Global Developments

- Fourth quarter US GDP was revised downward to a contraction of 6.2%. The surprise factor was consumption, down to a 4.3% decline from a 3.5% decline (from nondurable goods) while revisions to net exports and inventories confirmed their lower contribution to GDP growth.

- The Obama budget for 2010 ($1.75 trillion deficit or 12.3% of GDP) called for huge shifts in spending – toward programs like health care, education and energy, and paying for some of it through taxes on the rich, and cuts in farm subsidies.

- The stimulus package proposed by the US government was defended by President Obama in his first speech to Congress in which he stressed that new funds would be made available to banks and other troubled sectors like the auto industry.

- More weak data on US durable goods and initial jobless claims – orders sank by 5.2% in Jan, an acceleration from the 4.6% decline in Dec while initial jobless claims increased to 667k from the 630k’s earlier. The only good news was the contraction in inventories, which could set up for increased production from inventory restocking down the road.

- The German IFO survey in February slipped to 82.6, having risen in January, but future expectations continue rise, which is not more than a silver lining in Euroland, though noteworthy. The Belgian Manufacturing Index recorded another drop to -36.8 from -30.3 as manufacturing orders in Euroland fell by more than 24% on the year.

- Signs of some stabilization in the public’s mood in Euroland came from French consumer confidence (inched up to 43 from 41) and Italian consumer confidence (gained two points to 104 from a month earlier).

- The economic downturn hit both Japanese exports (which nearly halved for Jan09) and Hong Kong 4Q GDP (which contracted 2.5%). Hong Kong private consumption declined 3.2% while fixed investment suffered the largest decline among the GDP components (contracting 17.3% year-on-year after growing 3.2% in 3Q 2008).

- Bank Negara and Bank of Thailand continued rate cuts – policy easing by 50 basis points each – to support worsening growth expectations amidst receding inflationary risks.

- India rating was downgraded from stable to negative by Standard and Poors on worsening fiscal conditions. Additionally, GDP for Oct-Dec08 showed growth slowing to 5.3% year-on-year versus 7.6% in the previous quarter.

Regional Overview

- Annual inflation in Saudi Arabia fell to a 12-month low of 7.9% in January after the pace of rise in rents and food prices eased. The Central Bank expects inflation to decline further in the first quarter.

- Bahrain plans to issue almost $800 million in bonds (in tranches over the next six months) to finance housing projects, as mentioned by the minister of housing, in an attempt to boost public spending during economic slowdown.

- Kuwait Parliament is still debating the KD1.5bn bailout package, with the final vote to be cast on Mar 3rd.

- Banks led the Doha index lower in the last two trading days as investors reacted to a Moody’s Investors Service report highlighting a negative outlook for the Qatari banking system.

Market Intelligence on the UAE:

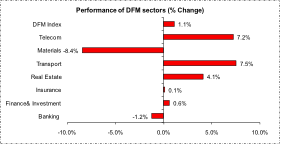

- The Dubai government issued bond for USD 20bn of which half have been subscribed by the UAE Central Bank, in a move widely interpreted as a support by the federal government to the Dubai government. Dubai entities including commercial ventures, real estate and banking and finance can access this bond fund and as a consequence markets and sentiment rallied.

- In a press conference by the Dubai Dept. of Finance, it was revealed that $10 billion in bond proceeds from the central bank would be enough to help state-linked firms settle debts and refinancing needs for this year.

- A strategy report issued by Real Estate Regulatory Agency (RERA) on Wednesday stated that Dubai developers were likely to delay the delivery of about 20% of residential units in 2009 and 40% in 2010.

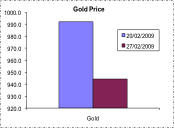

- Launch of a gold-backed Islamic security is expected this week by the World Gulf Council, given the backdrop of gold as an alternate investment haven and insurance against potential future inflation.

- Nasdaq Dubai reverts back to five-day working week in order to re-focus on the Middle East region as opposed to its overlap with the Asian markets earlier.

- Dubai airport traffic was up 6% in January to 3.3 million passengers in spite of slowing air traffic globally.

- As a relief to consumers affected by the global slowdown, DP World has announced its decision to maintain 2008 tariffs at Jebel Ali ports and also provide 10 days of free storage time for all local importers starting Mar 1st.

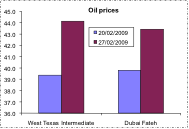

- Abu Dhabi National Oil Co (ADNOC), the main oil supplier in the UAE, said it will sell customers less of its flagship Murban crude oil and three other main grades in April than in March. Seen as a possible signal that OPEC will cut output further at its next meeting in March, this led to a rally in oil prices.

Market Snapshot as of 1/03/2009 at 14:00 (all % figures are weekly changes from 22/02/2009)

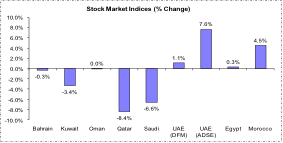

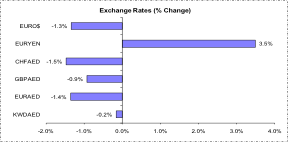

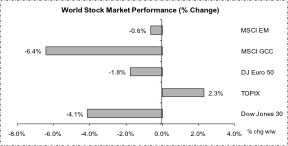

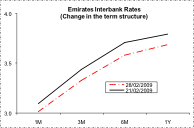

The widespread mood of equity weakness over the past two weeks has been driven mainly by two factors. One, investors appear less than enthralled with the lack of specificity coming from policy makers about the US Financial Stability Plan. Two, the economic data have been uniformly disappointing. The regional markets mirrored the global markets’ decline and widespread selling dragged all markets into the red except in the UAE where Dubai’s $20bn bond issuance led to a positive sentiment and rally. In commodities, oil showed signs of recovery on speculation about rising demand and further OPEC output cuts in March while gold fell from the previous week’s 11-month high as the dollar held onto gains against the yen. The Eibor has eased even further from last week, though still higher than the repurchase rate set by the UAE Central Bank.

Source: Reuters 3000Xtra, DIFC Economics.