Aathira Prasad joined Joumanna Bercetche on 28th August, 2025 as part of the Horizons Middle East & Africa show to discuss the Egypt central bank’s monetary easing cycle & outlook for the GCC economies in the global macroeconomic backdrop.

Main discussion points included the below:

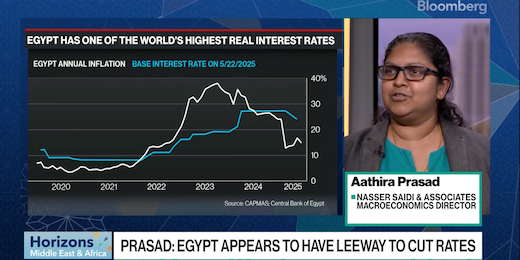

Given that inflation has been easing (13.9% in Jul 2025. vs a peak of 38% in Sep 2023) and real interest rates remaining high, the CBE appears to have the leeway to go ahead with a gradual easing strategy.

The rates could go lower than 20% by end of the year, if the international financial environment becomes less volatile as a result of a reduction in the US Fed rate and the ECB maintains or reduces rates and geopolitical regional risks diminish resulting in a restoration of Suez Canal traffic and revenues.

A potential rate cut from the Fed could lower pressure on Egypt’s external financing costs, reduce debt servicing costs, and support investor confidence, particularly among holders of Egyptian debt.

Egypt has been in a relatively strong position so far this year (despite lower Red Sea traffic, regional conflicts and the Gaza war): the IMF-backed reform agenda (it passed its fourth IMF review) is slowly being rolled out (including tax and subsidy reforms), supported by financing from IFIs (WB, EIB, EBRD and Chinese investment funds) and net FDI has picked up. Egypt’s current account deficit has improved sharply – surging remittances (record USD 36.5bn in 2024-25), higher tourism revenues, and a jump in non-oil exports.