Investing in the Future: Fiscal Firepower & Non-Oil Growth Drive Middle East Resilience, Weekly Insights 7 Nov 2025

1. A demand-led non-oil sector expansion in (most) Middle East nations

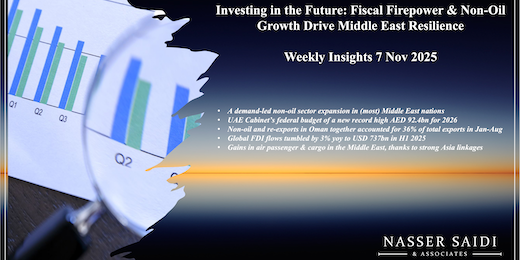

- Headline PMI readings across the Middle East have shown mixed moves in Oct (with upticks only in Saudi, Kuwait and Egypt), but the underlying story continues to be one of a demand-led expansion in the backdrop of higher input costs and wages (but with firms largely absorbing costs in a bid to remain more competitive).

- Growth in new orders and output is a recurring narrative, but there was a stark difference in the employment picture. The UAE’s sharp decline in the 12-month ahead business confidence to a 34-month low also contributed to a “the slowest rise in job numbers in seven months”. In contrast, Saudi reported the quickest pace of hiring since Nov 2009 and in Qatar the uptick in employment (the third fastest on record) was led by the manufacturing sector. Employment grew in Lebanon as well, at the fastest pace in over 12 years.

- In Egypt, where the PMI continues in contractionary territory, output fell below-50 while new orders fell at the weakest pace in five months. Lebanon’s PMI has been supported by domestic orders, while exports were stagnant; especially in the backdrop of a pessimistic outlook for the 12-months ahead (given the political pressures and regional geopolitics). Interestingly, Kuwait’s export orders rose, mostly to its neighbouring countries.

- In countries that reported an increase in input costs in Oct (Egypt, Saudi, Kuwait), it was a combination of increase in purchase costs, transport costs (UAE, Lebanon) and wages (Egypt’s increase in wages was the most since Oct 2020; Saudi also reported salary revisions & bonus payments). Selling prices were held steady or at negligible increases in most countries as firms reported competitive pressures, but in Saudi it rose at the fastest pace since May 2023.

2. UAE federal budget of a new record high AED 92.4bn for 2026; UAE is leveraging its current strong financial position to investing long-term

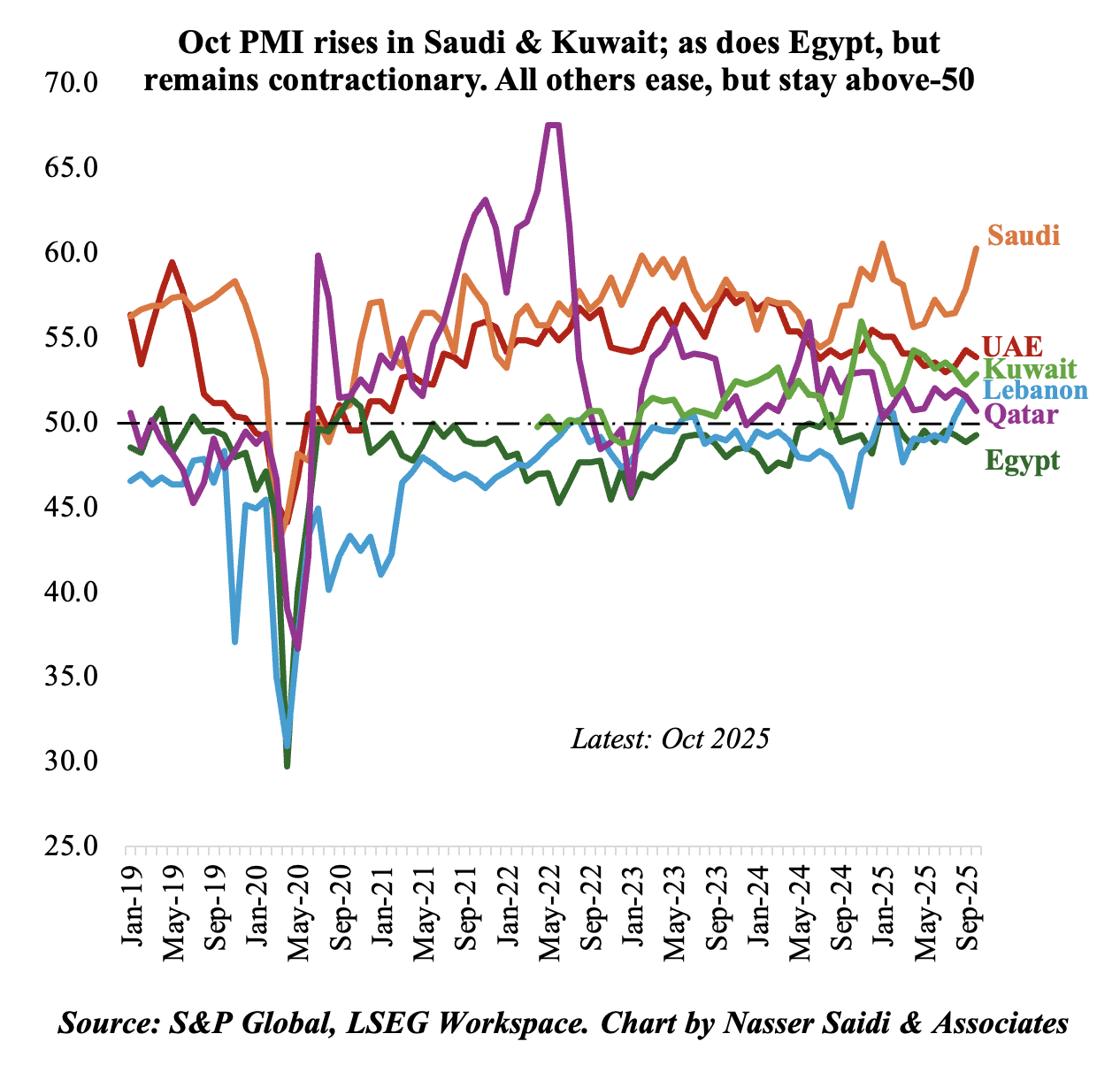

- The UAE Cabinet approved the largest-ever federal budget of AED 92.4bn for 2026, surpassing the 2025 budget of AED 71.5bn (+29% yoy). Social development and pensions together accounted for 37.5% of the federal budget in 2025.

- A breakdown shows government affairs and public & higher education sectors accounting for the largest share of spending (AED 27.1bn and AED 18bn respectively).

- The fastest growing sectors were financial investment, which surged more than five times to AED 15.4bn, and public & higher education (AED 18bn from AED 10.9bn in 2025 budget).

- The UAE is leveraging its current strong financial position to investing long-term: both in its future workforce (education) and its future wealth (financial investment).

- In H1 ‘25, UAE consolidated federal fiscal balance posted a surplus of AED 53.7bn: narrower than AED 74.7bn surplus in H1 ‘24.

- Revenues inched up by 0.44% yoy to AED 265.0bn in H1 2025; revenues grew 19.4% qoq in Q2 2025 partly due to a 17.1% qoq jump in tax revenues (to AED 88.1bn). This is a strong forward-looking indicator as it suggests UAE’s economic diversification policies are bearing fruit, creating a resilient and growing non-oil tax base.

- Spending grew by 11.7% yoy to AED 211.3bn in H1 2025; it is highly targeted. Quarterly data shows a sharp re-allocation of capital: “other expenses” cut dramatically (-64.2%), while spending on compensation of employees (+9.6%) and social benefits (+13.2%) grew. This signals a clear strategic priority: government is investing directly in its people and social foundation.

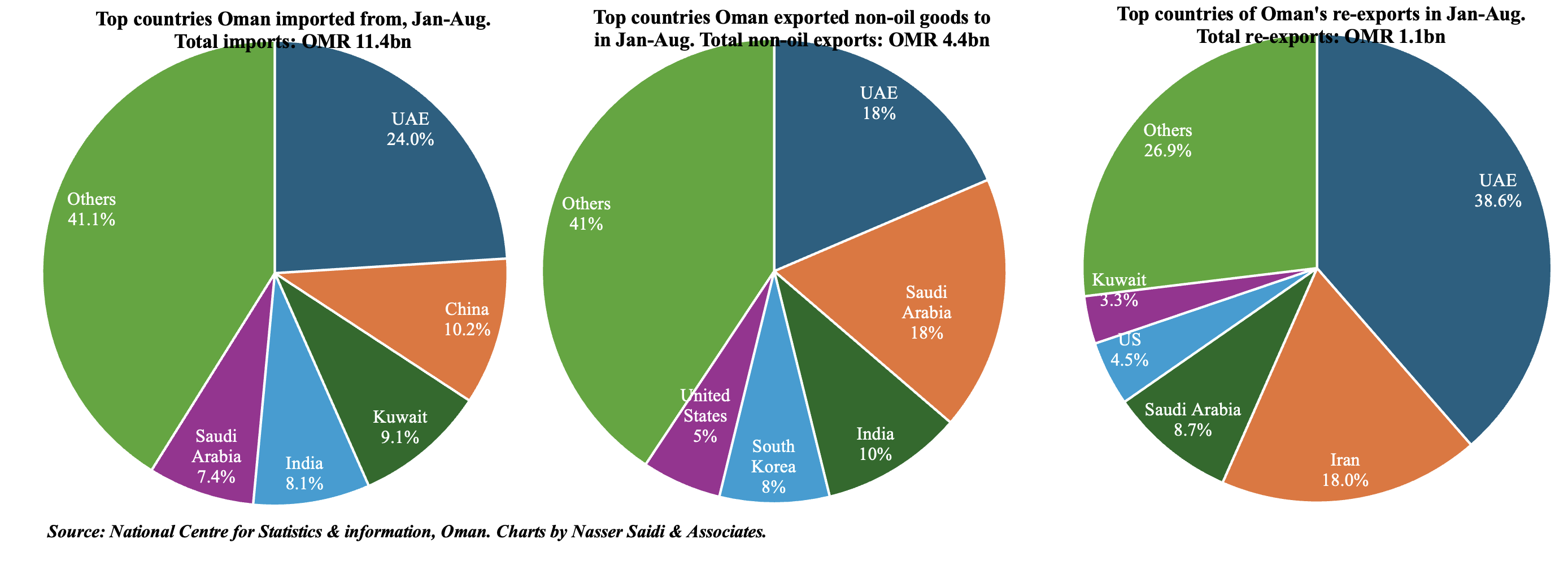

3. Oil & gas exports drag overall exports in Oman; non-oil and re-exports together accounted for 36% of total exports in Jan-Aug

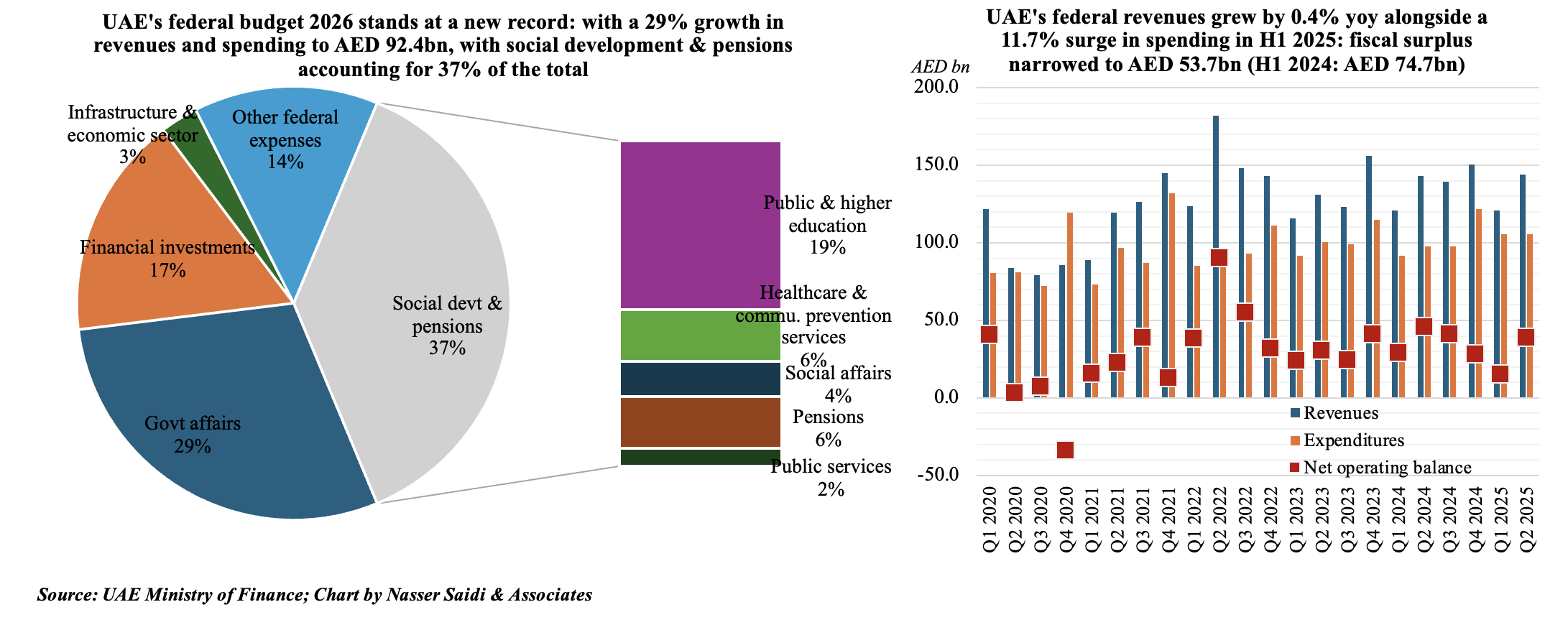

- Oil and gas exports accounted for around two-thirds of Oman’s overall exports in Jan-Aug (63.8%). Exports fell by 9.5% yoy to OMR 15.3bn (as oil & gas exports plunged by 16.8% yoy to OMR 9.8bn). Imports increased by 5.6% to OMR 11.4bn – resulting in a narrower trade surplus (OMR 3.9bn in vs OMR 6.2bn in Jan-Aug 2024).

- Non-oil exports during the year grew by 9.4% yoy to OMR 4.4bn; this comprised mainly mineral products (OMR 1.13bn, down by 5.8% yoy, but accounting for 7.4% share of total exports) and base metals & articles (OMR 912mn). Re-exports fell by 0.8% to OMR 1.12bn, with by electrical machinery & equipment and transport equipment accounting for 27.6% and 27.0% of total re-exports respectively.

- UAE was Oman’s largest non-oil trade partner: non-oil exports to UAE grew by 28.8% yoy to OMR 821mn in Jan-Aug 2025, while re-exports were OMR 433mn (5.6%). Oman’s imports originated mainly from GCC: UAE was Oman’s largest source of imports (OMR 2.7bn, or 24.0% of total); along with Kuwait and Saudi, the 3 countries accounted for 40.5% of imports.

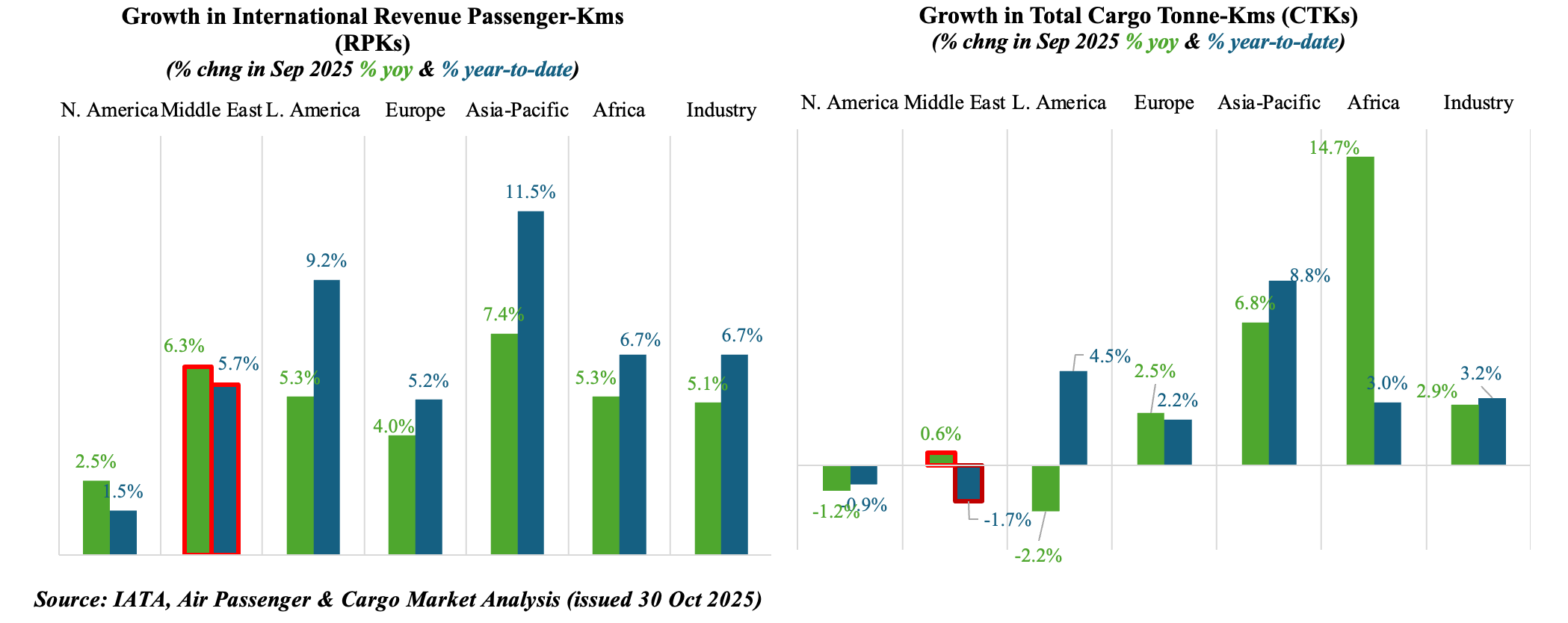

4. Gains in air passenger & cargo in the Middle East, thanks to strong Asia linkages

- International revenue passenger-kilometers (RPKs) growth in Sep (5.1% yoy) was driven by the Asia-Pacific region (7.4%, with intra-Asia route expanding 9.4%; China and Japan were the main source markets). Middle East airlines experience was also strong, up 6.3% in Sep, with the Middle East-Asia travel corridor posting a gain of 7.6%. Year-to-date gains in the Middle East was slightly muted (5.7% during the year vs industry average of 6.7%), underscoring the impact earlier in the year from ongoing regional conflicts.

- Air cargo demand remained relatively resilient in the backdrop of tariffs uncertainty. Cargo tonne-kms (CTKs) grew by 2.9% yoy in Sep, posting the 7th straight month of growth, and was up 3.2% year-to-date. Middle East carriers cargo demand grew by 0.6% yoy in Sep, much than the 2.6% clocked in Aug, and was down by 1.7% so far this year. This weakness is being driven by a sharp deterioration in the Middle East-Europe trade route, which fell 4.6% in September. However, the Middle East-Asia cargo corridor grew by 4.6% in Sep; this was also one of the three corridors that posted a positive growth of 4.1% in 2025 year-to-date.

- The forward-looking strategy for the region’s carriers is becoming increasingly clear: capitalize on the booming Asia-Pacific corridors while mitigating weakness in European trade routes.

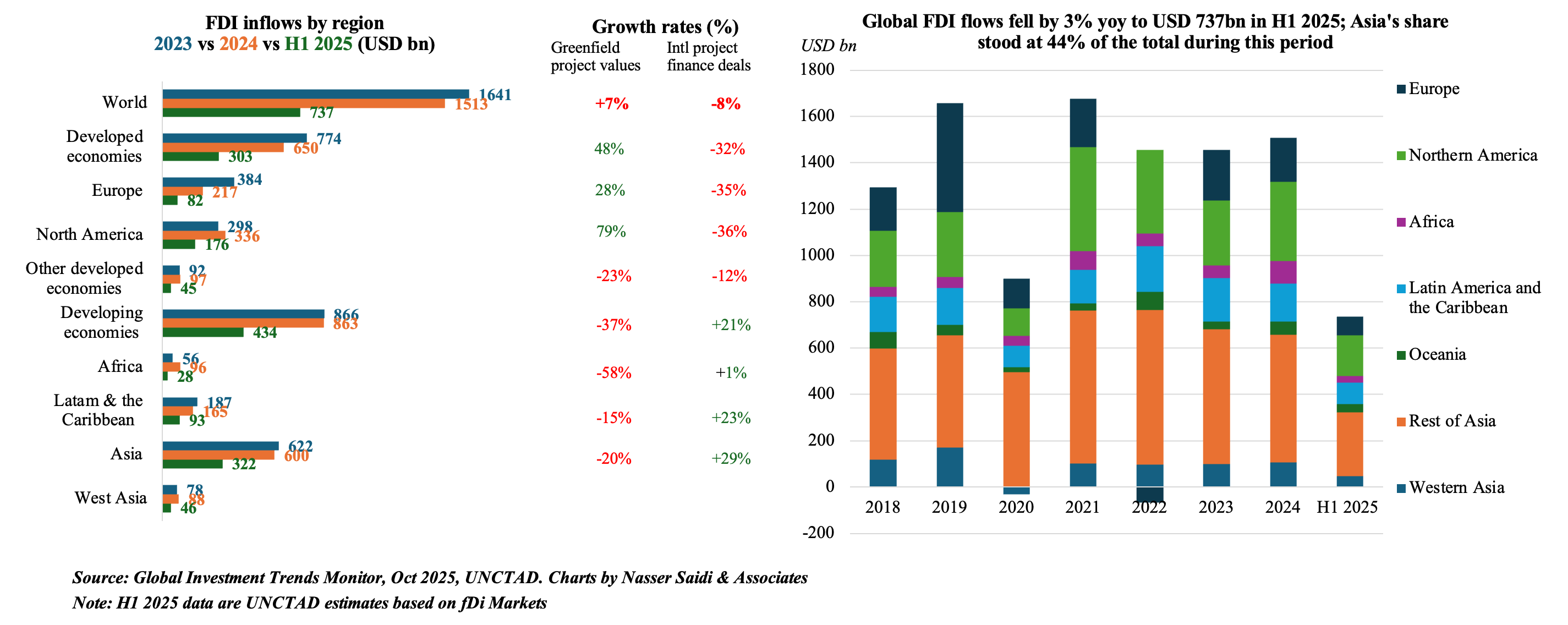

5. Global FDI flows tumbled by 3% yoy to USD 737bn in H1 2025; Latam, Asia and North America posted yoy gains

- UNCTAD’s World Investment Report for H1 2025 revealed a 3% yoy fall in FDI (on a like-to-like basis) globally to USD 737bn in H1 2025, with a clear divergent pattern. Developed nations witnessed a 7% drop (dragged down by a 25% decline in flows to Europe) while that to the developing nations (accounting for 58.9% of global FDI) was stable. FDI increased most in Latam (12% yoy), Asia (7%) and North America (5%). Tariffs uncertainty and geopolitical tensions continue to affect investment sentiment.

- Overall value of international project finance deals fell by 8% in H1 2025, mostly in the infrastructure and manufacturing sectors. Despite a 20% drop in the number of greenfield project announcements in developed countries in H1 2025, overall value of greenfield investments rose by 48% – the latter driven by a more than 2X increase in the US (matching the total for 2024; more than half in AI-related sectors) and a sixfold increase in France (largest was a USD 43bn data centre investment by UAE).

- In developing economies, number of greenfield announcements fell by 12% and total project value dropped by 37%. The number of international project finance deals declined (-2%; Saudi posted a decline in numbers), largely due to reduced investments in renewable energy projects, while the value rose by 21% (driven by countries including UAE in the region).

Powered by: