Download a PDF copy of the weekly economic commentary here.

Markets

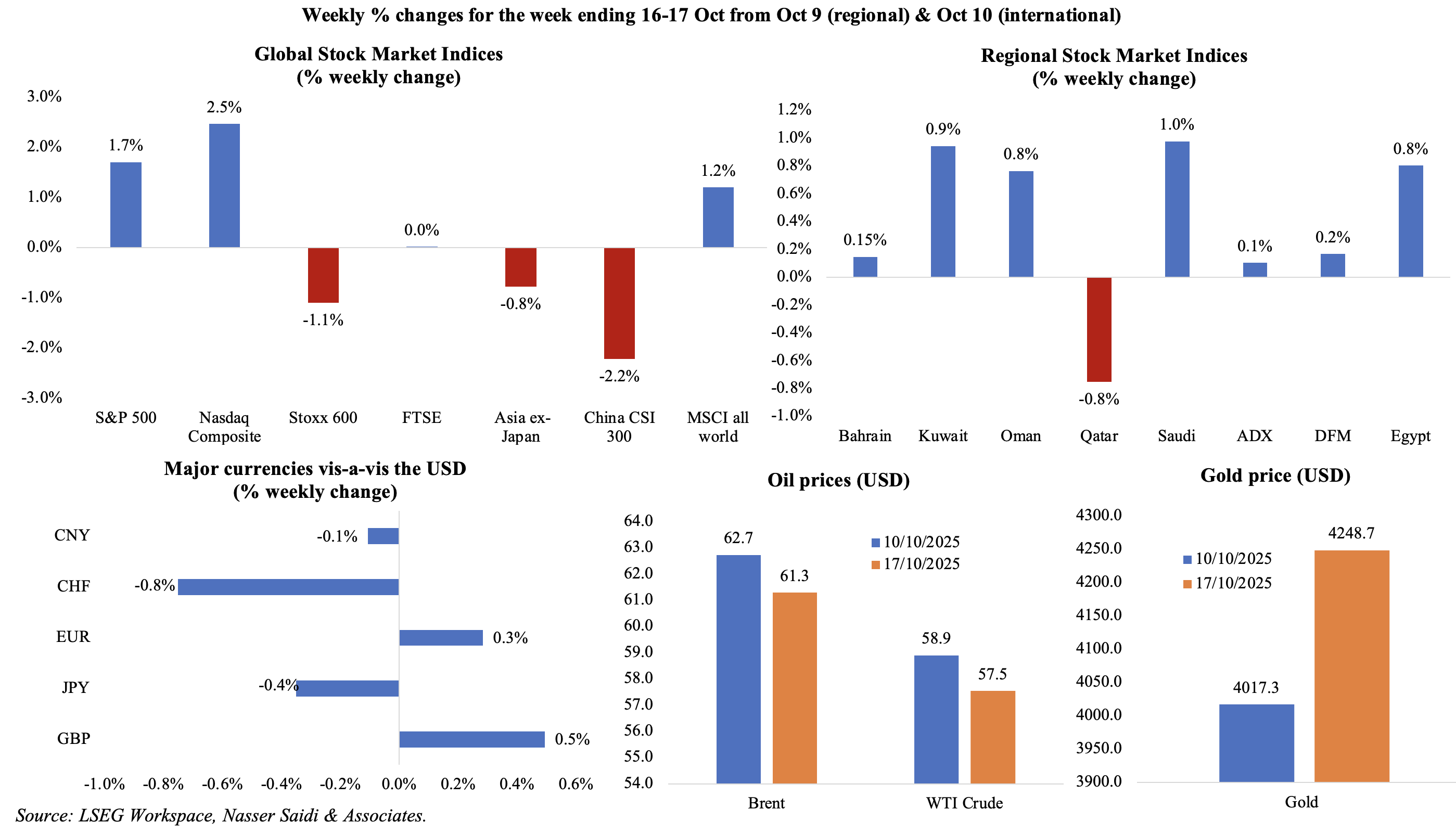

Major US markets were up last week after trade tensions with China and credit quality concerns in US regional banks were deemed to be less of a threat, and investors calmed down. European markets ended in the red (FTSE slid to a 2-week low on Friday), as did many Asian markets while regional markets were mostly up. The USD ended up lower on continuing trade uncertainty and safe haven assets benefitted, including the JPY and CHF as well as gold price (pulled back from a record high to close near USD 4230 an ounce). Oil prices slipped by more than 2% compared to a week prior.

Global Developments

US/Americas:

- After commentating that a “full scale” tariff on China would be unsustainable, President Trump revealed that he is scheduled to meet Chinese President Xi Jinping in 2 weeks, calming trade tensions for the time being.

- US NFIB Business Optimism Index edged down to 98.8 in Sep (Aug: 100.8). The decline suggests growing unease among small business owners, particularly supply chain disruptions (64% owners reported), inflationary pressures (14% reported so) and labour market challenges. Persistent concerns over consumer demand and rising input costs could further dampen small business sentiment unless policy clarity and labour market conditions improve.

- NY Empire State manufacturing index jumped to 10.7 in Oct (Sep: -8.7), a modest rebound in factory activity, thanks to an increase in new orders (3.7 from -19.6) and a rebound in shipments (14.4 from -17.3). Separately, the Philadelphia Fed manufacturing survey plunged to a 6-month low of -12.8 in Oct (Sep: 23.2) reflecting a 20-point drop in shipments, as well as elevated price indices. This regional disparity underscores the fragility of the sector.

Europe:

- EU inflation stood at 2.2% yoy in Sep (Aug: 2.0%), in line with preliminary estimates, while core CPI ticked up to 2.4% (from 2.3% the month before) – the highest level since Apr. This reflects ongoing cost pressures in services (+3.2% from 3.1%) and food, alcohol & tobacco (+3.0% from 3.2%), indicating that inflationary momentum has not fully dissipated. Various ECB board members stated separately that the apex bank’s easing cycle was close to its end.

- Industrial production in the EU fell by 1.0% mom in Aug (Jul: 0.4%), with declines across all industrial groups other than non-durable consumer goods (+0.1% mom). The monthly contraction highlights ongoing challenges faced by the manufacturing sector, including weak external demand, high input costs and tight financial conditions. In yoy terms, IP grew by 1.1%, slower than Jul’s 1.9% rise. In the near term, industrial output is expected to remain under pressure, especially if global trade volumes continue to soften.

- The ZEW Economic Sentiment Index in Germany moved up to 39.3 in Oct (Sep: 37.3), though the current situation sub-index worsened to -80 (from -76.4) – underscoring persistent weakness in the real economy, particularly in industrial and export sectors. In the eurozone, Economic Expectations Index slipped to 22.7 (from Sep’s 26.1), largely due to the troubles in France while the assessment of the current situation also dipped (-3 points to -31.8).

- Wholesale price index in Germany accelerated by 0.2% mom and 1.2% yoy in Sep (Aug: -0.6% mom and 0.7% yoy) The yoy increase was the fastest since Mar, driven by prices for non-ferrous ores & metals (23.5%) and food, beverages & tobacco (4.2%).

- UK GDP grew by 0.1% mom in Aug (Jul: -0.1%), thanks to a rebound in industrial production and manufacturing, up 0.4% and 0.7% (Jul: -0.4% and -1.1% respectively) while services sector flatlined and construction shrank (-0.3% mom). Growth remains fragile, and the economy continues to hover near stagnation. Sustainability of this recovery will depend on household consumption near-term and the Bank of England’s monetary policy stance.

- Unemployment rate in the UK increased to 4.8% in the 3 months to Aug, the highest reading since the 3 months to Jun 2021. Average earnings including bonus rose by 5% yoy in the 3 months to Aug from 4.8% the month before. Excluding bonus, average earnings edged lower to 4.7% (vs 4.8%). Labour market conditions will remain a key determinant of the Bank of England’s rate decisions, with policymakers watching for signs of wage deceleration.

- Like-for-like retail sales in the UK grew by 2% yoy in Aug (Jul: 2.9%), with the moderation reflecting waning discretionary spending, especially on non-food sales (0.7% yoy vs food sales at 4.3%). Retailers are increasingly reliant on promotions and pricing strategies to maintain volume amid persistent cost pressures.

Asia Pacific:

- Exports from China grew by 8.3% yoy in Sep (Aug: 4.4%), the fastest pace in 6 months, alongside a 7.4% jump in imports (Aug: 1.3%). This narrowed trade surplus to USD 90.45bn in Sep from USD 102.33bn the month prior. China’s exports to the US fell 27% and imports declined 16%. In contrast, exports to ASEAN, EU and Africa were up by 15.6%, 10.4% and 56.4% respectively.

- Consumer prices in China continue to hover in deflationary territory, at -0.3% yoy (Aug: -0.4%), reflecting weak domestic demand, falling food prices (-4.4% from Aug’s -4.3%), and lower production costs. Core inflation rose to a 19-month high of 1.0% yoy. China’s producer price index fell to 2.3% in Sep (Aug: -2.9%), continuing the decline for the third year in a row. These trends reinforce concerns about sluggish consumer confidence and the need for stronger demand-side support.

- China’s new loans more than doubled to CNY 1290bn in Sep (from Aug’s CNY 590bn) – as seasonal factors supported a boost in Sep credit flows amid weak private sector demand and sluggish investment. Outstanding yuan loans grew by 6.6% yoy, a record low (from 6.8% in Aug) and M2 money supply grew by 8.4% (slower than Aug’s 8.8%).

- Japan’s industrial production fell by 1.5% mom and 1.6% yoy in Aug. This was the sharpest monthly decline since Nov 2024 and points to continued weakness in manufacturing activity, driven by softer global demand, supply chain disruptions and weakness in sectors such as automobiles, electrical machinery (-4.9% vs 1.2% in Jul) and information & communication electronics equipment (-16.5%).

- Consumer price inflation in India eased to 1.54% yoy in Sep (Aug: 2.07%), the lowest since Jun 2017, also falling below the RBI’s lower 2.0% limit. Food prices fell by 2.28%, the largest decline since Dec 2018. Wholesale price index rose by 0.13% in Sep (Aug: 0.52%), largely due to lower food prices (-1.99%) and manufacturing costs (2.33% from Aug’s 2.55%). The continued decline in both inflation readings reflects easing food prices and benign input cost dynamics across sectors.

- Trade deficit in India widened to a 13-month high of USD 32.15bn in Sep (Aug: USD 26.49bn) reflects a surge in imports (particularly gold and silver) and exports (3.7% mom to USD 36.38bn). Exports to the US dropped sharply by 20% to USD 5.5bn in Sep, the full month of 50% tariffs, and was down by 37.5% in the last four months. Gold imports nearly doubled to USD 9.6bn in Sep (Aug: USD 5.14bn) while oil imports ticked up to USD 14bn (Aug: USD 13.2bn). The widening gap may also be influenced by domestic restocking and festival-related demand but poses risks to the current account balance and INR’s stability.

- Singapore’s GDP grew by 1.3% qoq and 2.9% yoy in Q3 (Q2: 1.5% qoq and 4.5% yoy) reflects flat manufacturing growth (vs Q2: 5.0%) while sectors such as construction and services contributed positively, growing by 3.1% and 2.5% respectively, though lower than Q2 (6.2% and 4.9% respectively).

Bottom line: The IMF projects global economic growth to ease to 3.2% in 2025 (2024: 3.3%) and further to 3.1% in 2026. The shift toward greater protectionism & fragmentation, particularly US tariff hikes, is creating uncertainty that weighs on consumption, investment & trade volumes. Emerging market economies (EMEs) will also witness slower growth, projected at 4.2% in 2025 and 4.0% in 2026. Debt crisis in US with the recent filing by First Brands for bankruptcy protection highlights the dangers of the lightly or non-regulated (and opaque) private debt & asset management market – one that could affect regional banks and spillover into global markets. The IMF also highlighted concerns about links between the traditional banks and non-bank financial intermediaries, and potential ripple effects. Though no US data has been released by government entities (affected by the shutdown), this week will see a delayed release of US inflation data – just in time ahead of the Fed meeting next week.

Regional Developments

- Growth in MENA is forecast to increase to 3.3% in 2025 and 3.7% in 2026, according to the IMF. This is largely due to the faster unwinding of oil production cuts, lower disruptions to oil production & shipping (spillover from regional conflicts) and GCC’s robust non-oil sector growth.The UAE is projected to growth by 4.8% this year (2026: 5.0%) and Saudi Arabia by 4.0% in 2025 & 2026. Though the region has a relatively smaller exposure to the US tariff hikes, there will be indirect effects from commodity prices (as global demand remains subdued). Inflation is expected to ease, partly due to monetary policy tightening and lower energy costs, with oil importers’ averages declining to 12.2% and 8.8% in 2025 and 2026.

- Exports from Egypt climbed 17.3% yoy to USD 29.9bn in Jan-Jul, driven by higher shipments of manufactured and semi-manufactured goods (up 22.2% to USD 23.7bn).

- Egypt increased domestic fuel prices for the second time this year by around 11‑13% (following Apr’s 15% hike), in line with lowering subsidies and complying with IMF program conditions. The authorities stated that domestic fuel prices will be frozen for at least a year following the latest hike.

- Egypt submitted a new IPO / divestment program to the IMF, according to the finance minister, targeting three to four major offerings this fiscal year in sectors like finance, logistics, renewables, and airports. He also indicated that a debt-management strategy to extend maturity profiles would be announced in Dec. The minister also noted that Egypt has already reduced its debt-to-GDP ratio by nearly 10 percentage points (to 85%) in two years and aims to reach 75% within three years.

- Egypt welcomed about 15mn tourists in Jan-Sep, up 21% yoy, in line with meeting the year-end target of 17 to 18mn, driven by renewed global travel demand and the opening of the Grand Egyptian Museum in Nov is expected to nearly triple current daily numbers.

- Egypt unveiled plans to drill 480 exploratory wells with investment of USD 5.7bn over five years, with close to 101 wells planned for next year. The plan underscores Egypt’s strategic pivot to energy self-sufficiency: more upstream activity, exploration in the Mediterranean & inland basins and raise petrochemical exports (USD 4.2bn by 2030 from USD 2.4bn in 2025).

- Kuwait issued a new decree relaxing real estate ownership restrictions for companies, investment funds, and portfolios (including those with foreign participation), subject to certain conditions and oversight. The reform maintains safeguards: entities must include real estate activities in their charter and ownership of residential property for purely private use is still prohibited.

- Kuwait Oil Company announced its third offshore discovery this year, with initial production potential exceeding 29mn cubic feet per day of natural gas and substantial condensates. The Jazza field is characterized by low CO₂ content and absence of hydrogen sulphide, making it technically favourable and lower cost for development.

- Lebanon’s economy minister confirms that the cabinet looks set to approve and forward a long‑awaited “fiscal gap” law – which aims to allocate the financial losses of the 2019 economic collapse across the state, central bank, commercial banks and depositors – to parliament shortly. The minister did not share any numbers but stated that depositors would get back their money over time with no haircut and that smaller depositors would get their money back faster than larger depositors. This crucial step is needed for securing financing from the IMF and restoring trust in the banking‑sector and sovereign frameworks.

- Oman’s Etlaq Spaceport in Duqm is entering a new phase: the Civil Aviation Authority introduced a framework for approving commercial space‑launch activities, positioning Oman as a competitive regional launch hub given its favourable geography. If Etlaq and Oman deliver credible launch capability and attract international customers, the country could carve a niche in the global space‑industry value chain – though the initial challenge will be securing anchor clients and proving operational reliability.

- Inflation in Qatar increased to 1.15% yoy in Sep (Aug: 0.74%), with upticks recorded in six of the 12 main groups (including recreation & culture’s 3.75%, miscellaneous goods & services’ 2.99%) while food & beverages costs fell (-0.99%) as did transport (-0.16%).

- Qatar’s Energy Minister warned that the EU’s Corporate Sustainability Due Diligence Directive (CSDDD) could render business with Europe unattractive, including LNG exports from Qatar. Adopted in 2024, the law mandates large companies to assess human‐rights and environmental issues in their supply chains or risk fines up to 5% of global turnover. QatarEnergy currently supplies between 12‑14% of Europe’s LNG.

- Egypt’s foreign minister stated that resolving the Palestinian territories question is a critical pre-condition for advancing the India‑Middle East Economic Corridor, the US‑backed sea‑and‑rail transit route stretching from India via the Middle East to Europe.He cited that increased conflict and instability had impacted Egypt’s revenues – Red Sea disruptions led to about a 60% drop in shipping traffic. This underscores the vulnerability of region‑wide connectivity ambitions.

- Bond issuance in the MENA region grew by 20% yoy to USD 125.9bn in Jan-Sep 2025, according to LSEG data. Saudi Arabia was the leader with USD 67.6bn in offerings (more than half of total proceeds), up 37% yoy, followed by the UAE (USD 32.7bn, down 4% yoy).

- Venture capital funding in the Middle East surged by 152% yoy to a record USD 2.77bn in Jan-Sep 2025, according to MAGNiTT, also defying a global downturn in investment. The number of deals also rose by 10% to 388, indicating a growing appeal of the region to global investors. Q3 alone saw USD 1.2bn in VC funding, the highest quarterly total on record, driven by significant investments in companies like XPANCEO, Airalo, and Hala.

- Intra-GCC trade totalled USD 1.5trn in 2024, accounting for 3.2% of global trade and positioning the bloc as the sixth-largest trading entity worldwide, according to a senior GCC General Secretariat official. Notably, the GCC bloc also posted a ten-year average annual growth rate of non-oil goods of 5.3% and a USD 110bn trade surplus in 2024, ranking third globally. Continued investment in infrastructure, digital transformation, and regulatory harmonization will be crucial to sustain this momentum and enhance competitiveness.

Saudi Arabia Focus

- Inflation in Saudi Arabia edged down to 2.2% yoy in Sep (Aug: 2.3%): housing & utilities costs saw a 5.2% uptick (though lower than Aug’s 5.8%) stemming from a 6.7% rise in residential rents (Aug: 7.6%), and the price of insurance & financial services also surged (7.7%, because of the 12.7% jump in insurance prices).

- Saudi Arabia’s Finance Minister, speaking at an event in the US, highlighted sovereign debt as a significant global risk, particularly in low-income countries and emerging economies lacking fiscal buffers. He went on to say that the rise in Saudi’s debt-to-GDP (to 40.6% by 2030 from 30% this year) is a “policy choice” considering that the spending is on programmes that lead to “productivity”, “jobs” and “business opportunities”.

- Saudi Arabia’s total number of commercial registrations surpassed 1.7mn as of end-Q3, thanks to reforms that have streamlined procedures and eliminated subsidiary registers, making a single registration valid nationwide. The number of limited liability companies climbed to over 500k (+158%) while joint-stock company registrations reached 4,488 (+49% vs same period in 2020). Women now own 49% of the 128k new commercial registrations in Q3 while businesses owned by young Saudis (aged 18-40) account for 38% of all active commercial registrations.

- Saudi Arabia’s four main industrial free zones aim to attract SAR 100bn (USD 26.7bn) in investments, revealed the president of the Royal Commission for Jubail and Yanbu. Firms are being offered incentives such as exemptions from VAT on exchanged goods and customs duties on stored goods, a reduction in income tax to 5% from 20% for 20 years and exemption from fees for foreign employees and their families.

- The volume of mortgage financing in Saudi Arabia has exceeded SAR 900bn (USD 240bn+) this year, and this now accounts for 27% of Saudi banks’ portfolios, according to the minister of municipalities and housing.

- Industrial rents in Riyadh surged by 16% yoy in H1 2025, reaching an average of SAR 208 (USD 55.47) per square meter. This increase is attributed to heightened demand in e-commerce warehousing, logistics, data centers, and cold storage for pharmaceuticals and food. Despite 1.2mn square meters of new industrial space entering the market, overall occupancy remains high at 98%, reported Knight Frank.

- Mineral exploration spending in Saudi jumped to SAR 487 (USD 130) per sq. km, more than double its Vision 2030 target of SAR 200, revealed the CEO of the Saudi Geological Survey. The estimated value of discovered mineral wealth was close to USD 2.5trn by end-2024, double the 2017 estimates.

- Aramco’s President and CEO stated that the world will remain “locked in” on oil and gas for decades as the narrative around energy transition is “shifting” as renewable energy sources (like electric vehicles and solar power) are not yet growing sufficiently enough to meet global demand. He also revealed that Aramco plans to accelerate development of its gas resources and petrochemicals, and its low-cost production capabilities and substantial resource base position it to continue leading in the oil industry.

UAE Focus

- UAE Foreign Trade Minister disclosed that the UAE has started to introduce new safeguards – including anti-dumping duties on specific categories of imports such as ceramic tiles, porcelain, and certain electrical equipment – to protect “local markets” after seeing “huge dumping” from China as it attempts to circumvent US tariffs.

- UAE’s strong current account surplus (AED 293.7bn in 2024) is driven by its large positive balance in goods & services, which reflects its status as a major exporter (& re-exporting hub), particularly oil & gas. Goods trade surplus grew by 11.8% to AED 243.7bn. Services surplus grew 14.1% yoy to AED 237.5bn. The largest sectors were travel (net surplus of AED 147bn, +19.6% yoy) and transport (net surplus of AED 64bn, down by 4.5%); net financial services surplus was up 14% to AED 6.5bn, underscoring the contribution of the financial sector to the economy.

- Sharjah emirate is close to finalizing its first Chinese yuan-denominated loan valued at USD 400mn. The 5-year loan arranged by China Construction Bank (Asia) is expected to be signed this month, with the funds be used for general corporate purposes, as per Bloomberg.

- Mubadala is marketing dirham-denominated five-year bonds through local and global banks; the value of the bonds were not specified. The bonds are being offered by Mamoura Diversified Global Holding, with a price guidance of approximately 4.45%.

- Etihad Airways welcomed 1.9mn passengers in Sep, up 21% yoy, raising the total number this year to 16.1mn passengers (18% yoy). The airline expects to cater to approximately 21.5mn passengers in 2025, more than double the number recorded in 2022 – supported by the delivery of 18 new aircraft and an expanded network (80+ destinations).

- Dubai’s in5 incubator successfully facilitated over AED 9bn (USD 2.45bn) in funding for startups since its inception in 2013, up 14% versus total funding as of Oct 2024. The incubator supports firms across four sector-specific verticals: technology, media, design and science.

- The Sharjah Entrepreneurship Center (Sheraa) has set an ambitious goal to support over 1,000 entrepreneurs by 2030. Since inception, Sheera has trained over 10k Emirati youth and supported more than 450 startups, with the latter generating combined revenues of over USD 370mn and attracting USD 300mn in capital.

Media Review:

Investments being finalized for Syria, Saudi finance minister says

https://www.reuters.com/world/middle-east/investments-being-finalized-syria-saudi-finance-minister-says-2025-10-17/

IMF’s Global Economic Outlook shows modest change amid policy shifts and complex forces

https://www.imf.org/en/Blogs/Articles/2025/10/14/global-economic-outlook-shows-modest-change-amid-policy-shifts-and-complex-forces

India refiners to buy more US LPG in 2026, cut Middle East imports, sources say

https://www.reuters.com/business/energy/india-refiners-buy-more-us-lpg-2026-cut-middle-east-imports-sources-say-2025-10-16/

Powered by: