Weekly Insights 14 Jun 2024: Saudi GDP declines but non-oil activities provide buffer; inflation eases in Egypt & Lebanon

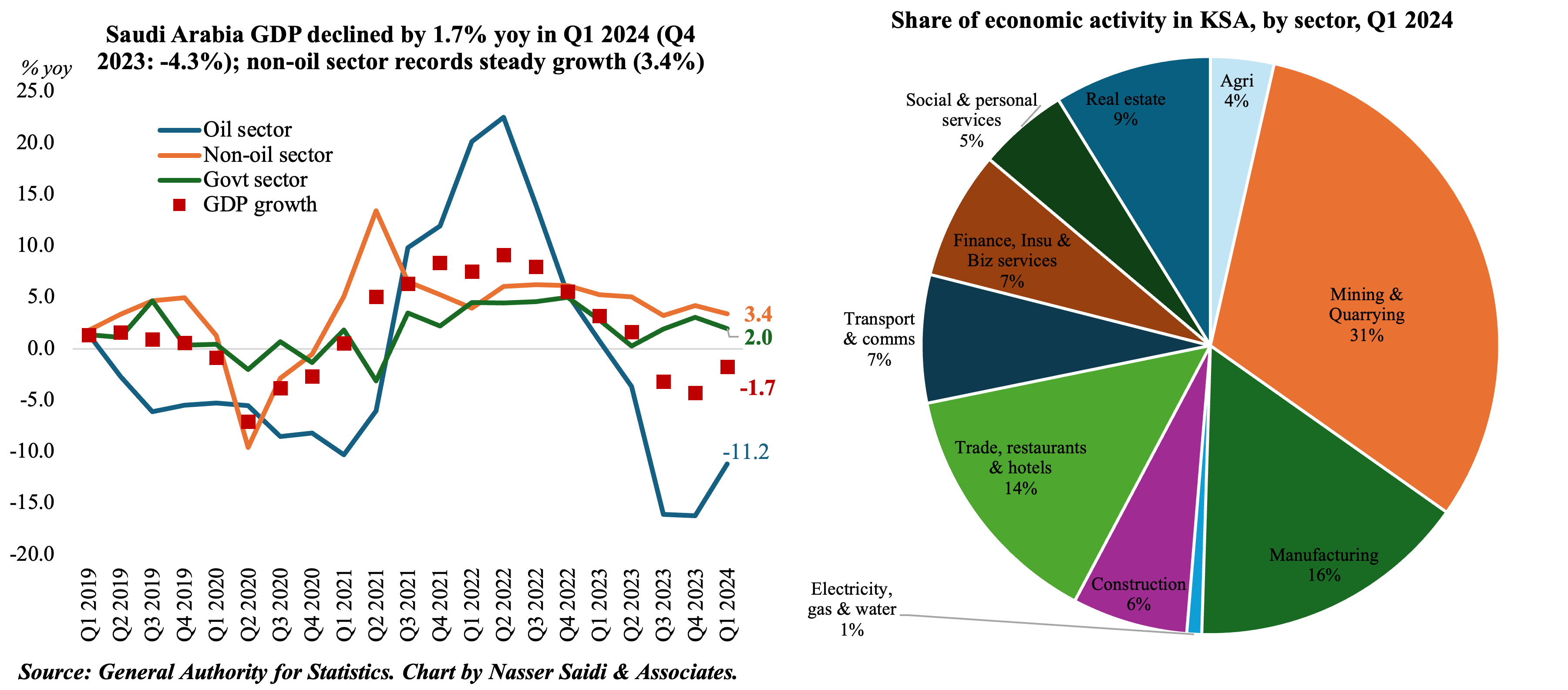

1. Saudi Arabia GDP fell by 1.7% yoy in Q1 2024, with non-oil sector growing at a steady pace alongside a drop in oil sector activity

- Saudi Arabia’s real GDP declined by 1.7% yoy and 2.6% qoq in Q1 2024, as per the moving chain methodology, using 2018 as base year.

- Non-oil sector grew by 3.4% in Q1 (Q4: 4.2%), though the pace has been slowing – the full year rate in 2023 was 4.4%. Government sector activity was up by 2.0% in Q1, following 3.1% growth in Q4 2023 and by 2.0% for the full year 2023.

- The mining and quarrying sector was the dominant sector, accounting for 24.5% of total output while manufacturing had a significant 12.3% share alongside real estate & construction (12%). The share of non-oil activities clocked in at 51.3% of overall GDP in Q1 2024.

- By expenditure components (at current prices), final consumption expenditure accounted for close to two-thirds of overall GDP in Q1 2024. Gross fixed capital formation grew by 7.9% yoy to SAR 317.5bn in Q1 – both government (7% share, growing by 18% yoy) and non-government (93% share, rising by 7.2% yoy).

- The regional HQ program has seen the relocation of 127 international firms to Saudi Arabia in Q1 2024, up 477% yoy (including Goldman Sachs). The giga projects pipeline (even in a reduced capacity e.g., The Line) and projects ahead of with the Expo 2030 will contribute to expansion in non-oil sector activity in the coming quarters: KSA projects pipeline is currently valued at more than USD 1.28trn

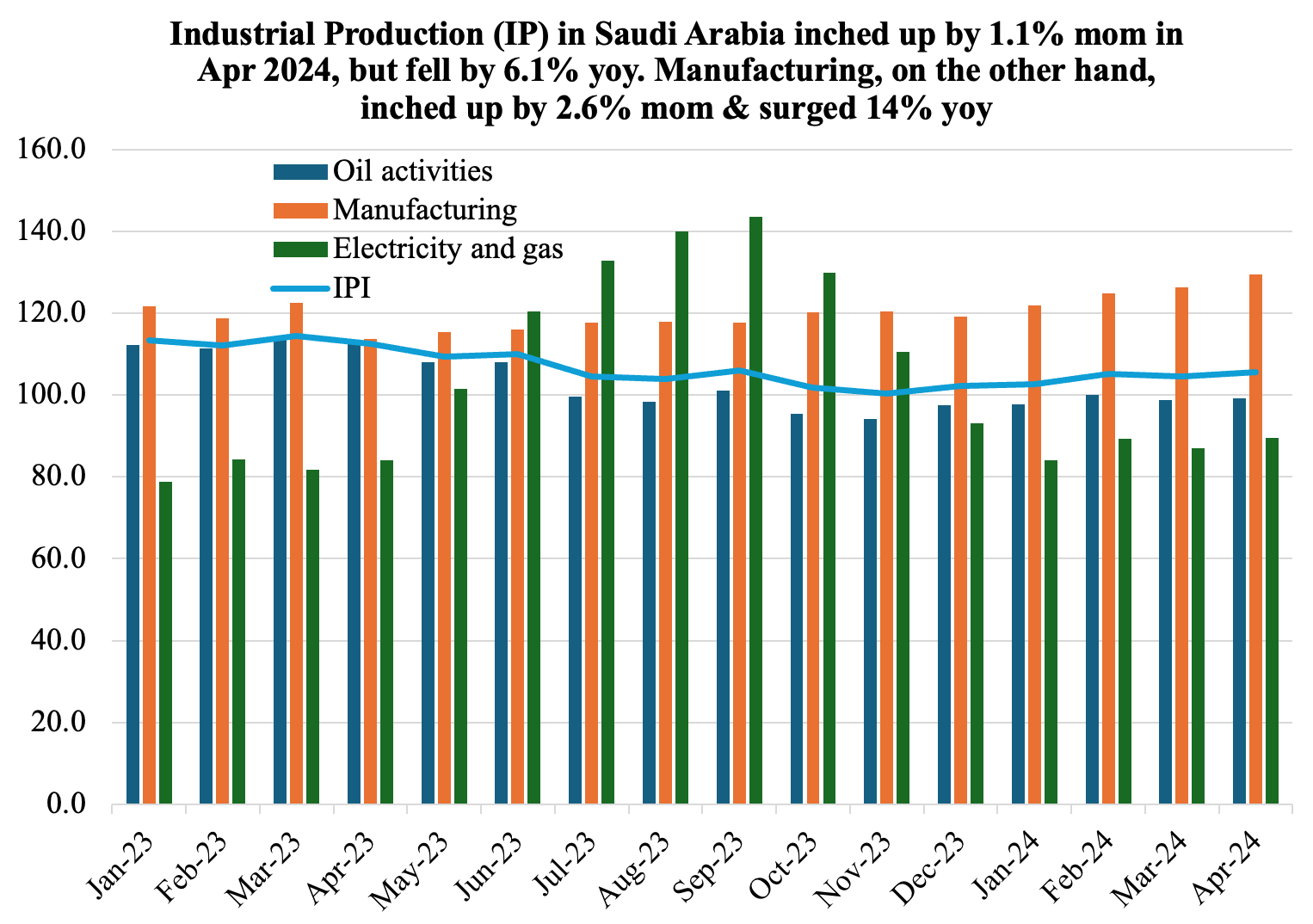

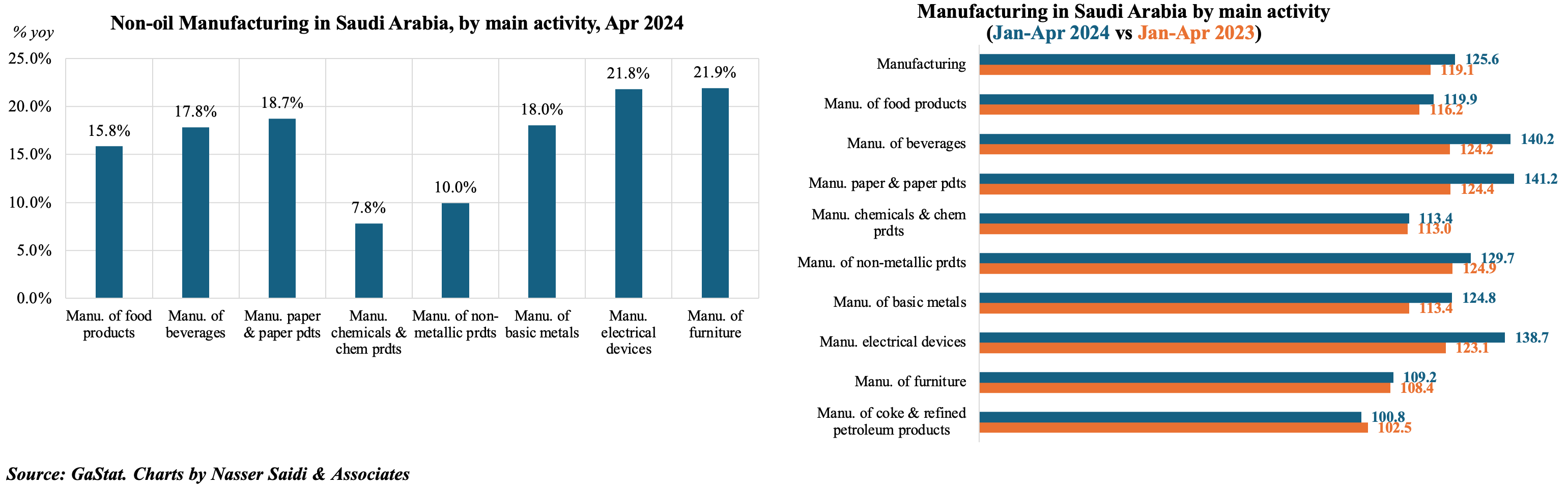

2. Saudi Arabia’s year-on-year industrial production fell by 6.1% in Apr, dragged down by oil sector activities; manufacturing surged by 14%

- Industrial production in Saudi Arabia declined by 6.1% yoy in Apr, falling for the 12th month in a row, as oil activities reported a fall of 12.2%. In month-on-month terms, IP rebounded, rising by 1.1% (Mar: -0.6%). Overall manufacturing inched up by 2.6% mom and 14.0% yoy.

- Non-oil activities grew by 12.8% yoy in Apr 2024. Within manufacturing, the manufacture of furniture and electrical devices grew the fastest growing (21.9% and 21.8% respectively) alongside manufacture of paper & paper products (18.7%) and manufacture of basic metals (18%).

- In Jan-Apr 2024, gains in manufacturing was supported by manufacture of paper & paper products (13.5%), manufacturing of beverages (12.9% yoy), and manufacture of electrical devices (12.7%).

- There are positive signs for increased non-oil sector activity in the near-term. The Saudi Ministry of Industry & Mineral Resources disclosed that more than 300 industrial licenses were issued in Q1 2024 (highest were non-metallic mineral and food products permits); many of these firms open factories with a slight lag.

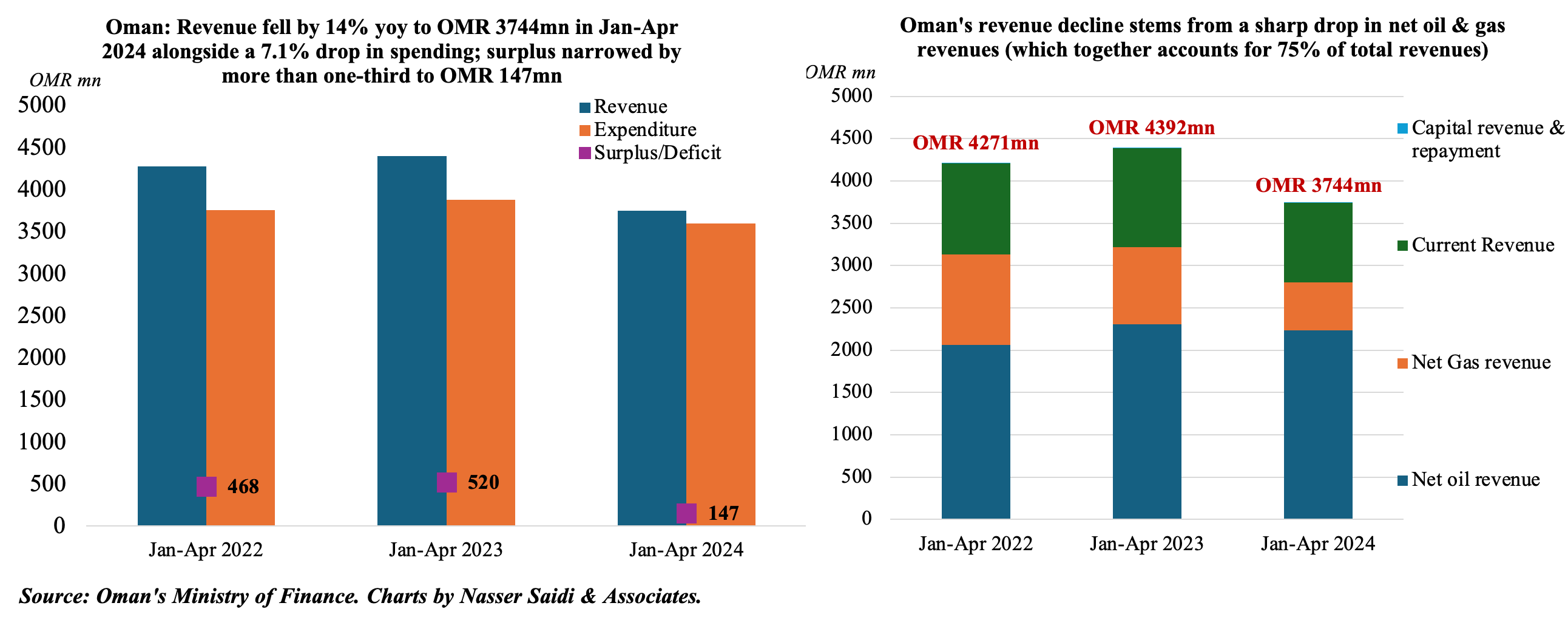

3. Oman budget surplus narrowed to OMR 147mn as of Apr 2024

- Oman’s budget surplus clocked in at OMR 147mn as of end-Apr, declining from a surplus of OMR 520mn as of Apr 2023. Both revenues and spending fell during the period. Average oil price stood at USD 82 (-6.8% yoy) and average daily oil production down by 5.2% to 1009k bpd.

- Public revenues fell by 14.75% yoy to OMR 3.744bn as of Apr 2024, driven down by declines in both net oil & gas revenues. Net oil revenues dropped by 3.1% to OMR 2.2bn while net gas revenues plunged by 37.8% to OMR 565bn. Together, net O&G accounted for three-quarters of revenues at end-Apr.

- Expenditure declined by 7.1% yoy to OMR 3.597bn at end-Apr: current expenditure edged slightly lower (-0.1% yoy to OMR 2.67bn) alongside a 68% jump in development expenditure (to OMR 304mn, or 34% of total development spending for 2024) while contributions & other expenses surged by 68% yoy to OMR 615mn.

- Oman’s ministry of finance disclosed that it had paid OMR 700mn towards maturing international sukuk, thereby lowering the volume of public debt. Public debt to GDP declined to 33.9% in H1 2024 (end-2023: 36.5%; Q1 2024: 35%) and its external debt to the volume of public debt slipped to 71% in H1 2024, from a high 74% at end-2023.

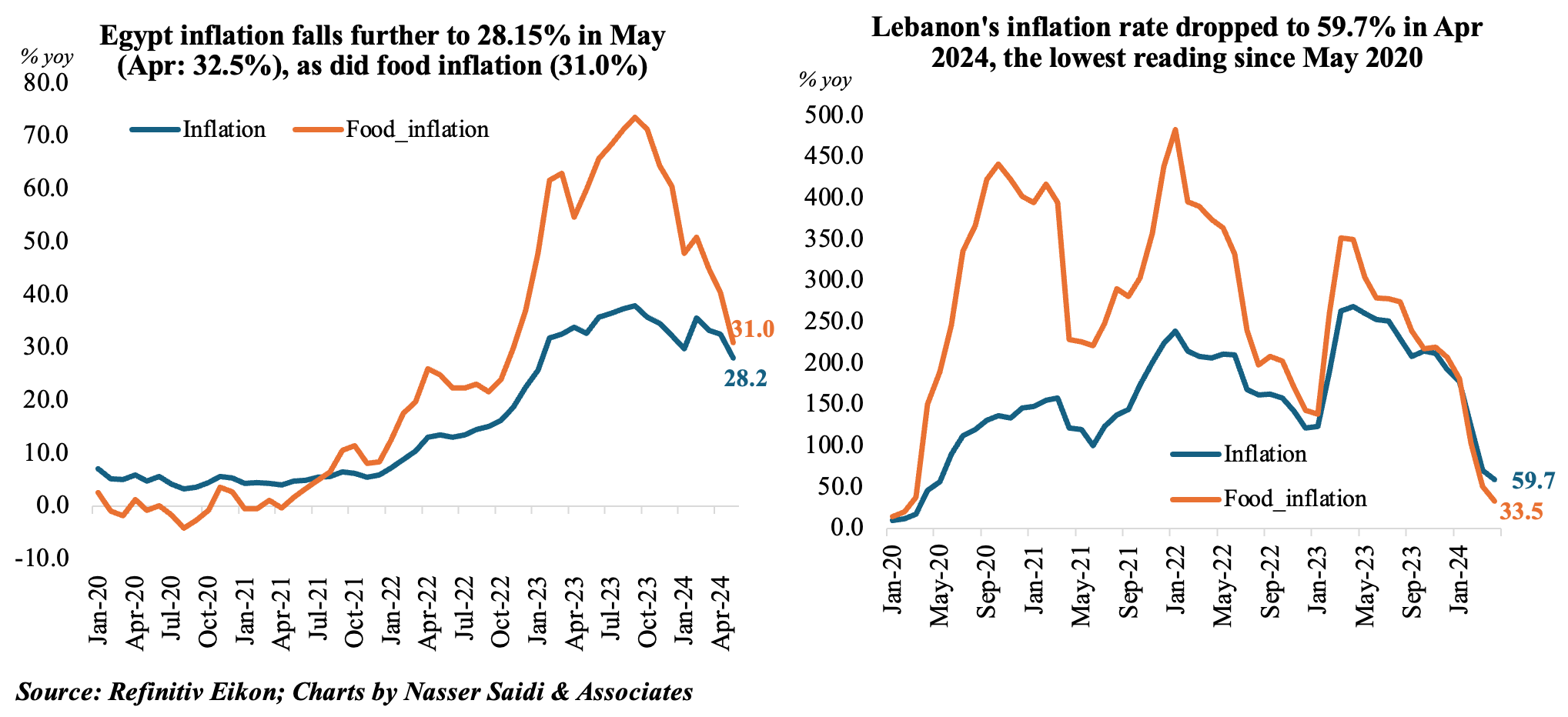

4. Inflation rates fall in Egypt & Lebanon; food prices also ease, though remaining in double-digits

- Egypt’s annual urban inflation eased to 28.15% in May (Apr: 32.5%), the lowest reading since Jan 2023. Prices continued to ease for the third month in a row but remains much higher than than the upper limit of the central bank target of 5-9% . Food and beverage costs were up by 31% (Apr: 40.5%) but core inflation also eased (to 27.1% from 31.8% in Apr).

- Latest PMI reading from Egypt shows that the easing of inflation has benefitted businesses alongside improvements in exchange rates and availability of foreign currency – leading to less uncertainty in economic prospects. The rate of purchase price inflation was at a four-year low and prices charged increased only marginally: all boding well for consumer spending and confidence.

- While the cut in bread subsidies in Egypt this month (the first since 1988) is likely to tick up inflation slightly, the subsidy reduction will provide relief to import bills and fiscal deficits.

- Inflation in Lebanon fell to 59.7% yoy in Apr 2024 (Mar: 70.4%), the lowest reading since May 2020, and massively lower than the peak rate of 269% touched a year ago. Food and beverages costs declined sharply to 33.5% (from Mar’s 51.3%) while transport costs slipped to 9.2% (from 13.2%). Growing dollarization has seen some sectors’ inflation rates remain high: education (589.2%), owner-occupied housing (128.2%), recreation & culture (64.1%) and restaurants & hotels (30.2%) among others.

Powered by: