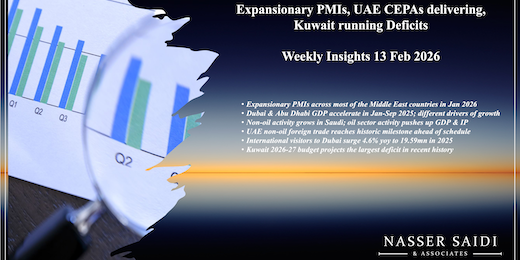

1. Expansionary PMIs across most of the Middle East countries in Jan 2026

- UAE PMI accelerated to a near one-year high (54.9), driven by a sharp uptake in new business and strong orders. Momentum cooled slightly in Saudi Arabia (a six-month low of 56.3) and Kuwait (53.0) though remaining firmly in expansionary territory.

- Resurgence of input cost pressures. Saudi Arabia & UAE reported accelerated rises in input prices driven by raw materials, wages & technology costs. Firms in the UAE and Kuwait are limiting output price increases to maintain market share that could have a significant impact on businesses operating margins.

- Though Qatar and Lebanon posted expansionary readings of 50.4 and 50.1 respectively, underlying data reveals some fragility. Weak order inflows and heightened worries over potential US-Iran escalation underlie Lebanon’s readings. Qatar posted seven months of declining new business in the past eight months, with headline PMI driven by employment & growth in stocks of purchases than demand.

- Labour market pressures. Egypt slipped back into contraction (49.8 in Jan), with firms trimming jobs at the sharpest rate since late 2023 amid spare capacity and softer domestic sales. Kuwait reported outstanding business accumulating at a record pace, indicating an urgent need for hiring (especially if new orders continue to rise).

- Domestic vs external demand. Most GCC nations have benefitted from strong domestic demand. Saudi also demonstrated resilience in external trade: export orders expanded at the fastest pace since Oct 2025. In contrast, Egypt’s production was supported almost entirely by foreign demand, amid weak domestic consumption.

- The ongoing increase in input costs and wage bills presents a major headwind, especially in the backdrop of businesses absorbing costs to remain competitive and secure market share. If inflationary pressure on raw materials persists, it could impact corporate profits significantly by mid-year. Furthermore, geopolitics could also become a significant factor: should the US-Iran tensions cited in Lebanon become a larger concern across the region, business sentiment could be affected. Remember that Trump plans to impose additional tariffs on countries doing business with Iran.

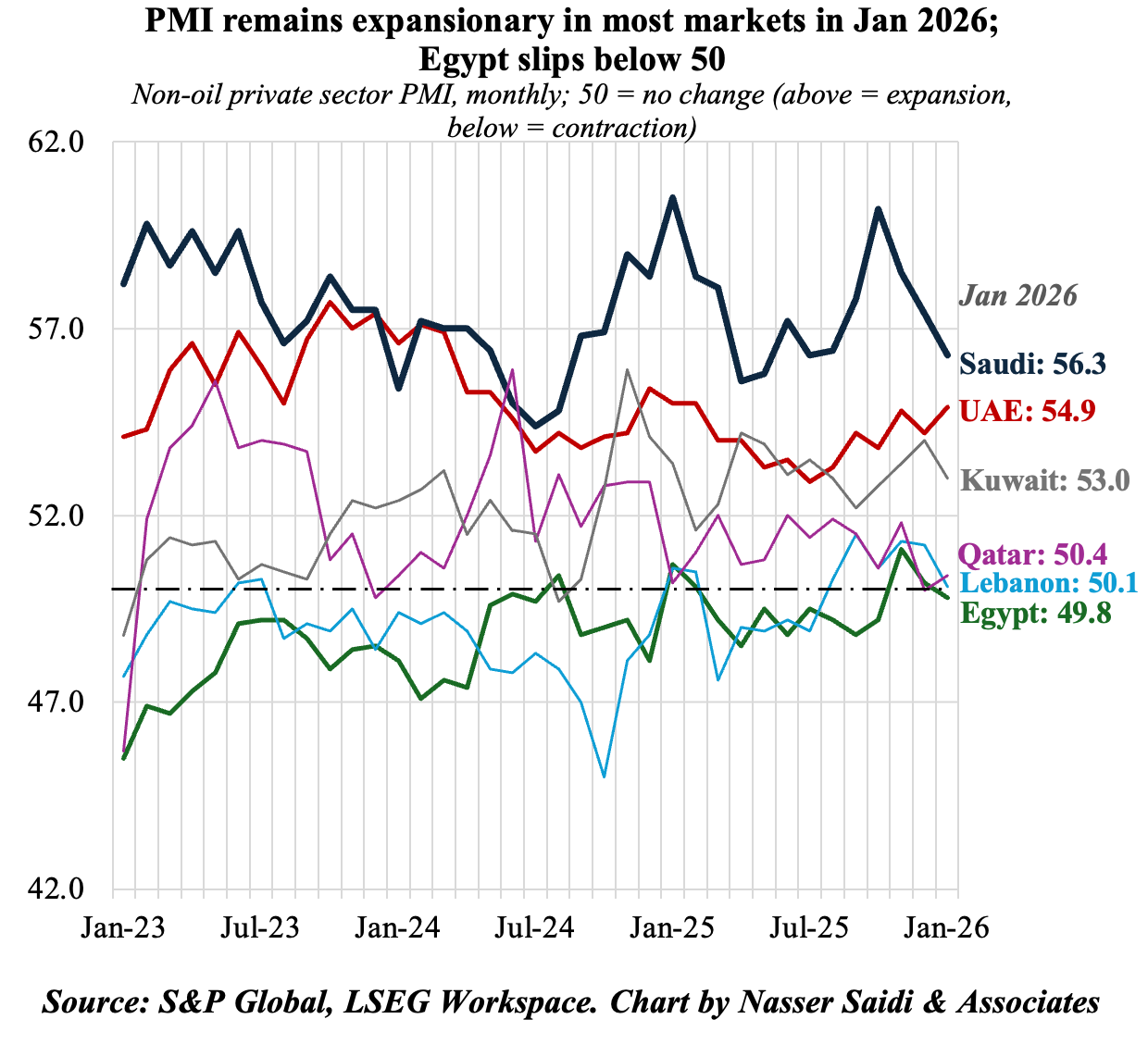

2. Dubai & Abu Dhabi GDP accelerate in Jan-Sep 2025, but with different drivers of growth

- Dubai GDP grew by 4.7% yoy to AED 355bn in Q1-Q3 2025: trade, logistics, financial services, manufacturing & real estate were the top contributors to growth (together accounting for under two-thirds of GDP).

- Post-pandemic population boom remains one of its strongest forward-looking indicators. Net inflows of high-income expatriates are reinforcing consumption, housing demand, retail, transport and SME activity. Growth will be supported by an active private sector, benefitting from higher capital inflows into more dynamic sectors (AI/ Tech, financial services etc.). Its D33 agenda includes doubling foreign trade: plausible considering current trade patterns (next slide)

- What to watch out for? (a) Can the market absorb the rapid supply growth in real estate – will it lead to a correction? (b) Will infrastructure strain (traffic, utilities) have a negative impact on productivity?

- Abu Dhabi grew steadily in Q1-Q3 2025, up 5.0% yoy to AED 923.1bn. The emirate’s diversification away from oil is evident: in Q3 alone, real GDP grew by 7.7%, with non-oil GDP posting its highest quarterly value on record (+7.8% yoy to AED 175.6bn).

- The non-oil pivot (6.8% growth in Q1-Q3) stems from state-led investment in “high-value” sectors like clean energy, high-tech manufacturing & finance (ADGM). The finance sector’s growth (9.3% in Jan-Sep) signals its rise in attracting hedge funds & family offices (“a capital of capital”).

- What to watch out for? (a) Will a fall in oil prices lead to lower government spending that slows support for industrial projects driving non-oil growth? (b) Will increased oil production quotas revive growth in the oil sector (as being seen in Saudi)?

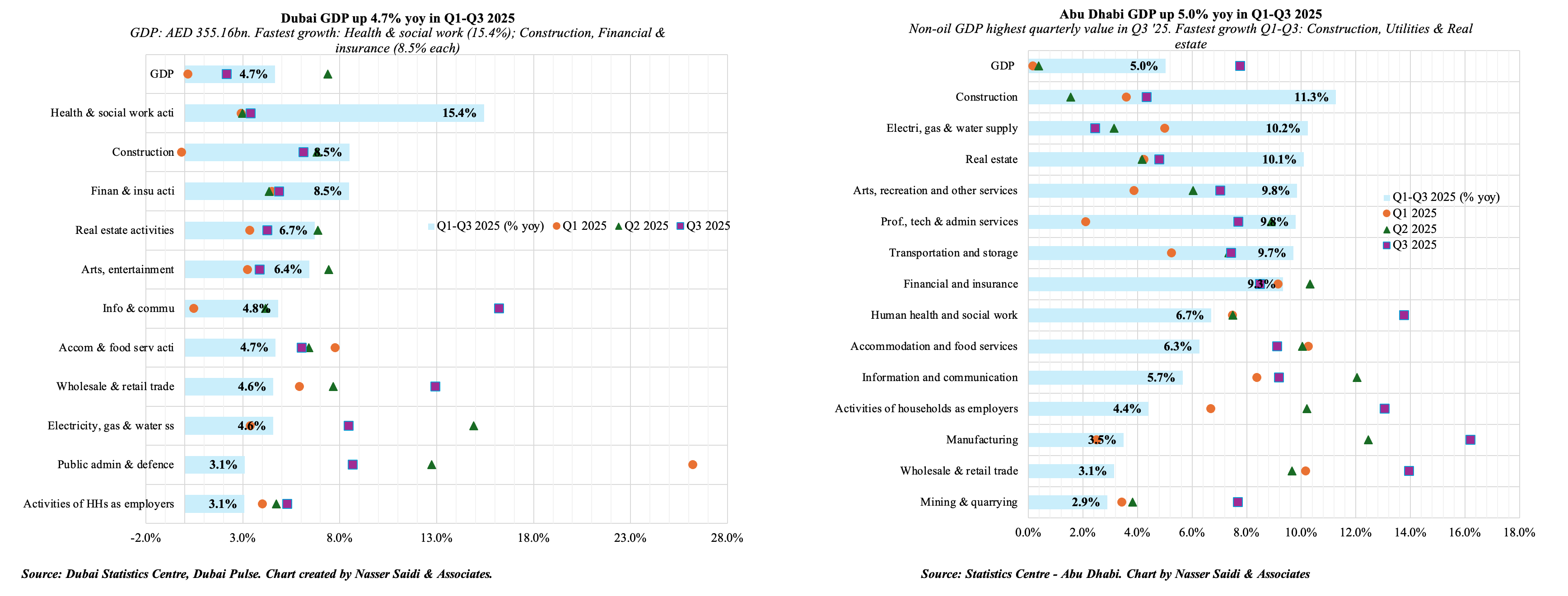

3. Non-oil activity grows in Saudi; oil sector activity pushes up GDP & IP

- Saudi Arabia’s GDP grew by 4.9% yoy in Q4 (Q3: 4.8% and Q4 2024: 5.2%), according to flash estimates from Gastat.

- Growth was supported by a double-digit growth in oil activities (10.4% in Q4 vs 8.3% in Q3 and 3.4% a year ago), resulting from the unwinding of voluntary oil production cuts. By Dec 2025, Saudi crude production reached 10.1mn barrels per day (bpd), up significantly from around 8.9mn bpd a year earlier.

- The non-oil sector continued to grow by a solid 4.1% (Q3: 4.3%) but was overshadowed by the surge in oil sector activity.

- For the full year 2025, GDP grew by 4.5% – a much faster pace than 2024’s 2.7%. Once again, oil was a key factor: the sector posted a rebound in 2025, growing by 5.6% versus a 4.4% drop in 2024.

- Saudi industrial production data mirrors this oil surge. In Dec, IP grew by 8.9% yoy, driven by the 10.1% jump in oil activity. The extraction of crude petroleum and natural gas, which has a heavy weight of 61.4% in the index, grew by 13.2% yoy – pulling up the headline IP number. Non-oil manufacturing also increased, up 2.1% mom and 6.5% yoy in Dec.

- Within non-oil manufacturing, the fastest growth was recorded by chemicals (13.4% yoy) – possibly that the extra O&G produced is also feeding into downstream industries (petrochemicals).

- IP rebounded in the full year 2025, growing by an average 5.3%, from a 2.1% drop in 2024. Oil activities recovered in 2025, rising 5.8% (2024: -4.7%).

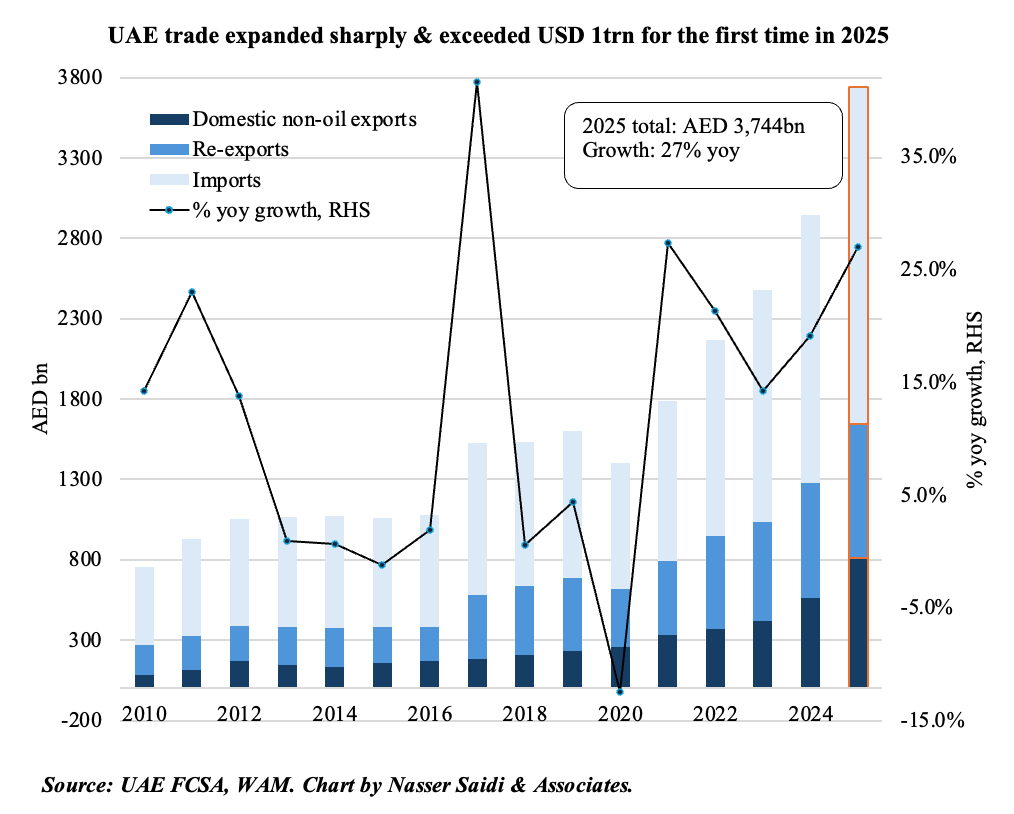

4. UAE non-oil foreign trade reaches historic milestone ahead of schedule

- UAE’s non-oil foreign trade surged 27% yoy to a record-high AED 3.744trn in 2025, hitting its 2031 trade target five years early.

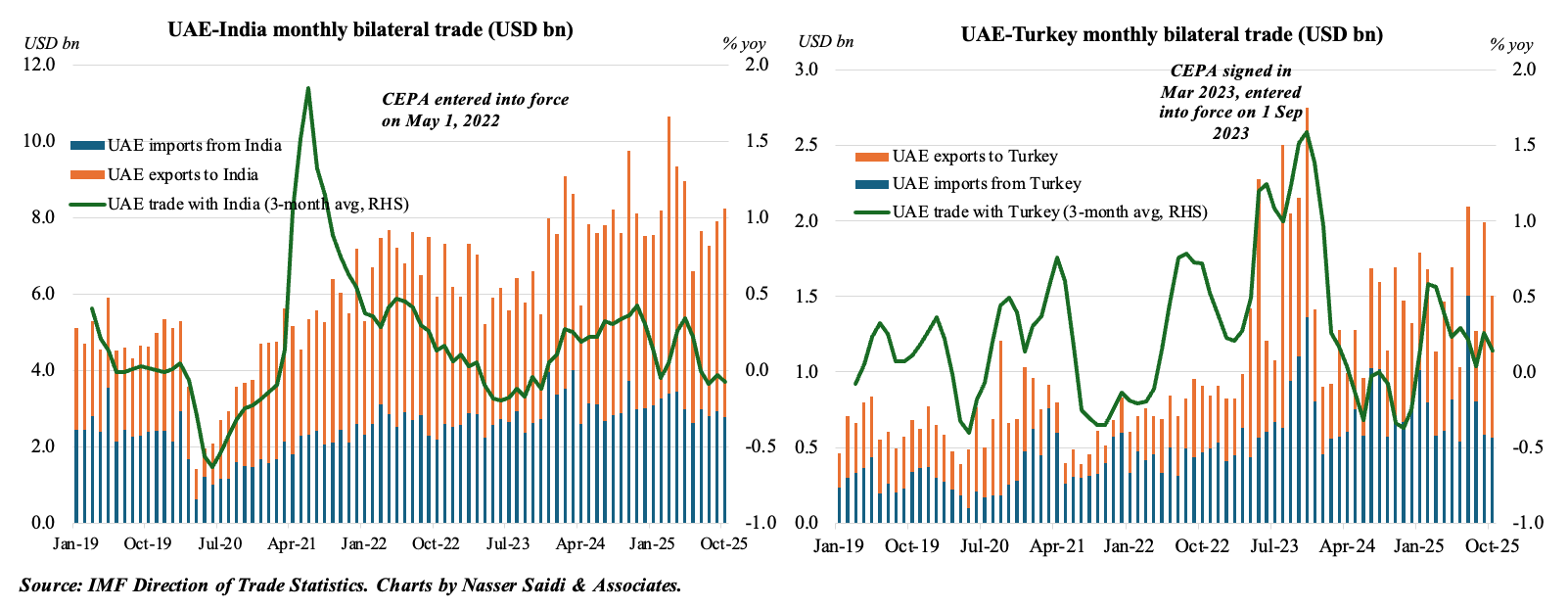

- UAE trade volumes are less correlated with oil prices, thanks to diversification efforts via products (non-oil exports, re-exports) and new markets (Comprehensive Economic Partnership Agreements or CEPAs). Trade with CEPA partners, including India & Turkey, grew by 18.2%.

- Non-oil exports are the primary engine of growth, surging 45% to AED 813.8bn. Despite the surge in domestic exports, traditional re-exports grew by 15.7% (to AED 830bn), underscoring UAE’s efficient logistics operations.

- Going forward, the UAE will continue to benefit from the CEPAs (35 signed so far & others in various stages of discussions). It’s role as a neutral party amid the trade and tariff wars and logistical connectivity will support Global South trade (bridging Asian production with Africa & Middle East consumption). Furthermore, expect the UAE to benefit from digital trade – both infrastructure and services exports.

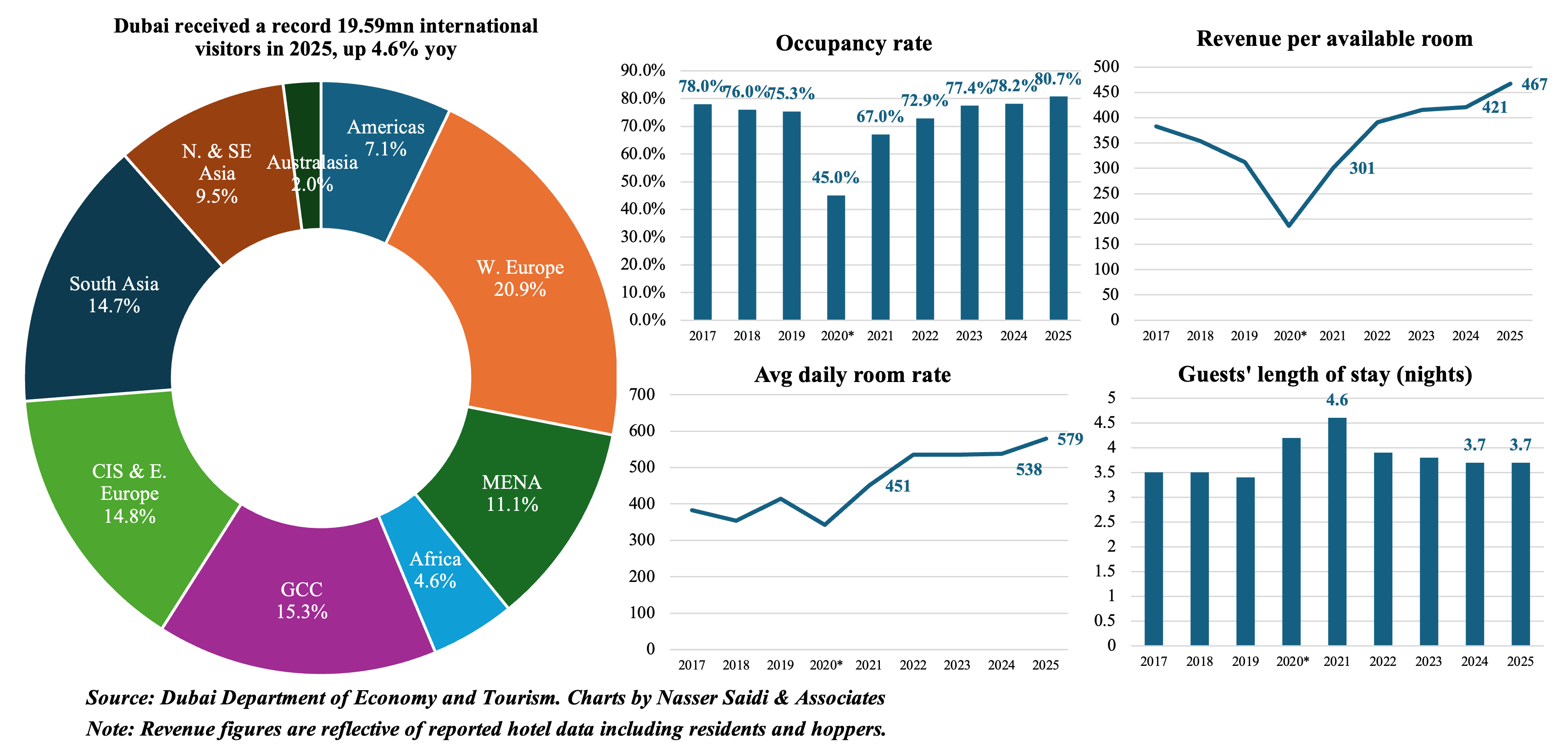

5. International visitors to Dubai surge 4.6% yoy to 19.59mn in 2025

- Visitors into Dubai increased by 4.6% yoy to 19.59 million in 2025. Western Europe and South Asia accounted for the largest shares of visitors at 20.9% and 14.7% of total visitors in 2025 (4.1mn and 2.9mn respectively) while GCC & MENA together accounted for 5.16mn visitors (or 26.4% of the total).

- Annual gains were highest in CIS & E. Europe (+10.1% yoy to 2.89mn), followed by Americas (9.8% to 1.4mn) and Western Europe (9.7% to 4.1mn); there was a slight dip in tourists from South Asia (-7.9% to 2.9mn) and Africa (-0.7% to 897k).

- Growth in tourism is also supported by the tourism infrastructure: there were 154,264 hotel rooms (+0.2% yoy) across 827 establishments in Dubai. Hotels also reported new-highs (as per available data) amongst multiple indicators: hotel occupancy rate at a robust 80.7%; revenue per available room of AED 467 (+10.9% yoy) and room rates were at AED 579 (+7.6% yoy). However, length of stay held steady at 3.7, but higher than the pre-Covid 3.4 in 2019.

- Dubai International Airport handled a record high 95.2mn passengers in 2025 (vs 91.9mn in 2024 and the previous pre-pandemic record of 89.1mn in 2018), reinforcing Dubai’s strength as the world’s busiest international travel hub — a major driver of tourism inflows.

- Tourism will continue to be a core engine of economic growth in Dubai: improved air connectivity, ease of tourist entry, large events, exhibitions & conferences help smooth out seasonal demand & are attracting higher-spending visitors => increase inbound demand & spending. Strategic plans like GCC unified visas, sustainability, smart infrastructure and cultural tourism will further contribute to Dubai’s GDP.

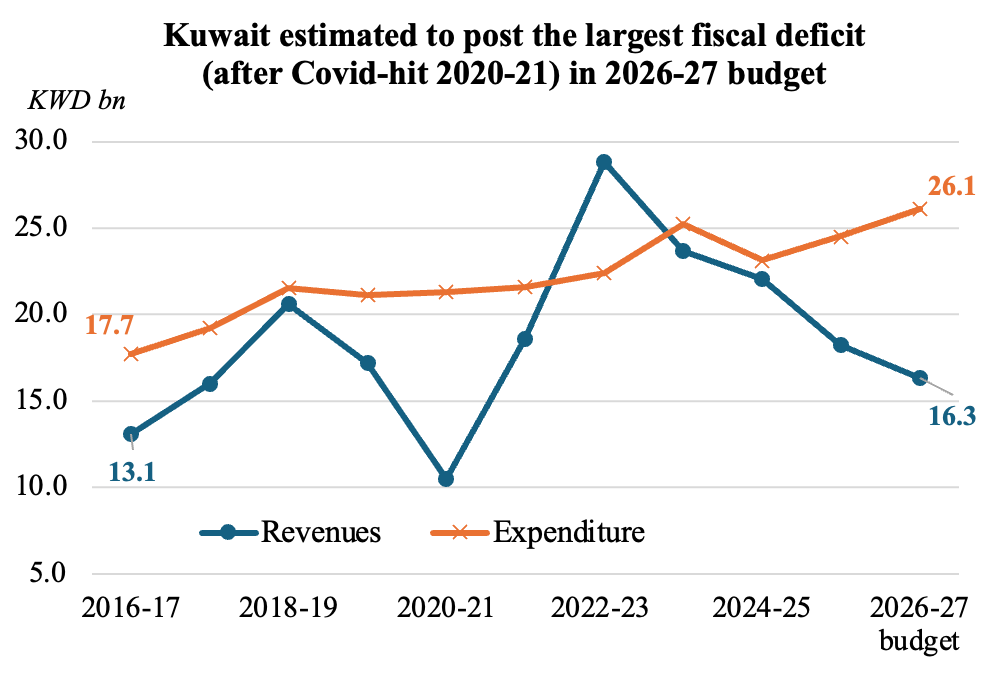

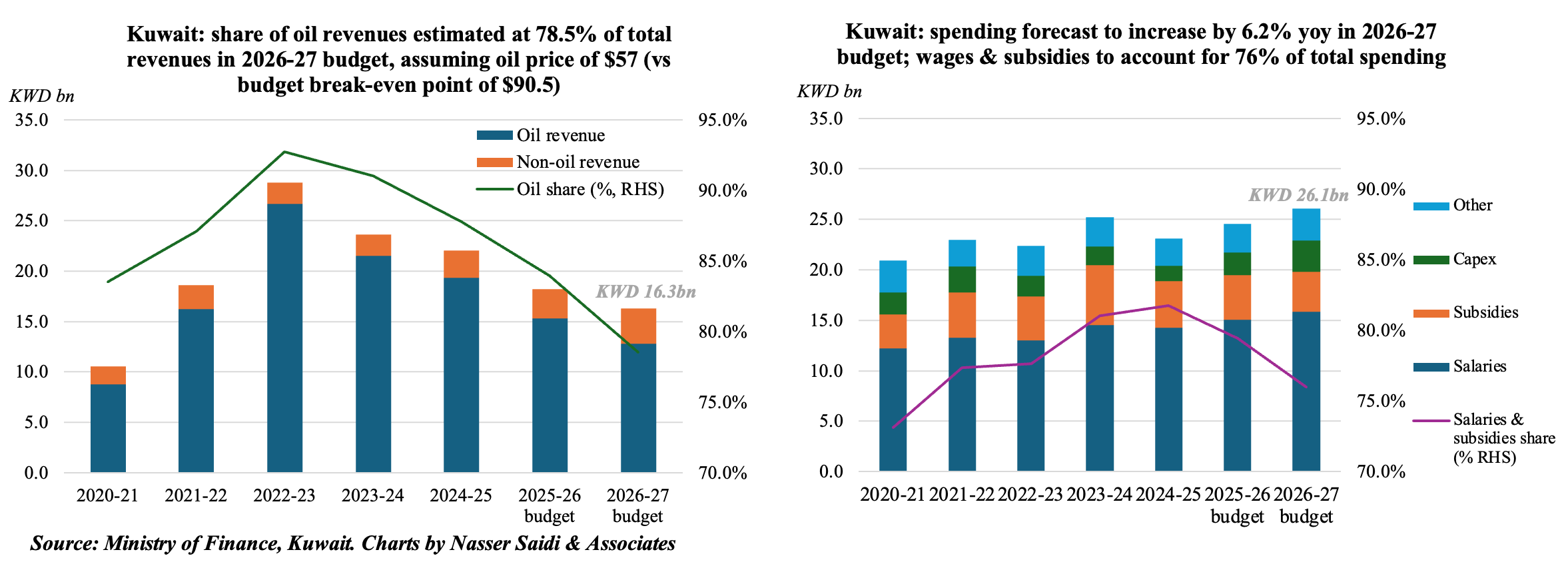

6. Kuwait 2026-27 budget projects the largest deficit in recent history

- The 2025-26 budget in Kuwait projects a fourth consecutive year of deficit: at KWD 9.8bn, it is wider than the previous budget’s KWD 6.3bn and the largest deficit excluding the Covid-hit year of 2020-21 (KWD 10.8bn). This is driven largely by weaker oil revenue assumptions (USD 57) and mandatory transfers; the budget breakeven point is a much higher USD 90.5.

- Compared to the 2025-26 budget, oil revenues are estimated to plunge 16.3%; non-oil revenues, which accounts for just over one-fifth of total revenues, is expected to surge by 20%. Overall revenues are down by 10.5% to KWD 16.3bn.

- Expenditures are projected to increase by 6.2% to KWD 26.1bn (vs 2024-25 budget), thanks to increases in capex (36.8% to KWD 3.1bn or 12% of total spending) and wages (5.2% to KWD 15.1bn); subsidies dipped 10.5% to KWD 4.0bn.

- There were some positive moves towards greater revenue diversification last year: for example, the 15% CIT was extended to cover all large MNCs in Jan 2025, the Public Debt Law (Mar 2025) enables the government to issue debt for the first time in almost a decade. While the rise in non-oil revenues in the 2026-27 budget is notable, the high budget breakeven price should necessitate discussions over measures such as broadening the tax base, subsidy rationalisation or introducing long-term fiscal frameworks to improve resilience. But, for now, Kuwait’s fiscal health continues to be highly sensitive to global oil demand and price volatility.

Powered by: