Download a PDF copy of the weekly economic commentary here.

Markets

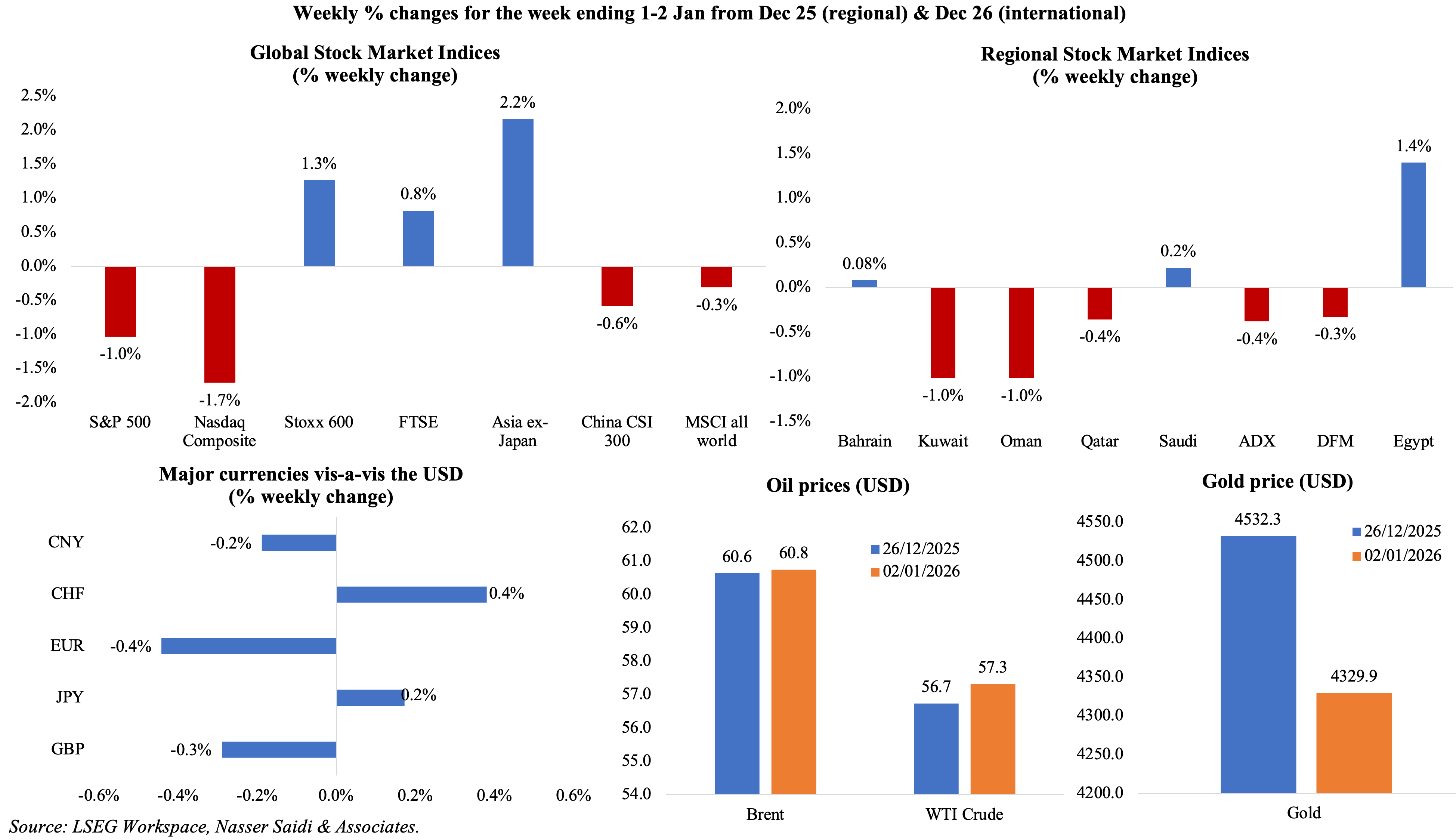

US stocks ended the year with a weekly loss, especially at the tech-heavy Nasdaq while European shares hit new record highs, FTSE100 touched 10k points and Japan’s Topix closed at a record at the end of the year (up 23.7% since start of Jan). Regional markets were mostly in the red with the UAE markets down given regional tensions related to the crisis in Yemen (more in Media Review section). Egypt’s exchange outperformed its regional peers last year while Oman posted its biggest yearly gain since 2007. The dollar posted an annual drop and potential rate cuts are likely to weaken it further. Oil prices edged up from the week before, but prices were down close to 20% in 2025. Gold price fell by 4.5% last week but ended the last year up 64%. The Venezuela attack will raise global geopolitical risks associated with regime change, increased uncertainty on lifting of sanctions, impact on the oil market and Venezuela’s sovereign debt. After the attack in Venezuela, stocks edged up slightly (MSCIs broadest index of Asia-Pacific shares outside Japan rose to a record high) and while oil prices seem to have steadied (offset by the OPEC+ decision over the weekend), gold has risen to a one-week high; safe-haven bonds also held steady.

Global Developments

US/Americas:

- Fed minutes showed a divided FOMC that narrowly approved the rate cut (9-3 vote, the most dissents since 2019). While most members agreed further rate cuts could occur if inflation continued easing, they disagreed on timing and pace. The 19 officials at the meeting (12 vote on rates) indicated the likelihood of another cut in 2026 and one more in 2027.

- Pending home sales in the US unexpectedly grew by 3.3% mom in Nov (Oct: 2.4%), the highest since Feb 2023, thanks to “improving housing affordability” on lower mortgage rates (the 30-year fixed mortgage rate was 6.15% as of Dec 31st, the lowest level in 2025) and rising wage growth. Sales were up by 2.6% yoy after two months in a row of declines.

- Dallas Fed manufacturing business index slipped to -10.9 in Dec (Nov: -10.4), the lowest level since Jun as manufacturing weakened across the board. The production and new orders indices fell 24 and 11 points respectively while the outlook index plunged further to -11.9.

- Initial jobless claims declined for the third consecutive week, as claims fell by 16k to 199k in the week ended Dec 27 (one of the lowest levels this year), and continuing jobless claims also declined, by 47k to 1.866mn in the week ended Dec 20.

- S&P Case Shiller home price index grew by 1.3% yoy in Oct (Sep: 1.4%), the smallest annual increase since Jul 2023 and the ninth straight month when annual gains have slowed. Inflation-adjusted home values seem to have edged modestly lower over the past year.

- Chicago PMI increased to 43.5 in Dec, after falling to a 1.5-year low of 36.3 in Nov, staying below-50 for the 25th straight month. The slower contraction was partly due to less weakness in new orders, production and order backlogs.

- S&P Global manufacturing PMI in the US was confirmed at 51.8 in Dec. New orders declined for the first time in a year, and exports fell for a seventh consecutive month. Tariffs continued to raise input prices: although input cost inflation weakened to an 11-month low, it remained historically elevated.

Europe:

- Manufacturing PMI in Germany slipped to a 10-month low of 47 in Dec (Nov: 48.2), as new orders dropped for the third time in four months and export sales fell for a fifth consecutive month. Input costs meanwhile rose for the first time in almost three years.

- Eurozone’s manufacturing PMI declined to a nine-month low of 48.8 in Dec (Nov: 49.2), as new orders fell at the fastest pace in almost a year and production levels declined for the first time since last Feb. Germany recorded the steepest deterioration while new contractionary readings were recorded in Italy and Spain.

- UK manufacturing PMI eased to 50.6 in Dec (Nov: 50.2), the highest in 15 months: output rose for the third month in a row and new orders increased for the first time since Sep 2024.

Asia Pacific:

- China’s NBS manufacturing PMI ticked up to 50.1 in Dec (Nov: 49.2), the first expansion since Mar, given increases in output (51.7 from 50.0) and new orders (50.8 from 49.2). Employment stayed under-50 (48.2 from 48.4) while input prices rose for the sixth month in a row (53.1 from 53.6). Non-manufacturing PMI rose to 50.2 (from 49.5) supported by domestic demand; new orders and employment fell at a slower pace.

- RatingDog manufacturing PMI in China unexpectedly inched up to 50.1 in Dec (Nov: 49.9) supported by domestic demand thanks to government’s efforts to shore up spending. Production shifted from stagnation to growth and total new orders expanded for the 7th month.

- India’s manufacturing PMI slipped to a two-year low of 55 in Dec (Nov: 55.6) as new work orders rose at the weakest rate since Dec 2023, output levels at the slowest pace since Oct 2022, and employment rose at the slowest pace in the last 22 months.

- Industrial output in India grew by 6.7% yoy in Nov (Oct: 0.4%), the sharpest increase since Oct 2023, with growth up in manufacturing (8.0% from 2.0%) and a rebound in mining (5.4% from -1.8%).

- India’s fiscal deficit widened to INR 9.7trn in Apr-Nov or 62.3% of the annual budget target for 2025-26 (Oct: INR 8.5trn). Receipts and expenditure, at INR 19.49trn and INR 29.25trn, stood at 55.7% and 57.8% of the current budget target.

- Manufacturing PMI in South Korea rebounded in Dec, rising to 50.1 following two months of sub-50 readings (Nov: 49.4). Sales improved due to “new product launches and improved external demand”, new orders gained the most since Nov 2024 and the 12-month ahead optimism surged to a 3.5 year high.

Bottom line: The year 2025 saw the global economy handle US tariffs hikes, a US government shutdown, the AI hype and gains, growing international economic fragmentation as well as geopolitical tensions. The year 2026 started with new geopolitical tensions with the US capture of Venezuelan President Maduro. President Trump stated that the US “world run” Venezuela and the White House is expected to disclose its “next plans” for the country this week. US monetary policy and central bank independence are likely to come under the microscope this year, given selection of the next Fed Chair as Powell’s term is coming to an end.

Regional Developments

- OPEC+ left its oil output unchanged at the latest meeting despite various political crises (Saudi Arabia-UAE tensions related to Yemen, US capture of Venezuela’s President), underscoring the continued prioritisation of stability over geopolitical discord. The decision comes against a backdrop of a significant oil price decline in 2025 driven by oversupply concerns and despite geopolitical tensions.

- Bahrain’s real GDP expanded roughly five-fold since 2000 (to USD 47bn+ by end-2024), reflecting diversification beyond oil and growing private sector activity, albeit underpinned by modest hydrocarbon contributions. Social and economic reforms have bolstered growth, with average monthly wages of citizens nearly doubling between 2005 and 2024.

- Bahrain unveiled a targeted fiscal reform package to strengthen public finances, including measures to improve revenue generation (via increase in fuel prices, higher electricity and water tariffs) and contain expenditures, as part of broader efforts to stabilise the fiscal and debt trajectory. The Cabinet revealed that electricity and water prices will remain unchanged for the first and second tariff bands for citizens’ primary residences.

- The IPO by Silah Gulf (a portfolio company of Bahrain’s sovereign investment arm Mumtalakat) aims to raise USD 7.7mn; the firm is offering 16.36mn new shares or 30% of its issued share capital. The listing is expected to stimulate broader equity market participation and deepen Bahrain’s investor base.

- Bahrain is ranked second regionally and 15th globally on the World Bank’s GovTech Maturity Index highlighting its digital governance strengths, which enhances public sector efficiency and service delivery while reducing administrative costs. Bahrain is classified as having “a very high digital maturity” with an overall maturity rate of 93.6% in 2025 (2020: 51%) reflecting investments in e-government platforms that support transparency.

- Egypt received USD 3.5bn in Qatar-backed financing for a Mediterranean coastal development project, representing a strategically significant injection of capital into infrastructure and real estate sectors. This deal underscores ongoing support from the GCC for Egypt’s economic stabilisation efforts.

- Egypt’s trade deficit narrowed to a decade low during Jan-Oct 2025, driven by robust non-oil export performance (+19% yoy to USD 40.7bn). Trade volume grew by 8% yoy to USD 107.6bn in the same period, also clocking in the highest level in a decade.

- Egypt issued a new EGP 5bn sovereign Sukuk issuance in the wake of recent monetary easing, signalling confidence in domestic fixed-income markets and investor appetite for Shariah-compliant instruments.

- Egypt’s equity market emerged as the top performer in the MENA region in 2025, thanks to rate cuts, improving macro fundamentals, weaker USD increasing appetite for Egyptian risk assets and investor inflows into key sectors such as cement, banking and tourism. The market’s resilience despite broader regional headwinds reflects strengthening domestic demand and clearer policy direction. Separately, the exchange is poised for a potential record year in 2026, with preparations underway for approximately eight new IPOs, mainly in healthcare and tourism, after a strong 42% surge in market-cap last year and rising investor participation.

- Egypt introduced multiple investor incentives to attract fresh GCC and Turkish capital, including streamlined “golden licences” and reduced bureaucratic hurdles, targeting USD 14-15bn in FDI in fiscal 2025-26 after receiving roughly USD 12bn in 2024 (excluding the Ras El Hekma project). The strategy broadens the focus beyond mega deals to include SMEs across green energy, industry (particularly car sector), textiles, logistics and technology.

- Egypt’s credit card ecosystem has expanded markedly, with the number of cards rising 61% over four years to about 6.7mn, supported by corresponding growth in ATMs (+52% to 26k units) and POS terminals (+49% to 258k devices) as consumer payment habits evolve.

- Oman’s 2026 budget projects a 1.5% yoy increase in public spending to OMR 11.977bn, continued investment in development projects and human capital, even as oil revenue volatility remains a constraint. The budget anticipates a deficit of approximately OMR 530mn (a decline of 14.5% from the approved deficit for 2025) against projected revenues of OMR 11.447bn (+2.4%); revenues were calculated on an average oil price of USD 60 per barrel.

- Oman’s Eleventh Five-Year Development Plan for the period 2026–2030) expects a real growth rate of approximately 4%, with targeted emphasis on manufacturing, tourism, and the digital economy to drive value-added growth, increase private investment, and accelerate non-oil export expansion. It also reinforces a gradual transition to a low-carbon economy and the implementation of sustainable environmental policies, as well as policies enhance national export capacity and generate job opportunities for the citizens.

- The Omani government earmarked around OMR 1.2bn for labour market initiatives under the newly announced 11th five-year development plan, including incentives tied to public contracts to encourage employment and national workforce participation. The Plan targets the creation of 700k job opportunities.

- Oman rolled out its 2026-2030 SME Sector Implementation Plan to deepen market access, boost competitiveness, and expand SME contribution, reflecting a pivot toward a more active private sector. The plan emphasises financing, value chain integration, and innovation as core pillars to support entrepreneurship and job creation.

- Oman awarded new public projects worth nearly OMR 363mn (USD 940mn) to boost growth and create jobs, particularly in road construction, pharmaceuticals, chemicals and food processing (to be rolled out in Q1 2026).

- Oman’s aviation industry contributes roughly USD 1.8bn in GDP and supports some 42,000 jobs, according to a report by IATA. This is supported by tourism-driven spending (nearly USD 2.9bn annually) and cargo contributions enhancing trade linkages.

- Qatar’s real GDP expanded by 2.9% to QAR 186.1bn in Q3 2025, supported by a 4.4% jump in non-hydrocarbon activities such as construction (9.1%), wholesale & retail trade (8.9%) and accommodation (6.4%). With non-hydrocarbon sectors constituting about two-thirds of output, domestic demand and infrastructure spending have offset headwinds from energy price volatility.

- Qatar’s General Tax Authority announced the tax return filing window for the 2025 financial year to be from Jan 1 to Apr 30, 2026.

- Qatar is on track for a record tourism year with over 5.1mn visitors in 2025, given strong international demand and the successful hosting of global events. This has boosted service-sector employment and deepens integration into global tourism networks.

- The food and beverage sector attracted roughly USD 22bn in FDI projects across the Arab region since 2003, according to data from Dhaman. The UAE, Saudi Arabia, Egypt, and Qatar led in project counts and capital deployment, reflecting investor confidence in demographic-driven demand and supply chain expansion. This FDI inflow generated about 93k jobs from 516 projects and signals the sector’s strategic importance to regional value chains.

Saudi Arabia Focus

- Saudi non-oil exports (including re-exports) surged by 32.3% yoy in Oct alongside overall exports up by 11.8% and imports rising 4.3%. China was the leading trade partner in both exports and imports, accounting for 14.1% of total exports and 24.8% of total imports.

- Net FDI inflows into Saudi Arabia rose 34.5% yoy and 5.2% qoq to SAR 24.9bn in Q3, signalling renewed investor confidence in Saudi’s reform trajectory and large-scale project pipeline.

- Overall unemployment rate in Saudi Arabia stood at 3.4% in Q3 2025, higher than Q2’s 3.2% but lower than Q3 2024’s 3.7%. Unemployment rate among Saudis reached 7.5% (Q2: 6.8%), with male and female unemployment rates ticking up to 5.0% and 12.1% respectively (Q2: 4.3% and 11.3%). Labour force participation rates remained a high 66.9% overall.

- Saudi Arabia’s digital economy share reached 16% of GDP in 2024 (2023: 15.6%), reflecting rapid adoption of digital services, fintech, e-commerce, and government platforms. A further breakdown showed that the contribution of the core and narrow digital economy stood at 2.7% and 2.4% of GDP respectively while the largest share was for the broad digital economy (10.9%). The value of exports and re-exports of ICT goods surged 118% yoy to SAR 25.8bn in 2024.

- Saudi Arabia approved regulatory frameworks for four special economic zones effective Apr 2026, offering tailored incentives aimed at attracting foreign investment, boosting exports, and accelerating sector-specific clusters. The zones cover priority sectors including maritime, mining, advanced manufacturing, logistics and automotive sectors among others.

- Saudi Arabia’s National Debt Management Centre finalized a USD 13bn seven-year syndicated loan to finance utility-related investments, underscoring the country’s medium-term debt strategy of diversified funding channels to support large-scale infrastructure and energy transition projects.

- The Saudi finance ministry increased its stake in the Binladin International Holding Group to 86.38%, highlighting the state’s ongoing role in restructuring strategically important construction firms following earlier financial stress. No financial details were disclosed for move, which was described as a debt to equity conversion deal.

- Saudi Arabia has rolled out a four-tier excise tax on sweetened beverages from Jan 2026, shifting from a flat 50% rate, designed to influence consumption patterns as well as aligning public-health objectives with revenue diversification efforts.

- New mining exploration and development licences in Saudi Arabia were awarded to 24 companies, reinforcing mining as a strategic pillar of resource security. This covers three mineralised belts in the regions of Riyadh, western Medina, and Qassim in central Saudi Arabia covering more than 24,000 square kilometres.

- Saudi issued tax bills to 60k+ landowners under updated land-use regulations (“White Land” fees) aimed at discouraging speculation and boosting urban land supply. Owners must now pay an annual tax of 10% of a property’s value, up from 2.5%; this is applicable to plots larger than 5,000 square metres.

- King Abdulaziz International Airport handled a historic 53.4mn passengers, 310k flights and 60.4mn pieces of luggage in 2025, positioning it among the world’s busiest hubs as Saudi civil aviation expands connectivity and capacity. This milestone underscores the airport’s growing role as a regional gateway for tourism, business travel, and pilgrimage flows.

- Saudi Arabia approved its 2026 borrowing plan with financing needs of approximately SAR 217bn (USD 57.8bn) to cover an expected deficit and debt maturities (estimated at SAR 52bn), signalling an active debt management strategy. The plan will be funded via a diversified mix of domestic bonds, international markets and private-market instruments.

- Saudi Arabia’s Capital Market Authority has proposed a draft framework regulating real estate ownership – how listed companies, investment funds, and special purpose entities own real estate and other in-kind property, aligning with the upcoming Non-Saudi Real Estate Ownership Law expected in early 2026. The reforms aim to strengthen oversight, improve market transparency, and increase attractiveness to both domestic and international investors.

UAE Focus

- The UAE and Egypt are moving to finalise negotiations on a Comprehensive Economic Partnership Agreement (CEPA) aimed at boosting bilateral trade and investment, particularly in value-added manufacturing and services sectors. The agreement is designed to boost competitiveness and economic integration between the two economies. Timely conclusion and effective implementation of the CEPA could enhance capital flows and export diversification.

- Sharjah’s 2026 budget approval of AED 44.5bn (up 3% compared with the 2025 budget) reflects continued public investment in infrastructure, services, and socioeconomic development, signalling fiscal priorities aimed at supporting sustainable growth and quality of life enhancements. While public revenues are estimated to rise by 26% yoy, the share of tax revenues is expected to double to 16% of public revenues (vs 2025 budget tax revenue).

- UAE’s Ministry of Human Resources and Emiratisation has raised the private sector minimum wage for Emirati nationals to AED 6,000 per month starting Jan 2026, tying compliance to work-permit issuance and other enforcement mechanisms by end-Jun. This policy is part of a broader Emiratisation strategy aimed at incentivising citizen participation in the private labour market.

- The UAE introduced a new tax structure on sugary drinks starting Jan 1st: the “tiered-volumetric model” links the amount of tax imposed to the quantity of sugar and other sweeteners per 100ml of the beverage. This measure is aimed at improving public health outcomes and diversifying fiscal revenue streams.

- Abu Dhabi Investment Authority (ADIA) backed the IPO of Chinese AI firm Minimax, investing USD 65mn to acquire 3.35 million shares: this shows sovereign capital’s shift toward strategic technology investments, confidence in high-growth digital markets and cross-border portfolio diversification.

- Dubai Duty Free posted robust sales of approximately AED 8.7bn in 2025, up 10% yoy, benefiting from strong international tourism inflows and sustained consumer spending in travel retail. The top five selling categories for the year were perfumes (18%+ of total sales, valued at AED 1.6bn), liquor (AED 1.1bn), gold (AED 896.5mn), tobacco and confectionery.

Media Review:

Ten charts to help make sense of markets in 2025

https://www.reuters.com/markets/what-just-happened-ten-charts-help-make-sense-markets-2025-2025-12-31/

Donald Trump’s great Venezuelan oil gamble

https://www.economist.com/finance-and-economics/2026/01/04/donald-trumps-great-venezuelan-oil-gamble

Clashes in Yemen & the UAE-KSA alliance

https://www.ft.com/content/2097d5e6-5e59-4af8-bcda-3707d8e9f9ef

https://www.bbc.com/news/articles/cjrz34qdr9no

UAE foreign policy in spotlight after Yemen escalation

https://www.reuters.com/world/middle-east/uae-foreign-policy-spotlight-after-yemen-escalation-2025-12-31/

Powered by: