Download a PDF copy of the weekly economic commentary here.

Markets

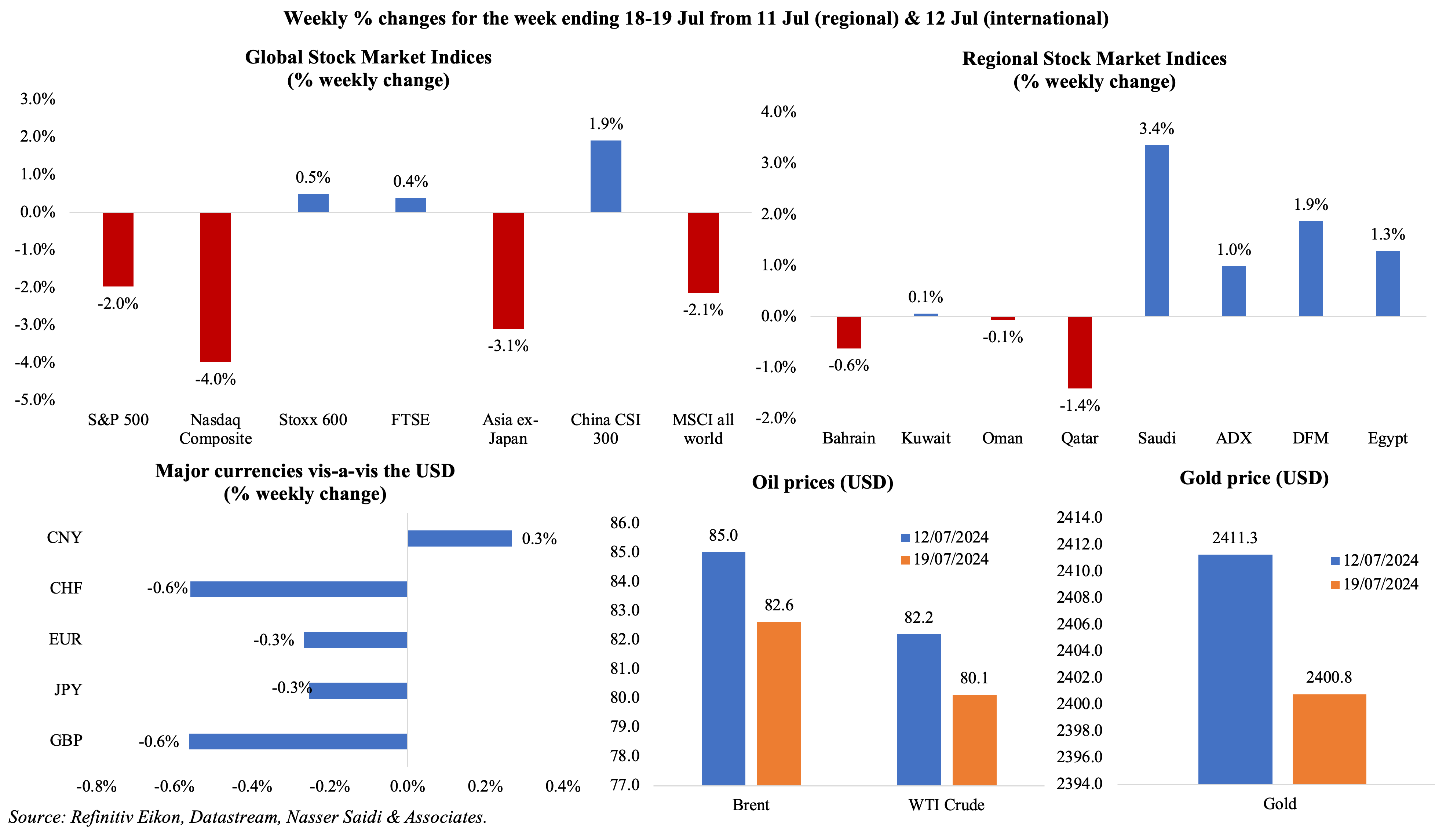

Major equities markets ended in the red last week, following a global tech outage that led to disruptions across multiple sectors from airlines to banks, raising questions about cybersecurity and interconnected / integrated ecosystems. Regional markets including in Saudi Arabia and UAE performed well thanks to strong corporate earnings and hopes about Fed rate cuts. The euro and GBP weakened vis-à-vis the dollar last week, given the ECB’s lack of forward guidance on its policy direction and weak economic data. Oil prices fell on a strong dollar and concerns about Chinese demand while eyes are also on a potential ceasefire in Gaza. Gold price fell from its peak hit earlier in the week (USD 2483.6 on Wednesday) on profit taking and dollar strength.

Global Developments

US/Americas:

- Industrial production in the US rose by 0.6% mom in Jun (May: 0.9%), supported by output from utilities (2.8%) and manufacturing (+0.4%, with motor vehicle production surging to a nine-year high) while mining gained 0.3%. Capacity utilisation inched up to 78.8% (May: 78.3%). In yoy terms, IP was up by 1.6%, the most since Nov 2022, and gained 4.3% in Q2.

- Retail sales stayed flat in Jun (May: 0.3% mom), as sales at gas stations and autos fell by 3.0% and 2.3%. Sales excluding autos grew by 0.4% mom while sales excluding food services, auto dealers, building materials stores & gas stations were up 0.9%, the most since Apr 2023.

- Building permits in the US grew by 3.4% mom to 1.446mn in Jun, though single-family home permits fell by 2.3% to 934k units (the lowest since May 2023). Housing starts inched up by 3.0% mom to an 8-month low of 1.353mn, with single-family housing starts down by 2.2% to 980k (the lowest since Oct 2023).

- NY Empire State manufacturing index edged down to -6.6 in Jul (Jun: -6): new orders were stable, and employment was weak amid a slight uptick in shipments and selling prices.

- Philadelphia Fed manufacturing index surged to a 3-month high of 13.9 in Jul (Jun: 1.3): new orders and employment turned positive (to 20.7 & 15.2 from -2.2. & -2.5 respectively).

- Initial jobless claims increased by 20k to 243k in the week ended Jul 12, affected by shutdowns at auto plants and disruptions due to Hurricane Beryl, making the 4-week average rise by 1k to 234.75k. Continuing jobless claims ticked up by 20k to 867mn in the week ended Jul 5th, the highest reading since Nov 2021. Earlier in the week, the Fed’s Beige Book had indicated “employment rose at a slight pace” with manufacturing employment declining.

Europe:

- ECB left its main interest rates unchanged at 3.75%, with the ECB chief calling the decision for a Sep rate cut “wide open”; services inflation above 4% is worrisome and a rate cut will be “data dependent” (i.e. only if data supports such a move).

- Germany’s ZEW economic sentiment index slipped to 41.8 in Jul (Jun: 47.5), posting a decline for the first time since Jul 2023. However, the current situation sentiment improved slightly to -68.9 in Jul (Jun: -73.8). Additionally, the ZEW economic sentiment index in the eurozone fell to 43.7 in Jul, down 7.6 points from Jun’s 51.3 while the current sentiment gained 2.5 points to -36.1.

- Producer price index in Germany moved up 0.2% mom in Jun after a flat reading in May. In yoy terms, PPI was -1.6% from -2.2%, the 12th consecutive month of producer deflation, as energy prices dropped (-5.9%) as did cost of intermediate goods (-0.9%).

- UK inflation was unchanged at 2.0% in Jun, as housing & utilities costs fell by 4.7% alongside an uptick in restaurants & hotels (6.2%) and transport costs (0.9%) while cost of food & non-alcoholic beverages was 1.5% (lowest since Oct 2021). Core CPI stood at 3.5%.

- Producer output (factory gate) prices in the UK eased to 1.4% in Jun (May: 1.7%) while in mom terms, it dropped by 0.3%. According to the ONS, services producer prices slowed in Q2: it rose by 3.1% yoy in Q2 2024 compared to a revised increase of 3.7% in Q1.

- Retail sales in the UK fell by 1.2% mom and 0.2% yoy in Jun (May: 2.9% mom and 1.7% yoy), partly affected by the elections. Sales at non-food stores dell by 2.1% while online sales also fell by 2.7%.

- Average earnings growth in the UK slowed in the 3 months to May, clocking in 5.7% including bonuses (from 5.9% in Feb-Apr). Excluding bonus, earnings eased to 5.7% (from 6.0% the month before). Separately, unemployment rate in the UK held steady at 4.4% in the 3 months to May. Job vacancies fell by 30k to 889k in the April-to-June period, posting the 24th consecutive fall although it is almost 12% higher than pre-pandemic figures.

- GfK consumer confidence in the UK improved to -13 in Jul (Jun: -14), the highest reading since Sep 2021, largely thanks to upticks in consumers’ willingness to make major purchases (a rise of 7 points) and views on personal finances (up 2 points).

Asia Pacific:

- In a surprise move, the People’s Bank of China cut the seven-day reverse repo rate to 1.7% from 1.8%, the first in almost a year: it also lowered the 1-year and 5-year loan prime rates by 10bps each to 3.35% (the first cut since Aug 2023) and 3.85% (the first time since Feb 2024) respectively.

- Industrial production in China grew by 5.3% yoy in Jun (May: 5.6%), taking the cumulative output to up 6% in H1. Retail sales expanded by 2.0%, slowing from May’s 3.7% uptick. Fixed asset investment increased by 3.9% in H1 2024 (Jan-May: 4.0%).

- Inflation in Japan held steady at 2.8% in Jun, with cost of gas rising for the first time in more than a year (2.4% vs May’s -2.5%) and utility bills rose by 13.4%. Excluding food and energy, prices inched up (2.2% from May’s 2.1%). Excluding fresh food, inflation inched up to 2.6% (May: 2.5%), much higher than BoJ’s target.

- Japan’s exports rose for the 7th month in a row, up by 5.4% yoy in Jun (May: 13.5%) while imports grew by a slower pace of 3.2%. Trade balance moved to a surplus JPY 224bn in Jun (May: deficit of JPY 1.22bn). Exports to the US and China gained 11% and 7.2% respectively while that to the EU dropped 13.4%.

- Wholesale price inflation in India accelerated to a 16-month high of 3.36% in Jun (May: 2.61%), as food prices surged (8.68% from 7.4%) and manufactured products prices rose (1.43% from May’s 0.78%). Compared to May, prices jumped by 2.48% (May: 0.6%).

- India’s trade deficit narrowed to USD 20.98bn in Jun (May: USD 23.8bn) as exports rose by 2.6% yoy to USD 35.2bn alongside a 4.9% gain in imports to USD 56.18bn. Exports of petroleum products contracted by 18% yoy to USD 5.52bn despite an uptick in prices.

Bottom line: Biden’s withdrawal from the Presidential race with just over 100 days to go to elections introduces a new uncertainty – is it too late for a new nominee to get the necessary endorsements (the Democratic National Convention in August will be too late) and launch a new campaign? Vice President Harris has already received support from both donors and democratic officials, but it is still unclear whether she will be the Democratic nominee. Separately, China’s third plenum (meeting of the Communist Party’s Central Committee) did not result in any major announcements in terms of macro policy goals – existing policies were reaffirmed e.g. improve social security & healthcare, introduce land, tax and financial system reforms. Details related to phrases such as “expand domestic demand” and “foster new drivers of foreign trade” were missing – explanations are expected in the coming weeks. With PBoC surprising markets with a rate cut this morning, the next major meetings from the Fed & Bank of Japan later this month will be watched. While the Fed is widely expected to hold, the latter’s move could depend on the Tokyo inflation report as well (higher inflation would raise expectations for further tightening). This week’s flash PMI readings will also highlight the divergence across sectors (manufacturing, services) and markets (EU vs US and emerging markets).

Regional Developments

- The IMF lowered MENA’s growth forecast to 2.2% this year (from 2.7% in its Apr 2024 report), citing the impact from both lower oil production (affecting oil exporting nations) and regional conflicts (affecting trade, tourism and FDI flows among others). Saudi Arabia’s growth was revised down to 1.7% this year on lower oil production (a drop by 0.9 percentage points) and 4.7% in 2025 while Egypt’s was slightly lowered to 2.7% this year (before growing by a faster 4.1% in 2025).

- Egypt’s interest rate was left unchanged stating that leading indicators suggested economic sluggishness and “the current monetary stance is appropriate to support the sustained moderation of inflation”.

- Exports from Egypt inched up by 0.8% yoy to USD 3.3bn in Apr – with gains across petroleum products (+16.3%), pharma (64%) and readymade garments (31.4%) among others – while imports dropped slightly by 0.7% to USD 5.97bn. Trade deficit hence narrowed by 2.5% to USD 2.68bn.

- Egypt is planning to boost its strategic commodity reserves to be sufficient for 9 months instead of 6, revealed a government official to Asharq Business, backed by availability of currency reserves and relatively lower prices for some basic commodities.

- Total budget deficit in Egypt narrowed to EGP 505bn in the fiscal year 2023-24 that ended in June (2022-23: EGP 610bn deficit), with revenues surging by 59.3% yoy. It also achieved a record high primary surplus of EGP 875bn (USD 18.14bn).

- Suez Canal revenues fell by 23% yoy to USD 7.2bn in 2023-24, according to the head of the Canal’s Authority, from USD 9.4bn in 2022-23. The number of ships using the crossing fell to 20,148 from 25,911 the year before (-22.2% yoy). Separately, the Suez Canal Authority plans to float a subsidiary (Canal Mooring & Lights Company, a specialist in the mooring and unmooring of ships) next year.

- Egypt is planning to invest USD 1.2bn in the 2024-25 fiscal year to drill 110 exploratory wells in a bid to boost its oil and gas production capabilities. Currently, there are 145 active exploration agreements in oil and gas with 40 partners.

- Iraq has resumed talks to join the WTO, about 20 years since it first applied for membership.

- Sweden will phase out development aid to Iraq from next year, revealed Sweden’s Minister for International Development Cooperation and Foreign Trade, given Iraq’s progress into a middle-income country with increased ability to support its economy. The current aid package of SEK 190mn (USD 18mn) will be lowered to a total of 100mn next year and phased out by June 30th.

- Kuwait’s trade surplus with Japan widened by 32.7% yoy to JPY 90.1bn (USD 556mn) in Jun, thanks to strong exports (24.3% yoy to JPY 115.6bn).

- Money supply growth in Oman accelerated by 12% yoy to OMR 23.6bn by end-Apr and demand deposits jumped by 11.2%. Total assets of Islamic banks and windows combined amounted to OMR 7.5bn, accounting for 17.7% of the total assets of the banking sector.

- Hotel revenues in Oman increased by 10.2% yoy to OMR 108.3mn (USD 281.5mn) in Jan-May 2024, supported by the number of hotel guests (13.7%) while occupancy rate rose to 51.5% (+6%). GCC visitors grew by 6.8% to 58,572 while 306,255 guests were Omanis.

- Global sukuk issuances ticked up by 0.87% yoy to USD 91.9bn in H1 2024, according to S&P Global, driven by Saudi Arabia and the UAE. Volume of sustainable sukuk issuance inched lower to USD 5.2bn in H1, down from USD 5.7bn a year ago.

- An EIU report highlighted Qatar as the country clocking in the biggest improvement in business environment in the MENA region. With a 0.93 change in score, Qatar was the 5th most improved country in the rankings, with financing the most improving category.

- Bilateral trade between GCC and Mexico surged by 25% yoy to USD 4.4bn in 2022, as exports doubled to USD 1bn.

Saudi Arabia Focus

- The IMF revised down Saudi growth to 1.7% this year. Non-oil sector activity has been robust and will continue to be a driving force (thanks to the mega & giga projects underway). Growth is forecast to rise 4.7% in 2025. The IMF also welcomed “recalibrations” on Saudi major projects.

- Consumer price inflation in Saudi Arabia eased to 1.5% yoy in Jun (May: 1.55%): most categories saw price increases slow including food & beverages (1.13% from 1.43%) and hotels & restaurants (2.4% from 2.5%) while education costs held steady (1.1%). Housing costs eased slightly to 8.4% yoy (May: 8.7%) with housing rents rising by 10.2% (from 10.5%) while recreation and transport costs remained deflationary (both down by 2.0%).

- Wholesale prices in Saudi Arabia inched up to 3.21% in Jun (May: 3.18%), with most categories posting declines except agriculture & fishery products (0.9% in Jun from May’s 1.3% dip). In H1 2024, wholesale prices accelerated: averaging 3.5% (vs H1 2023: 0.9%), with the surge driven by “other transportable goods” (8.5% from 0.9% in H1 2023).

- Saudi Arabia’s FDI stock grew by 6.1% yoy to SAR 817.7bn (USD 218bn) in Q1, as per a report released by the Ministry of Investment.

- Crude oil exports from Saudi Arabia rose by 2.51% mom to 6.12mn barrels per day in May, according to data from the Joint Organizations Data Initiative. Crude oil production inched up by 0.08% mom to 8.99mn bpd.

- Saudi Aramco completed the issuance of a USD 6bn USD-denominated international bond; this will be traded on the London Stock Exchange.

- US Treasury bonds held by Saudi Arabia surged by 22.46% yoy to USD 136.3bn in May, making it the 17th largest investor globally in the instrument.

- Saudi Arabia welcomed 60mn tourists in H1 2024, disclosed the Minister of Tourism. Tourist spending touched approximately SAR 150bn (USD 40bn) during the period, up 10% yoy. The minister also stated that a tourist visa would be launched next month to boost visitors.

- Home ownership by citizens in Saudi Arabia touched 63.74% at end-2023, up 16.7% compared to 2016, in line with meeting the goal of 70% ownership by 2030. The report highlighted that more than 96k families benefited from the program in 2023.

- Saudi Arabia’s Ministry of Industry and Mineral Resources announced the launch of its largest mineralised belts (spanning 4788 square kilometres), and also five new exploration licenses (three for the Jabal Sayid site in Madinah).

- Saudia placed an order for all-electric flying taxis: Germany-based air taxi developer Lilium received its biggest ever order for 50 of the firm’s electric Vertical Take-Off and Landing (eVTOL) Jets (to be delivered by 2029) with an option for an additional 50 later. Value of the whole order was around USD 700mn.

- PIF signed 3 deals with the world’s second-largest manufacturer of solar cell components (TCL Zhonghuan Renewable Energy Technology Co.) to establish a USD 2.8bn power production plant (for renewable energy component manufacturing) in Saudi. Plans include manufacturing of wind turbines & components and localize production of photovoltaic cells & modules among others.

- With sights set on becoming a major hydrogen producer, Aramco signed final agreements to buy 50% of the blue hydrogen industrial gases business of Air Products Qudra (a joint venture between US industrial gases producer Air Products and a Saudi start-up Qudra Energy). Financial details were not disclosed, but the deal includes options for Aramco to buy hydrogen and nitrogen.

- Saudi Space Agency and NASA signed an agreement to boost cooperation on civilian space exploration and research.

- Saudi government agencies have increased technology adoption and implemented new solutions: the Emerging Technology Adoption Readiness Index jumped to 70.7% in 2024 from 60.35% in 2023, as the number of participating agencies surged to 35 (2023: 13).

UAE Focus

- UAE’s gross bank assets grew by 1% mom and 13% yoy to AED 4.254trn in Apr 2024. The central bank’s foreign assets surged by 25% yoy to a record AED 789.82bn in Apr. Deposits in the UAE increased by 2.3% mom & 15.6% yoy in Apr while gross credit ticked up by 0.8% mom and 8.8% yoy to AED 2.06trn.

- Real GDP in Abu Dhabi expanded by 3.3% yoy in Q1 2024(Q4 2023: 4.1%), supported by a faster growth in the non-oil sector (4.7%) alongside oil sector GDP (which grew by 1.6%). Non-oil GDP clocked in at AED 154.66bn in Q1 (4.7% yoy & 0.2% qoq), accounting for 54.1% of total GDP, the highest since 2015 (previous high was 55.8% in Q4 2014). Oil GDP which fell by 2.4% qoq to AED 131.3bn in Q1 (due to lower prices and production cuts). Among non-oil sectors, construction accounted for the largest share of GDP (8.8% of total and 16.2% of non-oil), followed closely by manufacturing (8.7% & 16.1% of total & non-oil GDP respectively) and financial sector (7.0% & 12.9% of total & non-oil GDP).

- UAE and Ethiopia’s central banks signed a currency swap agreement with a value of up to AED 3bn (USD 816.79mn). The banks also inked an agreement to establish a framework for using local currencies for settling cross-border transactions and linking payment systems. The Central Bank of the UAE also signed 2 similar MoUs with the Central Bank of Seychelles: for use of local currencies for cross-border transactions and interlinking payment systems.Separately, the Central Bank of the UAE and Bank Indonesia signed a MoU to boost cooperation in payment systems.

- Sharjah plans to quadruple FDI to USD 10bn over the next 5 years. FDI into Sharjah surged by 140% to USD 2.75bn in 2023, with the launch of 19 new greenfield projects.

- UAE’s debt capital market outstanding surged by 11.8% yoy to USD 281bn in H1 2024, according to Fitch Ratings. The UAE was the 3rd largest USD debt issuer among emerging markets excluding China, with an 8.9% share of the total – ahead of the UAE were Saudi Arabia (17.4%) and Brazil (9.4%).

- Abu Dhabi’s Masdar raised USD 1bn through its second green bond issuance – with the allocation split between 70% to international and 30% to MENA investors. The proceeds will be used to fund Masdar’s equity commitments on new greenfield projects.

- UAE is considering a second nuclear power plant to meet the nation’s growing electricity demand, according to a government official. The final reactor of the UAE’s only nuclear plant will start commercial operations this year. The official stated that even though the location of the plant or size are still undecided, it is possible that a tender could be issued this year.

- UAE’s energy startups secured USD 30mn in investment in H1 2024, much higher than the USD 24mn raised in full year 2023, according to IEA’s data. UAE wind energy firms accounted for 8.3 percent of the overall financing received in H1 this year. Startup companies operating in the UAE’s energy sector reached 54 by end-2023, with 12 working on energy storage & batteries. (Data: https://www.iea.org/data-and-statistics/data-tools/energy-start-up-data-explorer)

- Abu Dhabi National Hotels (which trades on the Abu Dhabi stock exchange) appointed banks to work on the IPO of its catering business, and hopes to raise USD 300-400bn, reported Bloomberg. The company, which owns 12 hotels in the UAE, did not confirm offering size or timing of the listing.

- Amanat Holding, a Dubai investment company, plans to list its education platform which includes Middlesex University Dubai, Human Development Company, a special education and care services provider in Saudi Arabia, and Nema Holding, a privately held education company in the UAE.

- Eos-X Space, a European space exploration company, will begin operating balloon flights to the edge of space from Abu Dhabi in Q3 2025. The emirate will host the launch facility and spaceport, though no further details were shared.

Media Review:

The Global Economy in a Sticky Spot: IMF World Economic Outlook, Jul 2024 issue

https://www.imf.org/en/Publications/WEO/Issues/2024/07/16/world-economic-outlook-update-july-2024

UAE: A temporary international mission is needed in Gaza

https://www.ft.com/content/cfef2157-a476-4350-a287-190b25e45159

Oman is on a steady path to a hydrogen-powered future

https://www.agbi.com/opinion/renewable-energy/2024/07/oman-is-on-a-steady-path-to-a-hydrogen-powered-future/

Trump 2.0 would not play out like Trump 1.0 in markets

https://www.ft.com/content/0aca4515-757c-42d4-9e08-a7087d70133f

AI can predict tipping points before they happen

https://www.economist.com/science-and-technology/2024/07/17/ai-can-predict-tipping-points-before-they-happen

Powered by: