Download a PDF copy of the weekly economic commentary here.

Markets

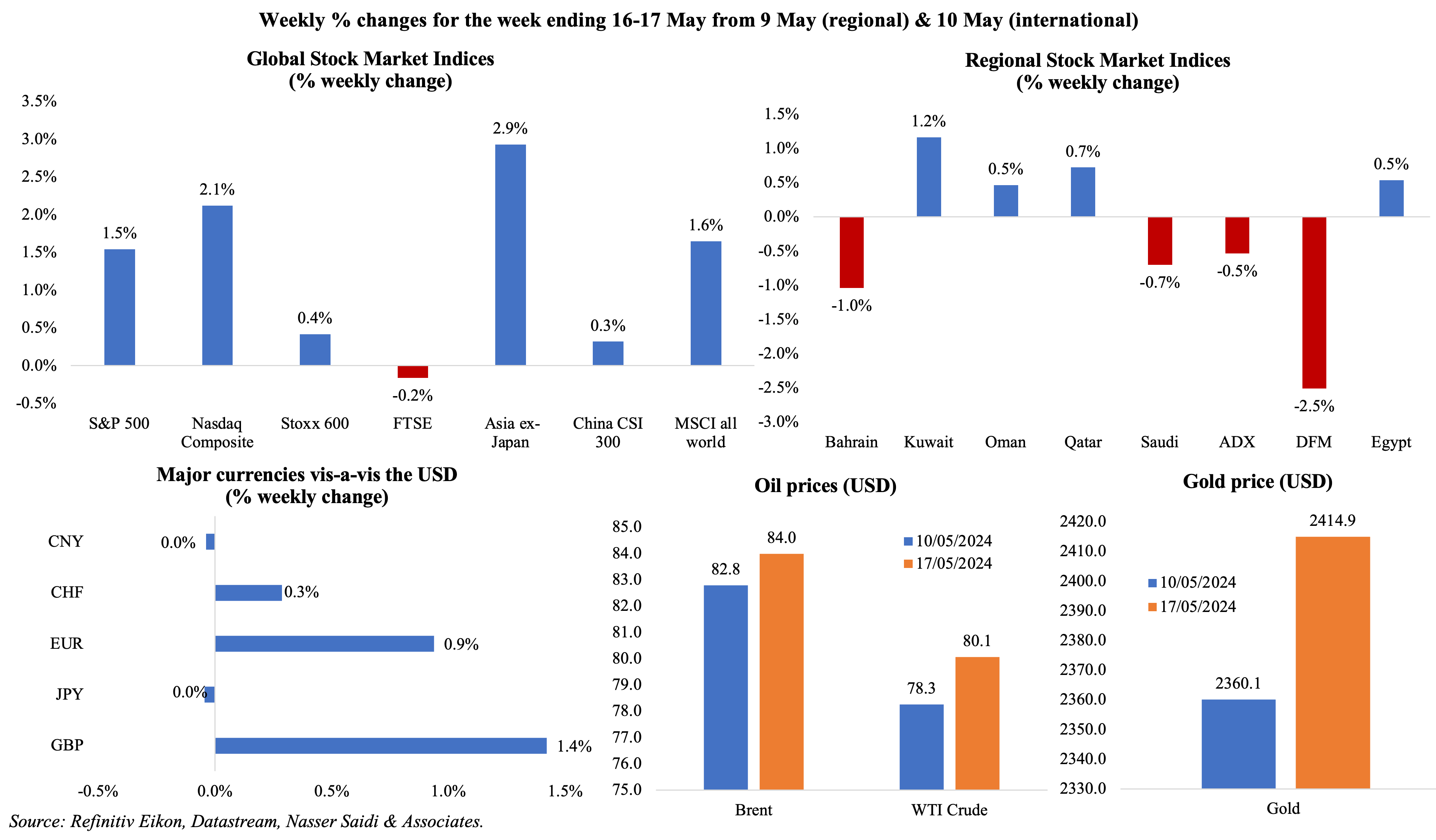

Major equities markets gained, with timing of the interest rate cut remaining the major talking point and driver of expectations across markets: while S&P 500 and Nasdaq were up by 1.5% and 2.1% last week, MSCI’s global index was near a record high close. Regional markets were mixed with Dubai’s DFM falling the most – by 2.5% – on losses in real estate / property and utility stocks. The dollar had its worst day this year on Wednesday amid signs of persistent but easing inflation in the US; GBP posted a weekly gain of 1.4%. Oil price rose last week, with Brent moving up after 3 weeks of dips, on expectations of higher demand ahead of the OPEC+ meeting in early-Jun. Meanwhile, other commodities benefited from China’s stimulus measure: gold price rose, as did silver (to a 11-year high) and nickel (to the highest since Aug 2023).

Global Developments

US/Americas:

- US inflation eased slightly to 3.4% in Apr (Mar: 3.5%), with food prices steady at 2.2% while prices declined for new vehicles (-0.4% from -0.1%) and used cars & trucks (-6.9% from -2.2%). Core inflation slipped to 3.6% (Mar: 3.8%), the lowest gain since Apr 2021.

- Producer price index in the US gained by 0.3% mom (Mar: 0.2%), the largest gain since Jul 2023, with services’ 0.6% uptick accounting for almost three-fourth of the PPI increase. In yoy terms, PPI rose to 2.2% in Apr (Mar: 1.8%); excluding food and energy, prices were up to 3.1% (Mar: 2.8%), the largest uptick since Apr 2023.

- US industrial production was flat in Apr (Mar: 0.1%), with manufacturing decreased by 0.3% while mining fell by 0.6%. Capacity utilisation moved down to 78.4% in Apr (Mar: 78.5%), remaining below its long run average.

- Retail sales in the US was flat in Apr compared to Mar (Mar: 0.6%), with declines recorded across multiple sectors including non-store retailers (-1.2%), sporting goods, musical instruments & bookstores (-0.9%) and motor vehicles (-0.8%) among others.

- Building permits in the US fell by 3% mom to 1.44mn in Apr, the lowest reading since Dec 2022, as multi-family permits tumbling to the lowest level since Oct 2020 (-9.1% to 408k). Housing starts grew by 5.7% mom to 1.36mn in Apr, with single-family housing starts down by 0.4% to 1.031mn units.

- NY Empire State manufacturing index declined for the sixth consecutive month, down to -15.6 in May (Apr: -14.3), as new orders fell and labour market conditions were weak.

- Philadelphia Fed manufacturing survey slipped to 4.5 in May (Apr: 15.5), with new orders turning negative (-1.2 from 19.1) while employment gained 3 points to -7.9.

- NFIB business optimism index inched up to 89.7 in Apr (Mar: 88.5) with inflation remaining a major concern for 22% of the small business owners. The reading has been below the series average (of 98) for the 28th month in a row.

- Initial jobless claims fell by 10k to 222k in the week ended May 10th and the 4-week average moved up by 1.5k to 217.75k. Continuing jobless claims rose by 13k to 794mn in the week ended May 3rd (from 1.781mn the week before).

Europe:

- Euro area’s GDP grew by 0.3% qoq and 0.4% yoy in Q1 (Q4: -0.1% qoq and 0.1% yoy) – the strongest qoq gain since Q3 2022. A rebound in Germany (0.2% from -0.5%) supported the gains while France and Italy expanded by 0.2% and 0.3% respectively.

- Industrial production in the euro area grew by 0.6% mom in Mar (Feb: 1%), even as production declined for both capital goods (-1%) and non-durable consumer goods (-2.7%). Across countries, Ireland and Belgium posted the largest increases (+12.8% and +6.8% respectively). In yoy terms, IP declined by 1% in both the euro area and the EU.

- There were signs of recovery as Germany’s ZEW economic sentiment index jumped to 47.1 in May (Apr: 42.9) and the current situation improved (to a -72.3 reading from Apr’s -79.2), thanks to “better assessments of the overall eurozone and of China as a key export market”. The ZEW economic sentiment index in the eurozone also improved, rising to 47 (Apr: 43.9); the current situation indicator surged by 10.2 points to -38.6.

- Unemployment rate in the UK inched up to 4.3% in the 3 months to Mar, with unemployment rising by 166k. UK average earnings including (excluding) bonus remained unchanged at 5.7% (6%) in the 3 months to Mar.

Asia Pacific:

- China’s industrial production grew by 6.7% yoy in Apr (Mar: 4.5%). Retail sales grew by 2.3% (Mar: 3.1%), the slowest rise since Dec 2022. Fixed asset investment grew by 4.2% in Jan-Apr (Q1: 4.5%) while the jobless rate slipped to 5% in Apr (Mar: 5.2%).

- China’s finance ministry auctioned 30-year bonds at a yield of 2.57% last Friday, as part of the government’s special bond issuance spread over a 6-month period. The bid-to-cover ratio for the first tranche of the special bonds was 3.91 times.

- GDP in Japan shrank by 0.5% qoq and at a 2% annualised rate in Q1, as private consumption fell by 0.7% (the 4th quarter of decline) and capital spending declined by 0.8%.

- Industrial production in Japan grew by 4.4% mom in Mar, the highest increase since Jun 2022. In yoy terms, IP was down by 6.2% (Feb: -6.7%) – the steepest fall since Sep 2020.

- Japan’s machine tool orders plunged by 11.6% yoy in Apr (Mar: -8.5%) as domestic demand plunged (-12.9% to JPY 36.2mn). In Jan-Apr, machine tool orders fell by 9.3%.

- Inflation in India edged lower to an 11-month low of 4.83% in Apr (Mar: 4.85%), with food prices surging to a 4-month high of 8.7% (Mar: 8.52%) while fuel & power prices fell by 4.2%. Wholesale price inflation nudged up to a 13-month high of 1.26% (Mar: 0.53%), with a rise in food prices (7.74% from Mar’s 6.88%) and fuel & power prices (1.4%).

Bottom line: Market expectations and pricing are still centred around timings of rate cuts from major central banks – while the ECB has been preparing to lower rates ahead of the Fed, while the latter’s meeting minutes to be released this week, will be scrutinised for officials’ views on potential rate cut timings. Additionally, the UK’s inflation & flash PMI could provide hints if the BoE will cut rates as early as Jun or if it would likely be pushed for later this year. While China rolled out a few stimulus measures last week, relatively weak retail sales and investment readings underscore the need for further measures. Meanwhile, the tech war is intensifying the trade war at a time of greater geopolitical tensions. Sparks of further trade wars intensified given last week’s US announcement of an increase in tariffs on Chinese imports of EVs (quadruple to 100%), solar cells (levy doubled to 50%) and lithium-ion EV batteries (triples the rate to 25%). About USD 18bn worth of Chinese goods would be affected by these tariffs.

Regional Developments

- Egypt disclosed receipt of the second payment (USD 14bn) from the UAE towards the development of Ras al-Hikma peninsula. The PM stated the government was also working to waive UAE’s deposit of USD 6bn in Egypt’s central bank and convert its value to the equivalent in EGP.

- The share of private sector investments in Egypt increased to 40% in the current fiscal year, revealed the Minister of Planning and Economic Development. The sector’s contribution to GDP reached 71% this year and share in employment touched 80%.

- Unemployment rate in Egypt fell by 0.2 percentage points to 6.7% in Q1 2024. During the period, total labour force jumped to 31.39mn from 31.1mn while the number of unemployed stood at 2.1mn (of which 1.13mn were males). Urban and rural unemployment reached 9.4 % and 4.6% respectively in Q1.

- Egypt is in discussions with the IMF for a USD 1.2bn financing package for climate-related projects under the IMF’s Resilience and Sustainability Facility.

- Exports to Arab countries from Egypt grew by 8.7% yoy to USD 13.6bn in 2023. Saudi Arabia topped the list, with exports amounting to USD 2.7bn in 2023, followed by UAE (USD 2.2bn) and Libya (USD 1.8bn).

- Egypt received USD 9bn in investments from International Finance Corp (IFC) during the period Jul 2023 to May 2024. The latest USD 100mn financing agreement between IFC and Banque du Caire (signed May 12th) aims to provide funding for privately owned MSMEs.

- Egypt’s Vice Minister of Tourism and Antiquities revealed that around 24k hotel rooms were to be added this year as part of tourism expansion initiatives.

- The projected cost to Egypt from the ongoing conflict in Gaza over two fiscal years (2023-24 and 2024-25) stands at between USD 5.6bn in the least severe scenario to USD 19.8bn under the high-intensity scenario. Download the report: https://www.undp.org/arab-states/publications/potential-socio-economic-impact-gaza-war-egypt-rapid-assessment

- India signed a 10-year deal with Iran to develop and operate the port of Chabahar. The long-term agreement was signed between Indian Ports Global Limited (IPGL) and the Port & Maritime Organisation of Iran and will see investments to the tune of USD 370mn over time.

- Kuwait’s newly formed government headed by Sheikh Ahmad Abdullah Al-Sabah has been sworn in with the oil, finance and foreign ministers unchanged.

- Moody’s affirmed Kuwait’s rating at “A1” with a stable outlook on strong balance sheet and fiscal buffers. The recent dissolution of the parliament is seen to have the potential to overcome institutional constraints and accelerate reforms.

- Kuwait’s Beyout Investment Group (BIG) Holding plans to float a 30% stake on the Kuwaiti stock exchange. The firm, which provides manpower solutions and manages real estate projects, will be the first potential listing in two years (expected to debut next month).

- Kuwait and Oman signed 4 MoUs in the fields of direct investment, metrology activities, diplomatic studies and training; another MoU was also signed between the Oman Investment Authority and the Kuwait Investment Authority.

- Oman posted a budget surplus of OMR 162mn in Mar (showing sharply from a surplus of OMR 450mn in Q1 2023), as both revenues and spending slowed – the former at a much faster pace.Revenues fell by 12.2% yoy to OMR 2.83bn in Q1, driven down by declines in both net oil & gas revenues while expenditure declined by 3.7% yoy to OMR 2.66bn at end-Q1. Public debt stood at OMR 15.1bn in Q1, edging up slightly from OMR 15.3bn in end-2023, with the ministry of finance disbursing over OMR 206mn rials in dues to the private sector.

- The IMF following its staff visit to Oman disclosed that Oman’s economic activity continues to expand alongside low inflation. GDP growth is expected to be 0.9% this year, and non-oil sector is projected to rise to 2.6% this year and 3.2% in 2025. It was also revealed that Oman Investment Authority’s SOEs reform agenda saw the completion of 9 divestments in 2023, raising proceeds of close to USD 3bn.

- Oman’s trade surplus widened to OMR 1.693bn in Jan-Feb 2024, up 23% yoy, as exports expanded by 19.5% to OMR 4.414bn. Oil and gas exports formed the bulk of exports (7.2% yoy to OMR 2.566bn), non-oil exports surged by 49.1% to OMR 1.601bn. Imports and re-exports also grew by 17.4% and 8.9% to OMR 2.721bn and OMR 247mn respectively.

- Qatar will sign more long-term LNG contracts this year, after securing 25 million tons of long-term LNG sales in the last 12 months, revealed the CEO of QatarEnergy.

- In its concluding statement following the IMF Staff visit to Qatar, the IMF noted that post-World Cup growth normalization continued in Qatar: growth is expected to clock in at 1.75% in 2024-25 and in the medium-term growth is to average around 4.5% as a result of both LNG expansion plans and implementation of the Third National Development Strategy.

- The travel and tourism sector in Qatar is expected to contribute QAR 90.8bn to GDP (or 11.3% of GDP) this year, according to the World Travel and Tourism Council (2023: QAR 81.2bn or 10.3% of GDP). The sector added 20300 new jobs last year, taking the total to 286k – this is expected to rise to more than 334,500 jobs in 2024.

- Bilateral trade between Qatar and US grew to USD 6.47bn in 2023, with US the sixth largest trade partner for Qatar.

- Qatar Airways will announce an equity investment in an airline in southern part of Africa soon, according to the CEO. Separately, Qatar Airways and RwandAir will open a major international airport in Rwanda’s capital Kigali by 2028; construction of the airport, valued at USD 1.3bn in 2019, is currently underway.

- The Arab League Summit’s Bahrain Declaration called for convening an international conference to resolve the Palestinian issue as well as for “international protection and peacekeeping forces of the UN in the occupied Palestinian territories” until a two-state solution is implemented.

- FDI in the Middle East and Africa region, measured by number of projects, grew by 19% yoy to 2658 in 2023, according to fDi Intelligence, roughly 16% of global FDI projects. Capital investment however fell by 6% to USD 249.8bn. Versus pre-pandemic 2019, number of projects and investment were up by 46% and 111% respectively.Renewables was the region’s top sector in 2023 by value: however, investment was down by 21% yoy to USD 100.9bn. Dubai was the world’s top location for “greenfield” FDI for the third consecutive year, with 1070 projects (more than double that of Singapore, 2nd globally, with 442 projects).

- Saudi holdings in US Treasuries rose for the eighth month in a row in Mar, up 3.66% mom to USD 135.9bn – the 17th largest investor.

Saudi Arabia Focus

- Consumer price inflation in Saudi Arabia eased to 1.58% yoy in Apr(Mar: 1.6%), with multiple categories posting slight declines: food & beverages (0.8% from 0.9%), education (1.1% from 1.2%), hotels & restaurants (2% from 2.4%). In month-on-month terms, prices rebounded in Apr, up by 0.33% from a 0.1% dip in Mar. Housing costs eased but stayed at a relatively high 8.7% yoy (Mar: 8.8%) as housing rents slipped to 10.4% (Mar: 10.55%). Recreation costs on the other hand moved into deflation territory (-1.4% from Mar’s 0.7%) and transport costs remained deflationary (-1.59% from -1.79%).

- Wholesale price inflation in Saudi Arabia slipped to 3.4% in Apr(Mar: 3.8%), with most categories posting declines. “Other transportable goods” category posted the highest readings (8.06% from 9.23% in Mar); within this category, prices accelerated most in basic chemicals (54%) and refined petroleum products (12.01%). Deflation was visible in ores & minerals (-2.25% vs -2.2% in Mar) and in metal products, machinery & equipment (-0.55% from -0.65%).

- Saudi Arabia’s Crown Prince and US National Security Adviser met to review “the semi-final version of the draft strategic agreements between the two countries, which are almost being finalised”. The agreement reportedly includes US security guarantees and civilian nuclear assistance while discussions also focused on the need for a two-state solution.

- The Saudi minister of investment disclosed that UK was the second largest foreign investor in Saudi Arabia, with USD 16bn in investment stock in the 6 years till 2023. Economic ties between the nations remain strong: bilateral trade between UK and Saudi climbed by a third since 2018, there were an estimated 14k Saudi students in the UK between 2020-23, and Saudi recorded over 165k visitors from the UK in Q1 2024.

- Government spending on information and communications technology in Saudi Arabia grew by 20% yoy to SAR 41.87bn (USD 11.16bn) last year. The health and social development, military and infrastructure & transportation sectors accounted for SAR 20.14bn (17%), SAR 19.92bn (17%) and SAR 18.22bn (15%) respectively. ICT spending totalled SAR 120.15bn between 2019-2023.

- Saudi exporters are set to gain from two agreements signed between Saudi EXIM Bank and Saudi National Bank: a Murabaha deal aims to increase trade and an insurance agreement will cover commercial and political risks.

- Saudi Arabia’s Public Investment Fund (PIF) reduced its US equity holdings by 42% to USD 20.55bn as of March 31st as per a filing to the US Securities and Exchange Commission. PIF divested itself of 25 companies, including a USD 602mn stake in Blackrock and a USD 942mn stake in the cruise operator Carnival. Registration and book building are set to happen this week with retail investor share sale to be held from May 28-29.

- Saudi PIF’s subsidiary Seven merged with Qiddiya to boost the Saudi entertainment sector: Seven will remain part of the PIF and continue with its plans to build 21 entertainment destinations in 14 cities, investing more than SAR 50bn, across Saudi.

- Riyadh-based aluminium producer Al Taiseer Group Talco Industrial Company (Talco) announced an IPO, offering 12mn shares (a 30% stake) in the company at a nominal value of SAR 10 per share.

- Saudi Arabia published Air Transport Statistics for last year:the country welcomed 111.7mn passengers (26% yoy), with the split between domestic and international travellers at 51mn (+9% yoy) and 61mn (+46% yoy) respectively. Domestic and international flights rose by 2% and 36% to 421k and 394k respectively. The three busiest airports in 2023 were King Khalid International Airport (based in Riyadh, the top destination for international flights), King Abdulaziz International Airport (based in Jeddah, and connecting Mecca, the top destination for domestic flights) and King Fahad International Airport (in Dammam). These 3 airports together accounted for more than ¾-th of the passenger traffic (77.0%).

- Saudi aviation sector contributed USD 21bn to GDP in 2023, supporting 241k direct jobs and about 717k jobs in tourism-related areas, also generating a further USD 32.2bn in tourism receipts, according to the General Authority for Civil Aviation. Saudi is expected to launch a roadmap detailing how to grow the sector ten-fold by 2030.

UAE Focus![]()

- UAE announced a new 10-year Blue Residency visa for individuals who have made “exceptional contributions and efforts in the field of protecting the environment” including fields such as green technology and boosting air quality.

- Revenues collected from VAT and excise taxes in the UAE reached AED 173.6bn since its implementation till end-2023, revealed the Undersecretary of the Ministry of Finance. Of this, VAT revenues collected at the state and federal levels stood at AED 159.57bn and AED 47.87bn respectively.

- The Dubai Financial Services Authority (DFSA) reported a 25% yoy increase in the number of licensed firms to close to 800 in 2023. DFSA also reported a 50% increase in number of applications and received more than 40 domestic fund registration applications. Separately, the DIFC disclosed that more than a dozen wealth and asset management firms joined in Apr, taking their total number to 370+.

- Mubadala’s asset under management grew by 9.5% yoy to AED 1.11trn in 2023, with proceeds edging down by 6.6% yoy to AED 99bn (including “divestments of certain legacy assets and capital recycling into priority investment areas”). Its portfolio mix comprised of private equity (38% direct and indirect), public markets (25%) and real estate and infrastructure (16%) – “similar year on year”.

- Dubai road toll revenues grew by 8% yoy to AED 562mn (USD 153mn) in Q1 2024, from 122mn revenue generating trips through the 8 toll gates in the emirate. Road toll operator Salik expects revenue-generating trips to increase by 4-6% yoy this year.

- Dubai-listed Amanat Holdings is planning for a potential IPO of its education platform. The education platform includes Middlesex University Dubai, a special education and care services provider in Saudi Arabia (Human Development Company) and a UAE-based privately-held education company Nema Holding.

- Dubai Chamber of Commerce members exports and re-exports grew by 4.5% yoy to AED 73.5bn in Q1 2024, with exporting members rising to 9496 (Q1 2023: 8848). The Chamber attracted 8 MNCs and 29 SMEs in Q1, up by 70% and 45% yoy respectively.

- Dubai Quality of Life Strategy 2033 has been approved: well-being districts and 20-minute city concepts are part of this initiative which includes the construction of more than 115 km of pedestrian and cycling tracks, in addition to the planting of 3k+ trees and plants as well as more than 20 investment opportunities.

- Visitors into Dubai grew by 10.9% yoy to 5.18mn in Q1 2024:this was 9.1% higher compared to Q1 2019. At end-Q1 2024, there were 152,162 hotel rooms (+2% yoy) across 832 establishments (+2% yoy) in Dubai. Hotel occupancy rate at 83% was a tad below that in 2019 and revenue per available room in Q1 2024, at AED 527, was lower than the previous Q1 high of AED 534 in 2022.

- Emirates airline reported a sharp jump in full-year profit to AED 17.23bn (USD 4.69bn) in 2023 (+62.5% yoy), ferrying 51.9mn passengers as seat capacity rose by 21.4% and despite operating costs rising by 8%. Staff will receive a bonus equivalent to 20 weeks’ salary. Emirates Group’s annual profit surged by 71% to AED 18.7bn, allowing it to pay Investment Corporation of Dubai a dividend of AED 4bn.

- UAE citizens with at least 3 years of experience in the private sector will be given priority in federal government jobs, according to a Cabinet decision. Separately, it was revealed that the around 96k citizens were working in the private sector as of end-2023, up 170% from 2021.

Media Review

China-Gulf free trade talks stall on Saudi industrial agenda, sources say

https://www.reuters.com/world/china-gulf-free-trade-talks-stall-saudi-industrial-agenda-sources-say-2024-05-14/

Saudi Arabia’s nuclear plans stall while UAE pushes on

https://www.agbi.com/analysis/energy/2024/05/saudi-arabias-nuclear-plans-stall-while-uae-pushes-on/

America’s 100% tariffs on Chinese EVs: bad policy, worse leadership

https://www.economist.com/leaders/2024/05/15/americas-100-tariffs-on-chinese-evs-bad-policy-worse-leadership

Can Nvidia be dethroned? Meet the startups vying for its crown

https://www.economist.com/business/2024/05/19/can-nvidia-be-dethroned-meet-the-startups-vying-for-its-crown

Powered by: