Download a PDF copy of the weekly economic commentary here.

Markets

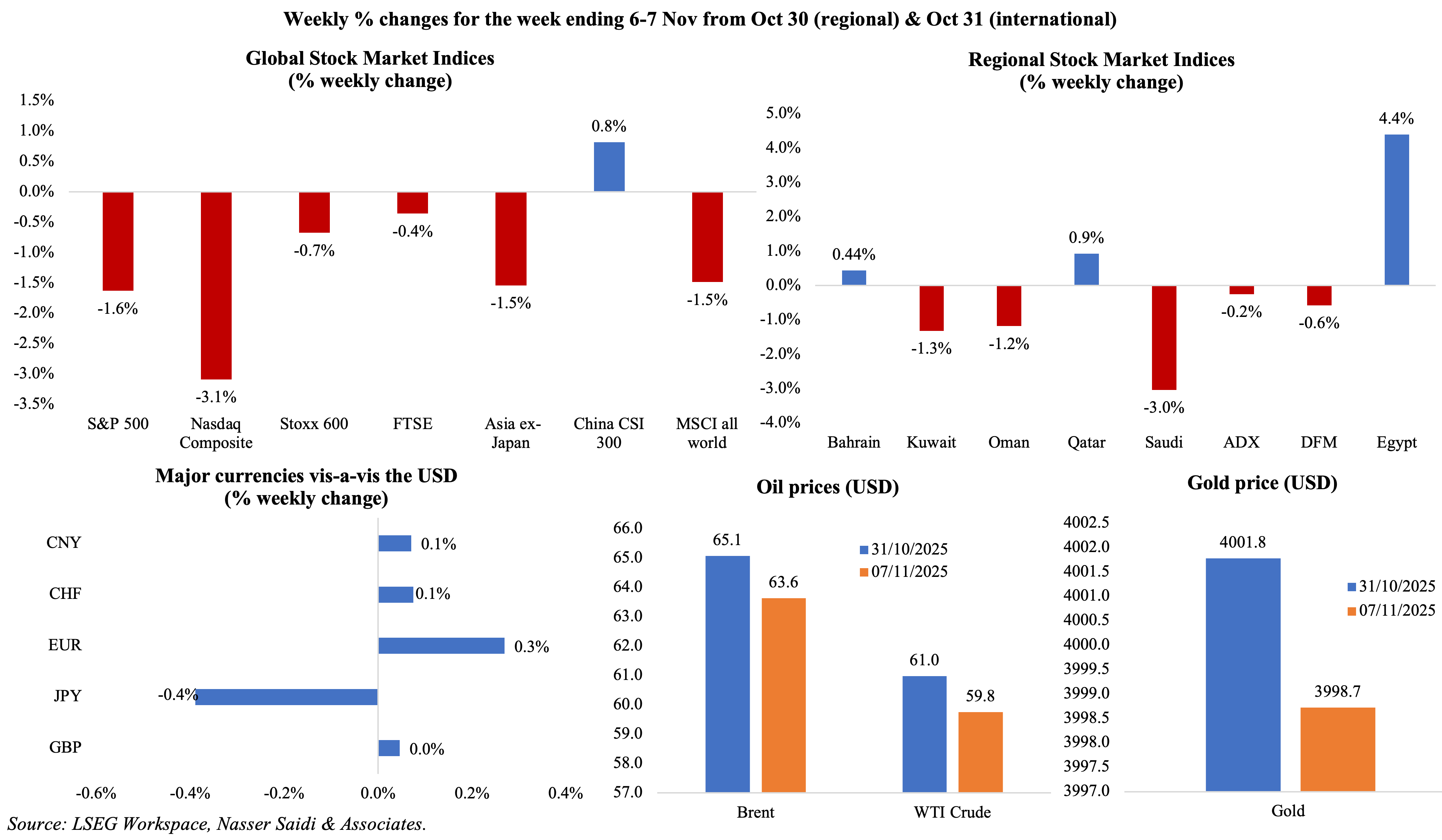

Major markets saw selloffs following weeks of new record highs after elevated valuations and concentration of the AI and tech stocks led to market jitters. Eight of the most valuable AI related stocks lost about USD 800bn since end of the week prior, according to FT. Stoxx closed 0.7% lower, with tech stocks bearing the brunt while in the UK, FTSE’s loss stemmed from corporate earnings and the Bank of England’s rate decision. Regional markets were mostly down, except for Egypt which jumped to a new record high (following news about an Egypt-Qatar partnership deal on a real estate and tourism project). The JPY hit a new 8-month low versus the greenback last week and GBP is at its weakest since 2023 against the euro. Oil prices continued to decline on worries about a supply glut amid slowing demand. Gold price ended the week slightly up as worries the extended US government shutdown supported to its safe-haven demand, but it closed the week lower.

Global Developments

US/Americas:

- US private sector added 42k jobs in Oct, as per ADP, while Sep’s reading was upwardly revised to a loss of 29k jobs. Services sector added 33k jobs, mostly in trade/ transportation, education & health and financial activities. Employers hired after two straight months of declines, but signs of weakness indicate that businesses are becoming more cautious.

- S&P manufacturing PMI in the US ticked up to 52.5 in Oct (Sep: 52 and prelim: 52.2), thanks to output growth and an uptick in new orders (the most in 20-months) though exports fell for the fourth consecutive month. Services PMI slipped to 54.8, lower than the preliminary reading of 55.2; PMI climbed from 54.2 in Sep though, as new orders grew on strong client demand and input costs rose the least in six months.

- ISM manufacturing PMI eased to 48.7 in Oct (Sep: 49.1), staying below-50 for the eighth month running. Output shrank (48.2 from 51) alongside a moderate pickup in new orders (49.4 from 48.9) and employment (46 from 45.3) while prices paid slowed (58 from 61.9).

- ISM services PMI ticked up to 52.4 in Oct (Sep: 50), the highest since Feb, underpinned by new orders (56.2 in Oct from Sep: 50.4) though employment continued to contract for the fifth month in a row (up to 48.2 from 47.2) and prices paid increased (70 from 69.4).

- The University of Michigan consumer sentiment index declined to 50.3 in Nov (Oct: 53.6), the lowest since Jun 2022, with current conditions index at a record low (52.3) and expectations falling to a 6-month low (49 from 50.3). The one-year ahead inflation expectations rose to 4.7% (from 4.6% the month before) while the 5-year ahead expectations eased slightly (to 3.6% from 3.9%). Persistent concerns over cost-of-living pressures (particularly housing and services) could restrain discretionary spending in the months ahead.

Europe:

- Manufacturing PMI in the eurozone inched up to the neutral 50-reading in Oct (Sep: 49.8) as output grew slightly alongside stagnant new orders and export orders (down for the fourth month in a row). Services PMI came in at 53.0 (Sep: 51.3), taking the composite PMI to 52.5, its highest since May 2023. Lingering weakness in manufacturing output and subdued new orders highlight that recovery remains fragile.

- Producer price index in the euro area fell by 0.1% mom and 0.2% yoy in Sep (Aug: 0.4% mom and 0.6% yoy). The easing in input costs reflects declining energy prices (-0.2% mom and -2.4% yoy) while prices rose for capital goods (1.8% yoy), durable (0.3% mom and 1.6% yoy) and non-durable goods (0.1% mom and 1.9% yoy).

- Exports from Germany grew by 1.4% mom in Sep (Aug: -0.8%) while imports grew at a faster 3.3% pace (Aug: -1.4%). Imports from non-EU countries drove the increase, rising by 5.2% on the month, with imports from China up by 6.1% mom. Trade surplus narrowed to an 11-month low of EUR 15.3bn (Aug: EUR 16.9bn). The data suggest domestic demand is regaining traction, partly offsetting weaker external momentum.

- German industrial production rebounded in Sep, up by 1.3% mom (Aug: -3.7%) thanks to a surge in automotive production (+12.3% vs -16.7%) alongside gains in capital (3.8%), consumer (0.2%) and intermediate goods (0.2%). In yoy terms, IP fell by 1% (Aug: -3.6%).

- Factory orders in Germany grew by 1.1% mom in Sep, the first increase since Apr and up from Aug’s 0.4% dip, thanks to an increase in foreign orders (3.5%) while domestic orders were subdued (-2.5%). By sector, gains came via the manufacture of electrical equipment (9.5%), aircraft, ships, trains, military vehicles (7.5%), and the automotive sector (3.2%). In annual terms, fell by 4.3% yoy (Aug: 2.1%).

- German manufacturing PMI held steady at 49.6 in Oct, in line with the preliminary reading, with higher production volumes for the eighth month in a row and output continued to be driven mainly by the investment goods segment. Services PMI increased to 54.6 (Sep: 51.5), on stronger demand; the marginal decline in export sales was the slowest since it began to fall in mid-2024. The divergence between weak industrial momentum and resilient services continues to define Germany’s two-speed economy.

- Retail sales in the eurozone edged down by 0.1% mom in Sep. In yoy terms, sales grew by 1.0%, the slowest pace since Jul 2024, and following Aug’s 1.6% gain. The marginal decline underscores household caution amid positive real wage growth.

- The Bank of England left interest rates on hold at 4.0% but hinted at a cut at the upcoming meeting in Dec. The BoE forecast that inflation will remain above its 2% target until Q2 2027 while also cautioning about jobs market weakness.

- UK’s manufacturing PMI moved up to a 12-month high of 49.7 in Oct (Sep: 46.2): not only did new orders and employment register sub-50 readings, but domestic and export markets demand also declined. Business optimism climbed to an 8-month high.

Asia Pacific:

- Inflation in China ticked up by 0.2% mom and yoy in Oct (Sep: 0.1% mom and -0.3% yoy): this is the first yoy increase since Jun and fastest pace since Jan 2025. The increase was largely owing to non-food inflation (-0.9% from 0.7%) during the Golden Week holidays while food prices declined (-2.9% from -4.4%) Core inflation rose to a 20-month high of 1.2%. Producer price index fell by 2.1% yoy, slower than the 2.3% drop in Sep. This modest rebound reflects gradual improvement in household demand and some base effects, but inflation remains subdued by historical standards.

- China’s manufacturing PMI slipped to 50.6 in Oct (Sep: 51.2), on slower growth of output and new orders, with export orders falling at the quickest pace since May. On a positive note, employment rose for the first time in seven months. Services PMI slipped to 52.6 in Oct (Sep: 52.9): though new orders expanded, foreign sales posted a modest decline, and employment fell amid easing capacity pressures and cost concerns.

- Exports from China unexpectedly fell by 0.8% yoy in Oct (Sep: 8.4%), the lowest reading since Feb, while imports grew by just 1.0% (Sep: 7.4%) on subdued domestic demand. Exports to the US plunged 25.17% yoy as front-loading effects taper and exports to the EU and ASEAN gain by 0.9% and 11.0% respectively. Surplus narrowed slightly to USD 90.07bn (Sep: USD 90.45bn). Looking ahead, export-led growth will likely be constrained by structural headwinds including shifting global supply chains, trade protectionism in the West, and subdued external demand from developed markets.

- The Bank of Japan minutes show board members being cautious in the backdrop of more than a decade of deflation while discussing timing of the rate cut. However, there seems to be a growing consensus that the interest rate hike is nearing– as early as Dec, or else by Jan. Indications about wage hikes next year will also have an important bearing on the BoJ decision.

- Household spending in Japan increased by 1.8% yoy in Sep (Aug: 2.3%). Labour cash earnings in Japan grew by 1.9% yoy to JPY 297,145 in Sep (Aug: 1.3%) while inflation-adjusted real wages slumped for the ninth consecutive month (-1.4% yoy following Aug’s revised -1.7%) as price rises outpaced nominal pay. Going forward, sustained wage increases will be critical to underpin domestic demand.

- Retail sales in Singapore fell by 1.4% mom in Sep (Aug: 0.7%) while in yoy terms, sales grew by 2.8%, weaker than Aug’s 5.3% gain. The weakness was broad-based – petrol sales dropped by 8% yoy while sales slowed for supermarkets (5.1% from 8.8%), computer & telecom equipment (2.8% from 7.7%) and furniture & household equipment (0.3% from 7.2%) – and reflects cautious consumer spending.

Bottom line: The ongoing US shutdown (the longest in history now) and lack of visibility on macro performance means that investors will be looking to the latest round of corporate earnings for clues related to consumer demand and jobs. A new report from Challenger, Gray & Christmas found that more than 1mn US jobs have vanished in 2025 and in Oct alone employers cut 150k+ job cuts (the highest Oct reading since 2003). PMI readings for Oct pointed to faster output growth (especially in the US, EU and India); not only did new export business decline across both developed and emerging markets, but the 12-month ahead business confidence also dropped to a near 3-year low, similar to readings during the pandemic. Lastly, COP30 begins today – at a time when global temperature is getting hotter faster and the US government under President Trump continuing to deny the existence of climate change. Renewables seem to be the only silver lining for now: renewable energy overtook coal as the world’s leading source of electricity in H1 (according to Ember) and wind and solar power are expected to meet 90% of new electricity demand this year (according to the IEA).

Regional Developments

- OPEC’s collective oil output edged up by 30k barrels per day to 28.43bn bpd in Oct 2025, driven primarily by Saudi Arabia and Iraq, reported Reuters.

- Bahrain signed new investment deals (60+) worth USD 17.0bn at the Gateway Gulf forum organised by Bahrain’s Economic Development Board. The deals support five non-oil sectors including financial services, information and communication technology, manufacturing, logistics and tourism and will boost private sector activity, essential for Bahrain its diversification goals. Bahrain attracted USD 17bn in FDI since the event began in 2018.

- Bahrain’s Ahli Bank and Al Salam Bank (both listed firms) have initiated preliminary discussions for a potential merger. This move, subject to regulatory and shareholder approvals, signals a clear trend toward market consolidation within the GCC financial sector.

- Egypt’s non-oil sector PMI showed signs of stabilization, rising to 49.2 in Oct 2025, the softest decline in eight months. Although still marginally in contraction (below 50.0), the improvement was driven by a significant easing in the decline of new orders while purchasing activity and employment were broadly stable. Input costs were at a five-month high, with wages rising at the fastest pace since Oct 2020.

- Egypt’s net foreign assets clocked in at EGP 996.148bn by end-Sep, almost double versus EGP 498.697bn a year ago. Total foreign assets with the CBE stood at EGP 2.324trn, while foreign assets with banks amounted to EGP 1.993trn.

- Egypt and Qatar signed an agreement to jointly develop a major real estate and tourism project on Egypt’s Mediterranean coast as part of Qatar’s USD 7.5bn commitment to Egypt. This partnership between a state-run Egyptian entity and Qatari Diar marks a significant inflow of GCC capital into Egypt’s high-value tourism sector – including a USD 3.5bn payment in Dec for the land allocated for the project (fresh FDI and not deposits, according to the finance minister). Egypt will also receive housing units valued at USD 1.8bn and 15% of the project’s profits after Qatari Diar recovers its investment costs, stated the FM.

- Egypt launched a global tender for four oil and gas exploration blocks in the Red Sea, with a deadline set for May 2026.This initiative is a key part of the government’s strategy to attract fresh international investment into its upstream energy sector – in a bid to enhance Egypt’s long-term energy security and shore up its foreign currency-earning capabilities.

- PMI in Kuwait rose to 52.8 in Oct (Sep: 52.2), with firms reporting faster increases in output, new orders, and employment (hiring grew at the fastest pace in 4 months). Though input costs and wages ticked up, firms raised output prices only marginally, opting to remain competitive.

- Consumer spending in Kuwait slowed down in Jan-Sep 2025, declining by 4.66% yoy to KWD 34.35bn, marking the first such decline in four years. This reversal stemmed from both cash withdrawals (-10.56% to KWD 6.8bn) and online spending (-8% yoy to KWD 13.11bn) while PoS transactions were the exception (+3% to KWD 14.39bn).

- Kuwait’s Ministry of Commerce has issued a new regulation banning all cash transactions for the purchase of precious metals and gems, mandating all payments be processed through formal banking channels. This policy, which also imposes new record-keeping and reporting requirements, is a significant move to tightening the anti-money laundering framework, enhance market transparency and combat illicit financial flows.

- Credit extended to Oman’s private sector grew by 5.7% yoy to OMR 28.2bn as of end-Sep, resulting in an 8% gain in total credit extended by the banking sector to OMR 34.5bn. Total deposits with the banking sector also grew, up by 4.7% to OMR 33.1bn. The total value of real estate transactions rose to OMR 2.35bn by end-Sep.

- Oman signed new gas supply agreements to supply 14 local manufacturing industries with a total of 27mn cubic metres per day of gas over ten years starting Jan 2026 – valued at USD 8.8bn. This is a clear, long-term industrial policy move designed to provide energy security and price predictability for domestic producers.

- Qatar sold USD 4bn in a two-tranche debt issue last week, with orders hitting USD 13.5bn ahead of the launch. The country had raised USD 3bn from debt markets in Feb.

- Qatar Exports trade mission to Oman successfully concluded with potential deals valued at QAR 223mn. These span diverse sectors including energy, infrastructure and industrial – highlighting a strategy to deepen intra-GCC trade and boost bilateral non-oil export volumes.

- Qatar’s headline PMI eased to a 9-month low of 50.6 in Oct (Sep: 51.5), reflecting softer output and new order volumes (construction sector showed weak readings). Meanwhile, the uptick in employment was the third fastest on record and led by the manufacturing sector.

- QatarEnergy confirmed that the first LNG from its North Field expansion is on track to arrive in H2 2026. This will eventually nearly double Qatar’s production capacity to 142mn tonnes per annum by 2030, solidifying its dominance in the global gas market.

- The UAE captured a dominant 38.4% share of the global Islamic syndicated financing market by end-Sep 2025, according to Fitch Ratings. The GCC accounted for 67.5% of issuances and 78% of global Islamic syndicated financing outstanding during the period, driven by significant deals from government-related entities and large corporates.

- In a significant policy shift, US and UK governments removed sanctions on the new Syrian President and Interior Minister – “in recognition of the progress demonstrated by the Syrian leadership after the departure of (former President) Bashar al-Assad”. The EU confirmed it would follow suit, potentially allowing for the West to re-engage with Syria on a limited basis.

- Mergers and acquisitions in the MENA region reached USD 69.1bn through 649 deals in Jan-Sep, according to EY. GCC accounted for the lions share: 500 deals with a value of USD 65.9bn. Canada attracted the highest outbound deal value from MENA investors (USD 7.1bn) while the UK was the preferred target country by volume.

Saudi Arabia Focus

- Saudi Arabia’s non-oil private sector PMI surged to 60.2 in Oct (Sep: 57.8), driven a surge in domestic demand (nearly half the surveyed firms reported higher sales), strong business optimism and a 16-year high in the pace of job creation.However, a sharp rise in input costs led by wage hikes, bonuses and costlier raw materials also caused output price inflation to rise at the fastest pace since May 2023.

- The PIF has invested USD 170bn+ directly in US public and private markets since Vision 2030 was launched almost 10 years ago and USD 80bn in procurement, disclosed PIF’s head of investment strategy & economic insights.

- Three Saudi companies – Consolidated Gruenenfelder Saady Holding, Cherry Trading, and Al Masar Al Shamil Education Company – across manufacturing, car rental, and education sectors are set to raise over USD 300mn in IPOs on the Tadawul by end of this year. The continued robust pipeline of listings demonstrates the increasing maturity and depth of the Saudi capital market. So far, IPOs on the main market have raised USD 3.3bn this year.

- Saudi Arabia revealed that 12 local and international mining companies qualified for the second round of the Exploration Enablement Program – preliminary approval has been given for 38 licenses and SAR 664mn in exploration commitments. The projects are also expected to support around 63 direct jobs, including 27 Saudi nationals.

- The Biban Forum by Saudi Monsha’at – one of the largest entrepreneurial platforms in Saudi – held last week attracted more than 100k visitors and generated agreements of over SAR 38bn from more than 50 agreements and MoUs.

- Saudi Arabia is expanding its tourism market focus beyond luxury to include more affordable, “broader market” segments, including families and adventure travellers, according to the Saudi Tourism Minister. While religious tourism remains at the core of its tourism agenda, developing more diverse and affordable tourism products will be essential for Saudi to achieve its ambitious 150-million-visitor target by 2030.

- The Saudi Real Estate General Authority clarified that the new law allowing 100% foreign ownership of property applies only to registered properties and only five categories of non-Saudis would be eligible including foreign individuals, foreign companies, Saudi companies with foreign shareholders, non-profit entities and diplomatic missions.

UAE Focus

- UAE’s non-oil private sector PMI moderated slightly to 53.8 in Oct (Sep: 54.2), with output and sales growth stable alongside a near-stagnation in hiring as business confidence softened to a 34-month low. However, Dubai’s economy bucked this trend, accelerating to a nine-month high PMI of 54.5, driven by a surge in new orders and output as well as employment up for the seventh month in a row.

- UAE’s Minister of Cabinet Affairs disclosed that about 67% of the targets set under its “We the UAE 2031” vision had already been achieved, with six years remaining in the plan. This rapid progress, underpinned by strong non-oil trade growth and high global competitiveness rankings, demonstrates an exceptionally high degree of policy implementation effectiveness. He also highlighted the country’s rising diplomatic and humanitarian presence on the international stage.

- Dubai GDP accelerated by 4.4% yoy to AED 241bn in H1 2025, with Q2 alone seeing a robust 4.7% expansion, underscoring the emirate’s economic resilience and successful implementation of diversification policies. Growth was broad-based, with human health and social work sector posting the highest expansion (20%) while other key drivers included construction (8.5%), real estate (7.0%), and financial services (6.7%). Traditional cornerstone sectors also showed solid growth, including accommodation & food services (4.9%) and wholesale & retail trade (4.4%).

- UAE’s Minister of Energy and Infrastructure announced a massive AED 170bn investment package for national transport and road projects to be implemented by 2030, aimed at easing significant traffic congestion and boosting mobility across major highways; one of the plans is to study the construction of a potential fourth federal highway. This is a necessary and corrective measure to address the capacity constraints created by the rapid population and economic growth, ensuring that physical infrastructure does not become a limiting factor.

- The Dubai Chamber of Commerce saw a 4% yoy increase in registered member companies to 53,838 new firms in Jan-Sep 2025. During this period, the value of member exports and re-exports also grew a robust 16% to AED 260bn. Separately, the Dubai International Chamber successfully attracted 44 multinational companies and 217 SMEs to Dubai in Jan-Sep 2025, up 10% and 84% yoy, respectively. This expansion of business entities provides a strong forward-looking indicator for non-oil GDP growth and job creation.

- Microsoft plans to invest over USD 15bn in the UAE by end-2029 to expand its AI and cloud infrastructure, a move secured with US export licenses for advanced Nvidia chips. This landmark investment and “AI-diplomacy” move establishes UAE as a critical, trusted hub for US-aligned AI development, also solidifying the UAE’s geopolitical position.

- Abu Dhabi’s investments in the UK have exceeded GBP 20bn, exceeding the target of achieving the original commitment of GBP 10bn by 2026. This long-term deployment of capital formed part of a partnership signed between Mubadala and the UK Office for Investment. This strategic relation is likely to continue, with a focus on acquiring assets in technology, renewable energy, and infrastructure to secure global returns.

- Masdar announced it will invest in Austria’s largest green hydrogen project – a strategic move aimed at securing a foothold in the European hydrogen market. This not only helps to diversify UAE’s energy portfolio internationally but also helps build the technical expertise and supply chain credibility needed to become a long-term, global exporter of green fuels.

- Family businesses in the UAE are a cornerstone of the economy, contributing 60% of GDP and employing 80% of the private sector workforce, according to the Ministry of Economy and Tourism. These entities also represent about 90% of all private sector firms in the country.

Media Review:

Before talks with Trump, Saudi Arabia doubles down on terms for Israel ties

https://www.reuters.com/world/middle-east/before-talks-with-trump-saudi-arabia-doubles-down-terms-israel-ties-2025-11-09/

Work starts on Oman-UAE USD 2bn economic free zone

https://www.agbi.com/trade/2025/11/work-starts-on-oman-uae-2bn-economic-free-zone/

GCC debt market sees a flurry of bond, sukuk issuances this week

https://www.zawya.com/en/capital-markets/bonds/gcc-debt-market-sees-a-flurry-of-bond-sukuk-issuances-this-week-sc5p27cj

The world is struggling to halt climate change. But can it adapt?

https://www.ft.com/content/caf9895d-63b7-4410-969a-2cee05910213

Powered by: