Download a PDF copy of the weekly economic commentary here.

Markets

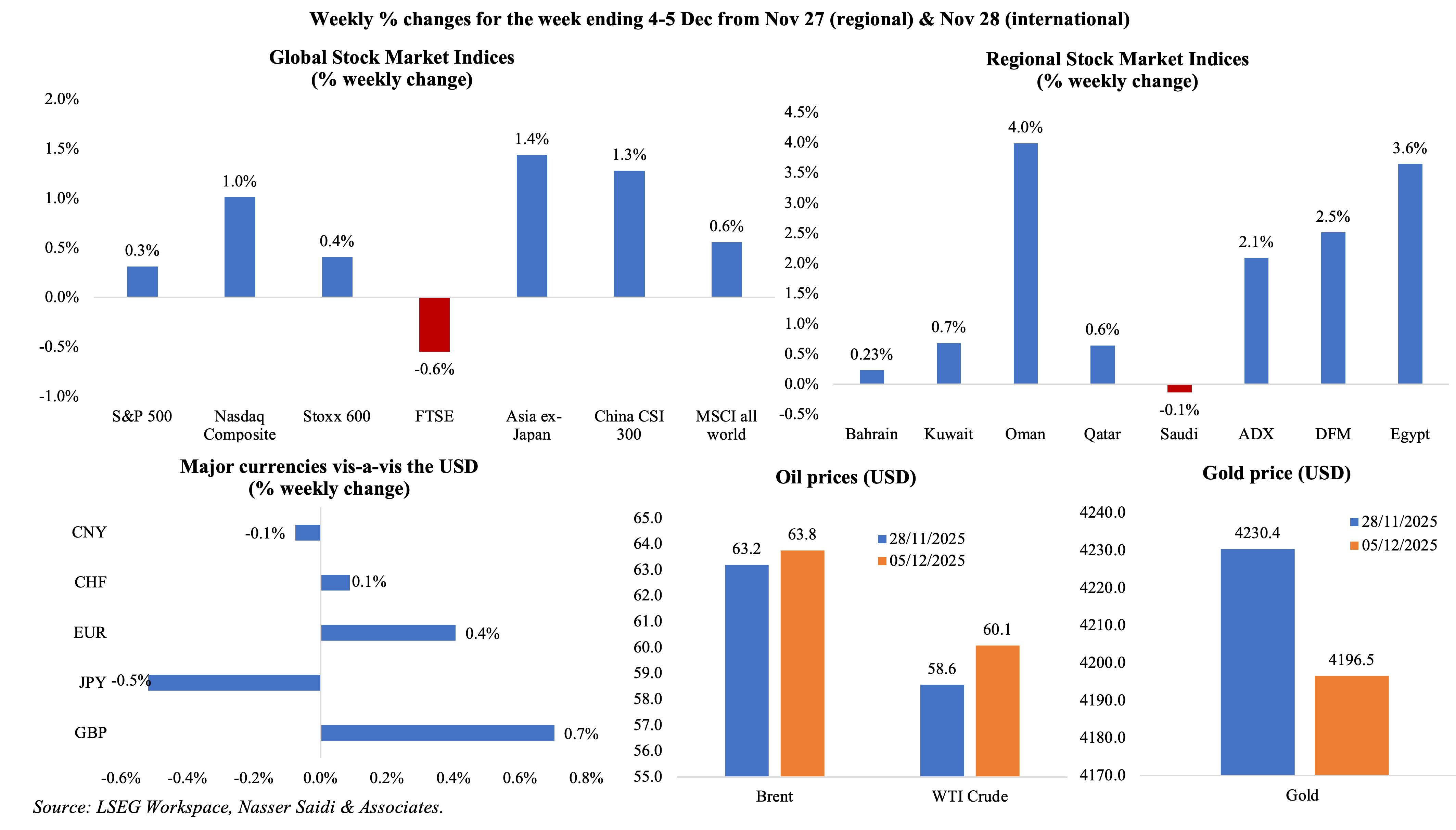

Fed rate cut expectations affected market performance through last week. Equity markets were mostly up for a second consecutive week, with investors expecting a 25bps rate cut at the Fed meeting this week. Regional markets posted significant gains on higher oil prices, excluding Saudi where a minor 0.1% drop was recorded: DFM gained 2.5% (the most in 4 months) and ADX was up by 2.1% (the best since late-Jun). The USD was weighed down by the expectation of a Fed rate cut and the euro touched an almost 7-week high. Oil prices ticked up slightly higher while gold price slipped by 0.8%.

Global Developments

US/Americas:

- Personal income in the US grew by 0.4% mom in Sep, following a similar gain in Aug, supported by an increase in wages (0.4%). Personal spending was up 0.3% (from 0.5% in Aug) on higher prices for gasoline, as well as housing and utilities. The saving rate was unchanged at 4.7%.

- Core PCE price index, the Fed’s preferred inflation measure, cooled slightly – ticking up by 0.2% mom and 2.8% yoy in Sep (down from 2.9% yoy in both Jul and Aug). The headline PCE price index rose 0.3% mom and 2.8% yoy (the largest increase since Apr 2024): prices of goods and services rose by 0.5% and 0.2% respectively.

- US private sector cut 32k jobs in Nov (Oct: 47k), the biggest drop since Mar 2023, consistent with a broader trend of labour market rebalancing. Though job losses remain modest in historical context, the decline was led by small establishments (where jobs plunged by 120k).

- Initial jobless claims fell by 27k to 191k in the week ended Nov 29, lowest since Sep 2022, and continuing jobless claims also declined, by 4k to 1.939mn in the week ended Nov 22.

- US industrial activity showed tentative signs of stabilization. Industrial production rebounded in Sep, up 0.1% mom (Aug: -0.3%), thanks to a jump in utilities output (1.1% vs -3.0% in Aug). Capacity utilisation was unchanged at 75.9%. Factory orders grew by 0.2% mom in Sep (Aug: 1.3%) indicating continued demand for manufactured goods albeit at a slower rate; transportation equipment orders climbed for a second month.

- Services PMI in the US clocked in at 54.1 in Nov, down from a preliminary 55.0 and Oct’s 54.8, supported by resilient demand and new orders rising the most since early this year, though firms faced a sharp acceleration in input cost inflation (a 6-month high).

- The ISM surveys echoed the theme of sectoral divergence.ISM manufacturing PMI slipped to 48.2 in Nov (Oct: 48.7), staying below-50 for the ninth month in a row, as new orders slipped (47.4 from 49.4) as did employment (44 from 46) while prices paid inched up to 58.5 (from 58). ISM services PMI inched up to 52.6 in Nov (Oct: 52.4), the strongest growth in nine months, despite the plunge in new orders (52.9 from 56.2) while employment rose (48.9 from 48.2) and prices paid eased (65.4 from 70).

- The University of Michigan consumer sentiment contributed a cautiously optimistic note, rising to 53.3 in Dec (Nov: 51.0), the first improvement in five months. The one- and five-year expectations fell to 4.1% and 3.2% (from 4.5% and 3.4% respectively).

Europe:

- Eurozone inflation dynamics remained broadly stable in Nov: the preliminary headline inflation inched up to 2.2% (Oct: 2.1%), as services inflation accelerated to 3.5% (the highest since Apr) while core inflation held steady at 2.4%. Energy prices fell at a slower pace (-0.5% from -0.9%). German inflation rose to the highest since Feb (2.6%) while Spain and Netherlands’ rates eased to 3.1% and 2.6% respectively.

- Retail sales in the eurozone grew by 1.5% yoy in Oct (Sep: 1.2%) – with increases in sales of food, drinks and tobacco (0.9%), non-food products except fuel (2.1%) and automotive fuel (1.8%) – reflecting some resilience in real purchasing power as inflation eases. However, monthly sales were stagnant, reinforcing the view that household spending remains cautious.

- Eurozone’s manufacturing PMI declined to 49.6 in Nov (prelim: 49.7), signalling a renewed contraction in activity after a brief stabilisation in Oct (to 50). Germany and France saw PMI readings fall to 9-month lows, in stark contrast to the rest of the bloc. Job losses continued, and new export orders fell for the fifth month in a row. In contrast, services PMI rose for the sixth consecutive month, up to 53.6 (vs prelim: 53.1; Oct: 53.0): this was the fastest pace of growth since May 2023.

- Producer price index in the euro area fell 0.5% yoy in Oct (Sep: -0.2%), the third consecutive month of yoy decline, on lower energy prices (-3.9%).

- Unemployment rate in the euro area was unchanged at 6.4% in Oct, close to historic lows, while the youth unemployment rate stood at 14.8% (unchanged from Sep’s reading).

- Manufacturing PMI in Germany retreated further to a 9-month low of 48.2 in Nov (vs prelim of 48.4 and 49.6 in Oct), dragged down by a drop in new orders and weak export sales (on softer demand from key markets including in Asia). Employment continued to fall, though at a slower pace, and output charges fell following Oct’s uptick. Services PMI slipped to 53.1 compared to Oct’s 54.6 (a 29-month high) but stood higher versus preliminary reading of 52.7.

- German factory orders fell by 0.7% yoy in Oct (Sep: -3.4%), driven by large scale orders, while in monthly terms orders grew by 1.5% (from 2%).

- Manufacturing PMI in the UK ticked up to 50.2 in Nov (Oct: 49.7), the first increase since Sep 2024, thanks to improvements in domestic demand, production and new orders. Meanwhile, input cost pressures eased to their lowest level in just over a year, selling prices fell for the first time since Oct 2023 and 12-month ahead outlook rose to a 9-month high.

Asia Pacific:

- China’s NBS manufacturing PMI stood at 49.2 in Nov (Oct: 49.0), staying below-50 for the eighth month in a row. New orders fell for the fifth consecutive month (49.2 from 48.8) alongside weak foreign sales (47.6) and employment (48.4). The NBS non-manufacturing PMI slipped to 49.5 (from 50.1), the lowest since Dec 2022. Both readings underscore the persistence of sluggish demand, particularly in construction and real estate linked services, and point to continued pressure on firms’ operating conditions.

- The RatingDog manufacturing PMI in China fell to 49.9 in Nov (Oct: 50.6), the lowest since Jul, on stagnant output and new orders and despite foreign orders rising at the fastest pace in eight months.Furthermore, services PMI eased to 52.1 (from 52.6), highlighting a modest slowdown in activity, while business sentiment declined to one of the lowest on record.

- Manufacturing PMI in Japan eased to 48.7 in Nov from the preliminary reading of 48.8 but higher than Oct’s final reading of 48.2. Firms reported milder declines in output and new orders on weak customer demand, while employment increased for the 26th month in a row.

- Overall household spending in Japan unexpectedly fell by 3.0% yoy in Oct (Sep: 1.8%), the first decline in six months and the most since Jan 2024. A ministry official related this decline to declines in spending on food (-1.1%, dropping for the fifth month in a row) and automobile-related expenses (a 27.9% plunge in vehicle purchase costs).

- Monetary policy took a dovish turn in India, with the Reserve Bank of India lowering the repo rate by 25 bps to 5.25% (the fourth rate cut since Feb 2025) while the reverse repo was left untouched at 3.35%. The RBI governor stated that US tariff hikes have a “minimal impact” on the economy; furthermore, the inflation forecast was lowered to 2.0% this fiscal year (from 2.6% previously) and GDP growth was projected to increase to 7.3% (from 6.8% previously).

- Industrial output in India slowed sharply in Oct, rising by 0.4% yoy from Sep’s upwardly revised 4.6% gain, taking the cumulative output to 2.7%. Manufacturing output followed a similar trajectory, growing by 1.8% in Oct (Sep: 5.6%) while capital goods output grew by 2.4% (Sep: 5.4%).

- India’s manufacturing PMI edged down to 56.6 in Nov (prelim: 57.4 and Oct: 59.2), remaining firmly in expansionary territory despite its decline, underscoring the continued strength of output and new orders while new export orders slipped to a 13-month low. The 12-month ahead positive sentiment fell to its lowest in nearly 3.5 years. Services PMI accelerated to 59.8 (from 59.5), illustrating sustained strength in domestic services demand. Input cost inflation retreated to its lowest level since Aug 2020 and resulting in selling prices at the weakest in over four years.

- Current account deficit in India stood at USD 12.3bn or 1.3% of GDP in Jul-Sep 2025, moderating from the USD 20.8bn deficit (or 2.2% of GDP) in the same period a year ago though widening from the Apr-Jun quarter’s reading of USD 2.4bn.

- South Korea’s Q3 GDP grew by 1.3% qoq and 1.8% yoy (prelim: 1.2% qoq and 1.7% yoy), the strongest qoq gain since Q4 2021, benefitting from higher construction investment (0.6%), government spending (1.3%) and private consumption (1.3%).

- Trade surplus in South Korea widened to USD 9.735bn in Nov (Oct: USD 5.995bn), the largest surplus since Sep 2017. Exports grew for the sixth month in a row, up 8.4% yoy in Nov, supported by improved global tech demand especially for semiconductors (38.6% yoy to a record-high USD 17.26bn). Imports grew by 1.2%, rebounding from Oct’s 1.5% drop.

- Current account balance in South Korea has been in surplus since May 2023: with Oct surplus at USD 6.81bn (Sep: USD 13.47bn), the cumulative surplus for the period Jan-Oct stands at USD 89.6bn (the highest ever for this period).

- Retail sales in Singapore grew by 2.3% mom and 4.5% yoy in Oct (Sep: -1.7% mom and 2.7% yoy). The monthly rebound reflects tourism flows (including higher arrivals for the Singapore F1 in Oct) and seasonal spending. Watches & jewellery sales grew the most (25% yoy) followed by recreational goods (20.4%) while sales at department stores were up 2.8%.

Bottom line: The Fed is widely expected to cut rates by 25 bps, with the CME’s FedWatch showing a near 90% chance of a rate cut. The government shutdown had delayed the release of key data, and missing even now are Nov inflation data as well as jobs for Oct and Nov. The BoE is expected to cut rates later this month: GDP data this week should offer more clarity. Final PMI readings for Nov show the US leading across developed nations while in the eurozone, Spain was the better performer; India led key emerging markets while growth was slower in China. Overall, economic uncertainty continues to affect business sentiment negatively and this is also seen in slow hiring patterns.

Regional Developments

- The IMF’s latest GCC report forecasts growth to accelerate to 3.3% this year (2024: 1.7%), supported by the unwinding of oil production cuts as well as robust non-hydrocarbon activity. The report also stated that further fiscal consolidation would be needed in the medium- to long-term (of about 6 to 18% of non-oil GDP) in Bahrain, Kuwait, Oman and Saudi Arabia. More structural reforms were proposed spanning productivity enhancing reforms (leveraging digitalization and AI), deepening of domestic financial markets (increase depth of credit to SMEs, local currency bond markets) and trade & financial integration. More: https://www.imf.org/en/publications/policy-papers/issues/2025/12/05/gulf-cooperation-council-gcc-enhancing-resilience-to-global-shocks-economic-prospects-and-572372

- The World Bank’s Gulf Economic Update report highlights that the UAE and Saudi Arabia will lead growth in the bloc (4.8% and 3.8% growth forecast this year), thanks to balanced growth and export-diversification efforts. The report called for Gulf states to accelerate AI adoption and structural reforms to sustain growth, while also emphasising that digital infrastructure, AI readiness and non-hydrocarbon export diversification are now essential rather than optional. More:https://documents.worldbank.org/en/publication/documents-reports/documentdetail/099703212012571773

- Bahrain lowered the minimum real estate investment required to qualify for the Golden Residency Visa to BHD 130,000 from BHD 200k previously, a roughly 35% reduction. The lower threshold broadens eligibility to a wider pool of foreign investors, professionals, retirees, and high-skilled individuals enabling the country attract long-term foreign capital and talent.

- Egypt’s PMI recorded the first expansion since Feb, rising to 51.1 in Nov (Oct: 49.2) and the highest since Oct 2020 (suggesting improving domestic and external demand). Output rose for the first time since Jan and new orders rise at the quickest rate in five years.

- Egypt’s economy grew by 5.3% in Q1 of fiscal year 2025-26, the fastest quarterly growth in over three years, driven by robust performance in construction, trade, electricity, financial services and tourism. Total implemented investments grew by 24.2% yoy to EGP 278.7bn in Q1, a sign of strong capital formation and signalling a shift toward private-led growth rather than public-driven investment. Private sector investments achieved outstanding growth of 25.9%, accounting for 66% of total investments during the quarter, while public investment fell to 34% of the total.

- Egypt banking sector’s net foreign assets climbed to EGP 1.07trn (USD 22.656bn) by Oct, a strong reversal from deficits in recent years, indicating improved foreign-currency buffers for banks. Foreign-currency deposits fell 1.8% mom to EGP 2.992trn in Oct, across both demand deposits and time/savings deposits. At the same time, local-currency deposits rose, and M2 increased, more activity and saving in domestic currency.

- In Egypt’s second package of tax incentives, plans include replacing capital-gains tax on listed securities with a stamp duty – a move aimed at improving attractiveness of the Egyptian Exchange for institutional and retail investors. Other measures include three-year benefits for companies listing on the stock exchange (conditional on improving trading volume), lower VAT or exemptions on some goods/services, and streamlined procedures for tax payments and refunds. This forms part of a broader reform agenda to improve the investment climate, broaden the tax base, and support private-sector growth.

- Egypt unveiled a revamped incentives package to attract international mining firms, including reduced early-stage fees, tax and customs exemptions, and a streamlined licensing system via single-license issuance for multiple minerals.

- Bilateral trade between Egypt and US grew by 14% yoy to USD 5.6bn in H1 2025. An official statement also revealed that US investments in Egypt reached USD 9.44bn, with an American equity contribution of USD 2.47bn as of end-Feb 2025.

- Tourist arrivals into Egypt grew by 21% yoy to 15mn in Jan-Sep, prompting the country to raise its tourist target to nearly 19mn this year. US arrivals grew by 20% yoy to near 529k.

- PMI in Kuwait rose to a four-month high of 53.4 in Nov (Oct: 52.8), thanks to the increase in new orders. Job creation increased to a five-month high while the 12-month outlook sentiment rose for the third straight month to the highest level in 18 months.

- Kuwait’s Cabinet approved a law criminalising cash transfers outside the formal banking system, including informal remittance or “alternative remittance” networks often used by expats. This aims to reduce financial-crime risks, enhance transparency, and ensure all cross-border and domestic transfers flow through regulated, monitorable channels.

- Lebanon PMI rose to 51.3 in Nov (Oct: 50.6), with new orders at a joint-survey record. The 12-month outlook index stood at a firmly pessimistic 40.1, staying low for the sixth month in a row, dampened by security concerns.

- Oman’s bond and sukuk market expanded nearly 16% yoy to OMR 4.98bn by end-Q3, according to the Capital Market Authority. Omani investors continued to lead trading activity, with purchases totaling OMR 43.6mn compared with OMR 8.7mn by foreign investors.

- Qatar’s industrial producer‑price index (PPI) fell by 3.64% mom and 10.6% yoy, dragged largely by a drop in mining output prices (particularly crude oil and natural‑gas extraction). Within the PPI basket, while mining weakened sharply, manufacturing component showed modest growth – with gains in food products, chemicals, rubber/plastic, and beverages.

- Qatar PMI inched up to a 3-month high of 51.8 in Nov, thanks to new orders (the first increase in 6 months) and job creation was the fifth highest in the survey’s history with hiring up for sales, marketing, operations and new projects.The headline reading was however slightly below the long-run average of 52.2 since 2017 and overall input costs fell for the fourth consecutive month.

Saudi Arabia Focus

- Saudi Arabia’s PMI slipped to 58.5 in Nov from Oct’s multi-year high of 60.2. The output subindex recorded the fastest pace in 10 months, and new orders remained elevated, though slower versus Oct. Employment slowed from Oct’s quickest pace of hiring since Nov 2009 and wage inflation was near historical highs.

- Saudi Arabia approved its 2026 state budget with a projected deficit of SAR 165bn, equivalent to 3.3% of GDP (versus the estimated 2025 deficit of SAR 245bn). Oil revenues share is estimated at almost two-thirds of total revenues of SAR 1147bn next year (vs 70% in 2024 and an estimated 64% in 2025). Spending is being re-prioritised: away from real estate “giga-projects” and more spending is directed toward infrastructure upkeep, essential public services (health, education) and improving quality-of-life indicators.

- SAMA’s total assets increased by 6.6% yoy to SAR 1.91trn in Oct, supported by growth in overseas deposits (10.6% to SAR 343.9bn) while foreign-currency and gold holdings grew by 3.8%. Net foreign assets grew in yoy terms after 10 consecutive months of declines, up 1.5% yoy to SAR 1.57trn. Pace of credit growth was healthy (12.0% yoy in Oct and 13.8% average this year), also outpacing deposit growth (averaged 8.6% in Jan-Oct) for 21 straight months. Banks’ claims on public sector hit a record SAR 895.3bn; government deposits, which accounted for just 13.9% of total deposits, grew sharply by 1.9% mom & 6.7% yoy.

- Saudi Arabia’s total international trade grew by 8.6% yoy to SAR 540.5bn in Q3, with merchandise exports accounting for 56.1% of the total and imports standing at SAR 237.2bn. Oil exports represented 68.5% of total exports and non-oil domestic exports (excluding re-exports) were down 0.4% yoy to SAR 57bn. Asian countries led Saudi exports, accounting for 71.7% of the total, while China remained the top destination for Saudi exports (14.9 % of the total), followed by the UAE (10.8%) and India (9.5%).

- Tadawul’s CEO stated that there are about 40 new IPO applications under review by the regulator, while 80 to 100 companies have started preparing to list – underscoring a push to deepen capital markets and attract more foreign investor capital.If even a fraction of these IPOs come to fruition, Tadawul could significantly broaden its sectoral base and liquidity.

- Al Ramz launched the retail tranche of its IPO on 7 Dec, offering 20% of the total 12.86mn new shares, after institutional demand already oversubscribed the offering by about 11 times. The firm plans to use roughly 37% of proceeds for developing new projects, 36% to finance investments in real estate funds, 23% for general purposes and 4% to cover IPO expenses.

- PIF secured an inaugural A-1 short-term credit rating with a stable outlook from S&P Global, reflecting confidence in its “robust balance sheet, strong liquidity position, and disciplined financial management”. This will likely lower borrowing costs and improve PIF’s capacity to attract co-investors, strengthening the overall investment climate Saudi Arabia.

- PIF plans to increase its investments in Japan to USD 27bn by 2030, significantly higher than the USD 11.5bn invested through 2024 (since 2017), according to the PIF governor.Strengthening ties with Japan could open access to advanced technologies, supply chains and financial markets supporting Saudi’s diversification. Saudi also targets attracting Japanese firms in 6 priority areas including travel, tourism & entertainment, industrial & logistics and clean energy & renewable infrastructure among others.

- Official data show 5,651 mineral sites were discovered in Saudi Arabia last year and there was a 21% cumulative surge in mining licences issued since 2016 – both signalling rapid expansion of the mining sector.Non-metallic minerals were the majority share of discovered sites (54.1% of the total), though metallic deposits are also present – underscoring potential for export and industrial input supply. Separately, Saudi opened a bidding round for three mineral exploration licences across a 13,000 km2 area, according to the Industry and Mineral Resources Ministry.

- Revenues of Saudi Arabia’s nonprofit organizations grew by 22% to SAR 73.1bn in 2024. Among the various sectors, education and research groups accounted for 29% of total revenue, followed by health organizations (24%) and culture and recreation entities (19%). GASTAT report disclosed that 42% of employees in the nonprofit sector work in culture & recreation.

- Saudi Arabia and Russia agreed to mutual visa-free travel for citizens of both countries for tourism, business or family trips. The deal, signed at a Saudi-Russian Investment & Business Forum, allows stays of up to 90 days per year under ordinary passports, is expected to boost inbound Russian tourism and strengthen bilateral economic and cultural links.

UAE Focus

- UAE PMI jumped to a 9-month high of 54.8 in Nov (Oct: 53.8), also posting the fastest growth in 11 months, on improved customer demand, output growth (highest increase this year) and a strong pickup in new orders (57.4 from 56.0). Employment grew to its highest level in 18 months, even as input cost inflation ticked up to the most in 14 months, driven by rising wages and cost-of-living adjustments.

- UAE announced an ambitious target to produce 60 trillion AI tokens via its Stargate AI campus in Abu Dhabi. Roughly equivalent to 60% of global token production, this goal underscores the UAE’s goal to be a leading centre for AI infrastructure and establishing itself as the “world’s factory of intelligence”. No timeline was specified for this goal.

Media Review:

The 3S axis: Syria, Saudi Arabia and the SilkLink revolution

https://www.agbi.com/opinion/infrastructure/2025/12/the-3s-axis-syria-saudi-arabia-and-the-silklink-revolution/

Syrian central bank welcomes Visa’s launch amid digital payments deal

https://www.reuters.com/world/middle-east/visa-plans-syria-launch-after-deal-with-central-bank-digital-payments-2025-12-04/

Kuwait’s Vision 2035 plan reaches critical juncture

https://www.agbi.com/analysis/finance/2025/12/kuwaits-vision-2035-plan-reaches-critical-juncture/

The power crunch threatening America’s AI ambitions

https://ig.ft.com/ai-power/

Do Markets Believe in Transformative AI?

https://www.nber.org/papers/w34243

How Stablecoins Can Improve Payments and Global Finance

https://www.imf.org/en/blogs/articles/2025/12/04/how-stablecoins-can-improve-payments-and-global-finance

Powered by: