“Global Economic Diversification Index 2023” was released by the Mohammed Bin Rashid School of Government (MBRSG) at the World Government Summit held in Dubai on 14th Feb 2023. Dr. Nasser Saidi & Aathira Prasad were co-authors of the report, which was developed in cooperation with Salma Refass and Fadi Salem (MBRSG) and Ben Shepherd (Developing Trade Consultants).

Access the latest and past reports as well as the underlying data on the website. The report’s release was covered in newspapers like The National and Khaleej Times among others.

Economic diversification has been a guiding policy theme for commodity producing nations to minimize volatility, support economic growth and development, create jobs. alongside greater private sector activity and more sustainable public finances. While research about economic diversification centers around its determinants and the impact of policies on economic development, there had been no agreed, available measure or index of economic diversification till the first edition of the Global Economic Diversification Index (EDI) was published in 2022. The EDI measures and ranks countries on the extent of their economic diversification from a multi-dimensional angle, exploring diversification of economic activity, international trade as well as of government revenues (away from a dependence on natural resource or commodity revenue).

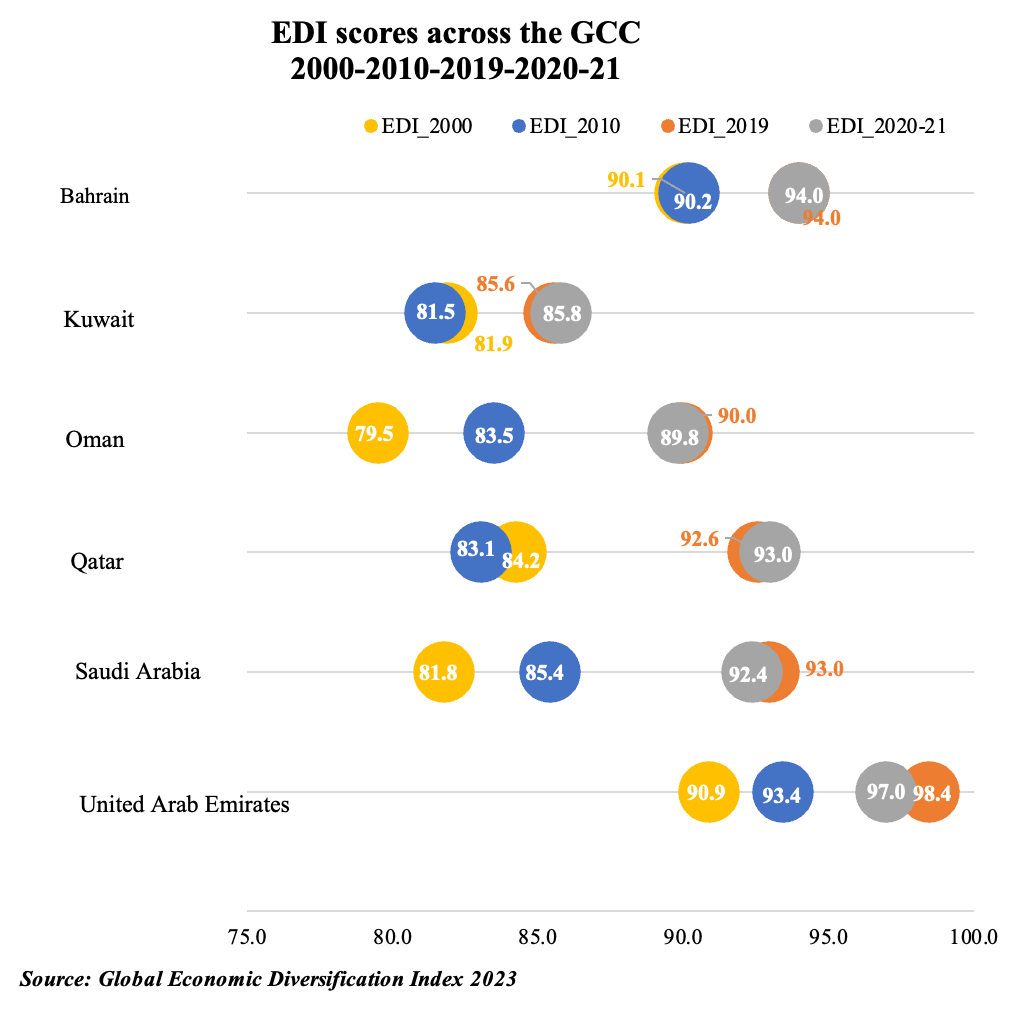

The EDI is based solely on quantitative indicators, with no survey or perception indicators, providing a quantitative benchmark and ranking of the economic diversification of countries, using 25 publicly available indicators, data and information. This edition of the EDI extends the coverage to a total of 105 countries, for the period 2000 to the Covid19 affected 2020 and 2021, allowing an international, cross-country, regional comparison and ranking of commodity dependent countries.

The United States, China and Germany hold on to their top 3 positions in this edition of the EDI. Nations that rank 4th to 10th have only a 6-point difference between them, highlighting the strength of diversification among the highly ranked countries. Three oil producing nations continuously remain in the bottom 10 nations across the period, but the MENA region has recorded an improvement towards the latter part of last decade (supported by the acceleration of many oil producer’s diversification plans).

Overall regional rankings held steady even during the pandemic years (though the scores were much lower): North America topped the list while Sub-Saharan Africa remained a laggard. The analysis highlights that while commodity dependent nations have made gains in both output and trade diversification sub-indices over time, revenue diversification has been holding back overall advances for many. Tax revenue as a % of GDP in Norway, highly ranked in the revenue sub-index, stands at a high 30%+ and compares to single digit readings in countries like Bahrain, Iran or Kuwait, to name a few.

Within the GCC, UAE and Saudi Arabia have made the most significant economic diversification progress, thanks to a conscious effort to diversify into the non-oil sector. Following the onset of Covid-19, which put the brakes on non-oil sectors of focus (like tourism, infrastructure and logistics), there has been an accelerated shift in policies rolled out to enable economic transformation. This includes structural reforms (especially directed at the labour market and increased mobility), embracing the digital economy, efforts to broaden the tax base and a concerted push towards the privatisation of certain state-owned assets and enterprises to de-risk fossil fuel assets among others. This will support the next phase of economic diversification in the region.