eased on the output side to 13.5% in Jan, the lowest since Feb 2022, and down from Dec’s 14.6%.

- Retail sales (volume) in the UK fell by 5.1% yoy in Jan (Dec: -6.1%). Excluding fuel sales were down by 5.3% (Dec: -6.5%).

- UK unemployment rate remained unchanged at 3.7% in the 3-months to Dec, with claimant count down by 12.9k to 1.53mn. Average earnings excluding bonus rose by 6.7% in the 3 months to Dec (prev: 6.5%), the fastest pace since records began in 2001. However, real earnings shrank by the most since 2009.

Asia Pacific:

- The People’s Bank of China left its 1-year and 5-year prime loan rates unchanged at 3.65% and 4.3% respectively this morning, in line with expectations.

- China’s FDI grew by 6.3% yoy to CNY 1.27trn in 2022, with FDI into the manufacturing and high-tech industries up by 46.1% and 28.3% respectively.

- GDP in Japan grew by 0.2% qoq and 1.1% yoy in Q4, avoiding a recession. Japan expanded at an annualised 0.6% in Q4 (Q3: 1.0%), with capital expenditure declining by 0.5%.

- Industrial production in Japan edged up by 0.3% mom in Dec (Nov: 0.2%), thanks to an increase in transport equipment output. In yoy terms, IP declined by 2.4% yoy, following a 2.8% drop in Nov.

- Exports from Japan grew by 3.5% yoy in Jan (Dec: 11.5%), while imports were up by 17.8% (Dec: 20.7%), widening trade deficit to a record-high JPY 3.49trn – the most since 1979. Goods exports to China, its largest trading partner, fell 17.1% yoy in Jan, dragged down by shipments of cars, car parts and chip-making equipment.

- Japan’s machinery orders rebounded by 1.6% mom in Dec (Nov: -8.3%).

- Inflation in India increased to 6.52% yoy in Jan (higher than the RBI’s upper limit of 6% and Dec’s 5.72%), with food price inflation rising to 5.94% (Dec: 4.19%). Wholesale prices meanwhile eased to a 24-month low of 4.73% in Jan, from Dec’s 4.95%.

- India’s trade deficit narrowed to a 12-month low of USD 17.75bn in Jan (Dec: USD 23.76bn), as both exports and imports declined by 6.6% (to USD 32.9bn) and 3.6% (to USD 50.7bn) respectively.

- Singapore GDP grew by 0.1% qoq and 2.1% yoy in Q4 2022, slightly lower than the preliminary estimate due to slightly weaker construction and services sector growth. Full year GDP growth stood at 3.6% yoy and the government kept its forecast for growth this year to range between 0.5% – 2.5%.

Bottom line: Last week data showed an easing of inflation rates (but slower than expected), while tight labour markets might pose a problem to central bankers’ decision making – in the US jobless claims fell while in the UK wages grew faster than expected (though not keeping pace with inflation). According to the IMF, 4/5th of the world’s nations have inflation higher than 6%: even as goods inflation eases (due to the decline in energy prices), a similar decline is yet to be seen in services sector. Central banks should stay the course before embarking on slowing the pace of rate hikes – this week’s Fed minutes will be an interesting read to see how many members are open to higher hikes for longer. Also up are (dovish) central bank meetings in South Korea and New Zealand while BoJ’s next governor Ueda’s testimony in the lower house will be watched for signals on ending yield curve controls.

Regional Developments

- Revenues from tourism in Bahrain reached BHD 1.5bn (USD 3.98bn) in 2022, about 50% higher than the target figure, disclosed the tourism minister. Last year, the number of visitors touched 9.9mn and average duration of the stay was 3.5 days. Inbound tourism has recovered by 90% compared to pre-pandemic levels.

- Egypt’s oil exports surged by 41% yoy to USD 18.2bn in 2022, according to the petroleum minister. He also revealed that Egypt plans to offer three international tenders for oil and gas exploration and production in 2023 (in addition to drilling 300 wells until 2025).

- Turkish investments in Egypt total USD 2bn, and a visiting delegation of Turkish businesses committed to invest USD 500mn in the country.

- Moody’s assigned a (P)B3 rating to Egypt’s first proposed sovereign USD 5bn sukuk program: the rating implies it being speculative and subject to high credit risk. This is in line with the lowering of Egypt’s sovereign rating earlier this month (to B3 from B2).

- Lebanon’s finance minister stated that it would be difficult to replace the central bank governor, this despite the ongoing three and a half year banking and financial meltdown and economic crisis, also saying “there is no consensus yet” regarding an extension of term. Separately, the governor disclosed in an interview that he would leave in Jul even if asked to stay longer.

- Oman’s state energy company OQ plans to raise around USD 244mn from the IPO of its oil and gas drilling businessAbraj Energy Services (selling 49%). The offering opens from Feb 20 onwards and trading will begin on or around March 14th.

- Renewables alone cannot achieve the Paris agreement climate goals, according to the OPEC Secretary General, as the overall focus needs to be emissions reductions and the use of all fuels to meet the goals.

- OPEC+ is likely to continue with the current deal till end of the year, disclosed the Saudi energy minister. He stated that output cannot be increased based on just initial signals of higher oil demand. An OPEC report last week raised global oil demand by 2.32mn barrels per day (bpd) or 2.3% while expecting Russian production to fall by 900k bpd this year, down from a decline of 850k bpd expected last month. Separately, UAE energy minister stated that there was no need for an early OPEC+ meeting in the backdrop of Russia’s output cut.

- Saudi Arabia was ranked highest in the Middle East in the electronic and mobile government services maturity index published by UN ESCWA (from being second in 2021). The country moved up 12 places to 31st in the UN’s e-government development index.

Saudi Arabia Focus

- Saudi Arabia launched the New Murabba Development Company to develop an ambitious New Murabba project in downtown Riyadh by 2030 – including a museum, a technology and design university, a multi-purpose immersive theatre and more than 80 cultural and entertainment venues. It is expected to add SAR 180bn (USD 48bn) to non-oil GDP and create 334k direct and indirect jobs by 2030.

- Inflation in Saudi Arabia inched up to 3.4% in Jan (Dec: 3.3%), the highest since Jun 2021, largely owing to the uptick in housing and utilities costs (6.6%) and food and beverages (4.2%). Separately, the wholesale price index rose by 3.6% yoy in Jan (higher than Dec’s 3%), but below last year’s average.

- The National Debt Management Centre plans to launch a sukuk savings program to further strengthen the domestic market; this is in addition to efforts to get riyal-denominated sukuk included in global indices as well as expand its local and international investors base.

- Saudi PIF bought a USD 265mn stake in Chinese esport company VSPO, becoming the company’s single largest equity holder as well as raising its stake in Nintendo (to 8.26% from 7.08%), making it the largest outside investor. Separately, the PIF also invested a total of USD 1.3bn in 4 local construction firms, as part of its capital increase initiatives.

- The PIF’s US stocks value declined to USD 30.9bn at end-2022, from USD 36.8bn at end-Sep largely due to the decline in value of Lucid (electric carmaker).

- Venture capital funding in Saudi Arabia surged by 72% yoy in 2022 with investments touching USD 987mn across 144 deals, revealed MAGNiTT. Saudi Arabia saw 10 M&A transactions last year, out a total 17 in the MENA region.

- Saudi Arabia’s traded debt value jumped by 62% qoq to SAR 4bn (USD 1.1bn) in Q4 2022. GCC green bond and sukuk issuance hit USD 8.5bn from 15 deals last year (2021: USD 605mn, 6 deals), with Saudi the leading issuer accounting for more than half the total volume.

- Riyadh Development Co (ARDCO) aims to attract SAR 1bn in revenue over the next 10 years under the new strategy.

- Saudi Ports Authority and Maersk announced development of the region’s “largest logistics park” at the Jeddah Islamic Port: the USD 346mn park is scheduled to be completed by Q1 2024, will have an annual capacity of 200k TEUs and will help create more than 2500 direct and indirect jobs.

- Foreign and domestic tourists in Saudi Arabia rose to 93.5mn in 2022 (with foreign tourists at 16.5mn), with tourism spending rising by 93% yoy to SAR 185bn.

UAE Focus![]()

- Abu Dhabi’s ADNOC plans to float 4% of its gas business, selling more than 3bn shares; the offer price, “determined based on the offer price range”, will be announced on Feb 23rd (first day of the offer period). The company plans to raise USD 2bn or more, giving Adnoc Gas a valuation of at least USD 50bn. Adnoc has already transferred 5% of Adnoc Gas to Taqa, the main power producer in the UAE. Adnoc Gas has a capacity of about 10bn standard cubic feet of gas per day, while reporting adjusted revenue of USD 21.2bn and net income of USD 4.2bn in the Jan-Oct 2022 period.

- GDP in Abu Dhabi grew by 10.5% yoy in Jan-Sep 2022, with the non-oil sector contributing 50.3% to GDP and the real estate sector expanding by 20.3%.

- UAE-India trade relations jumped by 27.5% yoy to USD 57.8bn (AED 212.5bn) between Apr-Nov 2022, according to data from the Indian consulate in Dubai.

- UAE accounted for 40% of VC investments in the MENA region (which totaled more than USD 3bn in 2022), revealed the CEO of the Economic Development Department at the Department of Economy and Tourism.

- The president of the COP28 summit stated that “keeping 1.5 [goal] alive is a top priority” given the reality that global emissions must decline 43% by 2030, and that a major “course correction” would be needed to get to the target.

- The International Finance Corporation (IFC) will sign an MoU with the Abu Dhabi Fund for Development to jointly invest USD 1.5bn in energy transition, disclosed the IFC Director at the World Government Summit.

- The net earnings of 123 listed Emirati companies grew by 60% yoy to AED 191bn in 2022, reported WAM (the Emirates News Agency). Banking sector dominated the earnings, with 18 banks posting a 32% yoy rise in net earnings to AED 50.319bn. IHC was the most profitable listed company, with a 175% surge in net earnings to AED 31.86bn in 2022.

- The World Travel and Tourism Council (WTTC) forecast that Dubai and Abu Dhabi’s travel and tourism sector grew to AED 46bn and AED 11bn respectively in 2022 (only 10% and 12% below 2019 levels). Employment in the sector is estimated to have risen to 262k and 43k respectively in Dubai and Abu Dhabi (up by 13% and 0.4%).

- Emaar’s group property sales touched a record-high AED 35.1bn (USD 9.5bn) in 2022, according to the company; the backlog of property sales jumped to AED 53.2bn.

Media Review

Global Economic Diversification Index 2023 released at the World Government Summit

https://www.worldgovernmentsummit.org/observer/reports/2023/detail/global-economic-diversification-index-2023

Arab states need new Syria approach: Saudi foreign minister

https://www.reuters.com/world/middle-east/arab-states-need-new-approach-towards-syria-says-saudi-foreign-minister-2023-02-19/

Support for Climate Action Hinges on Public Understanding of Policy

https://www.imf.org/en/Blogs/Articles/2023/02/09/support-for-climate-action-hinges-on-public-understanding-of-policy

The world’s USD 13trn interest bill

https://www.economist.com/finance-and-economics/2023/02/19/the-worlds-13trn-interest-bill

Powered by: