Download a PDF copy of the weekly economic commentary here.

Markets

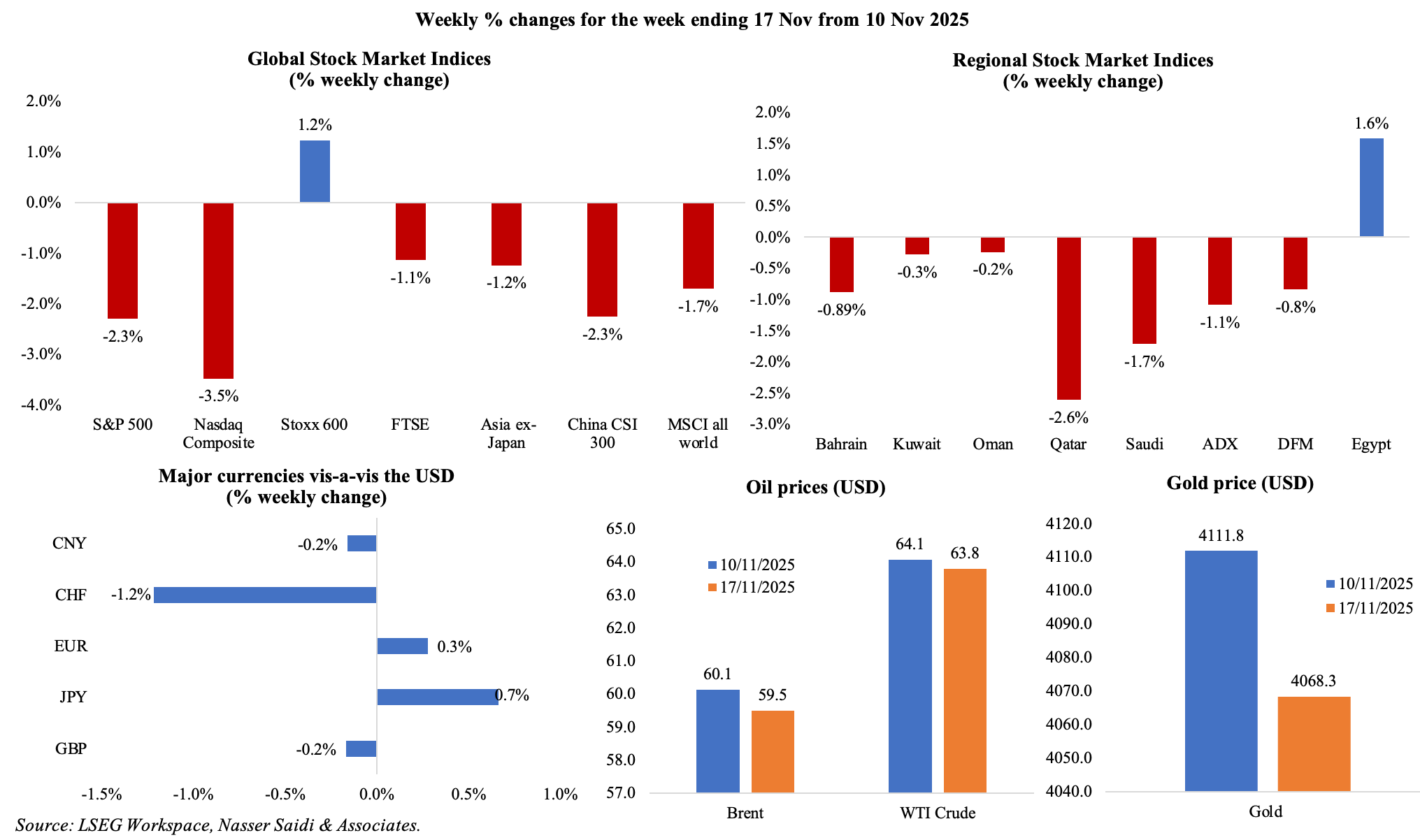

Major equities markets ended in the red ahead of multiple data releases from the US scheduled for this week post-shutdown including the non-farm payrolls data. The fear gauge index VIX climbed to a one-month high on Monday and the third highest since May. Treasury yields also dipped given growing concerns about AI growth & firms’ valuations. Middle East markets were mostly in the red, mirroring the global picture after Fed officials sounded more cautious. The dollar was stronger on Monday as the shutdown ended, while the sterling is under pressure ahead of the UK’s upcoming Autumn Budget. Compared to a week ago crude oil prices were lower on concerns of oversupply (though Ukraine’s attacks on Russian oil infrastructure and sanctions on Russian supply are rising concerns) as was the price of gold (given the dollar strength).

Global Developments

US/Americas:

- The longest government shutdown in the US ended after 43 days and the new funding bill extends money for most federal agencies till Jan 30th. Delayed economic data releases (including non-farm payrolls, trade balance) will be issued this week, providing a clearer picture of the economy.

- US NFIB business optimism index slipped to a 6-month low of 98.2 in Oct (Sep: 98.8), with quality of labour the top concern for small business owners (27%, the highest level since Nov 2021). While supply chain disruptions affected 60% of small businesses to some degree, the net percent of businesses expecting better business conditions (20%) remained above historical average.

- Private sector jobs in the US fell by 11.25k in the 4-weeks ending Oct 25th (prev: 14.25k), as reported by ADP Research. Separately, the Challenger, Gray & Christmas Oct report revealed US-based employers cut 153,074 jobs (a 183% mom and 175% yoy surge), the highest total for any Oct since 2003; tech firms cut 33,281 jobs, about six-times that of Sep.

Europe:

- GDP in the euro area grew by 0.2% qoq and 0.5% yoy in Q3 (Q2: 0.1% qoq and 1.3% yoy) though both Italy and Germany posted zero growth.

- The European Commission forecast the region to grow by 1.3% in 2025 (supported by the surge in exports in H1 ahead of the tariff hikes) and then slow marginally in 2026 (to 1.2%). Budget deficit is expected to rise to 3.2% of GDP (higher than the 3% of GDP mark) with that in Germany accelerating to 4% of GDP (due to higher spending on defence and infrastructure).

- Industrial production in the eurozone rebounded moderately by 0.2% mom in Sep (Aug: -1.1%), with gains in energy (1.2%) and capital goods (0.3%) while non-durable consumer goods plunged (-2.6%). In annual terms, IP grew by 1.1% – the same pace as in Aug.

- Sentix investor confidence in the EU worsened to -7.4 points in Nov (Oct: -5.4). Germany sank deeper into pessimism (-20.4 from -17.9), driven mainly by deteriorating expectations.

- Wholesale price index in Germany eased to 1.1% yoy in Oct (Sep: 1.2%), with prices higher for non-ferrous ores, non-ferrous metals and non-ferrous semi-finished metal products (+26.3%) as well as food, beverages and tobacco (3.5% yoy). HICP stood at 2.3%, the same as the provisional estimate.

- German ZEW Economic Sentiment Index eased to 38.5 in Nov (Oct: 39.3) while the current situation index improved to -78.7 (Oct: -80). EU ZEW Economic Sentiment Index rose to 25 in Nov (Oct: 22.7) and assessment of the current situation was up 4.5 points to -27.3.

- GDP in the UK inched up by 0.1% qoq and 1.3% yoy in Q3 (Q2: 0.3% qoq and 1.4% yoy), ahead of the Autumn Budget on 26th Nov (new tax hike announcements are expected); this was the slowest growth rate since end-2023. Industrial production and manufacturing fell by 2.5% yoy and 2.2% in Sep (prev: -0.5% yoy and -0.7%), partly due to a fall in car production and in pharma. Services and construction edged up by 0.2% and 0.1% while total business investment eased in Q3 (0.7% from 3.0%).

- UK unemployment rate increased to 5.0% in the three months to Sep (Aug: 4.8%), the highest in a decade (excluding the pandemic period). Average earnings excluding (including) bonus eased to 4.6% (4.8%) in the 3 months to Sep, from 4.7% (5.0%) the month prior. Output per hour worked rose at an annual rate of 1.1% in Q3, a rebound from Q2’s 0.5% contraction.

- Retail sales in the UK grew by 1.6% yoy in Oct, the slowest since May and easing from Sep’s 2.0% Many have delayed spending given the upcoming budget announcement and Black Friday slides later this month.

Asia Pacific:

- China’s broad money supply grew by 8.2% yoy in Oct (Sep: 8.4%). New loans fell sharply to CNY 220bn in Oct (Sep: CNY 1.29trn) and totalled CNY 14.97trn in Jan-Oct. Outstanding total social financing rose 8.5% yoy, a 7-month low and slowing from 8.7% in Sep.

- Industrial production in China grew by 4.9% yoy in Oct (Sep: 6.5%) and retail sales growth eased (2.9% from Sep’s 3.0%) – both readings were the weakest since Aug 2024. Fixed asset investment shrank by 1.7% in Jan-Oct (Jan-Sep: -0.5%).

- Preliminary estimates show that the leading economic index in Japan ticked up one point to 108 in Sep while the coincident index rose to 114.6 (from 112.8). Private consumption showed signs of picking up and business investment is expected to continue rising.

- Japan’s current account surplus widened to JPY 4.5trn in Sep (Aug: JPY 3.7trn); the Apr-Sep current account surplus hit a record high of JPY 17.51trn, up 14.1% yoy. The surplus was largely due to trade balance moving to a surplus thanks to lower imports.

- Hit with the new US tariffs standing at 50%, India approved a USD 5.1bn (INR 450.6bn) support package for exporters, including credit guarantees on bank loans (INR 200bn), affordable trade finance for small exporters, logistics and market support.

- Consumer price inflation in India slipped to a record low of 0.25% in Oct (Sep: 1.44%), on lower food prices (-5.02%) and the recent consumer tax cuts. Wholesale prices fell 1.21% yoy in Oct (Sep: 0.13%), a 27-month low, as food prices dropped (-5.0%) and manufactured products’ inflation eased to a 13-month low of 1.54%.

Bottom line: The delayed release of US data this week will be crucial ahead of the next Fed meeting. Non-farm payrolls data will be closely watched as other related indicators have shown a substantial softening of the labour market. It was reported over the weekend that Japan is considering spending around JPY 17trn (USD 110bn) in new PM Takaichi’s first stimulus package – and is likely to include larger exemptions on income tax and tax cuts on gasoline among others. The yen’s weakness and CPI data this week could be key to the BoJ’s next move in Dec.

Regional Developments

- Inflation in Egypt accelerated to 12.5% in Oct (Sep: 11.7%), rising for the first time in five months, while core inflation also rose to 12.1% (Sep: 11.3%). This was largely due to the recent increase in fuel prices (by nearly 13%) and a law that allowed landlords to hike rents. Housing prices jumped (27.1% vs 18.2%), driven by rent increases, while food inflation ticked up to 1.5% (from 1.4%) and transport prices were high at 26.0% (from 26.1%).

- Egypt is in discussions with Saudi Arabia and Kuwait to double bilateral trade volumes while also aiming to increase joint investments, strengthen industrial integration and improve logistics connectivity among others. This signals a concerted push to strengthen alliances with the GCC via long-term, structural trade and investment partnerships.

- Private investments in Egypt surged by 73% during the 2024-2025 fiscal year, according to the finance minister. The minister highlighted the importance of expanding the tax base, improving competitiveness and adhering to tax facilitation measures. Separately, the minister of investment and foreign trade stated that the government intends to expand annual tax revenues by 35% through digitization and broadening the tax base.

- Egypt’s foreign reserves exceeded USD 50bn, after rising for 38 consecutive months, revealed the PM. This was supported by recent Gulf investments and IMF tranches.

- Gulf investment flows into Egypt surged to USD 41bn in the 2023-2024 fiscal year, according to the minister of investment and foreign trade. Trade between Egypt and the GCC increased to nearly USD 14bn in 2024, up from USD 9bn in 2020.

- Egypt forecasts a 20% rise in international arrivals in 2026, and to meet this target the Egyptian Tourism Authority plans to focus on high-growth Asian and Latin American markets (thanks to the high population density and strong spending potential). National tourism goals are to attract 30mn visitors by 2030–31 and raise tourism revenues to USD 30bn by 2028.

- Egypt is actively courting Chinese firms to expand their investments: currently China has invested more than USD 8bn and more than 2800 Chinese firms operate in the country.

- Kuwait is working on a battery storage project to manage a severe power crisis driven by infrastructure strain. It will have a discharge capacity of up to 1.5 gigawatts and total energy storage of 4GWh to 6GWh. While this is a tactical fix for a critical infrastructure bottleneck, the crisis will ultimately force an acceleration of Kuwait’s delayed renewable energy program.

- Oman launched two new government development bond issues (valued at OMR 75mn and OMR 15mn) aimed at proactively managing its 2025-26 debt maturities. The government raised OMR 100mn in its previous issuance, with the bond attracting bids more than 2.2 times the offer size.

- Oman plans to build a new 125MW wind farm: the project will cost OMR43mn and is expected to begin commercial operations in Q3 2027, providing electricity to more than 18k homes. This project is a tangible step in diversifying the domestic power mix, which will free up around 76mn cubic metres of natural gas annually.

- The Central Bank of Oman’s Annual Report disclosed that the labour market saw a 10% growth in the employment of Omani nationals in 2024. The long-term challenge remains ensuring that these are productive private-sector jobs rather than public-sector absorption, which could strain the state’s wage bill and overall finances.

- Chinese firm Jiangsu Changhong Intelligent signed an agreement to establish an automotive factory, to make and assemble parts mainly for Chinese cars, in the free trade zone next to Salalah’s port in Oman. This is a significant FDI win, anchoring a new industrial cluster in Oman and positioning it as a key manufacturing base for Chinese firms seeking to build regional supply chains.

- Qatar clocked in revenues to the tune of QAR 109.2bn in H1(55.4% of 2025 budget estimate). With spending at QAR 110.5bn (or 52.5% of budget), the budget deficit stood at QAR 1.3bn. Oil and gas revenues, at QAR 76.5bn in H1, accounts for 1% of total revenues for the period. Total expenditures touched QAR 110.5bn in H1 (52.6% of the amount budgeted for full year 2025), of which 32% was wages and salaries while another 27.7% went towards major projects.

- The Qatar Investment Authority is partnering with Japan’s ORIX Corp to launch a USD 2.5bn private equity fund. This marks Qatar’s first domestic investment in Japan, with the former committing USD 1bn to the fund.

- The Middle East’s sports economy holds a USD 75bn growth opportunity, according to Oliver Wyman. Governments in the region have already committed more than USD 100bn billion to sports infrastructure through 2034. This state-led investment strategy is effectively creating an entirely new, high-growth economic sector that will act as a powerful catalyst for the tourism, hospitality, media, and construction industries.

Saudi Arabia Focus

- Saudi Arabia’s consumer price inflation stood unchanged at 2.2% in Oct. Housing costs remain elevated though decelerating (4.5% from 5.2%) – largely due to the sharp decline in rental costs (5.7% from 6.7%) – while food & beverages inflation is ticking up (1.5% from Sep’s 1.1%). Increase in costs of finance & insurance (8.2% from 7.7%) and personal care, miscellaneous goods & services (5.9% from 5.4%) indicate cost pressures in non-tradable sector (including rising wages / administrative costs, that are often cited in the PMI responses).

- Wholesale prices in Saudi Arabia rose sharply to 2.9% in Oct (Sep: 2.1%), with the monthly gain the most since Jan 2025. However, the pressure is concentrated in specific sectors – prices of other transportable goods jumped to 5.4% (Sep: 4.0%) as did metal products (0.5% from 0.1%); deflation continued in ores & minerals for the 27th month in a row. A consistent increase in wholesale prices could pass through to CPI down the line.

- Industrial production in Saudi Arabia grew by 1.9% mom and 9.3% yoy in Sep. Oil activities expanded by 2.3% mom and 10.1% yoy, as crude oil production rose (given the OPEC+ decision). Extraction of crude petroleum & natural gas grew by 6.5% yoy, the 6th straight month of upticks. Non-oil activities increased by 0.8% mom and 7.3% yoy in Sep. Within manufacturing, manufacture of food products was the fastest growing (12.9% yoy) followed by non-metallic products (10.0%) and chemicals & chemical products (9.2%).

- Saudi Arabia’s General Authority for Military Industries revealed that the localization of military spending rose significantly, reaching 24.89% by end-2024 (2023: 19.35%) – on track to meet its Vision 2030 goal of more than 50%.

- Reuters reported that Saudi Aramco is set to sign two major LNG supply deals in the US during the crown prince’s visit – with Woodside Energy and Commonwealth LNG. This move will enable the company to establish a major foothold in the global LNG market, particularly in the US where LNG capacity is set to almost double in the next four years. This is a clear diversification strategy, hedging against long-term oil demand stagnation while positioning Aramco as a dominant, integrated energy player across both oil and gas value chains.

- Saudi Arabia is set to ease control on imports with Lebanon, reported Reuters, following recent efforts to curb drug smuggling. This signals a potential normalization of economic relations, which had been frozen due to political and security concerns, also signalling that Saudi Arabia is willing to re-engage and could unlock critical investment for Lebanon.

- Saudi airports received 103.1mn passengers in Jan-Sep 2025, up 9.0% yoy, and total flight movements rose by 5% to 713k (connecting 170+ destinations). This growth in passengers and connectivity is in line with the National Transport and Logistics Strategy objectives, which aims to raise the sector’s contribution to 10% by 2030 (from 6% in 2021).

- The Qiddiya City giga-project has set a public opening date: its Six Flags theme park (the first outside North America) will open on Dec 31st. This launch moves Qiddiya from a construction-phase concept to an operational, revenue-generating asset. The PIF expects the giga project to eventually attract 48mn visitors annually and contribute about SAR 17bn (USD 4.5bn) to Saudi Arabia’s GDP.

UAE Focus

- The UAE is finalizing a Comprehensive Economic Partnership Agreement (CEPA) with Chad, and negotiations are likely to “conclude before the end of the year”, according to the trade minister. This will boost the strategic expansion of UAE’s bilateral trade model into Central Africa: bilateral trade between the two nations stands at USD 1.9bn, up 30% from the year prior.

- Dubai real GDP grew by 1.7% qoq and 4.7% yoy to AED 121.7bn in Q2, pointing to robust underlying demand and broad‐based sectoral strength.The fastest growing sectors were construction (14.9%), health & social work (12.8%), and finance & insurance (7.7%). In H1 2025, GDP grew by 4.4% yoy: growth was not reliant on any single sector, showcasing successful diversification. Robust growth in high-value sectors like finance (6.7% in H1) and health (20%), combined with the foundational strength in real estate (7.0%) and construction (8.5%), suggests that Dubai is well-positioned to maintain its high-growth trajectory.

- The DMCC free zone’s Chairman disclosed that the zone aims to attract over 2,000 new companies in 2025 (it attracted 1k+ firms in H1), with total company registrations having already crossed 26k. This sustained, high-volume influx of new businesses underscores the DMCC’s appeal as a global business hub and a key engine for FDI and will generate significant positive spillovers (including in real estate, financial services and employment).

- The Abu Dhabi Chamber reported a 38.4% surge in memberships from Indian companies from 2019 to 2024, a clear dividend from the UAE-India CEPA. As of Sep 2025, 17,457 Indian companies were active members of the Abu Dhabi Chamber – spanning diverse sectors including wholesale and retail trade (45%of memberships) and construction (14%). This corridor is expected to deepen further, driving significant cross-border investment in strategic sectors like fintech, manufacturing and technology, well beyond simple trade.

- An HSBC survey reveals that 9 out of 10 UAE-based international firms plan to invest in Saudi Arabia over the next five years, with 78% planning to strengthen trade and investment ties with Saudi in the next six months. Key drivers behind the decision are economic stability in Saudi (59% cited this as the key factor), economic growth (58%) and its role as a regional gateway (42%).

- The number of real estate transactions in Abu Dhabi almost doubled to 29,400 in Jan-Sep, while total value of deals rose 43% yoy to AED 94bn. While 97 nationalities invested in the sector, strong demand came from Russia, China, UK, France, Kazakhstan and the US.

- Abu Dhabi’s cultural sites attracted 4mn visitors in H1 2025, a successful translation of massive capital investment in cultural infrastructure (e.g., the Louvre Abu Dhabi, Manarat Al Saadiyat) into a high-volume tourism asset This “cultural economy” is a cornerstone of its diversification strategy and core pillar of non-oil GDP.

- Abu Dhabi’s hotels received 2.9mn guests in H1, up 2% yoy, leading to a jump in hotel revenues (20%), revenue per available room (24% yoy to AED 446) and occupancy rate at a robust 80%. It was also reported that hotels received 2.04mn guests during the traditionally slower summer months of May to Aug, aided by a 10% yoy jump in international visitors.

- The selection of the first two vertiport sites (Zayed International Airport and Al Bateen Executive Airport) moves Abu Dhabi’s “air taxi” program from a concept to a concrete infrastructure project. Though costs of building the vertiports were not disclosed, this move signals a serious commitment to pioneering next-generation urban mobility solutions.

Media Review:

The Fed’s delicate balancing act over liquidity

https://www.ft.com/content/471d2c3a-0a63-4989-b22c-62e3f5fa6f5f

Saudi Arabia scales back salary premiums for foreign talent, recruiters say

https://www.reuters.com/world/middle-east/saudi-arabia-scales-back-salary-premiums-foreign-talent-recruiters-say-2025-11-16/

Will superfast, super-expensive electric vehicles catch on?

https://www.economist.com/the-world-ahead/2025/11/12/will-superfast-super-expensive-electric-vehicles-catch-on

Financial Integrity Implications of Retail Central Bank Digital Currencies (rCBDCs)

https://www.imf.org/en/publications/fintech-notes/issues/2025/11/14/financial-integrity-implications-of-retail-central-bank-digital-currencies-rcbdcs-571769

Powered by: