Steady Prices & Stronger Diversified Foundations in the GCC: Weekly Insights 24 Oct 2025

1. International visitors to Dubai rise 5.1% yoy to 12.54mn in Jan-Aug 2025; DXB to attract approx 2.2% of all international tourists’ arrivals worldwide in Q4

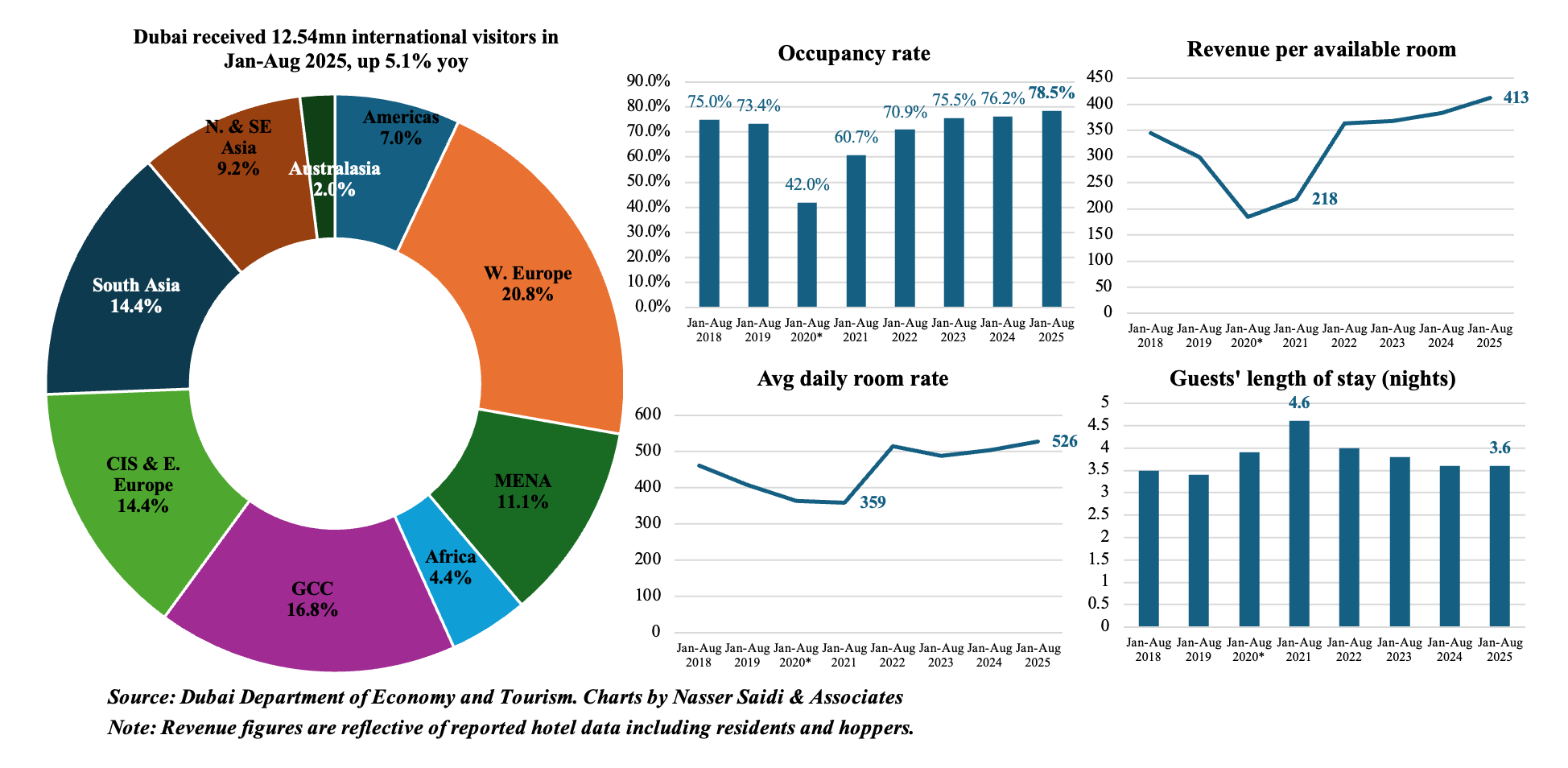

- Despite the seasonal summer lull, visitors into Dubai grew by 5.1% yoy to 12.54mn in Jan-Aug 2025.

- Western Europe had the largest shares of visitors at 20.8%, while South Asia and CIS & Eastern Europe accounted for 14.4% each during the period (2.6mn, 1.81mn and 1.8mn respectively); GCC & MENA combined accounted for 3.5mn visitors (or 27.8% of total).

- At end-Aug 2025, there were 152,284 hotel rooms (+1% yoy) across 818 establishments (-1% yoy) in Dubai. Hotel occupancy rate at a strong 78.5% was higher than 76.2% in Jan-Aug 2024; revenue per available room of AED 413 (+7.6% yoy) remains among the highest recorded during the same period in past years while room rates stood at AED 526 (+4.6% yoy) and length of stay remained steady at 3.6 nights, but higher than 3.4 in Jan-Aug 2019). Occupied room nights also inched up 4.5% yoy to 29.03mn in Jan-Aug 2024.

- Tourism is gaining momentum: (a) data from ForwardKeys (that tracks forward bookings) shows that Dubai will attract more international visitors in Q4 (6% yoy); this will be approximately 2.2% of all international tourist arrivals worldwide in Q4; (b) Dubai International Airport expects to handle a record high 95.3mn passengers this year (vs 92.3mn in 2024); (c) Dubai is expected to add more than 5k new rooms across 19 properties by end-2025 (Source: Cavendish Maxwell).

2. Oil & gas exports account for around two-thirds of Oman’s overall exports

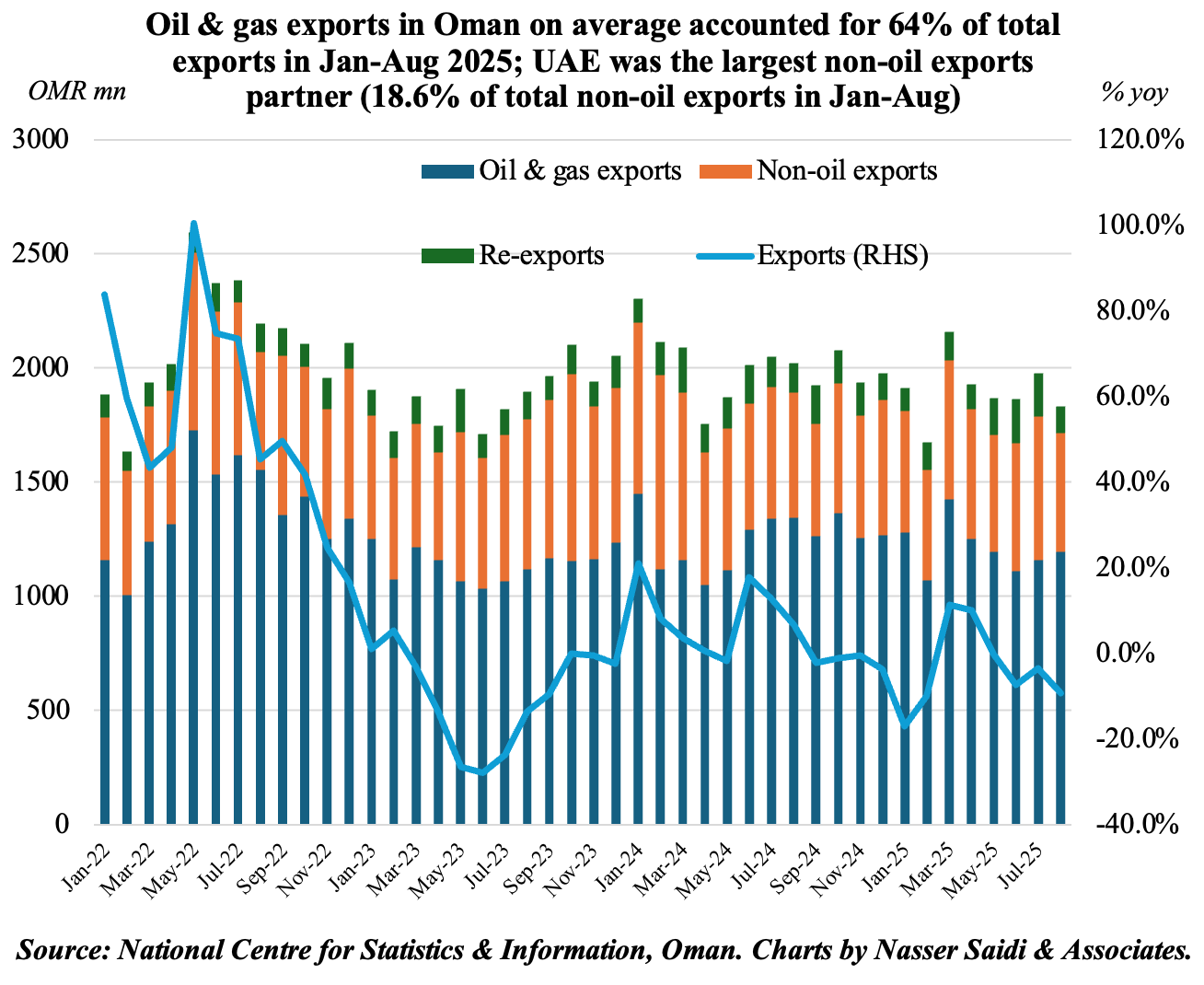

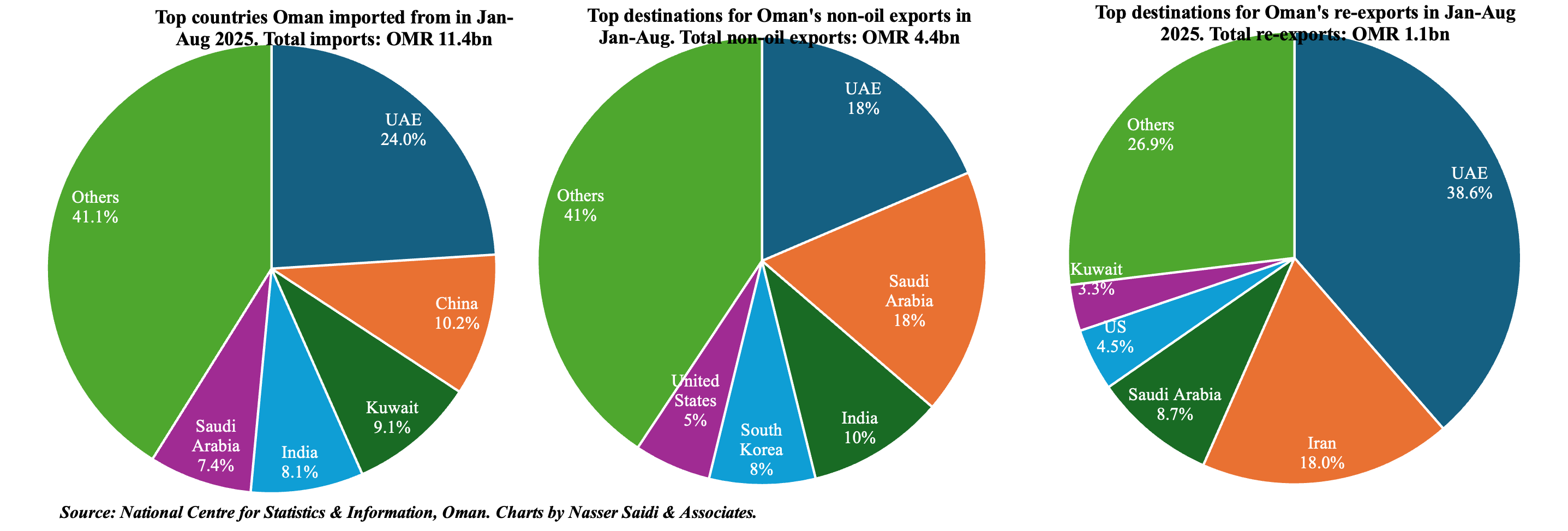

- Oil & gas exports accounted for 64% of Oman’s overall exports in Jan-Aug 2025 (vs 69.4% in Jan-Aug 2024). Exports fell by 9.5% yoy to OMR 15.32bn (as oil & gas exports plunged 16.8% to OMR 9.78bn). Imports rose by 5.6% to OMR 11.4bn, resulting in trade surplus narrowing by around 1.5-times to OMR 3.9bn in (vs OMR 6.2bn in Jan-Aug ‘24).

- Non-oil exports grew by 9.4% yoy to OMR 4.4bn in Jan-Aug; this comprised mineral products (OMR 1.13bn, down by 5.8% yoy, but accounting for 7.4% share of total exports) and base metals & articles (OMR 912mn). This is aided by improved logistics, infrastructure and a growing industrial base. Govt reforms + digital platforms + export incentives reduce barriers for non-oil exporters.

- Re-exports edged down by 0.8% to OMR 1.12bn, with share of electrical machinery & equipment and transport equipment at 27.6% and 27.0% of total re-exports.

- Greater regional integration – UAE is Oman’s largest non-oil trade partner: non-oil exports to UAE grew by 28.8% yoy to OMR 821mn in Jan-Aug 2025, while re-exports were OMR 433mn (5.6% yoy). Oman’s imports originated mainly from GCC: UAE was Oman’s largest source of imports (OMR 2.73bn, or 24.0% of total); along with Kuwait & KSA, these 3 countries accounted for 40.6% of imports.

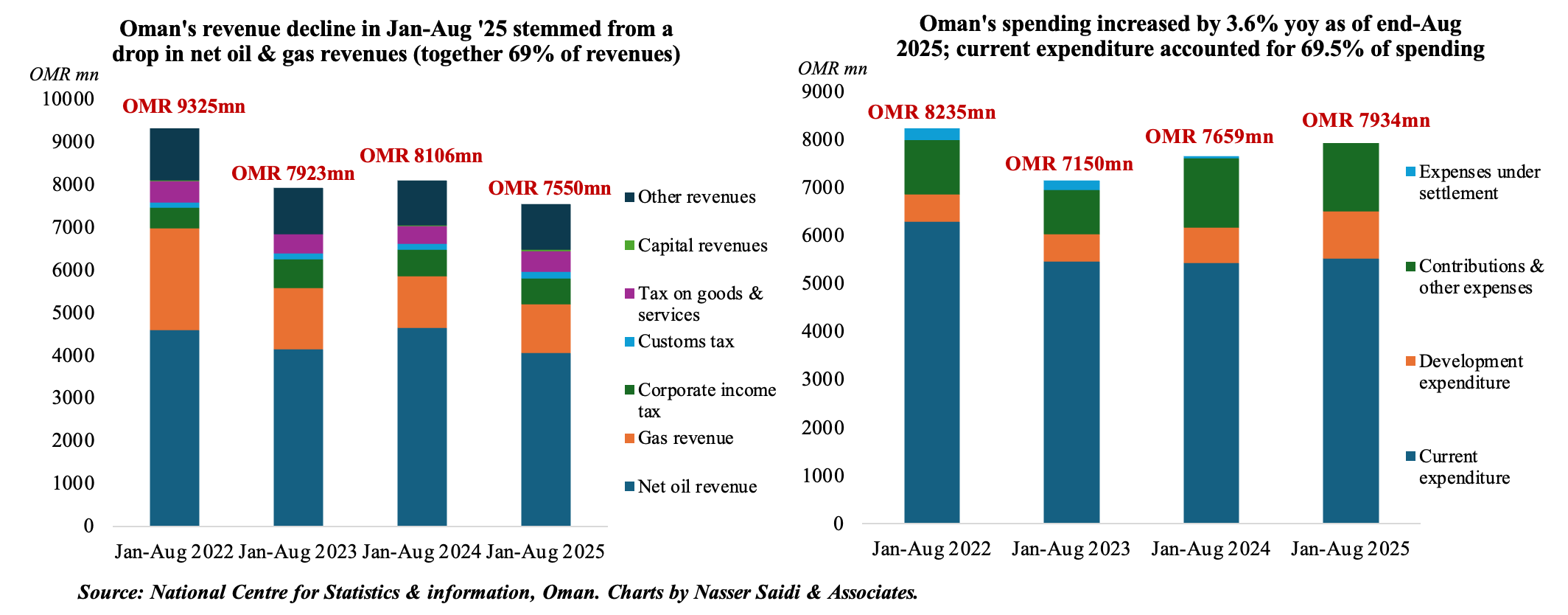

3. Oman’s fiscal deficit stood at OMR 384mn in Jan-Aug 2025, dragged down by oil & gas revenues

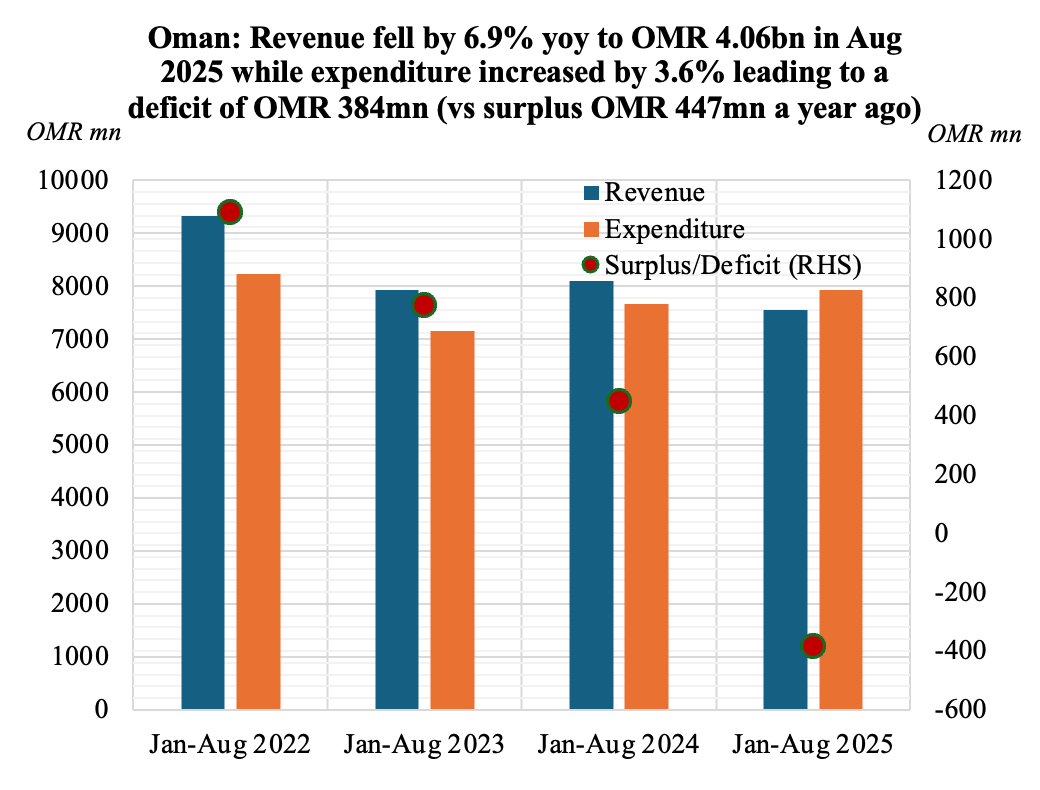

- Oman posted a budget deficit of OMR 384mn in Jan-Aug 2025. Revenues fell by 6.9% yoy to OMR 7.55bn alongside a 3.6% rise in spending (to OMR 7.93bn).

- There was a sharp decline in net oil revenues (-12.7% yoy to OMR 4.06bn) and gas revenues (-5.8% to OMR 1.14bn). Net O&G together accounted for 68.9% of revenues during this period. Tax revenues grew by 6.0% yoy to OMR 1.25bn: corporate taxes and taxes on goods & services accounted for 48.4% and 39.0% of tax revenue.

- Expenditure grew by 3.6% in Jan-Aug 2025: current expenditure edged up slightly (1.5% yoy to OMR 5.52bn) alongside a 34.7% surge in development expenditure (to OMR 990mn) while contributions & other expenses slipped by 0.9% to OMR 1.43bn. Social protection system and electricity sector subsidy together accounted for 50% of contributions & other expenses; oil subsides were 4%.

- The IMF projects fiscal surplus to narrow to an average of 0.5% of GDP during 2025-2026 on an uptick in oil production & continued fiscal reforms.

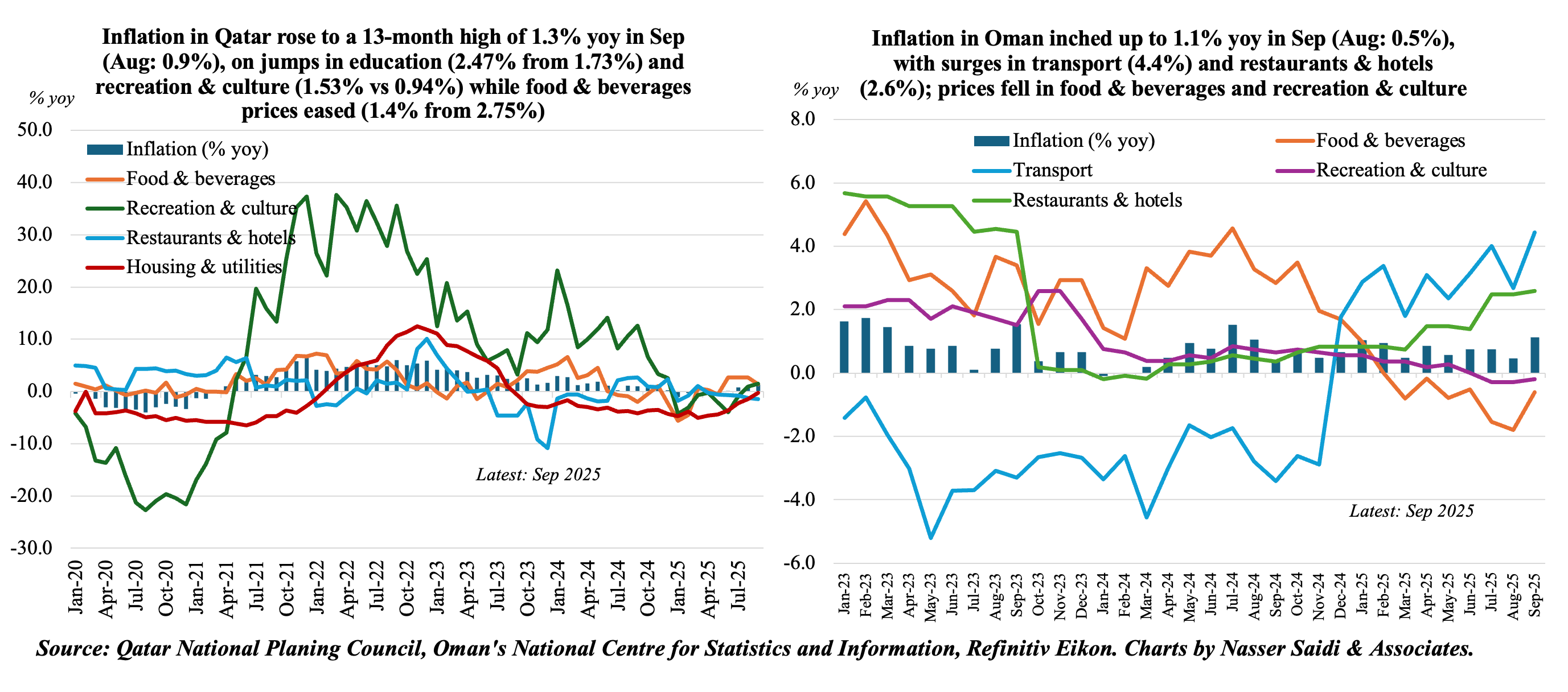

4. Inflation in Qatar & Oman rise in Sep, but stays relatively low

- Inflation in Qatar increased to 1.3% yoy in Sep (Aug: 0.9%), the highest reading since Aug 2024). Miscellaneous goods and services posted the largest increase (12.57% from Aug’s 10.5%), the most on record for the series with base year 2018. Other than this, the price gain stemmed from clothing & footwear (2.9%), education (2.47% vs 1.7%) as well as recreation & culture (1.53% vs 0.94%) while food & beverages prices eased to 1.4% (Aug: 2.75%). Both transport and restaurant & hotels costs fell (-1.12% & -1.48% respectively).

- Overall inflation clocked an average 0.26% in Jan-Sep 2025, slowing from 1.54% a year ago. Almost all categories showed a lower average in 2025 except communication costs (12.3% from 1.51% in Jan-Sep 2024), miscellaneous goods & services (10.7% vs 2.85%) and clothing & footwear (0.15% from -1.83%). Food & beverages went deflationary this year (-0.02% from a 2.1% gain a year ago).

- Inflation in Oman ticked up to 1.13% yoy in Sep (vs Aug: 0.47%), taking the Jan-Sep average to 0.78% (Jan-Sep 2024: 0.58%).

- Prices of food & non-alcoholic beverages clocked in negative readings in 7 of the 9 months this year taking the average to -0.59% from 2.98% a year ago. Higher prices this year were seen in health (1.85% from 1.37% in Jan-Sep 2024), transport (3.1% vs -2.8%), clothing & footwear (0.45% vs 0.09%) and restaurant & hotels (1.6% vs 0.21%).

- Inflation is widely expected to stay subdued this year, especially in the GCC, on lower food costs.

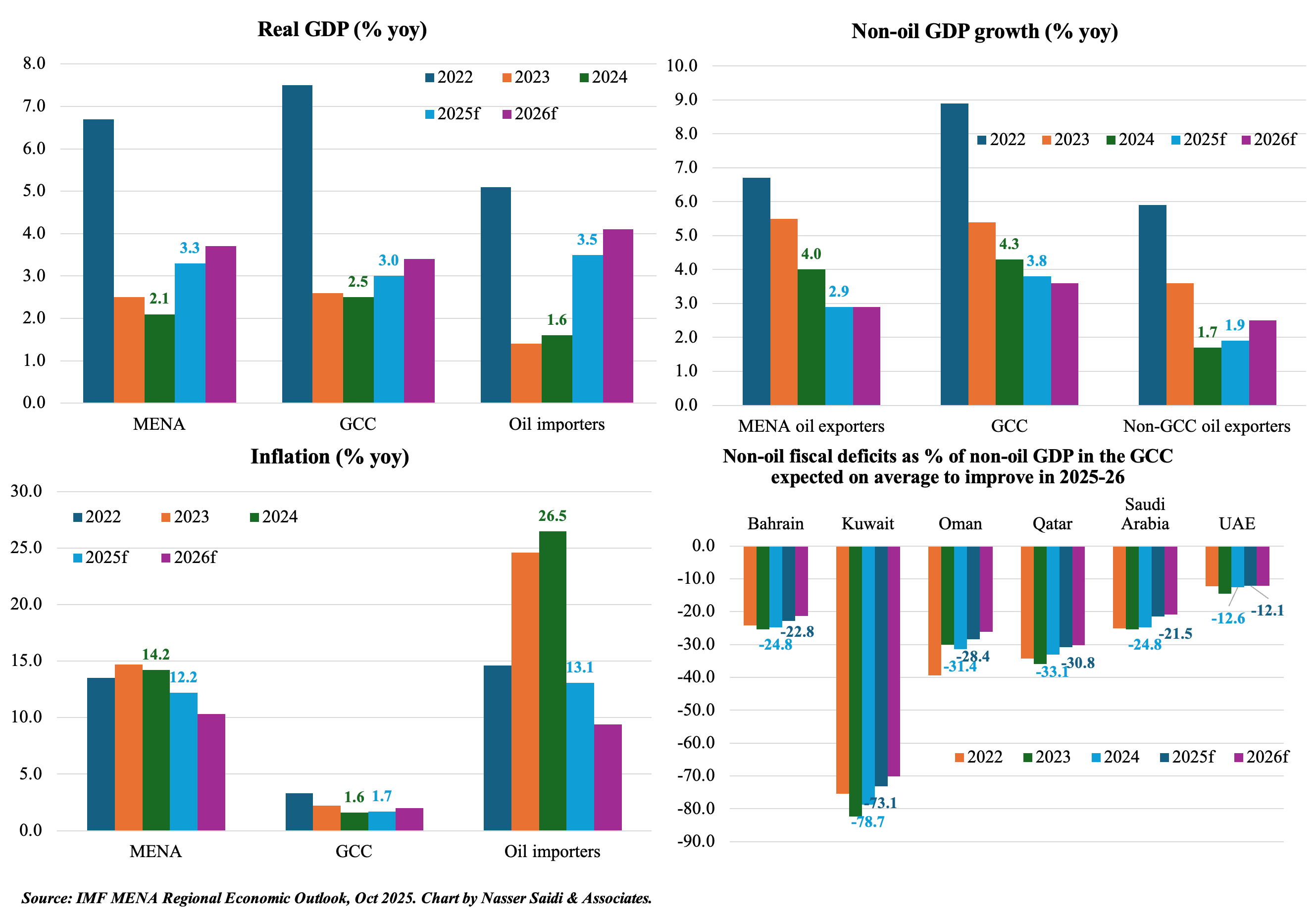

5. GCC growth to increase in 2025 (3.0% from 2.5% in 2024), thanks to non-oil sector activity; inflation stays below 2%

- Economic growth is expected to edge up in the MENA in 2025 (+3.3% yoy) and rise further in 2026 (3.7%).

- GCC growth is projected to increase in 2025 (3.0% from 2.5% in 2024), given unwinding of oil production cuts and robust non-oil sector activity (3.8% and 3.6% in 2025 and 2026 respectively).

- While a ceasefire has been agreed to in Gaza, any conflict (or escalation) will weigh on growth for a longer period. The IMF estimates that successful recoveries in the region would lead to a rebound in real consumption and investment by 25% and nearly 75% on average within five years of a conflict ending.

- Inflation shows signs of easing in 2025-26, running at close to 2% in the GCC versus double-digits in the wider MENA.

- Fiscal consolidation measures undertaken by GCC are showing up as improvements in non-oil fiscal balances (as % of non-oil GDP).

Powered by: