Weekly Insights 25 Jul 2024: GCC are adjusting to lower oil revenues

1. Dubai real GDP grew by 3.2% yoy in Q1 2024; inflation has eased across most categories in H1 2024

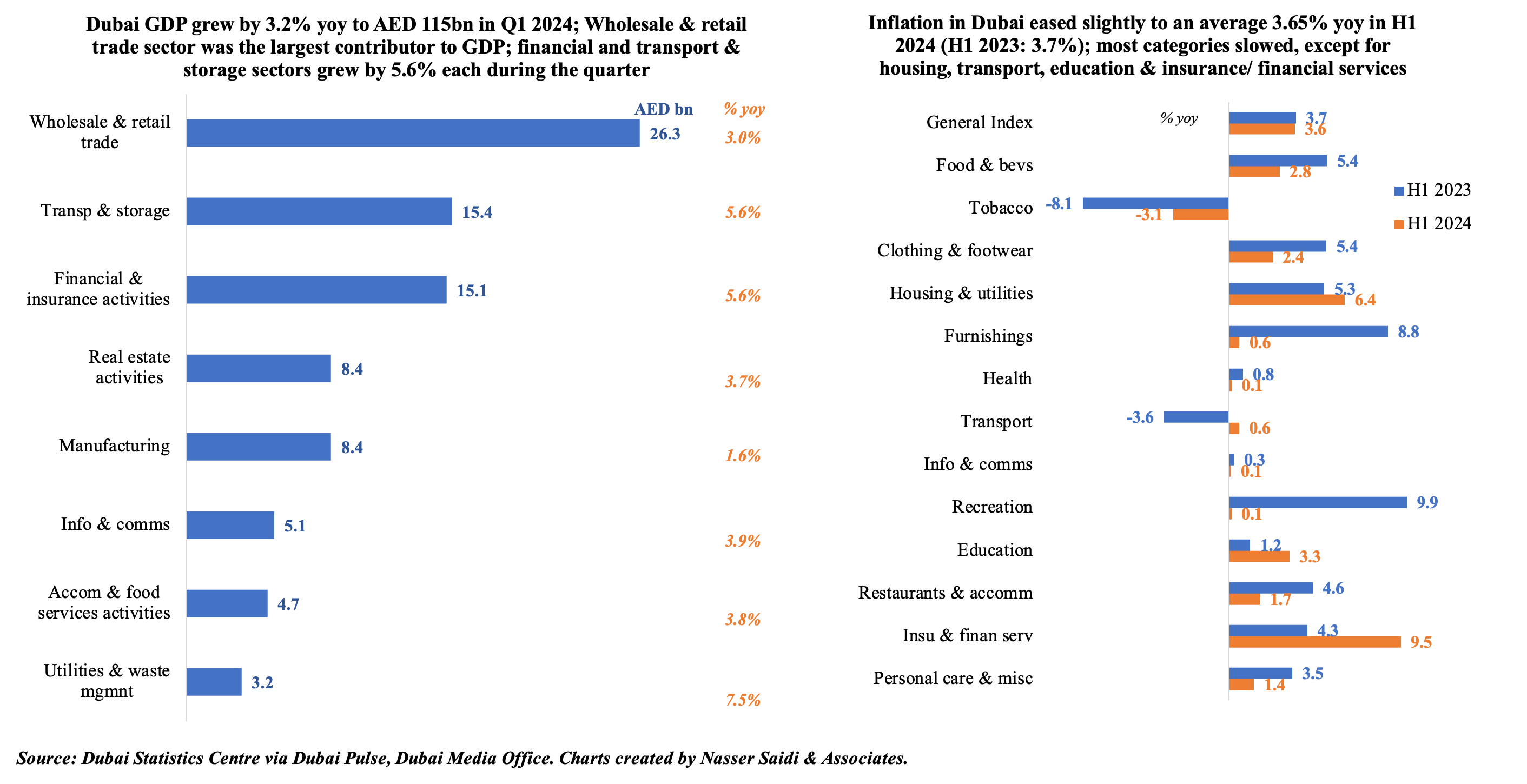

- Dubai real GDP grew by 3.2% yoy to AED 115bn in Q1 2024. Wholesale and retail trade was the largest contributor to GDP (22.9% of total), followed by transportation & storage (13.4%), financial & insurance activities (13.1%). Growth rate was a high 5.6% in the latter two sectors – transportation & storage and financial & insurance activities – while the highest growth was in utilities & waste management (7.5%). Real estate activities grew by 3.7% yoy in Q1 (vs. 5.6% in 2023) and its contribution to GDP was 7.3%.

- Dubai PMI averaged 57.2 in Q1 2024, 6% higher than Q1 2023. GDP prospects for Q2 will likely be affected by the floods in Apr, with PMI declining by 4.4% qoq and 2.7% yoy to 54.7 in Q2 (the same as Q1 2023). Some sectors are expected to perform relatively better including finance (uptick in DIFC & ADGM), tourism (Dubai welcomed 8.12mn visitors in Jan-May 2024, +10% yoy).

- Inflation eased in Dubai to 3.65% in H1 2024 from 3.7% in H1 2023. Mostly slower than last year, some sectors posted upticks in costs: finance & insurance (9.5% vs 4.3%) housing & utilities (6.4% vs 5.3%), education (3.3% vs 1.2%), and transport (0.6% vs -3.6%).

2. Saudi exports & imports accelerated by 5.8% & 2.6% yoy in May; surplus stands at SAR 34.5bn

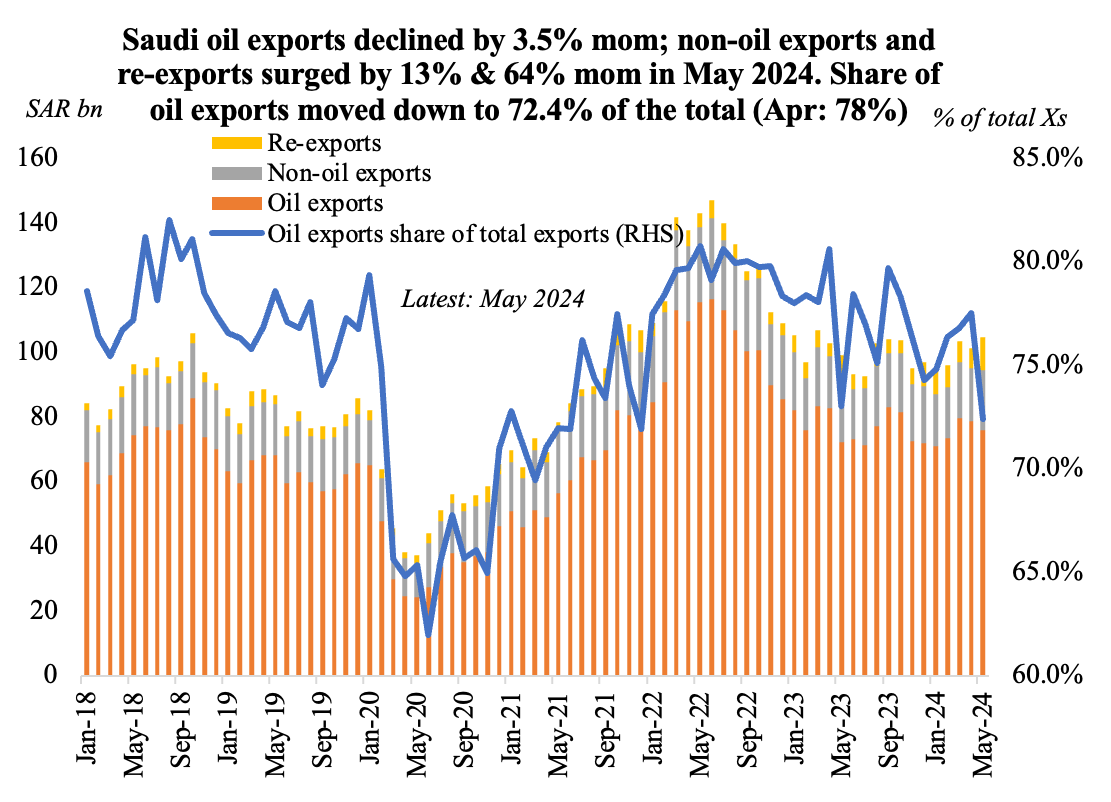

- Saudi Arabia’s exports grew by 3.3% month-on-month to SAR 104.8bn in May, with oil exports declining by 3.5% mom alongside upticks in both non-oil exports (13%) and re-exports (63.9%).

- In yoy terms, oil exports grew by 4.9% to SAR 75.9bn in May and its share in overall exports was 72.4% (lowest since end-2021). Non-oil exports declined by 2.1% yoy to SAR 18.7bn while re-exports surged by 33.9% to SAR 10.2bn in May.

- Imports also grew by 10.6% mom and 2.6% yoy to SAR 70.3bn, thereby moving trade surplus to SAR 34.5bn (vs Apr: SAR 37.8bn; May 2023: SAR 30.6bn).

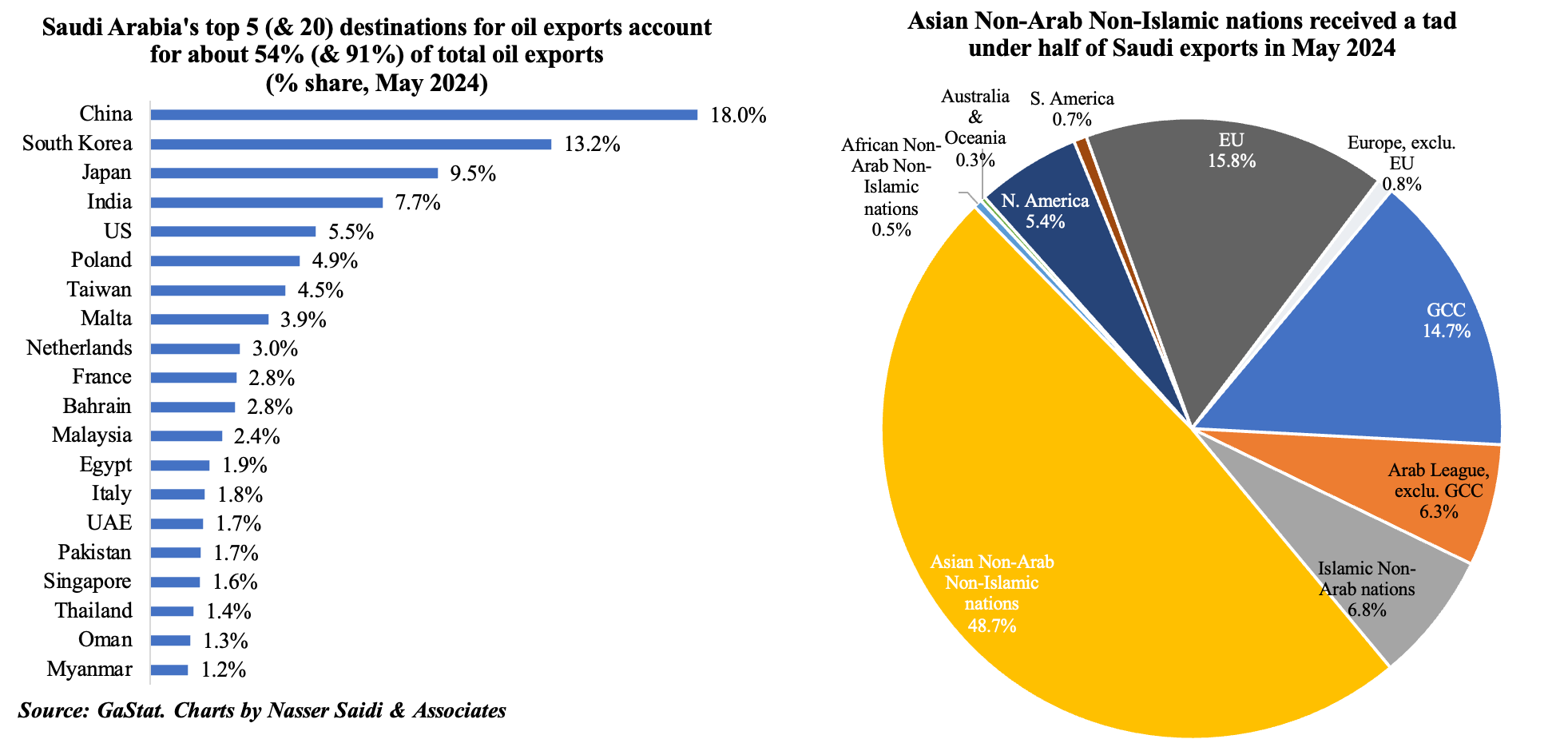

- Oil exports to top 5 destinations (China, Japan, India, South Korea & Poland) stood at 53.8% of total oil exports in May. Share of top 25 nations was 95.5%.

- China was the top trade partner in May: accounting for 15.2% of overall exports and one-fourth of total imports.

- Asian Non-Arab Non-Islamic nations received 48.7% of Saudi exports in Apr 2024 & GCC 14.7%.

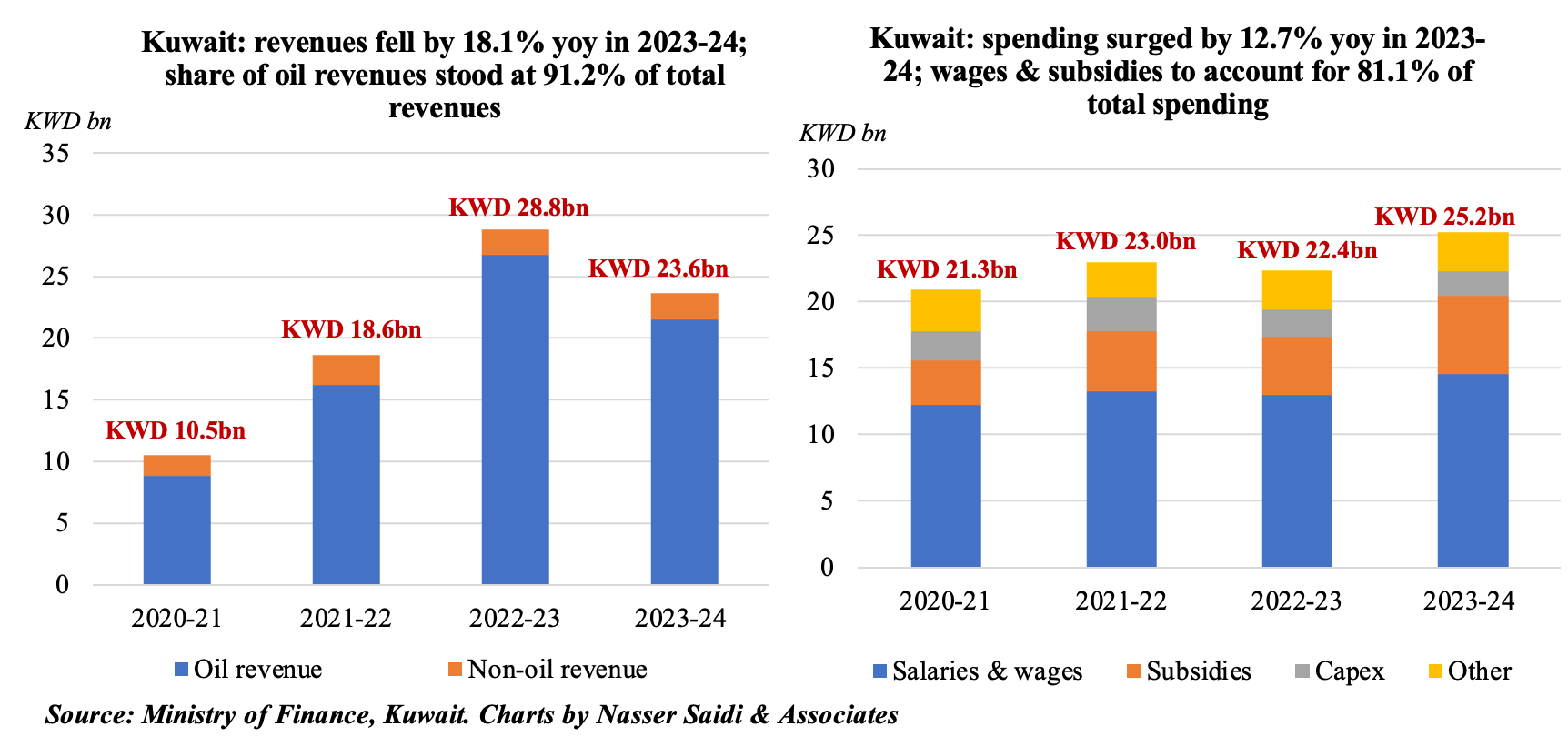

3. Kuwait posts a deficit of KWD 1.6bn in 2023-24

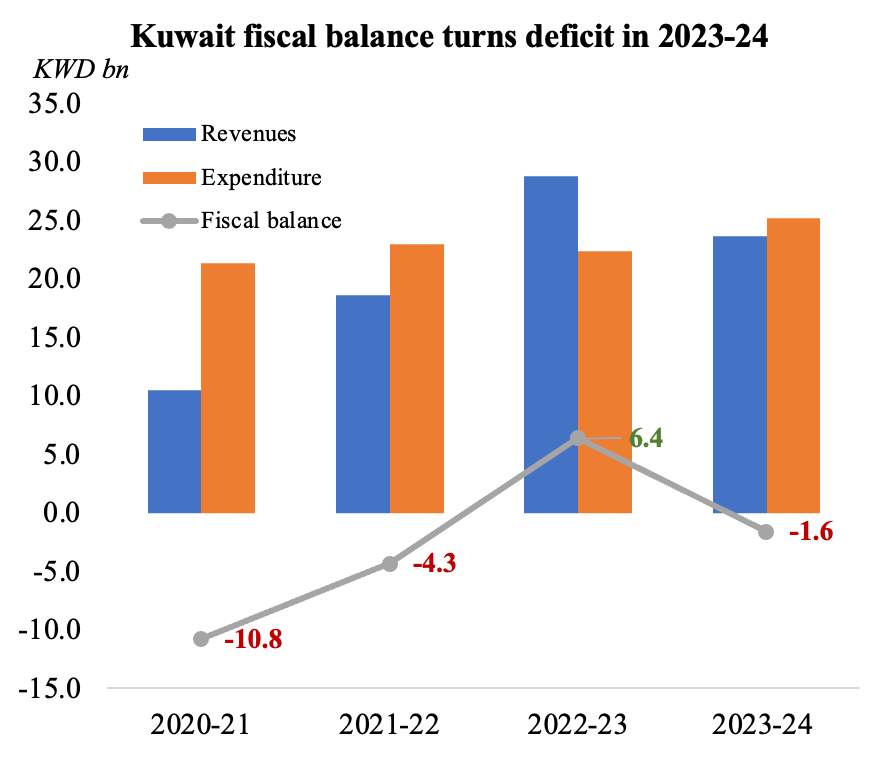

- Kuwait’s finance ministry disclosed that fiscal balance moved to a deficit of KWD 1.6bn in 2023-24 compared to a surplus of KWD 6.4bn in 2022-23. The budget had estimated a much wider deficit of KWD 6.8bn in the fiscal year.

- Revenues declined by 18% yoy to KWD 23.6bn; this was 21.3% higher than estimated in the budget for the year. The drop was largely owing to oil revenues, which fell by 19.4% to KWD 21.5bn (as per an average oil price of USD 84.36 a barrel). Non-oil revenues, which accounted for under 10% of total revenues, posted a slight uptick of 1% to KWD 2.4bn.

- Expenditures increased by 12.7% yoy to KWD 25.2bn, with wages and subsidies rising by 12.1% (to KWD 14.6bn) and 34.1% (to KWD 5.9bn) respectively. Salaries wages and subsidies together accounted for 81.1% of total spending in 2023-24. Capex spending meanwhile fell by 8.9% to KWD 1.9bn. Spending was 4.1% lower than estimated in the budget for the year.

- Fiscal performance has been weak, given Kuwait’s political gridlock & delayed reforms including introduction of a 5% VAT & public debt law. Volatility in oil prices & production will continue to impact fiscal and external balances in the absence of reforms to drive diversification efforts.

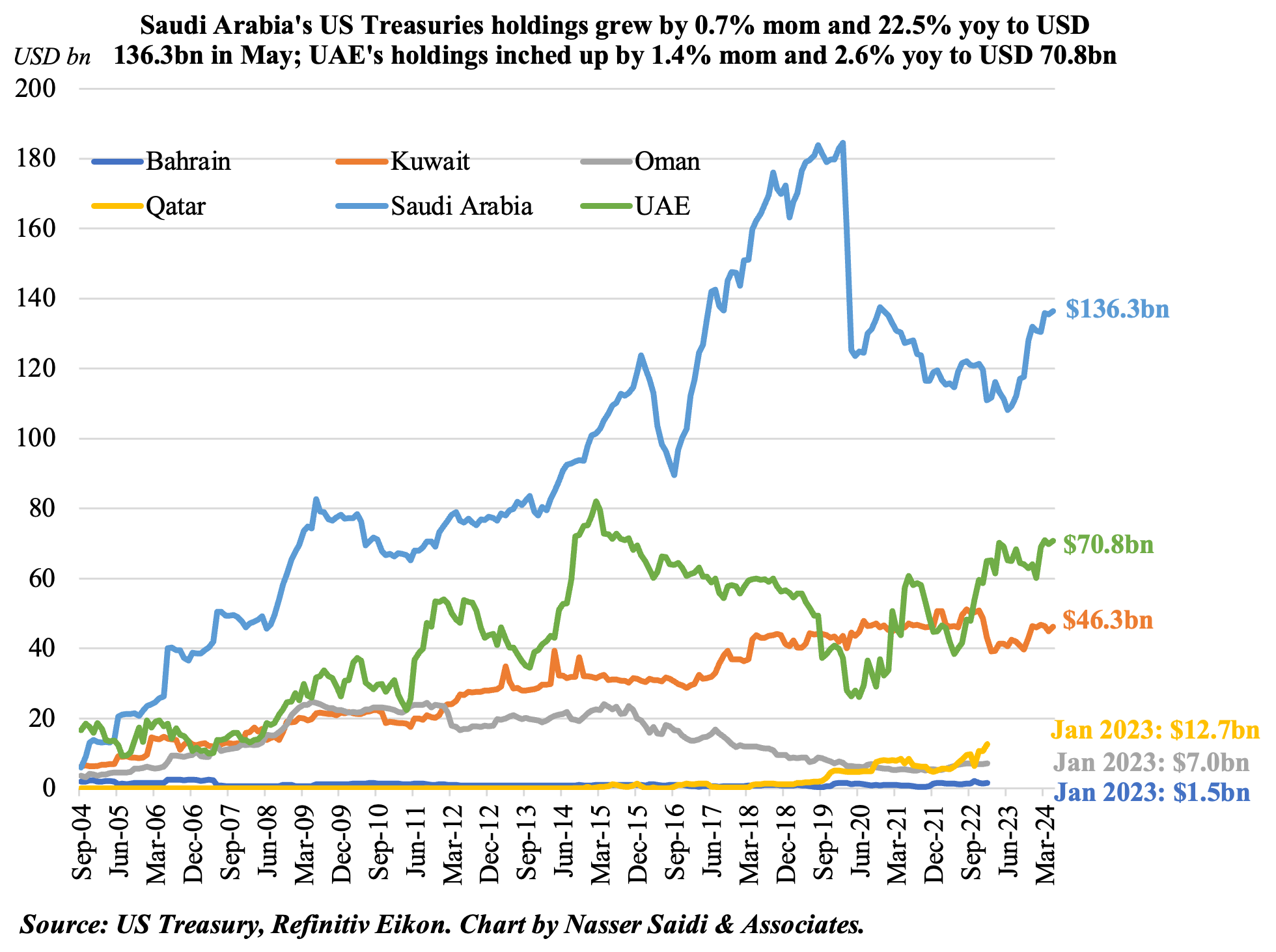

4. Saudi Arabia’s US Treasuries holdings, at USD 136.3bn in May 2024, is the highest since Jan 2022

- Foreign holdings of Treasuries hit a record high of USD 8.129trn in May (Apr: $8.04trn).

- Japan, largest foreign holder of US Treasuries, saw holdings shrink to USD 1.128trn (-2% mom). The ongoing US-China trade war has seen China reduce its holdings to USD 768bn (Apr: USD 770bn).

- Saudi Arabia is the 17th largest investor in US Treasury bonds as of May 2024 (USD 136.3bn): the highest since Jan 2022.

- In May 2024, the 3 GCC nations – Kuwait, UAE and Saudi Arabia – increased their holdings in both mom & yoy terms.

- Compared to end-2023, Kuwait decreased their holdings (by 0.3%), while Saudi Arabia and UAE holdings have ticked up by 3.3% and 10.7% respectively.

- KSA’s holdings grew by 0.7% mom and 22.5% yoy to USD 136.33bn in May. UAE’s holdings clocked in at USD 70.8bn in May, up by 1.4% mom and 2.6% yoy.

Powered by: