Weekly Insights 5 Jul 2024: Middle East non-oil sector activity eases in June alongside active SWF investments

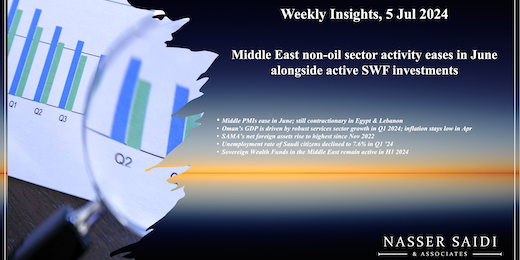

1. Middle PMIs ease in June; still contractionary in Egypt & Lebanon

- GCC’s PMIs for June were all expansionary, supported by robust demand, but increased only in Qatar (to 55.9, the highest since Jul 2022). PMI readings for Egypt and Lebanon stayed below-50 though the former’s inched to 49.9 in Jun, rising to the highest in three years.

- In Q2 2024, only Egypt and Qatar posted an uptick compared to Q1 (6.3% qoq and 2.9% respectively). The sharpest decline in qoq terms was seen in UAE (-3.2% qoq) with Saudi down by 0.7% qoq.

- UAE PMI was the lowest in 16 months, but new orders rose (highest since Mar) as did export orders (most since Oct 2023). Saudi Arabia posted the weakest PMI reading since Jan 2022, dragged down by slower rise in new orders. In contrast, Qatar’s manufacturing & construction sectors grew, as overall new orders rose at the fastest pace in 13 months and employment rose for the 16th straight month.

- Cost pressures have been increasing across the GCC because of higher employees’ salaries & input prices. In the UAE input cost inflation was near a 2-year high. As seen in previous months, firms offered discounts to remain competitive (Qatar, Saudi Arabia) while UAE businesses raised selling costs for the second month in a row (but the largest uptick in more than 6 years).

- Egypt had much to cheer: export orders were up the most in 2.5 years and new orders grew for the first time since Aug 2021, supported by manufacturing and services. In contrast, Lebanon’s PMI slipped to the lowest in 17 months (47.8); new orders fell the most in almost 18 months. Businesses remained pessimistic about the 12-month outlook, the most in a year adversely affected by security situation in the South.

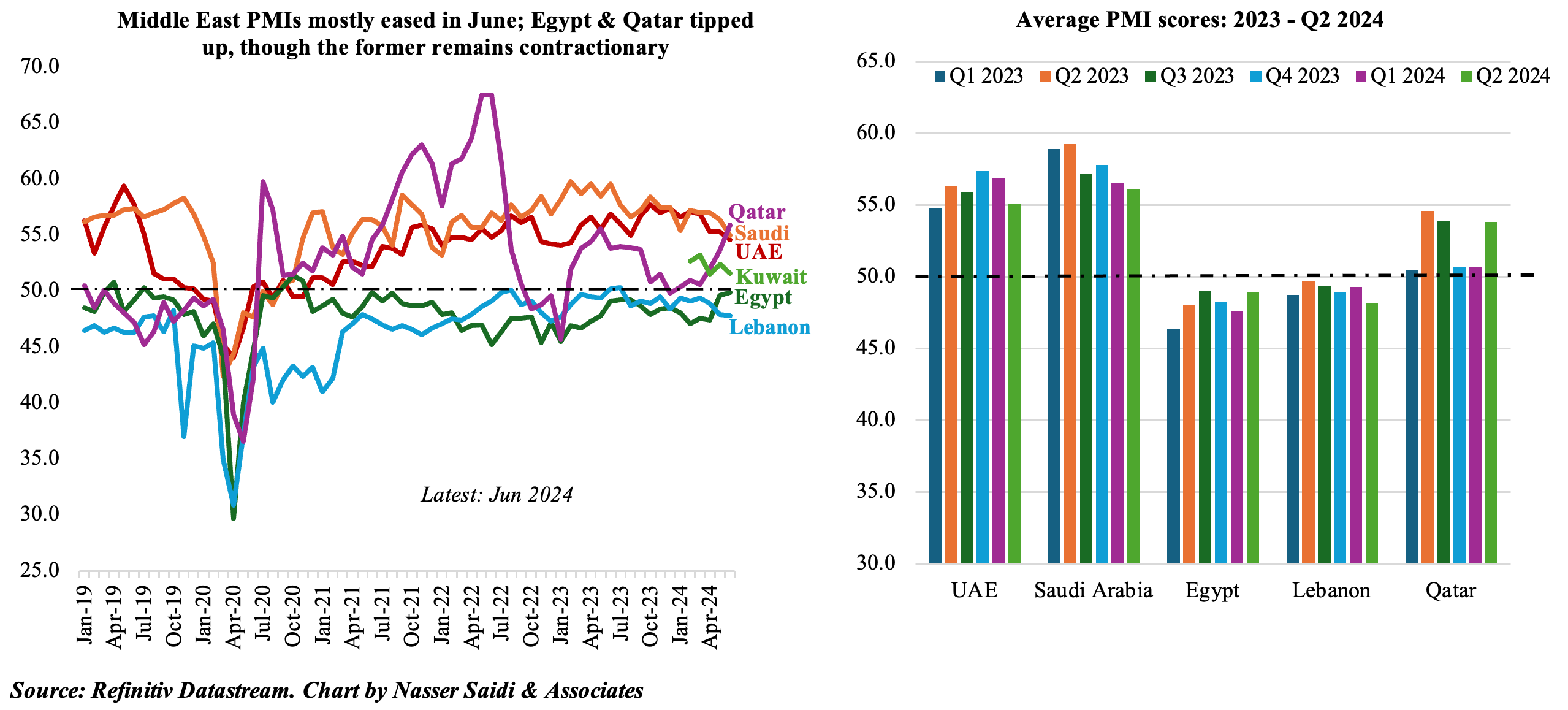

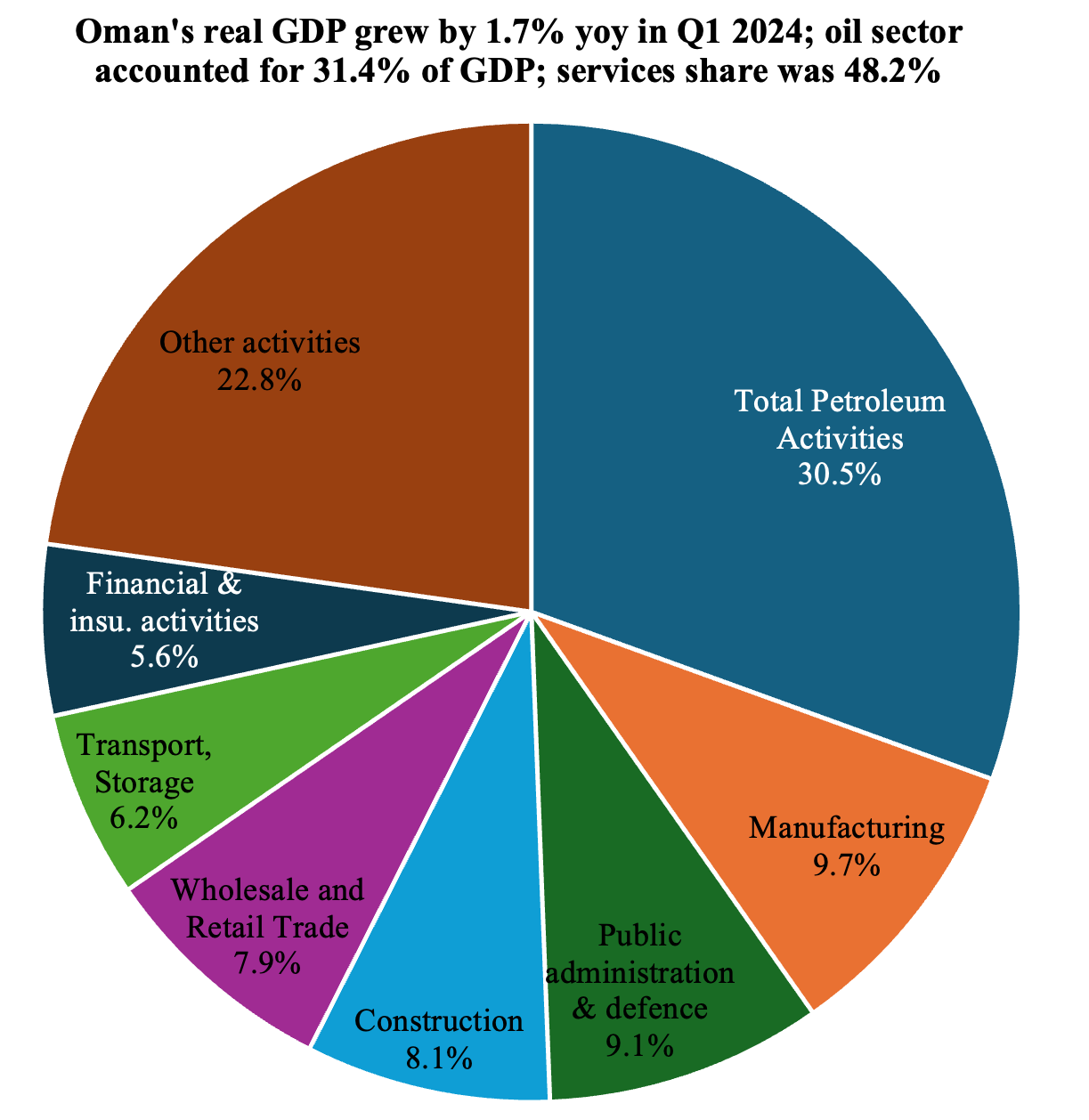

2. Oman’s GDP is driven by robust services sector growth in Q1 2024; inflation stays low in Apr

- Oman’s real GDP grew by 1.7% yoy in Q1 2024 (Q4 2024: 0.3%), supported by non-oil sector (4.5%) alongside a 2.4% drop in oil sector growth.

- A breakdown by sector shows that oil and gas sector accounted for less than one-third of total GDP (30.5%) while public administration and defence accounted for close to 10%. Manufacturing and construction (both within the industry sector) together accounted for 17.8% of overall GDP. Within services, trade and logistics dominated (14.1% of total GDP).

- In Q1, transportation & storage grew at the fastest pace (7.8% in Q1) while accommodation & food services activities was the only sector posting a decline (-12.1%).

- Inflation in Oman increased to 0.94% yoy in Apr (Mar: 0.17%). Food prices increased (3.8% from 3.6%) as did recreation costs (0.6% from 0.4%) while restaurants & hotels costs rebounded (0.29% from -0.1%). Transport and education costs continued to be deflationary.

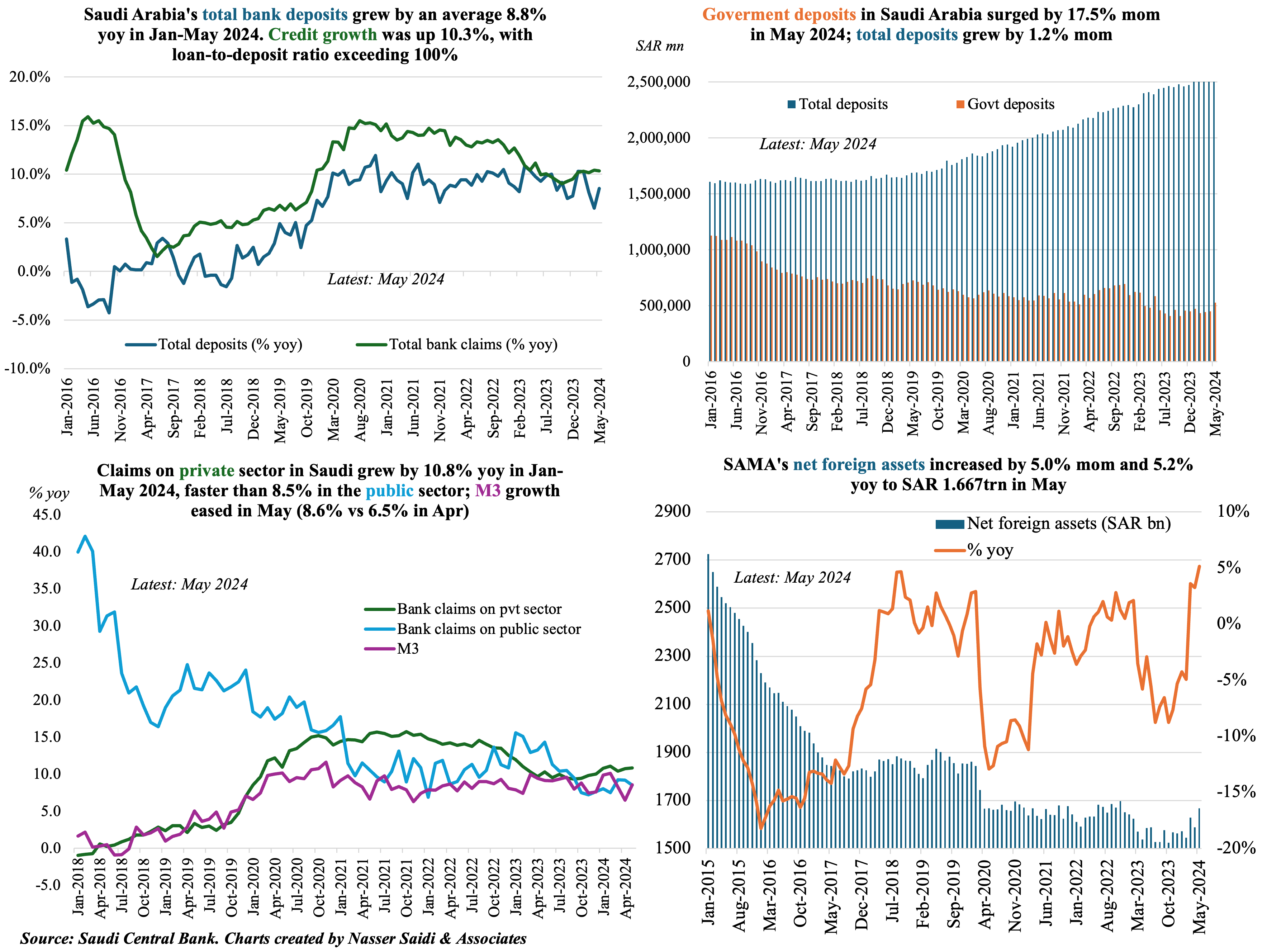

3. Total deposits in Saudi Arabia grew month-on-month in May, supported by surge in government deposits; credit growth averaged 10.3% in Jan-May; SAMA’s net foreign assets rose to highest since Nov 2022

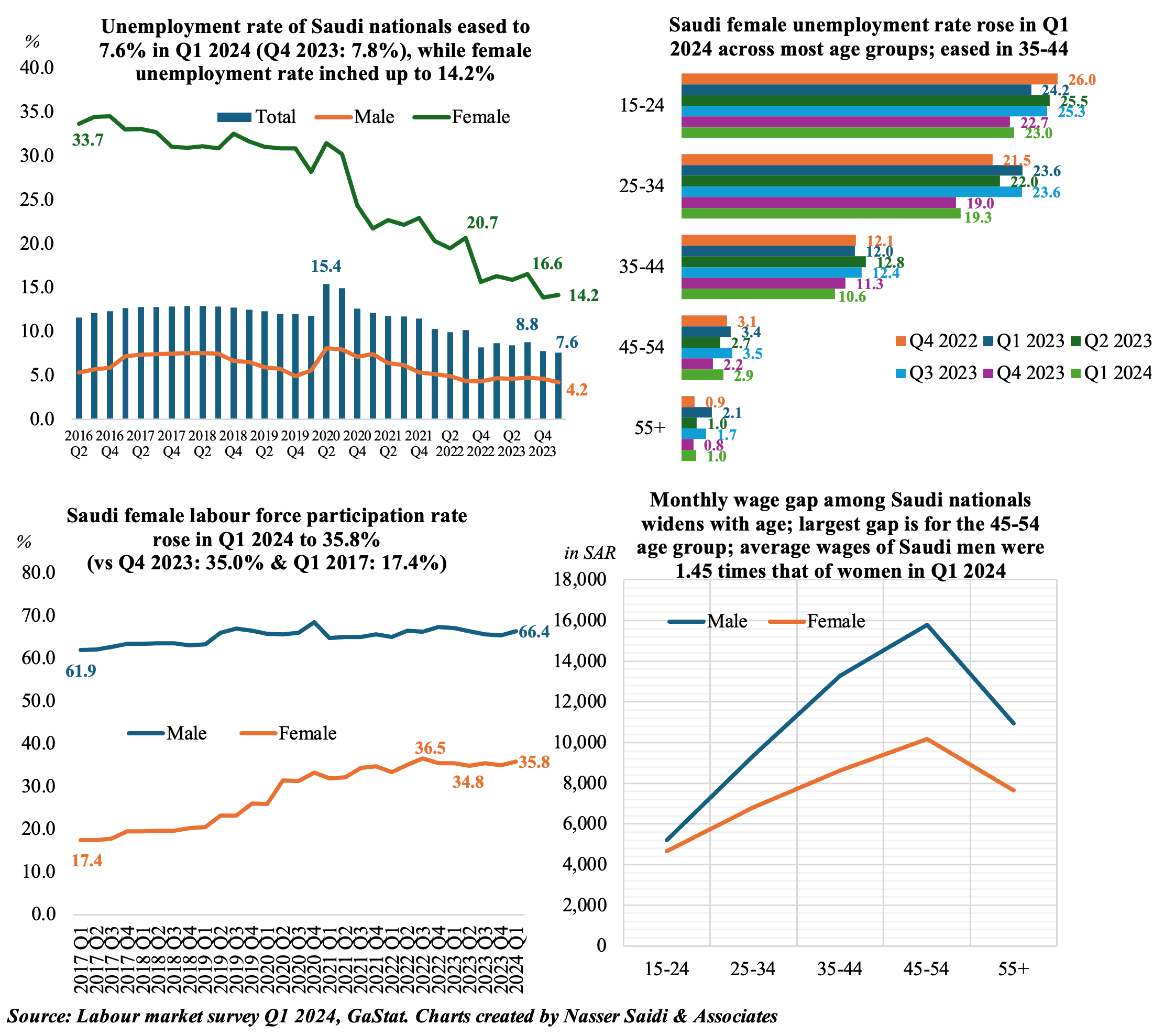

4. Unemployment rate of Saudi citizens declined to 7.6% in Q1 ‘24

- Unemployment rate in Saudi Arabia (inclusive of expats) inched up to 3.5% in Q1 2024 (Q4: 3.4%). Saudi citizens unemployment rate edged lower to 7.6% (Q4: 7.8%).

- Saudi female unemployment rate rose from a record-low of 13.9% in Q4 to 14.2% in Q1, with only the 35-44 age groups recording a dip.

- Saudi female labour force participation rose to 35.8% (Q4: 35.0%).

- Females’ wages for citizens averaged SAR 7,662 in Q1 2024 & wages of the 45-54 age group was the highest (SAR 10,185). Overall male-female wage gap is high: Saudi women earn 44.7% less on average compared to men. The gap is most in the 45-54 age group.

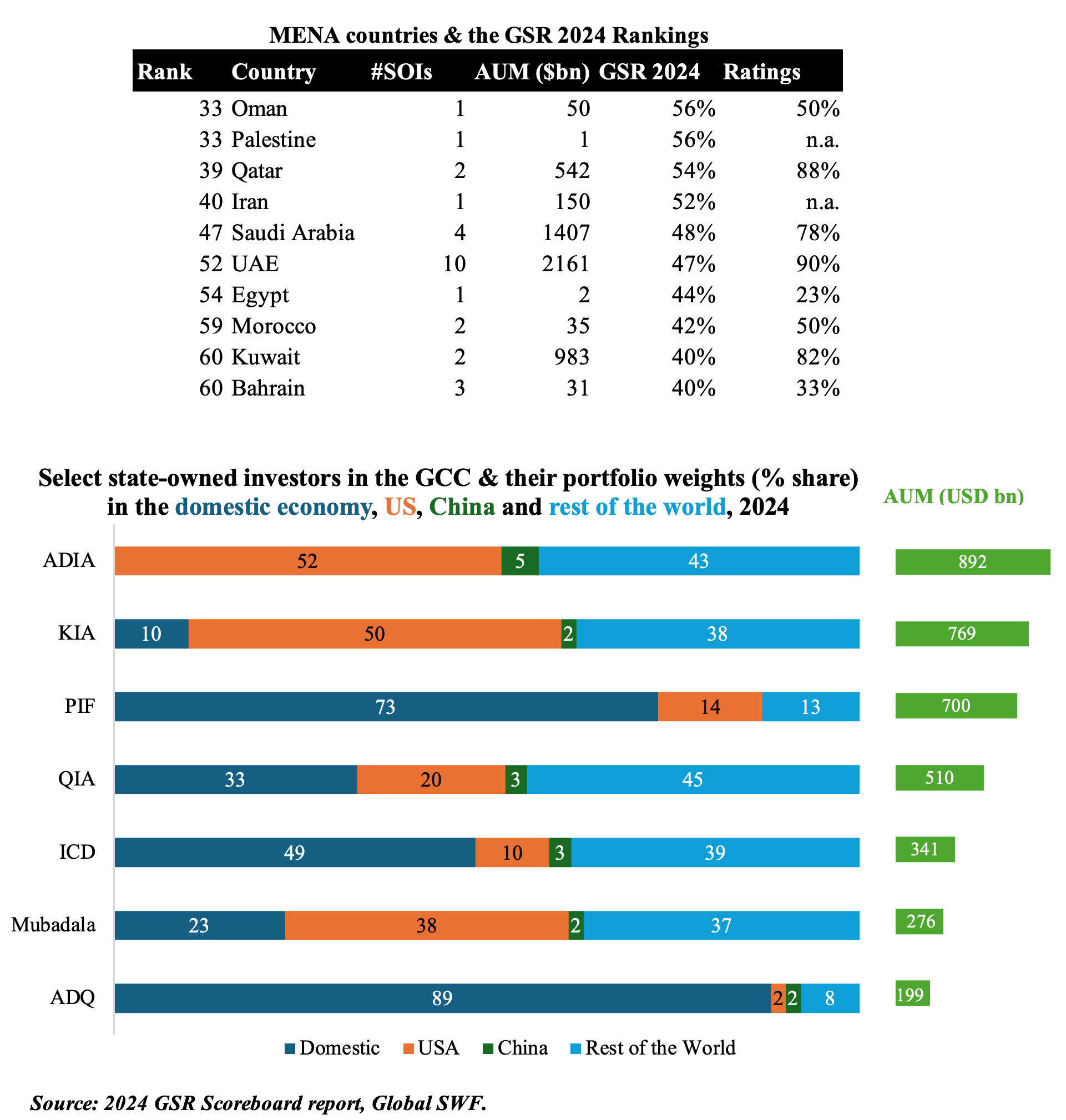

5. Sovereign Wealth Funds in the Middle East remain active in H1 2024; Saudi PIF ranks among the top 10 state-owned investors by GSR score: Global SWF

- Active Middle East funds: according to Global SWF, investments in H1 2024 were led by the “Oil Five”, i.e., Saudi’s PIF, Abu Dhabi’s ADIA, Mubadala and ADQ, and Qatar’s QIA. Combined, these entities invested USD 38.2bn in 58 different deals.

- Investments in “green assets” (mostly renewable energy) continued to outpace investments in “black assets” (mostly, oil and gas and mining) in H1 2024: including Mubadala’s investments in Australian, Indian and Japanese renewable energy.

- Middle East state-owned investors (SOIs) were part of 8 out of the 10 largest investments in H1 2024.

- The US-China geopolitical tensions notwithstanding, the region’s SWFs continued to invest in China: Mubadala re-opened its Beijing office in 2023 & ADQ helped finance CYVN Holdings (controlled by the govt of Abu Dhabi)’s USD 3.3bn investment in EV NIO.

- Middle Eastern funds have experienced the largest improvement in Governance, Sustainability and Resilience (GSR) scores globally, from 32% in 2020 to 48% in 2024.

- While Saudi PIF was ranked among the top 10 globally by GSR scores (rose to 96% from 28% in 2020), rankings by country placed Saudi Arabia 47th in the list – as not all state-owned investors are managed in the same manner.

- Of the 22 funds tracked from the GCC (managing USD 5.2trn in assets), nine of them scored better in 2024 edition including Abu Dhabi’s ADQ (score rose thanks to their recent bond prospectus) & Mubadala (expected to publish its first annual impact report in H2 2024).

Powered by: