Non-Oil Expansion, Fiscal Adjustments & Air Connectivity Lift Middle East Prospects, Weekly Insights 5 Dec 2025

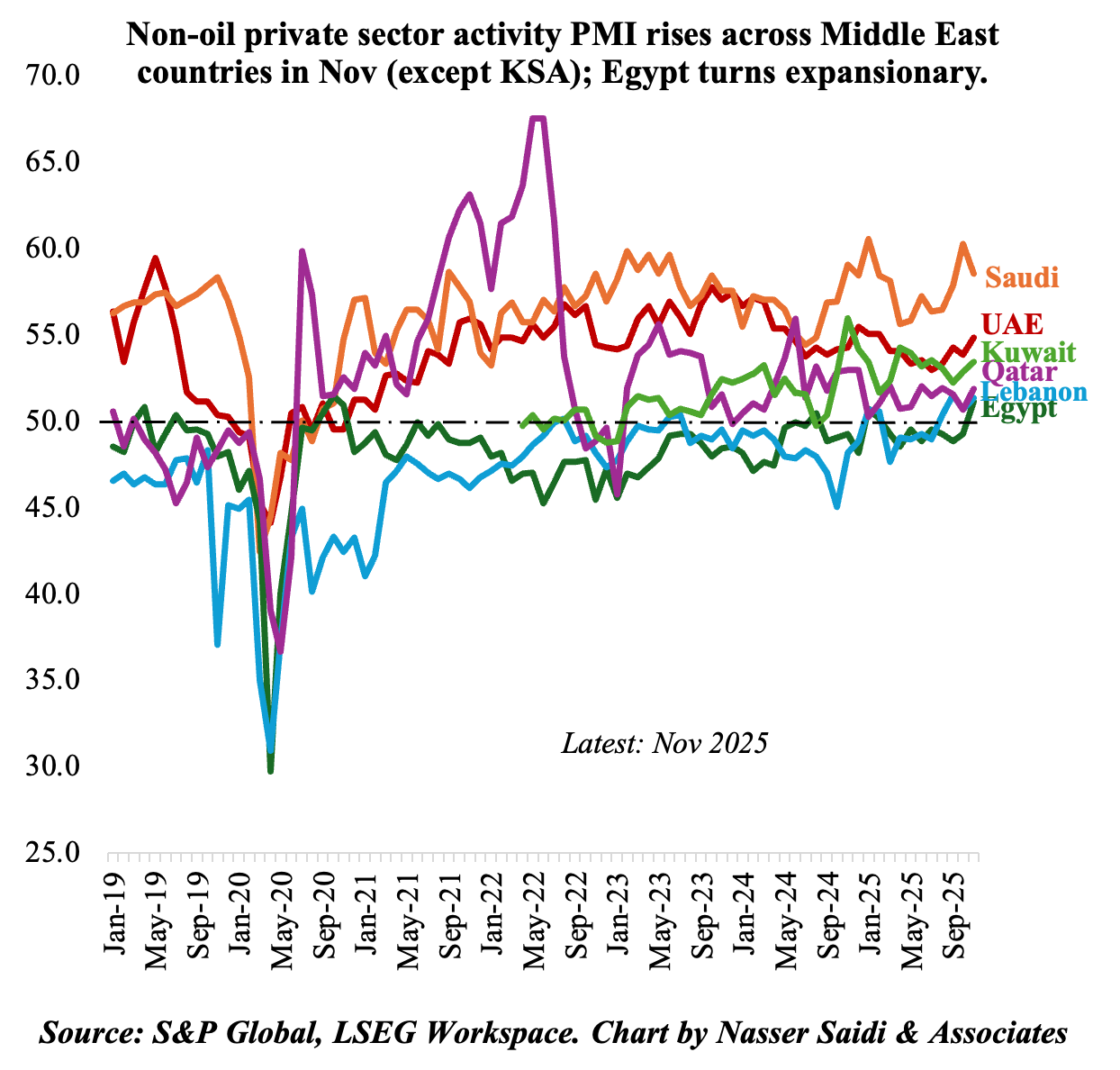

1. Non-oil sector expansion in the Middle East, including in Egypt

- PMIs across the Middle East were expansionary in Nov, with only Saudi recording a slight drop from Oct’s multi-year high. Egypt recorded the first expansion since Feb, and the highest since Oct 2020 (suggesting improving domestic and external demand), while the UAE’s reading rose to a 9-month high. Most countries reported broad-based gains – across output, new orders and employment.

- Improvement in new orders is a positive sign: Qatar posted the first increase in 6 months on increased demand while in Egypt it grew after 8 months of decline. In Lebanon, it was at a joint-survey record and even where new orders eased in Saudi, the fall was to 64.6 (Oct: 68.1). Competitive pricing seems to be a common theme, and Kuwait also reported aggressive marketing efforts.

- Employment in the UAE reached an 18-month high while in Qatar, job creation was fifth highest in the survey’s history with hiring up for sales, marketing, operations and new projects. In Saudi & Lebanon it moderated: in KSA from Oct’s quickest pace of hiring since Nov 2009 and in Lebanon, from the fastest pace in 12+ years.

- Alongside employment, wage inflation continues to be strong: near historical highs in Saudi while in the UAE, it contributed to the sharpest increase in input costs in 14 months.

- The 12-month ahead outlook was very positive in Kuwait: it rose for the third month in a row to the highest level in 18 months. In Lebanon however this reading stood at 40.1, very pessimistic for the sixth consecutive month, as security concerns grew.

- While Egypt’s rebound is encouraging, its sustainable growth will likely depend on stability in import costs, currency, consumer demand, and external financing. Strong private-sector PMIs in the GCC reflect the promise in sectors such as construction, logistics, services, real estate and non-oil trade. However, input-cost inflation and rising wages signal a potential margin squeeze and if sustained, it could affect growth momentum (e.g. new projects, employment).

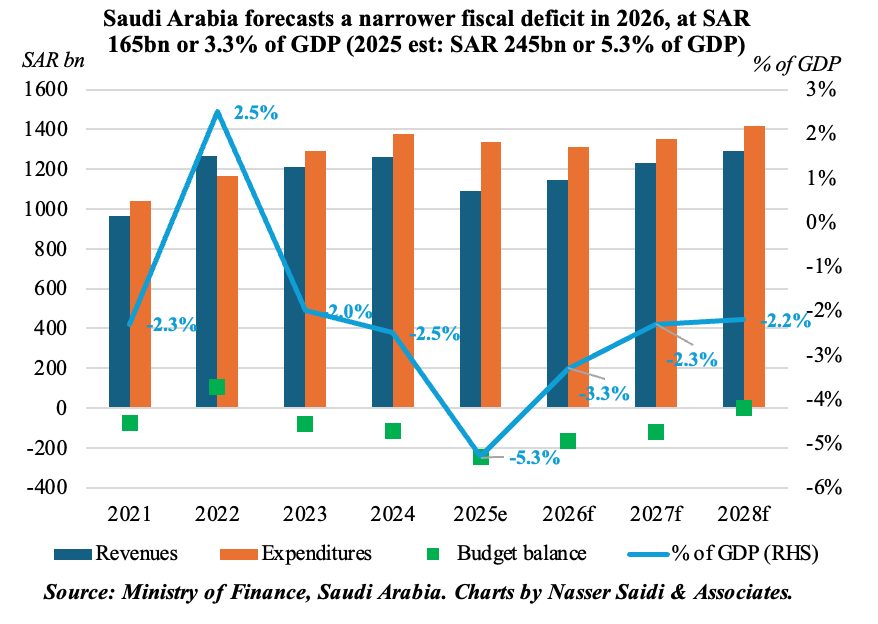

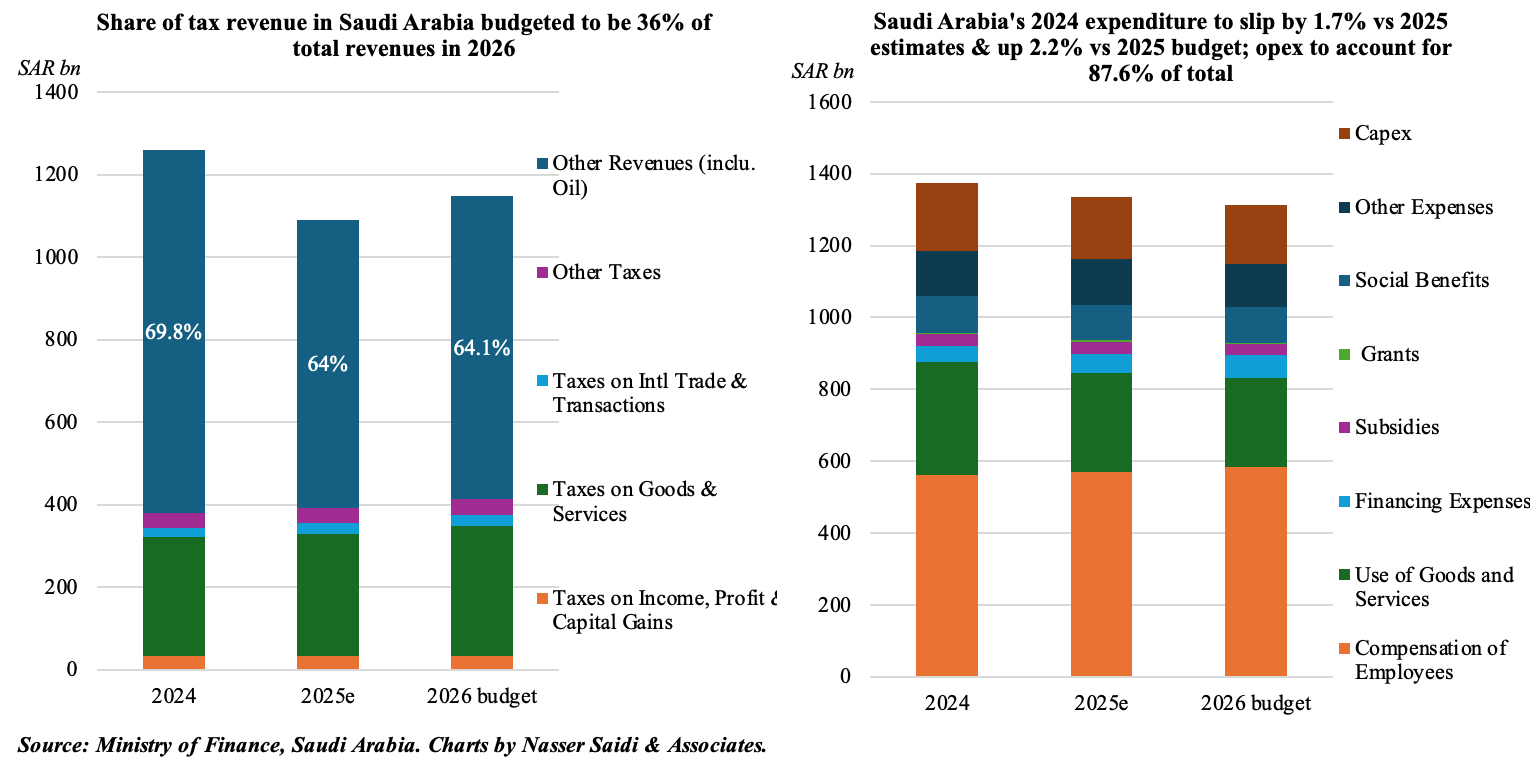

2. Saudi Arabia’s expansionary 2026 budget, with a sharper focus on efficiency & outcome, features a narrower deficit vs 2025 estimates

- Saudi fiscal deficit is projected at SAR 165bn in the 2026 budget versus an estimated SAR 245bn in 2025 (but higher than SAR 101bn as per the 2025 budget).

- Overall revenues are forecast to touch SAR 1147bn in 2026 budget: this is 3.1% lower than the 2025 budget but 5.1% higher than the 2025 full-year estimate. Oil revenues share is estimated at almost 2/3-rd of total revenues next year (vs 70% in 2024 and an estimated 64% in 2025). Tax revenues are expected to increase by 4.8% (compared to the 2025 estimate), also supported by the broadening of tax base (e.g. White Land Tax hike & VAT amendments).

- Total expenditures are projected to rise to SAR 1313bn in 2026 (up 2.2% vs 2025 budget & down by 1.7% vs 2025 estimates), with capex and compensation of employees accounting for 12.3% and 44.5% respectively of total spending. Capex has declined by 5.5% versus 2025 estimates, partly due to various project completions. More of the spending is directed toward infrastructure upkeep, essential public services (health, education) and improving quality-of-life indicators.

- Public debt will amount to approximately SAR 1622bn (32.7% of GDP) in 2026.

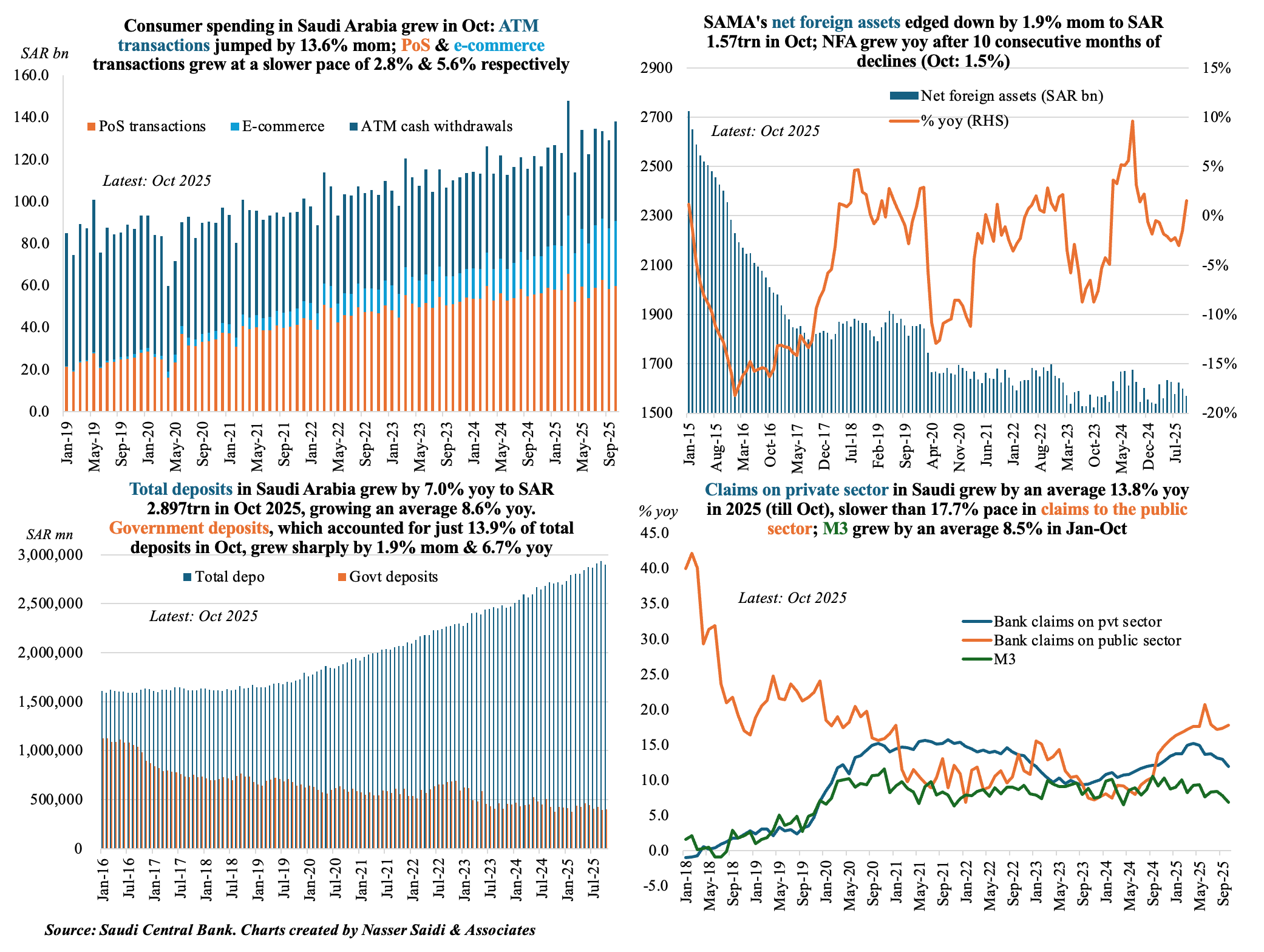

3. Money supply expansion in Saudi Arabia – a sign of robust liquidity & supports consumer demand. Pace of credit growth is healthy (12.0% yoy in Oct & 13.8% avg in 2025) & has outpaced deposit growth (averaged 8.6% in Jan-Oct) for 21 straight months. Slight drop in NFAs notwithstanding, the scale of reserves remains comfortable.

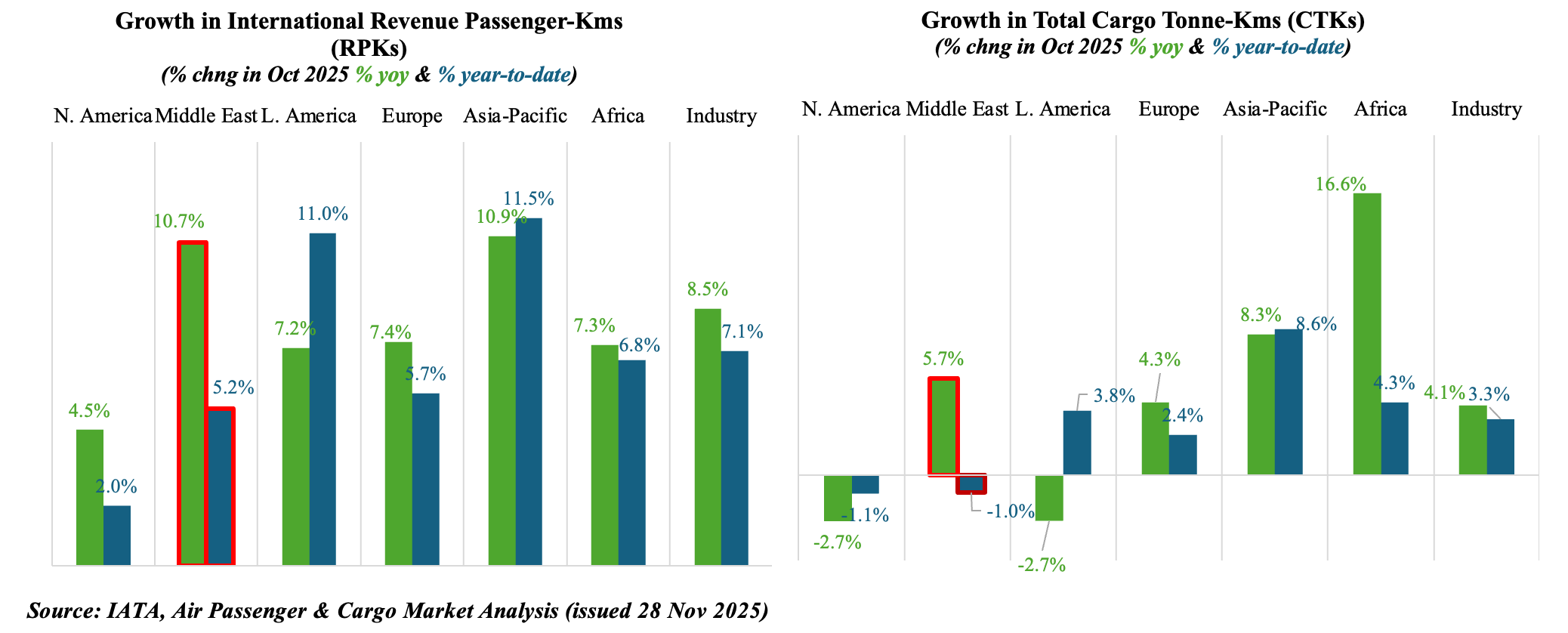

4. Middle East stands out with above-global average performance in air passengers & cargo for Oct, underscoring the region’s resilience & global connectivity role

- International revenue passenger-kilometers (RPKs) growth in Oct (8.5% yoy) was driven by the Asia-Pacific region (10.9%) while the Middle East airlines experience was among the strongest (10.7%, partly due to its low base a year ago). Year-to-date gains in the Middle East was slightly muted (5.2% during the year vs industry average of 7.1%), underscoring the impact from ongoing regional conflicts.

- Air cargo demand remained relatively resilient: cargo tonne-kms (CTKs) grew by 4.1% yoy in Oct, posting the eighth straight month of growth, and was up 3.3% year-to-date. Middle East carriers grew by 5.7% in Oct(the highest growth registered by the region this year; Sep: 0.5%) but was down by 1.0% so far this year. Cargo capacity in the region rose even more: at 10.0% yoy, it was the strongest in 2025 and one of the largest capacity expansions among all regions. Interestingly, the Middle East–Asia cargo corridor saw the eighth consecutive month of growth (11.5%, more than doubling growth in Sep) and the Middle East-Europe trade route posted a slight growth (0.1%, only the second month with positive growth this year).

- IATA expects seat capacity increases in Nov and in Dec, which could reinforce passenger growth. Tourism, business travel, MICE (meetings/conferences) and transit travel could see renewed momentum during the end-of-the- year holiday season, also helpful for non-oil diversification strategies. With global trade and supply-chain diversification set to continue, cargo volumes are likely to keep increasing. Various airlines’ orders for additional aircraft during the Dubai Air Show in Nov (such as Emirates, Riyadh Air, Saudia Group) with deliveries through 2030s will add to rising capacities in the years to come.

Powered by: