MENA Momentum Continues: UAE Credit Uptick, Saudi Trade Gains, and Rising Air Traffic: Weekly Insights 28 Nov 2025

1. UAE deposits grow at an average 12.2% pace in Jan-Sep; credit growth inching closer

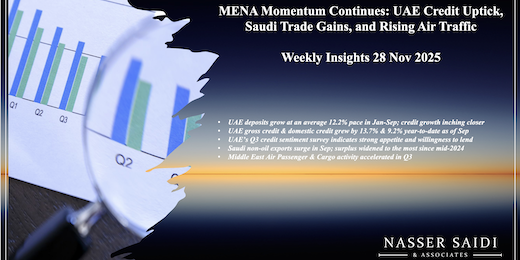

- UAE’s gross bank assets continue to grow at a fast pace: it increased by 14.1% year-to-date (ytd) to a record AED 5.199trn in Sep. The central bank’s total assets grew to AED 1.012trn in Sep, up 18.4% yoy & 0.4% mom.

- Central bank’s net international reserves grew 0.5% mom to AED 966.99bn, but its gold holdings have jumped to AED 28.9bn (10.6% mom and 46% ytd).

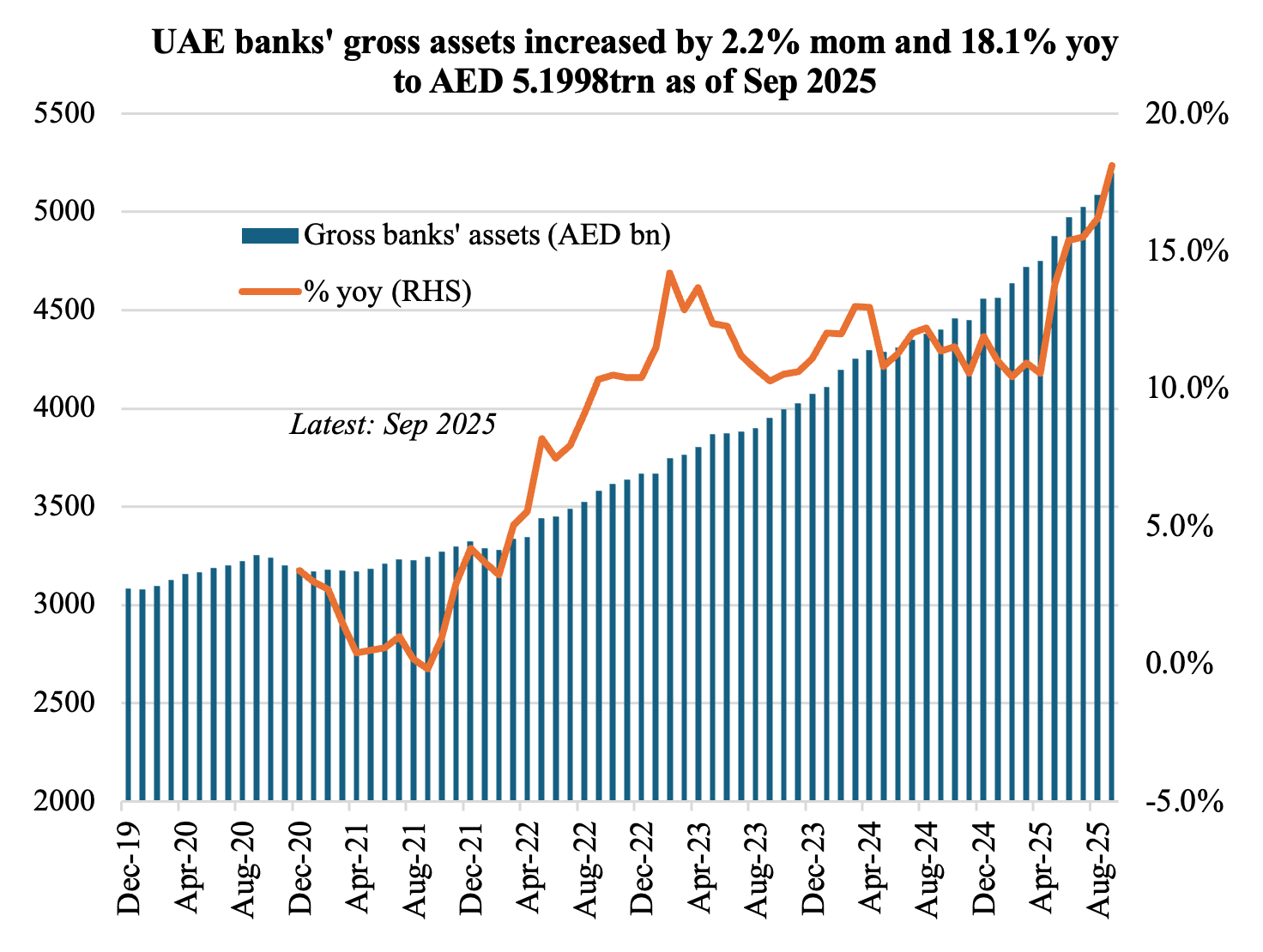

- UAE banks’ deposits grew at an average 12.2% pace in Jan-Sep 2025. It grew 15.4% yoy in Sep, thanks to a 13.5% yoy rise in resident deposits (to AED 2.9trn) and 38.0% growth in non-resident deposits (9.3% of total deposits).

- Private sector deposits (at AED 2.1trn) accounted for 73% of residents’ deposits (13.5% yoy). Government & GREs, accounted for one-fourth of residents’ deposits, rising by 4.7% yoy and 8.1% % respectively.

2. UAE gross credit & domestic credit grew by 13.7% & 9.2% year-to-date as of Sep

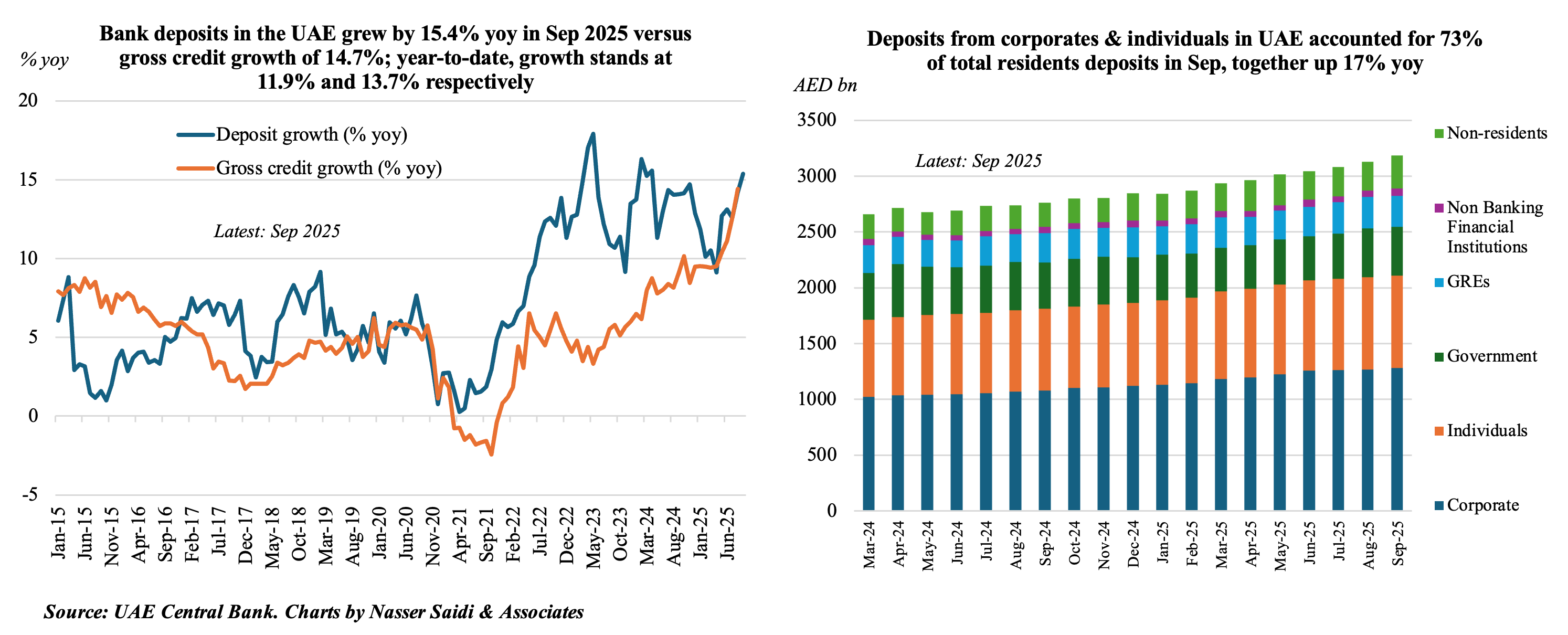

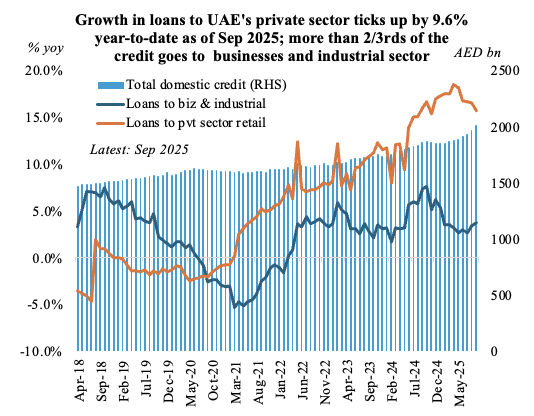

- Average growth in Jan-Sep 2025 of gross credit (11.2% yoy) and domestic credit (6.0% yoy) lagged overall deposit (12.2%) in the UAE. Year-to-date, both gross credit & bank deposits are up by 13.7% and 11.9% respectively.

- Gross credit in the UAE grew by 2.5% mom and 14.7% yoy to AED 2.478trn in Sep. This was driven by growth in domestic credit (8.2% yoy to AED 2.01trn) and a surge in foreign credit (54.5% yoy to AED 466.8bn). Foreign credit also includes loans and advances to non-residents, which grew by 59.6% yoy to AED 39.1bn.

- Loans to the private sector accounted for close to three-fourths of domestic credit. Loans to the government increased by 17% yoy to AED 226.4bn while growth of loans to GREs fell 2.4% to AED 276.6bn.

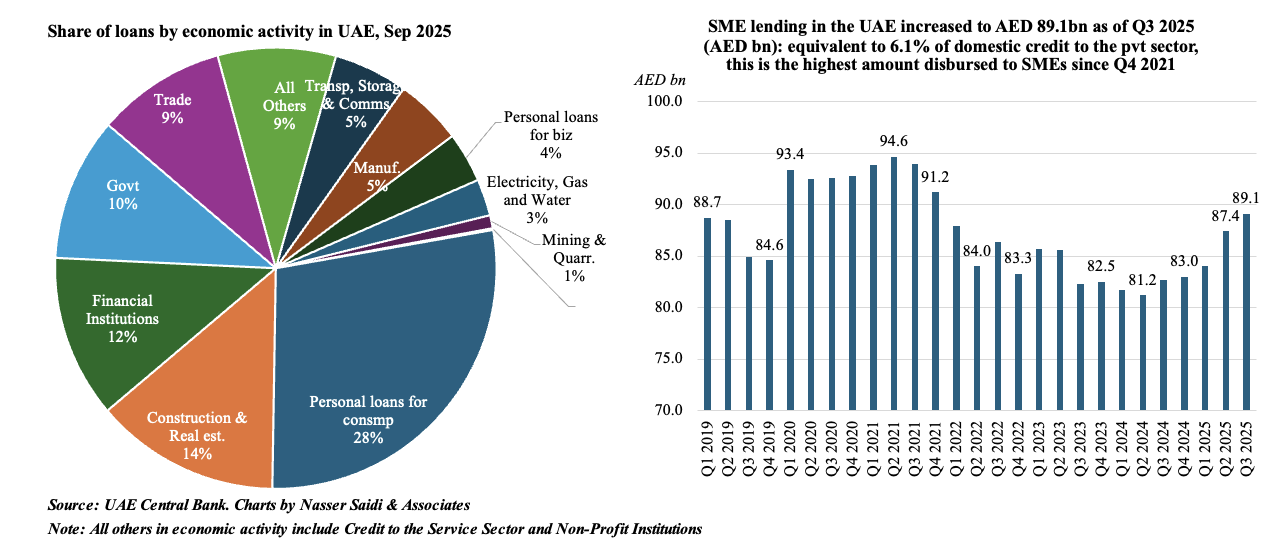

- Lending to SMEs increased to AED 89.1bn, the most since end-2021, up 7.7% yoy (fastest growth since Q4 2020) and 1.9% qoq.

- When classifying bank credit to residents by economic activity, construction & real estate (14%), financial institutions (12%) and government (10%) were among the top.

3. UAE’s Q3 credit sentiment survey indicates banks’ strong appetite and willingness to lend; rapid increase in personal lending

- Loans disbursed to UAE’s business & industrial sector accounted for 45.8% of total domestic credit in Sep 2025. It grew by 3.7% yoy in Sep (& 5.6% year-to-date) versus a faster pace in the private retail sector (9.4% yoy and 15.7% ytd).

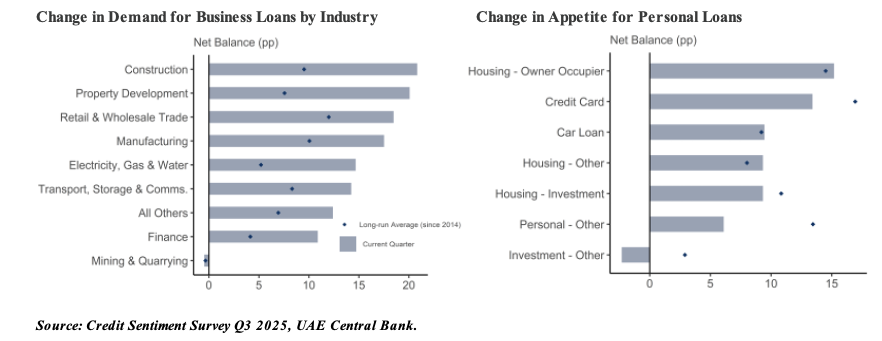

- The UAE central bank’s Q3 2025 credit sentiment survey shows a strong appetite for credit demand. But domestic credit grew by 8.2% yoy in Sep, at a quicker pace than 6.0% and 7.5% in Jul and Aug respectively.

- Demand for business loans rose in Q2 2024: demand was strongest from Dubai (among all emirates) and large firms (by firm category). The highest growth was seen in construction, property development and retail & wholesale trade while mining dropped. Appetite will remain strong in Q4 given favourable economic conditions and interest rate changes.

- Demand for personal loans has increased and financial institutions reported increased lending appetite – most for housing loans and credit cards. This is widely expected to strengthen further in the rest of the year.

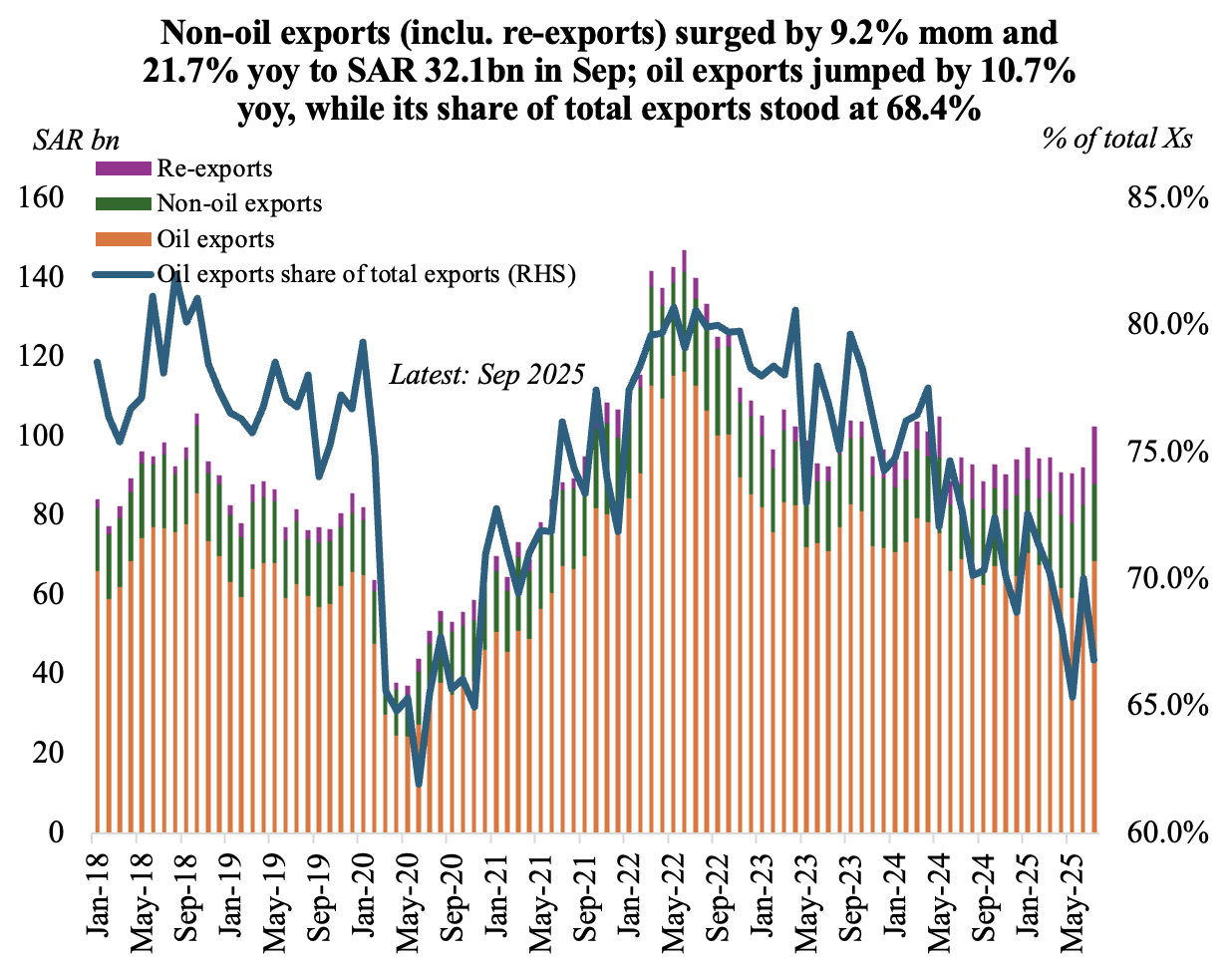

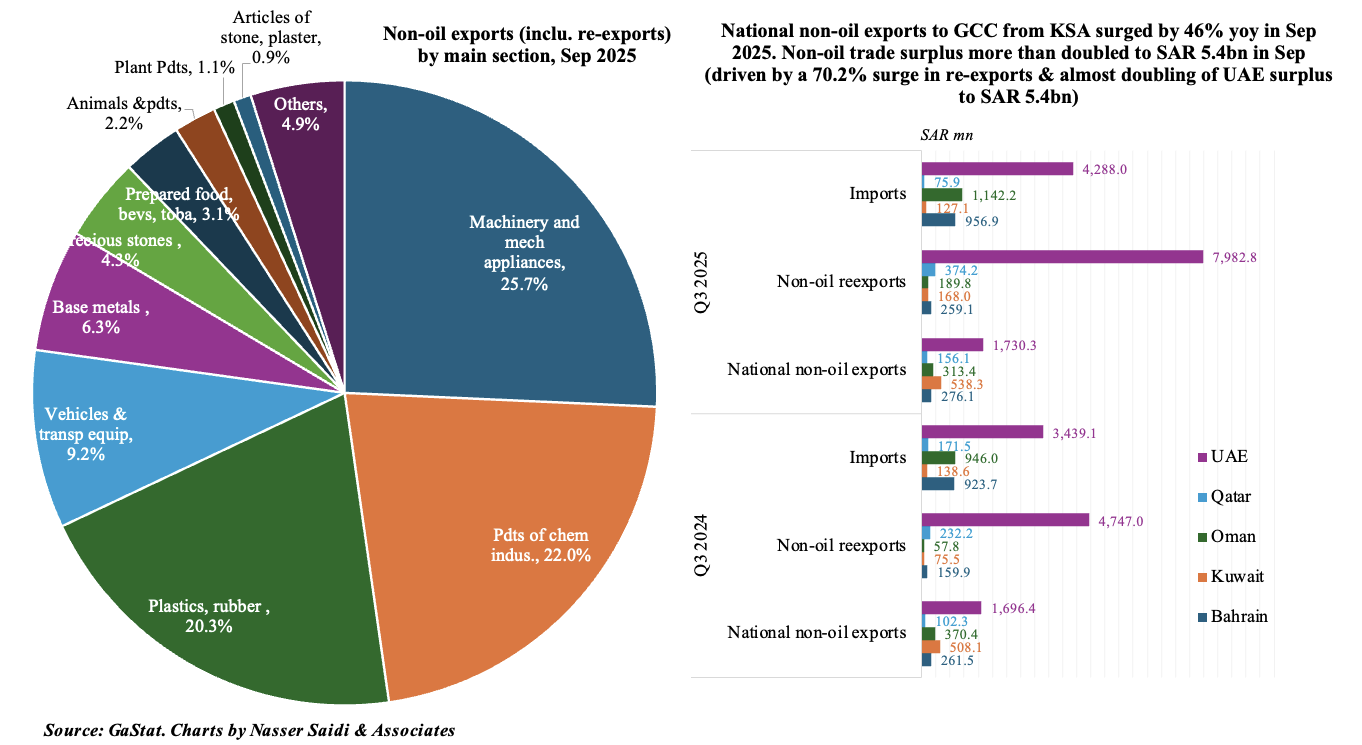

4. Saudi non-oil exports surge in Sep; surplus widened the most since mid-2024

- Saudi Arabia’s overall exports grew by 2.2% mom and 14% yoy to SAR 101.4bn, with annual gains across all components. Share of oil exports to overall exports slipped to 68.4% (Aug: 70.4%).

- Total non-oil exports (i.e. including re-exports) grew by 9.2% mom and 21.7% yoy to SAR 32.1bn in Sep. A breakdown shows that re-exports and domestic non-oil exports (i.e. excluding re-exports) grew by 7.7% mom and 10.1% mom to SAR 12.3bn and SAR 19.7bn respectively.

- Imports fell by 4.3% mom to SAR 75.4bn (but rose 2.8% yoy), resulting in a wider trade surplus, SAR 25.99bn, the most since May 2024.

- Machinery was the largest segment of total non-oil exports (26%), followed closely by chemicals & its products (22%) and plastics, rubber and their articles (20%). UAE accounted for 30.3% of non-oil exports; share of non-oil exports to GCC was just over 37%.

- China was the largest trade partner for KSA in Apr: it received 14.3% of Saudi exports and was source nation for 28.2% of KSA imports.

- UAE was the top trade partner in West Asia: received 10.7% of Saudi’s total exports and the source for 5.7% of Saudi imports.

- Saudi non-oil trade with the rest of GCC is substantial: 37.4% of total in Sep. Non-oil trade surplus with the GCC more than doubled to SAR 5.4bn in Sep from a year ago. This was largely due to a 70.2% surge in re-exports & almost doubling of UAE surplus to SAR 5.4bn.

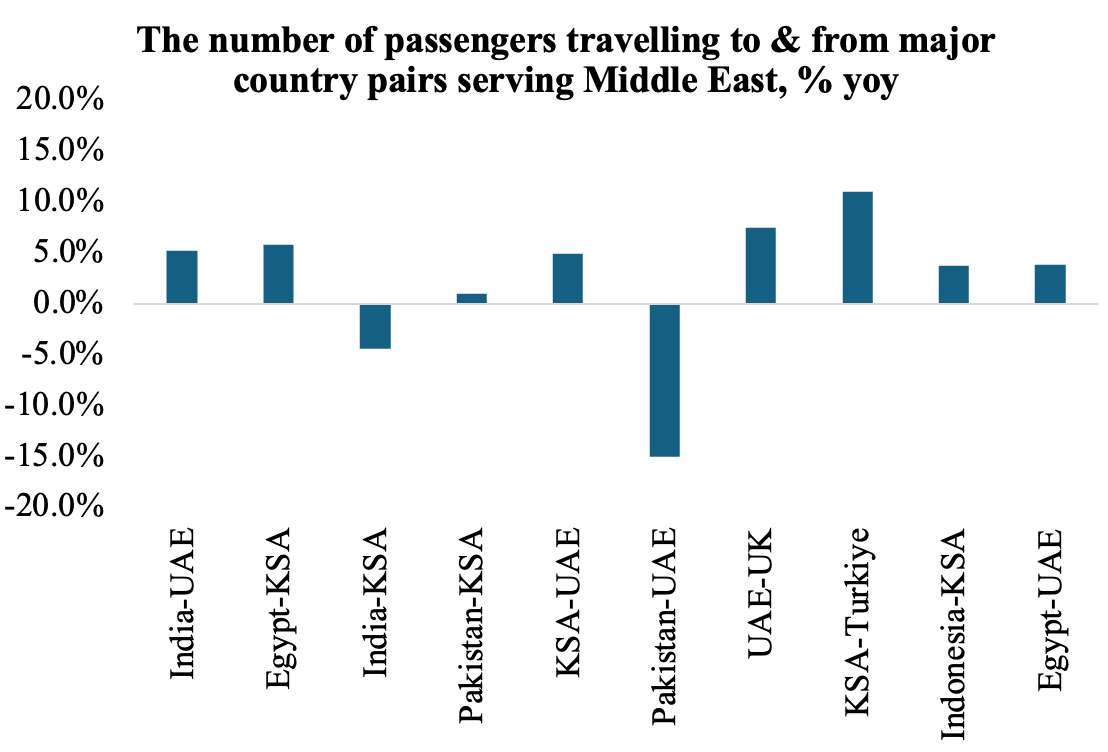

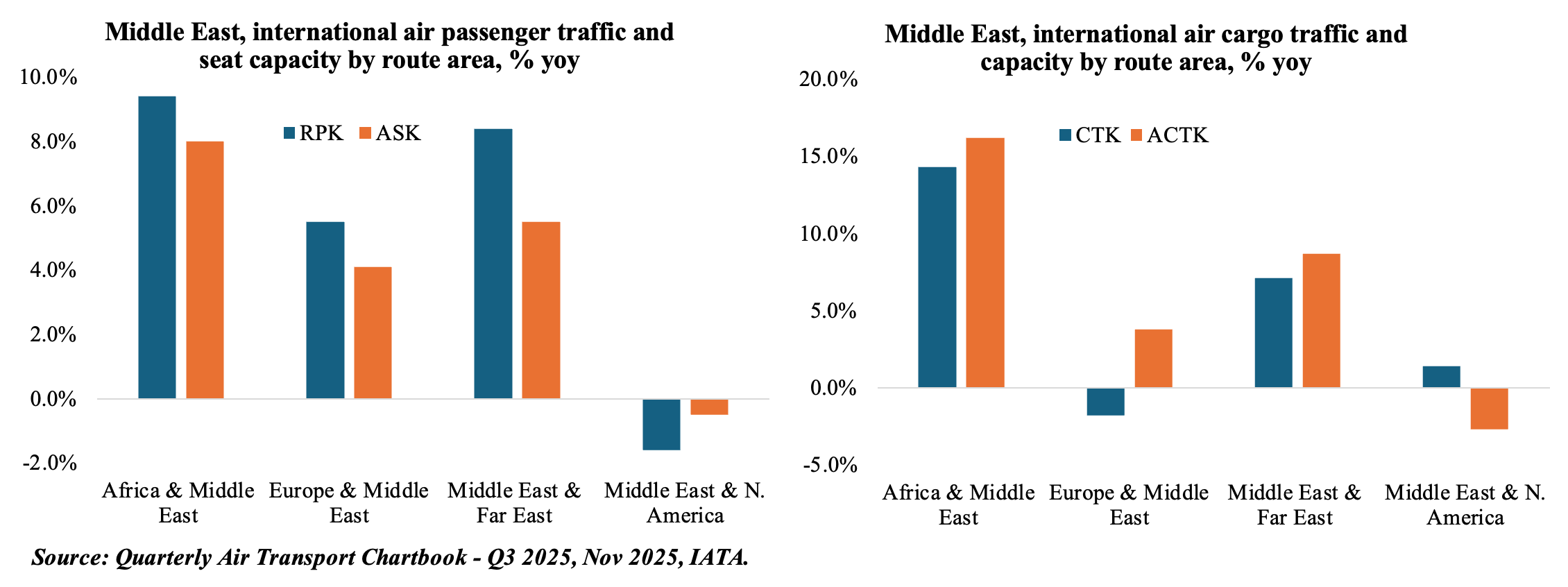

5. Middle East Air Passenger & Cargo activity accelerated in Q3

- Middle East airlines recorded an acceleration in both passenger and cargo demand in Q3, with overall increases 7.2% yoy and 1.9%. Both capacities also expanded in Q3 (6.8% & 4.7% respectively). Passenger Load Factor rose to 83.3%, a historical high for the region.

- The Middle East-Asia corridor continues to dominate in passenger traffic, while the Africa-Middle East corridor has been expanding at a much quicker pace in both passenger & cargo.

- Interestingly, there is evidence of a diversification of cargo routes away from North America (ACTK dropped 2.7%) into new regions; Middle East-Europe continued its decline though capacity is rising.

- India & Pakistan were the main Asian destinations for travellers from the Middle East: however, visitors to India grew (0.3% yoy) while it fell to Pakistan (-5.3%, given the 15% dip in UAE-Pakistan route). Türkiye (due to the strong KSA corridor) and Egypt (both with UAE & KSA) were the main connections to Europe & Africa respectively. Capacity is expected to rise further, given the demand & launch of new airlines (KSA).

Powered by: