GCC & MENA Buck the IMF’s Global Slowdown Forecast, Weekly Insights 17 Oct 2025

1. Global economy is forecast to grow by 3.2% in 2025 & 3.1% in 2026: IMF

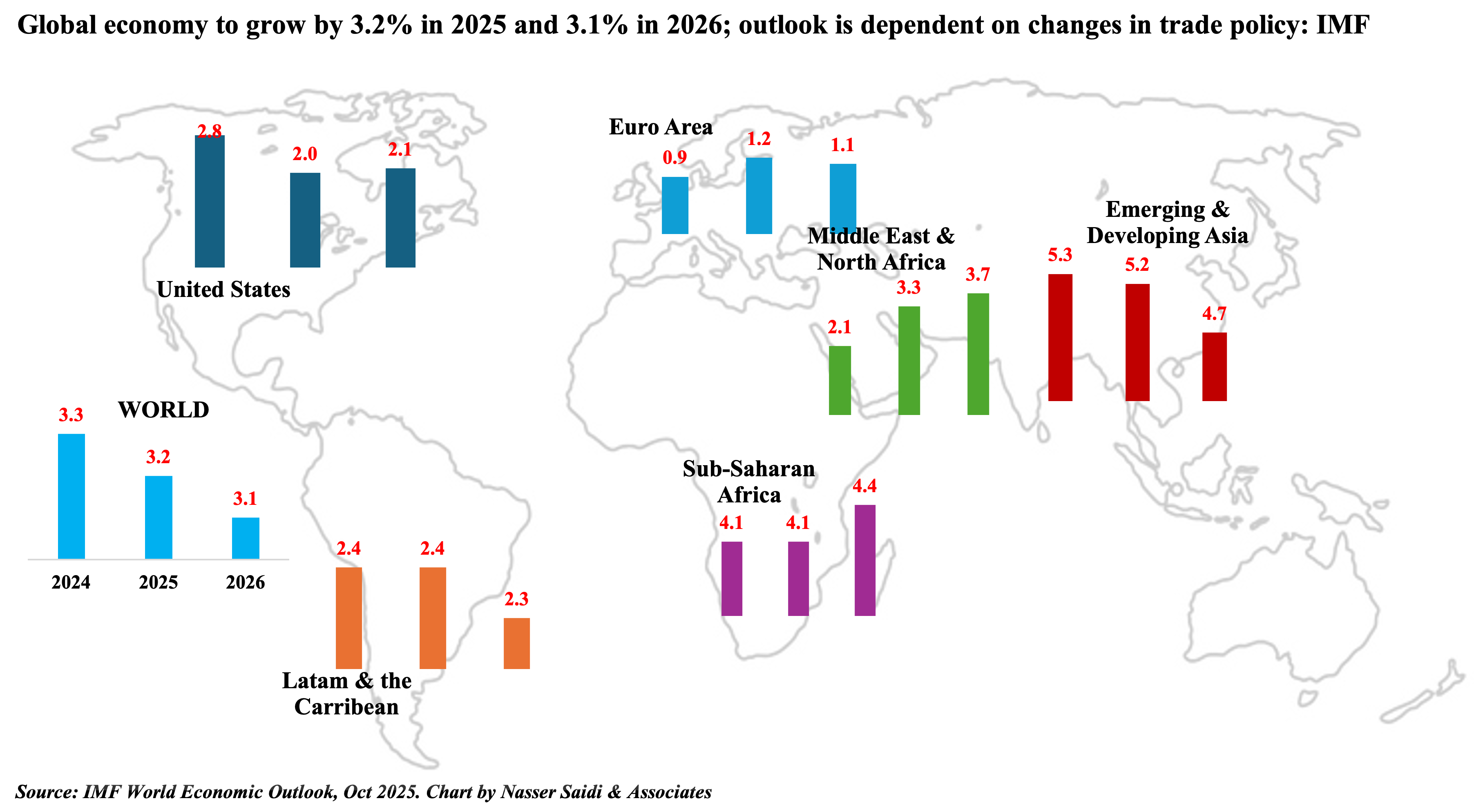

- Global economic growth is projected to ease to 3.2% in 2025 (2024: 3.3%) and further to 3.1% in 2026. The shift toward greater protectionism & fragmentation, particularly US tariff hikes, is creating uncertainty that weighs on consumption, investment & trade volumes. Emerging market economies (EMEs) will also witness slower growth, projected at 4.2% in 2025 and 4.0% in 2026, with higher growth rates in Middle East & North Africa (3.3% and 3.7% in 2025 and 2026, from 2.1% in 2024) and Sub-Saharan Africa (4.1% and 4.4% from 4.1% in 2024).

- Growth in Emerging Asia is estimated to slow (2025: 5.2% & 2026: 4.7%), as growth slows in India (2025: 6.6% & 2026: 6.2%) and China (2025: 4.8% & 2026: 4.2%). ASEAN nations have been most affected by tariff hikes and that is reflected in their slower growth.

- Global inflation is forecast to decline to 4.2% in 2025 and to 3.7% in 2026, with divergences across countries and regions. – the US is facing above-target inflation while it remains subdued elsewhere.

- Any changes to trade policy will have a spillover effect on global growth. Major risks to IMF projections include: (a) prolonged policy uncertainty; (b) potential escalation of protectionism; (c) fiscal vulnerabilities; (d) restrictive immigration policies; (e) excessively optimistic growth expectations about AI; and (f) financial market fragility.

2. MENA growth to edge up to 3.3% in 2025 (2026: 3.7%); inflation to ease

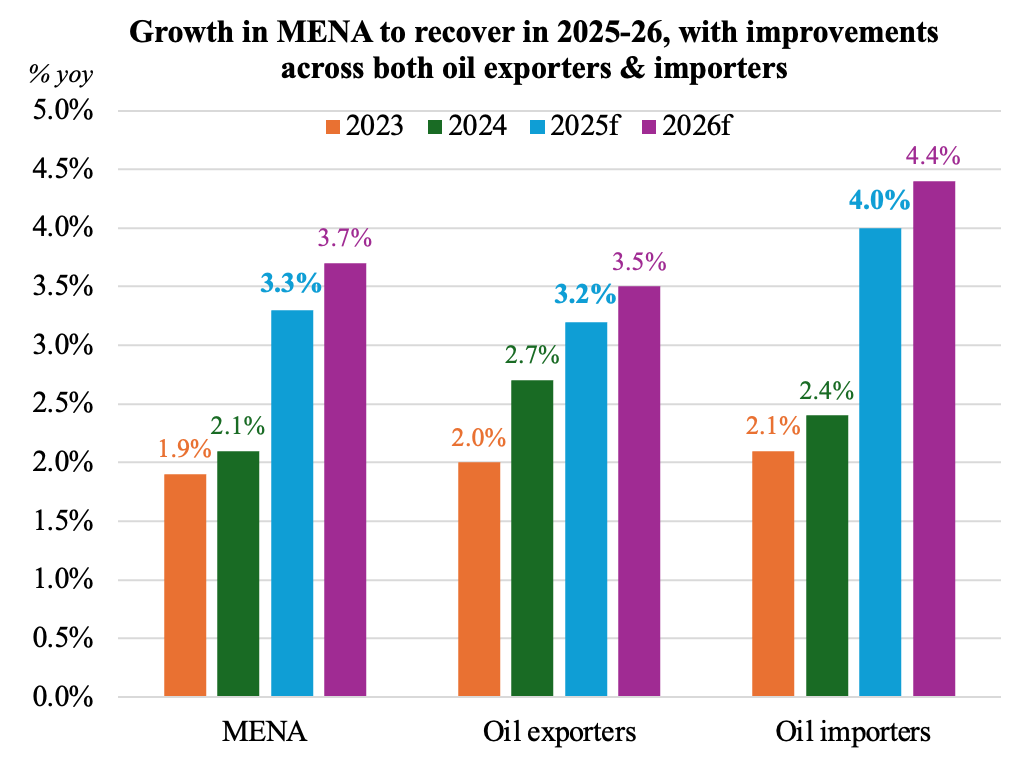

- Growth in MENA is forecast to increase to 3.3% in 2025 and 3.7% in 2026. Why? Faster unwinding of oil production cuts; lower disruptions to oil production & shipping (spillover from regional conflicts); GCC’s non-oil sector growth. UAE is projected to growth by 4.8% this year (2026: 5.0%) and Saudi by 4.0% in 2025 & 2026. Though the region has a relatively smaller exposure to the US tariff hikes, there will be indirect effects from commodity prices (as global demand remains subdued). GCC growth improves to 3.4% in 2025 from 2024’s 2.0%, with non-oil sector driving growth (alongside an uptick in oil sector activity).

- Inflation is easing, partly due to monetary policy tightening and lower energy costs, with oil importers seeing averages decline to 12.2% and 8.8% in 2025 and 2026. Among oil exporting nations, GCC inflation remains muted while the increase stems from Iran’s high readings (40%+ in 2025 and 2026).

- Current account balances in MENA remains in surplus in 2025-26 due to the high surpluses run by oil exporting nations (though it is narrowing as a % of GDP).

- Geopolitical tensions continue to exist in the region. But reconstruction and redevelopment needs are high in light of the ceasefire in Gaza & Syria’s gradual return to normalcy; how soon the funds can be deployed and its successful rollout could support future growth in the region.

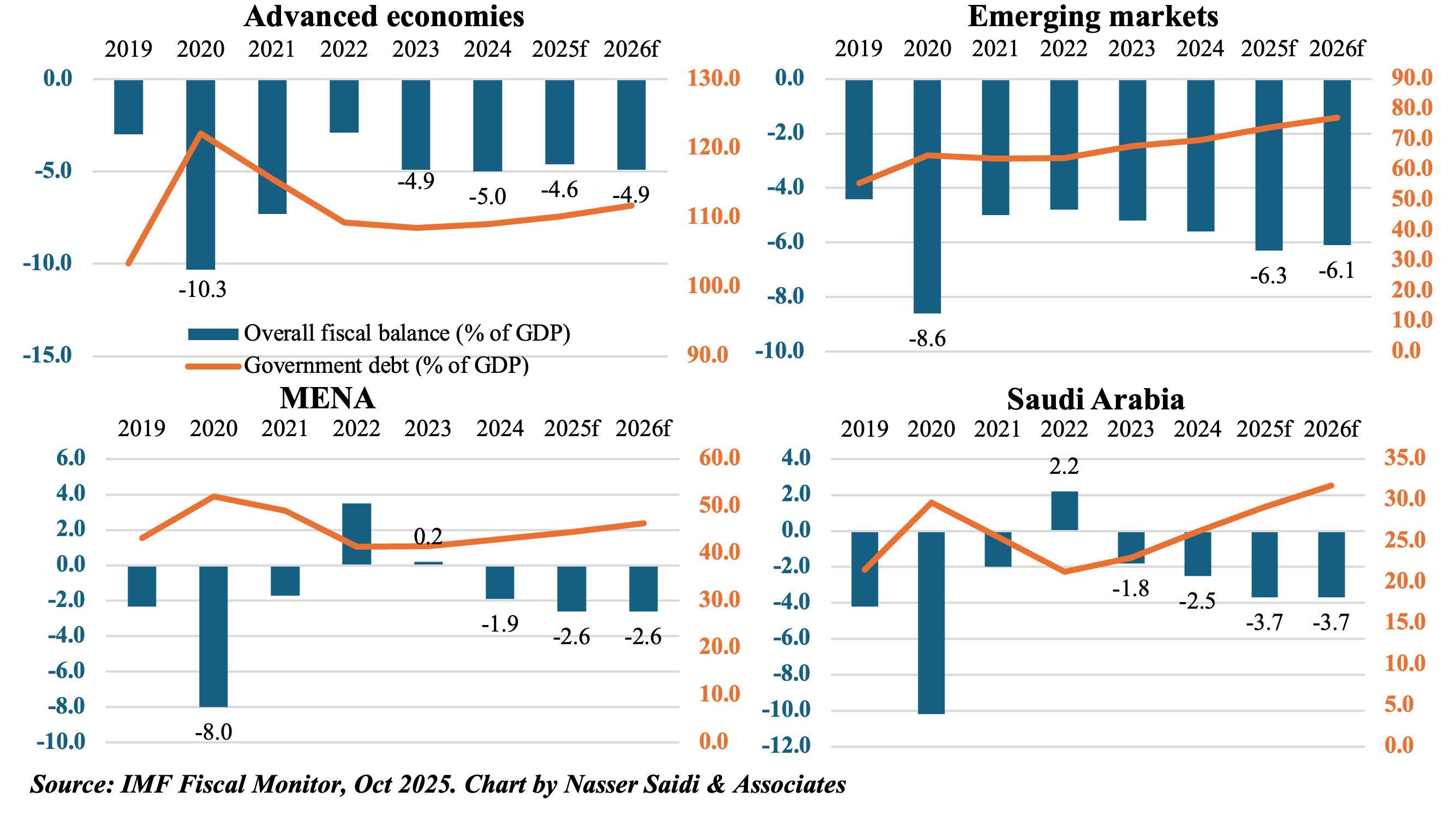

3. IMF cautions about the surge in government debt

- IMF has issued a caution about the substantial increase in global public debt: it is projected to rise to above 100% of GDP by 2029, the highest level since 1948. Many economies have public debt levels already greater than 100% of GDP (e.g. US, Canada, China, France etc.)

- China and US are the main countries driving the increase in debt but are viewed as less risky; emerging markets & low-income nations that have relatively low debt ratios are considered riskier given access to fewer resources amid higher borrowing costs, debt-related risks and rising geopolitical tensions.

- Fiscal balances in the MENA region will continue to record deficits in 2025-26 (after a surplus 0.2% of GDP in 2023), with Saudi Arabia running large fiscal deficits (3.7% in 2025-26). The rise in fiscal deficit also reflects the increase in interest expenses.

- Public debt levels in the region have been rising for almost a decade: more than half the countries in the Arab region have higher than pre-pandemic debt to GDP levels. Among the GCC, Bahrain’s public debt as share of GDP is the highest (142.5% in 2025) while Oman has seen a sharp decline (an estimated 35.1% in 2025 from close to 70% in 2020).

- The risk of growing debt levels including in GCC is critical given the developing debt crisis in US with the recent filing by First Brands for bankruptcy protection: highlights the dangers of the lightly or non-regulated private debt & asset management market that could affect regional banks and spillover into global markets.

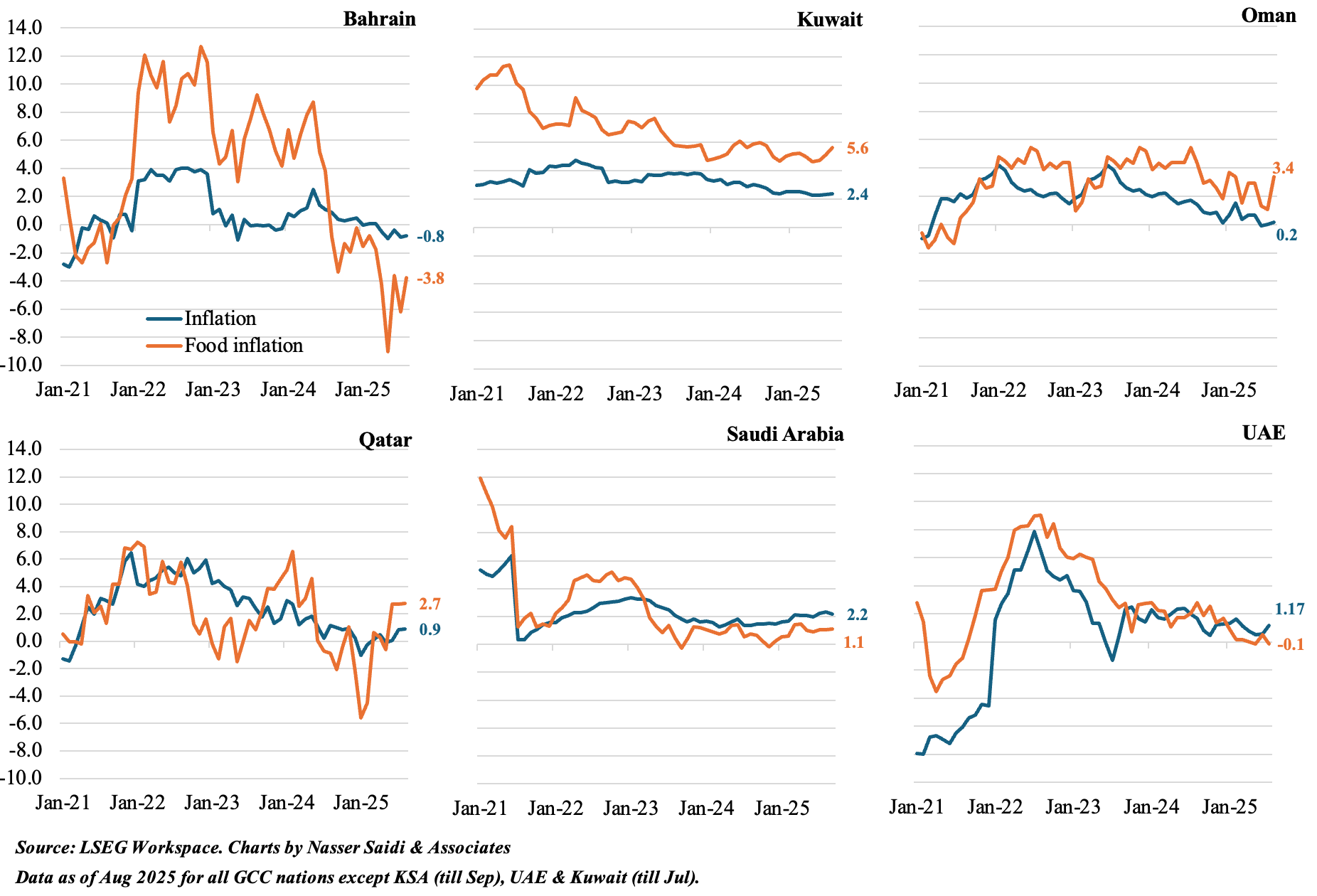

4. GCC headline inflation remains relatively low vs MENA peers: highest in GCC was Kuwait (2.4% in Aug) vs 14.2% in Lebanon (in Aug, despite continued fixed rate and high dollarisation indicating major distortions) & 11.7% in Egypt (in Sep). Food inflation dropped in Bahrain (-3.8%) and UAE (-0.1%) while it was highest in Kuwait (5.6%). Dubai inflation rose to 2.88% in Sep (Aug: 2.43% & avg in 2025: 2.7%)

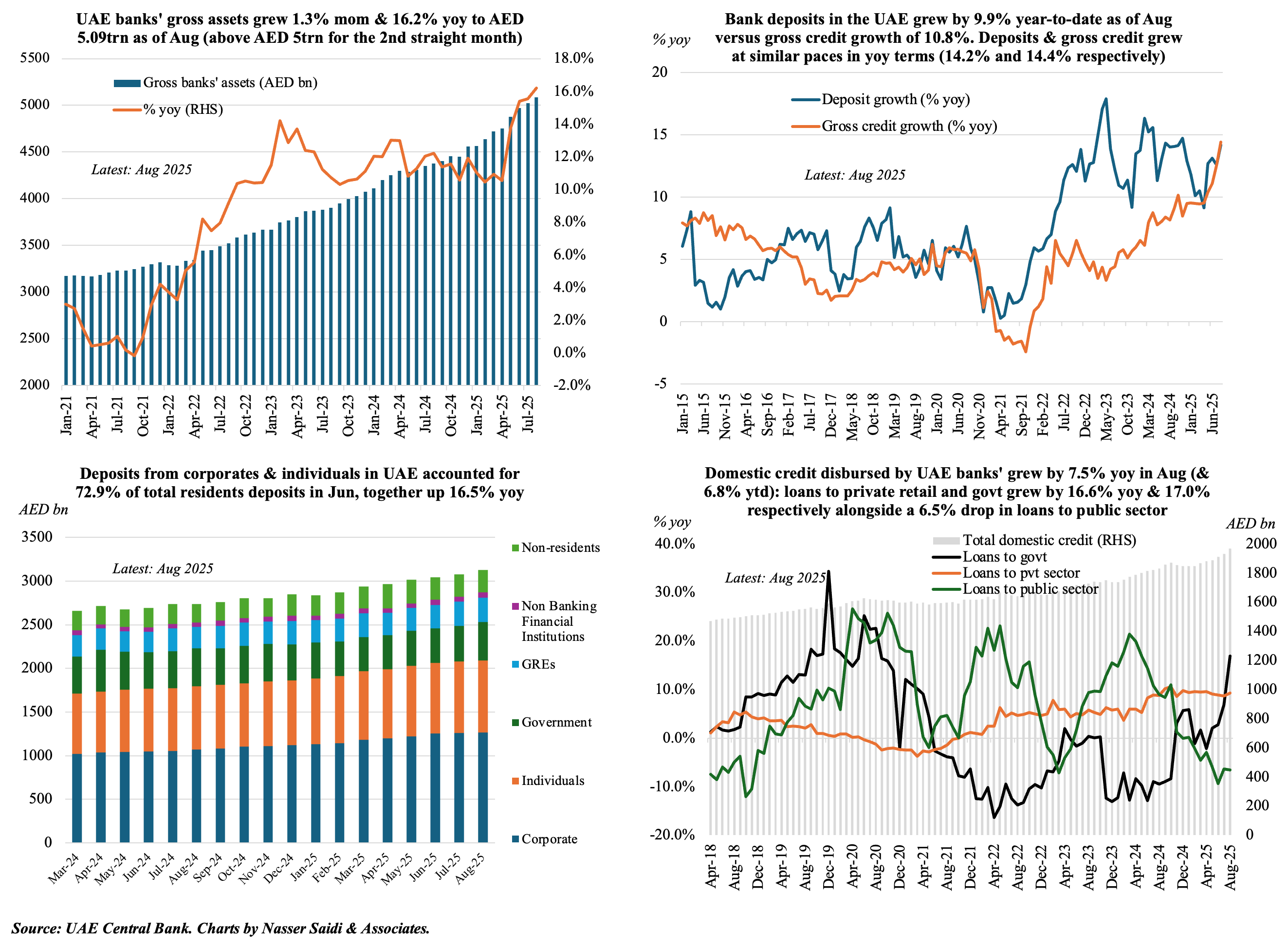

5. UAE deposit growth, at 9.9% year-to-date in Aug, outpaced domestic credit growth (6.8% ytd) but was lower than gross credit (10.8%, includes foreign credit). Deposits grew thanks to resident private sector (12.4% ytd) while domestic credit was driven by upticks in retail private sector (10.7% ytd) & government (15.9% ytd).

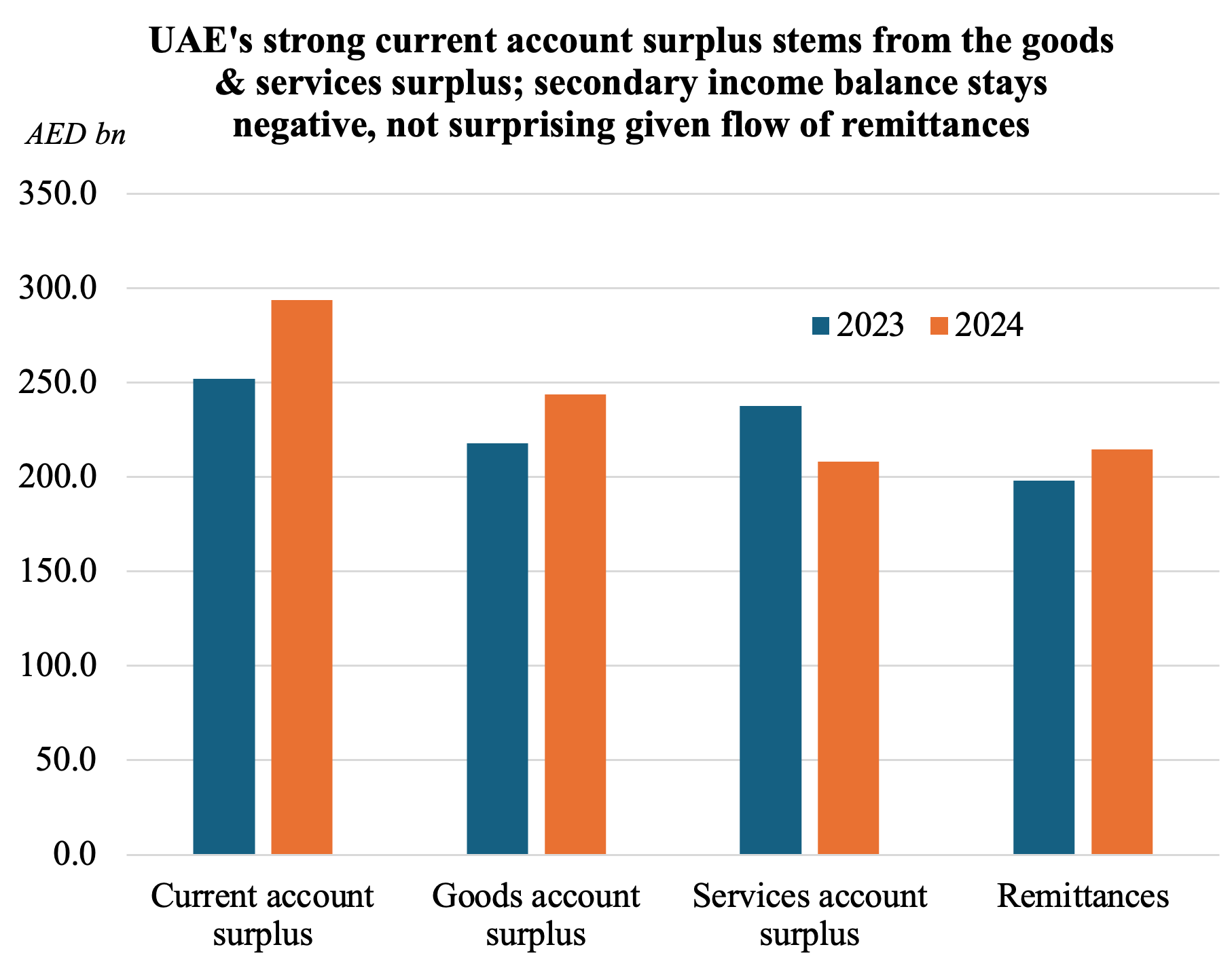

6. UAE’s current account surplus grew by 16.6% yoy to AED 293.7bn in 2024, supported by goods and services trade & financial accounts

- UAE’s strong current account surplus (AED 293.7bn in 2024) is driven by its large positive balance in goods & services, which reflects its status as a major exporter (& re-exporting hub), particularly oil & gas. Goods trade surplus grew by 11.8% to AED 243.7bn.

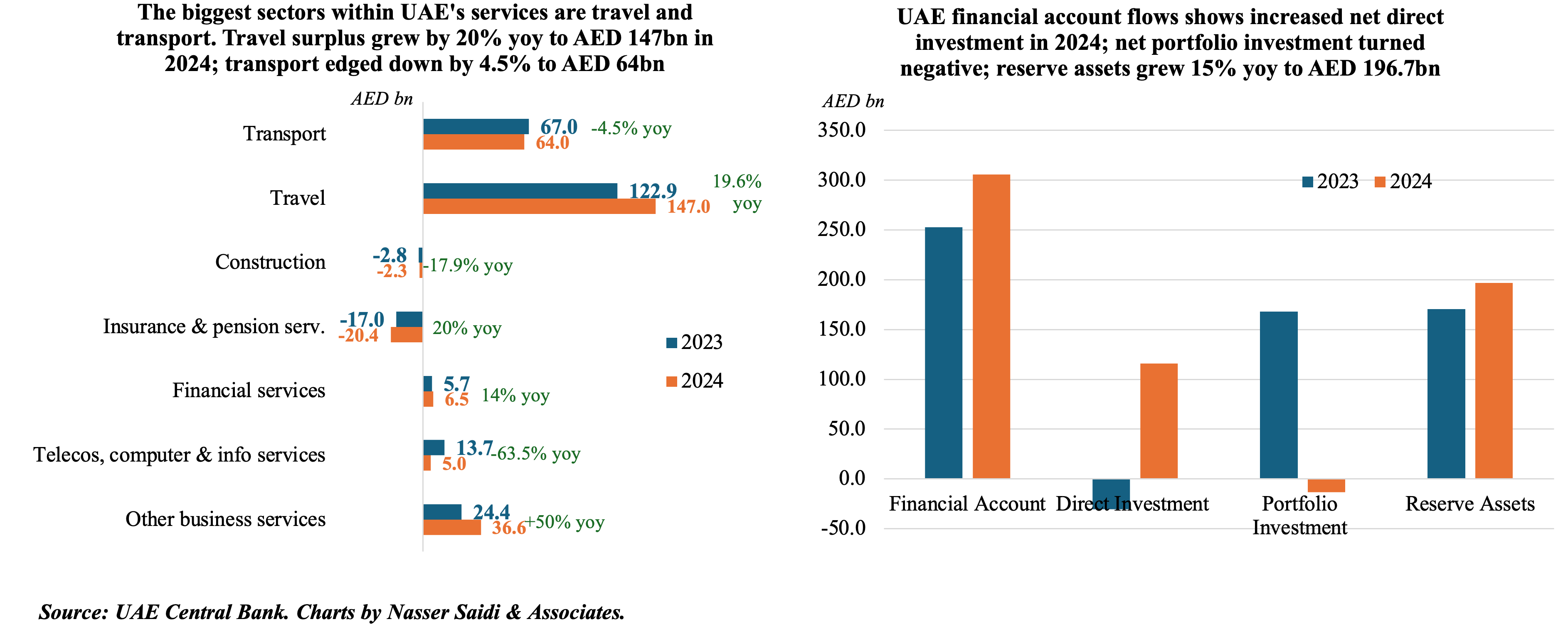

- Services surplus grew 14.1% yoy to AED 237.5bn. The largest sectors were travel (net surplus of AED 147bn, +19.6% yoy) and transport (net surplus of AED 64bn, down by 4.5%); net financial services surplus was up 14% to AED 6.5bn, underscoring the contribution of the financial sector to the economy.

- The secondary income balance is consistently negative (widened by 8.1% to a negative AED 246.3bn in 2024) – typical for a country with a large expatriate workforce sending remittances (which grew 8.3% yoy to AED 214.7bn). The primary income balance (+9.5% yoy to AED 58.8bn) is also a significant, and positive, contributor to the current account surplus.

- Financial account posted a significant surplus in 2024 (+21% to AED 305.9bn), as net direct investment surged and reserve assets jumped by 15% (to AED 196.7bn). This reflects UAE’s role as a major capital exporter as well as increased foreign investor confidence in the financial markets & wider economy.

Powered by: