Download a PDF copy of the weekly economic commentary here.

Markets

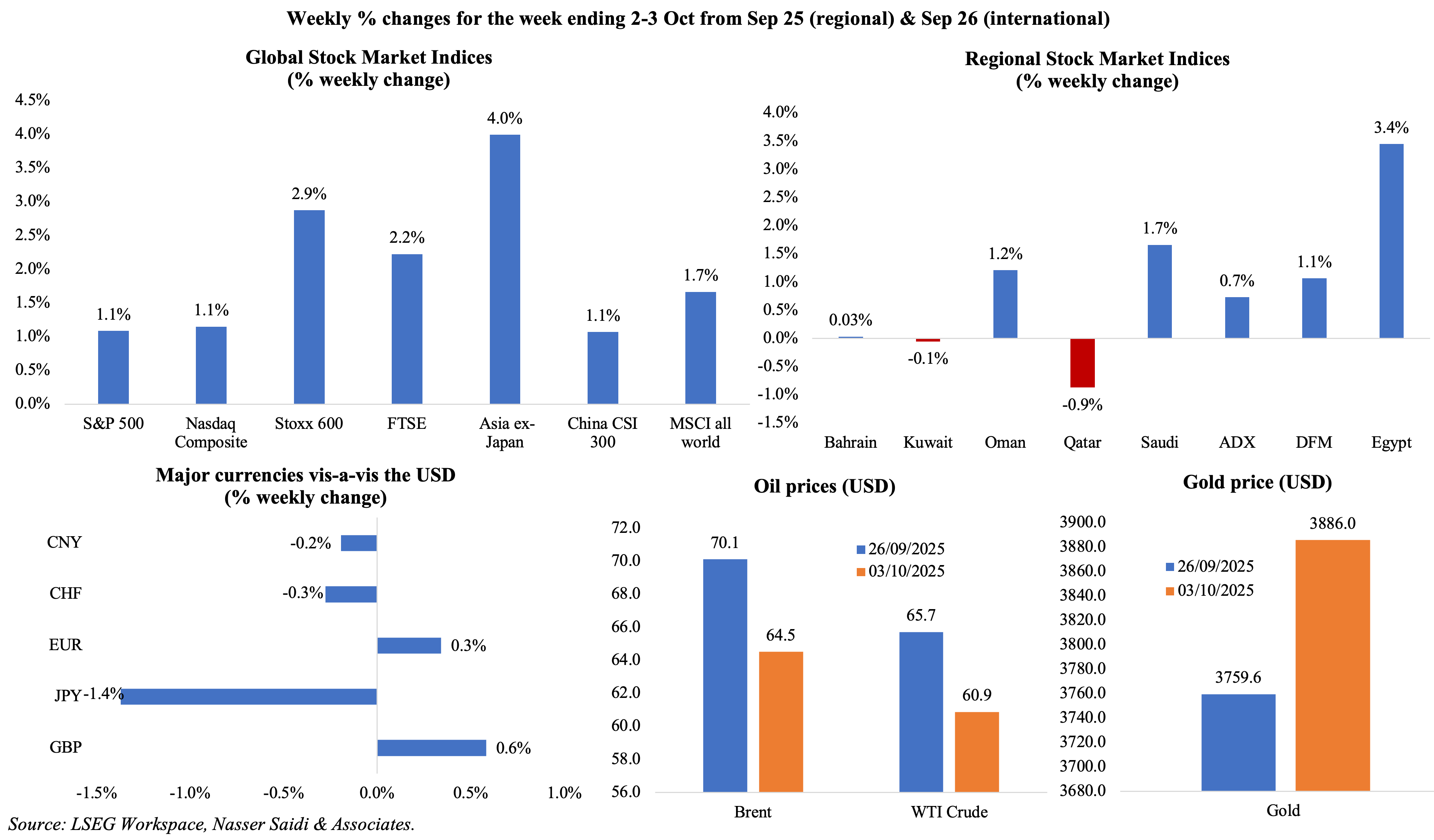

Major equity markets gained last week, with US markets at new record highs despite the US government shutdown and related delays in key data releases. Positive PMI releases brought some cheer to European markets while Taiwan and Japan (ahead of the weekend vote to determine the new PM) supported Asian gains. Regional markets had a good week, mostly up, with Saudi Arabia and UAE’s DFM and ADX ending the week 1.7%, 1.1% and 0.7% higher respectively. On the currency front, the dollar continued to weaken which affected the JPY; the Indian rupee is at near record lows. Oil prices fell by more than 8% from a week ago, on concerns of oversupply (in anticipation of OPEC+ further unwinding of production cuts). Gold price continued its safe-haven role, completing a 7th consecutive week of gains, and inching closer to the USD 4,000 a troy ounce mark (from just above USD 2,600 at the start of the year).

Global Developments

US/Americas:

- US went into a government shutdown on Oct 1st after Republicans and Democrats could not pass a bill that would allow funding of government services. Delays in government services, data releases (including key labour data) and federal pay checks could affect the economy. The longest shutdown to date, 35 days in 2018-19, is estimated to have lowered economic output by USD 11bn according to the Congressional Budget Office (including USD 3bn that was not regained). While short-term shutdowns may have limited macroeconomic effects, repeated brinkmanship undermines confidence among consumers and investors.

- Pending home sales rebounded in Aug, up by 4.0% mom (Jul: -0.3%) suggesting an increase in demand amid lower mortgage rates (the 30-year rate is near an 11-month low).

- S&P Case Shiller home prices posted moderate gains in Jul, up by 1.8% (Jun: 2.2%), the smallest uptick since Jul 2023. The continued upward trajectory underscores a persistent supply-demand imbalance in the housing market.

- JOLTS job openings increased to 7.227mn in Aug (Jul: 7.208mn) suggesting resilience in labour market demand. Layoffs held relatively steady indicating that firms are still cautious but reluctant to shed workers amid ongoing uncertainty about demand and cost pressures. However the gap between job openings and hires (declined by 114k to 5.126mn in Aug) remains elevated, pointing to persistent labour mismatches.

- US private sector lost 32k jobs in Sep, after the Aug reading was revised down to a negative 3k. The largest losses were in professional & business services and leisure & hospitality. This indicates growing caution among businesses, reflecting cost pressures and macro uncertainty.

- Dallas Fed manufacturing business index plunged to -8.7 in Sep (Aug: -1.8) while the Chicago PMI slipped to 40.6 in Sep (Aug: 41.5). The sharp decline in the Dallas index stemmed from a drop in both production and employment indices (by 10 and 12 points respectively). Together with Chicago PMI’s 22nd consecutive month of contraction, these indices underscore the industrial sector’s fragility amid slowing demand and cost challenges.

- US S&P manufacturing PMI fell to by one point to 52.0 in Sep: new orders grew for the ninth month in a row while export demand was weak given tariff hikes. Though input prices climbed to among the highest since the pandemic, selling prices was the lowest since Jan as firms failed to pass along rising costs given weak demand and rising competition. Services PMI softened to 54.2 (Aug: 54.5, but higher than the preliminary reading of 53.9), with weak demand and activity alongside a rebound in exports (first time since Mar).

- ISM manufacturing PMI inched up to 49.1 in Sep (Aug: 48.7) as employment rose (45.3 from 43.8) while new orders fell (48.9 from 51.4) and prices paid declined to 61.9 (from 63.7). ISM services PMI slipped to a neutral 50 in Sep (from 52), as new orders slowed (50.4 vs 56) while employment increased (47.2 vs 46.5) and prices paid ticked up to 69.4 (from 69.2).

Europe:

- Inflation in the eurozone inched up to 2.4% in Sep (Aug: 2.1%), rising above the ECB’s 2% target since Apr. Core inflation rose to 2.2% (from 2.0%) raising concerns that underlying price pressures remain persistent, particularly in services (where prices ticked up to 3.2% from 3.1%) and wage-sensitive sectors. This modest uptick complicates the ECB’s path forward, in light of the recent pause in rate hikes.

- Eurozone’s manufacturing PMI dipped back to contraction, clocking in 49.8 in Sep from the prelim 48.5 (and Aug’s 50.7), as new orders dropped sharply (fastest pace in 6 months) amid subdued external demand alongside a continued fall in employment. Services PMI improved to 51.3 (from Aug’s 50.5 though lower than the preliminary 51.4), driven by an improvement in new orders and employment while inflationary pressure eased.

- Euro area PPI fell by 0.3% mom and 0.6% yoy in Aug (Jul: 0.3% mom and 0.2% yoy): this was the first annual decline since Nov 2024, a reflection of falling energy prices and signals weak pricing power among producers.

- EU business climate fell to -0.76 in Sep (Aug: -0.72) and consumer confidence stood at -14.9. Both staying firmly in negative territory reflects the growing concerns over economic stagnation, persistent inflation and geopolitical risks. Firms continue to report low order books while households remain cautious amid high borrowing costs and an uncertain job market.

- Manufacturing PMI in Germany inched up to 49.5 in Sep from the preliminary 48.8 (but lower than Aug’s 49.8) as new orders fell for the first time in 4 months and export sales dropped while production expanded (though at a slower pace). Services PMI increased to growth territory (an 8-month high of 51.5 vs preliminary reading of 52.5 and Aug’s 49.3), though there were signs of frailty (decline in new orders and employment). Looking ahead, unless industrial demand stabilizes (including from the wider Eurozone) Germany risks prolonged economic stagnation despite pockets of resilience in services.

- German retail sales inched lower by 0.2% mom in Aug (Jul: -0.5%) pointing to fragile consumer spending dynamics, as online and mail-order sales fell (-3.8%) as did non-food sales (-1.0%). In yearly terms, sales grew by 1.8%, the slowest pace in 13 months.

- Unemployment rate in Germany was unchanged at 6.3% in Aug. Unemployment in the euro area ticked up to 6.3% (from 6.2%), with youth unemployment holding steady at 14%: this underscores broader economic softness, especially in manufacturing-heavy economies.

- GDP in the UK grew by 0.3% qoq and 1.4% yoy in Q2 (Q1: 0.7% qoq), unrevised from the initial estimate; total business investment fell by a revised 1.1% qoq (prev estimate: -4.0%), which could limit productivity gains and long-term growth potential.

- UK manufacturing PMI slowed to a 5-month low of 46.2 in Sep (Aug: 47), on weak output and export orders that fell at one of the quickest rates in over two years amid employment declining for the 11th month in a row. Services PMI eased to 50.8 from Aug’s 16-month high of 54.2, with firms reporting slow increases in output and new orders, elevated cost pressures (wage pressures, rising energy bills, food prices and technology costs) amid weakened business confidence.

Asia Pacific:

- China’s manufacturing PMI rose to 49.8 in Sep (Aug: 49.4), contracting for the sixth month in a row. Output grew at the fastest pace since Mar (51.9 from 50.8) while new orders, foreign sales and employment continued to shrink (to 49.7, 47.8 and 48.5 respectively). But, confidence increased to a 7-month peak. Non-manufacturing PMI stood at 50 (50.3), with new orders and employment contracting further (to 46.0 and 45.0 respectively from 46.6 and 45.6 the month before).

- Japan’s manufacturing PMI fell for the 14th month in a row in Sep, to 48.5 (prelim: 48.4 and Aug: 49.7) as new orders, foreign sales and output fell at a sharp pace. Services PMI was up to 53.3 in Sep (prelim: 53 and Aug: 53.1), supported by strong sales growth and an increase in employment (in contrast to manufacturing where recruitment slowed). Overall, foreign demand for Japanese goods and services meanwhile declined for the sixth month in a row.

- Japan’s leading economic index ticked up to 106.1 in Jul (prelim: 105.9 and Jun: 105.0) as did the coincident index (114.1 from 113.3). Gains were modest and likely supported by improving labour market conditions, services strength and government support measures, rather than a broad-based rebound.

- Tankan large manufacturing index inched up to 14 in Q3 (Q2: 13): this was the first tankan since the Japan-US deal was set in July. Sentiment at large non-manufacturers remained 34, unchanged from Q2, the highest level in more than three decades.

- Industrial production in Japan fell by 1.2% mom and 1.3% yoy in Aug (Jul: -1.2% mom and -0.45 yoy) driven by weakness in electrical machinery (-5.7%) and chemicals (-5.2% mom). These declines reinforce the message from PMI surveys – Japan’s manufacturing sector is stuck in a mild but persistent downturn.

- Japan’s unemployment rate rose to 2.6% in Aug (Jul: 2.3%), the highest reading since Jul 2024; the jobs to applicants’ ratio eased to 1.2 (from 1.22), the lowest level since Jan 2022.

- Japan’s retail trade fell by 1.1% yoy in Aug (Jul: 0.4%), the first drop in 42 months, dragged down by lower auto sales – reflecting declining household confidence amid rising living costs.

- Inflation in South Korea rose to 2.1% yoy in Sep (Aug: 1.7%), driven by food (3.2%) and non-food items (2.1%), highlighting persistent price pressures. Core inflation stood at 1.9%.

- The Reserve Bank of India kept repo rates unchanged at 5.5%, citing tariff related uncertainties, as the apex bank decided to continue with a “neutral” policy stance.

- HSBC manufacturing PMI in India revised down to 57.7 in Sep (from the prelim 58.5 from Aug’s 17.5-year high of 59.3): this remains higher than the long-run average, with new orders and employment increasing though at a slower pace. Output charges surged at the quickest pace since Oct 2013. Services PMI also slowed to 60.9 (prelim: 61.6 and from 62.9 in Aug, the strongest since Jun 2010) as foreign sales slowed amid moderate expansions in output and job creation.

- Industrial output in India grew by 4% yoy in Aug (Jul: 4.3%), with manufacturing up 3.8% (from 6%). Separately, infrastructure output grew by 6.3% yoy in Aug (Jul: 3.7%), reflecting ongoing implementation of capex-intensive government programs and increased private sector participation in energy and construction.

Bottom line: The JPMorgan global manufacturing PMI stood at 50.8 in Sep, posting a Q3 average of 50.4 – this was the best reading since Q2 2024 (50.7). Sep reading was a result of improvements in output and new orders while both input cost and selling price inflation eased. With the US shutdown underway, key data releases will remain unpublished; so, some focus will be on the FOMC minutes from the last meeting (for hints about its direction, and also if the Fed focus has shifted to labour market risks from inflation risks) as well as inflation data from Europe. It could turn out to be an important week for the Middle East if the Gaza ceasefire talks are successful, especially as the war enters into its third year. Japan’s election of the new ruling party leader Sanae Takaichi, on track to become the first female PM if confirmed later this month, sent markets into an all-time high on her pro-stimulus stance and expectations of her favouring low interest rates (following her mentor Shinzo Abe’s vision).

Regional Developments

- OPEC+ plans a modest increase in oil output of 137,000 barrels per day (bpd) starting Nov, adding to over 2.7mn bpd of raised output this year (or about 2.5% of global demand).

- Bahrain’s two‑tranche US dollar debt issuance last week raised USD 2.5bn at launch. This underscores the confidence that investors remain receptive to Gulf sovereign credits; Bahrain had raised USD 2.5bn from a combined sukuk and conventional issue earlier this year.

- Egypt’s PMI continued to contract, down to a 3-month low of 48.8 in Sep from 49.2 in Aug, with new orders weakening (dropping at the fastest pace in 5 months) amid inflationary pressures, rising wage pressures and subdued domestic conditions.

- Egypt’s central bank cut interest rates to 21% (from 22%), lowering rates for the fourth time this year. Inflation has been easing – to 12% in Aug from 13.9% in Jul and from a peak of 38% in Sep 2023 – giving the central bank space to ease.

- Egypt recorded its strongest GDP performance in two years in the financial year 2024-25. Growth for the full year stood at 4.4% while Q4 growth clocked in at nearly 5% – driven by gains in non‑oil industries and tourism, offsetting headwinds in other sectors.

- Private investment in Egypt accounted for 47% of total capital – rising to its highest level in five years – and overtaking public capital (at 43%) reflecting business optimism and renewed capital deployment amid structural reforms.

- Qatar reportedly acquired 20.2 sq. km. of land in Egypt’s Ras Alam El-Rum for USD 4bn, to develop a tourism project, reported Ashraq Business. Official announcement of the project, to be developed by a subsidiary of Qatar Investment Authority, is expected later this month.

- Bilateral trade between Egypt and the UAE grew by 71% yoy to USD 5.4bn in Jan-Jul 2025, with Egypt’s exports to UAE up by 141.2% to USD 4.1bn. Remittances from the UAE to Egypt dropped by nearly 25% to USD 1.7bn in Jan-Jul 2025: this was more than 9% of Egypt’s total remittances, and the decline in remittances likely reflects currency pressures, shifts in migrant labour flows, or tightening of remittance channels.

- Kuwait successfully raised USD 11bn in debt issuance last week, the first dollar issue since 2017: this was a result of the new debt law, pent-up demand and high local liquidity in Kuwaiti banks, apart from international investor interest. The rapid absorption of this funding, with order books over USD 23bn at launch, also reflects confidence in Gulf sovereigns despite global rate pressures.

- Non-oil private sector in Kuwait stayed expansionary in Sep: PMI eased to 52.2 in Sep (Aug: 53.0) as output and new orders growth softened while discounting supported new export orders. Input costs were quite muted – still the second slowest since end-2022.

- Kuwait’s non-oil exports stood at KWD 1.59bn (USD 5.17bn) in H1 2025, with exports to the GCC at KWD 913.3mn (57.4% of the total) and to the Arab countries KWD 207.4mn.

- Development spending in Kuwait grew to KWD 132.4mn in Q1 of 2025-26, the highest level in 5 years, and compares to KWD 54.5mn in the same period in 2024-25.

- Kuwait is planning a sizable expansion of 14 GW in power generation by 2031, according to the electricity minister, to avoid power shortages and secure additional supplies amidst rapidly growing electricity demand.

- The Central Bank of Oman has mandated commercial banks to begin disclosing climate related risks from the 2026 financial year. This was disclosed in the 2025 Financial Stability Report, which highlighted the need for integrating climate-related risks into financial policy.

- Crowdfunding platforms in Oman financed 43 projects (+87% yoy) worth OMR 2.28mn (+81% yoy) in Q2 this year, according to data from the Financial Services Authority. Overall funding via crowdfunding stood at a total OMR 14.9mn since the first crowdfunding platform was launched in 2022.

- Qatar PMI declined to 51.5 in Sep (Aug: 51.9), with PMI staying below its long-run average since 2017. Output grew but new orders declined while workforce increased across all sectors (with manufacturing clocking in the most). Overall input costs fell slightly but prices charged for goods and services rose for the first time since Jul 2024, albeit only slightly.

- Qatar, home to the largest helium production facility globally, signed a direct long-term helium supply deal with Germany’s Messer. QatarEnergy will deliver 100 million cubic feet of helium each year from its Ras Laffan facility.

Saudi Arabia Focus

- Saudi Arabia’s PMI increased to a 6-month high of 57.8 in Sep (Aug: 56.4), on increases in new orders (both domestic and international), output (largest one-month gain in 4 years) and hiring (driven by higher demand) amid rising input cost pressures (higher than series average). This signals a resilient non-oil private sector that is no longer tied to volatilities of oil revenues.

- Deposit growth in Saudi Arabia averaged 8.9% in the period Jan-Aug 2025. Credit growth outpaced deposit growth for the 19th straight month while in yoy terms, net foreign assets at SAMA fell for 9th consecutive month in Aug. Consumer spending inched lower, dragged down by ATM and e-commerce transactions.

- Fiscal deficit in Saudi Arabia is forecast to narrow to SAR 165bn in 2026 (or 3.3% of GDP from an estimated 5.3% of GDP in 2025), on higher revenues (+5.1% from 2025 estimate) and lower spending (-1.7% from 2025 estimate). Compared to 2025 budget, full year estimate for this year’s revenues was down by 7.9% (to SAR 1.09trn) and spending up 4.0% (to SAR 1.336trn). Fiscal deficit in 2025, estimated at SAR 245bn (or 5.3% of GDP), was double the forecast in 2025 budget (SAR 101bn, or 2.3% of GDP).

- Net FDI inflows into Saudi Arabia grew by 14.5% yoy to SAR 22.8bn in Q2; in quarterly terms, however, it was down 3.5% qoq. Inflows into Saudi fell by 4.1% qoq and 11.5% yoy to SAR 24.9bn in Q2. Outflows plunged, falling almost 75% yoy to SAR 2.1bn, possibly as Saudi Arabia reduces investments abroad and retains capital.

- Unemployment rate of Saudi citizens ticked up to 6.8% in Q2 (vs Q1’s record low 6.3%). Overall unemployment rate including expats also moved up to 3.2% (Q1: 2.8%). Saudi female unemployment rate increased to 11.3% (Q1: 10.5%). All groups (except 15-24 age) saw an increase in unemployment rate (vs Q1); readings are lower vs a Q2 2024. The improvement in 15-24 age group is promising: hinting at success of the “Early Work” initiative or possibly public-private partnership programs targeting entry-level jobs. Saudi female labour force participation rate declined to 34.5% (Q1: 36.3%): this is the lowest since Q3 2022 (36.5%).

- Saudi Arabia’s Capital Market Authority has given the green light for IPOs from three companies – an education company that operates schools and training facilities, a facility‐management firm, and a restaurant chain. The firms, allowed to float 30% of their shares on the Saudi Exchange, have a six‑month window to initiate listings. This brings the total number of companies in the IPO pipeline to six.

- Saudi Arabia’s PIF entered a consortium deal to acquire US videogame developer Electronic Arts for USD 55bn. PIF, which already holds 9.9% of the company will rollover its stake and once the deal is closed (expected by Q1 2027), EA will delist from Nasdaq – this would become the largest leveraged buyout ever.

- Saudi Arabia aims to create 300k new jobs in its cultural and creative sectors over the next decade, supporting industries such as heritage, entertainment, arts, and media. To meet the need for skilled professionals in the sector, significant public investment is being deployed including the launch of Riyadh University of Arts (RUA).

UAE Focus

- UAE’s non‑oil private sector PMI climbed to a 7-month high of 54.2 in Sep (Aug: 53.3) thanks to a domestic demand supported sharp uptick in new orders (57.2 from Aug’s 4-year low of 53.1) and accelerating employment growth (fastest pace since May). Input costs rose, but intense competitive pressures led to a softening in output prices.

- The IMF, following its 2025 Article IV mission, forecast UAE GDP growth at 4.8% in 2025 and 5.0% in 2026, thanks to accelerating non‑oil expansion and rising oil production (as OPEC+ production cuts unwind) amid efforts to expand CEPAs alongside “ample sovereign buffers”. The Fund also called for “continued vigilance” of real estate activity (including potential risks from real estate tokenisation) and for tighter regulatory coordination in the nascent virtual assets space. More: https://www.imf.org/en/News/Articles/2025/10/02/pr-25326-united-arab-emirates-imf-staff-completes-2025-article-iv-mission

- Real GDP in Abu Dhabi grew by 3.8% yoy to AED 306.3bn in Q2 2025 (Q1: 3.4%), supported by robust non-oil sector activity (a quarterly record AED 174bn, up 6.6% yoy). Contribution of non-oil sector stood at a record high 56.8% of total GDP, highlighting broad-based diversification. GDP also expanded by 5.3% qoq, with both oil and non-oil sector growing by a strong 3.7% and 6.4% respectively. Manufacturing sector also had the largest contribution to GDP in Q2 (9.8%), followed closely by construction (9.8% share) and financial (7.1% share) sectors.

- Alec Holdings’ IPO in Dubai was oversubscribed by 21 times, with demand reaching AED 30bn, and the final price was set at AED 1.4 for the one billion shares. The IPO recorded one of the highest levels of non-UAE investor participation among the latest UAE government-related listings on DFM. If Alec can execute on its backlog and maintain margins in the near-term, it may pave the way for large-scale IPOs in traditionally cyclical sectors.

- Abu Dhabi approved AED 42bn to expand the “Liveability Strategy”, aimed at improving public infrastructure, social amenities, and overall urban experience. Strategically, this reinforces Abu Dhabi’s bid to attract global talent and investment by lifting standards of living.

- The UAE and Turkey central banks formalized a bilateral currency swap of AED 18bn, along with MOUs to deepen local‑currency settlement infrastructure. The move aims to provide local currency liquidity to financial markets as well as facilitate smoother bilateral trade and financial flows, reducing dependence on third‑party currencies. Over time, this could encourage broader regional adoption of local‑currency clearing and settlement frameworks.

- Two Comprehensive Economic Partnership Agreements (CEPAs) officially came into force on Oct 1st, with Australia and Malaysia, eliminating tariffs on most goods and deepening services, investment, and mobility commitments. Strategically, this diversifies UAE’s trade links and successful implementation could anchor deeper investment ties over time across sectors including energy, infrastructure, logistics and technology among others.

- The Abu Dhabi Agriculture and Food Safety Authority has reaffirmed that cryptocurrency mining is strictly prohibited on agricultural land, and that violators would be penalized with AED 100k fines (doubled for repeat offenses), service suspensions, electricity disconnection, and confiscation of mining equipment. This measure reinforces a broader regulatory posture: safeguarding sustainability, land use integrity, and controlling spillovers from digital asset activity.

- Commercial licences in tourism, hospitality, aviation, aviation technologies, and digital tourism solutions in the UAE surged by 275% from mid-Sep 2020 to 39,546 by mid-Sep. The minister of economy & tourism attributed this to ongoing streamlining of business regulations & reforms and intent to attract international companies and capital to the sector.

- US corporate memberships at the Abu Dhabi Chamber recorded a CAGR of 53% between 2019 and 2024; there was a 50 % jump in new US member applications in 2024 alone. About half of these firms are in wholesale and retail trade, while the rest are spread across professional services, construction, ICT, hospitality, and mining.

Media Review:

Gulf sovereign wealth funds defy lower oil prices to top global investment

https://www.ft.com/content/10bd26c4-ebf0-4b27-9a8b-2a8c64ff23cf

Geopolitics at play: China’s banks lend to Saudi gas project while its funds sit out of BlackRock-led deal

https://www.reuters.com/business/finance/chinas-banks-lend-saudi-gas-project-while-its-funds-sit-out-blackrock-led-deal-2025-10-02/

IMF: Good Policies (and Good Luck) Helped Emerging Economies Better Resist Shocks

https://www.imf.org/en/Blogs/Articles/2025/10/06/good-policies-and-good-luck-helped-emerging-economies-better-resist-shocks

As Growth Decouples From Employment, the Fed Faces a Trilemma: El-Erian

https://www.project-syndicate.org/commentary/fed-financial-stability-concerns-as-growth-decouples-from-employment-by-mohamed-a-el-erian-2025-10

Powered by: