IMF Economic Forecasts update. Our outlook & risks for MENA region. Saudi GDP & monetary stats.

Download a PDF copy of this week’s insight piece here.

Weekly Insights 3 Feb 2023: Economic Outlook & Risks for the MENA region

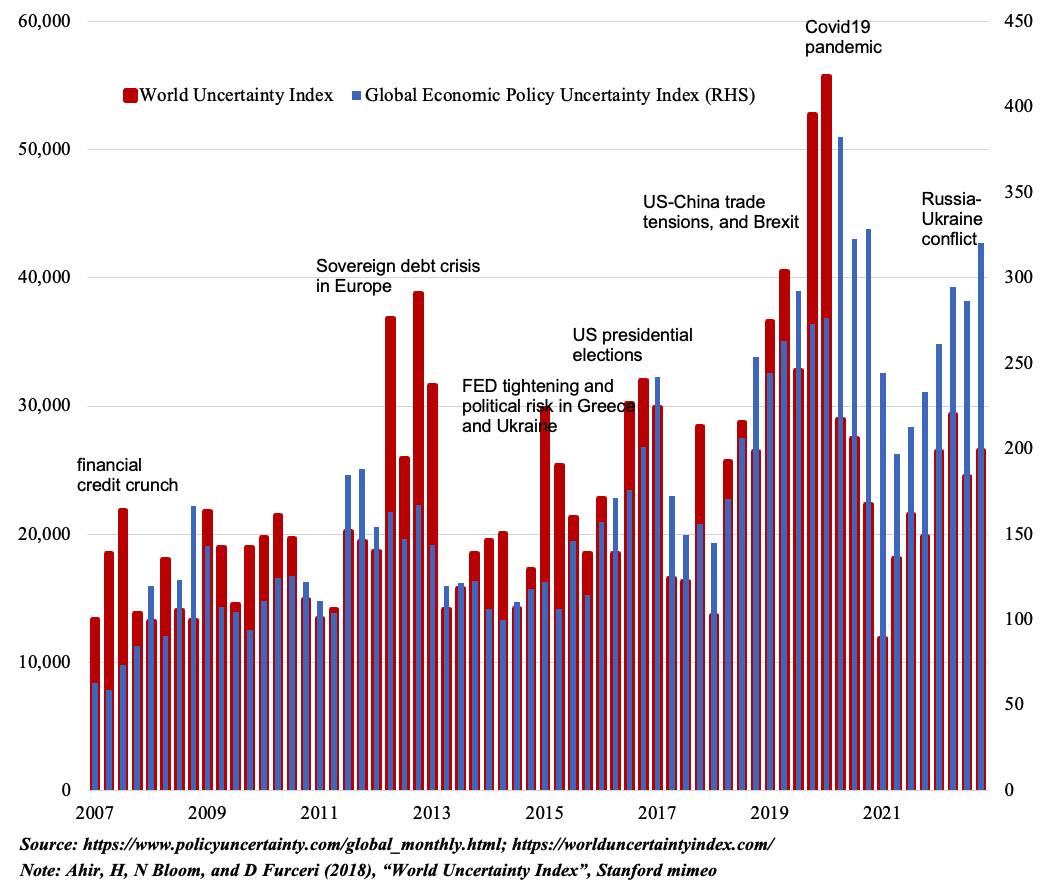

1. Economic Policy Uncertainty Remains High, given ongoing Russia-Ukraine conflict & high inflation levels

- The World Uncertainty Index has declined considerably since the highs during the Covid19 pandemic months.

- In contrast, the Economic Policy Uncertainty Index stays high even in Q4 2022, given the economic spill overs from the ongoing Russia-Ukraine conflict.

- In addition to potentially persistent inflation (8.8% in 2022), there are risks from high debt distress in emerging markets (given rising interest rates, stronger dollar), higher food and gas prices (leading to social unrest) and geopolitics (e.g. Russia-Ukraine conflict worsens, US-China), among others.

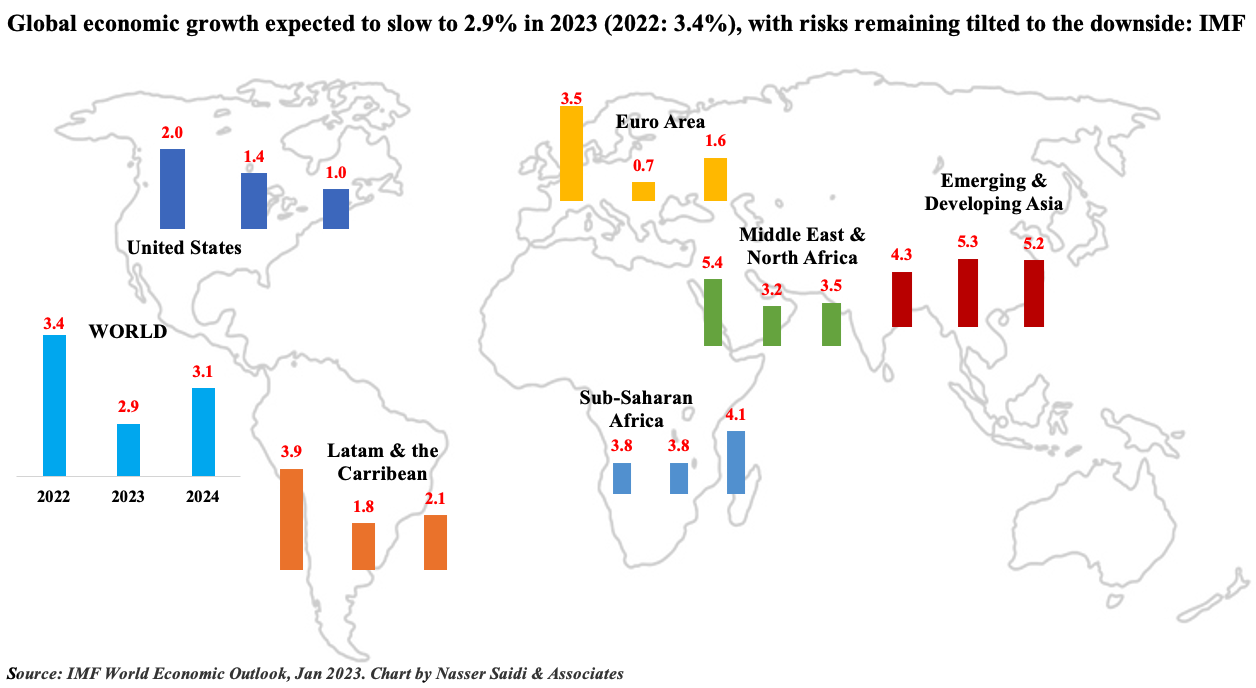

2. IMF projects global growth to ease to 2.9% this year

- Economic growth is forecast to fall to 2.9% in 2023, following 3.4% growth in 2022. A slowdown is expected this year (as seen from PMI data, business & consumer sentiment indicators) partly due to the rise in central banks’ interest rates. Re-opening of China could lead to a faster recovery as mobility increases, factories re-open and pent-up demand leads to increased consumption spending.

- Inflation is to remain high this year, even though it is projected to ease to 6.6% in 2023 (2022: 8.8%). Both food and fuel prices have declined from last year’s highs, reflecting weaker demand and effects of policy tightening. However, services inflation is high, as seen from relatively stable core inflation readings & labour markets remain tight amid risks of further rise in food & energy prices.

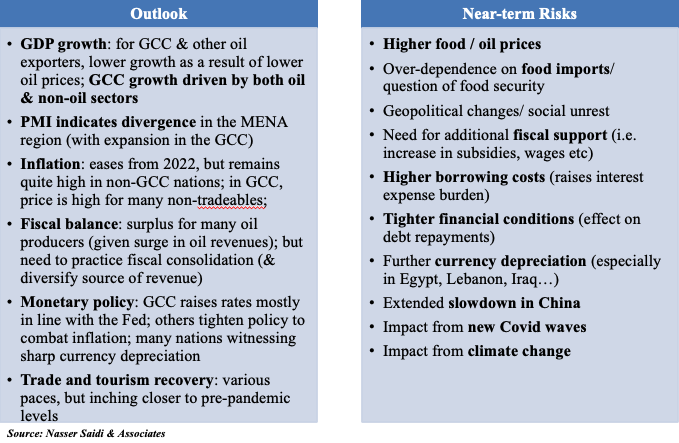

3. Growth in Middle East and North Africa is set to decline to 3.2% this year: IMF. What is our outlook for the region?

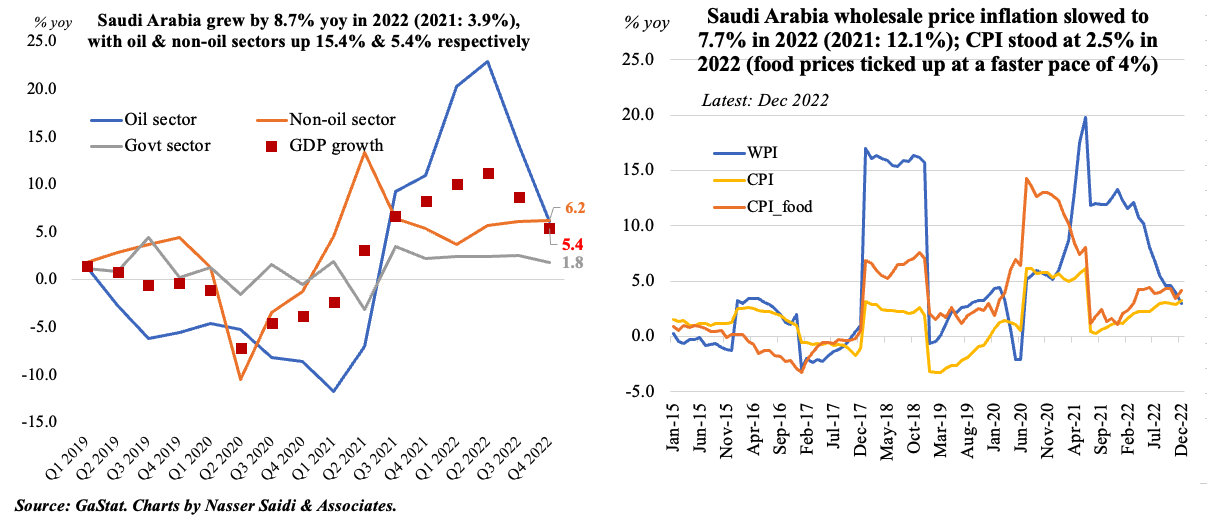

4. Saudi Arabia’s GDP grows by 5.4% in Q4 2022, taking full year growth to 8.7% (vs 3.9% in 2021)

- Q4 GDP grew by 5.4% yoy in Saudi Arabia, supported by a 6.2% increase in non-oil sector activity alongside a 6.1% uptick in oil sector growth. This brings the full year growth to 8.7%, largely due to boost from the oil sector (15.4% yoy) while non-oil sector activity increased by 5.4%. The IMF, in its Jan WEO update, projects growth at 2.6% this year (1.1 percentage points lower than Oct 2022 projection) and 3.4% in 2024.

- In addition to the boost from oil prices, Saudi Arabia has witnessed a recovery in the non-oil private sector, as seen from PMI readings as well as monetary indicators including consumer spending. Furthermore, work on its various megaprojects (driven by the PIF) will also support growth in the near-term.

- Reform-supported growth: a conscious shift away from following a procyclical fiscal policy, ongoing financial market reform, ambitious plans to attract regional HQs/ MNCs and allocating funds from the SWF for domestic investments will further benefit Saudi Arabia’s diversification efforts and macroeconomic stability.

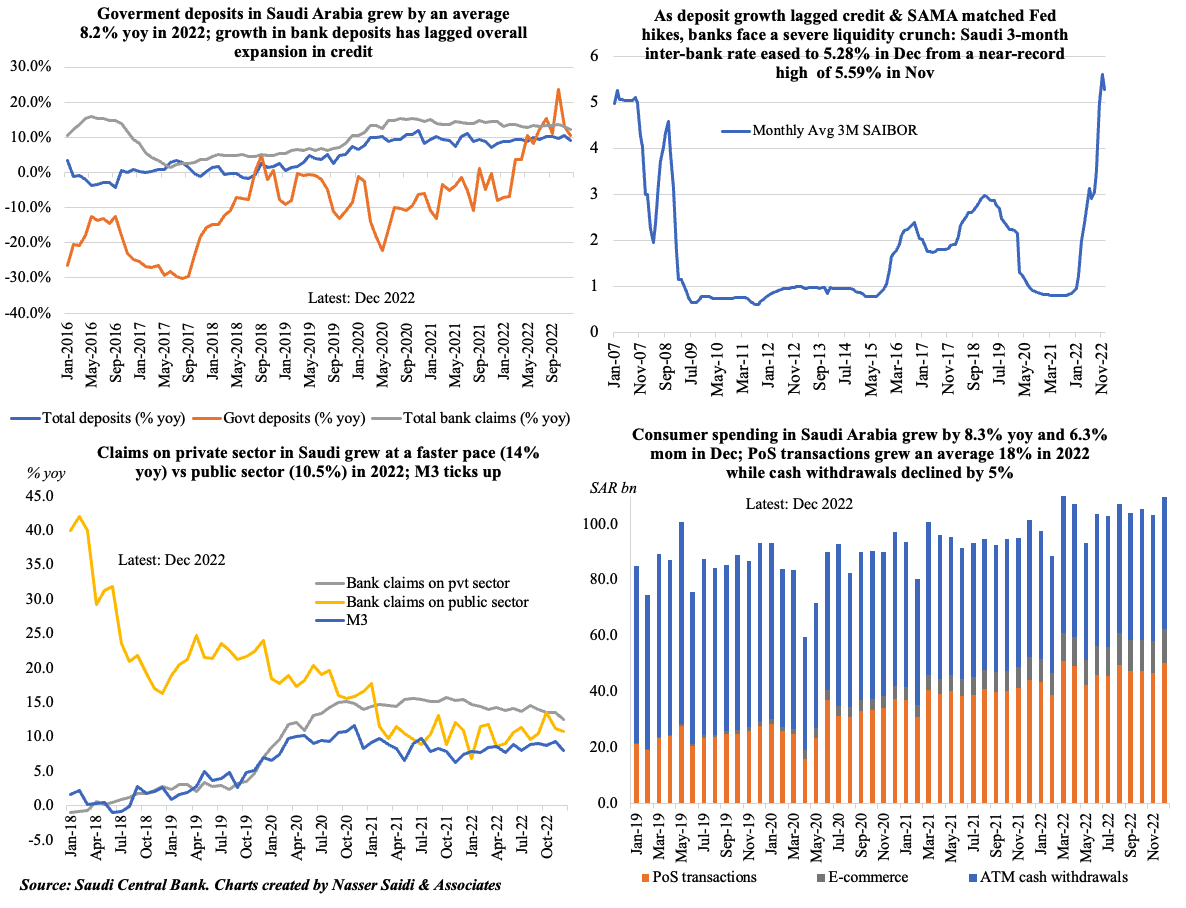

5. Saudi Central Bank data: rising consumer spending; deposits not growing in tandem with credit expansion; in addition, interest rates being raised in line with the Fed is resulting in tighter liquidity (unusual for period of high oil prices, but points to fiscal discipline).

- Without support on liquidity, lending growth could decline further – this could affect both home ownership targets (via mortgages) and spending on infrastructure / mega projects. Makes a strong case for accessing capital markets for funding

- Higher inter-bank rates also mean higher cost of borrowing (for businesses and consumers)