Countering Global Fragmentation: Trade Expansion & Economic Resilience in the GCC, Weekly Insights 23 Jan 2026

1. UAE’s CEPAs (32 & counting) for Trade & Economic Diversification

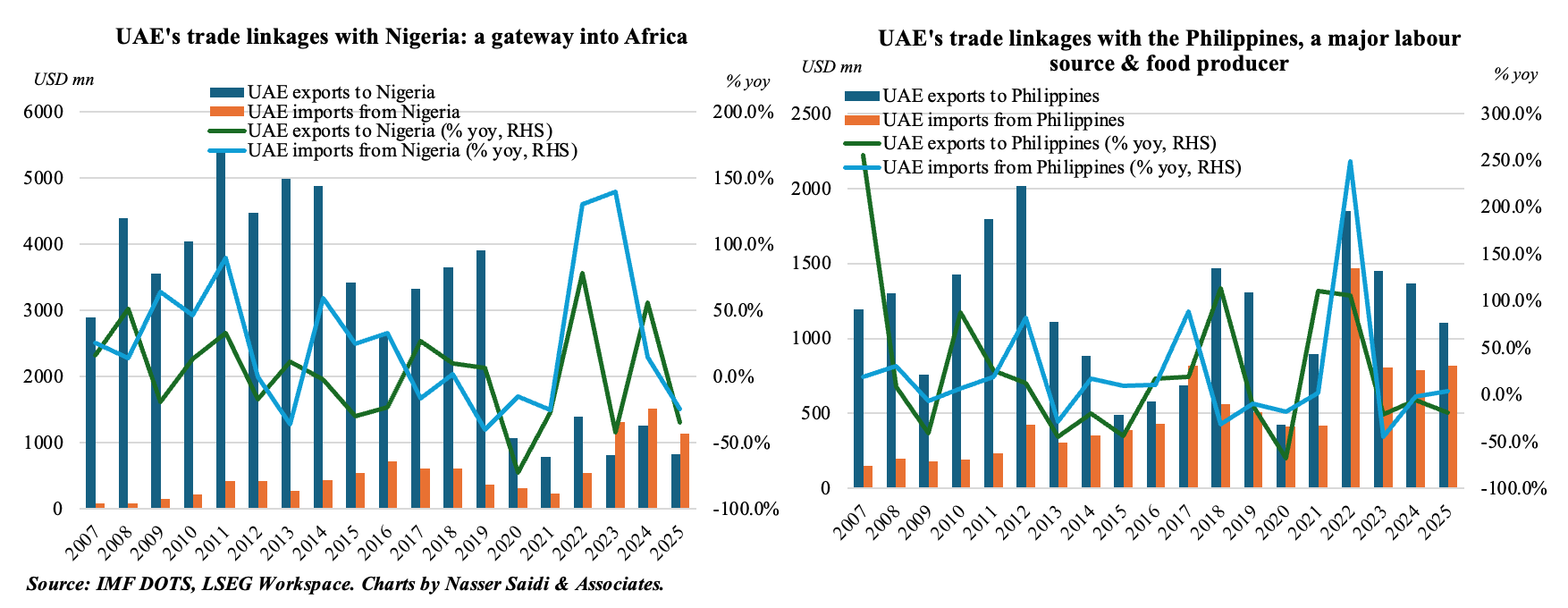

- UAE’s CEPA programme strengthens global economic ties with 32 strategic agreements: latest concluded with Nigeria & the Philippines (the first was signed with India in Feb 2022). About 14 CEPAs are currently in force.

- The initiative aims to expand non-oil trade (by lowering/ eliminating tariffs and non-tariff barriers) and increase export diversification (beyond oil exports and widening the number of trade partners) with the aim to expand non-oil foreign trade to AED 4trn by 2031.

- UAE-Nigeria CEPA: Bilateral non-oil trade stood at USD 4.3bn in 2024 (and USD 3.1bn in Jan-Sep 2025), with UAE’s exports to Nigeria diversified beyond hydrocarbons (e.g. machines, transportation). A large domestic market and being one of Africa’s fastest-growing economies makes Nigeria a strategic trade and investment partner for the UAE’s external diversification. Enhanced services access (covering finance, logistics, professional services) and improved business mobility under the CEPA strengthen long-term connectivity. This will deepen regional supply chains and become a hub for UAE firms to access Africa’s emerging markets.

- UAE-Philippines CEPA as a gateway to ASEAN & services growth. Bilateral non-oil trade was USD 940mn in 2024 (in Jan-Sep, it grew 22.4% to USD 853.7mn). UAE ranks as the Philippines’ 17th largest global partner & top export destination among Arab and African nations. Philippines is a large labour source (~700k Filipinos live and work in the UAE) and dynamic consumer market in Southeast Asia; stronger economic ties complement bilateral aviation and investment links, including in renewable energy & infrastructure. Beyond goods, the CEPA opens services trade (digital, professional, tourism, healthcare) and strengthens UAE’s access to ASEAN’s broader markets.

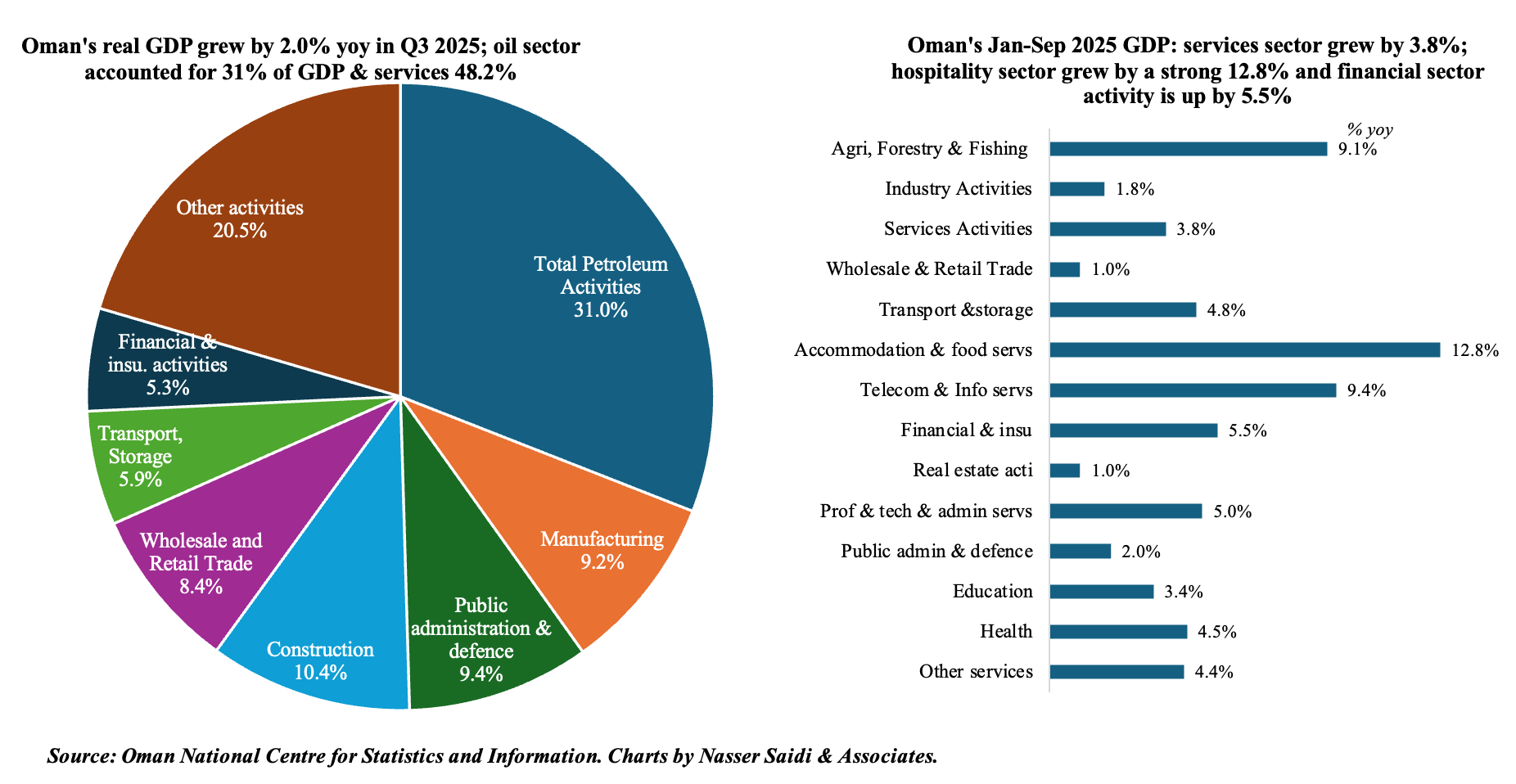

2. Oman’s real GDP expanded by 2.0% yoy in Q3 2025, and 2.2% in Jan-Sep, supported by services sector activity

- Real GDP in Oman grew by 2.0% yoy to OMR 9.91bn in Q3 2025, with the non-oil sector supporting the increase. Among non-oil sector, services and industry activities grew by 0.6% and 2.7% while agriculture inched up by 2.5%. Petroleum sector activity rose by 1.9% in Q3, with natural gas and petroleum sectors growing by 1.6% and 2.0% respectively.

- The share of oil and gas sector in Oman’s real GDP stood at 31.0% in Q3 while the contribution of construction, government, manufacturing and wholesale & retail trade sectors stood at 10.4%, 9.4%, 9.2% and 8.4% respectively.

- Services sector grew by 2.7% yoy in Q3, with acceleration fastest across hospitality (13.9%), information & communication (5.6%) and transportation & storage (3.8%). In Jan-Sep, hospitality grew fastest (12.8%); wholesale & retail was one of the slowest (1.0%).

- Oman’s Q3 GDP reflect a transition toward more diversified, non-hydrocarbon-led growth, with modest & resilient expansion. External balances saw lower oil export revenues but continued trade and investment activity.

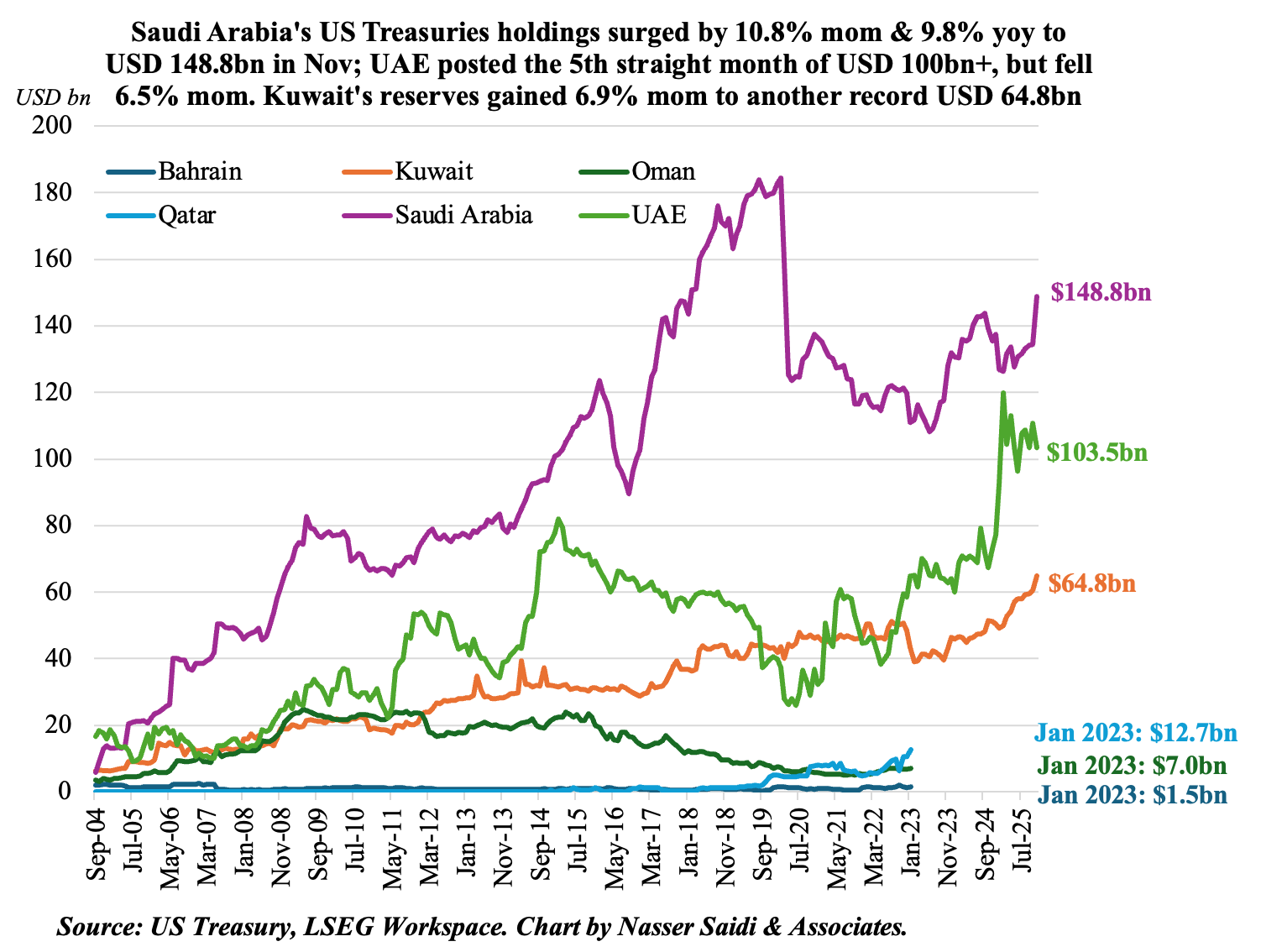

3. Europe, India, China reducing US Treasury holdings while GCC steady/ growing

- Foreign holdings of Treasuries hit an all-time high of USD 9.355trn in Nov.

- Japan was the largest holder: its holdings rose for the 11th month to USD 1.202trn in Nov & the most since Jul 2022. UK, largely a custody hub, came in second (USD 888.5bn) & China was third (USD 682.6bn).

- With rising geopolitical risks & weaponisation of the dollar, it is no surprise that countries are selling. India’s holdings were at a 5-year low & China’s the lowest since Sep 2008. Separately, the Danish pension fund announced it would sell USD 100mn in US Treasuries & Sweden’s Alecta stated it had divested most of its Treasury holdings since early-2025.

- In contrast, GCC has been increasing their holdings. Saudi holdings jumped 10.8% mom and 9.8% yoy to USD 148.8bn in Nov. UAE holdings dipped by 6.5% mom but stayed above USD 100bn for the fifth month in a row. Kuwait posted yet another record high in Nov (USD 64.8bn, up 6.9% mom & 26.6% yoy).

- GCC’s appetite for US assets is likely to continue: Treasuries are a pillar of stability, enabling GCC to meet international payment obligations, provides a buffer against oil revenue shocks & access to high-quality liquid assets (e.g. in case of fiscal volatility).

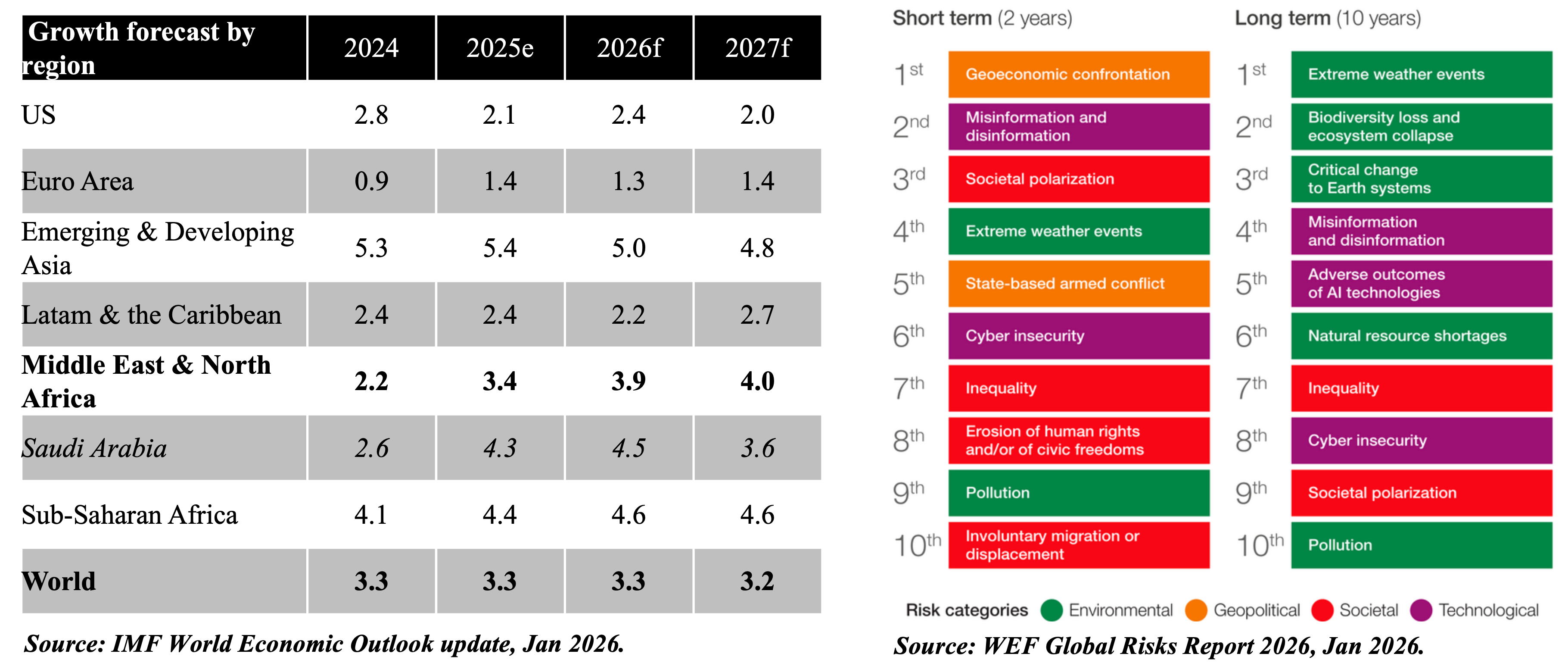

4. Resilient Global Growth, but with Uneven Momentum & Risks. Extreme weather events were simply superseded this year given geopolitics, economic uncertainty etc.

- The IMF projects global growth at a resilient 3.3% in 2026 before easing to 3.2% in 2027, cushioned by continued investments in AI and high-tech sectors amid trade policy and geopolitical headwinds. Inflation is trending down and indicates a convergence toward central bank targets in many advanced economies; there however remains differentiated monetary policy paths across region.

- The MENA region is forecast to grow by 3.9% in 2026, and 4% in 2027, reflecting improved economic activity. Though there is divergence in growth within the region, non-oil sector activity, fiscal reform & public investment are a few key drivers of performance. Risks to stable growth remain commodity price volatility and geopolitical headwinds.

-

WEF’s latest Global Risks Report 2026: Extreme weather events were simply superseded this year, with geoeconomic confrontation identified as the most pressing risk in the short term (up 8 positions from the past year and selected by 18% of global respondents as the top risk); environmental risks have fallen (extreme weather events and pollution are 4th & 9th). However, in the long-term (10-year horizon), environmental risks occupy the top three.

- An important point to note is that tech risks are growing – misinformation & disinformation is identified as #2 risk and cyber insecurity at #6 in the short-term and is joined by AI risks (#5 in the long-term).

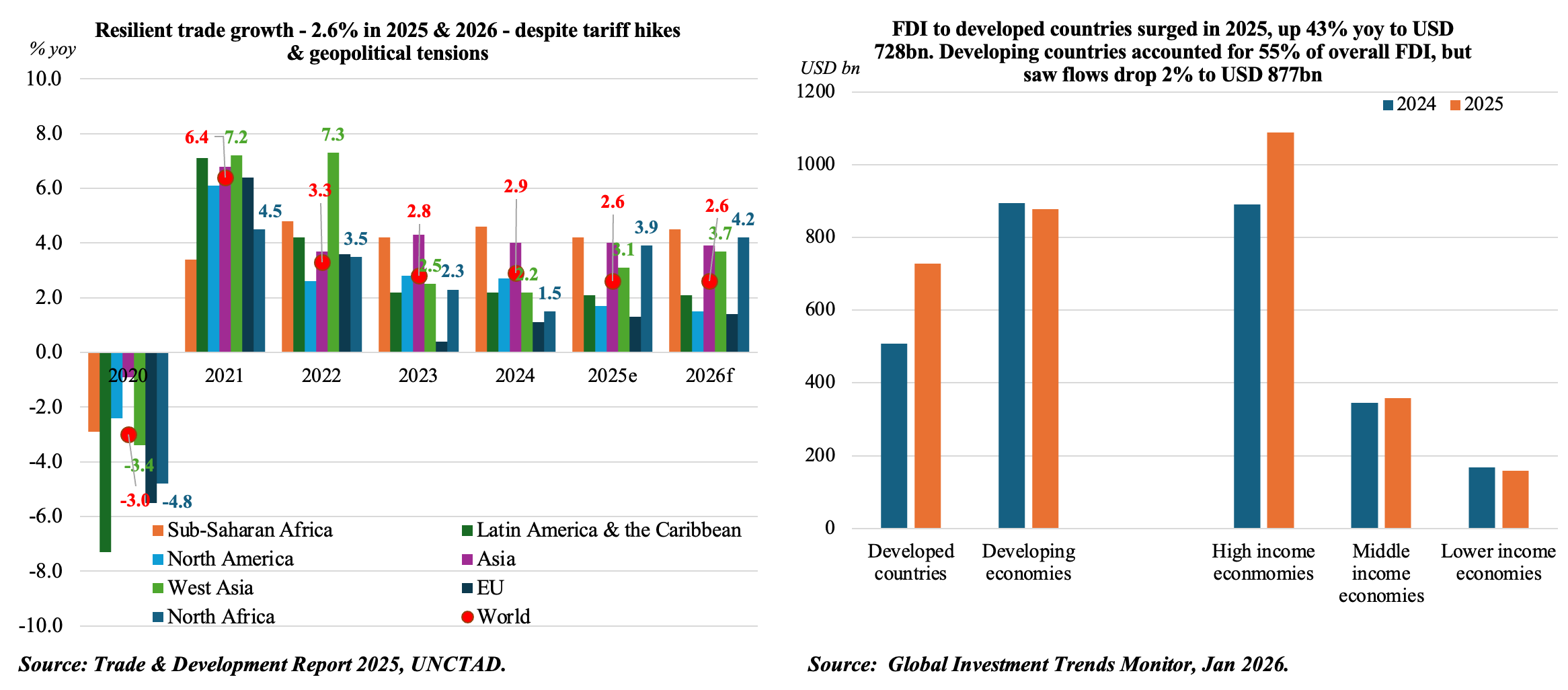

5. Global Trade & Investment Update: 2025

- An increase in tariffs in 2025 (in manufacturing the tariff-weighted average applied tariff on global trade jumped to 4.7% vs 1.9% in 2024) notwithstanding, global trade grew by 2025. Tariff uncertainty is likely to persist in 2026, as with the recent US threat to impose a 10% tariff on 8 European nations (related to Greenland).

- The services sector, particularly digitally deliverable services like finance, ICT and consulting, has become the primary engine of trade growth. While this is less sensitive to logistical disruptions (e.g. tensions in the Red Sea), the existing digital divide could further widen if the least developed nations continue to be left out.

- With ongoing trade and tariff uncertainty, growing South-South trade is important. UNCTAD finds that 57% of developing country exports go to other developing markets now, up from 38% in 1995.

- Global FDI grew by 14% yoy to USD 1.6trn in 2025, rebounding after two consecutive years of declines. An important caveat is that financial centres drove the growth & without it, FDI grew just 5% (Source: UNCTAD)

- Very concentrated investments: (a) FDI to developed countries surged 43% vs three-quarters of least developed countries seeing stagnant or lower flows; (b) Data centres attracted more than one fifth of global greenfield project values in 2025 (USD 270bn+). Renewable energy investment was weak.

- 2025 data underscore a “two-speed” recovery, with investment decisions affected by policy uncertainty and deepening geopolitical fragmentation; this seems likely to extend into 2026.

Powered by: