Download a PDF copy of the weekly economic commentary here.

Markets

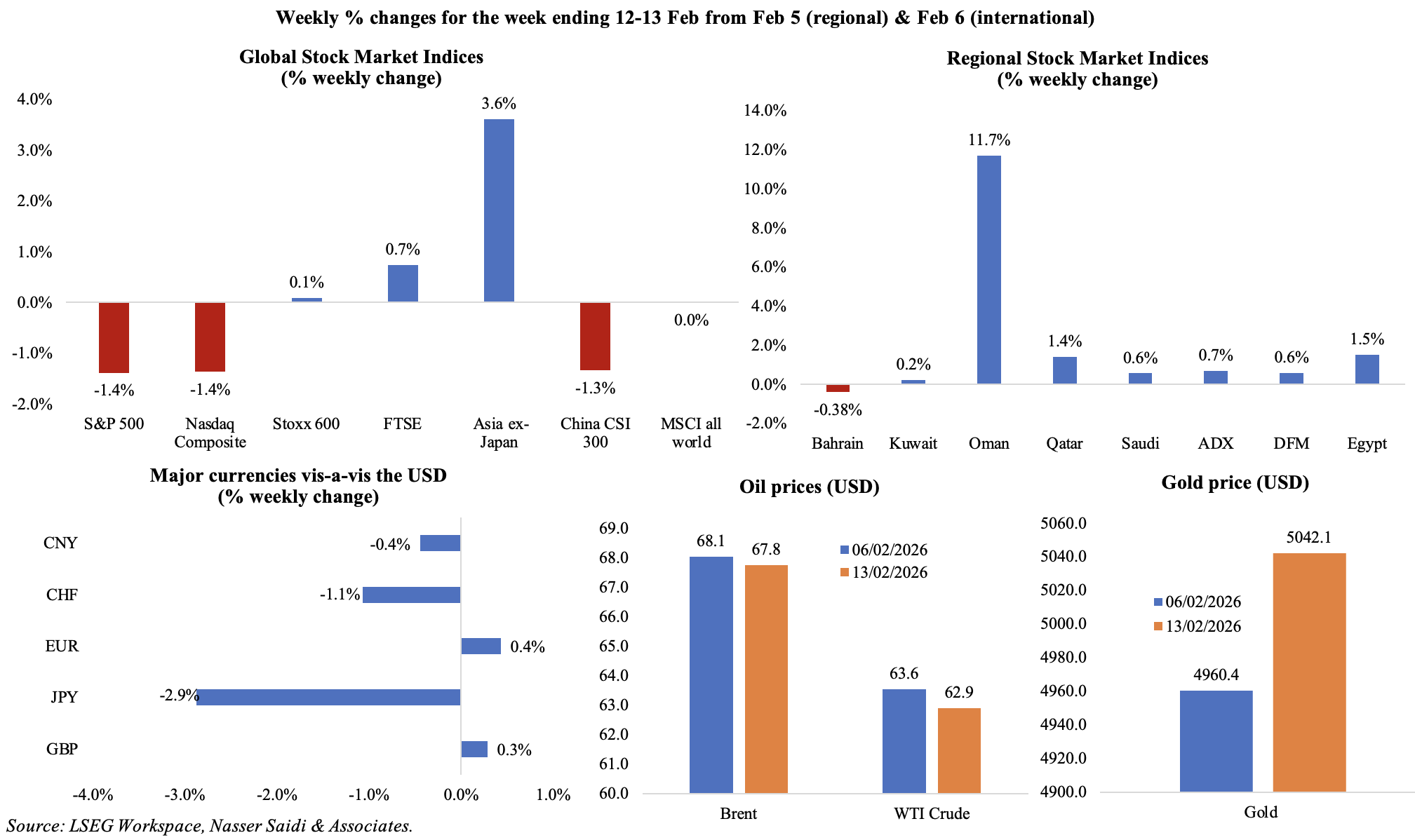

Global equities were mostly down last week, with the US indices down by 1.4% from the week prior (on tech sell-offs). Investors’ AI concerns have in the past affected performance of tech stocks; however, last week, the “AI scare trade” widened into other sectors as well including wealth management, legal, consulting, transportation and logistics given fears of how quickly AI could transform/ disrupt such sectors too. Though European equity markets were also affected by AI worries, both Stoxx and FTSE managed to eke some gains. Asia ex-Japan posted the largest gains after hitting record highs (3.6%). Regional markets gained last week – Oman was the main story, crossing 7000-points (+11.7% weekly and rising to an 11-year peak), with banking and investment firms leading gains. Japan PM’s historic election win led JPY to dominate activity last week (nearly 3% last week vis-à-vis the USD). Oil prices edged down slightly (Brent by 0.5% and WTI by 1%) on expectation that the OPEC+ may be heading towards production increases while gold price increased to over USD 5000 after a volatile week.

Global Developments

US/Americas:

- Non-farm payrolls increased 130k in Jan (Dec: 48k); however, signs of a weak labour market emerged after total new jobs for the year 2025 was revised down to 181k, from an initially reported 584k and much lower than the 2mn added in 2024. Labour force participation rate in Jan edged up to 62.5%. Unemployment rate edged down to 4.3% (Dec: 4.4%).

- US wage growth slowed to 0.7% qoq in Q4 (Q3: 0.8%). In the 12 months to Dec wages were up only 3.3% while labour costs grew 3.4% – both the smallest gains since Q2 2021.

- US inflation eased more-than-expected to 2.4% yoy in Jan (Dec: 2.7%), the lowest since May, thanks to a decline in gasoline prices (-7.5% from -3.4%) and shelter costs (3% from 3.2%). Excluding food and energy, prices eased to 2.5% (Dec: 2.6%) – lowest since Mar 2021.

- Budget deficit in the US narrowed to USD 95bn in Jan (Dec: USD 145bn), with revenues up 9% yoy to USD 560bn while spending grew 2% to USD 655bn. Net customs duties during the fiscal year-to-date (Oct 2025-Jan 2026) were USD 117.7bn (vs USD 28.2bn a year ago); treasury debt interest grew 9% to USD 426bn, a record for the period Oct-Jan.

- Retail sales in the US grew by 2.4% yoy in Dec, slower than Nov’s 3.3% gain. In monthly terms, sales were flat in Dec 2025, with declines recorded across multiple categories including auto dealerships (-0.2%), clothing outlets (-0.7%) & electronics stores (-0.4%) among others.

- US existing home sales plunged 8.4% mom (the largest drop in almost four years) to 3.91mn in Jan, the lowest level since Dec 2023. Higher mortgage rates are weighing on home sales and median days on the market for listed properties rose to 46 (from 41 a year ago). Meanwhile, the NAR’s housing affordability index ticked up to 116.5 in Jan, the highest since March 2022 (Dec: 111.6).

- NFIB business optimism index in the US eased to 99.3 in Jan (Dec: 99.5) but remained above the 52-year average. The Uncertainty Index rose seven points from Dec to 91; while 62% of small business owners reported that supply chain disruptions were affecting their business to some degree, unfilled job openings remained above the historical average of 24%.

- Initial jobless claims declined by 5k to 227k in the week ended Feb 7, with the 4-week average rising by 7k to 219.5k. Continuing jobless claims increased by 21k to 1.862mn in the week ended Jan 31.

Europe:

- GDP in the eurozone grew by 0.3% qoq and 1.5% yoy in Q4, according to the second estimate issued by Eurostat; this brings the full year growth to 1.5%.

- Sentix investor confidence in the eurozone jumped to 4.2 in Feb (Jan: -1.8), third straight month of improving sentiment and the first positive reading since Jul 2025.

- UK GDP grew by 0.1% qoq and 1.0% yoy in Q4, resulting in an estimated full year growth of 1.3% (2024: 1.1%). Growth was driven by higher industrial production (1.2%) while construction output fell by 2.1% and services remained flat. Consumer and. Government spending ticked up by 0.2% and 0.4% respectively in Q4 while business investment fell 2.7%.

- BRC like-for-like sales in the UK grew by 2.3% yoy in Jan (Dec: 1.0%), a five-month high, as both food and non-food sales climbed (3.8% and 1.7% respectively).

Asia Pacific:

- China’s inflation inched up by 0.2% yoy in Jan (Dec: 0.8%), partly due to base effects and given lower food prices (-0.7% from Dec +1.1%) and a sharper drop in transport prices (-3.4% from -2.6%) while services prices ticked up (0.1%). Core CPI eased to 0.8% (Dec: 1.2%).

- Producer price index in China dipped 1.4% in Jan, easing from the 1.9% drop in Dec but staying in negative territory for the 40th month in a row. The uptick in PPI inflation for non-ferrous metals input prices was high (16.1%); mining prices fell quicker (-8.1% from -4.7%).

- Money supply in China grew by 9% yoy in Jan (Dec: 8.5%). New loans surged to CNY 4.7trn, more than five times Dec’s reading of CNY 910bn, but lower than the record CNY 5.13trn clocked a year ago. New bank lending in China had slipped to a seven-year low of CNY 16.27trn in 2025.

- Japan’s average nominal wages grew by 2.4% yoy to JPY 631,986 in Dec (Nov: 1.7%). Real wages shrank for a 12th consecutive month in Dec, causing it to fall 1.3% in 2025, for a fourth year of reduction since 2022.

- Current account surplus in Japan widened to JPY 7288bn in Dec, taking the full year surplus to a new record JPY 31.87trn (up 11% yoy). Annual trade deficit narrowed to JPY 848.7bn (2024: JPY 3.66trn), with exports to the US declining for the first time in five years.

- Inflation in India accelerated to 2.75% yoy in Jan and food price inflation was 2.13%. This is the first reading under the updated data series which has drastically lowered the weightage of food about 37% (from 46% earlier), increased weightage of transport & communication (12% from 9%) and housing & fuels (18% from 17%); under the old series, the headline Jan reading was 1.33%.

- Singapore GDP grew by 2.1% qoq and 6.9% yoy in Q4 – higher than the advance estimate of 1.9% qoq and 5.7% yoy. The full year 2026 growth forecast was raised to a range of 2%-4% (following a strong 5% print in 2025).

Bottom line: It will be a relatively quiet week given Lunar New Year holidays across many Asian countries. US GDP data arrives this week, following a government shutdown-led delay, and is expected to show a resilient economy despite the tariff uncertainty. A slew of data from the UK this week including inflation and wage growth – both key the Bank of England’s rate decision for the next meeting in Mar. Separately, the fear of disruption has been a running theme in global equity markets for weeks. With a new range of AI tools (announced by companies including Altruist and Anthropic) that can carry out tasks with little human oversight, this has threatened to upend professional services including legal, finance, sales and marketing among others. However, before we resign our fate to AI doom & gloom and predict immediate structural unemployment, it might be prudent to take a step back and think how the technology is likely to be rolled out. What will matter at the end of the day is not the capability of the tools, but their integration: whether AI emerges as a labour-substituting force or a labour-augmenting tool (similar to the experience with fintech and the banking sector).

Regional Developments

- Bahrain’s VAT registrants exceeded 27,070 by end-2025, reflecting widening tax base compliance and broader participation by SMEs and service providers, enhancing fiscal resilience amid moderate oil revenues.

- The central bank of Egypt lowered the overnight deposit and lending rates by 100bps to 19% and 20% respectively, signalling confidence in the weaker inflation readings and easing monetary conditions after an extended tightening cycle. The move aims to support private-sector credit growth and investment recovery while maintaining currency stability; real rates remain relatively tight.

- Egypt’s annual urban inflation edged down to 11.9% in Jan (Dec: 12.3%), reflecting easing costs of transport (27.5% from 28.4% as impact of the fuel price hike lessened) and restaurants & hotels (11.9% from 12.8%) while food inflation ticked up (1.9% from 1.5%) as did housing (29.8% from 29.2%). Core inflation remains slightly elevated at 11.2% (Dec: 12.8%), indicating underlying persistent price pressures (especially services & non-food).

- Egypt plans to mobilize USD 1bn over five years under a new startup charter to support startups and venture capital ecosystems. The initiative is expected to reach around 5,000 companies over its duration, including 500 startups that secure funding over USD 1mn, as well as support the development of five companies valued at USD 1bn. Overall, this is expected to strengthen innovation capacity, attract foreign capital and enhance job creation in tech sectors.

- The 2025-26 budget in Kuwait projects a fourth consecutive year of deficit: at KWD 9.8bn, it is wider than the previous budget’s KWD 6.3bn and the largest deficit excluding the Covid-hit year of 2020-21 (KWD 10.8bn). Compared to the 2025-26 budget, oil revenues are estimated to plunge 16.3%. There is a notable jump in non-oil revenues – accounting for just over one-fifth of total revenues, it is expected to surge by 20%. Overall revenues are down by 10.5% to KWD 16.3bn. Expenditures are projected to increase by 6.2% to KWD 26.1bn (vs 2024-25 budget), thanks to increases in capex (36.8% to KWD 3.1bn or 12% of total spending) and wages (5.2% to KWD 15.1bn); subsidies dipped 10.5% to KWD 4.0bn. The budget is based on oil price assumption of USD 57 versus budget breakeven of USD 90.5.

- The IMF mission concluded a four-day visit to Lebanon last week, but expressed reservations relating to the financial gap law – especially the “hierarchy of claims”, which is supposed to be reviewed “soon” by a parliamentary committee.The current draft law stipulates that banks and the central bank share the burden of repaying deposits for both small and large depositors; but the legal hierarchy of claims is that local bank shareholders should bear the losses first, followed by creditors, and then depositors. Lebanon’s PM, in a Bloomberg interview, expressed confidence that the government could overcome any differences with the IMF over the law.

- Oman’s manufacturing sector contributed roughly OMR 3.879bn (USD 10bn) to GDP in 2025, up 7.2% yoy, underscoring diversification momentum. foreign investment in the industrial sector grew by 24.6% to OMR 3.49bn in 2025. Separately, industrial exports reached approximately OMR 1.618bn in Q1 2025, accounting for nearly 28% of total exports alongside non-oil industrial exports growing to OMR 6.2bn.

- Non-oil and gas exports in Oman reached a record OMR 7bn (USD 18bn) in 2025, up 11.0% yoy, with the goods being exported to more than 80 countries. Foreign investments clocked in at OMR 3.5bn over 2025, up more than a quarter since 2024. The UK, US, China and GCC were the top investors.

- Passenger traffic through Omani airports increased significantly in 2025, up 2.8% to 14.9mn, reflecting tourism recovery even as airlines reduced flight frequencies during the year (-2.8% to 104,510 flights).

- The IMF delegation visit to Qatar (for the Article IV consultation) disclosed medium-term economic growth and inflation at around 4% and 2% respectively. The fund recommended that revenue diversification be improved by introducing VAT given the overall positive economic outlook. Ongoing structural reforms, labour market flexibility and easing SME’s access to finance were emphasized in the country’s bid “to transition to a diversified, knowledge-based economy”. More: https://www.imf.org/en/news/articles/2026/02/11/pr26041-qatar-imf-staff-completes-2026-article-iv-mission

- Industrial producer price index in Qatar rose modestly in Dec, up 0.64% mom; in yoy terms, PPI posted a decline of 8.36% yoy. PPI for the Manufacturing sector grew by 4.9% mom and 6.05% yoy.

- Qatar recorded a Q4 budget deficit of QAR 5.3bn (USD 1.5bn), given hydrocarbon revenue fluctuations; total revenues stood at QAR 51.6bn and total spending was QAR 56.9bn. The 2026 budget projects a 5% rise in government spending together with modest revenue growth.

- Foreign exchange reserves in Qatar rose by 2.63% yoy to USD 71.95bn in Jan, alongside a significant 12.8% mom jump in gold investments (USD 18.13bn, the highest on record).

- Qatar listed its first green sukuk on the Qatar Stock Exchange: the QAR 500mn green sukuk issuance by Al Rayan Bank also made it the first by an entity registered with the Qatar Financial Centre to be locally listed, cleared and settled.

- The US military withdrew from Syria’s Al-Tanf base, handing it to Syrian forces, altering regional geopolitical dynamics. The shift could affect border security and trade routes (e.g. regional trade flows through the Iraq-Syria-Jordan border triangle) while stability implications could influence reconstruction and regional integration prospects.

- MENA mergers and acquisitions activity shows renewed momentum in 2025, up 15% yoy to USD 106.1bn, according to EY data. The number of deals rose 26% yoy to 884 last year, driven by sovereign wealth funds, domestic deals (that accounted for 46% of total deal volume) and cross-border investments. The GCC was home to 685 deals worth USD 102.1bn.

Saudi Arabia Focus

- Inflation in Saudi Arabia eased to 1.8% yoy in Jan (Dec: 2.1%), the lowest reading since Sep 2024, on softer upticks in food (0.2% from 1.3%) and insurance & financial services (3.3% from 4.1%) among others.Housing, water, and fuel prices rose by 4.2% in Dec (with actual residential rents up 5.2%), indicating that the influx of expatriates and companies are exerting pressure on the real estate market.

- Wholesale price inflation in Saudi slipped to 2.9% in Jan (Dec: 3.1%), as prices eased for other transportable goods excluding metal products, machinery and equipment (4.9% from 5.7%) as well as for food products & beverages (0.3% from 0.5%); agricultural and fishery products prices jumped (4.2% from 3.6%).

- Saudi industrial production grew by 8.9% yoy in Dec, driven by the 10.1% jump in oil activity. The extraction of crude petroleum and natural gas, which has a heavy weight of 61.4% in the index, grew by 13.2% yoy – pulling up the headline IP number. Non-oil manufacturing also increased, up 2.1% mom and 6.5% yoy in Dec and within this category, the fastest growth was recorded by chemicals (13.4% yoy). IP rebounded in the full year 2025, growing by an average 5.3% (2024: -2.1%) as oil activities recovered (5.8% vs -4.7%).

- Saudi Arabia appointed Fahad Al-Saif as the new Minister of Investment, replacing Khalid Al-Falih. The minister was previously head of the PIF’s investment strategy and economic insights division.

- Saudi reported a 220% jump in new mining exploitation licenses to 61 in 2025 – aligning with industrial data showing mining as a key growth driver. Total investments in the new licensed projects exceeded SAR 44bn for the extraction of high-quality mineral ores, including gold and phosphate. Supportive regulatory reforms and geological investment programs are improving the attractiveness of the mining landscape.

- Expatriate remittances from Saudi Arabia grew by 15% yoy to a record SAR 165.5bn (USD 44.1bn) in 2025, reflecting stronger employment conditions and higher wage flows. Personal remittances from Saudis grew by 3% yoy to SAR 70.4bn in 2025: this was the highest remittance figure since 2022.

- Remittances from Saudi Arabia to Pakistan surged 15.4% yoy to USD 739mn in Jan, the highest ever for that month, according to data from the State Bank of Pakistan. Remittances grew by 11.3% yoy to a cumulative USD 23.2bn during the period Jul 2025-Jan 2026.

- A USD 100mn VC fund (Masna Ventures) was launched to invest in defence manufacturing. The goal is to localize50% of defence spending, reducing imports reliance.

- Saudi EV brand Ceer signed 16 deals worth AED 3.7bn (USD 986.6mn) to localize EV and battery manufacturing. The company aims to source 45% of components locally by 2034, moving beyond simple assembly.

UAE Focus

- UAE Minister of Economy and Tourism disclosed GDP growth projections exceeding 5% yoy in 2026, with non-oil sectors contributing a significant share (78% of GDP, growing at 5.5%). This reflects ongoing diversification efforts underway – with services, tourism, logistics and manufacturing key engines underpinning this expansion, supported by sustained public and private investment. He also revealed that the number of companies registered in the national economic register has crossed 1.45mn (versus 650k five years ago) and this is likely to hit 2mn by 2031.

- UAE bank balance sheets expanded strongly in 2025, with gross assets climbing by 17.1% yoy to AED 5.34trn by end-Dec, driven by robust growth in gross credit (17.9%) and deposits (16.2%). Credit growth was supported by both foreign currency lending (54.3% to AED 521.4bn) and an uptick in domestic private-sector credit (11.2% to AED1.5trn). Deposits rose across resident (15.7% to AED 3.0trn) and non-resident (21.2% to AED 297.8bn) categories, reflecting confidence in the financial system. Broader monetary aggregates (M1, M2, and M3) also expanded, signifying rising liquidity and financial intermediation across the economy.

- Abu Dhabi grew steadily in Q1-Q3 2025, up 5.0% yoy to AED 923.1bn. The emirate’s diversification away from oil is evident: in Q3 alone, real GDP grew by 7.7%, with non-oil GDP posting its highest quarterly value on record (+7.8% yoy to AED 175.6bn). The non-oil pivot (6.8% growth in Q1-Q3) stems from state-led investment in “high-value” sectors such as clean energy, high-tech manufacturing & finance (ADGM). The finance sector’s growth (9.3% in Jan-Sep) signals its rise in attracting hedge funds & family offices.

- Visitors into Dubai increased by 4.6% yoy to 19.59 million in 2025. Western Europe and South Asia accounted for the largest shares of visitors at 20.9% and 14.7% of total visitors in 2025 (4.1mn and 2.9mn respectively) while GCC & MENA together accounted for 5.16mn visitors (or 26.4% of the total); there was a slight dip in tourists from South Asia (-7.9% to 2.9mn) and Africa (-0.7% to 897k). Growth in tourism is also supported by the tourism infrastructure. Hotels also reported new-highs (as per available data) amongst multiple indicators: hotel occupancy rate at a robust 80.7%; revenue per available room of AED 467 (+10.9% yoy) and room rates were at AED 579 (+7.6% yoy). However, length of stay held steady at 3.7, but higher than the pre-Covid 3.4 in 2019.

- Dubai International Airport forecasts handling 99.5 million passengers in 2026, building on record traffic in 2025 (+3.1% yoy to 95.2mn) and reinforcing the UAE’s position as a premier global travel hub. Last year, India (11.9mn), Saudi Arabia (7.5mn) and UK (6.3mn) were the largest markets, with China, Egypt and Italy posting double-digit growth rates.Continued route expansions and capacity enhancements, including investments in Al Maktoum International (which handled 1.4mn passengers in 2025 and saw flights rise by 30%), point to strong future connectivity.

- The UAE Central Bank joined Hong Kong’s debt depository network: this grants investors“direct and cost-effective access” to Chinese mainland capital markets and financial assets, enabling the diversification of investment opportunities, financing sources and broadening asset allocative opportunities. This strategic integration with Hong Kong’s Central Moneymarkets Unit will enhances cross-border connectivity.

- Ras Al Khaimah (RAK) posted a 31.5% increase in new business licences to 1,789 in 2025, with active economic licences rising 5.4% to 21,938 and registered capital climbing sharply (to AED 10.9bn), highlighting growing investor confidence and economic diversification. Net capital inflows into RAK amounted to AED 923mn, remaining at historically high levels.

- UAE industrial exports climbed to arecord AED 262bn in 2025, marking robust growth of 25% yoy and more than doubling since the Ministry of Industry and Advanced Technology was established in 2020. Exports from medium- and high-technology industries advanced 42% yoy to AED 92bn, ahead of the 2031 target (of AED 90bn). This export expansion underscores the success of industrial policy frameworks aimed at enhancing competitiveness.

- The DIFC Courts reported a 68% increase in small claims tribunal cases in 2025, reflecting heightened utilization of structured dispute resolution services by businesses. Handling 995 cases, the tribunal’s total claims also rose substantially (44% yoy to AED 83mn), with notable case values spanning commercial, financial, and arbitration matters.

- Dubai Electricity and Water Authority (DEWA) acquired Dubai Holding’s 24% stake in Emirates Central Cooling Systems Corporation (Empower) for AED 5.2bn, boosting DEWA’s holding to 80% and consolidating control over Dubai’s district-cooling infrastructure. The strategic transaction underscores confidence in the long-term demand for energy-efficient cooling amid ongoing urban growth and real estate expansion in Dubai.

Media Review:

How China could win the geopolitical game by default

https://www.ft.com/content/9784d307-f0d0-4c1e-b81a-0f89b426c1dc

Donald Trump’s schemes to juice the economy

https://www.economist.com/finance-and-economics/2026/02/15/donald-trumps-schemes-to-juice-the-economy

Saudi Arabia wealth fund set to announce strategy revamp, sources say

https://www.reuters.com/world/middle-east/saudi-pif-unveil-new-20262030-strategy-this-week-sources-say-2026-02-09/

PIF sounds alarm on Saudi manufacturing delays

https://www.agbi.com/construction/2026/02/pif-sounds-alarm-on-saudi-manufacturing-delays/

Powered by: