Weekly Insights 12 Jul 2024: Middle East airlines benefit from strong demand amid trade disruptions & weak oil activity

1. Trade disruptions, shipping costs & supply chain pressures inch up

- The Fed’s Global Supply Chain Pressure Index (GSCPI) increased to -0.03 in Jun from May’s -0.5 reading, inching closer to being above normal supply chain pressures (zero is the “normal” reading); the reading had peaked at 4.33 in Dec 2021. Supply chain disruptions are still a big concern and logistics-related troubles have shown little signs of abating.

- Trade disruptions have been rising, causing time delays & higher shipping rates, that in turn puts pressure on selling prices. The IMF’s PortWatch platform shows that, compared to a year ago, shipping volume via Suez Canal was down by two-thirds as of 7th July and down by 3% from end-Q1. Not only is about 70% of Red Sea trade currently being re-routed around Africa, but the detour has also raised average travel distance for a container by 9% this year (vs 2022).

- Shipping costs are on the rise: freight rates via major shipping routes are almost half of the peaks seen during the 2021-22 years – though not yet close to crisis levels. Air freight rates are also increasing given the uptick in global jet fuel price (9.7% yoy to USD 100.4 in May).

- A prolonged period of shipping disruptions and increase in shipping rates could increase supply chain pressures and pose inflationary risks, especially if it continues further into 2025. Food prices also remain vulnerable to shipping disruptions.

2. Airlines strong passenger demand & double-digit gains in cargo for 6th consecutive month

- Air passenger traffic grew by 10.7% yoy in May, with international traffic at record high levels and growing by 14.6%. Ticket sales continue to rise for travel during summer.

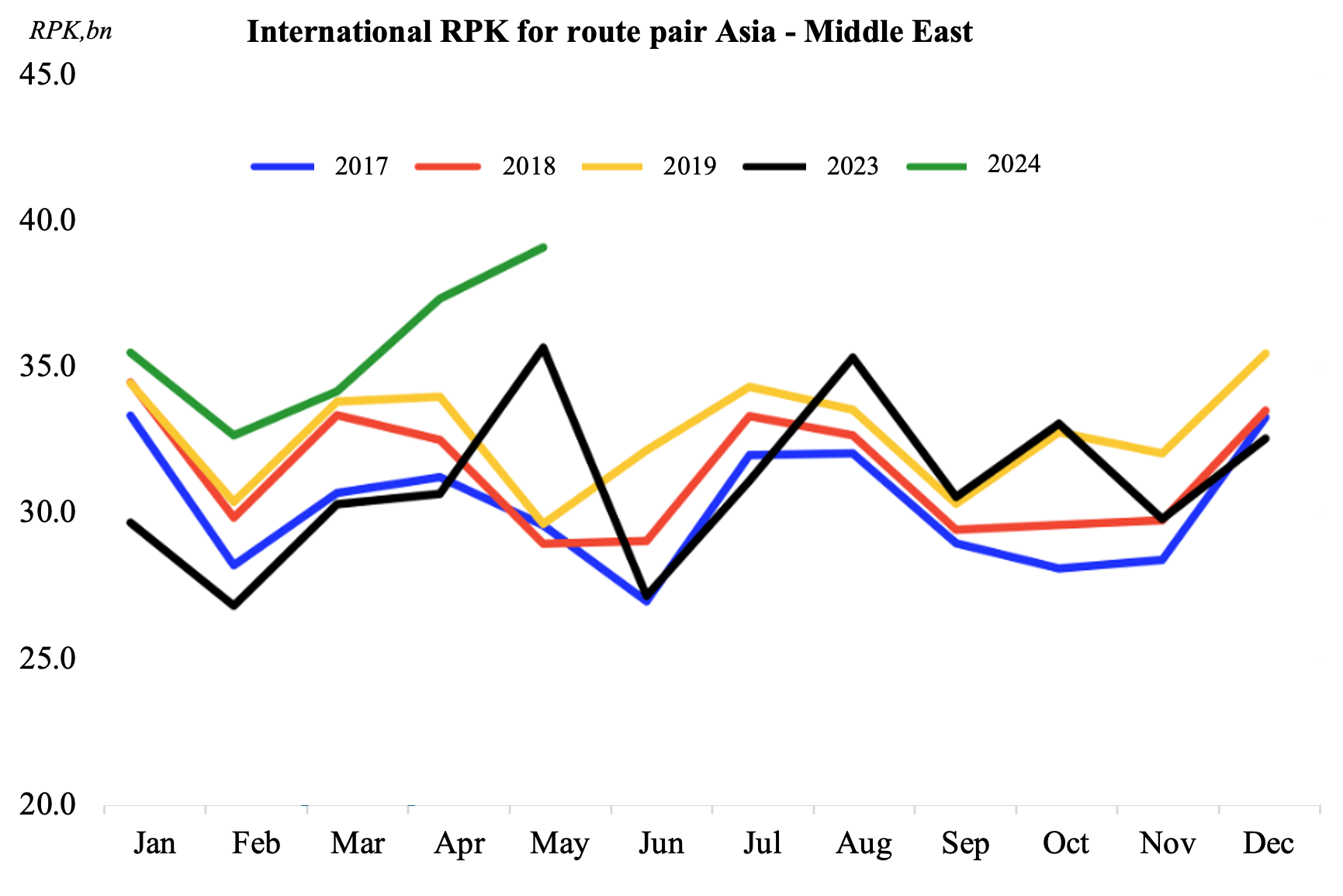

- Middle Eastern airlines grew their international revenue passenger per km (RPKs) by 9.7% yoy in May (despite geopolitical tensions). Middle East-Asia route has not only risen above its 2019 peak but also set new records to-date for the whole 2024 (+32% higher than the corresponding value of 2019).

- Resilient cargo demand: Middle East cargo tonne-kms (CTKs) grew most year-to-date (18.8% in May). An uptick in new orders & manufacturing output bode well for cargo. By route, growth was strong in Middle East-Europe (33.8% yoy, double-digit growth since Sep 2023) and Middle East-Asia (18.6%, double-digit in 3 months+).

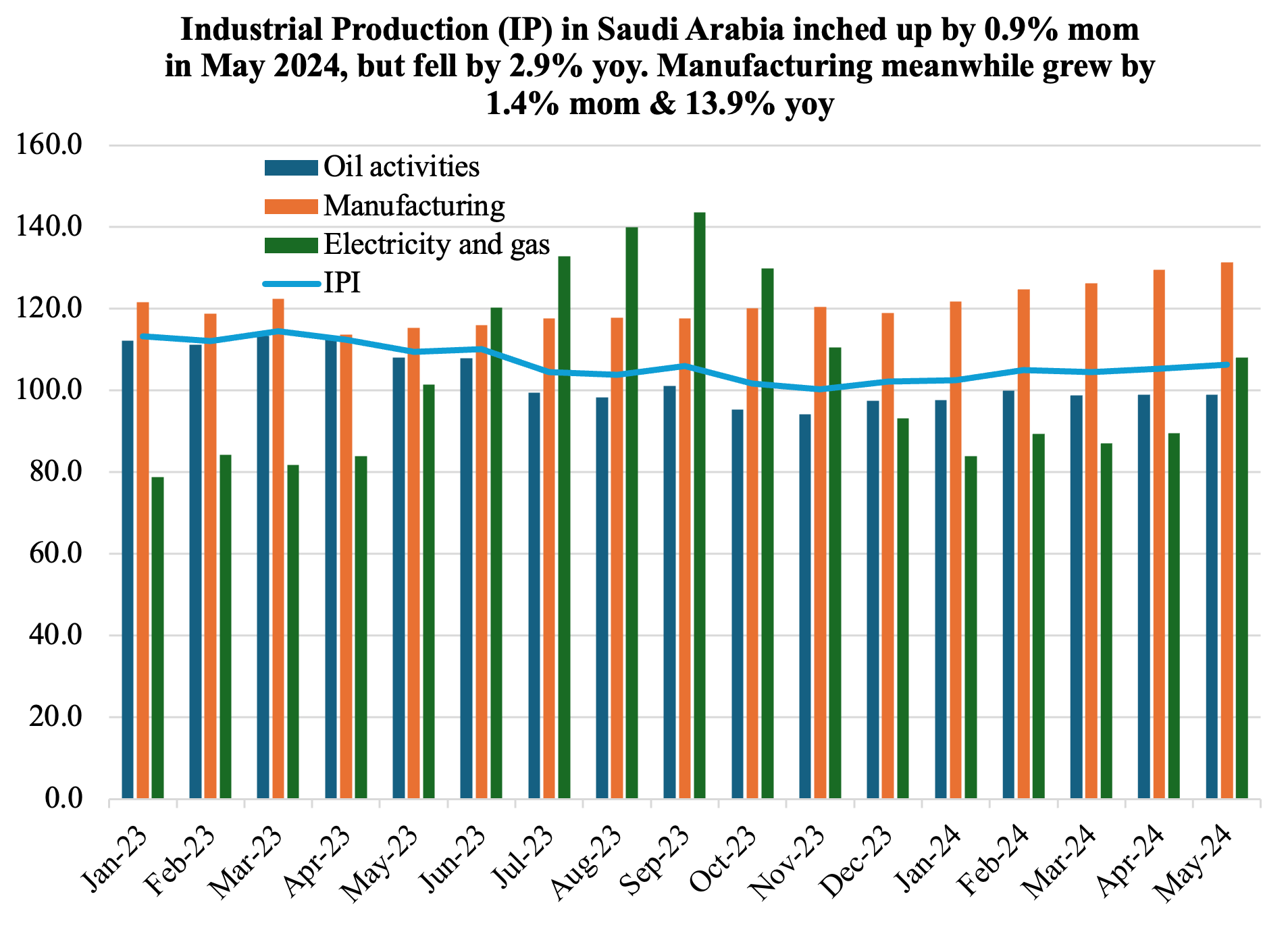

3. Saudi Arabia’s year-on-year industrial production fell by 2.9% in May, dragged down by oil sector activities; manufacturing surged by 14%

- Industrial production in Saudi Arabia declined by 2.9% yoy in May, as oil activities fell by 8.4%. Although IP dropped for the 13th consecutive month in yoy terms, it grew by 1.4% compared to Apr. Overall manufacturing inched up by 1.4% mom and 13.9% yoy.

- Non-oil activities grew by 12.8% yoy in May 2024. All categories in non-oil manufacturing posted growth: manufacture of electrical devices and paper & paper products were the fastest growing (20.5% & 18.6% resp.).

- In Jan-May 2024, gains in manufacturing was supported by manufacture of paper & paper products (14.5%) and electrical devices (14.3%) while manufacture of coke and refined petroleum products was the only one posting a decline (-2.1%)

- PMI data (new orders) and industrial licenses issued indicate continued, strong non-oil sector activity in the near-term. The Saudi Ministry of Industry & Mineral Resources disclosed that 410 industrial licenses were issued in Jan-Apr (highest in Apr were metal products permits); many of these firms open factories with a lag.

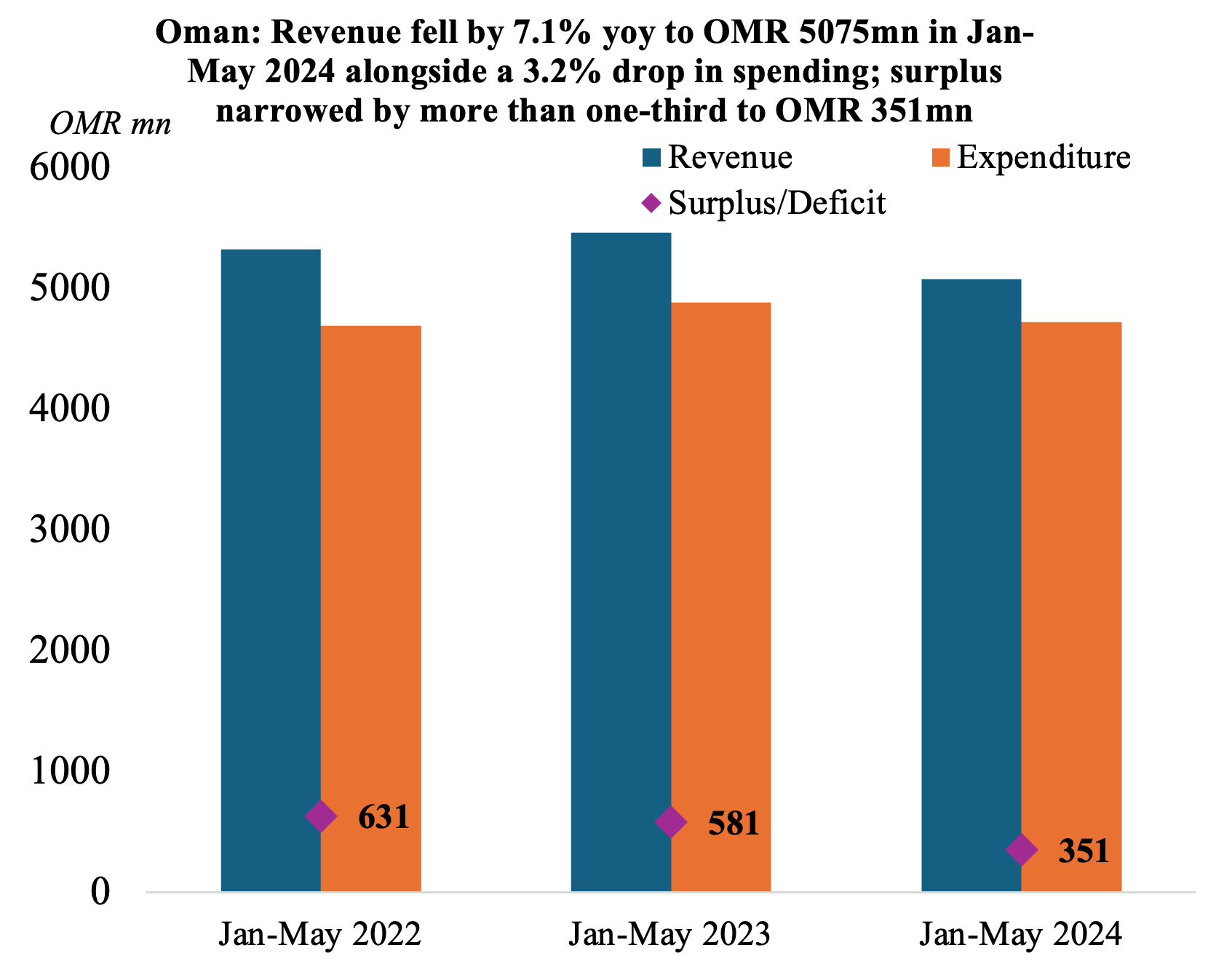

4. Oman budget surplus narrowed to OMR 351mn as of May 2024

- Oman’s budget surplus clocked in at OMR 351mn as of end-May, narrowing from a surplus of OMR 581mn as of May 2023, as both revenues and spending declined. Average oil price stood at USD 82(-2.4% yoy) and average daily oil production down by 5.5% to 1006k barrels per day.

- Public revenues fell by 7.1% yoy to OMR 5.075bn as of May 2024: net oil revenues dropped by 2.5% to OMR 2.7bn net gas revenues fell by 23.9% to OMR 763mn. Net O&G accounted for almost 70% of revenues at end-May.

- Expenditure declined by 3.2% yoy to OMR 4.724bn at end-May: current expenditure edged slightly lower (-0.7% yoy to OMR 3.34bn) while development expenditure grew by 49% (to OMR 430mn). Development spending accounted for 48% of total development spending allocated for 2024. Social protection, oil product and transport subsidy together accounted for over half of contributions and other expenses.

5. Egypt’s inflation rate dips in Jun while international reserves surge to record-high

- Egypt’s annual urban inflation slipped to 27.5% in Jun (May: 28.15%), the lowest reading since Jan 2023 and slowing for the 4th month in a row. Food and beverage costs increased by 30.8% yoy and by 3% mom while core inflation eased (to 26.6% yoy from 27.1%).

- Though price of subsidised bread was raised 300% in June, it is not fully reflected in the headline number given bread’s weight of just 1% in the food basket. The government announced this week that both fuel & electricity prices would be raised, though timing was not indicated. These hikes would add to higher prices once implemented, but start from a low base, mitigating the impact.

- Egypt’s net international reserves grew to a record high of USD 46.4bn in June, supported by the rise in foreign currency reserves (+37.9% ytd to USD 36.9bn). This will support repayment of external debt and interest payments while also providing essential import cover. Additionally, gold reserves were up 12.4% this year to USD 9.5bn. UAE’s Ras Al Hikmah deal, financing from the IMF, World Bank and other foreign investments (including from Europe) will support the country’s financial stabilisation going forward. However, recovery requires continued reform implementation including fiscal reform and stabilising the exchange rate.

- The IMF rescheduled this week’s executive board meeting for Egypt to Jul 29th, though no reason was given. An official source disclosed that the recent cabinet reshuffle (including change in the minister of finance) was a reason for the delay. It is possible that reforms could be pushed through during this time (e.g. subsidy reform), resulting in a more positive evaluation. When this review is completed, another USD 820mn will be provided by the IMF.

Powered by: