Download a PDF copy of the weekly economic commentary here.

Markets

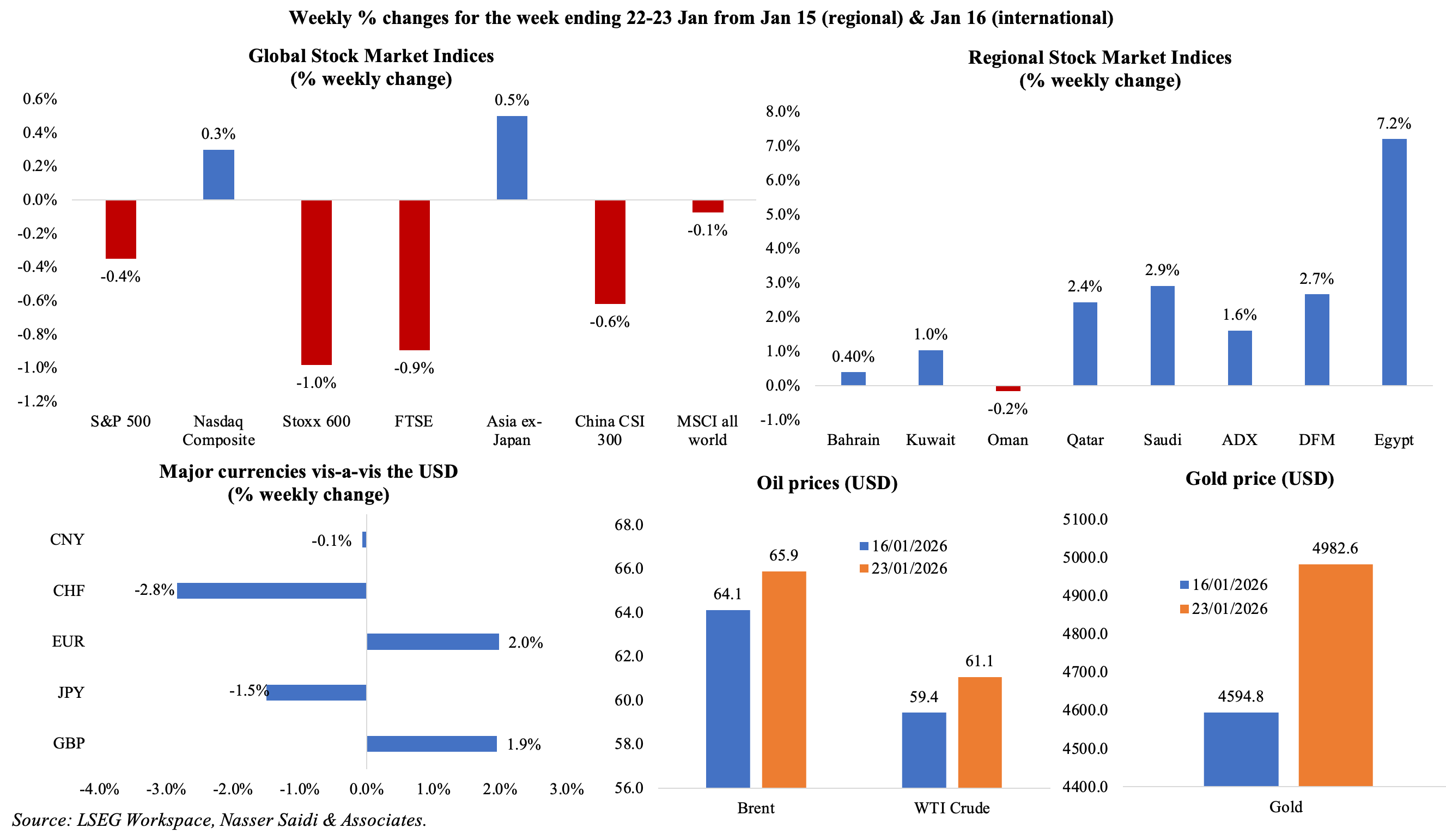

Geopolitical issues were high on investors’ minds as markets started last week with a selloff and then benefitted from a rally later in the week (after President Trump withdrew tariff threats and ruled out military action in Greenland). Regional markets were mostly higher, with only Oman slipping by 0.2%; UAE markets closed lower on Friday on renewed US threats against Iran (which also resulted in oil prices gaining 3.0% weekly). The dollar posted a weekly decline on rising geopolitical tensions; the GBP and EUR posted gains while the yen was volatile on Friday given expectations that the BoJ would intervene to support the yen. Gold and silver prices clocked in record highs.

Global Developments

US/Americas:

- GDP in the US increased at an annualised 4.4% in Q3 (prelim: 4.3%), with consumer spending one of the key drivers (+3.5% in Q3) alongside final sales to private domestic purchasers growing by 2.9% (slightly revised down from the initial 3.0% growth).

- The PCE price index, both headline and core, stood at 2.8% in Nov (Oct: 2.7%): food was flat while energy-related costs rose 1.9% and after falling 0.7% in Oct. Personal consumption expenditures, a proxy for consumer spending, rose 0.5% in both months.

- Personal income grew by 0.3% mom to USD 26.403trn in Nov (Oct: 0.1%), the sixth straight month of increase, with real disposable personal income inching up by 0.1%. Personal spending grew by 0.5% (Oct: 0.5%) with both durable and non-durable goods increasing by 0.7%. The personal saving rate was 3.7% in Oct, followed by 3.5% in Nov.

- US pending home sales plunged by 9.3% mom and 3% yoy in Dec (Nov: 3.3% mom & 2.6% yoy), weighed down by the falling supply of homes (9% mom to 1.18mn homes), stagnant mortgage rates (30-year fixed loan rate of around 6.25%) and continued economic uncertainty.

- Preliminary manufacturing PMI in the US edged up to 51.9 in Jan (Dec: 51.8), the second weakest since Jul. Though output accelerated and new orders rebounded, employment growth slipped to a 6-month low.

- Michigan consumer sentiment index rose to 56.4 in Jan (prelim: 54; Dec: 52.9): the sentiment is more than 20% lower compared to a year ago given high prices and “the prospect of weakening labour markets”. The one and 5-year inflation expectations slipped to 4% (the lowest since Jan 2025) and 3.3%.

- Initial jobless claims inched up by 1k to 200k in the week ended Jan 17, with the 4-week average slipping to 201.5k (prev: 205.25k) – the lowest since Jan 2024. Continuing jobless claims increased by 26k to 1.849mn in the week ended Jan 10.

Europe:

- Inflation in the EU edged down to 1.9% yoy in Dec from the preliminary estimate of 2% and Nov’s 2.1%, with services inflation easing (to 3.4%) and energy prices declined 1.9% (Nov: -0.5%). Core inflation eased to a 4-month low of 2.3%.

- Consumer confidence in the euro area stood at -12.4 in Jan (Dec: -13.1), the highest reading since Feb 2025 but much lower than the long-term average.

- Eurozone’s preliminary manufacturing PMI rose to 49.4 in Jan (Dec: 48.8): production returned to growth and new orders grew while input prices surged to a 3-yeat high. Flash manufacturing PMI in Germany increased to 48.7 in Jan (Dec: 47.0) on higher new orders, smaller drop in export orders amid input cost inflation accelerating to a 37-month high.

- Producer price index in Germany fell by 0.2% mom and 2.5% yoy in Dec (Nov: -2.3% yoy), with lower energy prices driving the decline (-1.2% mom and -9.7% yoy). For the full year, producer prices fell 1.2% as energy prices declined by an average of 6.2%; excluding energy prices, producer prices in 2025 increased by 1.2% yoy.

- German ZEW survey showed an improvement in economic sentiment index that climbed 13.8 points to 59.6 in Jan alongside the current situation sub-index which ticked up to -72.7 (from -81). In the eurozone, economic sentiment index increased to 40.8 (from 33.7) and the assessment of the current situation also rose, up 10.4 points to -18.1.

- UK inflation inched up to 3.4% in Dec (Nov: 3.2%), driven by transport costs (4% yoy, due to air fares around Christmas time) and tobacco prices (due to the change in duty) while core inflation remained unchanged at 3.2% (lowest since Dec 2024). Producer input price eased to 0.8% for inputs (Nov: 1.1%) on a sharp 15.1% drop in crude o il prices while producer output prices remained unchanged at 3.4% (food products prices climbed 4.3%).

- Retail sales in the UK unexpectedly grew by 0.4% mom in Dec (Nov: -0.1% mom and 1.8% yoy) as sales at non-store retailers and online jewellers increased. In yoy terms, sales grew by 5% – the strongest reading since Apr. For the full year 2025, sales increased by 1.3%, higher than the 0.2% gain in 2024.

- Unemployment rate in the UK remained unchanged at 5.1% in the 3 months to Nov. Wage growth slowed: average earnings grew by 4.5% excluding bonus in the 3 months to Nov (from 4.6% in Aug-Sep) but while including bonus it was up a higher 4.7% (from 4.8%).

- UK preliminary manufacturing PMI ticked up by one point to 51.6 in Jan: this is the strongest reading since Aug 2024, thanks to an increase in production and the first rise in new export orders in four years while employment continued to fall.

- GfK consumer confidence in the UK moved up to -16 in Jan (Dec: -17), the highest level since Aug 2024, as households turned more positive about their finances (up 4 points to +6); the 12-month ahead economic outlook fell by 2 points to -31.

Asia Pacific:

- The People’s Bank of China kept its loan prime rate unchanged last week. The PBoC governor in an interview confirmed a moderately loose policy stance for 2026, also stating there was room for further rate and RRR cuts. Bloomberg reported that the PBoC also injected a record amount of funds into the banking system through longer-dated liquidity tools in Jan.

- The PBoC set the yuan’s daily reference rate at 6.9929 per dollar on Friday (23rd Jan), breaching the psychologically important level of 7.0 per USD for the first time since May 2023, opening the door for further CNY gains.

- China’s GDP, which grew by 5.0% in 2025, was in line with the official target but highlighted a “two speed” economy: domestic demand indicators were weak while it was supported by a record trade surplus. The economy expanded 4.5% yoy and 1.2% qoq in Q4.

- Industrial production in China grew by 5.2% yoy in Dec (Nov: 4.8%), performing better than expected thanks to the uptick in manufacturing activity (5.7% from Nov’s 4.6%). For the full year, IP grew 5.9%. Retail sales grew by 0.9% yoy in Dec, slower than Nov’s 1.3% growth, and the weakest since Dec 2022. For the full year, sales climbed by 3.7% yoy.

- China’s fixed asset investment fell by 3.8% in 2025 (Jan-Nov: -2.6%), the first yearly drop since 1989: property investment fell the most (-17.2% following 2024’s 10.6%. drop) alongside a 2.2% drop in infrastructure investment while investment in manufacturing ticked up by 0.6%. FDI fell 9.5% to CNY 747.7bn in 2025 (Jan-Nov: -7.5%), down for three straight years, while the hi-tech sector attracted CNY 241.77bn. Despite the overall decline, FDI from Switzerland, UAE and UK into China last year grew by 66.8%, 27.3% and 15.9% respectively.

- The Bank of Japan left interest rates unchanged at 0.75%, striking a hawkish tone; the governor stated that the timing and path of rate hikes would depend on “economic, price and financial developments at the time”. The BOJ raised its growth forecast for fiscal 2025 and 2026 while also raising the core consumer inflation forecast for fiscal 2026 to 1.9%.

- Inflation in Japan eased to 2.1% yoy in Dec (Nov: 2.9%). Excluding food and energy, inflation slipped to 2.9% (From 3%). Excluding fresh food, prices slipped to 2.4% (from 3%) slowing down partly due to base effects (given changes to government energy subsidies).

- Exports from Japan grew for the fourth month in a row, up by 5.1% yoy in Dec (Nov: 6.1%) while imports were up 5.3% yoy (Nov: 1.3%). Trade balance narrowed to JPY 105.7bn from JPY 322.2bn in Nov. Exports to the largest trade partner China grew by 5.6% and grew by 10.2% to the wider Asia region while that to the US fell 11.1%. For full-year 2025, Japan’s exports rose 3.1% (2024: 6.2%), as shipments to mainland China and the US fell 0.4% and 4.1% respectively.

- Japan’s industrial production contracted by 2.7% mom and 2.2% yoy in Nov (Oct: 1.5% mom and 1.6% yoy). The monthly drop was the most since Jan 2024 as external demand weakened; this was visible in the production of motor vehicles (–6.6% from6.7% in Oct) and fabricated metals (–6.5% from 1.6%) among others.

- Core machinery orders fell by 11% mom and 6.4% yoy in Japan in Nov (Oct: 7% mom and 12.5% yoy); this was the steepest monthly drop since the Covid-affected Apr 2020. Declines were seen across multiple categories including non-ferrous metals (-66.6%), iron and steel (-37.9%), textile mill products (-33.4%) and finance & insurance (-32.6%) among others.

- Japan’s preliminary manufacturing PMI ticked up to 51.5 in Jan (Dec: 50), the first expansion since Jun and with foreign sales rising for the first time in nearly four years.

- Infrastructure output in India grew by 3.7% yoy in Dec (Nov: 2.1%), the fastest pace in four months, thanks to higher cement and steel production (13.5% and 6.9% respectively). Infrastructure output rose 2.6% yoy in Apr-Dec versus a revised growth of 4.5% a year ago.

- GDP in South Korea contracted in Q3, down by 0.3% qoq (Q2: +1.3%), the steepest fall since Q4 2022, as construction investment shrank (-3.9%), exports dropped (-2.1%) as did manufacturing and utilities supply (-1.5% and -9.2%). In yoy terms, growth was up 1.5% from the previous quarter’s 1.8%. GDP grew 1.0% for the full year 2025, the slowest annual expansion since 2020.

Bottom line: The Fed meets this week and is widely expected to hold rates. Though there has been no confirmation of Powell’s successor yet, questions related to central bank independence are likely to come up given Supreme Court’s judging a case against Governor Lisa Cook and the investigation into Powell about renovations to Federal Reserve buildings, which he described as an “unprecedented” action. Preliminary manufacturing PMI increased across most economies in Jan, showing resilience amid the geopolitical tensions. Geopolitical tensions remain high, and markets witnessed “Sell America” trades as investors dumped bonds and currencies in favour of gold and silver. This week sees tech companies report earnings: will they continue to shine in the backdrop of massive spending plans?

Regional Developments

- Egypt FDI inflows stood at USD 11bn in 2025, according to UNCTAD data, making it the largest FDI host country in Africa.

- Egypt and South Korea signed a joint statement advancing negotiations on a Comprehensive Economic Partnership Agreement, aimed at expanding trade, investment and technology transfer. This step signals an intent to deepen ties trade/ investment with Asia.

- Egypt’s current account deficit narrowed by 45.2% yoy in Q1 of the fiscal year 2025-26, driven by strong remittances (29.8% yoy to USD 10.8bn), tourism receipts (13.8% to USD 5.5bn) and improved services exports. The capital and financial account posted a net outflow of USD 366.4bn versus a USD 3.8bn net inflow the previous year.

- Egypt aims to raise USD 500mn through the sale of prime land in Cairo as part of its asset-monetisation strategy. The sale is expected to start in Feb and the ministry is offering prices of around USD 844 per metre, according to an unnamed official. This reflects ongoing efforts to attract private capital and ease fiscal pressures without increasing debt.

- Egypt announced the payment of USD 5bn to international oil companies, significantly reducing outstanding arrears and improving confidence among upstream investors. The move is part of a broader effort to stabilise energy supply, boost domestic production and ease FX pressures. Arrears are expected to narrow to USD 1.2bn by Jun 2026, according to the PM. Separately, Egypt plans to unveil new incentives for oil and gas companies in a bid to reverse declining oil production and attract fresh exploration spending amid regional competition.

- A Chinese firm – Hubei Xingfa Chemicals Group, one of the world’s largest phosphate producers – plans to invest USD 2bn in Egypt’s Golden Triangle mining and industrial zone. The area has nearly 1bn tonnes of phosphates, more than half of Egypt’s phosphates reserves.

- Kuwait awarded a USD 3.3bn sewage treatment plant contract to a Chinese consortium: it will be Kuwait’s largest sewage treatment plant and will support long-term urban expansion.

- Lebanon’s PM said the IMF is demanding changes to the government’s proposed draft financial gap plan including clearer provisions on the hierarchy of claims.

- Lebanon is courting Gulf investors to finance solar energy projects as it seeks to ease chronic power shortages and reduce reliance on costly fuel imports. The plan includes the construction of two power plants with capacity of 825 megawatts each at a cost of USD 2bn.

- Oman’s money supply grew at a steady rate, up 6.4% yoy to OMR 26.4bn in Nov, reflecting improving liquidity conditions and growth in bank deposits. However, credit growth remains measured amid cautious lending.

- Tax revenues in Oman are projected to rise to OMR 2.531bn in 2030, according to the IMF, up from an estimated OMR 1.99bn in 2026 thanks to ongoing tax reforms, diversifying its revenue base and improved compliance. The measures form part of a broader medium-term fiscal sustainability programme.

- The Muscat Stock Exchange’s market capitalisation rose 16% yoy to OMR 32bn in 2025, supported by higher corporate earnings, privatisations and improved investor sentiment. The number of trades executed jumped to 25bn shares, from 6.4bn in 2024.

- Oman’s refinery output rose by 11.4% to 76.992bn barrels by end-Nov, supported by capacity expansion and improved operational efficiency. Exports of octane gasoline surged by 166.4% to 1.526bn barrels, while exports of liquefied petroleum gas rose by 127.9%.

- Oman plans to launch an air taxi service by 2027, signalling early adoption of advanced urban mobility technologies. This will initially operate from vertiports in all Omani airports, four popular tourist spots, central Muscat and Salalah city – aligning with tourism development and smart-city ambitions.

- Qatar’s sovereign wealth fund QIA is taking a selective approach to AI and digital infrastructure investments, prioritising proven business models over speculative growth. QIA will focus on financial services and industrials where AI gains are visible, and investments in minerals, commodities and data centres will continue, according to the CEO. Separately, Bloomberg reported that QIA is considering a restructuring that would split overseas investments from its domestic portfolio, signalling a major strategic overhaul.

- Libya has partnered with Qatar and Italy to expand the Misurata Free Zone port, aiming to fast-track trade and logistics amid gradual economic normalisation. Investment is expected to reach USD 2.7bn and the project highlights Libya’s reliance on regional partners for capital and expertise.

- GCC has been increasing their US Treasury holdings in 2025. Saudi holdings jumped 10.8% mom and 9.8% yoy to USD 148.8bn in Nov. UAE holdings dipped by 6.5% mom but stayed above USD 100bn for the fifth month in a row. Kuwait posted yet another record high in Nov (USD 64.8bn, up 6.9% mom & 26.6% yoy).

- Canada and Qatar agreed to deepen investment and economic cooperation, including new strategic dialogues and a pipeline of trade, investment, defence and ICT partnerships, while also signalling expanded engagement with Egypt.

- The Qatar Cabinet confirmed approval of a GCC–New Zealand Free Trade Agreement in principle, reinforcing plans to deepen trade linkages between the GCC and a strategic Oceania partner. The agreement aims to liberalise goods and services trade, enhance investment flows and reduce regulatory barriers.

Saudi Arabia Focus

- The IMF raised Saudi Arabia’s economic growth forecast to 4.5% in 2026, up from its earlier estimate (of 4%), reflecting stronger momentum in both oil and non-oil sectors. The 2025 growth estimate was lifted to 4.3% (vs 4.0%), given resilient domestic demand, supportive macroeconomic policies and easing of OPEC+ oil production restrictions.

- Saudi Arabia’s non-oil exports jumped 20.7% yoy in Nov, with machinery, electrical equipment and parts leading the shipments (SAR 7.9bn, up 81.5%) and the ratio of non-oil exports to imports rising significantly (42.2% vs 34.9% a year ago). Main trade partners were China (13.5% of exports & 26.7% of imports) and UAE (11.7% of exports & 6.2% of imports).

- A major domestic quarry operator (Saleh Abdulaziz Al Rashed & Sons) launched Saudi Arabia’s first IPO of 2026, signalling renewed capital market activity. Last year, firms had raised nearly USD 4bn through offerings in Saudi Arabia.The firm will offer 5.58mn shares or 30% of the company.

- Saudi Aramco’s CEO expects USD 3-5bn in tech-realised value through lower capital spending, higher revenues or lower operating costs via increased deployment of AI. He stated that the company had deployed AI in production to improve output, accurately map and analyse oil and gas reservoirs, enhance maintenance operations, improve reliability and lower costs by reducing the number of wells needed per barrel of production.

- Assets held by Saudi Arabia’s public investment funds climbed 31% yoy to SAR 217.9bn by end-Q3, driven by domestic equity, fixed income, and real estate growth. Foreign investment assets grew by 21.1% yoy to SAR 31.1bn (or 14.3% of total asset value). Regulatory reforms to open markets to foreign investors will increase investor participation and further signals intent to deepen capital markets and enhance liquidity.

- S&P Global Ratings disclosed that Saudi banks remain well capitalised though warning that the banks’ use of riskier instruments like Additional Tier 1 hybrid bonds to support a surge in lending may weaken capital quality.

- The Operating Revenue Index in Saudi Arabia grew 5% yoy in Nov, supported by growth in financial activities (14.4%), trade (9.5%), construction (7.4%) and manufacturing (6.5%) among others. The index however fell 1.2% on a monthly basis.

- Saudi property prices fell for the first time in roughly five years. Gastat data showed a 0.7% yoy decline in the real estate price index in Q4 2025 (vs Q3: 1.3%), reflecting a cooling in residential property prices (-2.2%). Separately, Saudi Arabia’s real estate market is now open to foreign buyers: applications by non-Saudis to buy real estate via the official “Saudi Properties” portal are now under review, according to the Real Estate General Authority.

- Saudi Arabia’s AI firm Humain and the National Infrastructure Fund secured up to USD 1.2bn in financing to build out AI and data centre capacity. The deal signed at Davos includes plans to develop up to 250 MW of capacity and explore a data-centre investment platform to attract institutional capital.

- Saudi Arabia and the Olympic Council of Asia have indefinitely postponed the 2029 Asian Winter Games previously scheduled for the Trojena resort within the NEOM megaproject. While no official reasons were given, the postponement likely reflects strains on ambitious mega-project timelines amid fiscal prioritisation shifts and lower oil revenues. The FT reported that the NEOM project is “set to be significantly downscaled and redesigned” to something “far smaller”.

- According to the Ministry of Tourism, Saudi Arabia attracted 122mn tourists in 2025 (5% yoy) who spent an estimated SAR 300bn (6% yoy), buoyed by religious, leisure, cultural and business tourism. These figures highlight tourism as a key non-oil GDP driver, supported by recent visa reforms and increased connectivity.

- Saudia airline received 27mn passengers from 24 countries last year, supporting tourism-led diversification. Strong passenger volumes reflect demand growth across leisure, business and pilgrimage travel segments; Saudia will fly to 25 destinations in ‘26.

- Saudi PIF-owned Riyadh Air officially launched cargo services under the Riyadh Cargo brand, leveraging a planned fleet of over 120 wide-body aircraft. Riyadh Air expects to cover 100+ destinations by 2030 and contribute USD 20bn to non-oil GDP by 2030.

UAE Focus

- UAE’s President and India’s Prime Minister reaffirmed UAE-India ties, underscoring India as a core economic partner of the UAE given existing trade and investment linkages. The countries agreed to double bilateral trade to USD 200bn by 2032 (it crossed USD 100bn in 2024-25 from USD 72bn in 2022). Accelerating following the CEPA signed in 2022, UAE became India’s third largest trading partner and India’s second-largest export destination in 2024-25 and is now also a BRICS partner. The Indian diaspora has been long established in the UAE, accounting for close to one-third of the population (or 3.554mn), making the UAE-India remittance corridor a major financial channel. This becomes a major source of forex and capital inflows going into Indian financial markets and real estate investments – close to 20% of India’s remittances inflows came from the UAE in 2024, making it the second-largest source globally after the US. The UAE is not only a major provider of infrastructure services to India and Indians globally, but in recent years mutual agreements have also covered investments in sectors from education to healthcare, IT and infrastructure and clean energy. By end-Jun 2025, the total number of Indian companies operating in the UAE reached 264,687, underscoring the ease of doing business in the UAE (spans sectors including technology, trade/ logistics, professional & corporate sectors and construction among others). In addition to direct linkages, the growing links between UAE and the African continent will also benefit from the long and well-established Indian diaspora in Africa (from East to West).

- UAE and India agreed on a landmark USD 3bn LNG supply deal, underscoring energy as a pillar of their expanding partnership alongside trade and defence collaboration. The 10-year LNG agreement would make India UAE’s largest customer and reflects mutual interests in secure energy flows as well as strategic supply chain integration.

- Ras Al Khaimah’s tourism sector delivered strong growth with 1.35mn overnight visitors in 2025 (+6% yoy) alongside a 12% growth in tourism revenues (supported by MICE and weddings revenues which saw a 25% surge). Travel demand and growth was recorded across domestic (+7% yoy) and international markets including India (+14%), China (+19%) and UK (+10%) among others.

- Sharjah International Airport received a record 19.5mn passengers in 2025, up 14% yoy, alongside rising cargo volumes and flight operations. This expansion reflects robust demand, expanded flight network and logistical roles in global trade flows.

- The UAE maintained a top ten ranking in the 2026 Global Soft Power Index issued by Brand Finance, reflecting sustained strengths in governance, economic stability, generosity and influence in international diplomatic circles.

- UAE and Uzbekistan signed an MoU to expand cooperation in the mining sector, focusing on infrastructure modernisation and value-chain investment. This collaboration builds on significant UAE capital flows into Uzbekistan (USD 1.3bn in 2024), including in renewable energy (USD 700mn) and more than USD 4bn in joint projects under development.

- Sharjah’s real estate market reported strong domestic buyer participation, pushing total transaction value toward AED 66bn (+64% yoy) in 2025, reflecting rising investor confidence and population-driven demand; number of transactions rose 26% yoy to 132,659. Around 129 nationalities were invested in the market (up from 120 in 2024) and UAE citizens accounted for more than half of all investment.

- UAE’s Etihad Water and Electricity plans to launch a feasibility study for an undersea power link to India underscoring nascent energy-infrastructure integration ambitions. This project illustrates efforts to diversify energy exports and promote cross-border grid connectivity; a positive outcome could potentially lead to long-term regional energy integration initiatives.

- Abu Dhabi is planning targeted tariffs to support AI data centres, to attract digital economy investments by improving cost competitiveness while also shielding other customers from higher bills.

Media Review:

Digital remittances will unlock financial inclusion in the Middle East: op-ed by Dr. Nasser Saidi

Saudi private sector takes larger Vision 2030 role: Saudi Economy Minister @ Davos

Sharp rise in Dubai rental defaults, data shows

https://www.agbi.com/real-estate/2026/01/data-shows-sharp-rise-in-dubai-rental-defaults/

Are Central Banks Enabling Unsustainable Government Deficits?

Powered by: