Download a PDF copy of the weekly economic commentary here.

Markets

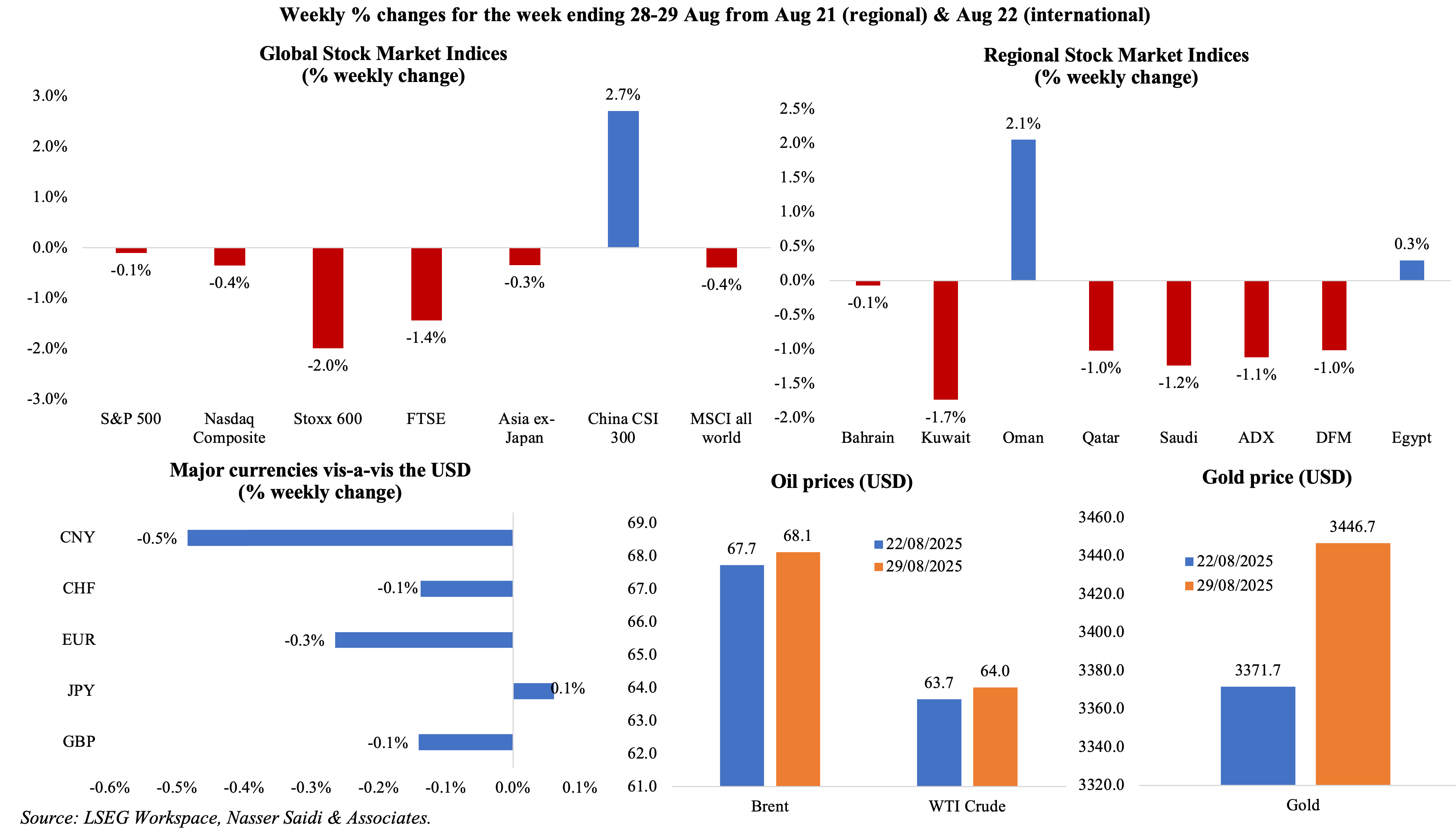

Global equities markets had a rough week, with a drop in technology and AI-related shares, and investors remaining cautious ahead of economic data that could determine the Fed’s next move. Markets in the Gulf also mirrored the global trend, except for Oman which crossed the 5000-mark for the first time in nearly eight years (reflecting investor confidence in the economy given ongoing economic reforms) while Egypt benefitted from news about a “partnership package” with Qatar. Among currencies, the Indian rupee dropped to a record low after US hiked tariffs (to 50%) while the Chinese yuan was the strongest vis-à-vis the USD in 10 months. Oil prices were moderately up (0.5%+ from a week ago), while gold price climbed more than 2% (inching closer to a record USD 3500) on increased expectations of a rate cut this month.

Global Developments

US/Americas:

- US imposed tariffs of 50% on goods from India last week, citing India’s purchases of Russian oil. Even as US continues trade negotiations with other trade partners, an appeals court (in a 7-4 decision) ruled that most of Donald Trump’s tariffs were illegal though the ruling will not take into effect till 14th Oct (potentially taking this to the Supreme Court). The de minimis exemption (i.e. USD 800 duty-free imports) also ended last week, prompting many global postal services to suspend US-bound shipments. Separately Bloomberg reported that US was exerting pressure on Mexico to raise duties on Chinese goods under its 2026 budget plan.

- GDP grew at an annualised 3.3% rate in Q2, revised up from the preliminary reading of 3.0%, reflecting upward revisions to investment and consumer spending. The Atlanta Federal Reserve is currently estimating GDP will increase at a 2.2% rate in Q3. Importantly, core PCE inflation stood at 2.5% qoq, unchanged from the preliminary print but slowing from the 3.5% uptick in Q1.

- Personal income grew by 0.4% mom in Jul (Jun: 0.3%) while spending grew by a faster 0.5% (from 0.3%) holding the savings rate at 4.4%. The encouraging uptick in personal income was underpinned by solid wage growth and continued labour market resilience; spending was boosted by spending on cars and financial services as well as summer sales events. The PCE price index rose by 0.2% mom and 2.6% yoy in Jul while core PCE saw prices accelerate to 2.9% yoy (from 2.8%)

- US durable goods fell by 2.8% mom in Jul (Jun: -9.3%) – this follows months when firms frontloaded orders to get ahead of the tariff hikes (Mar’s 7.6% & May’s 16.5%). Non-defense capital goods orders excluding aircraft rebounded (1.1% following a 0.6% dip in Jun). This divergence partly highlights ongoing volatility in transportation orders.

- The regional and national manufacturing indicators present a mixed picture: the Richmond (to -7 in Aug from Jul’s -20) and Kansas Fed (0 in Aug from Jul’s -3) indices show tentative signs of stabilization; the weakness in the Chicago PMI (to 41.5 in Aug from Jul’s 47.1) and the Dallas Fed (to -1.8 in Aug from Jul’s 0.9) index suggest that manufacturing remains under strain. Chicago Fed national activity index, which worsened to -0.19 in Jul (Jun: -0.18) is especially concerning, with three categories (production, sales, orders & inventories, and employment) making negative contributions to the index while the personal consumption and housing category made a neutral contribution.

- Chicago PMI slipped to 41.5 in Aug (Jul: 47.1), remaining below-50 for the 21st straight month, and the drop stemming from weaker new orders (-10.8 points) and production (-3.6 points, the fifth decline in a row) while inflationary pressures eased.

- Michigan consumer sentiment index slipped to 58.2 in Aug (prelim: 58.6 & Jul: 61.7), as buying conditions for durable goods subsided to their lowest reading in a year, and current personal finances declined 7%. The 1-and 5-year inflation expectations moved up to 4.8% and 3.5% (from 4.5% and 3.5% respectively in Jul), though both readings are well below the highs seen briefly in Apr and May 2025.

- New home sales edged down by 0.6% mom to 652k in Jul and the median sales prices was 0.8% lower at USD 403,800. Pending home sales fell by 0.4% mom in Jul (Jun: -0.8%), indicating buyer hesitance amid high borrowing costs.

- S&P Case Shiller home price index grew by 2.1% yoy in Jun (May: 2.8%), the softest increase since Jul 2023. While supply remains tight, high financing costs, affordability and weaker buyer demand are putting a cap on further price escalation.

- US goods trade deficit widened to USD 103.6bn in Jul (Jun: USD 85.9bn), driven by a combination of stronger imports (7% mom to USD 281.5bn, on higher industrial supplies and capital goods) and weaker exports (-0.1% to USD 178bn).

- Initial jobless claims in the US declined by 5k to 229k in the week ended Aug 23 and the 4-week average inched up by 2.5k to 228.5k. Continuing jobless claims rose to 1.954mn in the week ended Aug 16 and up from 1.961mn the week prior. Labour market data continue to suggest a gradual softening.

Europe:

- Euro area’s economic sentiment index slipped to 95.2 in Aug (from 95.7), with the index slipping further below its long-term average, dragged down by services (3.6 from 4.1), construction (-3.5 from -3.1) and consumer (-15.5 from -14.7).

- HICP in Germany ticked up in Aug, by 0.1% mom and 2.1% yoy (Jul: 0.4% mom and 1.8% yoy), according to provisional estimates. Detailed breakdown will be published this week.

- German Ifo business climate inched up to 89 in Aug (Jul: 88.6), with the current assessment moderating (86.4 from 86.5) while expectations rose (to 91.6 from 90.8). The slight deterioration in the current assessment suggests that business conditions remain weak, in industrial, construction and export-oriented sectors.

- German retail sales decreased by 1.5% mom in Jul (Jun: 1%), recording the sharpest decline since Aug 2023 on weaker sales across food (-1.8%), non-food (-0.7%) and online (-3.8%). In yoy terms, sales grew by 1.9% though sharply down from June’s 4.9% gain.

- German GfK consumer confidence fell further to -23.6 in Sep (Aug: -21.7), staying persistently negative for over two years, reflecting a 6-month low in economic expectations (2.7 from 10.1) and a drop in willingness to buy (-10.1 from -9.2) amid concerns about inflation, geopolitical risks, and economic policy uncertainty.

- A political and debt crisis looms in France: the government is expected to fall next week, after the PM called for a vote to get support for a EUR 44bn package of tax rises and spending cuts; opposition parties announced that he would be voted down – thus making this government the third to fall in just over a year’s time. The widening fiscal deficit is estimated to reach 5.4% of GDP this year and recession risk is just round the corner.

Asia Pacific:

- China’s NBS manufacturing PMI inched up to 49.4 in Aug (Jul: 49.3), remaining sub-50 for the fifth month in a row as output grew (50.8 from 50.5) even as multiple sub-indicators remained subdued including orders (49.5 from 49.4), export sales (47.2 from 47.1) and employment (47.9 from 48). Non-manufacturing PMI moved up to 50.3 (from 50.1) suggests some resilience in services, possibly driven by summer travel. NBS composite PMI rose to 50.5 in Aug (Jul: 50.2).

- Inflation in Tokyo slowed to 2.6% in Aug (Jul: 2.9%), with government subsidies lowering utility bills (electricity prices fell 6.5% yoy and gas dropped 6.0%). Excluding food and energy, prices inched lower to 3.0% (from 3.1%). Excluding fresh food, prices eased to 2.5% (from 2.9%) but remaining above the BoJ’s 2.0% target.

- Unemployment rate in Japan eased to 2.3% (from 2.5%), the lowest jobless rate since Dec 2019, as the number of unemployed fell to 1.64mn, the lowest since Jan 2020. The jobs-to-applicants ratio held steady at 1.22 for the second month in a row, remaining at its lowest since Mar 2022, pointing to ongoing labour market tightness.

- Leading economic index in Japan eased to 105.6 in Jun, from the preliminary reading of 106.1 though it was higher than May’s 104.8. Household spending grew at the fastest pace since Aug 2022, thanks to government initiatives to boost consumption. Coincident index at 116.7 was the highest since Feb, though below the preliminary reading of 116.8.

- Industrial production in Japan fell by 1.6% mom and 0.9% yoy in Jul (Jun: +2.1% mom and 4.4% yoy). The monthly contraction was the most since Nov 2024, partly due to a slowdown in output of motor vehicles (-6.7% mom from 0.5%) and production machinery (-6.2% vs 0.5%). The reversal from Jun’s robust performance highlights the volatility in Japan’s industrial base, which remains vulnerable to global trade swings and supply chain constraints.

- Retail sales in Japan grew by 0.3% yoy in Jul (Jun: 1.9%), posting the slowest pace of growth since Feb 2022. Large retailer sales grew by 2.0%, faster than 1% in Jun. The uptick in large retailer sales, however, points to a divergence in spending patterns — with consumers perhaps trading down or consolidating purchases with major retailers due to price sensitivity.

- India’s GDP grew by 7.8% yoy in Apr-Jun (Q1: 7.4%), with manufacturing and services posting high growth rates (of 7.7% and 9.3% respectively). The expansion was broad-based, supported by strong infrastructure-led government spending (7.4%), resilient private consumption (7.0%), and gross fixed capital formation (7.8%) while exports expanded by 6.3%, as firms in the US frontloaded goods ahead of tariffs implementation.

- Fiscal deficit in India widened to INR 4.684trn in Jul (Jun: INR 2.8trn) or 29.9% of the full year target, reflecting higher expenditure (particularly on infrastructure and subsidies) while revenue growth remained steady.

- Industrial output growth in India accelerated in Jul, up 3.5% following Jun’s 1.5% gain, with manufacturing growth rising by 5.4% (from 3.7%). The improvement reflects rising domestic demand: consumer durables production improved (7.7% vs 2.8%), thanks to automobiles and electronic products while the output for infrastructure/construction goods surged to a 21-month high of 11.9%.

- The Bank of Korea left the benchmark 7-day repurchase rate unchanged at 2.5%, reflecting a cautious approach amid financial stability risks. The BOK upgraded its inflation and GDP growth forecast for 2025 to 2.0% (from 1.9%) and 0.9% (from 0.8%) respectively. While domestic demand is expected to make a “modest recovery”, exports are likely to “gradually slow” given impact of US tariffs.

- Singapore’s industrial production grew by 8.2% mom and 7.1% yoy in Jul (Jun: -0.8% mom and 7.1% yoy). The monthly gain was the most in a year; in yoy terms all clusters except general manufacturing (-9.7%) reported growth including transport engineering (15.8%), electronics (13.1%) and precision engineering (9.6%) among others.

Bottom line: US non-farm payrolls data could seal the deal on the Fed move next week, after last week’s core PCE inflation remained higher than the Fed target. The Fed’s independence is coming into question, with President Trump’s stance to fire Fed governor Lisa Cook. With the US appeals court questioning the legitimacy of Trump’s tariffs, a fight looks set to be played out at the level of the Supreme Court. For now, with higher tariffs imposed by the US on India’s imports, PM Modi’s presence at the Shanghai Co-operation Organisation with China and Russia should be seen and read as a critical one – an aggressive / assertive display of a new economic world order.

Regional Developments

- Real GDP in Egypt grew by 4.5% yoy in the fiscal year 2024–25 (2023-24: 2.4% and higher than the government’s 4.2% forecast) thanks to the IMF-backed reforms and a rebound in manufacturing, and despite the loss in Suez Canal revenues. Growth is estimated to hold steady at 4.5% in the 2025-26 fiscal year, thanks to a 35% jump in investments to EGP 3.5bn, according to estimates from the ministry of planning.

- The Central Bank of Egypt lowered interest rates by 200bps at the meeting last week, after unexpectedly pausing at the previous meeting. Decline in inflation print to 13.9% in Jul (Jun: 14.9%), and from a peak of 38% in Sep 2023 will provide the central bank enough leeway to resume its rate cut cycle and aligns with a gradual easing strategy. Ongoing regional support (especially from the GCC) through joint ventures, sovereign wealth fund investments, and billion-dollar strategic partnerships, has helped the economy recover and will further improve growth prospects.

- Egypt and Qatar are planning to activate aUSD 7.5bn “partnership package”, as the former nation seeks to ease fiscal and external pressures through targeted project financing.

- Egypt’s exports to the UAE surged 153% yoy to USD 3.8bn in H1 2025, thanks to trade in pearls, precious stones, and jewellery (together clocking in USD 3.2bn). With imports from the UAE down by 16.6%, overall bilateral trade rose 77.7% yoy to USD 4.8bn in H1. Investments into Egypt from the UAE grew by 4.8% yoy to USD 2.2bn in H1.

- Bilateral trade between Saudi Arabia and Egypt increased by one billion to USD 5.9bn in H1 2025. Egypt’s exports to Saudi fell to USD 1.5bn (from USD 1.7bn).

- Four oil and gas exploration agreements worthUSD 340mn were inked by Egypt with global energy firms (including Shell, Eni, Zarubezhneft, and Arcius Energy) to drill 10 new wells across promising areas in the Mediterranean and Nile Delta. This aims to reverse declining domestic output amid rising energy demand and regional supply risks.

- Egypt reported a record-high USD 8.5bn in monthly dollar inflows in Jul, excluding volatile “hot money”. Foreign exchange reserves climbed to a new high of USD 49bn, providing crucial liquidity and external buffer strength, while remittance inflows reached a record USD 36.5bn in FY2024‑25 (+66% yoy).

- The manufacturing and extractive industries index (excluding oil and petroleum) in Egypt declined by 11.9% mom in June compared to May, with textile and wood production were down by 6% and 5.9% respectively while high-value sectors like electronics (+39.5%) and leather products (+10.7%) bucked the trend.

- Egypt’s finance ministry is considering plans to incentivize large-scale corporate listings on the Egyptian Exchange, in a bid to deepen the capital market, enhance liquidity, and expand both local and international investor participation. Derivatives trading and introduction of market-maker mechanisms are being considered to diversify financial product offerings and support private-sector financing.

- The Central Bank of Egypt gave its final approval to Onebank, Egypt’s first fully digital bank, to begin operations in 2026. The bank aims to attract 800k customers in its first year and mobilise around EGP 40bn in deposits. The firm plans to target corporate clients after 18 months of operation.

- An international consortium of companies from Egypt, UAE, Bahrain, and China signed a contract to develop a solar cell, panel, and energy storage manufacturing plant in the Suez Canal Economic Zone (a USD 220mn facility). The complex will annually produce 2 GW of solar cells and panels alongside 1 GWh of storage.

- Kuwait posted a second consecutive year of fiscal deficit of KWD 1.1bn in 2024-25 (vs a projected deficit of KWD 5.6bn) and 32% yoy lower than the KWD 1.6bn deficit recorded in 2023-24. Revenues fell by 6.6% yoy to KWD 22.1bn alongside a sharper drop of 8.3% in spending (to KWD 23.1bn). There was a sharp decline in oil revenues (-10.3% yoy to KWD 19.3bn) but accounted for 87.5% of revenues. Taxes, fees and charges accounted for just 2.75% of overall revenues. Expenditure declined by 4.7% in 2024-25, with wages and salaries moderating slightly. Fiscal reform & consolidation is a priority.

- Oman and Saudi Arabia signed a strategic joint investment agreement to boost bilateral trade, build industrial partnerships and deepen economic cooperation.

- Oman is in discussions with Burkina Faso to access the latter’s mineral reserves (including zinc and copper in addition to gold – it is Africa’s 4th largest producer of gold) as part of its broader economic diversification strategy.

- Qatar’s loan and financing provisions inched up by 0.6% yoy to QAR 33bn (USD 9.06bn) in Jul and expected credit losses surged 15.9% to around QAR 19.95bn.

- Qatar’s new corporate governance law for listed companies will replace those issued in 2016, and a one-year deadline is given for compliance. It mandates improvements in board structure and composition, transparency and integrity, internal controls and shareholder communication, in a bid to boost investor confidence and market integrity.

- Saudi Arabia and India emerged as the largest buyers of Russian fuel oil and vacuum gasoil in Jul, with import volumes of around 1.1mn tonnes to Saudi and 0.6mn tonnes to India, according to Reuters – underscoring persistent demand for discounted energy supplies.

Saudi Arabia Focus

- Saudi Arabia’s overall exports grew by 1.5% mom and 3.7% yoy to SAR 92.1bn in Jun 2025, as non-oil exports rose 8.4% yoy to SAR 17.9bn and re-exports surged 60.2% to SAR 9.6bn. Re-exports reached a record SAR 32.76bn in Q2, up 20.9% qoq & 46.2% yoy & oil exports were the lowest since Q3 2021 (-9.3% qoq & -15.8% yoy). Chemical products was the largest segment of non-oil exports (24.5%) in Jun, with the top 10 sectors accounting for 95% of non-oil exports. UAE the largest destination of overall non-oil exports (28.6%), followed by India (9.5%) and China (7.8%); top 15 accounted for 72% of total non-oil exports.

- Deposit growth in Saudi Arabia’s banking sector averaged 8.9% in Jan-Jul 2025 while government deposits fell to a 5-month low. As of Jul, credit growth has outpaced deposit growth for 18 months in a row. Consumer spending inched up: point of sale transactions surged 9.1% mom & 8.8% yoy in Jul; ATM & e-commerce transactions also increased by 7.3% mom & 15.0% respectively. SAMA’s net foreign assets (NFA) posted a sharp decline by 3.1% mom to SAR 1.577trn in Jul, with commercial banks NFA staying negative for the 13th straight month.

- Riyadh’s King Abdullah Financial District (KAFD) is set to begin trial runs on a 3.6 km elevated driverless monorail (with six stations and trains) in early 2027. This project, with a capacity to transport 3500 passengers per hour, reflects the “10‑minute city” vision aimed at enhancing urban mobility.

- A recent meeting between high-level officials from Saudi Arabia and China highlights the strong economic ties between the nations. Stronger cooperation was proposed in new energy, industrial supply chains and capital markets along with existing trade and investment ties including the China’s Belt and Road Initiative.

- Saudi Arabia’s non-listed corporate debt ballooned by 514% yoy to SAR 1.2bn (USD 320mn) in Q2 2025, thanks to the Capital Market Authority’s push for broadened investment instruments (beyond just equities). Concurrently, government debt trading rose by 132% to SAR 15.6bn and participation in funds expanded significantly – both indicating a maturing fixed-income market and growing investor sophistication.

UAE Focus

- UAE and Angola signed a Comprehensive Economic Partnership Agreement (CEPA) with an aim to raise non‑oil bilateral trade to USD 10bn+ annually by 2033 in addition to adding USD 1bn to each country’s GDP, generating 30k new jobs, and deepen cooperation across sectors including services, logistics, and renewable energy.

- The UAE-New Zealand CEPA came into force: the deal is expected to boost bilateral trade to USD 5bn+ by 2032 from the current average of USD 1.5bn recorded between 2019-23.

- ADNOC signed a15-year LNG Sales & Purchase Agreement with IndianOil, to sell 1mn tonnes per annum (mtpa) of LNG from the low-carbon Ruwais project starting 2028. IndianOil is projected to become ADNOC’s largest LNG customer, with total purchases reaching 2mtpa by 2029, thereby deepening energy cooperation.

- The UAE’s new Domestic Minimum Top-up Tax received transitional qualified status under the OECD’s Pillar Two framework. This recognition also provides certainty to multinational enterprises that no foreign tax will be applied to UAE profits and acceptance of the UAE top up tax liability by other countries.

- ADNOC raised USD 317mn from the sale of a 3% stake of its logistics and services arm (equivalent to 222mn shares) via a bookbuild offering that was more than seven times oversubscribed, given strong demand from domestic and international professional investors. This increases the firm’s free float to nearly 22%, leading to a potential MSCI index inclusion.

- New Indian enterprises at the Dubai Chamber of Commerce – 9,038 in H1 2025, up 14.9% yoy – signifies sustained investor confidence and vibrant growth in both trading and services sectors. Pakistan and Egypt followed with 4,281 and 2,540 new firms joining the Chamber (+8.1% and 8.3% respectively). The Chambers members’ exports and re-exports accelerated by 18% yoy to AED 171.9bn in H1 2025, with GCC accounting for the lion’s share (48.6%).

- UAE’s First Abu Dhabi Bank became the region’s first lender to issue a HKD 390mn (USD 50mn) five-year “blue bond” i.e. sustainable finance instruments designed to advance and promote water-related environmental objectives.

Media Review:

Xi Jinping outlines China’s ambition to reshape world order in showpiece summit

https://www.ft.com/content/ccf6e56a-0e54-4e0a-9b00-b574455bffff

France’s government is on the brink of collapse, again

https://www.economist.com/leaders/2025/08/28/frances-government-is-on-the-brink-of-collapse-again

What Trump’s Tariffs Mean for India

https://www.project-syndicate.org/onpoint/what-trump-s-tariffs-mean-for-india

The liberal nightmare: what if Trump is right?

https://www.agbi.com/opinion/trade/2025/08/the-liberal-nightmare-what-if-trump-is-right/

Powered by: