read 3 minutesThe 5th edition of the Global Economic Diversification Index “Global Economic Diversification Index 2026” was co-produced with and released by the Mohammed Bin Rashid School of Government (MBRSG) at the World Governments Summit held in Dubai on 4th Feb 2026. Dr. Nasser Saidi & Aathira Prasad were co-authors of the report, which was developed in cooperation with Keertana Subramani, Zeid Qiblawi & Fadi Salem (MBRSG) and Ben Shepherd (Developing Trade Consultants).

The presentation prepared for the WGS event highlights some of the main findings. Access the latest and past reports as well as the underlying data on the website.

The report arrives at a transformational juncture in the global economy – a global landscape defined by geo-economic fragmentation, trade protectionism and the accelerating digitalization and decarbonization transitions. Both economic and trade policy uncertainty readings have been rising since the end of 2024, touching historic highs in Apr 2025 (following the announcement of US tariff hikes). Trade policy uncertainty at the end of 2025 (308.3 vs 1151.4 in Apr 2025) was 6-times that of the average in 2023 more than double the average in 2024.

The Economic Diversification Index provides an assessment of three foundational pillars of diversification – Output, Trade, and Government Revenue – across 117 nations spanning the 2000–2024 period. The upper quartile of the Global EDI presents a remarkably stable hierarchy over time: the US, China, and Germany anchor the rankings, followed closely by a group of high-income, advanced economies. Conversely, the bottom rankings remain dominated by low-income developing nations, predominantly characterized by high commodity dependence.

The 2024-25 period has not just been about what countries trade, but who they trade with. Not only is it necessary to alter the structure of exports i.e. move from raw materials to processed goods and services, but also to move from market concentration dependence to a diversified portfolio of trading partners to avoid tariffs or trade and investment sanctions. Absent this structural transformation, commodity exporters risk remaining trapped as price-takers – exposed to volatility at every turn of the commodity price cycle.

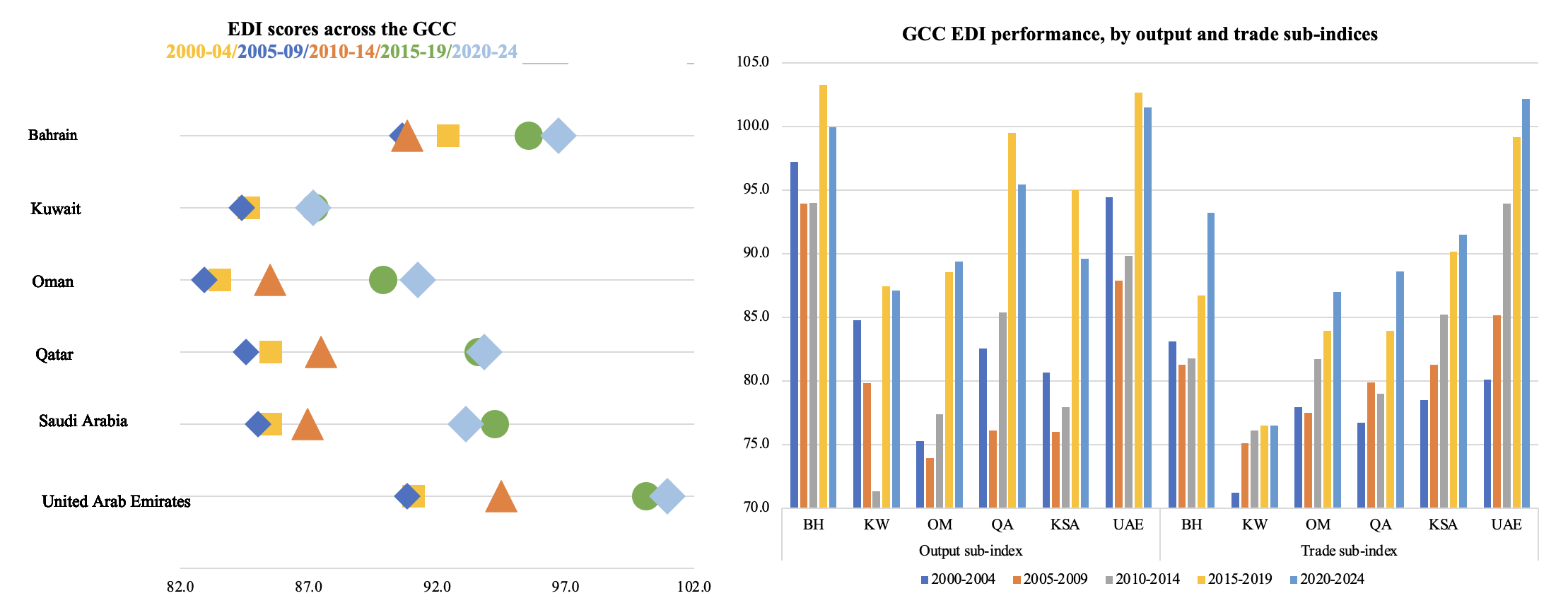

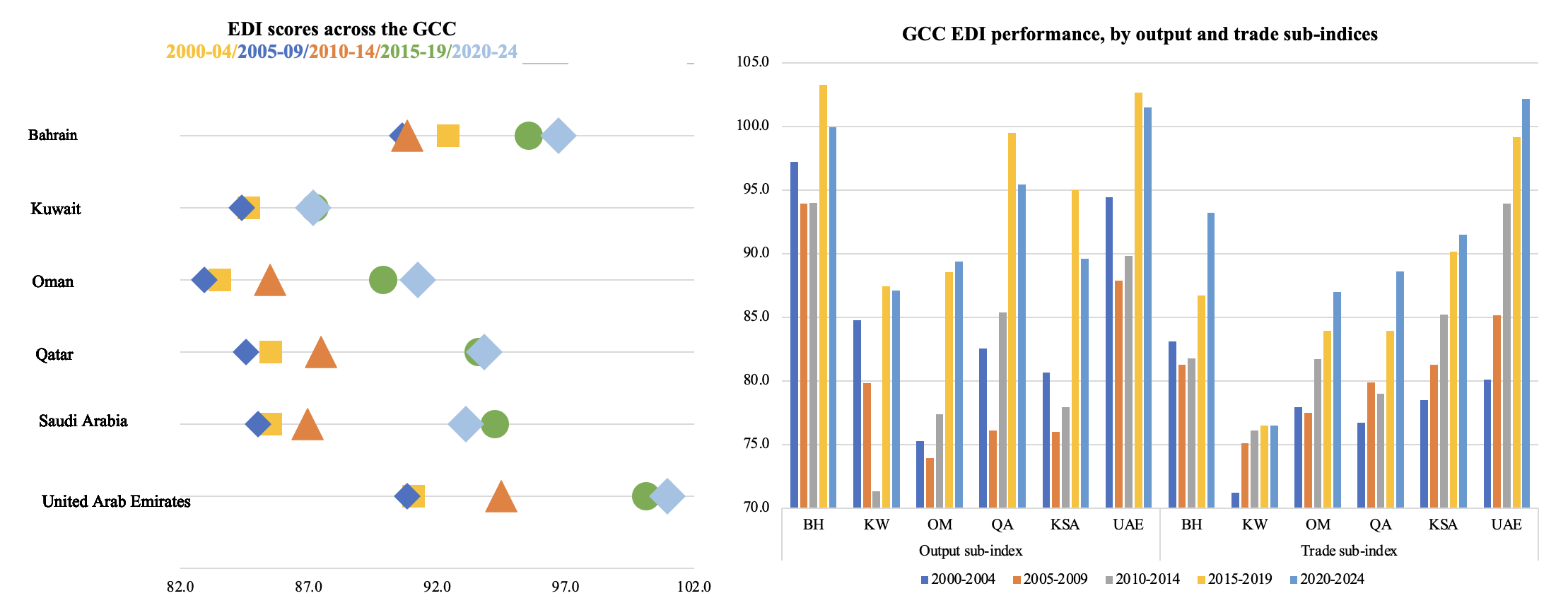

A central focus of the 2026 report is the performance of the 40+ commodity-dependent nations in the index. Data reveals a sharp divergence in trajectories with the GCC countries emerging as a distinct cluster of successful diversifiers within the commodity cohort (the UAE maintains its position as the distinct leader among the GCC countries for economic diversification), while for mineral exporters (e.g. Chile, Mongolia), the global energy transition presents a paradox. As the demand for critical minerals (lithium, copper, cobalt) has surged, it risks deepening commodity dependence rather than alleviating it. Without active policies to encourage domestic value addition (processing and refining), the green transition and accelerating investment in AI related chips and infrastructure could threaten economic diversification.

The GCC meanwhile is uniquely positioned to capitalize on a dual comparative advantage: remaining the central hub of “old energy” (hydrocarbons) while emerging as a global hub for “new energy” (renewables and hydrogen). Digitalisation and new tech sectors are a key component of GCC’s diversification effort, supported by low-cost sustainable power.

The report also captures the transformative role of the digital economy via an augmented metric EDI-plus. The findings reveal a widening diversification gap between advanced economies that have successfully leveraged technology to deepen their resilience to economic and trade shocks and many commodity-dependent nations that remain trapped in cycles of volatility. When digital indicators are included, the dispersion between high-performing and low-performing regions narrows. Though digitalisation provides the opportunity for commodity dependent countries to leapfrog, the persistent digital divide threatens to exclude the most vulnerable economies.

The 2026 EDI confirms that economic diversification is a marathon, requiring structural change and reforms, not a sprint. The winners are nations that have succeeded in pivoting to digital services and high-tech manufacturing, building diversified tax bases, investing in digital connectivity and leveraging their resources to fund the transition to a knowledge economy. The cost of inaction in a digital, decarbonizing world is the risk of remaining trapped in cycles of volatility and stagnation.