The Saudi Reset: Diversification Intact Despite Fiscal Headwinds, Weekly Insights 31 Oct 2025

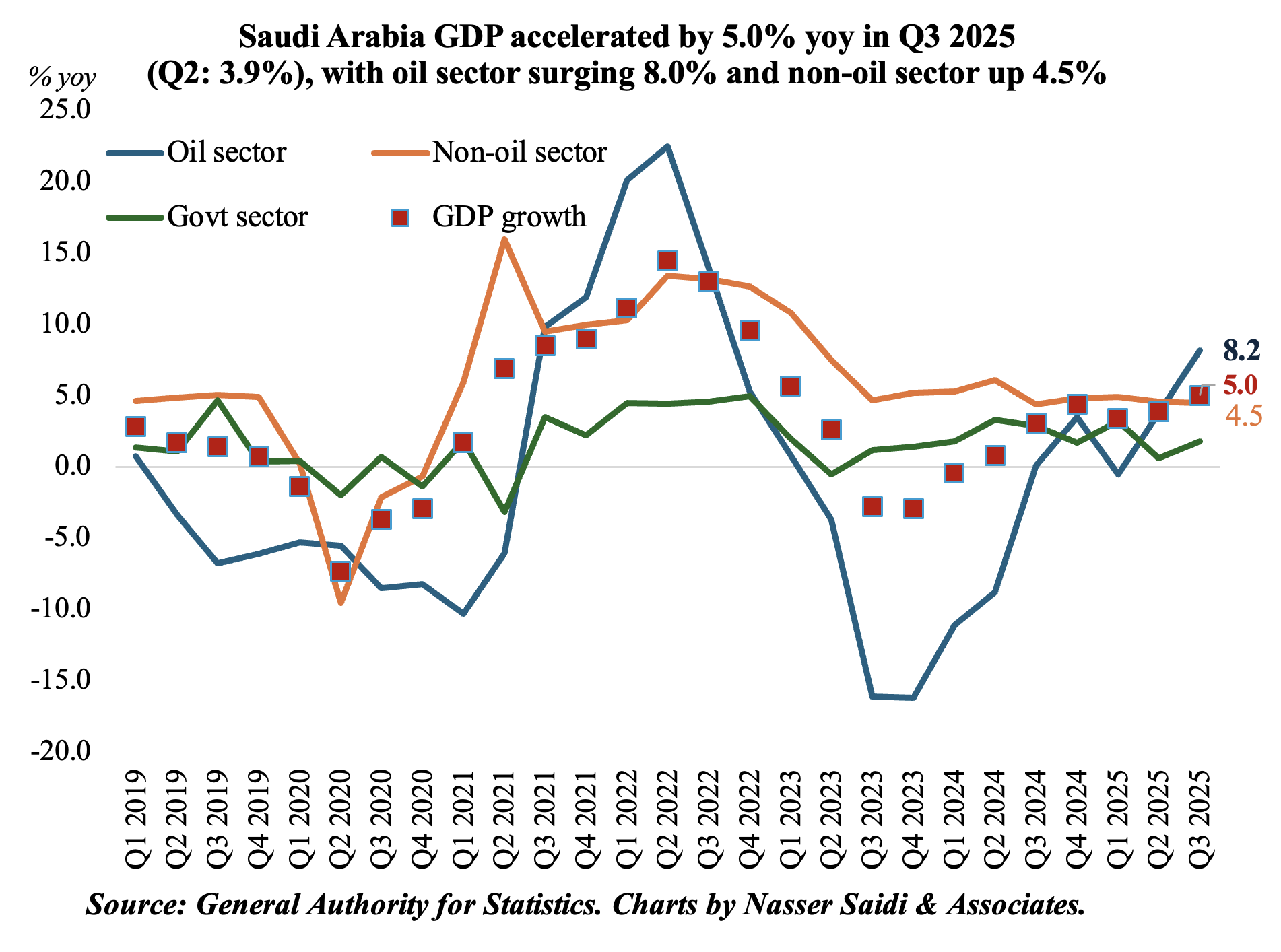

1. Saudi Arabia GDP accelerated by 5.0% yoy in Q3, driven by oil sector recovery

- Saudi Arabia’s preliminary GDP estimates showed an acceleration in Q3, up by 5.0% (Q2: 3.9%).

- This was driven by the 8.2% yoy surge in oil sector activity (Q2: 3.8%) and supported by a strong 4.5% increase in non-oil sector activity (Q2: 4.6%). Accelerated unwinding of oil production cuts will support oil sector activity during the rest of the year.

- The government sector also grew at a faster pace of 1.8% in Q3 (vs Q2: 0.6%). Government consumption will stay supportive, reflecting ongoing national development priorities. Funding is already being directed into various infrastructure projects – related to events being hosted in Saudi (e.g. 2027 AFC Asian Cup, 2029 Asian Winter Games, 2034 World Cup). In addition, bids are also being prepared for the 2030 Expo.

- The recent FII underscored that the Saudi story is still one of increased diversification. The Minister of Investment disclosed that about 40% percent of the state’s budget and expenditures were now financed by non-oil revenues; and that about 90% of all FDI flowing into KSA were directed toward non-oil sectors.

- We expect the robust expansion of the non-oil sector to continue, supported by strong domestic demand and projects pipeline. Notwithstanding the news about the PIF taking a step back to evaluate project feasibilities and potential returns, there continues to be a healthy pipeline of power & water, energy projects (both from Aramco & renewables space) and transport infrastructure – in line with greater demand due to increased tourist and labour inflows in recent years.

- Looking ahead, non‑oil sectors (manufacturing, tourism, hospitality, trade) are expected to grow further in line with diversification efforts and supportive policy. The Investment Minister’s call for greater participation from the private sector and for the PIF to take a step back from domestic investment could also see increased FDI inflow into key non-oil sectors. We believe this a signal of reset rather than retreat of government spending.

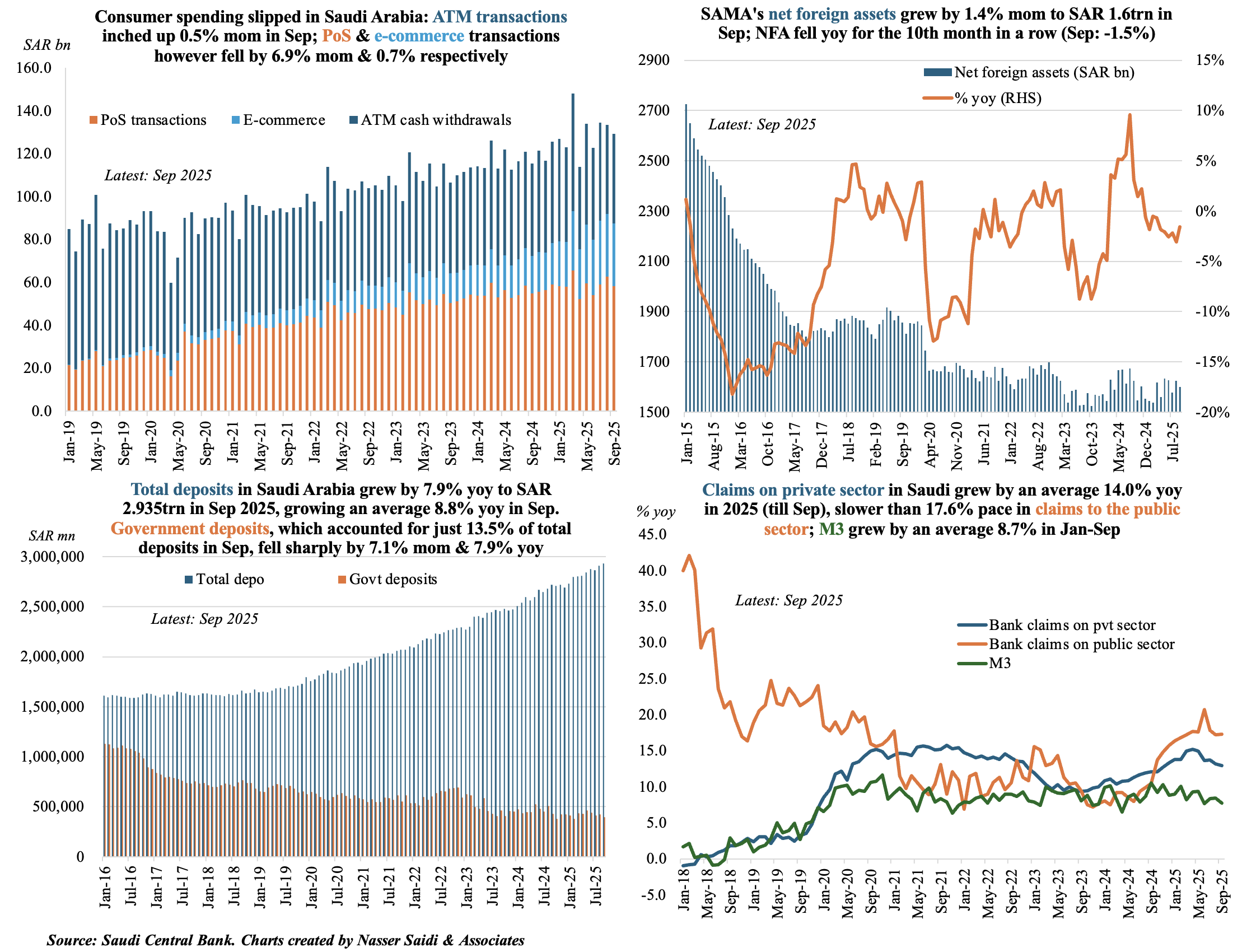

2. Consumer spending inched lower for the second consecutive month in Sep, as PoS transactions fell by a sharp 6.9% month-on-month. In yoy terms, NFA fell for 10th month running. Deposit growth in Saudi Arabia averaged 8.8% in Jan-Sep; credit growth outpaced deposit growth for the 20th straight month in Sep.

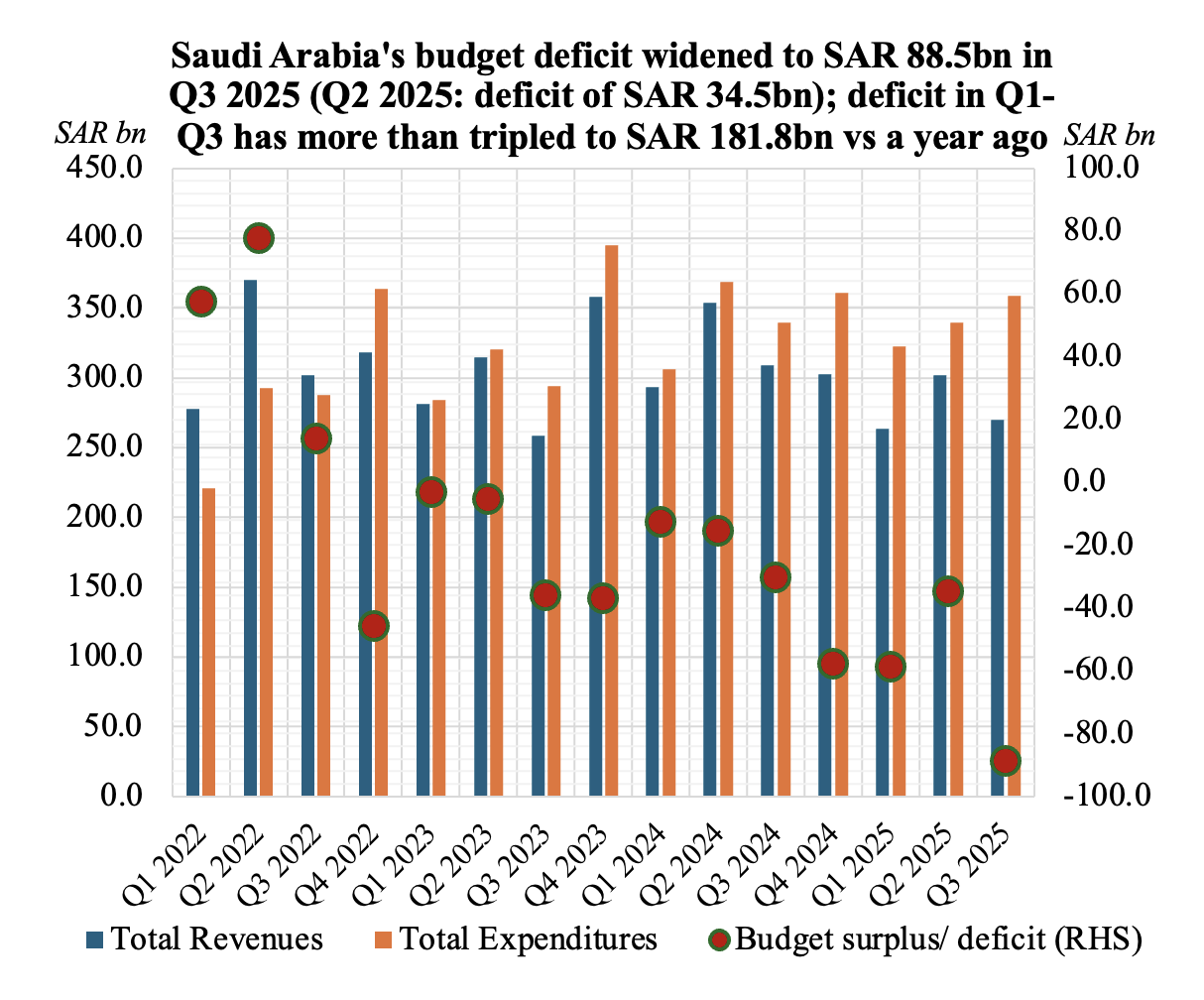

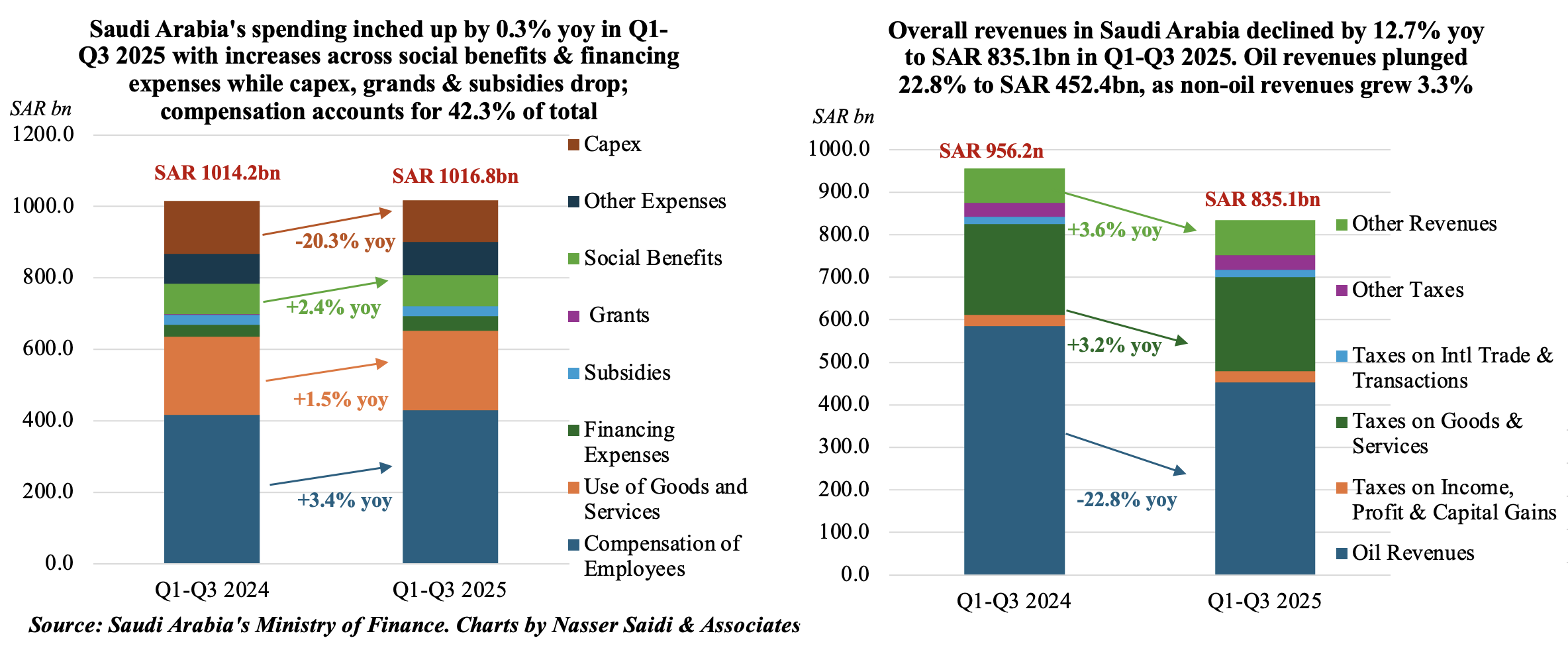

3. Saudi budget deficit widened in Q3 2025 as oil revenues plunged; fiscal deficit more than tripled to SAR 181.8bn in Q1-Q3 2025 from a year ago.

- Saudi fiscal deficit widened to SAR 88.5bn in Q3 2025 (Q3 2024: SAR 30.2bn), bringing the total deficit this year to SAR 181.8bn from SAR 58.0bn in Q1-Q3 2024.

- Overall revenues fell by 12.7% yoy to SAR 269.9bn in Q3, with oil revenues down by 21.0% (to SAR 150.8bn) given subdued oil prices. Oil revenues accounted for 55.9% of total income in Q3. Non-oil revenues grew by 0.6% in Q3, with taxes accounting for 75.4% of non-oil revenues. Broadening of tax base via the recent White Land Tax hike (to 10% from 2.5% of property value) and VAT amendments will raise tax revenues.

- Overall expenditures rose by 5.6% yoy to SAR 358.4bn in Q3, with capex up by 3.7% yoy and 25.1% qoq to SAR 49.9bn. Compensation of employees, which accounted for 45.3% of total spending gained 3.6% yoy and 2.3% qoq to SAR 143.6bn.

- For the period Q1-Q3, oil revenues fell by 22.8% leading to a 12.7% drop in total revenues; non-oil revenues grew by 3.3% to SAR 382.7bn (46% of total revenues). Expenditure ticked up by 0.3% to SAR 1.017trn in Q1-Q3, with compensation the largest component (42.3% of total) and capex down by 20.3% to SAR 117.6bn.

- Public debt jumped to SAR 1.467trn till Q3 of which 63.4% was domestic debt.

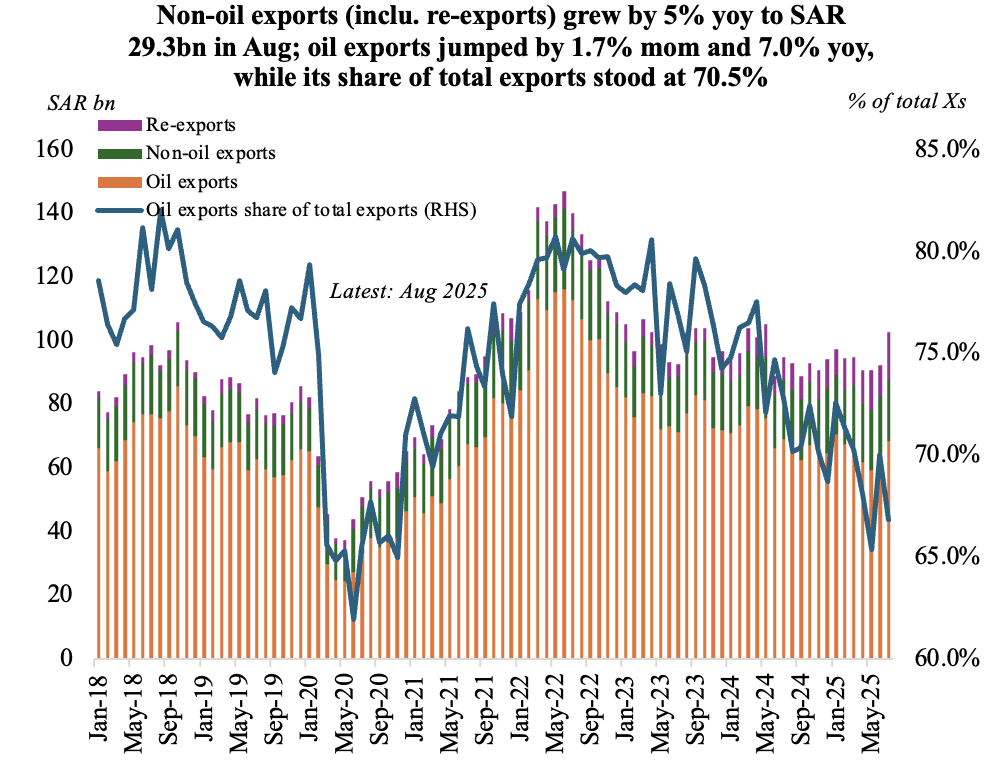

4. Resurgent Saudi oil exports failed to provide the push for exports in Aug; trade deficit widened

- Saudi Arabia’s overall exports fell by 3.5% mom to SAR 99.1bn despite the increase in oil exports (1.7% mom and 7.0% yoy to SAR 69.8bn). Share of oil exports to overall exports rose to 70.5% (Aug: 66.8%).

- Non-oil exports (including re-exports) grew by 5% yoy to SAR 29.3bn in Aug. A breakdown shows that re-exports and domestic non-oil exports (i.e. excluding re-exports) fell by 22.5% mom and 7.5% mom to SAR 11.4bn and SAR 17.9bn respectively.

- Imports fell by 9.1% mom to SAR 74.9bn in Aug 2025 (but was up 7.4% yoy). This resulted in a wider trade surplus – SAR 24.2bn vs Ju1’s SAR 20.4bn and Aug 2024’s SAR 23.3bn.

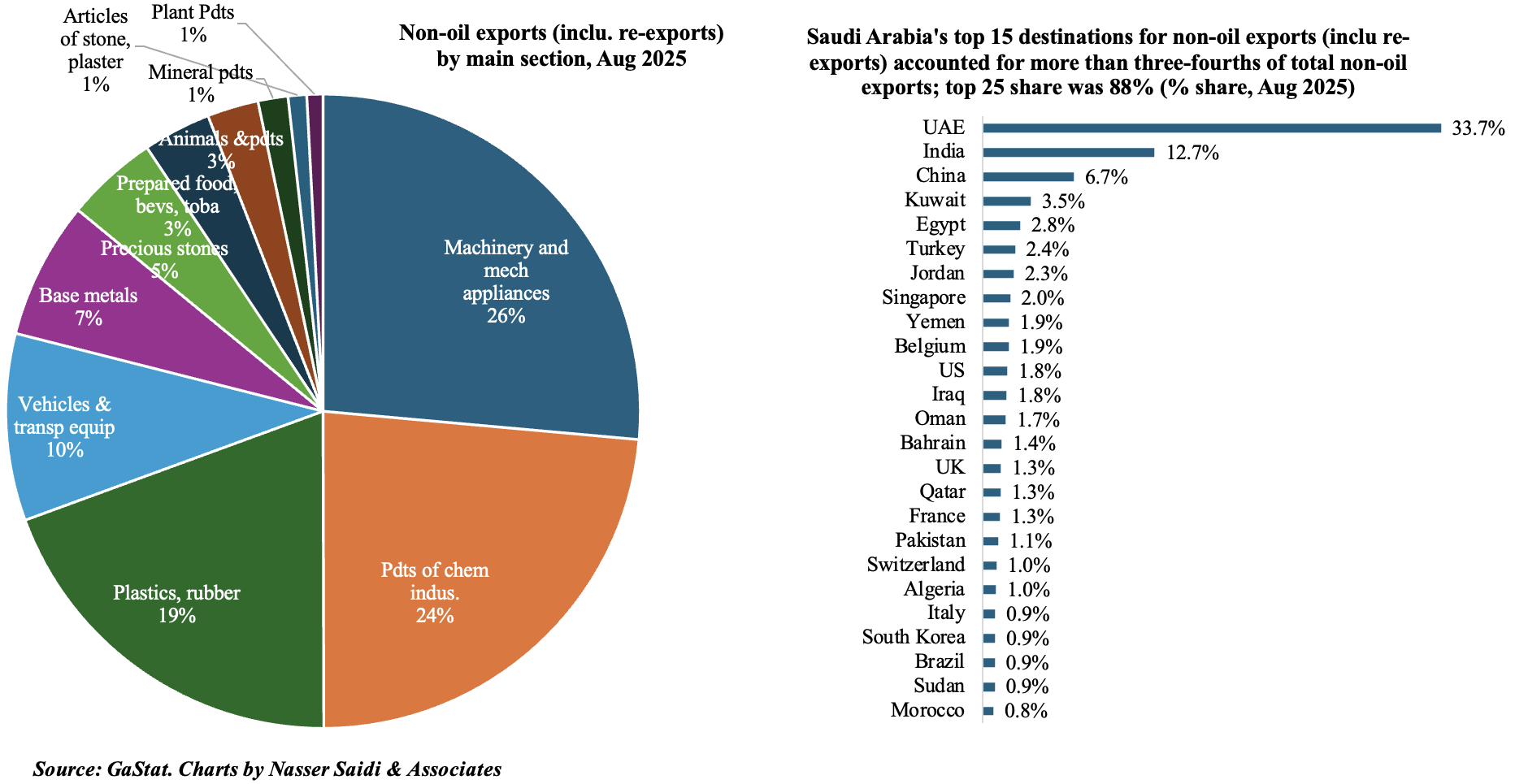

- Machinery was the largest segment of non-oil exports (26%), followed closely by chemicals & its products (24%) and plastics, rubber and their articles (19%). UAE accounted for one-third of non-oil exports; share of non-oil exports to GCC was 41.6%.

- Eastern Asia was the largest destination region for exports from Saudi Arabia (33.5%).

- China was the largest trade partner for KSA in Apr: it received 16.2% of Saudi exports and was source nation for 26.4% of KSA imports.

- From West Asia region, UAE was the top trade partner: received 11.1% of Saudi’s total exports and the source for 5.4% of Saudi imports.

Powered by: