Download a PDF copy of the weekly economic commentary here.

Markets

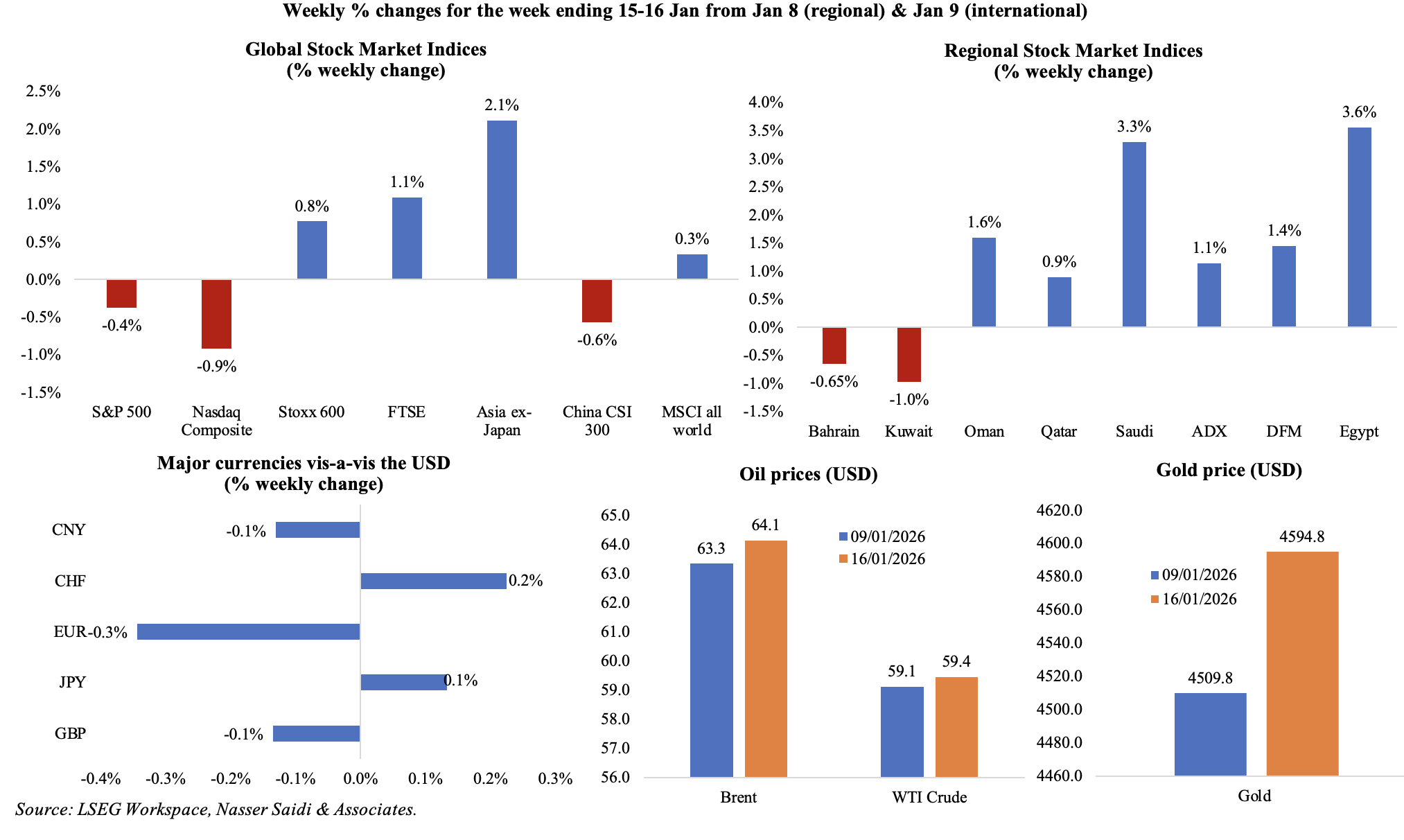

Equities markets were mixed last week, with declines in major indices in the US (despite strong tech and finance earnings) and China declining. Regional markets were also mixed given geopolitical tensions (news that US pulled personnel from bases in the Middle East) and some profit taking; Dubai and Abu Dhabi were up more than 1% from the week before while Qatar’s main market climbed to above the 11,000 level. The dollar index climbed to a 6-week high on Thursday while the JPY strengthened (from an 18-month low versus the USD) on comments from the finance minister that the country would “not rule out any options” to support the JPY. Oil prices edged up on supply fears (protests in Iran and President Trump’s hints of a potential military interventions) while gold price reached a record USD 4,642.72 on Wednesday before edging lower, while silver prices hit an all-time high of USD 93.57 (posting a 10%+ weekly gain).

Global Developments

US/Americas:

- Inflation in the US stood unchanged at 2.7% yoy in Dec while core inflation stood at 2.6%. Food prices jumped 0.7% mom (the most since Oct 2022) and 3.1% yoy.

- Producer price index ticked up to 3.0% in Nov (Oct: 2.8%; Sep: 3%) while core PPI was 3% (Oct & Sep was 2.9%). Producer goods prices rebounded 0.9% mom, the largest increase since Feb 2024, with energy prices (4.6%) accounting for more than 80% of the rise in PPI.

- Industrial production in the US grew by 0.4% mom in Dec (Nov: 0.4%), with manufacturing and utilities up 0.2% and 2.6% respectively. Capacity utilization ticked up to 76.3%, 3.2 percentage points below its long-run (1972–2024) average.

- New home sales fell by 0.1% mom to 737k in Oct (Sep: 3.8%), as single family homes fell slightly. With weak demand and high inventory lowering prices, the median new house price fell by 8.0% to USD 392,300.

- Existing home sales grew by 5.1% mom to 4.35mn in Dec (Nov: 4.14mn). For the full year 2025, there were 4.06mn existing home sales, unchanged from 2024.

- Budget deficit in the US moved to USD 145bn in Dec (Nov: USD 173bn and up USD 58bn from a year earlier): net customs receipts stood at USD 27.9bn (lower than the USD 30bn+ in recent months). Fiscal year-to-date receipts grew by 13% yoy to USD 1.225trn, a record for the period while outlays also climbed to a record USD 1.827trn.

- Current account deficit in the US narrowed to USD 226.4bn in Q3 (Q2: USD 249.2bn), due to the narrowing of goods deficit (USD 267.4bn vs USD 270.4bn) while the services surplus expanded (to USD 89.2bn USD 80.6bn).

- US retail sales rebounded in Nov, up 0.6% mom (Oct: -0.1%), the most since Jul, led by a 1.0% rebound in auto sales. Sales increases were noted in sporting goods, musical instrument, & bookstores (1.9%), miscellaneous store retailers (1.7%), gasoline stations (1.4%) and building & garden suppliers (1.3%) among others. In yoy terms, sales grew by 3.3%.

- NFIB business optimism index ticked up to 99.5 in Dec (Nov: 99), the highest since Aug and higher than the 52-year average of 98. The uncertainty index fell 7 points to 84, marking its lowest level since Jun 2024.

- NY Empire State manufacturing index accelerated to 7.7 in Jan (Dec: -3.7), thanks to new orders (6.6 from -1.0) and shipments (16.3 from -5.0) while employment declined (-9 from -7.5) and input price increases were almost similar (42.8 from 44.2).

- Philadelphia Fed manufacturing index surged to 12.6 in Jan (Dec: -8.8), the highest since Sep, on jumps in new orders and shipments to 14.4 and 9.5 respectively while employment was a positive 9.7.

- Initial jobless claims declined by 9k to 198k in the week ended Jan 10, with the 4-week average slipping to 205k (prev: 211.5k) – the lowest average since Jan 20, 2024. Continuing jobless claims also fell by 19k to 1.884mn in the week ended Jan 3.

Europe:

- Industrial production in the euro area grew by 0.7% mom and 2.5% yoy in Nov (Oct: 0.7% mom and 1.7% yoy). Increases were recorded for intermediate and capital goods (0.3% mom and 2.8% respectively) while both durable and non-durable consumer goods edged down by 1.3% and 0.6% respectively.

- Trade surplus in the EU narrowed to EUR 8.1bn in Nov (Nov 2024: EUR 11.8bn), as exports and imports fell by 4.4% and 2.9% respectively (to EUR 213.8bn and EUR 205.7bn).

- Wholesale price index in Germany eased to 1.2% yoy in Dec (Nov: 1.5%), on higher prices for non-ferrous ores, metals & semi-finished metal products (34.6%) and for food, beverages and tobacco (2.4%). For the full year 2025, wholesale prices were up 1.0% yoy.

- Sentix investor confidence in the eurozone improved to -1.8 in Jan (Dec: -6.2), the highest since Jul 2025, with an increase in the index measuring the current situation (-13.0 from -16.5). The survey showed that the US and Asia are “providing new impetus for growth”.

- GDP in the UK grew by 0.3% mom in Nov (Oct: -0.1%), as services increased by 0.3%, production by 1.1% and construction fell by 1.3%. Industrial production grew by 2.3% yoy in Nov while manufacturing grew by 2.1% (from 0.4%).

- Trade deficit in the UK narrowed to GBP 6.12bn in Nov (Oct: GBP 6.53bn), as exports grew by 0.6% mom (to a 3-month high of GBP 77.19bn) and imports were almost unchanged.

- UK like-for-like retail sales grew by 1% yoy in Dec (Nov: 1.2%), recording the weakest pace in seven months; non-food sales dropped by 0.3% mom while food prices were up 3.1% (partly due to food inflation).

Asia Pacific:

- China’s GDP, which grew by 5% in 2025, was in line with the official target but highlighted a “two speed” economy: domestic demand indicators were weak while industrial production performed better than expected. China’s fixed asset investment declined 3.8% yoy in 2025, posting the first full-year decline since the 1990s.

- The PBOC last week announced cuts to rates on structural policy tools by 25bps. The bank also disclosed an expansion of its re-lending programme for tech innovation by CNY 400bn to CNY 1.2trn, a CNY 500bn hike in the lending quota for agricultural and small enterprises and a CNY 1trn relending facility to support SMEs in the private sector.

- Exports from China grew by 6.6% yoy in Dec (Nov: 5.9%) and imports was up 5.7% (the fastest pace in three months), causing the trade surplus wider to USD 114.1bn. Exports to the US plunged by 30% in Dec (dropping for the ninth consecutive month) while that to the EU and ASEAN gained 12% and 11% respectively. Trade surplus climbed to a record high USD 1.2trn in 2025, as exports grew by 5.5% alongside flat imports growth.

- New loans in China surged to CNY 910bn in Dec (Nov: CNY 390bn) while broad money supply grew by 8.5% in Dec (Nov: 8%). For the full year 2025, new bank loans totalled CNY 16.27trn, the lowest since 2018.

- Japan’s current account surplus narrowed to JPY 3,674bn in Nov (Oct: JPY 2834bn), thanks to the widening trade surplus (to JPY 2137.8bn from Oct’s JPY 2476.4bn). Goods trade recorded a surplus of JPY 625.3bn, as exports grew 5.1% to JPY 9.39trn and imports edged down 0.5% to JPY 8.77trn.

- Machine tool orders in Japan grew by 10.6% yoy in Dec (Nov: 14.2%), the highest level of orders since Mar 2022, largely due to the surge in foreign orders (15.1% to JPY 118.769bn). Domestic orders meanwhile dropped by 1.1% yoy.

- Inflation in India ticked up to 1.33% in Dec (Nov: 0.71%), below the RBI’s target range for the fourth month in a row. Food prices fell 2.7% yoy (Nov: -3.91%) and eased for housing (2.86% from 2.95%) and fuel & light (1.97% from 2.32%). Wholesale price inflation was 0.83% in Dec, rebounding from Nov’s -0.32% reading, on an increase in manufacturing inflation (1.82% from 1.33%) and food products (0.9% from 0.62%).

- India’s trade deficit widened to USD 25.04bn in Dec (Nov: USD 24.53bn, but much lower than the record high gap of USD 42bn recorded in Oct) as imports grew by 8.7% yoy to USD 63.6bn. The US tariff hike (50%) has seen exports to the US edge down in recent months (USD 6.89bn in Dec vs USD 6.92bn in Nov). In Apr-Dec, US, UAE and China were India’s top three export destinations. Exports to China surged by 36.68% in this period.

- The Bank of Korea left interest rates unchanged at 2.5% but signalled an end to the monetary easing cycle (the apex bank had lowered rates by 100bps since Oct 2024).

Bottom line: Under President Trump, geopolitical news continues to dominate, with the latest being threats to impose fresh tariffs of 10% on countries that oppose his plan to acquire Greenland. Earlier in the week, the President announced a 25% tariff on countries engaged in business with Iran. On the cards this week are UK’s inflation and labour market data which would have a bearing on the BoE’s next interest rate move. China’s GDP was in line with the official target and followed last week’s record trade surplus reading: however, weak domestic demand remains an ongoing concern. Meanwhile, Japan’s PM is calling for a Feb 8 general election in hopes to achieve a majority in the parliament (and gain backing for tax cuts, increased spending and a new national security strategy).

Regional Developments

- According to the latest World Bank Global Economic Prospects outlook, the GCC is forecast to grow by 4.4% in 2026 and accelerate slightly to 4.6% in 2027, highlighting robust performance relative to slower global growth expectations (2.6% in 2026). This reflects growth in diversified non-oil sectors (such as services, trade and tourism) despite persistent global uncertainties including geopolitical tensions and trade frictions.

- President Trump announced that any country doing business with Iran would face a 25% tariff on all trade with the US, signalling an aggressive extension of US trade policy to penalize third-party economic engagement with Iran. Major trade partners of Iran including China, Turkey, Iraq, India and the UAE could see heightened uncertainty about access to US, complicating global supply chains and investment planning.

- Bahrain’s Telecommunications Regulatory Authority has authorised Sama X to roll out Starlink satellite broadband services in the country, expanding high-speed connectivity for businesses, government and maritime users.

- Egypt formalised a policy limiting external borrowing to between 40-50% of GDP, a move aimed at anchoring debt sustainability amid high financing needs. This cap seeks to improve borrowing terms and fiscal prudence.

- The investment and foreign trade minister of Egypt disclosed that the country recorded the highest tax revenue in two decades, driven by broader tax base expansion and tax reforms including stronger compliance measures.

- Egypt’s trade deficit widened by 1.3% yoy toUSD 4.58bn in Oct 2025, as exports slightly declined (-1.1% to USD 4.17bn) and imports grew (0.18% to USD 8.75bn). Export performance was mixed, with weakness in petroleum products (-29.6%) and some agricultural goods offset by growth in medicines & pharma (11.7%).

- Official gold reserves in Egypt increased by 79,600 ounces in 2025; in value terms, it surged by almost three-quarters to USD 18.2bn, bolstering foreign exchange buffers and improving reserve quality.

- The EU is scheduled to release EUR 11.6bn to Egypt under its macro-financial assistance (MFA) programme, part of a broader multi-year support framework. A total of 38 reforms have been completed under the MFA so far, including 22 measures linked to a EUR 1bn tranche disbursed in Jan 2025 and the 16 measures completed for the current instalment.

- Egyptian startups secured USD 614mn in funding in 2025, up 51% yoy, and the government is preparing fresh incentives to further catalyse innovation, investment and job creation in the private sector including a “Startup Charter” and unified investment incentives.

- Egypt announced the discovery of four new oil and gas fields in the Western Desert, strengthening its hydrocarbon resource base. These wells are expected to have a daily production capacity of nearly 4,500 barrels of crude oil and 2.6mn cubic feet of natural gas.

- Egypt plans to increase the sports sector’s contribution to GDP to 3% by 2032, more than double its current share (of 1.34%), by expanding the number of sports services companies (to 4500 from around 600) and commercialising the industry.

- Headline inflation in Kuwait climbed 0.07% mom and 2.46% yoy in Oct, with food and beverages up over 6.13% and broad price increases seen in clothing (2.39%), healthcare (1.85%), housing services (0.9%), signalling persistent cost pressures for consumers. Excluding food and beverage prices, inflation rose 0.23% mom and 1.88% yoy.

- Kuwait’s food subsidy outlays have declined by 7.7% yoy to KWD 309.43mn in Jan-Nov 2025, reflecting a retrenchment in government support for basic commodities compared with historical levels. Construction materials continued to receive the largest share of total support (51.13%). This reduction likely eases fiscal pressure on the budget but may transfer cost burdens onto households, particularly low-income groups sensitive to food price changes.

- Lebanon’s prosecutors indicted former central bank governor Riad Salameh on charges tied to an alleged USD 448mn embezzlement scheme, deepening scrutiny of governance failures at a critical financial institution. The charges come amid Lebanon’s ongoing economic crisis and legal action against a former senior official may signal a shift towards accountability.

- The IMF voiced their reservations about Lebanon’s Gap Law, calling for the authorities to work with the Parliament to ensure that the amendments align with international best practices, and also to provide the maximum possible protection to depositors consistent with debt sustainability.

- Jordan and Lebanon signed 21 new economic cooperation agreements covering trade, investment, energy, tourism, electrical interconnection and industry, highlighting strengthened bilateral partnership. Built on historical ties, these aim to boost regional connectivity.

- The IMF, in its latest Article IV consultation, affirmed that Oman’s economy remains strong and stable, underpinned by non-oil sector growth, fiscal reforms, well capitalised banking sector and healthy external balances, even as diversification remains a work in progress. More: https://www.imf.org/en/news/articles/2026/01/14/pr-2604-oman-imf-executive-board-concludes-2025-article-iv-consult

- GDP in Oman grew by 2% yoy to OMR 9.91bn in Q3 2025, with non-oil sector expanding by 2% to OMR 7.3bn while oil sector activity was up 1.9% (to OMR 3.07bn). This gradual GDP expansion happened alongside growing deposits (6.3% to OMR 26.4bn in Nov) and improving bank credit growth (8.5%), signaling rising private sector activity.

- Oman’s trade surplus narrowed by 36% yoy to OMR 4.7bn as of end-Oct, reflecting changes in export (-8% yoy, as oil and gas exports fell by 16%) and import (increased by 7%) dynamics, with non-oil sectors partially offsetting hydrocarbon export declines. UAE was the largest destination for Oman’s non-oil exports and re-exports; Saudi Arabia was second for non-oil exports, followed by India.

- Oman plans to raise OMR 850mn (USD 2.2bn) in debt to finance its budget deficit: the sukuk and conventional bonds will be listed on the Muscat Stock Exchange. Currently, national debt is estimated to be OMR14.6bn.

- The Ministry of Transport, Communications and Information Technology in Oman disclosed that its digital economy attracted USD 3.1bn in investments over the past five years (with 70% driven by FDI) and the logistics industry saw an investment of USD 8.8bn by end-2025, reflecting strategic priorities in technology, innovation, and knowledge-based sectors.

- Inflation in Qatar inched up to 1.95% in Dec (Nov: 1.38%), with core price movements influenced by food, housing and utilities.

- MENA sustainable finance issuance expanded sevenfold since 2020 to about USD 35.1bn in 2025 (though this is 18% below 2023 peak), driven by green bonds, sustainability-linked instruments and bank-led funding for renewable energy and climate adaptation projects. Financials accounted for almost 50% of MENA issuance in 2025, up from 32% in 2020, while Saudi Arabia emerged as the region’s largest sustainable finance issuer by volume (USD 19.7bn in 2025).

- According to MAGNiTT, the MENA venture capital market continued to gain traction in 2025, with funding up 145% yoy to USD 1.72bn from 257 deals (+45%) across sectors such as technology, fintech, health tech and digital services. Saudi Arabia was the most active, raising USD 3.43bn in funds (+89%) and transactions up 13% to a record 581.

- Qatar and the UAE joined the US-led Pax Silica initiative, aligning itself with major technology economies to strengthen AI and semiconductor supply chains – critical areas of future economic competition. Participation signals widening strategic economic cooperation with the US and partners such as Australia, UK and Japan, particularly in logistics, industrial capacity, and energy. A senior official disclosed that a very substantial bilateral AI deal had been negotiated with Saudi Arabia.

Saudi Arabia Focus

- Saudi Arabia’s CPI ended the year rising to 2.1% in Dec (Nov: 1.9%), driven by the high housing & utilities costs (4.1% in Dec) which in turn was due to the 5.3% gain in actual rental costs. Food & beverages inflation stood at a relatively unchanged 1.3% in Dec. CPI averaged 2.04% in 2025 vs 1.5% in 2024, with housing costs continually a major contributor (6.1% in 2025). Increases were noted across food & beverages (1.1% vs 0.7%), transport (0.45% vs 0.22%) and recreation & culture (2.6% vs 0.8%); average prices of personal care, miscellaneous goods & services more than doubled (5.11% from 2.32%). The overall rise reflects building domestic demand and continued upward pressure in key cost-of-living categories, but inflation stays relatively moderate by international standards.

- Wholesale prices in Saudi Arabia jumped sharply to 3.1% in Dec (Nov: 2.3%), with the monthly gain of 1.0% – the most since Jan 2025. However, the pressure is concentrated in specific sectors – prices of other transportable goods jumped to 5.7% (Nov: 4.3%) as did metal products (1.1% from 0.8%). Average wholesale prices tumbled to 2.1% for the full year 2025 (2024: 2.9%), as prices of “other transportable goods” plunged (4.1% vs 7.2%), in addition to food products (0.3% vs 1.0%).

- Saudi public investment fund assets expanded robustly, up 5.7% qoq and 36% yoy to SAR 217.9bn by Q3 2025, underpinned by strong domestic investment and sector diversification. Growth was driven chiefly by rise in assets of local funds (39% yoy to SAR 186.9bn), while foreign fund assets also climbed (21% to SAR 31.1bn), indicating widening investor confidence and diversification of investment instruments.

- The Saudi mining minister disclosed that the Public Investment Fund (PIF) is planning to spin off Manara Minerals to sharpen its focus on technical mining capabilities beyond pure investment activity, though no timing was provided on the spin-off. This repositioning underpins Saudi’s aim to capture value across the mining value chain versus merely holding equity stakes and will enable greater integration into global supply chains for clean-energy and EV-related minerals.

- Total foreign investment stock in Saudi Arabia reached nearly SAR 977bn, revealed the Minister of Investment. He also stated that FDI inflows have doubled since Vision 2030 reforms began, driven by liberalization of markets and stronger trade ties. Policies such as easing foreign access to capital markets, opening the real estate sector and expanding bilateral investment frameworks are reinforcing these trends.

- Saudi Arabia’s Ministry of Industry and Mineral Resources issued 138 new mining licenses in Nov (taking the total to 2719 as of Nov), reflecting its structural diversification strategy and building on a record increase in exploration activity during 2025. Concurrently, the Future Minerals Forum concluded with the signing of over 132 agreements and MoUs worth SAR 100bn across the mining value chain, underlining strong international interest and government support for critical minerals.

- Saudi announced development projects to the tune of USD 500mn across Southern Yemen, with projects ranging from schools and hospitals to the construction of roads and a mosque.

- Fitch affirmed Saudi Arabia’s sovereign credit rating at A+ with a stable outlook, citing strong fiscal and external balance sheets. The credit rating agency revealed that increase in non-oil revenues and/ or expenditure rationalisation and a stronger public sector balance sheet could potentially upgrade the rating further.

UAE Focus

- UAE’s banking sector has continued to grow: data show increases in money supply (M2 grew by 2% yoy in Nov vs Oct’s 14.8%) and banking assets (0.8% mom to AED 5.25trn) driven by rises in deposits and credit, reflecting expanding economic activity. UAE deposit growth, at 13.7% year-to-date (ytd) in Nov, outpaced domestic credit growth (10.6% ytd) but was lower than gross credit (16.1%, which includes foreign credit). Deposits grew thanks to resident private sector (17.4% ytd) while domestic credit was driven by upticks in retail private sector (15.7% ytd) & government (18.9% ytd).

- The UAE and the Philippines have formalised a Comprehensive Economic Partnership Agreement (CEPA), a broader bilateral trade and investment framework that reduces barriers and enhances market access for goods and services. The UAE is the Philippines’ top export market among Arab and African nations and its 17th largest global trade partner. Bilateral non-oil trade stood at USD 940mn in 2024 and grew 22.4% yoy to USD 853.7mn in Jan-Sep 2025. By strengthening supply-chain linkages, particularly in services, investment and trade facilitation, the agreement is expected to accelerate growth and deepen economic integration.

- Nigeria and the UAE signed a CEPA last week: the deal will eliminate tariffs on over 7,000 product lines (from seeds & oils to pharmaceuticals, chemicals and agricultural produce), significantly lowering export costs and enhancing competitiveness.Nigeria’s minister also revealed that the deal will allow Nigerian businesses to set up offices and subsidiaries in the UAE. The deal underscores UAE’s role as a gateway for trade into Africa and the expanded market access will benefit exporters, manufacturers and service providers in both economies.

- Canada and the UAE are set to launch negotiations on a CEPA next month, building on existing bilateral trade and investment linkages including a recent USD 50bn investment commitment by Abu Dhabi in areas including energy. Negotiations with the UAE represents Canada’s strategic diversification of trade partners beyond traditional markets (such as the US due to Trump’s tariffs).

- Dubai Chamber of Commerce reported a historic high of AED 356.5bn in member exports and re-exports in 2025, up 15.1% yoy and reflecting robust trade performance across sectors. Membership growth (13.2% to 292k+) and increased certificates of origin issuance (7.7% to 852k+) highlight expanding business activity and international market penetration.

- Despite geopolitical tensions, UAE’s DP World reaffirmed that operations at the Berbera port in Somaliland continue unaffected, underscoring the durability of commercial logistics investments even against political headwinds. The port, a key component of regional trade connectivity, plays an important role in linking Horn of Africa markets to global routes.

- UAE’s climate investment vehicle ALTERRA, in partnership with Spanish bank BBVA, plans to launch a USD 1.2bn climate-focused co-investment fund to scale climate-aligned investments across energy transition, decarbonisation technologies, climate tech and sustainable living. This initiative builds on ALTERRA’s broader strategy to mobilise significant third-party capital for climate tech and infrastructure. Such blended finance mechanisms could accelerate private capital flows into emerging markets and strengthen the UAE’s leadership in climate finance.

- Masdar reached 65 GW of global clean energy capacity as part of its drive toward a 100 GW target by 2030, reflecting the UAE’s commitment to renewable energy expansion and decarbonisation. The milestone was highlighted at Abu Dhabi Sustainability Week, with the growth reflecting robust project pipelines and strategic positioning in renewable markets.

- Dubai’s Roads and Transport Authority confirmed that electric air taxis (developed with Joby Aviation) are set to begin commercial operations by end-2026. These zero-emission aerial vehicles are designed to integrate with the city’s transport network and reduce congestion, underscoring a leap in urban mobility innovation and diversification of transport infrastructure.

Media Review:

IMF: Resilient growth as technology and adaptability offset trade policy headwinds

https://www.imf.org/en/publications/weo/issues/2026/01/19/world-economic-outlook-update-january-2026

Geopolitics is warping multinationals’ commercial decisions

https://www.economist.com/briefing/2026/01/15/geopolitics-is-warping-multinationals-commercial-decisions

Trump’s Gaza peace board charter seeks USD 1bn for extended membership: Reuters

https://www.reuters.com/world/middle-east/trumps-gaza-peace-board-charter-seeks-1-billion-extended-membership-document-2026-01-18/

Navigating the Trump-Powell Feud

https://www.project-syndicate.org/commentary/trump-powell-feud-offers-opportunity-to-reaffirm-fed-independence-and-promote-reform-by-mohamed-a-el-erian-2026-01

China-led cross-border digital currency platform sees surge

https://www.reuters.com/world/asia-pacific/china-led-cross-border-digital-currency-platform-sees-surge-2026-01-16/

Powered by: