Trade Surges, Fiscal Realignments & Monetary Easing in MENA, Weekly Insights 29 Aug 2025

1. Saudi Re-exports clock in a record-high in Q2; Non-oil exports surging as logistics grows

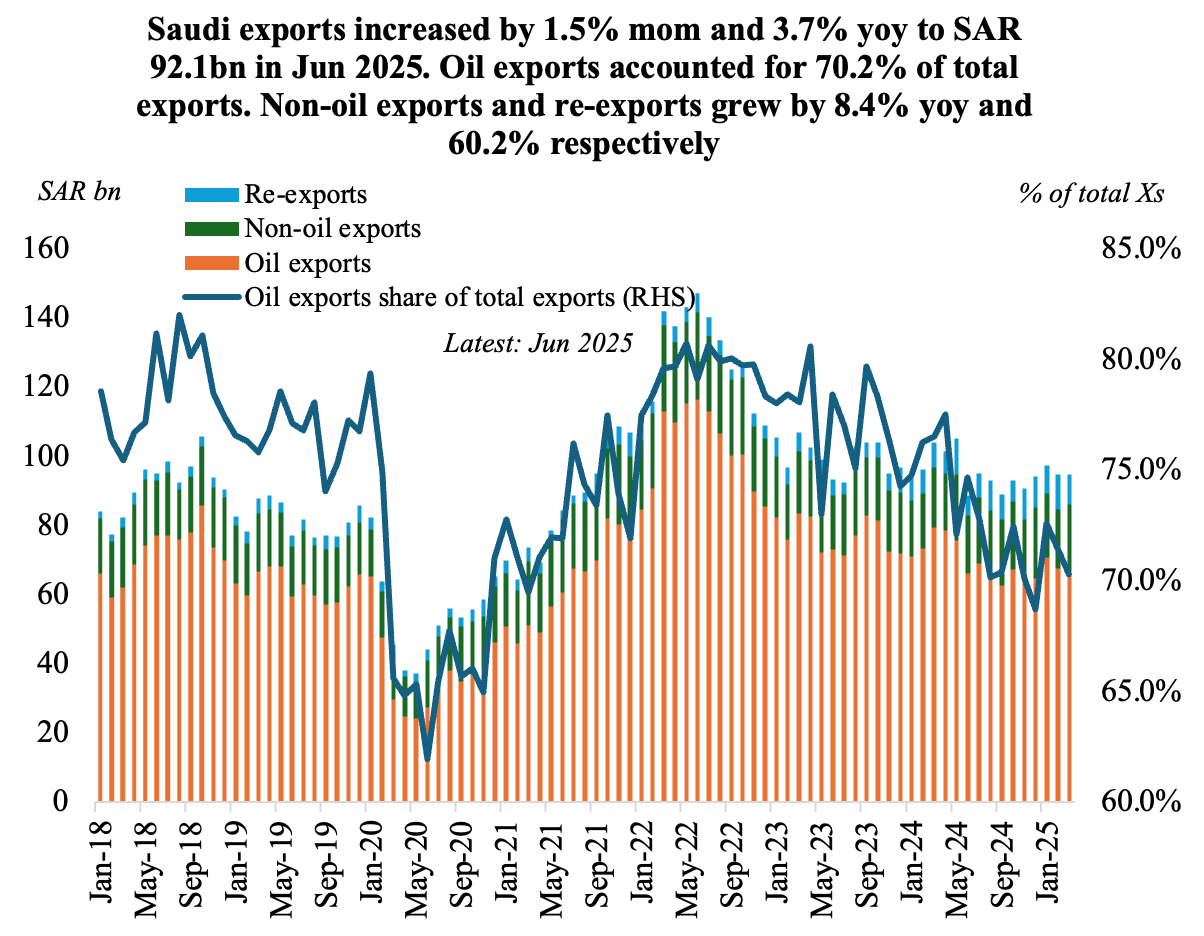

- Saudi Arabia’s overall exports grew by 1.5% mom and 3.7% yoy to SAR 92.1bn in Jun 2025, as non-oil exports rose 8.4% yoy to SAR 17.9bn and re-exports surged 60.2% to SAR 9.6bn; oil exports were down by 2.5% yoy but increased 9.0% mom thereby raising the share of oil exports to overall exports to 70.2% (May: 65.4%).

- Re-exports reached a record SAR 32.76bn in Q2, up 20.9% qoq & 46.2% yoy & oil exports were the lowest since Q3 2021 (-9.3% qoq & -15.8% yoy).

- Imports inched up by 2.3% mom and 0.1% yoy to SAR 74.0bn in Mar 2025. This resulted in a narrower trade surplus of SAR 19.8bn – down from Feb’s SAR 22.3bn and Mar 2024’s SAR 30.1bn.

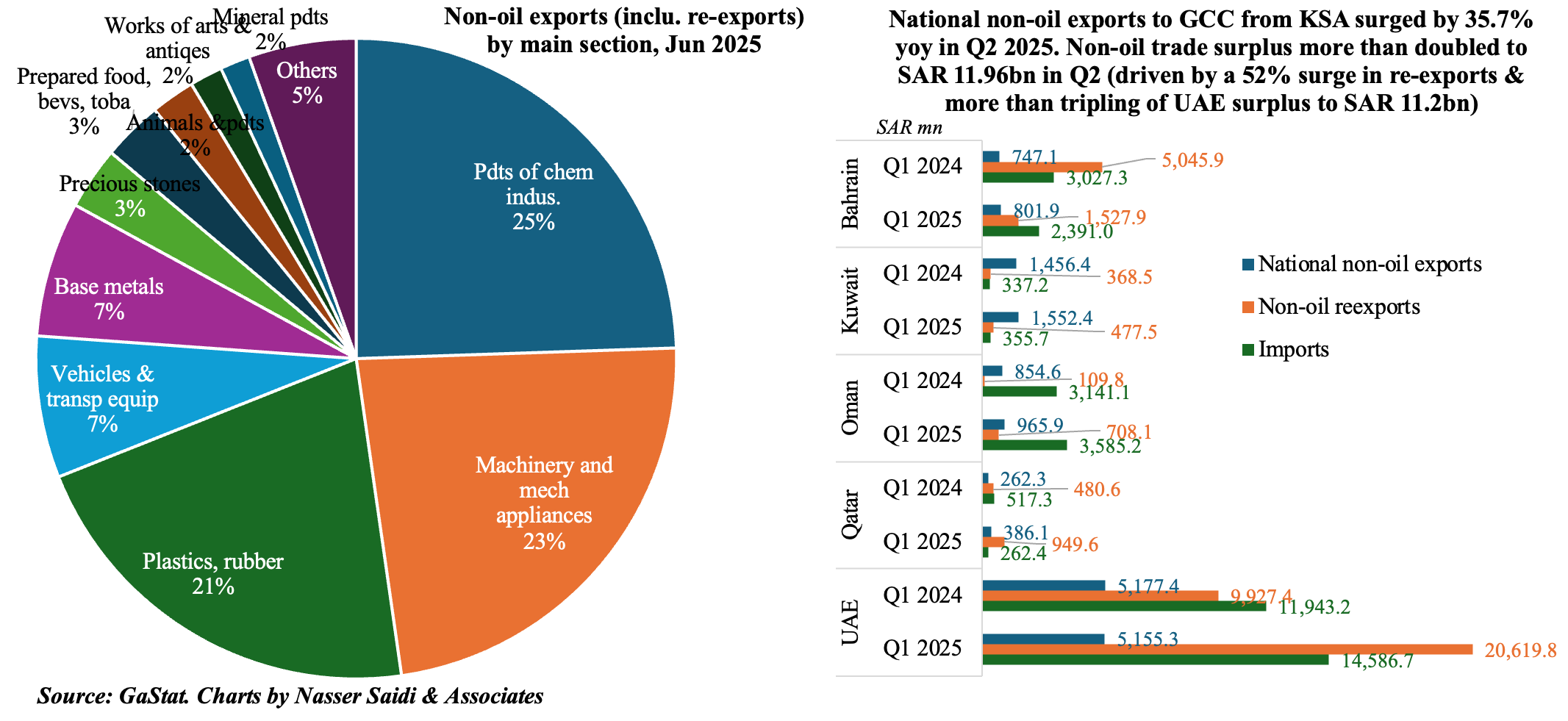

- Chemical products was the largest segment of non-oil exports (24.5%) in Jun, with the top 10 sectors accounting for 95% of non-oil exports.

- UAE the largest destination of overall non-oil exports (28.6%), followed by India (9.5%) and China (7.8%); top 15 accounted for 72% of total non-oil exports.

- Saudi Arabia’s non-oil trade with the GCC was led by a 52.4% yoy gain in non-oil re-exports and 4.3% uptick in non-oil exports.

- UAE was the largest non-oil trade partner.

- Non-oil trade surplus with UAE jumped more than three-times to SAR 11.2bn in Q2. Qatar’s surplus surged almost five times to SAR 1.07bn. Only Oman reported a deficit (SAR 1.9bn), though narrower than Q2 2024.

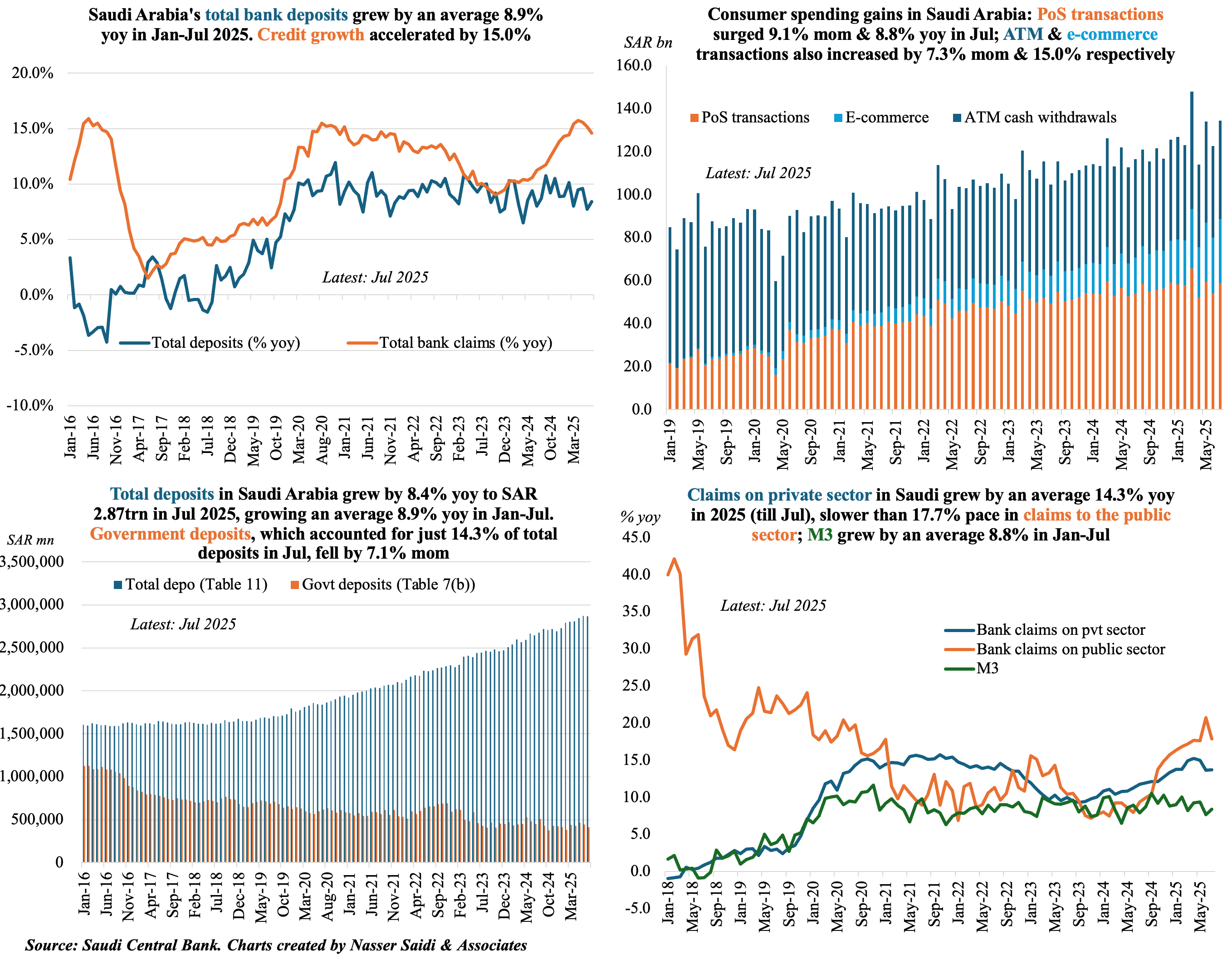

2. Deposit growth in Saudi Arabia averaged 8.9% in Jan-Jul 2025; govt deposits fell to a 5-month low. As of Jul, credit growth has outpaced deposit growth for 18 months in a row. Consumer spending inched up from Jun

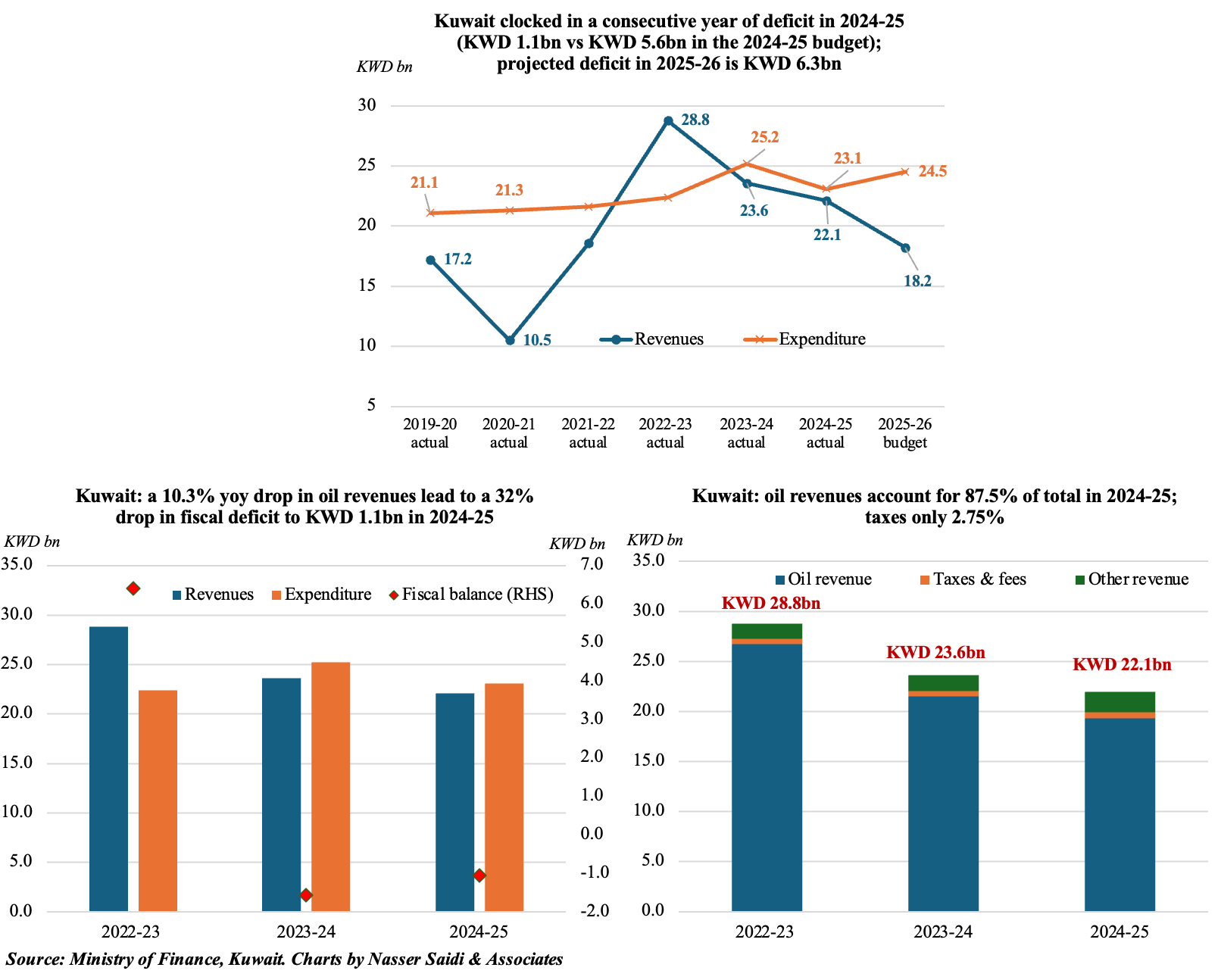

3. Kuwait posts a second consecutive year of fiscal deficit of KWD 1.1bn in 2024-25 (vs a projected deficit of KWD 5.6bn). Fiscal reform & consolidation is a priority.

- Kuwait posted a fiscal deficit of KWD 1.1bn in 2024-2025, one-fifth of the projected deficit of KWD 5.6bn as per the 2024-25 budget and 32% yoy lower than the KWD 1.6bn deficit recorded in 2023-24. This year, budget deficit is projected at KWD 6.3bn.

- Revenues fell by 6.6% yoy to KWD 22.1bn alongside a sharper drop of 8.3% in spending (to KWD 23.1bn). There was a sharp decline in oil revenues (-10.3% yoy to KWD 19.3bn) but accounted for 87.5% of revenues. Taxes, fees and charges accounted for just 2.75% of overall revenues.

- Expenditure declined by 4.7% in 2024-25, with wages and salaries moderating slightly. Public spending fell by 8.3% to KWD 23.1bn, thanks to efforts of rationalising spending; spending on goods & services plunged by 28.3% lower to KWD 3.3bn.

- Overall expenditures came in lower, with implementation of the development plan lagging significantly: as of Q3 2024-25, only less than one-fourth of the budget allocated for development projects had been disbursed! The new Public Debt Law allows the government to issue debt up to KWD 30bn for spending on long-term projects.

- IMF: Fiscal consolidation of about 13% of GDP should be implemented at a pace of 1 to 2% of GDP per year to reinforce intergenerational equity.

- Low-hanging fruit would be to phase out energy subsidies and rationalise public sector wage bill (which accounts for around 60% of overall spending) in addition to rolling out VAT and excise taxes.

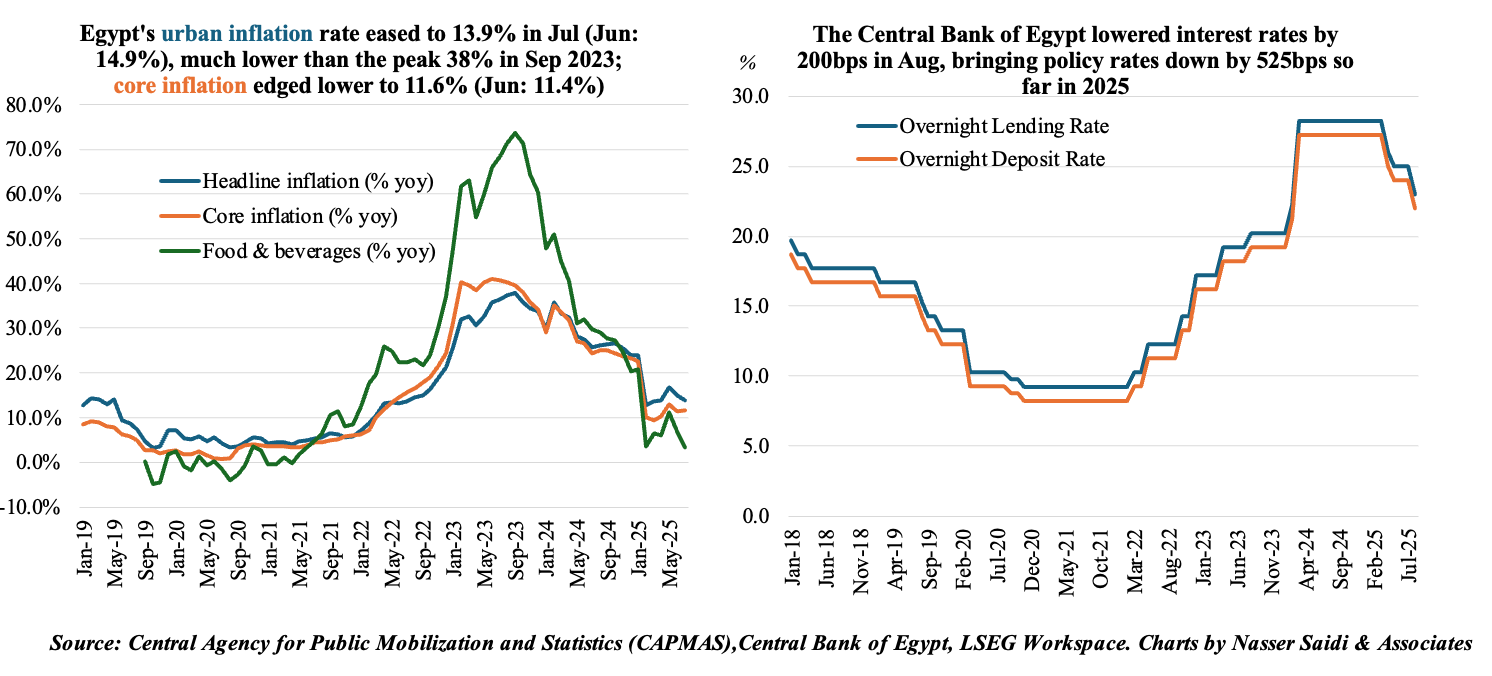

4. Egypt’s 200bps interest rate cut in Aug & improving growth prospects

- The Central Bank of Egypt lowered interest rates by 200bps at the meeting yesterday, after unexpectedly pausing at the July meeting.

- Decline in inflation print to 13.9% in Jul (Jun: 14.9%), and from a peak of 38% in Sep 2023 will provide the central bank enough leeway to resume its rate cut cycle and aligns with a gradual easing strategy.

- Expect the bank to further reduce rates to between 19-20% by the end of this year – facilitated if the international financial environment becomes less volatile (i.e. Fed lowers rate, the ECB maintains or cuts rates, and geopolitical regional risks diminish resulting in a restoration of Suez Canal traffic and revenues). A potential Fed cut could lower pressure on Egypt’s external financing costs, reduce debt servicing costs, and support investor confidence.

- Economic growth in Egypt rose to a preliminary 5.4% in Q2 this year (Q1: 4.8%). An overall boost to the economy has come from multiple avenues: manufacturing (within IPI rose to a record high in May), remittances (surged to a record USD 36.5bn in 2024-25), rise in non-oil exports (including textiles) and increase in tourist arrivals & occupancy rates (higher tourism revenues) among others.

- Egypt has benefitted from improved FX liquidity, a strong build-up in international reserves and successful bond issuances in addition to the IMF’s prescribed structural reforms (including phasing out of fuel subsidies) and net investment inflows into its strategic sectors. Reappointment of the central bank governor will help with continuity of discussions with the IMF including the upcoming 5th & 6th review in the fall this year.

- Furthermore, ongoing regional support (especially from the GCC) through joint ventures, sovereign wealth fund investments, and billion-dollar strategic partnerships, has helped the economy recover and will further improve growth prospects.

Powered by: