Dubai global top spot for Greenfield FDI in H1 2025; Saudi rapidly growing re-exports & wider trade surplus, Weekly Insights 26 Sep 2025

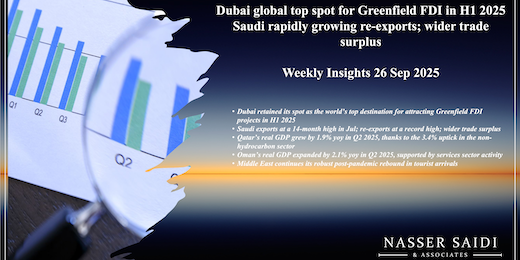

1. Dubai retained its spot as the world’s top destination for attracting Greenfield FDI projects in H1 2025, underscoring investor confidence in the Dubai story & business climate

Main points include: (a) Dubai attracted a record 643 greenfield FDI projects in H1 2025; total announced projects stood at 1090 (28.7% yoy), FDI capital inflows were up 62% to USD 11.0bn and estimated jobs stood at 38,433 (third highest globally, and up 47%); (b) Diversified investment types & sectors: greenfield projects accounted for 52.4% of total inflows; (c) business services was top sector in terms of both announced FDI projects and by capital inflow; (d) by value of FDI capital inflows, the top 5 countries accounted for more than two-thirds of the total, with US share alone at 35%; and (e) UK, US and India invested in close to 50% of total number of projects in H1 2025.

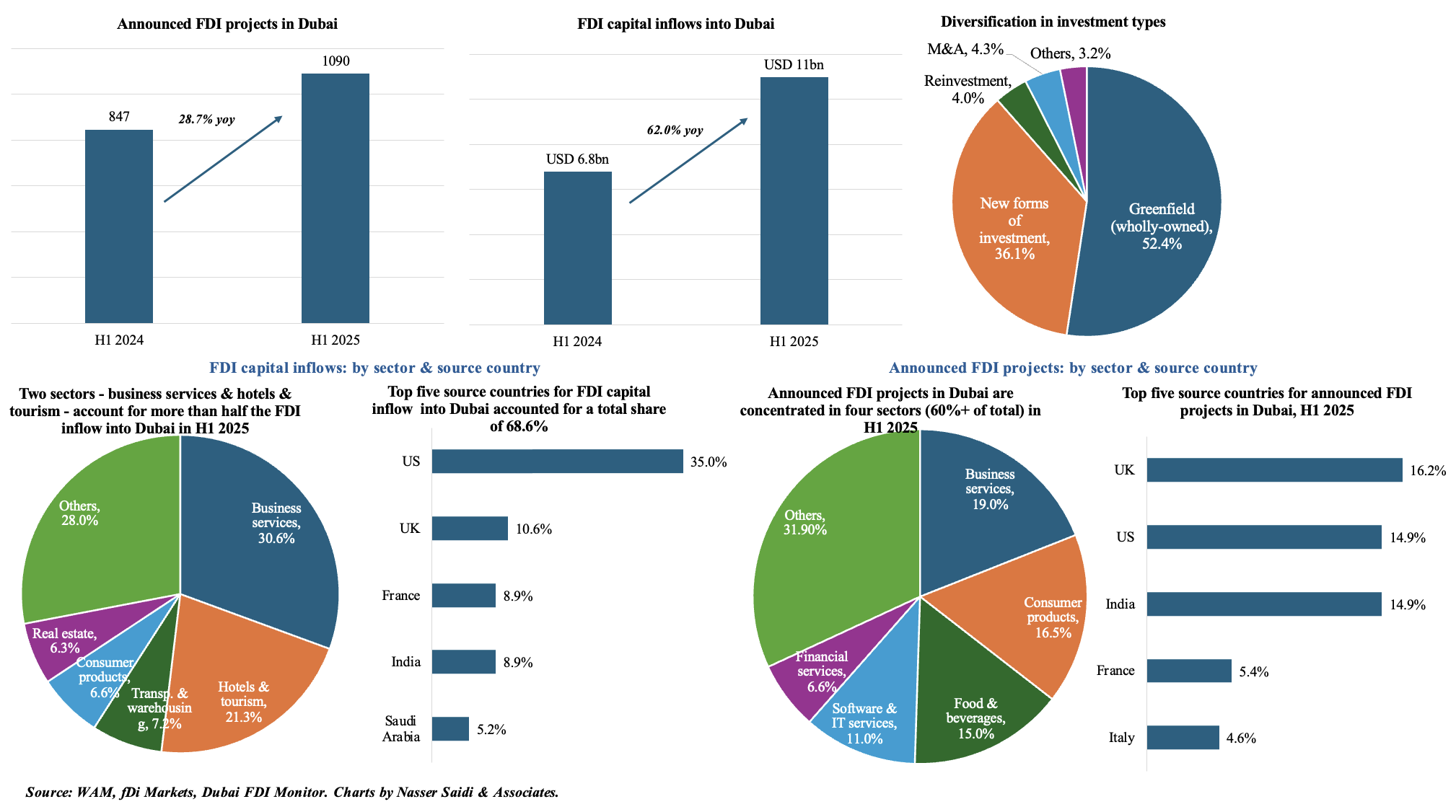

2. Saudi exports at a 14-month high in Jul; re-exports at a record high; wider trade surplus

- Saudi Arabia’s overall exports increased to a 14-month high in Jul, up 10.9% mom and 7.8% yoy to SAR 102bn. Oil exports was the highest this year: at SAR 68.7bn, but was 0.7% lower vs Jul 2024. Share of oil exports to overall exports dipped to 67.1% (Jun: 70.0%).

- Re-exports surged to a record-high SAR 14.7bn in Jul, while domestic non-oil exports (i.e. excluding re-exports) grew by 5.1% mom and 0.6% yoy to SAR 19.0bn.

- Imports fell by 2.5% yoy to SAR 75.5bn in Jul 2025 (but was up 3.7% mom). This resulted in a wider trade surplus – SAR 26.9bn vs Jun’s SAR 19.5bn and Jul 2024’s SAR 17.5bn.

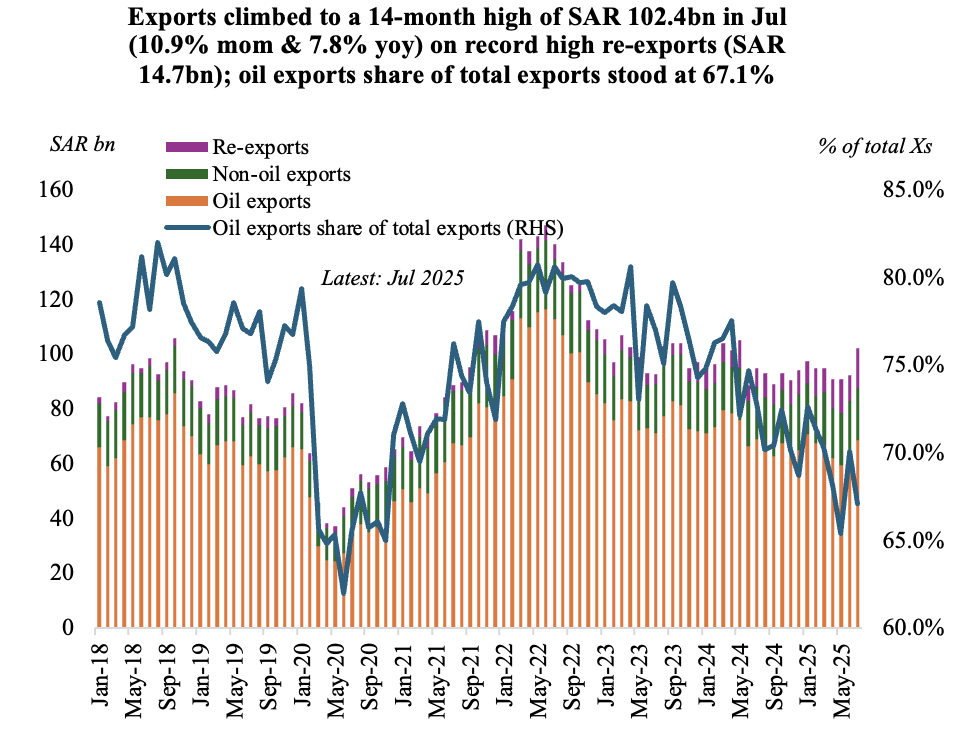

- Machinery was the largest segment of non-oil exports (31%), followed closely by chemicals & its products (20%) and plastics, rubber and their articles (18%). UAE the largest destination of overall non-oil export.

- Eastern Asia was the largest destination region for exports from Saudi Arabia (31.6%).

- China was the largest trade partner for KSA in Jul: it received 14.0% of Saudi exports and was origin for 1/4-th of KSA imports.

- From West Asia region, UAE was the top trade partner: received 10.6% of Saudi’s total exports and the source for 6.4% of Saudi imports.

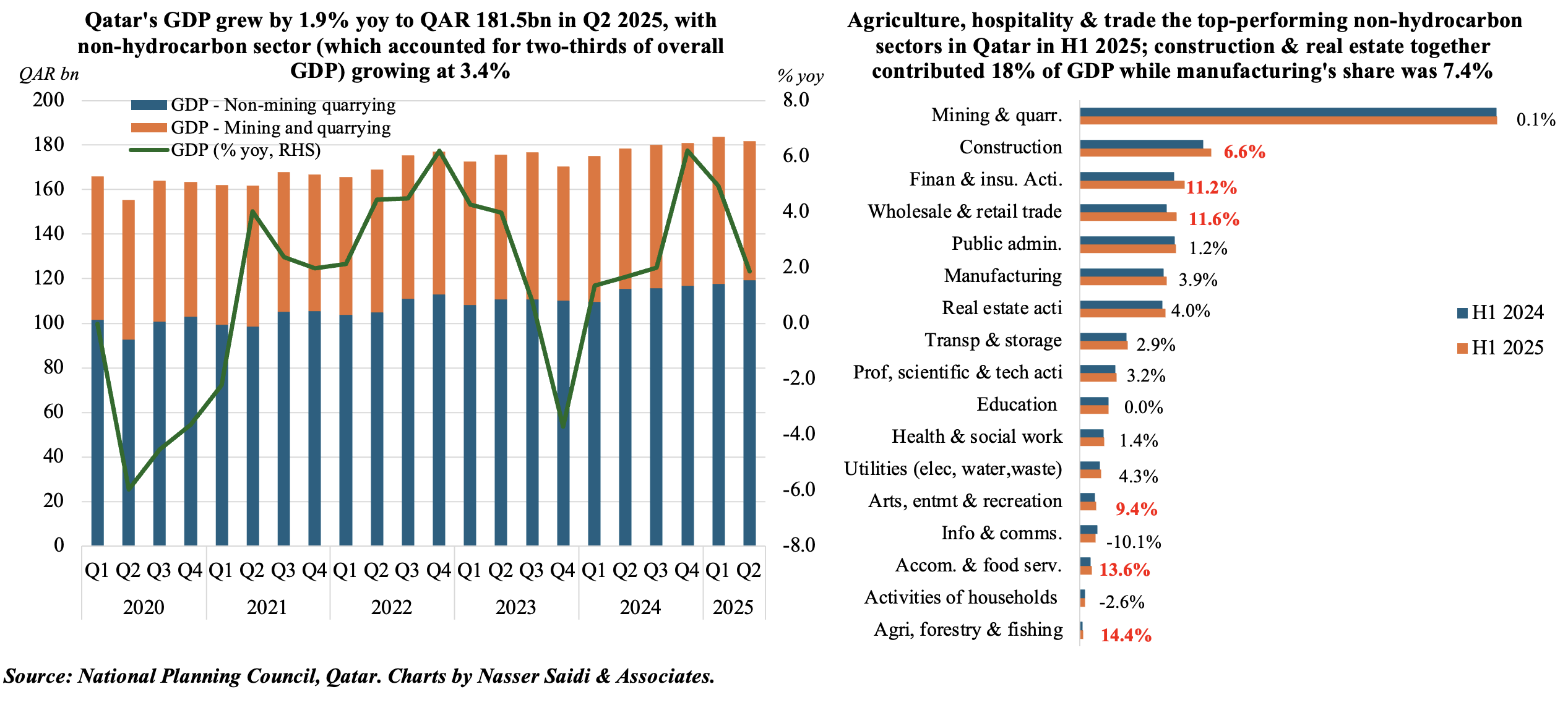

3. Qatar’s real GDP grew by 1.9% yoy in Q2 2025, thanks to the 3.4% uptick in the non-hydrocarbon sector

- Qatar’s real GDP grew by 1.9% yoy in Q2 2025, thanks to gains in the non-mining and quarrying sector (+3.4% yoy) while the hydrocarbon sector edged down by 0.9%; meanwhile. Compared to Q1 2025, mining & quarrying fell sharply by 5.2% while non-mining & quarrying posted a 1.4% gain. The non-mining & quarrying sector accounted for two-thirds of overall GDP in Q2 (65.6%).

- Contribution of the top five non-government, non-mining & quarrying sectors (construction, financial & insurance, wholesale & retail trade, manufacturing and real estate) accounted for 43.4% of overall GDP in Q2 (and 42.8% in H12025) and two-thirds of non-mining and quarrying GDP in both Q2 and H1 2025.

- A breakdown by sector showed the fastest upticks in agriculture, forestry and fishing (15.7% yoy in Q2) followed by accommodation & food services activities (13.5%), arts & recreation (8.9%) and wholesale & retail trade (8.8%). The pattern was broadly similar in H1.

- Qatar continues to be heavily reliant on its hydrocarbons sector: accounting for 34.4% of overall GDP in Q2 and 56.8% of overall fiscal revenues in Q2. GDP growth will be supported by new LNG capacity expansions, increased public investment on infrastructure and inbound tourism; potential risks could include geopolitical tensions, delays in energy projects coming online & lower gas prices.

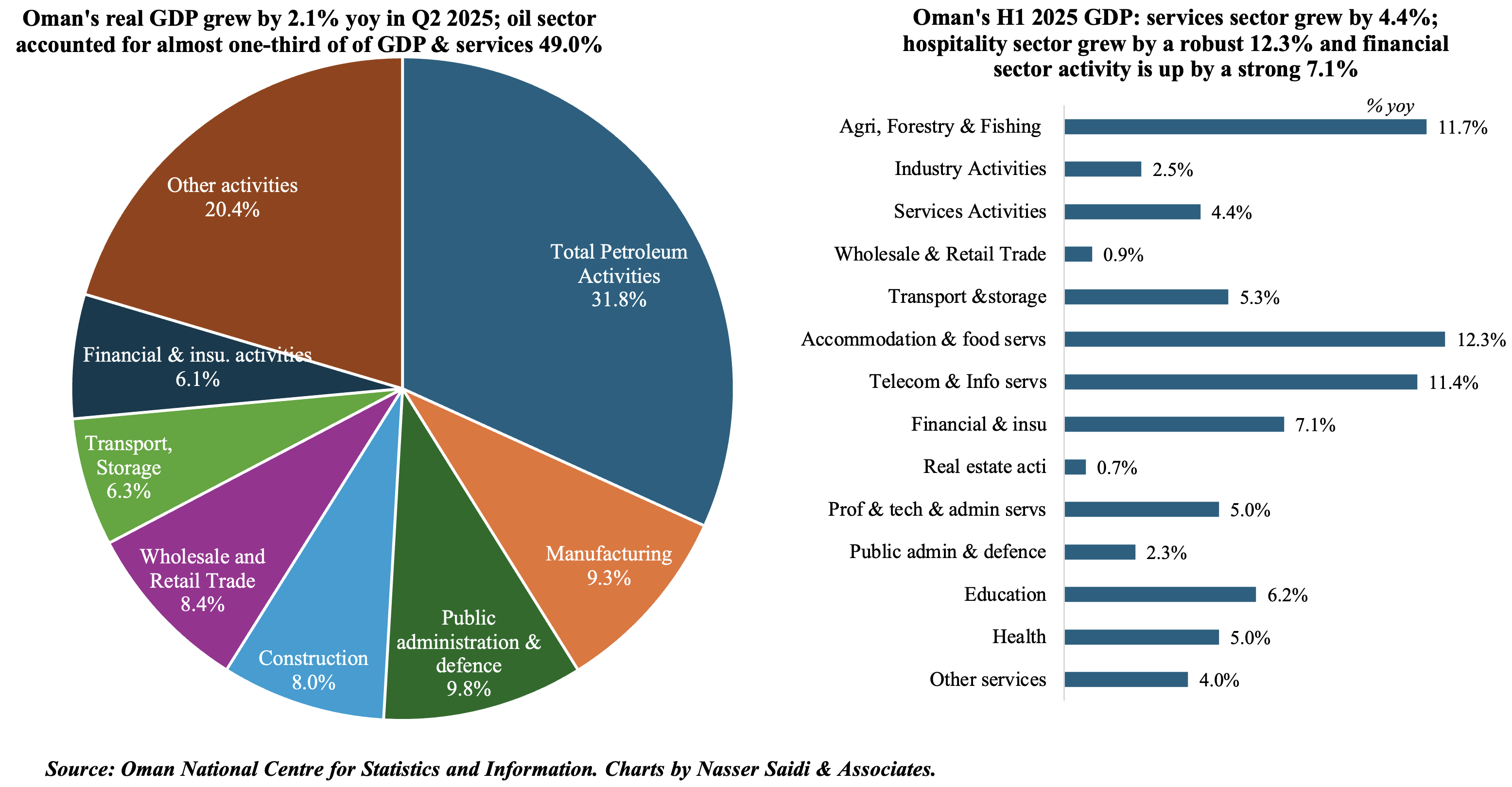

4. Oman’s real GDP expanded by 2.1% yoy in Q2 2025, supported by services sector activity

- Real GDP in Oman grew by 2.1% yoy to OMR 9.36bn in Q2 2025, thanks to the non-oil sector growing at 3.8%. Among non-oil sector, services activities grew by 4.9% while industry activities inched up by just 0.2%. Petroleum sector activity rose by 0.5% in Q2, with a drop in natural gas sector (-1.5% yoy to OMR 482.6mn) while crude petroleum sector gained (0.5% to OMR 2.97bn).

- The share of oil and gas sector in Oman’s real GDP stood at 31.8% in Q2 while the contribution of government, manufacturing and wholesale & retail trade sectors stood at 9.8%, 9.3% and 8.4% respectively followed by construction (8.0%).

- Services sector grew by 4.9% yoy in Q2, given high growth rates across hospitality (12.8%), information & communication (11.4%) and transportation & storage (8.0%). About 2.16mn visitors arrived in Jan-Jul 2025, with visitors from the UAE topping the list (629k).

- In H1 2025, hospitality grew the fastest (12.3%) while wholesale & retail trade was one of the slowest (0.9%). Goods trade had a relatively weak H1, especially given a 9.5% drop in exports (dragged down by oil and re-exports) alongside a 5.1% uptick in imports.

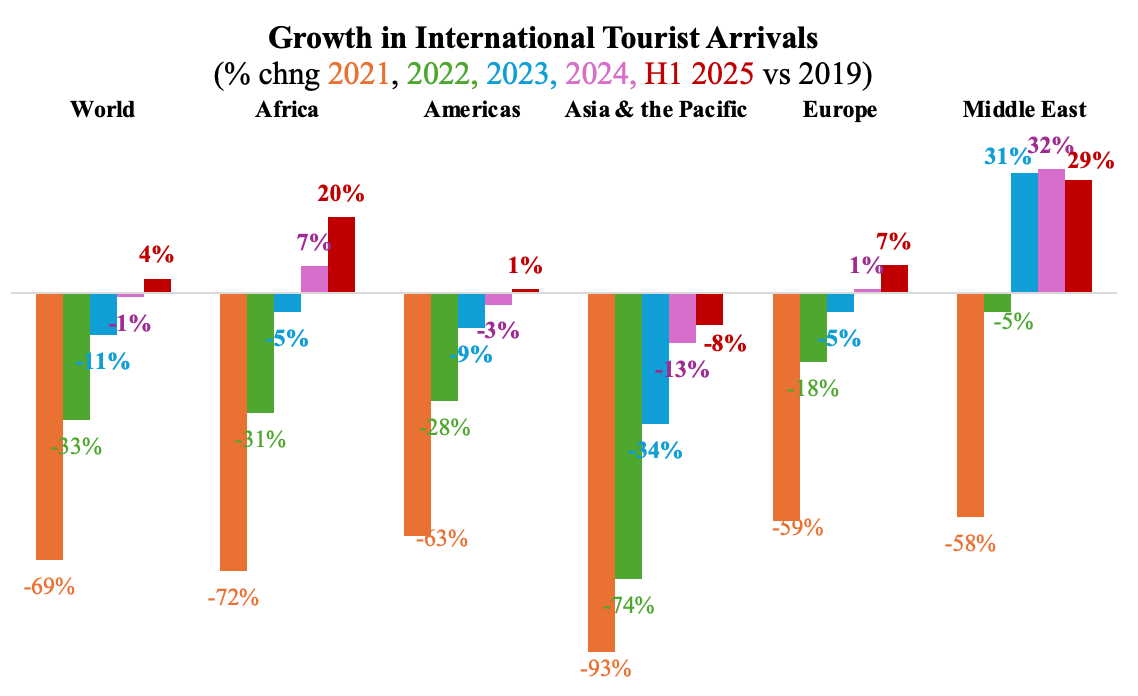

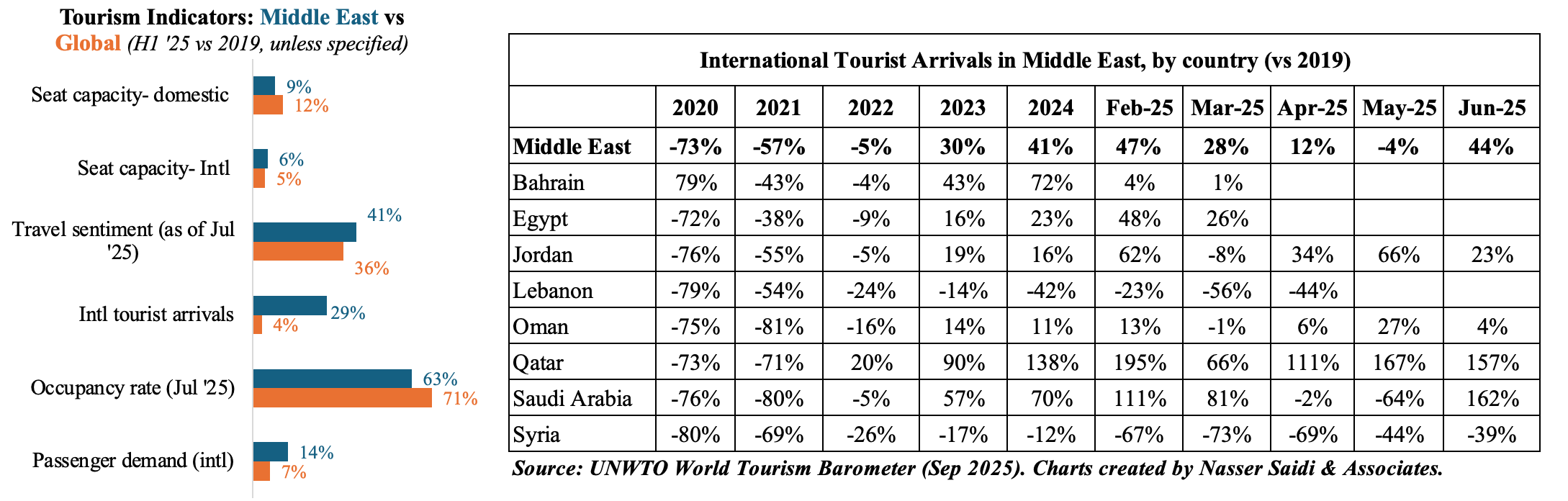

5. Middle East continues its robust post-pandemic rebound in tourist arrivals

- UNWTO: International tourist arrivals grew by 5% globally in H1 2025, with all regions except Asia & the Pacific posting gains. Middle East remains the strongest region when comparing to 2019, though in yoy terms arrivals were down by 4.0%.

- Tourism has been rising in the region despite ongoing conflicts; inflows into Qatar and Saudi Arabia have been surging. South Asia has been the top destination for passenger traffic from the Middle East, partly due to the immigration links. UAE-India corridor alone handled 4mn passengers, up 16.7% yoy in Q2.

- A survey of a panel of tourism experts ranks as risk factors high transport and accommodation costs, other economic factors, low consumer confidence, geopolitical risks & trade tariff hikes. Despite global uncertainty, some 50% of panel experts expressed better (44%) or much better (6%) prospects for Sep-Dec vs 33% expecting similar performance as was seen in 2024.

Powered by: