Weekly Insights 19 Jul 2024: MENA growth projections lowered by the IMF; GCC’s non-oil sector growth will stay robust

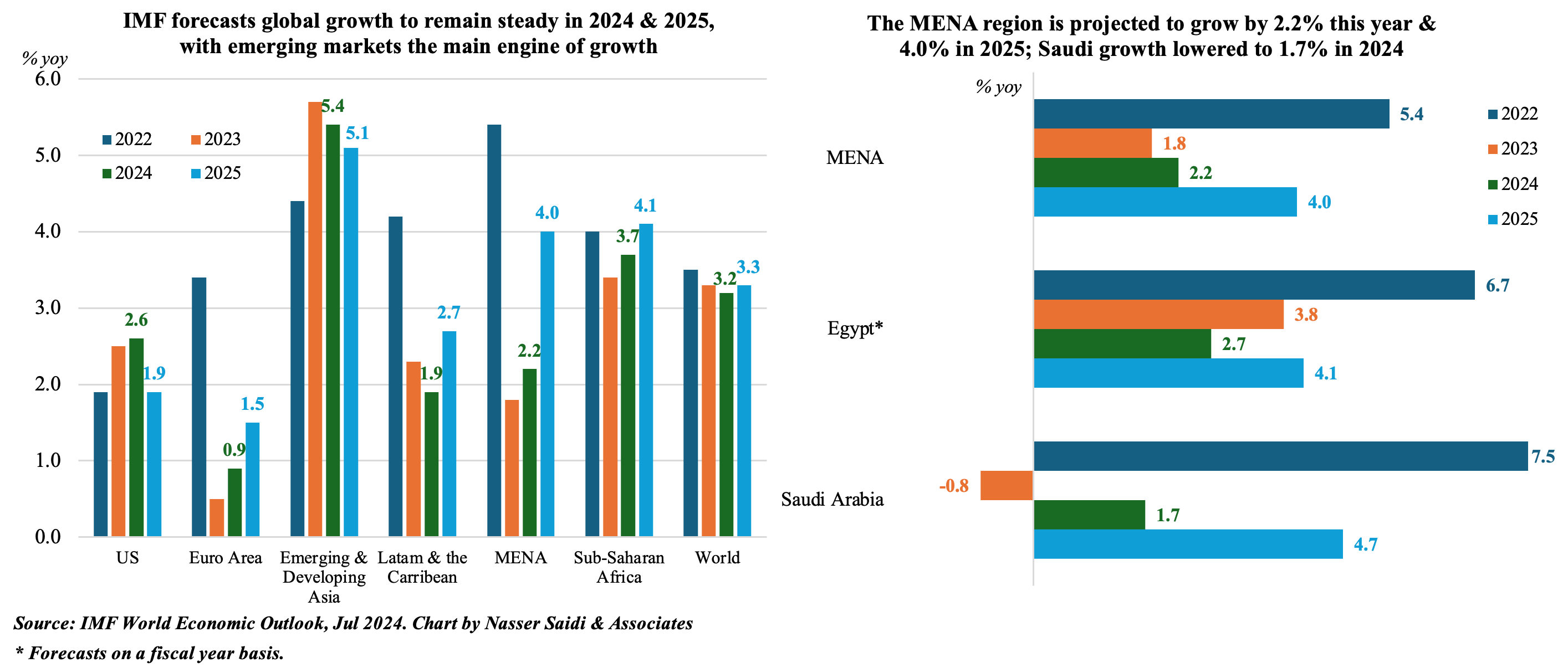

1. IMF lowers Middle East and North Africa growth forecast to 2.2% in 2024, from projection of 2.7% (in Apr 2024)

- The IMF lowered MENA’s growth forecast to 2.2% this year (from 2.7% in its Apr 2024 report), citing the impact from both lower oil production (affecting oil exporting nations) and regional conflicts (affecting trade, tourism and FDI flows among others).

- Saudi Arabia’s growth was revised down to 1.7% this year on lower oil production (a drop by 0.9 percentage points) and 4.7% in 2025 while Egypt’s was slightly lowered to 2.7% this year (before growing by a faster 4.1% in 2025).

- For Saudi Arabia, non-oil sector activity has been robust so far and will continue to be a driving force (thanks to the mega & giga projects under development). Many of these projects are still backed by the government (& the PIF) and funding needs are high – these entities have been tapping alternative funding sources including debt markets. While tourism & construction will continue to be two of the main sectors supporting non-oil growth, other sectors such as mining, entertainment and renewable energy have also been performing well.

- In Egypt, growth forecasts will depend on the impact from the conflict in Gaza (which has led to Suez & Red Sea disruptions) as well as the pace of reform implementation including fiscal reform, privatisation of state-owned enterprises and exchange rate flexibility.

- Risks: conflict extends with potential spillovers into neighbouring nations, increase in commodity prices if shipping disruptions are prolonged & trade routes affected, political uncertainty & social unrest. How the US responds to the conflict in the lead up to the elections & policy change if a new administration comes into power.

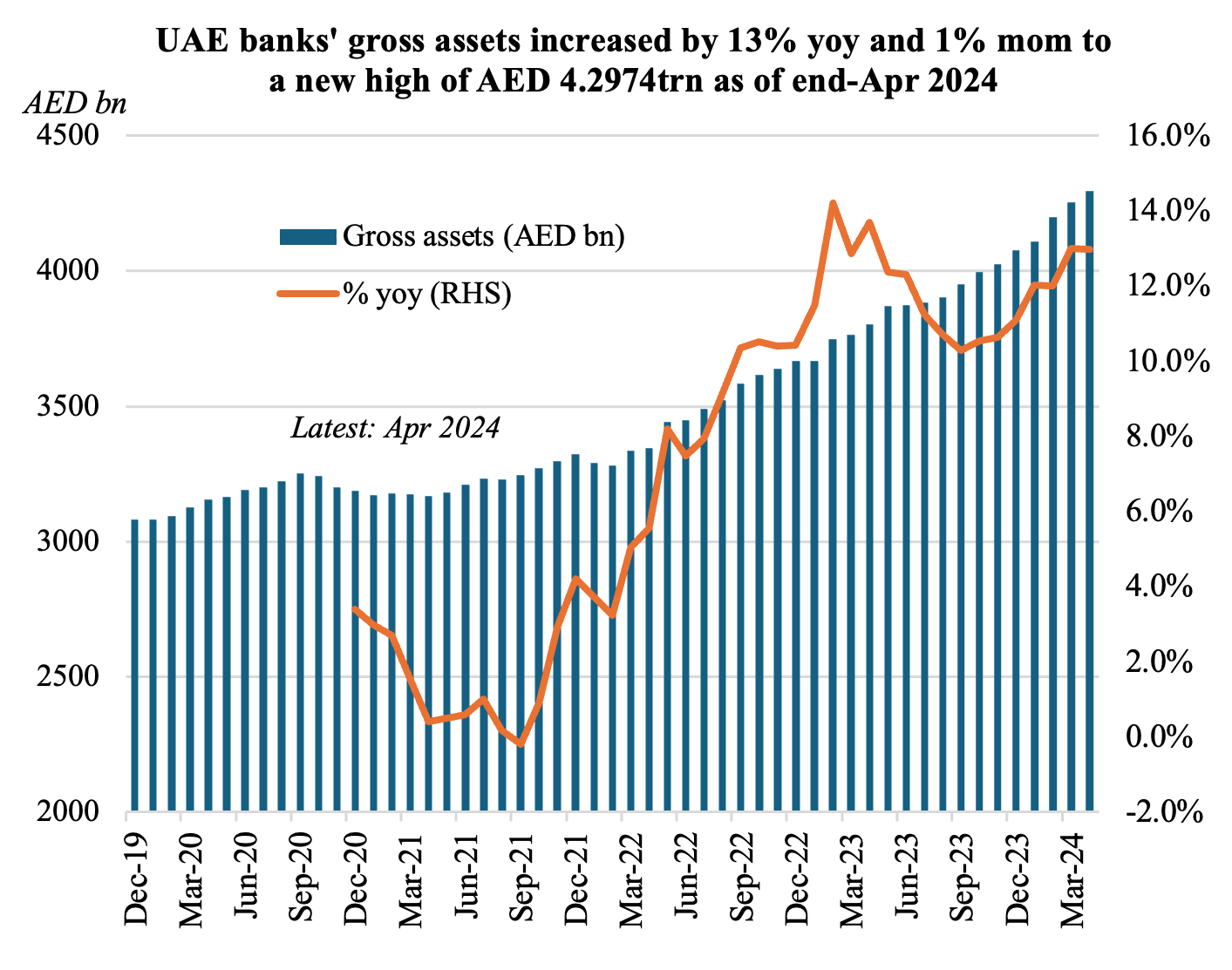

2. Strong growth of UAE banks’ deposits & assets in 2024

- UAE’s gross bank assets grew by 1% mom and 13% yoy to AED 4.254trn in Apr 2024. The central bank’s foreign assets surged by 25% yoy to a record AED 789.82bn in Apr.

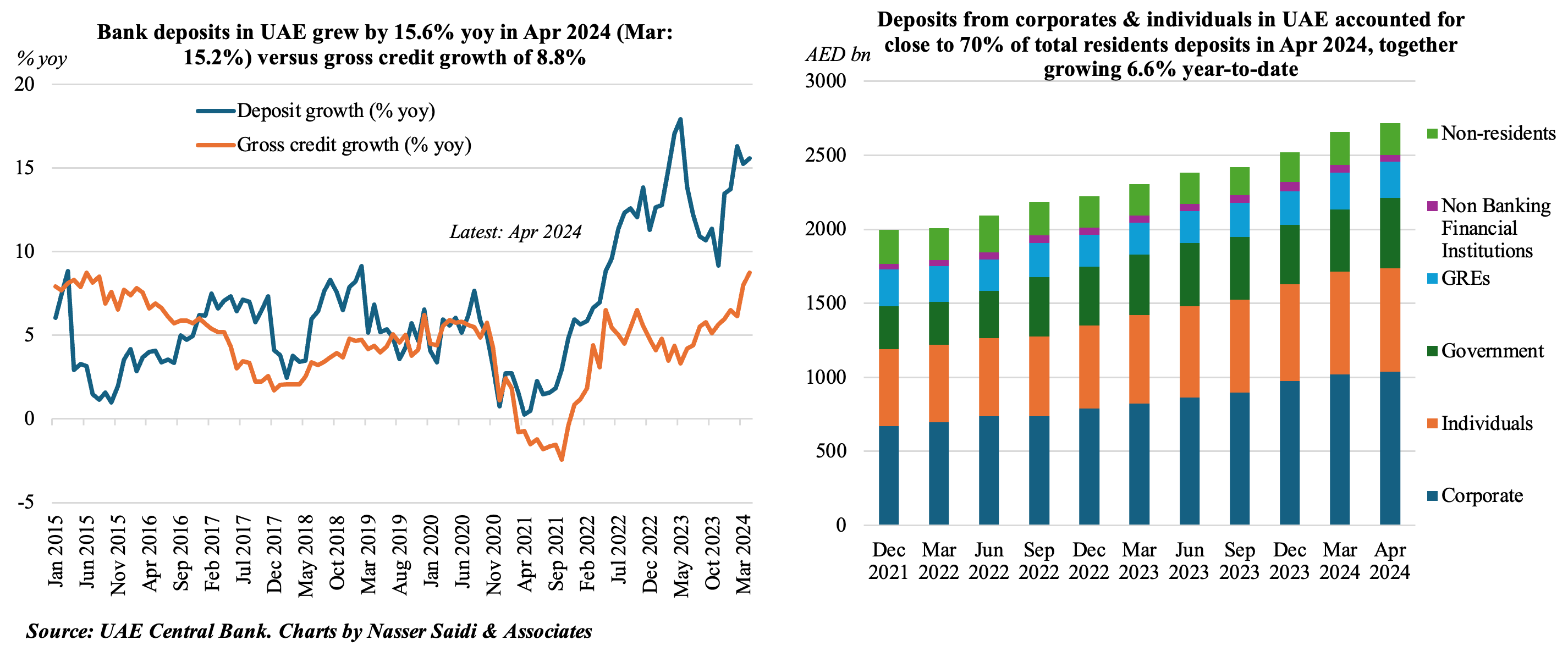

- Deposits in the UAE grew by 2.3% mom & 15.6% yoy in Apr, thanks to a robust 2.7% mom & 17.2% uptick in resident deposits; non-resident deposits share was 7.9% of overall deposits.

- Private sector deposits account for 63.9% of total deposits and 69.4% of total resident deposits as of Apr 2024. This includes both corporates and individuals’ deposits.

- Government and GREs together accounted for over one-fourth of total deposits in Apr; these grew by 18.1% and 10.1% year-to-date.

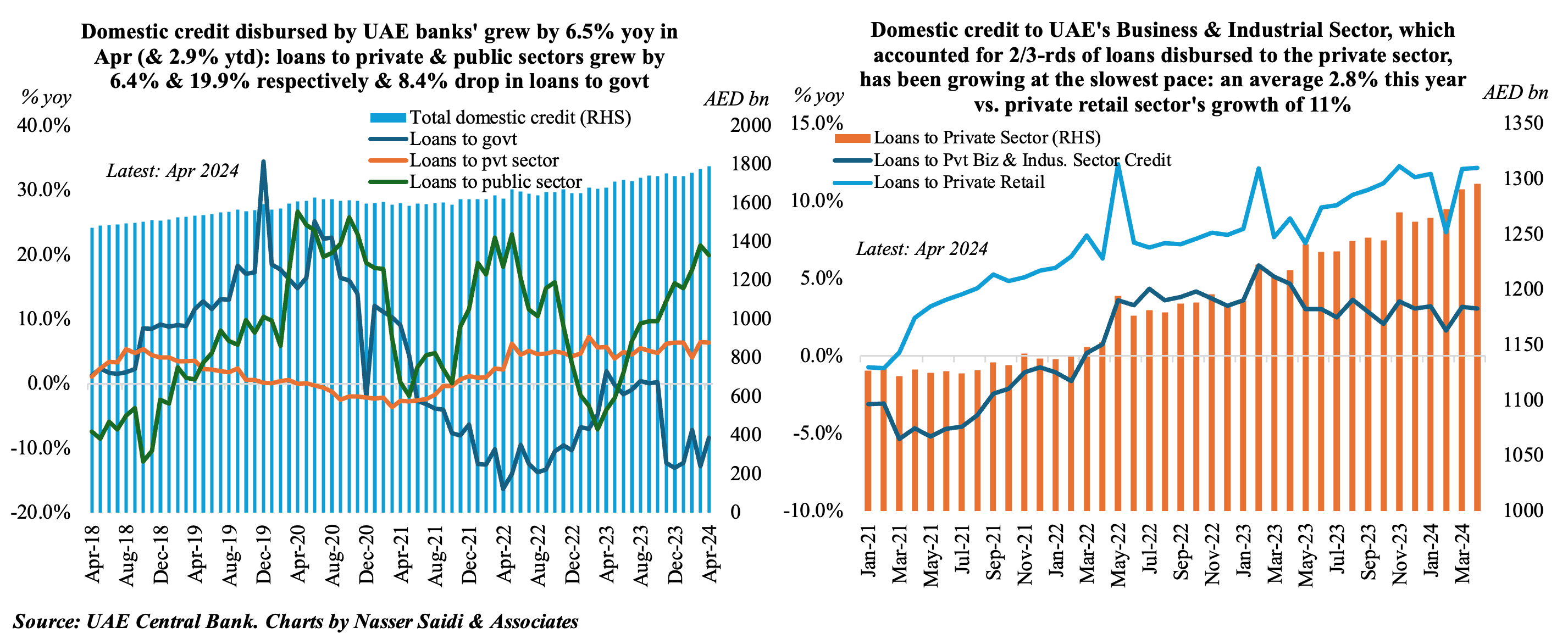

3. UAE’s domestic credit grew by 2.9% year-to-date as of Apr 2024

- Gross credit in the UAE grew by 0.8% mom and 8.8% yoy to AED 2.06trn in Apr. This was driven by growth in domestic credit (1% mom and 6.1% yoy to AED 1.789trn in Apr) and foreign credit (1.4% mom and 26.4% yoy to AED 274.1bn). Foreign credit also includes loans and advances to non-residents, which grew by 7.4% year-to-date to AED 20.3bn.

- Within domestic credit, the share of loans to the private sector stood at 71.4% in Apr. Loans to the government and GREs increased by 7.1% and 1.2% year-to-date to AED 197.1bn and AED 296.2bn respectively.

- Loans disbursed to business and industrial sector (at AED 844.1bn) accounted for 2/3-rds of credit to the private sector. Credit disbursed to the private business and industrial sector grew by an average 2.8% yoy during Jan-Apr this year while in contrast, private sector retail credit grew at a much faster pace of 11%.

- Overall, there has been a stronger appetite for loans this year despite the high borrowing costs amid an increase in projects in the non-oil sector (e.g. construction, manufacturing, tourism & hospitality), an uptick in home ownership (via mortgages; according to the Dubai Land Department, Dubai’s mortgage sector activity touched a 14-month high in May) and also as indicated in the central bank’s Credit Sentiment Survey (thanks to greater consumer & business confidence); Fed rate cuts later this year will be more supportive of loan growth. The robust acceleration in deposit growth indicates high levels of domestic liquidity and loan-to deposit ratio has been edging down.

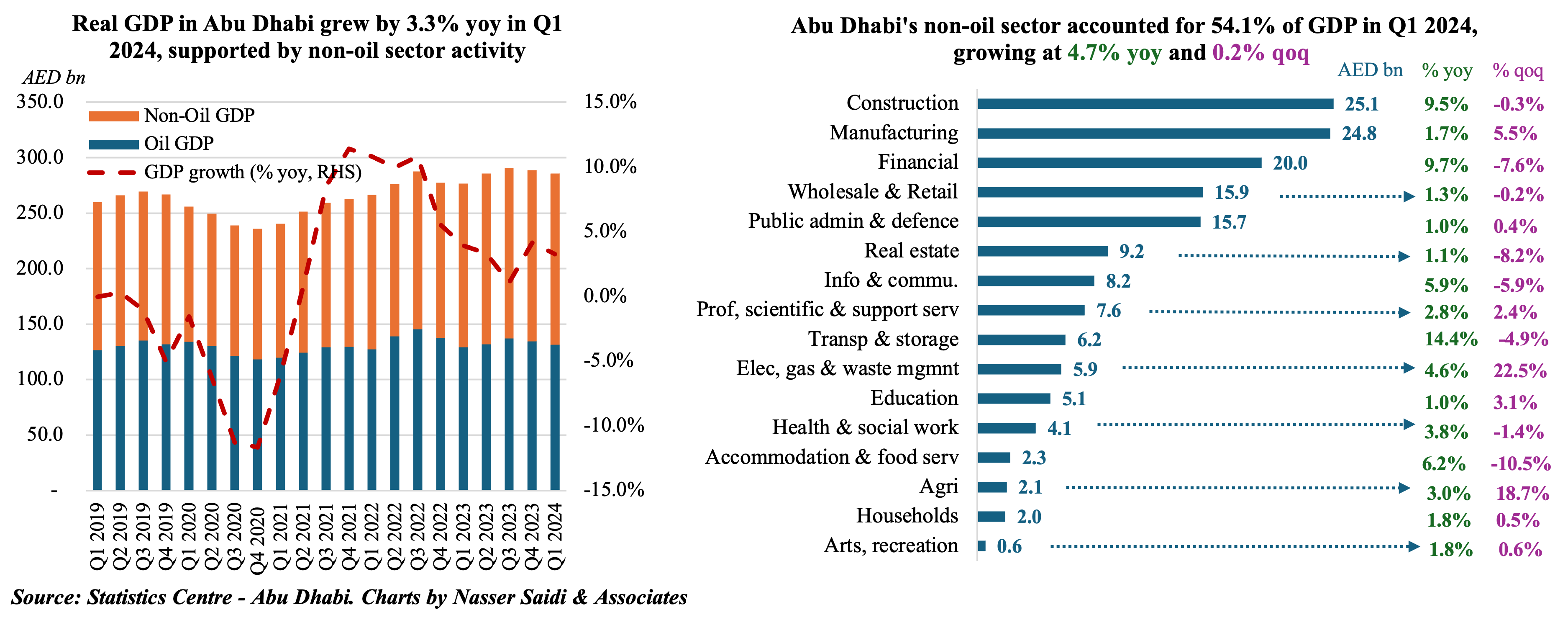

4. Abu Dhabi’s real GDP grew by 3.3% yoy in Q1 2024; non-oil sector’s share in GDP jumped to 54% (highest since 2015)

- Real GDP in Abu Dhabi grew by 3.3% yoy in Q1 2024 (Q4 2023: 4.1%), supported by a faster growth in the non-oil sector (4.7%) alongside oil sector GDP (which grew by 1.6%).

- Non-oil GDP clocked in at AED 154.66bn in Q1 (4.7% yoy & 0.2% qoq), accounting for 54.1% of total GDP, the highest since 2015 (previous high was 55.8% in Q4 2014). Oil GDP which fell by 2.4% qoq to AED 131.3bn in Q1 (due to lower prices and production cuts).

- Among non-oil sectors, construction accounted for the largest share of GDP (8.8% of total and 16.2% of non-oil), followed closely by manufacturing (8.7% & 16.1% of total & non-oil GDP respectively) and financial sector (7.0% & 12.9% of total & non-oil GDP).

- Both construction and financial sectors expanded by 9.5% yoy and 9.7% in Q1, while transportation & storage was the fastest growing in Abu Dhabi (14.4%). These 3 sectors declined in qoq terms, while in contrast, manufacturing grew by 1.7% yoy & 5.5% qoq.

- Manufacturing and financial sectors feature prominently in Abu Dhabi’s strategy towards greater economic diversification. Abu Dhabi has a goal to double the size of manufacturing by 2031 (funding for the industrial sector was raised more than AED 143bn to expand domestic manufacturing) while ADGM has been on the forefront in supporting financial sector performance (ADGM reported a 211% surge in AUM in Q1 2024).

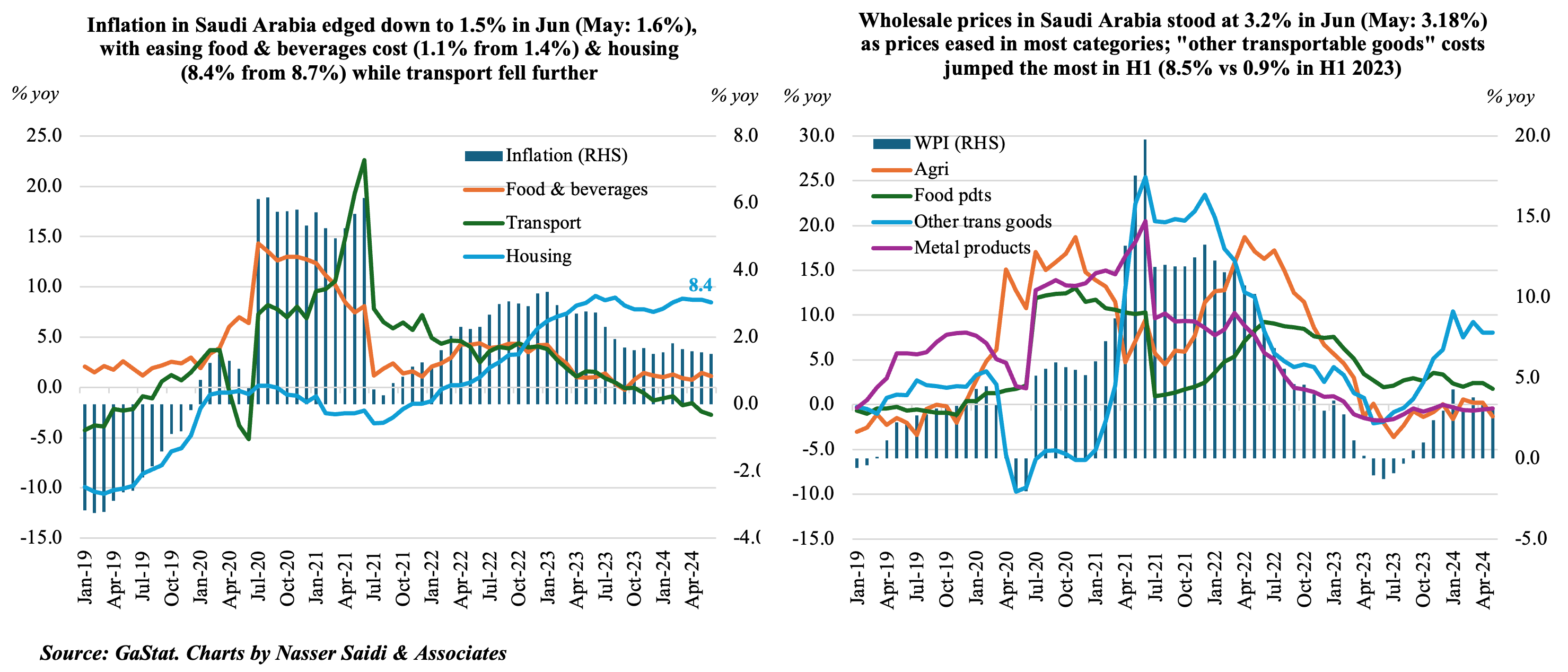

5. Consumer & wholesale price inflation in Saudi Arabia slowed further

- Consumer price inflation in Saudi Arabia eased to 1.50% yoy in Jun (May: 1.55%), as most categories saw a slight decline in inflation including food & beverages (1.13% from 1.43%) and hotels & restaurants (2.4% from 2.5%) while education costs held steady at 1.1%. Housing costs eased slightly to 8.4% yoy (May: 8.7%) with housing rents rising by 10.2% (from 10.5%) while recreation and transport costs remained deflationary (both down by 2.0%).

- CPI averaged 1.6% in H1 2024 versus 2.9% in H1 2023, with all categories showing a decline except housing costs – which increased by an average 8.5% in H1 2024 (vs 7.8% in H1 2023).

- Wholesale prices in Saudi Arabia inched up to 3.21% in Jun (May: 3.18%), with most categories posting declines except agriculture & fishery products (0.9% in Jun from May’s 1.3% dip). The price increase was highest in “other transportable goods” (7.97% from 8.02% in May); deflation continued in ores & minerals (-3.4% from -2.8%) and metal products, machinery & equipment (-0.55% from 0.4%).

- In H1 2024, wholesale prices accelerated: averaging 3.5% (vs H1 2023: 0.9%), with the surge driven by “other transportable goods” (8.5% from 0.9% in H1 2023).

Powered by: