Download a PDF copy of the weekly economic commentary here.

Markets

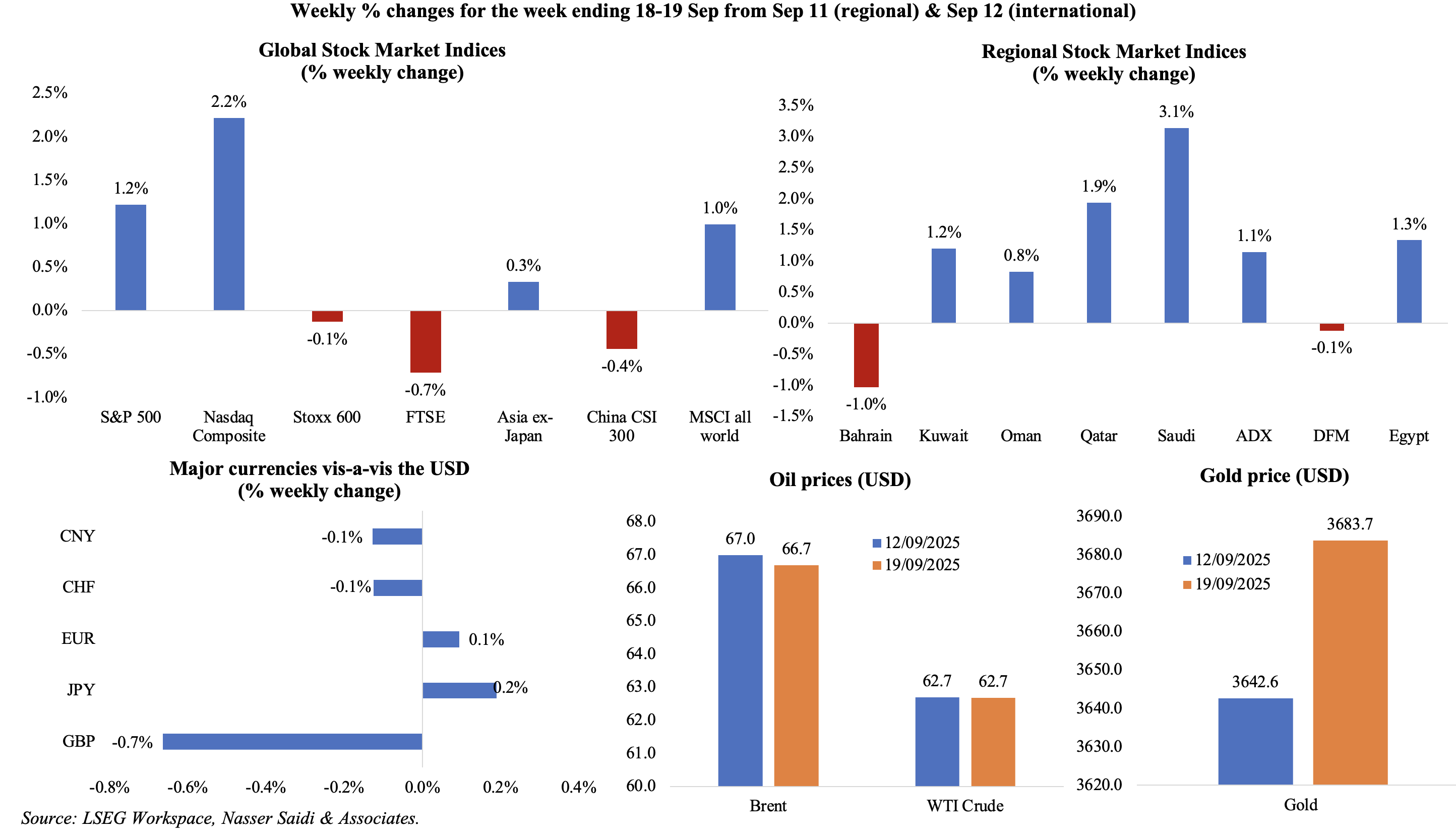

Among major markets, US equities gained last week, thanks to positive investor sentiment from the Fed cut while European and UK markets ended slightly lower. Middle East markets were supported by the GCC central banks’ lowering rates in line with the Fed. The US dollar rebounded against most major currencies last week; the GBP posted a sharp decline on concerns about the upcoming budget and the government’s borrowing. Oil prices were slightly lower on fears of weak demand despite the Fed rate cut (that should generally lead to higher consumption) alongside signs of oversupply. Gold price hit a new record on Wednesday, posting a fifth week of weekly gains.

Global Developments

US/Americas:

- US Fed reduced its key interest rate by 25bps, the first this year, and hinted at two more quarter-point cuts this year. Inflation remains above target, and the Fed chair stated that “overall effects [of tariffs] on economic activity and inflation remain to be seen”; he also disclosed that “the balance of risks…shifted” toward the employment side of the Fed’s mandate. Markets had broadly anticipated the cut, but critical issues ahead include questions about the Fed’s independence and pressure for fiscal dominance (i.e. running monetary policy to manage the debt).

- Industrial production in the US rebounded in Aug, up by 0.1% mom following Jul’s 0.4%. This marginal improvement reflects some resilience in manufacturing (+0.2% mom following Jul’s 0.1% dip), though it lacks the momentum typically seen in stronger growth phases. Capacity utilisation was unchanged at 77.4, but 2.2ppts below the long-run average.

- Building permits fell by 3.7% mom to 1.312mn in Aug, the lowest since May 2020, with declines across both single-family permits (-2.2% to an annualised 856k) and for buildings with 5+ units (-6.7% to 403k). Housing starts declined by 8.5% to 1.307mn, with single-family starts declining by 7.0% to 890k units (weakest since Jul 2024). This indicates a persistent housing market weakness and a cooling in residential construction amid affordability constraints and supply-side challenges including labour shortages and rising input costs.

- Retail sales grew by 0.6% mom and 5.0% yoy in Aug (Jul: 0.6% mom and 4.1% yoy), signalling continued strength in consumer spending, supported by gains across sales at non-store retailers (2.0% mom), clothing stores (1.0%), sporting goods, hobby, musical instrument and bookstores (0.8%) and food & beverage stores (0.3%) among others. However, the upticks also reflect the increase in prices: for example, though auto dealers posted a 0.5% gain in sales (vs Jul: 1.7%), the units sold posted a decline.

- NY Empire State manufacturing index plunged to a 3-month low of -8.7 in Sep (Aug: 11.9) as new orders and shipments fell to -19.6 and -17.3 respectively (from 15.4 and 12.2 in Aug). Meanwhile, Philadelphia Fed manufacturing survey surged to 23.2 in Sep (Aug: -0.3), the highest reading since Jan, supported by gains in new orders (+14 points gain) and shipments (up 22 points to 26.1). The sharp divergence between the two surveys highlights regional disparities and possibly differing exposure to supply chain issues, labour availability and market demand. These opposing signals complicate the overall assessment of manufacturing health underscoring that policymakers should monitor broader manufacturing data to determine whether the sector is stabilizing or slipping into contraction.

- Initial jobless claims in the US declined by 33k to 231k in the week ended Sep 13 (the largest drop in almost 4 years), and the 4-week average eased by 750 to 240k. Continuing jobless claims edged down by 7k to 92mn in the week ended Sep 6. Fed Chair Powell described the softening labour market as being in a “curious balance” given the slow demand (because of tariffs-related uncertainty) and a drop in workers’ supply (due to the ongoing immigration crackdown).

Europe:

- Trade balance in the euro area widened to EUR 12.4bn in Jul (Jun: EUR 8.05bn), driven by a stronger jump in imports (3.1% yoy to EUR 239.1bn) relative to exports (0.4% to EUR 251.5bn). Surplus with the US shrank in Jul; euro area exports and imports of goods to the rest of the world grew by 3.5% and 1.6% to EUR 1.74trn and EUR 1.63trn respectively in Jan-Jul while intra-euro trade rose by 1.6% yoy to EUR 1.55trn in Jan-Jul.

- Eurozone’s current account surplus shrank to EUR 27.7bn in Jul (Jun: EUR 35.8bn), on a lower surplus for services and a smaller primary income.

- Industrial production in the eurozone grew by 0.3% mom and 1.8% yoy in Jul (Jun: -0.6% mom and 0.7% yoy) The positive annual growth suggests that some industrial segments are recovering, potentially supported by inventory restocking and easing supply bottlenecks. However, this recovery remains fragile amid high input costs and ongoing weakness in manufacturing-heavy economies like Germany. The uptick offers cautious optimism.

- Wholesale price index in Germany ticked up by 0.7% yoy in Aug (Jul: 0.5%), signalling modest price pressures at the distribution level: prices of food, beverages and tobacco were higher by 4.2% yoy while prices of non-ferrous ores, non-ferrous metals and non-ferrous semi-finished metal products surged 21.1%. Separately, producer price index fell by 0.5% mom and 2.2% yoy in Aug (Jul: -0.1% mom and 1.5% yoy) as energy prices declined sharply (-8.5% yoy). The divergent trend suggests that while wholesale pricing power remains intact, upstream cost pressures are easing significantly, partly due to lower energy prices.

- German ZEW economic sentiment index increased to 37.3 in Sep (Aug: 34.7) – thanks to improved outlook for export-oriented sectors such as the automotive sector as well as the chemical and pharmaceutical industries – while the current situation worsened (-76.4 from -68.6). The divergence between future expectations and current assessments underscores a cautious optimism. Economic sentiment in the eurozone also improved, ticking up by one point to 26.1 while the current assessment also ticked up slightly (+2.4 points to -28.8).

- The Bank of England left interest rates unchanged at 4.0%, the lowest level since Feb 2023. This signals a wait-and-see approach amid signs of inflation moderation and economic softening. Two of the nine members of the Monetary Policy Committee voted to lower the rate down to 3.75%. The BoE also decided to slow the rate at which the Bank of England sells its stock of UK bonds. With two meetings left till end of 2025, and inflation running at nearly twice the BoE target of 2%, further rate cuts this year seem unlikely.

- UK inflation held steady at 3.8% in Aug – transport costs slowed (2.4% from 3.2%) as did services (4.7% from 5.0%) – while core inflation eased to 3.6% (from 3.8%). Retail price moderated to 4.6% (from 4.8%). With UK inflation holding much higher than its US and EU peers, this is likely to remain the focus for the Bank of England amid stronger than expected growth and employment.

- Retail sales in the UK grew by 0.5% mom and 0.7% yoy in Aug (Jul: 0.5% mom) while excluding fuel, sales grew by 0.8% mom and 1.2% yoy. Sales were higher in non-food stores, with clothing and non-store retailing reporting gains of 5.3% mom and 4.0% respectively, alongside a 0.4% mom uptick and 4.7% yoy rise in online sales.

- UK unemployment rate was unchanged at 4.7% in Jul, with the number of employed individuals up by 232k to a record-high 34.2mn. Wage growth remained elevated: average earnings excluding (including) bonus grew by 4.8% (4.7%) in the 3 months to Jul from 5% (4.6%) the period before. The tightness in the labour market continues to pose a challenge for policymakers, particularly in the backdrop of services-driven inflation.

- GfK consumer confidence dropped to -19 in Sep in the UK (Aug: -17) Consumers remain pessimistic about both their personal financial situation and the broader economic outlook, while the expected increase in tax when the budget is presented in Nov could only worsen sentiment further.

Asia Pacific:

- The People’s Bank of China left lending rates on hold in Sep – the one- and five-year loan policy rates at 3.0% and 3.5% respectively – amid an easing of trade tensions and relatively strong exports though domestic demand remains weak.

- China’s fixed asset investment grew by 0.5% yoy in Jan-Aug (Jan-Jul: 1.6%), with the contraction in property investment worsening (-12.9% in Jan-Aug vs -12.0% in Jan–Jul). Excluding the property sector, fixed asset investment grew by 4.2% (vs 5.3% in Jan-Jul). Infrastructure investment so far this year (2.0% in Jan-Aug) has failed to fully offset declines in real estate and manufacturing capex and the lack of stronger fiscal stimulus further compounds the sluggishness.

- Industrial production in China grew by 5.2% yoy in Aug (Jul: 5.7%), the softest increase since Aug 2024, on slower growth in manufacturing (5.7% from 6.2%) and utilities (2.4% from 3.3%). Retail sales eased slightly to 3.4% (Jul: 3.7%), the slowest pace since Nov 2024, suggesting a loss of momentum in consumer demand despite earlier policy efforts to boost consumption. The dual-track recovery highlights the limits of current stimulus measures in reviving household sentiment and boosting domestic demand.

- FDI in China fell by 12.7% yoy in Jan-Aug (Jan-Jul: -13.4%), with high-tech industries and services sectors attracting investments of CNY 148.28bn and CNY 336.16bn respectively.

- The Bank of Japan left interest rates unchanged at 0.5% though there were two members voting for rate hikes (with one member commenting on inflation risk). At the press conference, the BoJ governor stated that “underlying inflation is still slightly below (the target) and in the process of approaching 2%”. The BoJ also disclosed plans to sell its stash of ETFs and real estate investment trusts.

- Inflation in Japan eased to 2.7% in Aug (Jul: 3.1%), the lowest reading since Oct 2024; excluding fresh food, prices moved lower to 9-month low of 2.7% (from 3.1%), and remaining above the BoJ’s 2% target for three years. Domestic demand-driven inflation remains relatively sticky with core-core inflation still above 3% (Aug: 3.3% from Jul’s 3.4%).

- Exports from Japan declined for the fourth month in a row, down by 0.1% yoy in Aug (Jul: -2.6%) while imports fell by a sharper 5.2% (from -7.4%), widening the trade deficit to JPY 242.5bn (Jul: JPY 118.4bn). Exports to some key partners declined including the US (-18.3%), China (-0.5%) and ASEAN (-2.8%) while it increased to the EU (5.5%) and Russia (11.8%). Although the narrower decline in exports is mildly encouraging, overall trade momentum remains soft amid tepid global demand and currency volatility.

- Core machinery orders in Japan plunged by 4.6% mom in Jul (Jun: 3.0%), with the drop sharpest in the non-manufacturing sector (-3.9%). This volatility and sluggish capex momentum reflects hesitancy to commit to new investments amid rising global uncertainty and weak external demand.

- WPI inflation in India clocked in at 0.52% yoy in Aug, after two months of deflationary readings (Jun: -0.19% & Jul: -0.58%). The uptick was largely driven by higher food prices (0.21% from -2.15%) and faster uptick in manufacturing costs (2.55% from 2.05%) while energy costs continued to tumble (-3.17% from -2.43%).

- India’s trade deficit narrowed to USD 26.49bn in Aug (Jul: USD 27.35bn) as exports fell to a 9-month low of USD 35.1bn and imports were also lower (USD 61.59bn from USD 64.59bn). With the US tariff hike (50% levy on Indian exports) coming into force from Aug 27th, the full impact is likely to be reflected in the next month’s reading – in Aug, exports to the US fell to USD 6.86bn (Jul: USD 8.01bn). Trade negotiations are set to resume this week.

- Unemployment rate in Singapore eased to 2.0% in Q2, from an initial estimate of 2.1%. The data suggest that hiring activity remains strong, and the ratio of vacancies to unemployed people stood at 1.35.

Bottom line: After a week of major central bank announcements (mostly in line with expectations), the focus is back on the various preliminary PMI readings for Sep (this month could provide greater clarity on the impact of tariffs, as the boost from front-loading of shipments eases; price data in US PMI will also be key as a direct assessment of tariffs) and US PCE data. With the Fed Chair highlighting the softened labour market after the meeting, a softer PCE reading could support another Fed cut come Oct. The Swiss National Bank meets on Thursday and is widely expected to hold rates.

Regional Developments

- GCC central banks lowered their key interest rates by about 25bps, in line with the Fed’s cut given their peg to the US dollar. The rate cut will reduce borrowing costs for governments, firms and households, increase investment flows and further stimulate non‑oil investment while supporting non-oil diversification in sectors like tourism, real estate, and manufacturing.

- Egypt is in the process of finalising the fifth and sixth reviews under the IMF’s Extended Fund Facility: if completed successfully, it will unlock further disbursements of external financing, which are essential given Egypt’s foreign currency constraints and high debt servicing costs. The structural reforms should also improve investor perception, reduce risk premiums, and help stabilize the economy.

- Egypt’s PM disclosed that fuel prices are expected to be hiked in Oct – potentially the final one under the subsidy phase‑out plan if current inflation trends continue. He highlighted that subsidies on diesel prices would remain in place even after the hike in October.

- FDI net inflows into Egypt in FY 2023-24 largely went into the construction and real estate sectors (USD 35.8bn or 76% of net FDI inflows), thanks to the Ras El Hekma deal. The number of construction companies grew by 20% yoy to 2856 in 2024 while the number of real estate developers has surged to over 15k currently (vs 2015: 270).

- Egypt launched a new initiative, in coordination with the central bank, to restructure struggling and closed factories via a rescue fund. There are nearly 6000 industrial units under financial problems, and the aim is to restore its capacity, boost exports, and preserve employment – a part of broader efforts to target export‑oriented industrial projects. Long‑term success of such a rescue effort will depend on whether such reforms embed continuous productivity improvements, and whether the government avoids creating moral hazard (i.e. rescuing inefficient firms indefinitely) instead of driving competitiveness and restructuring.

- Revenues of the Suez Canal Economic Zone grew by 38% yoy to EGP 11.6bn in the 2024-25 fiscal year despite the drop in shipping traffic in the Red Sea, and net profits were up 51%. Over the past 14 months, the zone attracted USD 6.3bn in new investment across 155 projects, including industrial, logistics, service, and port infrastructure.

- Egypt is planning to sell 14 land plots in the Red Sea province to private investors, with an aim to raise EGP 150bn (USD 3bn). These plots meant for tourism, industrial, and service projects are also intended to create around 5,000 jobs. Such a move would result in a one-time boost to government revenues, support tourism and attract long-term foreign investment.

- Iraq’s Gas Growth Integrated Project – led by TotalEnergies (45%), Basra Oil Company (30%), and QatarEnergy (25%) – entered its second development phase. This development is projected to boost oil & gas output, help reduce gas flaring and also lower Iraq’s dependency on energy imports.

- Oman formally requested to join Iraq’s USD 17bn “Development Road” project as a partner along with Turkey, Qatar and the UAE: this will build a roughly 1,200 km dual infrastructure corridor (road + railway) from Faw Port in southern Iraq to the northern border with Turkey, connecting onward into Europe; the project, scheduled to be completed in 2029, will also see the creation of industrial/economic zones along the route.

- Kuwait is planning to issue KWD 250mn in bonds to local banks: this will be the ninth bond tranche by the central bank (it has issued KWD 1.6bn since Jul). With the new issuance, Kuwait will reach 80% of the targeted debt of KWD2bn planned to be issued during the 2025-26 fiscal year. The proceeds will be used to finance infrastructure projects.

- Kuwait’s government is inviting bids from local and international firms for the development of three new cities – aimed at easing the housing gap. The recently issued real estate development law allows for private investment into the sector.

- Remittances from Kuwait to the Philippines grew by 4.36% yoy to USD 330.9mn in Jan-Jul 2025, according to the latter’s central bank. Remittances from the GCC touched USD 3.4bn for the entire duration, with Saudi the top origin country (USD 1.24bn).

- Reuters reported that Lebanon’s distressed debt nearly quadrupled in price over the past year (to close to 24 cents to the dollar) after investors bet on the new government formed in Feb. However, the bonds “recovery value” is still a question mark.

- Oman’s Muscat Securities Market signed agreements with China’s Shanghai Stock Exchange and the Shenzhen Stock Exchange to allow for the cross-listing of traded funds.

- Natural gas production in Oman inched up by 0.7% yoy to 32.88bn in Jan-Jul 2025, according to official NCSI data, while total oil production fell by 0.8% to 210.12mn barrels.

- Real GDP in Qatar grew by 1.9% yoy to QAR 181.8bn (USD 49.9bn) in Q2 2025, supported by a 3.4% expansion in the non-hydrocarbon sector (to QAR 119.3bn). While 11 of the 17 economic activities expanded in Q2, the fastest growth was recorded in agriculture, forestry & fishing (15.8%), followed by accommodation & food services (13.4%), arts, entertainment & recreation (8.9%), wholesale & retail trade (8.8%) and construction (8.7%).

- Syria’s finance minister disclosed that the country expects its state-owned entities to contribute over USD 2bn to the national budget within 2-3 years. Boards of these entities are to include independent experts than government officials, according to the minister. Separately, the Central Bank of Syria signed an MoU with Mastercard to introduce advanced electronic payment systems to the Syrian market.

- Saudi Arabia, through the Saudi Development and Reconstruction Program for Yemen, will provide a grant of SAR 1.38bn (USD 368mn) to the Yemeni government in Aden. This will support the government, including to pay the public sector salaries.

Saudi Arabia Focus

- Saudi Arabia updated its methodology for calculating inflation. As per the latest data, consumer price inflation inched up to 2.3% in Aug (Jul: 2.1%), the highest reading since Jul 2023. Prices increased in most categories, with the sharpest upticks being in restaurants & accommodation (3.0% from 1.9% in Jul) and transport (1.2% from 0.9%). Prices did ease in housing & utilities (5.8% vs 6.2%) and recreation, sports & culture prices edged up (2.7% from 3.5%). A slow easing in housing costs stems from rental costs slowing to 7.6% (from 8.2%).

- Wholesale prices in Saudi Arabia moved up for the fifth consecutive month in Aug, to 2.13% in Aug (Jul: 2.10%), due to modest upticks in food products and other transportable goods; deflation continued in ores & minerals for the 25th month in a row (-0.84% from -0.85%). Average wholesale prices almost halved to 1.8% in Jan-Aug 2025 (vs Jan-Aug 2024: 3.4%), as prices of “other transportable goods” plunged (3.7% vs 8.4%), in addition to food products (0.1% vs 1.65%); costs of agriculture & fishery surged (4.3% from -0.1%).

- Saudi Arabia was included on JP Morgan’s Emerging Markets Government Bond Index watchlist: an inclusion is expected to attract about SAR 18.75bn (USD 5bn) in initial foreign inflows, enhancing liquidity and international investor participation in Saudi bonds and sukuk. The value of sukuk and debt on the Saudi Exchange is currently around SAR 688bn (USD 183bn). Once fully included, index‑driven demand should lower Saudi’s borrowing costs and possibly lead to sustained foreign investor presence though external risks (interest rate shifts, global credit conditions) will be important as well.

- The Saudi Central Bank’s (SAMA) real estate price index projects a slower growth in residential rents in Q3 2025. The index measures changes in property prices – this has moderated in Q2 (3.2%) following a 4.3% rise in Q1. Recent policy changes such as the “white land” tax and platforms such as Tawazon (that offer affordable land to first‑time buyers) aim to boost supply and ease pressure on prices. Though slowing rent growth (partly due to the higher base) will ease inflationary pressures in coming months, persistent demand amid a slower supply pipeline in major cities will keep rental pressures elevated in certain segments.

- Saudi Arabia and New Zealand signed MoUs worth about USD 100mn, across sectors such as agriculture (dairy, fruit), animal management, and creative industries. Exports have nearly doubled since mid-2021, with dairy dominating 80% of New Zealand’s exports. This deal underscores Saudi’s objective to attract foreign partners beyond traditional oil‑linked sectors: efficient implementation will support non‑oil GDP growth and strengthen regional value chains.

- French investment in Saudi Arabia has surged by 180% over five years to over EUR 16bn, disclosed the Saudi investment minister. This is in addition to the increase in bilateral non-oil trade that touched SAR 20bn in 2024.

- Saudi Arabia’s hotel sector posted a 1.9% yoy increase in Average Daily Rate (to SAR 821.8) in H1 2025, according to JLL, while overall occupancy slipped to 62.3% and Revenue per Available Room ticked up modestly by 0.2% (to SAR 512.3). Growth is being supported by the revised Vision 2030’s tourism targets (150mn visitors annually by 2030), increase in non-religious tourism (though religious tourism still dominates demand) alongside a strong hotel development pipeline.

- Saudi Arabia’s Power Procurement Company (SPPC) has put out request for qualifications for seven new renewable‑energy projects totalling 5,300 MW: includes five solar projects (total of 3,500 MW) and two wind projects (around 1,200 MW). SPPC has launched over 43 GW of renewable projects and power purchase agreements with capacity of over 38 GW.

UAE Focus

- The UAE Cabinet approved a national policy for economic clusters, aiming to enhance sectoral integration and competitiveness. The clusters – in key sectors, including financial services, tourism and hospitality, space, communications and data analytics, and food – are expected to contribute more than AED 30bn annually to UAE’s GDP and increase value of foreign trade by AED 15bn over the next 7 years.

- The UAE central bank projects overall economic growth of 4.9% in 2025, up from its previous estimate of 4.4%, thanks to expansions across both the hydrocarbon (5.8%) and non-hydrocarbon (4.5%) sectors. In 2026, the economy is expected to expand further, up 5.3% with non-oil sector growth at a resilient 4.8%.

- FDI into Sharjah surged in H1: number of FDI projects grew by 57% yoy to 74 and capital investment soared by 361% to USD 1.5bn, resulting in a 45% growth in job creation (2578 new positions), especially in consumer products (capital investment up 188%), food and beverage (+112% in project volume) and business services (500% in project activity).

- The Abu Dhabi Investment Authority (ADIA), UAE’s sovereign wealth fund with over USD 1.1trn in assets, in its annual review report disclosed that its 20-year annualised performance slipped to 6.3% in 2024 (2023: 6.4%), while the 30-year returns stood at 7.1%. The fund also indicated a transition towards a more data-driven investment strategy and implied its intent to capitalize on opportunities in sectors such as AI, private credit, and digital infrastructure.

- UAE’s construction sector firms are jumping on the IPOs bandwagon: ALEC Holdings, a Dubai-based diversified engineering and construction firm wholly owned by the Investment Corporation of Dubai (ICD), announced plans to sell a 20% stake on Dubai Financial Market (expected to raise about USD 400mn); post-IPO, ICD will retain an 80% stake in ALEC. Binghatti Holding is also reportedly exploring a potential listing on Dubai Financial Market. The firm recently posted a 189% yoy increase in revenue and a net profit of AED 1.82bn in H1 2025. Bloomberg reported that another contractor Arabian Construction Company, and online property platform Dubizzle are also planning to go public.

- The Abu Dhabi Securities Exchange and Hong Kong Exchanges and Clearing Limited signed an agreement to promote dual listings, cross-border financing, and the development of ESG-related products. Furthermore, the two regulators (UAE’s Securities and Commodities Authority and Hong Kong’s Securities and Futures Commission) have established a framework for mutual recognition of investment funds, thereby facilitating smoother cross-border investments.

- South America’s Mercosur blocand UAE could finalise a trade agreement by end-2025, according to Brazil’s foreign minister; negotiations had begun in 2024. He revealed this at the signing ceremony of the deal between Mercosur and EFTA blocs.

- Dubai ranked the fifth strongest international shipping centre globally, and top in the region, according to the 2024 International Shipping Centre Development Index report. The report highlights the Dubai as the only Arab city in the top 20 and also the Jebel Ali Port’s handling 15.5mn twenty-foot equivalent units (TEUs) last year, the highest since 2015.

Media Review:

Global Debt Remains Above 235% of World GDP

https://www.imf.org/en/Blogs/Articles/2025/09/17/global-debt-remains-above-235-of-world-gdp

Can the UAE gain a foothold in AI by being friends with everyone?

https://www.economist.com/business/2025/09/18/can-the-uae-gain-a-foothold-in-ai-by-being-friends-with-everyone

Whoever controls digital currency will direct the future of money: Dr. Nasser Saidi’s op-ed in AGBI

https://www.agbi.com/opinion/banking-finance/2025/09/whoever-controls-digital-currency-will-direct-the-future-of-money/

The Future of Electricity in the Middle East and North Africa: IEA

https://www.iea.org/reports/the-future-of-electricity-in-the-middle-east-and-north-africa

Powered by: