Middle East Growth Holds Firm: Expansionary PMIs, GDP Gains, and a Labour Market Caveat, Weekly Insights 9 Jan 2026

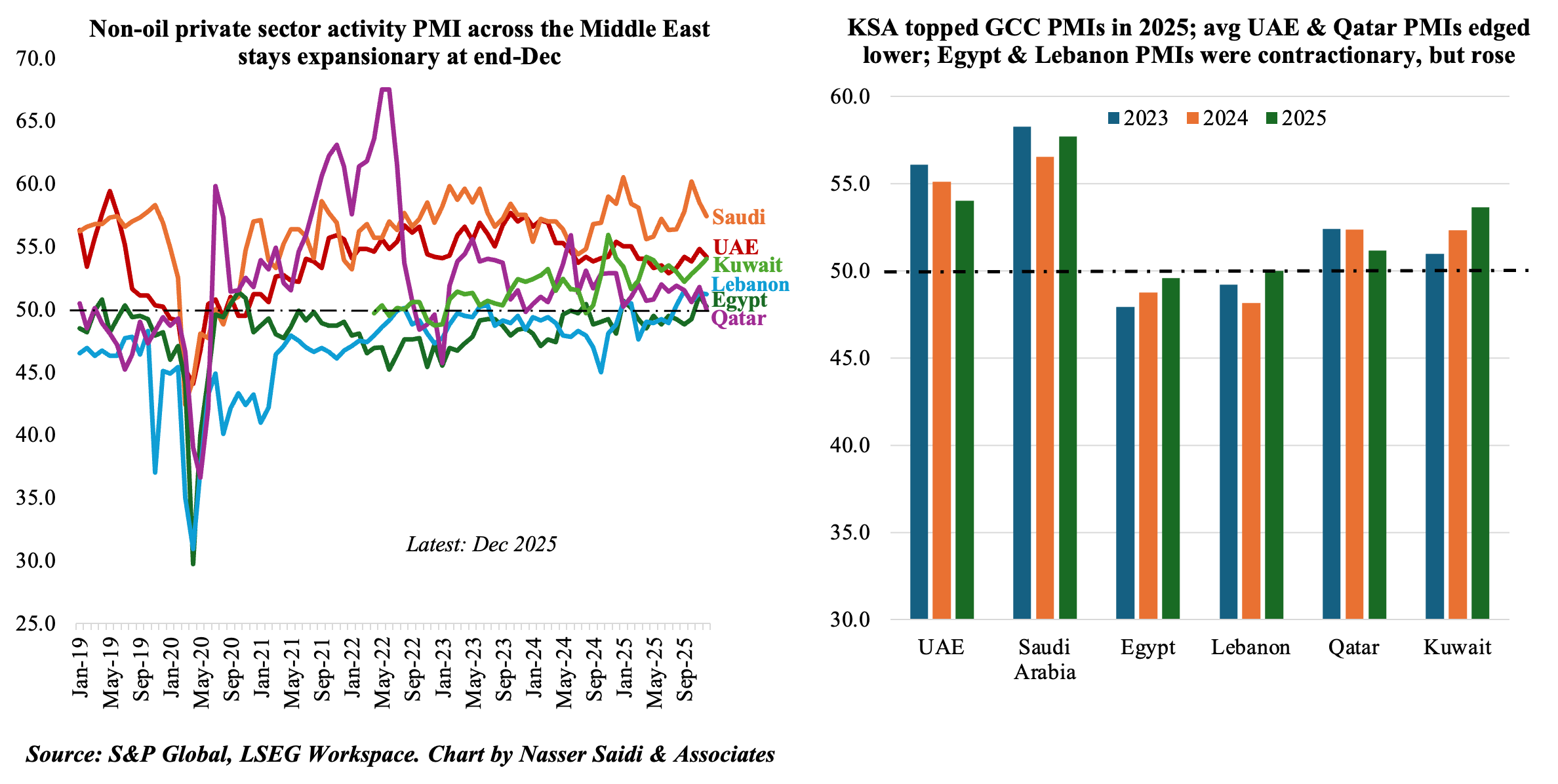

1. Non-oil sector activity expands across the Middle East at end-2025

- The 2025 picture: Saudi Arabia continued to stand out as the region’s major growth engine, with an average PMI of 57.7 in 2025. UAE and Qatar PMI eased while others ticked up. PMI in Qatar averaged 51.2 in 2025, the lowest since 2020 and below the long-run average of 52.2. Kuwait’s headline PMI average was close to the UAE, thanks to strong demand but the pace reflects slower reform rollout and implementation. Egypt and Lebanon both recorded contractionary readings on average in 2025, though both countries returned to 50+ readings in Nov & Dec.

- PMIs across the Middle East remained expansionary in Dec, with only Kuwait posting a monthly gain.

(a) Saudi PMI cooled to 57.4 in Dec, reflecting softer new orders alongside robust employment growth. Purchasing pressures increased, though wage pressures eased to their lowest in nearly two years;

(b) UAE’s output growth was strong in Dec but employment was unchanged and input costs rose at the sharpest pace in over a year;

(c) The improvement in Kuwait’s PMI reflects firmer domestic demand: output growth was at a 7-month high and new orders rose for the 35th month in a row. Output prices accelerated at the fastest pace since Mar 2024 while sentiment climbed to a 2-year high in Dec;

(d) Qatar’s PMI at 50.0 in Dec signals stagnation in the non-oil private sector. This does not imply broad economic weakness but it does indicate a near-term pause in private-sector expansion. Falling new orders were registered for the ninth time in 2025, causing a contraction in output for the seventh time in 2025;

(e) Though Egypt and Lebanon retuned to expansionary mode, the contrast with GCC performance highlights how macro stability and access to liquidity are important for business sentiment.

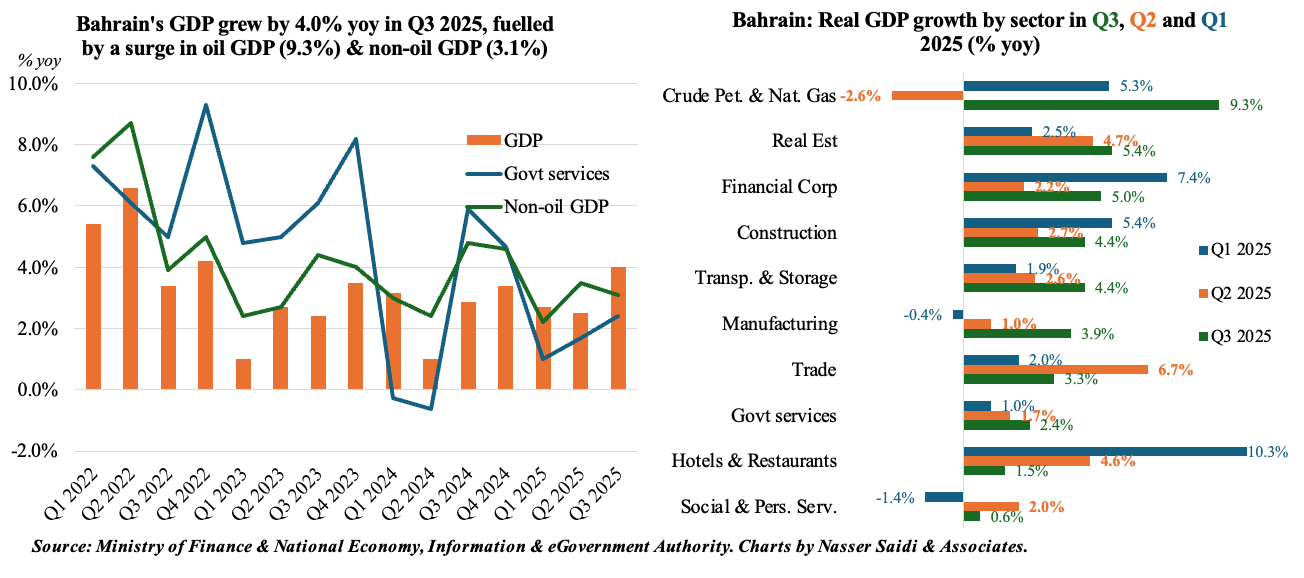

2. Bahrain’s GDP grew by 4.0% yoy in Q3, largely owing to an oil sector boost (9.3% in Q3) while non-oil GDP was up 3.1%

- Real GDP in Bahrain grew by 4.0% in Q3 (Q2: 2.5%), the fastest pace since late 2023, supported by a 9.3% and 3.5% gain in oil and non-oil sector activity. The non-oil sector contributed 85.0% to real GDP in Q3.

- An increase in oil production led oil GDP to expand 9.3%, rebounding from Q2’s 2.6% drop. In the non-oil non-govt sector, real estate sector posted the highest growth in Q3: 5.4% yoy in Q3 (Q2: 4.7%), thanks strong demand.

- Financial & insurance sector grew by 5.0% in Q3 (following growth rates of 7.4% and 2.2% in Q1 & Q2 respectively). The sector accounted for 65.2% of inward FDI stock and contributed most to real GDP in Q3: 17.8%, followed closely by crude petroleum & natural gas (15.0%) & manufacturing (16.1%). Tourism & hospitality sector grew by 1.5% in Q3 (vs growth of 10.3% and 4.6% in Q1 & Q2 respectively). Manufacturing, particularly aluminum production & downstream industries, continued to expand (3.9% in Q3), supported by strategic government investment. FDI into the sector accounted for 13% of total in Q3.

- Earlier this year, Bahrain unveiled a targeted fiscal reform package to strengthen public finances, including measures to improve revenue generation (via increase in fuel prices, higher electricity and water tariffs) and contain expenditures, as part of broader efforts to stabilise the fiscal and debt trajectory. These will reduce over-reliance on oil revenues and attract / boost investments. Continued non-oil growth, infrastructure investment and financial sector development will continue supporting overall growth.

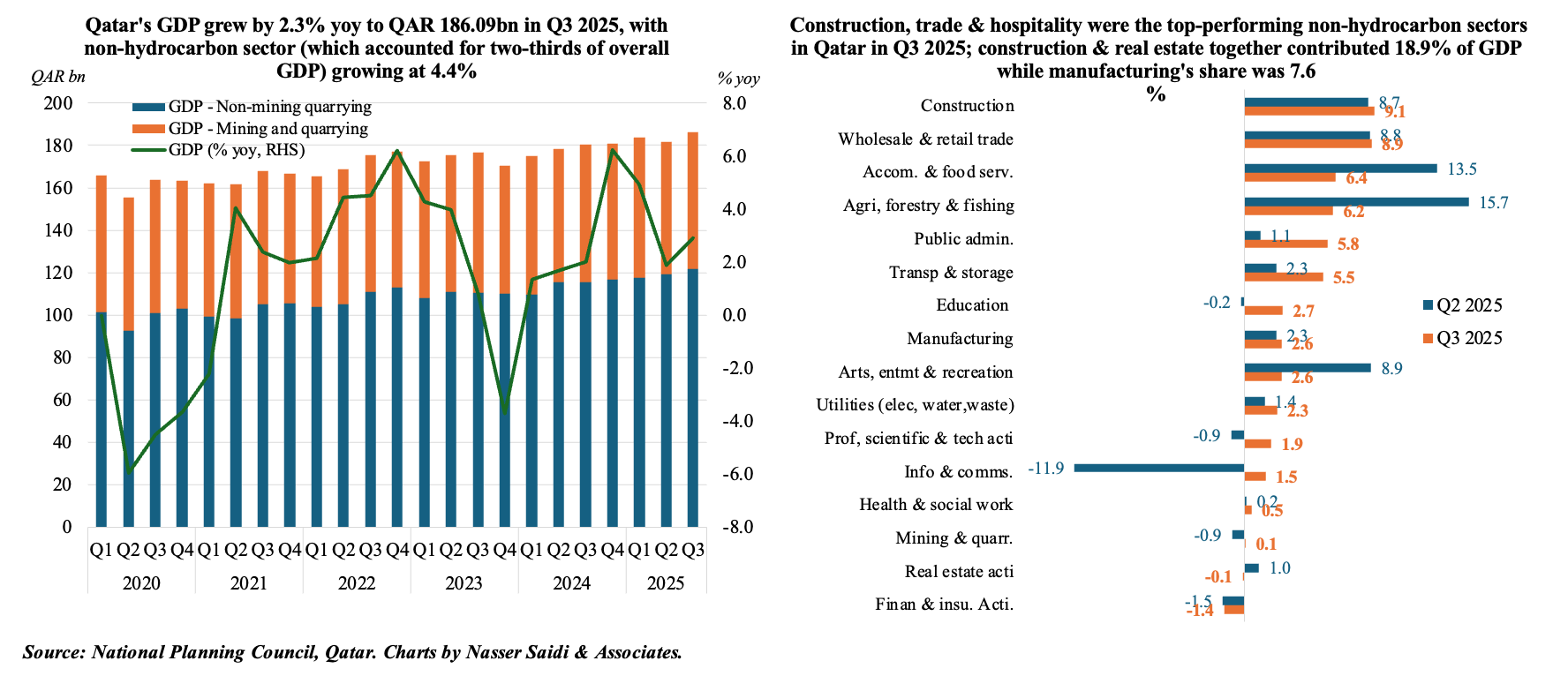

3. Qatar’s real GDP expanded by 2.9% yoy in Q3 2025, thanks to the 4.4% uptick in the non-hydrocarbon sector

- Qatar’s real GDP expanded by 2.9% yoy in Q3 2025, with the non-hydrocarbon sector the main driver of growth; it grew 4.4% and accounted for roughly 65.5% of total economic output. Mining & quarrying rebounded in Q3, up 0.1% yoy after a 0.9% drop in Q2.

- A breakdown by sector showed the fastest upticks in construction (9.1% yoy in Q3 vs 8.7% in Q2) followed by wholesale & retail trade (8.9%) and accommodation & food services activities (6.4%). This performance reflects strong domestic demand, increased tourist activity and continued implementation of infrastructure and public-sector projects.

- Contribution of the top five non-government, non-mining & quarrying sectors (construction, financial & insurance, wholesale & retail trade, manufacturing and real estate) accounted for 6% of overall GDP in Q3 and 68.1% of non-mining and quarrying GDP in both Q3.

- Qatar continues to be heavily reliant on its hydrocarbons sector: accounting for 34.5% of overall GDP in Q3. GDP growth will be resilient, supported by LNG capacity expansions, strategic public and private investment (including on infrastructure) and higher visitor arrivals; potential risks could include spillovers from regional geopolitics and external demand.

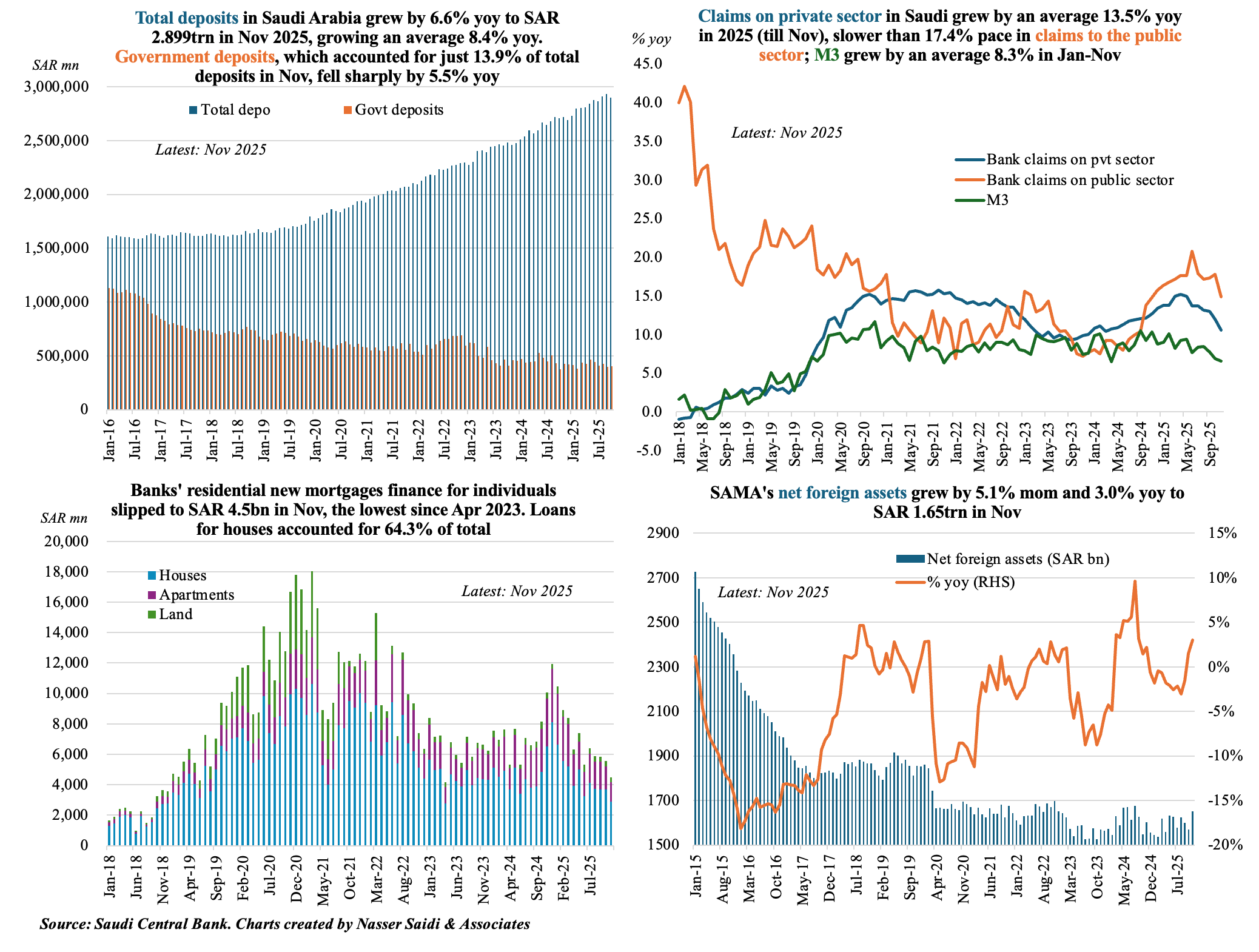

4. Broad money supply in Saudi Arabia grew by 6.6% yoy in Nov. Pace of credit growth is healthy (10.6% yoy in Nov & 13.5% avg in 2025) & has outpaced deposit growth (averaged 8.4% in Jan-Nov) for 22 straight months. Residential mortgage finance slipped to the lowest since Apr 2023. NFA increased to the most since Aug 2024.

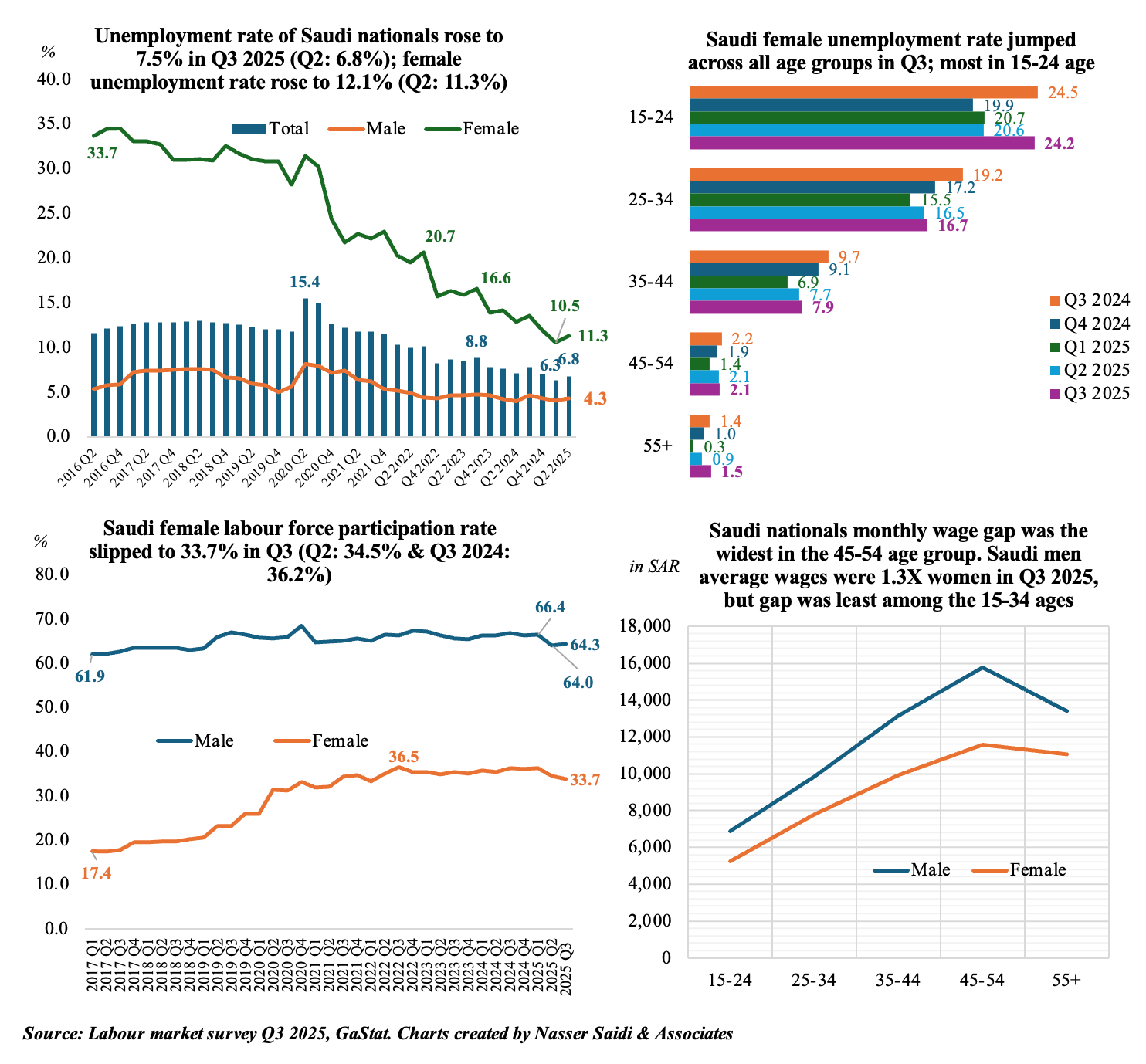

5. Unemployment rate among Saudis tick up to 7.5% in Q3

- Unemployment rate of Saudi citizens ticked up to 7.5% in Q3 (Q2: 6.8%, but down 0.3% vs a year ago). Unemployment rate including expats moved up to 3.4% (Q2: 3.2%).

- Saudi female unemployment rate increased to 12.1% (Q2: 11.3%). All groups saw a rise in unemployment rate (vs Q2); uptick was most in the 55+ group where it surged to 1.5% (Q2: 0.9%).

- Saudi FLFPR declined to 33.7% (Q1: 34.5%). Employment to population ratio for Saudi women fell to 29.7 in Q3 (Q2: 30.6); compares to 61.1 in Saudi men (Q1: 61.3).

- Wage gap remains persistent. Female citizens’ wages averaged SAR 9,180 in Q3, up 0.8% qoq (men: SAR 11,862, up 1.4% qoq); wages of women aged 45-54 was highest (SAR 11,588), also seen previously in Q3 2024.

- As diversification picks up pace, and private sector hiring increases (in line with PMI), overall unemployment is likely to show a downward trend. But continued policy support will be needed for further integration of citizens into the private sector (esp in high-growth sectors), higher female labour force participation & among the young.

Powered by: