Download a PDF copy of the weekly economic commentary here.

Markets

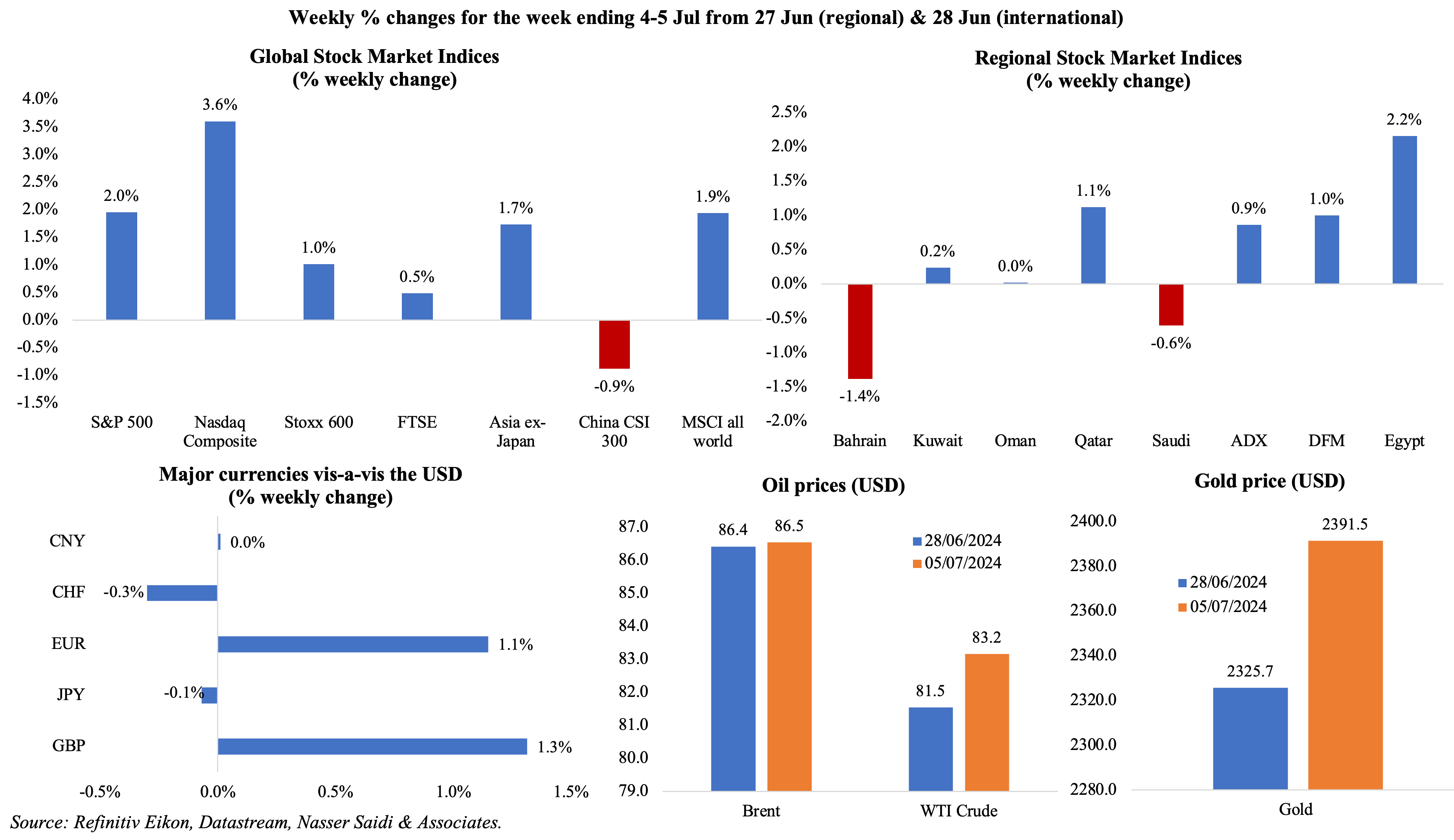

Equities markets were mostly up last week, with the S&P 500, Nasdaq and the MSCI global stocks index posting all-time highs on continued high earnings growth. Regional markets gained on hopes for a Fed rate cut; Bahrain’s equity market was dragged down by the financial and real estate sector stocks. In the currency markets, the GBP gained after the election and euro gained ahead of the voting in France (on July 7th). Brent oil price was little changed amid negotiations for a ceasefire deal in Gaza gaining traction. Gold prices grew by 2.7% from the previous week.

Global Developments

US/Americas:

- Cooling labour market indicators: US non-farm payrolls increased by 206k in Jun, lower than May’s 218k gain, with most gains recorded in government (70k). Average hourly earnings gained by 3.9% yoy (vs 4.1% in May), the smallest gain since Jun 2021. Labour force participation rate inched up slightly to 62.6% in Jun (May: 62.5%). Unemployment rate inched up to 4.1% (May: 4%), the highest level since Nov 2021.

- Private sector added 150k jobs in Jun (May: 157k), a 5-month low, with the services sector adding 136k jobs.

- Initial jobless claims increased by 4k to 238k in the week ended Jun 28, with the 4-week average jumped by 2.25k to 238.5k. Continuing jobless claims surged by 26k to 858mn in the week ended Jun 21st, the highest since Nov 2021.

- JOLTS job openings increased to 8.14mn in May (Apr: 7.919mn, the lowest in 3 years). There were 1.22 job openings for every unemployed person (unchanged from Apr) while the vacancy-to-unemployment ratio was close to its average of 1.19 in 2019.

- Factory orders in the US fell by 0.5% mom in May, reversing Apr’s 0.4% gain. Orders for machinery and manufactured goods fell by 0.5% and 0.7% respectively.

- Good and services trade deficit widened to USD 75.1bn in May (Apr: USD 74.6bn), the widest since Oct 2022, as exports dropped at a faster pace of 0.7% than imports (0.3% fall). Goods trade deficit narrowed slightly to USD 99.37bn (Apr: USD 100.6bn). US goods deficit with China increased by USD 1.9bn to USD 23.9bn in May, despite higher US tariffs.

- S&P Global manufacturing PMI in the US edged down to 51.6 in Jun from the preliminary estimate of 51.7. It was still at a 3-month high, supported by an uptick in new orders and as employment rising the most since Sep 2022.

- ISM manufacturing PMI in the US slipped to 48.5 in Jun (May: 48.7), as employment declined (to 49.3 from 51.1) while new orders improved (49.3 from 45.4) and prices paid fell (to 52.1 from 57). ISM services PMI fell to 48.8 in Jun (May: 53.8), as new orders plunged (47.3 from 54.1), employment slowed further (46.1 from 47.1) and prices paid eased (56.3 from 58.1).

Europe:

- Inflation in the eurozone eased in Jun, to 2.5% (May: 2.6%), as energy prices declined (0.2%) alongside high services costs (4.1%). Core inflation remained unchanged at 2.9%.

- Producer price index in the euro area fell by 0.2% mom and 4.2% yoy in May (Apr: -1% mom & -5.7% yoy). This was the 13th yoy drop in a row, as energy costs plunged by 11.4%.

- Manufacturing PMI in the eurozone rose to 45.8 in Jun (May: 47.3), rate of decline in sub-indices such as new orders and purchasing activity accelerated, recording the sharpest drop since Jan and employment fell for the 13th month in a row. Services PMI stayed expansionary for the fifth month in a row, clocking in 52.8 (May: 53.2 and preliminary estimate of 52.6), also supporting gains in composite PMI (50.9 from 50.8).

- Retail sales in the eurozone increased by 0.1% mom and 0.3% yoy in May. Sales grew for food & beverages (0.7%) and automotive fuel (0.4%) while non-food product fell by 0.2%.

- Unemployment rate in the eurozone held steady at a record-low of 6.4% in May. The number of jobless people in the bloc increased by 38k to 11.1mn.

- The harmonised index of consumer prices in Germany slowed to 2.5% in Jun (May: 2.8%), according to preliminary estimates.

- German factory orders declined by 1.6% mom and 8.6% yoy in May (Apr: -0.2% mom and -1.6% yoy). This was the fifth consecutive monthly fall, on a sharp drop in orders for aircrafts, ships & trains (-19.2%) and auto industry (-2.9%). Capital goods orders fell 4.3%.

- Industrial production in Germany tumbled by 2.5% mom and 6.7% yoy in May. This was the largest decline since late 2022, as manufacturing and construction decline by 2.9% and 3.3% respectively.

- German manufacturing PMI declined to 43.5 in Jun (May: 45.4), with declines in production, orders, and employment sub-indices. Services PMI moved lower to 53.1, below May’s 12-month high of 54.2, with modest increases in new work inflows and employment.

- UK general elections resulted in the Labour Party come to power in a landslide victory. Sir Keir Starmer is the new PM and his cabinet includes the UK’s first female chancellor.

- Manufacturing PMI in the UK slipped to 50.9 in Jun (prelim: 51.4 and May: 51.2), as export orders declined (particularly North America and China) alongside strong output and new orders while input cost inflation rose to a 17-month high.

Asia Pacific:

- China’s Caixin manufacturing PMI in Jun inched up to 51.8 (May: 51.7), the highest reading since May 2021, as output rose to a 2-year high and new orders picked up for the 11th month. Caixin services PMI moved down to 51.2(May: 54), recording the slowest pace of expansion since Oct 2023 while external demand remained strong.

- Japan downgraded GDP growth in Q1: GDP shrank at an annualised 2.9% in Jan-Mar, much lower than the previous estimate of a 1.8% fall.

- Overall household spending in Japan fell by 1.8% yoy to JPY 290,328 (USD 1800) in May (Apr: 0.5%). Expenditures on food, which account for around 30% of spending, fell 3.1% while spending on energy and water bills dropped by 9.7%.

- Japan’s nominal wages or average cash earnings per worker grew by 1.9% yoy to JPY 297,151 (USD 1,850) in May (Apr: 1.6%), the highest increase in 11 months but much lower than the inflation rates in May. Inflation-adjusted real wages fell 1.4% (Apr: 1.2%), falling for the 26th consecutive month.

- Current account surplus in Japan grew to JPY 2.85trn in May (Apr: JPY 2.05trn), as a record primary income surplus (JPY 4.2trn, the largest since 1985 when data was available) more than offset the trade deficit (of JPY 1.1trn).

- The preliminary leading economic index in Japan inched up to 111.1 in May (Apr: 110.9) while the coincident index shot up to 116.5 (Apr: 115.2), the highest reading since Sep 2019.

- Japan manufacturing PMI slipped to 50 in Jun (prelim: 50.1 and May: 50.4): output grew for the first time in over a year while new orders and foreign sales fell (the former for the 13th month in a row). Employment rose for the fourth straight month while input price inflation jumped to a 14-month high.

- Tankan large manufacturing index rose to 13 in Q2 (previous: 11), the highest since Mar 2022. These firms also plan to increase capital expenditure by 11.1% in the current fiscal year. Furthermore, the large non-manufacturers sentiment fell to +33 in Jun (Mar: +34), dropping for the first time in 2 years.

- South Korea’s manufacturing PMI rose to 52 in Jun (May: 51.6), the highest since Apr 2022, thanks to increase in new orders and output alongside strong export demand.

- Inflation in South Korea eased to an 11-month low of 2.4% in Jun (May: 2.7%) as prices of housing & utilities and food & non-alcoholic beverages slowed to 1.2% and 3.8% respectively. Core CPI was 2.2%, similar to May’s reading.

- Manufacturing PMI in India improved to 58.3 in Jun (May: 57.5) on increased new orders and output while hiring increased at the fastest pace in over 19 years.

- Retail sales in Singapore rebounded in May, rising by 2.4% mom and 2.2% yoy. The yoy increase was supported by sales of food & alcohol (11.1%) and watches & jewellery (7.4%) while sales were down in both department stores (-2.8%) and supermarkets (-1.1%).

Bottom line: Major events were the UK elections – which saw the Labour Party come into power after 14-years of conservative rule – and the second round of French elections – which has resulted in a hung parliament, but with the leftist coalition getting more seats than the far-right & Macron’s centrist party (which came in second). With the US elections four months from now, 538’s 2024 presidential election forecast model has Trump and Biden tied, calls are rising for a new Democratic nominee. June PMI releases globally indicate that while manufacturing continues to tick up (Asia the bright spot alongside a weak euro area), input cost inflation is accelerating. Disruptions to global shipping caused by issues in the Red Sea and Panama Canal have caused only a marginal increase in average vendor lead times (though Maersk’s CEO expect the disruptions to continue into Q3). This week’s US inflation reading will give some direction to Fed’s decisions at the next meetings (PCE reading suggested cooling inflation, though higher than Fed’s 2% target).

Regional Developments

- Egypt’s PMI inched up to a 3-year high of 49.9 in Jun (May: 49.6), with export orders up the most in 2.5 years and new orders growing for the first time since Aug 2021, supported by manufacturing and services. June saw the fastest rise in input prices for three months, but it is still slower compared to beginning of the year.

- The IMF will begin the third review under Egypt’s Extended Fund Facility (EFF) arrangement on Jul 10th.

- Egypt recorded a foreign asset surplus of EGP 676.4bn (USD 14.03bn) in May 2024 (Apr: deficit of EGP 174.38bn) – for the first time since Jan 2022. Total foreign assets in Egypt’s banking system grew by 3.99% mom to EGP 3.63trn while foreign liabilities dipped by 2.93% mom to EGP 2.96trn.

- The CEO of the Sovereign Fund of Egypt disclosed that Egypt will likely resume the government IPO program in early 2025. The government has raised up to USD 3.1bn so far from the IPO program since its inception in Mar 2023 and USD 2.5bn from divestments of government assets in 2022.

- Egypt’s external debt declined by 4.4% qoq to USD 160.6bn in Mar 2024, the lowest since Jul 2022; both long- and short-term external debt dropped to USD 135.257bn and USD 25.35bn respectively. The decline in external debt is partly due to the UAE’s decision to waive USD 11bn worth of dollar deposits held by the Central Bank of Egypt. The waiver is part of the overall USD 35bn deal for the Ras El Hikma development project on the Mediterranean coast.

- Tourism revenues in Egypt rose to USD 6.6bn in H1 2023 (H1 2022: USD 6.3bn) as tourist arrivals touched 7.069mn (H1 2022: 7.062mn) and nights spent jumped to 70.2mn (from 65.7mn a year ago).

- Egypt has resumed power outages, limited to a maximum of 2 hours per day between 3pm to 7pm.

- Kuwait PMI eased to 51.6 in Jun (May: 52.4): new orders expanded for 17 months in a row and firms output rose (thanks to advertising and competitive pricing) while employment ticked up at the fastest pace on record.

- Lebanon’s PMI slipped to the lowest in 17 months, clocking in at 47.8 in Jun (May: 47.9). New orders fell the most in almost 18 months. Businesses remained pessimistic about the 12-month outlook, the most in a year adversely affected by security situation in the South.

- Oman’s real GDP grew by 1.7% yoy in Q1 2024 (Q4 2024: 0.3%), supported by non-oil sector (4.5%) alongside a 2.4% drop in oil sector growth. A breakdown by sector showed that oil and gas sector accounted for less than one-third of total GDP (30.5%) while public administration and defence accounted for close to 10%.

- Oman’s lower house approved plans to introduce a personal income tax and it has been forwarded to the State Council (upper house). Both the UAE and Saudi Arabia have stated that there are no plans to introduce an income tax as a means of broadening revenue base.

- Qatar’s PMI rose to 55.9 in Jun (May:53.6), the highest since Jul 2022 and above long-run trend. Manufacturing & construction sectors grew, as overall new orders rose at the fastest pace in 13 months and employment rose for the 16th straight month. Prices charged for goods and services declined for the sixth time in the past eight months.

- According to Global SWF, Middle East state-owned investors(SOIs) were part of 8 out of the 10 largest investments in H1 2024. Investments in H1 2024 were led by the “Oil Five”, i.e., Saudi’s PIF, Abu Dhabi’s ADIA, Mubadala and ADQ, and Qatar’s QIA. Combined, these entities invested USD 38.2bn in 58 different deals. Saudi PIF was ranked among the top 10 globally by GSR scores (rose to 96% from 28% in 2020).

- Middle East airlines recorded a 9.7% yoy increase in passenger demand in May, thanks to the Asia-Middle East travel route regaining 2019 levels and setting “new records to-date for the whole 2024”. Furthermore, total cargo capacity of Middle East carriers grew by 2.7% in May, handling 13.5% of the overall cargo globally.

Saudi Arabia Focus

- Saudi Arabia posted the weakest PMI reading since Jan 2022, clocking in at 55 in Jun (May: 56.4), dragged down by slower rise in new orders (56 from 59.5) and jobs growth. Output sub-index inched up to support sales even as firms cited price pressures stemming from wages, materials and technology costs.

- Total bank deposits in Saudi Arabia grew 1.2% mom and 8.5% yoy in May, supported by surge in government deposits. Time and savings deposits grew by 23.4% yoy to a record high SAR 889.6bn. Credit growth averaged 10.3% in Jan-May and SAMA’s net foreign assets rose to SAR 1.668trn in May (the highest since Nov 2022). Residential new mortgage loans to individuals grew by 13% yoy to a 16-month high of SAR 7.67bn in May.

- Saudi Arabia’s foreign exchange reserves moved up by 7% year-to-date to an 18-month high of USD 445bn (SAR 167trn) in May.

- PIF reported a USD 36.8bn (SAR 138.1bn) profit in 2023 (2022: loss of USD 15.6bn), as revenues more than doubled to USD 88.3bn (2022: USD 44bn) largely thanks to higher investment returns and equity revenues. Assets jumped by a quarter over the year to USD 977bn from USD 778bn while the number of PIF subsidiaries jumped from 146 to 168 in 2023, all local acquisitions.

- Data from the General Authority for Statistics showed a 0.6% yoy increase in FDI to SAR 16.97bn (USD 4.5bn) in Q1. Outflows stood at SAR 7.5bn, leading to a net FDI reading of SAR 9.5bn in Q1.

- Commercial business registrations surged by 78% yoy to more than 12k in Q2 2024, according to the Saudi Ministry of Commerce. By sector, e-commerce registrations stood at 40,697 (+17.47%) while AI registrations climbed 53% to 8,948. Furthermore, 45% of registrations were issued to females.

- Saudi Arabia’s Ithraa Alkhair Company for Pilgrims Services, a licensed provider of Hajj services for non-Arab African pilgrims, is planning an IPO. The company plans to float a 11% stake on the Nomu parallel market and is in discussions for a dual listing overseas.

- Inward tourism spending in Saudi Arabia increased by 23% yoy to SAR 45bn (USD 12bn) in Q1 2024, according to the tourism ministry. The balance of payments for travel recorded a surplus of SAR 24bn, up 46% yoy.

- Seven oil and gas deposits were discovered in Saudi Arabia’s Eastern Province and Empty Quarter, according to the energy minister: two unconventional oil fields and one reservoir in the former and 2 natural gas fields and two reservoirs in the latter.

- About 16,500 Saudi citizens joined the labour force for the first time in Jun, according to Gastat data, taking the total to 2.34mn citizens in the private sector. Expats in the private sector rose to about 9mn including 8.7mn men. Total private sector employment grew by 1.24% mom to 4mn by end-Jun.

- Fourteen Saudi football clubs are up for sale including four from the Pro League, revealed the sports ministry, in a bid to attract FDI.

- Saudi Arabia’s Red Sea giga-project Amaala plans to open its first phase in 2025 with seven resorts and a yacht club. The project is expected to be home to 29 hotels by 2030.

UAE Focus

- UAE PMI, at 54.6 in Jun (May: 55.3), was the lowest in 16 months: however, strong demand has seen new orders rise to the highest since Mar and export orders were the most since Oct 2023.Input cost inflation was near a 2-year high leading to firms raising selling costs for the second straight month (rate of inflation was the fastest in 6+ years). Dubai PMI slipped to 54.3 in Jun (May: 54.7), the lowest since Feb 2023. S&P reported firms citing “high market competition” as limiting “their ability to take advantage of strong demand conditions”.

- UAE’s Q3 2024 Islamic Treasury Sukuk (T-sukuk) program attracted AED 6.76bn in bids: oversubscribed 6.1 times, strong demand originated from 8 banks. The sukuk a spread of 4.77% and 4.43% on the 3- and 5-year tranches, according to the Ministry of Finance.

- UAE and Japan signed multiple agreements to boost partnerships: ADNOC will use an AED 11bn (USD 3bn) green financing facility from Japan Bank for International Cooperation for its decarbonisation and energy transition programmes (in a bid to achieve net zero by 2045 and zero methane emissions by 2030). Another agreement signed related to strategic reserves between ADNOC and the Japanese agency for Natural Resources and Energy.

- Ajman’s GDP grew by 4.7% yoy to AED 32mn in 2023: manufacturing, wholesale & retail trade and construction sectors accounted for 18.9%, 18.31% and 17.36% of GDP respectively.

- ADNOC’s Ruwais LNG project assigned a total 10% stake each to four firms Shell, TotalEnergies, BP and Mitsui, reported Reuters. The project is expected to be the region’s first LNG export facility to run on clean power.

- UAE’s central bank is launching a “Zero Bureaucracy” drive, in cooperation with the PM’s office, to eliminate at least 2,000 bureaucratic procedures in a bid to improve efficiency and foster innovation in the financial sector.

- Abu Dhabi Development Holding Company (ADQ) completed the secondary listing of its USD 2.5bn bond on the Abu Dhabi Securities Exchange. This listing has increased the number of debt instruments listed on ADX to 60. The bond was listed on LSE in Apr 2024.

- Abu Dhabi airport reported a 40% jump in passengers to 22.4mn in 2023, with travellers from India, Western Europe and Asia topping the list (at 3.2mn, 1.9mn and 1.7mn respectively).

Media Review:

A GCC spaceport could bring galactic gains: op-ed by Dr. Nasser Saidi

https://www.agbi.com/opinion/tech/2024/07/nasser-saidi-a-gcc-spaceport-could-bring-galactic-gains/

https://nassersaidi.com/2024/07/05/a-gcc-spaceport-could-bring-galactic-gains-op-ed-in-arabian-gulf-business-insight-agbi-4-jul-2024/ (extended version)

Egypt’s renewable power ambitions face grid hurdle

https://www.reuters.com/business/energy/egypts-renewable-power-ambitions-face-grid-hurdle-2024-07-01/

The Decline and Fall of the Petrodollar?

https://www.project-syndicate.org/onpoint/saudi-petrodollars-do-they-matter-for-us-currency-hegemony-by-carla-norrlof-2024-07

How the investment world is trying to navigate geopolitics

https://www.ft.com/content/23ce295d-bf65-47fd-bebd-808b5a7bcab5

Powered by: