Download a PDF copy of the weekly economic commentary here.

Markets

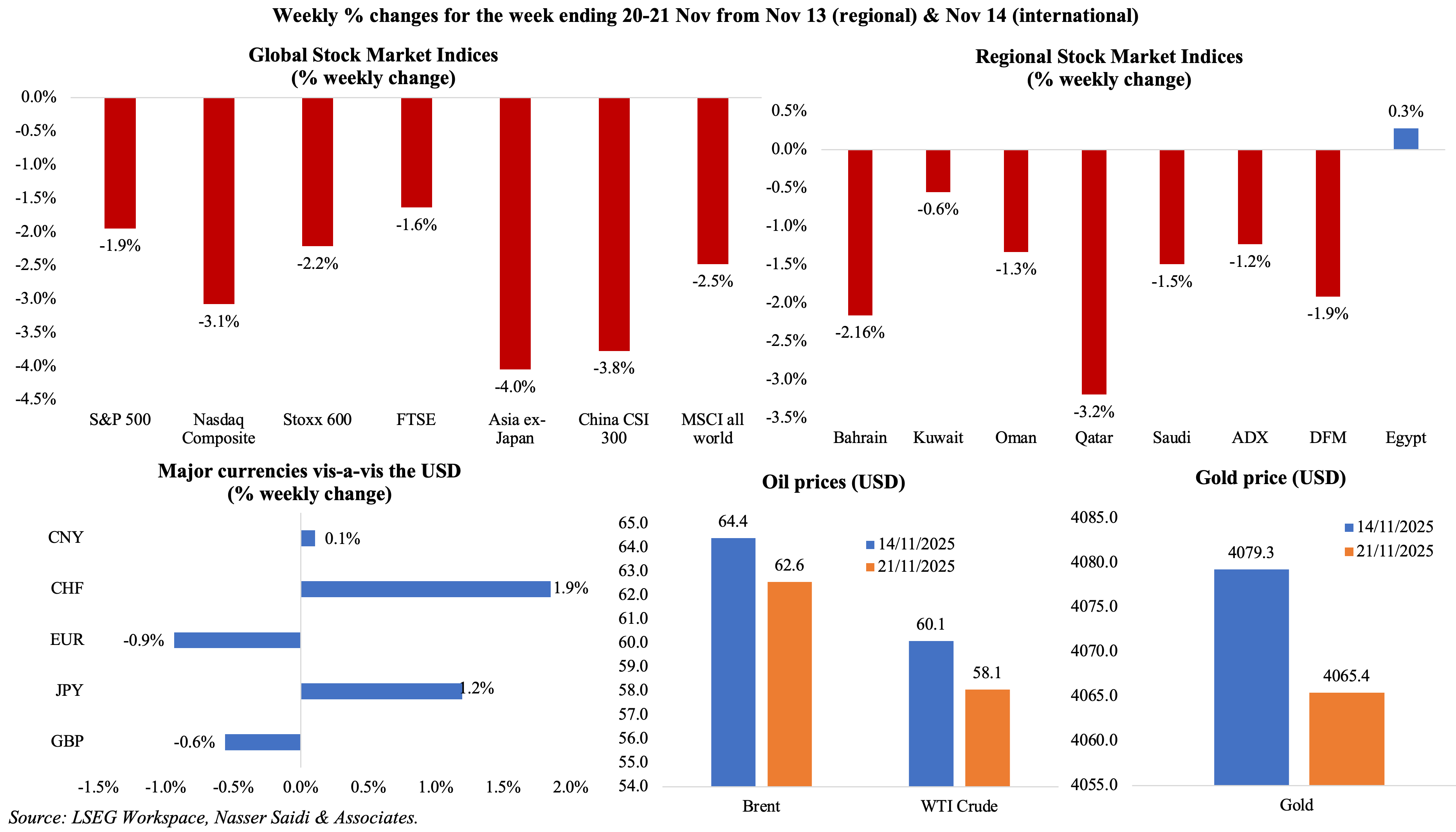

Major equities markets ended in the red, as concerns grew about tech valuations though rate cut expectations towards the end of the week led to a rally; in the UK, FTSE closed 1.7% lower versus a week before as investors wait for the budget announcement this week. These declines were mirrored in regional markets, with lower oil prices also weighing on the indices. The USD hit a 6-month high versus a basket of currencies last week; JPY slid to a 10-month low against the greenback, causing the Bank of Japan governor to signal a potential hike at the Dec meeting. Amid discussions about the proposed Russia-Ukraine peace deal, oil prices ended lower and gold slid slightly to close around USD 4,065 an ounce.

Global Developments

US/Americas:

- Non-farm payrolls rebounded in Sep, rising by 119k after Aug’s 4k dip. Unemployment rate inched up to 4.4% (from 4.3%), the highest since Oct 2021, reflecting softer hiring momentum and a still-gradual return of workers to the labour force. Average hourly earnings grew by 3.8% yoy and labour force participation rate was 62.4 (the highest since May).

- Factory orders rebounded in Aug, up 1.4% mom (Jul: -1.3%) and 3.3% yoy. Orders for non-defence capital goods excluding aircraft, a proxy of business spending plans, increased 0.4% instead of the previous estimate of 0.6%.

- Goods and services trade deficit in the US narrowed to USD 59.6bn in Aug (Jul: USD 78.2bn), driven largely by stronger services exports and a pullback in imports due to high tariffs, reflecting shifting domestic demand dynamics. Goods trade deficit was almost steady at USD 85.6bn. While the goods trade deficit with China widened, the surplus with UK narrowed and deficit with Canada declined (as imports fell to the lowest since May 2021).

- NY Empire state manufacturing index improved to a 12-month high of 18.7 in Nov (Oct: 10.7), with firms reporting better new orders (15.9 from 3.7) and shipment activity (16.8 from. 14.4). Confidence among producers appears to be firming, supported by stabilizing inputs and modest improvements in hiring intentions. However, cost pressures remain a main concern.

- Philadelphia Fed manufacturing index, at -1.7 points in Nov, indicates manufacturers are experiencing a slower pace of decline (Oct: -12.8), despite softening demand as new orders and shipments plunged 27 and 15 points respectively. Kansas Fed manufacturing activity in Nov ticked up to 18 in Nov (Oct: 15), the highest since Apr 2022. The surveys highlight growing regional divergence in manufacturing performance across the US.

- Existing home sales grew by 1.2% mom to 4.1mn in Oct, with buyers are gradually returning to the market despite elevated mortgage rates and constrained inventory (supply fell 0.7% mom to 1.52mn units). Overall activity remains subdued relative to historical norms.

- S&P US flash manufacturing PMI declined to a 4-month low of 51.9 in Nov (Oct: 52.5): underscores a slight dip in production and weaker new orders while employment ticked up. Services PMI rose to 55.0 (from Oct’s 54.8) with demand holding up amid a jump in input costs (the fastest pace since Jan 2023) and slight moderation in employment.

- Michigan consumer sentiment index remained deeply subdued in Nov: though ticking up to 51 from the preliminary reading of 50.3, Nov’s index was the second lowest ever after the current conditions index fell to an all-time low of 51.1. The one and five-year inflation expectation softened (to 4.5% and 3.4% respectively).

- Initial jobless claims in the US fell by 8k to 220k in the week ended Nov 15 while continuing jobless claims increased by 28k to 1.974mn in the week ended Nov 8.

Europe:

- Eurozone’s preliminary manufacturing PMI declined to a 5-month low of 48.4 in Nov, signalling a renewed contraction in activity after a brief stabilisation in Oct (to 50). Weaker new orders and continued declined in employment (declining on a monthly basis for 2.5 years) appear to be weighing on firms’ output plans.

- Flash consumer confidence in the euro area was unchanged at -14.2 in Nov, but remained below its long-term average, reflecting ongoing concerns about inflation, employment prospects, and real income pressures.

- Flash manufacturing PMI in Germany continues to face headwinds, with the PMI retreating further below the expansion threshold (48.4 in Nov vs 49.6 in Oct). Weak export demand, particularly from China and other key markets, remains a significant drag on factory output. Employment in the sector continued to fall, output charges fell for the first time in four months, and purchase prices continued to decline.

- German producer price index fell for the eighth consecutive month in Oct, down by 1.8% yoy vs Sep’s 1.7% drop. Energy costs fell 7.5% while increases were recorded across non-durable consumer goods (2.3%), durable consumer goods (1.7%), and capital goods (1.9%).

- UK inflation inched lower to 3.6% yoy in Oct (Sep: 3.8%), aided by slower rises in energy prices and softer domestic demand. While this is still above the BoE’s 2.0% target, it was the first time the rate has fallen since Mar. Services price inflation eased to 4.5% in Oct, the lowest since Dec 2024, and from Sep’s 4.7% gain. Core inflation also eased, to a 6-month low of 3.4% from 3.5% the month prior.

- Manufacturing PMI in the UK ticked up to 50.2 in Nov (Oct: 49.7), the most since Sep 2024. Improvements in production and new orders indicate tentative signs of recovering demand, particularly in domestic markets. Meanwhile, input cost pressures eased to their lowest level in just over a year and factory gate prices fell for the first time since Oct 2023.

- Retail sales in the UK fell by 1.1% mom in Oct (Sep: 0.7%), highlighting consumers’ cautious stance in the face of still-elevated prices and high borrowing costs. Uncertainty about the upcoming budget would have affected purchases and the Black Friday sales in Nov could have had consumers delay big purchases. In annual terms, sales grew by 0.2% (from 1%).

- GfK consumer confidence in UK slipped to -19 in Nov (Oct: -17) reflects rising pessimism among UK households regarding both current conditions and future expectations. Both past and future personal finance measures ended lower in Nov, and the major purchases measure dropped three points to -16.

Asia Pacific:

- The People’s Bank of China left the Loan Prime Rates unchanged: the one-year and five-year LPRs were at 3.0% and 3.5%.

- China’s FDI fell by 10.3% yoy to CNY 621.9bn for the Jan-Oct period (Jan-Sep: CNY 573.8bn).

- Japan GDP fell by an annualised 1.8% in Q3 (Q2: +2.3%): public demand grew at a 2.2% annualized rate, thanks mostly to government consumption, while private demand fell 1.8% (dragged down by a 32%+ drop in residential investments). GDP fell by 0.4% qoq (the first decline in six quarters), though it grew by 2.8% yoy.

- Inflation in Japan ticked up to 3% yoy in Oct (Sep: 2.9%), staying above the BoJ’s 2% target for the 43rd month in a row. Excluding food and energy, prices were up to 3.1% (From 3%). Excluding only fresh food, prices grew to 3% (from 2.9%). The BoJ governor warned that a weaker yen could affect underlying inflation (via import costs) and the finance minister hinted at a possible intervention in the market.

- Industrial production in Japan rebounded in Sep, up by 2.6% mom and 3.8% yoy (Aug: -1.5% mom & -1.6% yoy): this was the fastest monthly gain since Mar 2024 and the first since Jun 2025. Gains were recorded across inorganic & organic chemicals (9.1% in Sep vs Aug’s -5.4%) and fabricated metals (7.6% vs -8.1%) among others. Capacity utilisation grew by 2.5%.

- Japan’s exports grew by 3.6% yoy in Oct, buoyed by stronger shipments of automobiles (partly due to the trade agreement signed with US in Sep that lowered tariff to 15%), machinery, and technology-related products. Imports ticked up by 0.7%, reflects stabilising domestic consumption and continued energy-related purchases. Trade deficit of JPY 231.8bn signals improving competitiveness amid a weaker yen.

- The flash manufacturing PMI in Japan increased to 48.8 in Nov (Oct: 48.2). Firms reported milder declines in output and new orders on weak customer demand, while employment across Japan’s private sector increased for the twenty-sixth month in a row. Input prices rose at the sharpest pace in six months, and selling prices also increased.

- India’s manufacturing PMI edged down to a 9-month low of 57.4 in Nov (Oct: 59.2) remains firmly in expansionary territory despite its decline, underscoring the continued strength of output and new orders. Export orders remain healthy, supported by competitive pricing and resilient regional demand while input cost inflation eased to its lowest level in nearly five and a half years.

Bottom line: It is the end of November already – consumers, investors and economists are looking towards the Black Friday sales for an indication about consumer sentiment and spending. The UK’s Budget announcement will affect the already weaker pound and have a major impact on consumers spending decisions & sentiment as well. The US shutdown and its impact on data continues – though non-farm payrolls data for Sep was released, the report for Oct will be cancelled (according to the Bureau of Labour Statistics); meanwhile, the release of Q3 GDP and Sep inflation has been postponed (with dates to be advised) making it all the more difficult for the Fed to make a policy decision sans relevant data. Flash manufacturing PMI readings did not make for cheery reading, especially with German and EU headline readings slipping further into contractionary territory.

Regional Developments

- Egypt’s central bank held its benchmark interest rates steady (deposit rate at 21% and lending rate at 22%) opting for a wait-and-watch approach. The uptick in Oct inflation was due to recent energy price hikes and the CBE projects inflation to decline further in H1 2026.

- Egypt’s unemployment rate increased to 6.4% in Q3 2025 (Q2: 6.1%), with the labour force up 3.3% yoy to 34.727mn. High unemployment among youth (at 15.3% in Q3) and young women (21.8%) highlight the structural barriers for new entrants, and will persist unless the government translates its investment announcements into export-oriented, private-sector manufacturing and technology opportunities.

- Remittances from Egyptians working abroad surged by 45.1% yoy to USD 30.2bn in Jan-Sep 2025, according to central bank data. In Sep alone, remittances grew by 30.9% to USD 3.6bn. This capital inflow highlights the critical role of the diaspora as the country’s most stable and significant source of foreign currency earnings.

- The General Authority for Investment in Egypt is targeting a substantial increase in the industrial sector’s share of GDP to between 30% and 32% by 2030 (from 14-15% currently) and an ambitious goal of raising exports to USD 145bn by 2030. However, achieving this target will require massive private sector investment, streamlined licensing processes, and successful integration into regional manufacturing supply chains among others.

- Kuwait’s trade surplus with Japan widened sharply by 46% yoy to JPY 51.5bn in Oct, predominantly driven by strong crude oil exports. This underscores Japan’s continued structural reliance on Kuwaiti oil to secure its energy needs. Middle East’s trade surplus with Japan narrowed by 10.7% to JPY 507.7bn, as exports to Japan shrank by 6.3% in value.

- The Kuwait Investment Authority is co-investing in Brookfield’s USD 10bn global AI infrastructure initiative. No details were provided about the size of the contribution, but it demonstrates Kuwait’s strategic decision to leverage its sovereign wealth to acquire stakes in frontier technology infrastructure rather than developing it entirely domestically.

- Kuwait has invited bids for a new large-scale 0.5 GW solar energy project. This will be developed under the PPP framework, and is a crucial step in translating Kuwait’s long-term renewable energy targets into infrastructure development.The project, when complete, will supply the Ministry of Electricity under a 30-year power purchase agreement.

- Moody’s kept Lebanon’s issuer rating at C, citing that holders of Lebanon’s Eurobonds are facing estimated losses of 65% since the Mar 2020 default.

- Inflation in Oman inched up to 1.5% in Oct, the most since Jul 2024 (Sep: 1.1%), with the miscellaneous goods & services category posting the fastest rise (8.77%). Food & beverages costs rose 0.43%, following seven months of negative readings. Transport costs rose by 4.0% while restaurant & hotels costs were up by 2.5%.

- Oman’s exports fell by 3.6% yoy (to OMR 1.86bn) in Sep and imports surged 37.8% (to OMR 1.91mn), resulting in a deficit of OMR 53mn. This was the first monthly trade deficit since Dec 2015. Oil & gas exports continue to be under pressure: in Sep, oil exports fell by 10.5%, accounting for 60.9% of total exports. While Oman’s top five import products recorded only minor monthly gains, the others put together more than a doubled in value (to OMR 869mn in Sep from OMR 408mn in Aug). UAE was Oman’s largest non-oil trade partner: non-oil exports to the UAE grew by 28.3% yoy to OMR 945mn in Jan-Sep, while re-exports were OMR 484mn (8.8% yoy).

- Budget deficit in Oman of OMR 433mn in Jan-Sep 2025 compares to the projected deficit of OMR 620mn (as per the budget). Revenues fell by 7.8% yoy to OMR 8.48bn alongside a 2.2% uptick in spending (to OMR 8.91bn). There was a sharp decline in net oil revenues (-13.36% yoy to OMR 4.71bn) and gas revenues (-3.6% to OMR 1.296bn). Expenditure grew by 2.2% in Jan-Sep 2025: current expenditure edged up slightly (1.2% yoy to OMR 6.23bn) alongside a 31.3% surge in development expenditure (to OMR 1.1bn) while contributions & other expenses slipped by 8.6% to OMR 1.58bn.

- Omani airports welcomed 11.17 million passengers by end-Sep 2025, up 0.7% yoy, with Indians, Omani and Bangladeshi passengers the largest nationalities using the airports. This sustained recovery in air travel will accelerate the development of services such as retail, hospitality and logistics, thus ensuring robust tourism sector performance.

- At least 20 of the 60 road projects in Oman’s OMR 1bn project to build and expand its national road network are about 70% complete, according to the government. When completed, this upgrade will enhance physical logistics and internal connectivity as well as improve efficiency and lower non-oil trade costs.

- Oman signed an agreement with Airbus to design, manufacture and launch its first communications satellite, in a bid to modernize and secure the national telecommunications infrastructure.

- Inflation in Qatar eased to 1.11% yoy in Oct (Sep: 1.3%, the highest reading since Aug 2024), with the miscellaneous goods & services category (weight: 5.7%) posting the largest increase (a record 15.8% yoy). Food & beverages costs turned negative (-0.7%) while prices of housing and utilities turned positive (0.66%) following 25 months of deflationary readings.

- Syria’s Central Bank Governor disclosed that Syria sent its first SWIFT message to the New York Federal Reserve since the collapse of the former regime. This signifies the formal re-opening of crucial financial channels to the international banking system, critical for unlocking formal trade financing, facilitating reconstruction, and enabling liquidity flows.

- The US authorized the export of advanced US semiconductors to companies in Saudi Arabia and the UAE, according to the Commerce Department. This decision grants access to cutting-edge technology crucial for large-scale AI development, allowing for significant acceleration of the AI and supercomputing ambitions of both countries.

- US Treasury holdings by Saudi Arabia, the 18th largest investor globally, inched up 0.9% mom to USD 134.3bn in Sep though in yoy terms, it was down 6.7%. Kuwait’s holdings climbed to a record high of USD 59.43bn, up 0.3% mom & 23.1% yoy (previous high: USD 59.24bn in Aug 2025). UAE holdings declined by 5.0% mom to USD 103.3bn, the third consecutive month of USD 100bn+ readings though it surged by 43.7% yoy.

- The outstanding volume of the GCC debt capital market (including bonds and Sukuk) grew by 12.7% yoy to USD 1.1trn in Q3 2025, according to Fitch Ratings. Saudi Arabia and the UAE were the largest debt capital markets in the region, accounting for 46% and 30% of the outstanding volume.

Saudi Arabia Focus

- Saudi Arabia’s Crown Prince, during his meeting with the US President pledged to increase investment in the US to USD 1trn (from USD 600bn promised earlier this May), though no details or timetable was given. This investment surge will strengthen reciprocal economic and political ties, embedding Saudi Arabia as a crucial and permanent stakeholder in the future of the US energy, technology, and financial sectors. Separately, a US-Saudi Strategic Defence Agreement was also signed – this includes a “major defence sale package” of F-35 fighter jets & American tanks.

- Total investments and agreements signed by Saudi and US companies have reached USD 57.5bn across multiple sectors (beyond the oil sector, including manufacturing and technology), confirmed the Saudi Minister of Investment (this includes commitments announced earlier in May). Meetings have painted Saudi as a reliable, strategic partner, and a high-growth destination for private international capital.

- Saudi Aramco signed around seventeen MoUs and agreements deals worth over USD 30bn with US partners, largely focused on energy and industrial supply chains. This commitment emphasizes Aramco’s pivotal role in transforming its business beyond upstream oil production; it will enable Aramco to leverage US technology and expertise to enhance its domestic downstream and chemicals capabilities -hence solidifying its international presence.

- Bilateral trade volume between Saudi Arabia and the US exceeded USD 500bn over the last decade; the US is Saudi Arabia’s second largest import partner. Bilateral trade touched USD 16bn in H1 2025, and USD 33bn in 2024. Such sustained high trade volume could provide a solid foundation for a future FTA / CEPA aimed at increasing digital trade and advanced manufacturing cooperation.

- Saudi Arabia is set to offer remote, fractional property ownership opportunities to foreign investors, announced by the Real Estate Registry Authority. This regulatory innovation aims to open the domestic real estate market to international retail investors for the first time: about 4 million “parcels”, or fractional shares, are being tokenised across property in the country and could be available by end of the year. This policy could potentially expand the funding base for giga-projects and residential development, positioning real estate as a new avenue for FDI while improving housing affordability and access for the expat workforce.

- Saudi Arabia’s National Debt Management Center raised SAR 5.83bn via sukuk issuance in Nov, down by 22.7% mom.

UAE Focus

- The UAE Vice President approved the creation of a national investment fund (with an initial capital of AED 36.7bn) aimed at channelling foreign investment into strategic, high-growth sectors that align with the “We the UAE 2031” vision. This institutional move centralizes control over future investments, optimizing capital allocation and efficiency.Crucially, this is concurrent with a rapid digitalization drive spanning advanced infrastructure such as 5G and data centres capacity as well as investments in sustainable technology, notably solar and ClimateTech. All these investments will collectively accelerate the UAE’s economic diversification agenda.

- The Comprehensive Economic Partnership Agreement (CEPA) between the UAE and South Korea is projected to take effect by the end of 2025. The Minister of Foreign Trade announced that negotiations for a CEPA between the UAE and Canada are scheduled to begin soon: the agreement will double bilateral trade to USD 10bn+ in the coming years. Furthermore, trade talks with Japan and EU are making “substantial progress”, according to the minister. These bilateral agreements will lower trade barriers and facilitate deeper economic collaboration, underscoring the UAE’s “trade-first” foreign policy designed to secure market access for its non-oil products.

- The Government of Dubai’s record three-year 2026-28 budget has been approved: total spending of AED 302.7bn, total revenues of AED 329.2bn and an operating surplus of 5%.

- South Korea formally agreed to join the UAE’s Stargate AI Project to build a massive new artificial intelligence data campus in UAE, thereby establishing a deep cooperative partnership in artificial intelligence development and computing infrastructure.

- UAE announced a USD 1bn “AI for development initiative” dedicated to expanding AI adoption and infrastructure development across Africa. This strategic investment will help establish UAE as a dominant digital partner in Africa, driving future returns via access to vast data resources.

- UAE revealed plans to invest up to USD 50bn in Canadian industries, on the sidelines of the visit of Canada’s PM, under a framework targeting sectors such as energy, mining and AI.

- Passenger traffic at Dubai International Airport reached an all-time quarterly high of 24mn in Q3 (+2% yoy), taking the traffic till Q3 to 70mn (+2% yoy). India, Saudi Arabia, UK, Pakistan and the US were the top source markets for passengers. London, Riyadh, Mumbai, Jeddah and New Delhi were the busiest destinations.

- According to official data, Abu Dhabi’s real estate deals grew by 43% yoy to AED 94bn in Jan-Sep, from 29,400 transactions (almost doubled from the period before), reflecting robust investor sentiment.

Media Review:

The World Bank to advise Lebanon on power generation

https://www.agbi.com/energy/2025/11/world-bank-to-advise-lebanon-on-power-generation/

Oman’s Fiscal Reform: How a Gulf Nation is strengthening its public finances

https://blogs.worldbank.org/en/developmenttalk/oman-s-fiscal-reform–how-a-gulf-nation-is-strengthening-its-pub

IMF sees signs of recovery in Syria, plans intensive engagement

https://www.reuters.com/world/middle-east/imf-sees-signs-recovery-syria-plans-intensive-engagement-2025-11-17/

The G20 has a mission but not a role

https://www.ft.com/content/2f65ad4c-fc38-4cdb-bf7f-e1de40ac3845

Powered by: