The GCC Monetary Union, when initiated, will need to be accompanied by a re-assessment of the exchange rate policy that links the currencies of the GCC member states between each other and to the US Dollar. The peg to the US Dollar has constrained the monetary policy independence of GCC countries, and limited the options of Central Banks in addressing the global financial crisis that started in August 2007, in particular contagion and spillover effects on the banking sectors financial markets and the real economy similarly, the lack of monetary policy independence prevented an effective response to the surge in inflation over the period 2003- 2008 and has stood in the way of containing the volatility of the real effective exchange rate.

This DIFC Economic Note 3, “The Exchange Rate Regime of the GCC Monetary Union” discusses the optimal currency anchor for the GCC countries and the GCC region as an optimal currency area. We argue that by managing exchange rates against a basket of currencies rather than one currency would allow adequate flexibility to tailor monetary policy that can address domestic conditions and withstand external shocks. In discussing the optimality of a currency area, we stress the role of trade, output and price co-movements and linkages with major economies.

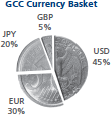

Our empirical analysis of the trade, output and inflation inter-linkages of the GCC economies with their major trade and economic partners suggests that a common GCC currency should be based on managing a basket of currencies comprising the US Dollar (USD), the Euro (EUR), the Japanese Yen (JPY) and potentially the British Pound (GBP). We calculate the weights of an optimal currency basket which could serve as a more appropriate external anchor for the GCC as a whole and the optimal weights are as below.

As a policy recommendation, we propose maintaining the peg of the GCC currencies to the US Dollar until the adoption of a unified currency for the region. Then, at the inception of the Gulf Monetary Union, we recommend that the Gulf Common Currency be pegged to a basket of currencies as calculated in this Note, with an intervention band of 5% around the central parity. This intervention band could be progressively widened as the ‘Khaliji’ gains credibility in international markets and the monetary policy framework of the Gulf Central Bank is well understood by the public and tested in its daily operation mechanisms.