Download a PDF copy of the weekly economic commentary here.

Markets

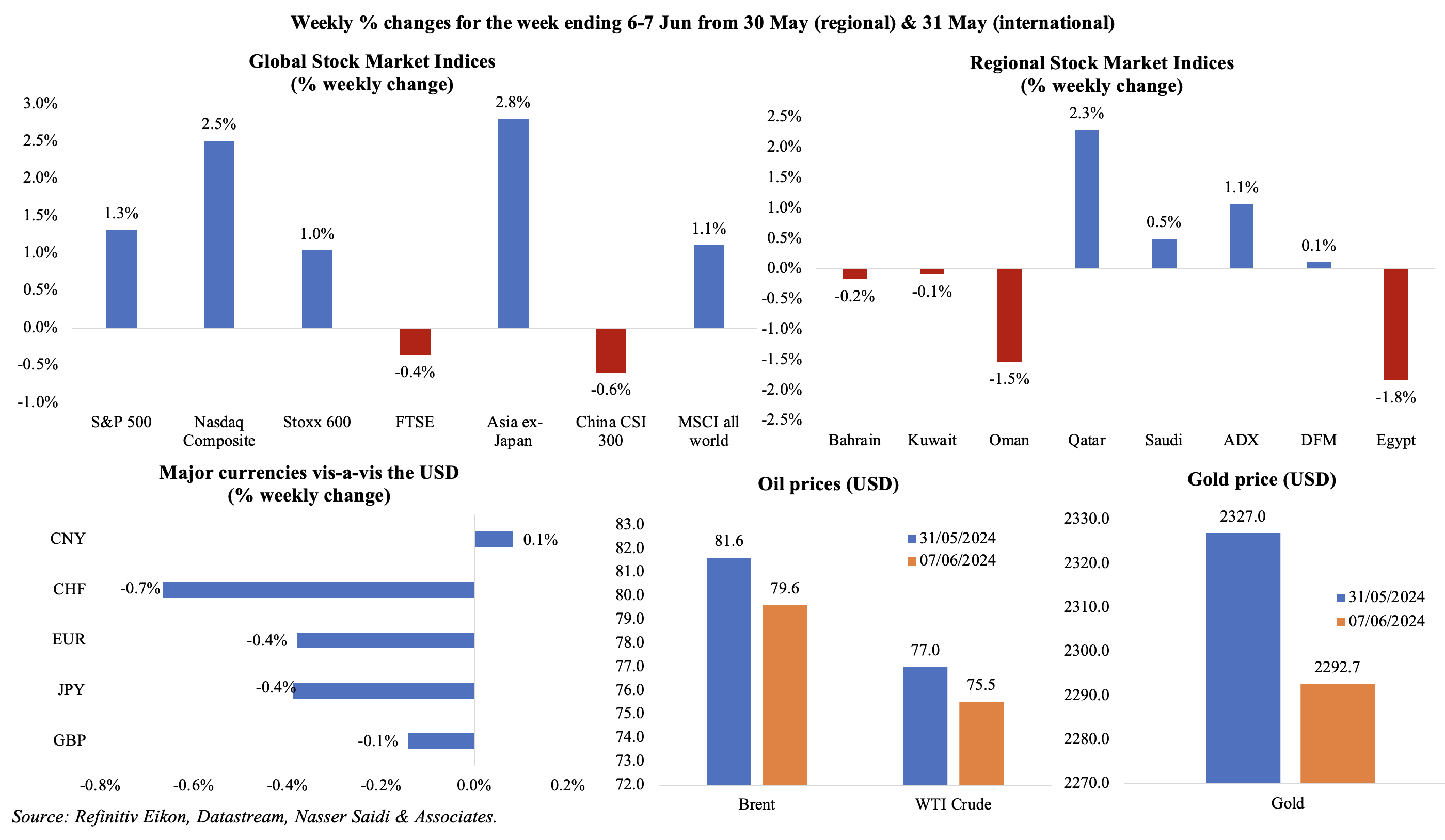

Equities markets were mostly in positive territory last week, though a strong jobs market report in the US dampened hopes for multiple rate cuts. S&P touched an all-time high during the week while the Stoxx index is up almost 10% higher till end-last week. Regional markets were mixed with Qatar Saudi and UAE markets posting gains last week. The dollar gained last week partly due to a strong payrolls report indicating continued high interest rates and which saw the number of rate cuts being lowered to just one this year (either in Nov or Dec); the EUR slipped a day after the ECB rate cut, while the JPY was supported by intervention in the currency market. Oil prices fell last week while gold price slipped (partly due to a stronger dollar).

Global Developments

US/Americas:

- Non-farm payrolls in the US expanded by 272k in May (Apr: 165k), higher than the average monthly gain of 232k in the previous year. Average hourly earnings were up by 0.4% mom and 4.1% in Mar. Labour force participation rates inched down to 62.5% in May (Apr: 62.7%). Unemployment rate inched up to 4% in May (Apr: 3.9%).

- Non-farm productivity increased at a 0.2% annualised rate in Q1, lower than the previous estimate of 0.3%. Unit labour costs in Q1 grew at a 4% annualised rate, slower than the initial estimate of a 4.7% gain.

- US private sector added 152k jobs in May (Apr: 188k), a 4-month low according to ADP, with a “steep decline in manufacturing” alongside lower gains in leisure and hospitality.

- JOLTS job openings in the US eased to 8.059mn in Apr (Mar: 8.355mn), the lowest reading since Feb 2021. There were 1.24 openings for every unemployed person, the lowest since Jun 2021, and down from Mar’s 1.3. The quits rate was 2.2% for the sixth straight month, the lowest since Sep 2020; layoffs were the lowest since Dec 2022, at 1.52 million.

- Initial jobless claims increased by 8k to 229k in the week ended May 31st and the 4-week average slipped by 750 to 222.25k. Continuing jobless claims rose by 2k to 1.72mn in the week ended May 24th.

- Factory orders in the US inched up by 0.7% mom in Apr, rising for the third month in a row: durable goods orders grew by 0.6% mom while non-durable goods orders rose by 0.8%. Nondefense capital goods orders fell 1.6% while their shipments grew by 2.3%.

- Goods and services trade deficit in the US widened to USD 74.6bn in Apr (Mar: USD 68.6bn), the largest since Oct 2022. Imports grew by 2.4% to USD 338.2bn, especially imports of motor vehicles & parts and capital goods; services imports slipped by USD 0.1bn to USD 66.3bn. Exports rose at a slower pace of 0.8% to USD 263.7bn.

- S&P Global’s manufacturing PMI in the US moved up to 51.3 in May, higher than the preliminary reading of 50.9, as new orders returned to above-50, export orders rose at the fastest pace in 2 years and employment rose for the fifth month in a row. Inflationary pressures accelerated, on both the input costs side and selling prices.

- ISM manufacturing PMI in the US slipped to 48.7 in May (Apr: 49.2), as new orders dropped (to 45.4 from 49.1) while employment inched up to 51.3 (from 50.9) and prices paid eased to 57 (from 60.9). ISM services PMI jumped to 53.8 in May (Apr: 49.4), as new orders jumped to 54.1 (from 52.2) though employment remained below-50 (at 47.1).

Europe:

- ECB lowered rates by 25bps for the first time in 5 years, but declined making a call about future moves stressing data dependency with the statement noting that “the Governing Council is not pre-committing to a particular rate path”. The ECB adjusted its inflation forecasts upwards to an average 2.5% and 2.2% for 2024 and 2025 respectively. Growth is expected at 0.9% in 2024 (up from previous estimate of 0.6%) and 1.4% in 2025 (down from 1.5%).

- Manufacturing PMI in the eurozone climbed to 47.3 in May (Apr: 45.7), though remaining below-50 for the 23rd month. Output jumped to a 14-month high of 49.4 (Apr: 47.3) and new orders rose to a 2-year high of 47.3 (from 44.1), all leading to future business confidence rising to its highest level since early 2022.

- Producer price index in the eurozone declined by 1% mom and 5.7% yoy in Apr: this was the 12th consecutive month of yoy deflation, as energy costs fell (-14.7%) as did prices for intermediate goods (-3.9%).

- Retail sales in the eurozone dropped by 0.5% mom in Apr (Mar: 0.7%): food sales and non-food product sales were 0.5% and 0.1% lower while sales of auto fuel dropped 2.2%.

- German factory orders unexpectedly fell by 1.6% yoy and 0.2% in Apr. New orders in manufacturing was down by 0.2% mom and 1.6% yoy. Excluding large-scale orders, new orders advanced 2.9% mom.

- Industrial production in Germany slipped by 0.1% mom and 3.9% yoy in Apr (Mar: -0.4% mom and -4.3% yoy). Production of intermediate goods and construction output declined by 0.9% mom and 2.1% respectively while capital and consumer goods production rose by 0.8%.

- Exports from Germany accelerated by 1.6% mom (to EUR 136.5bn) while imports were up by 2% in Apr (to USD 114.5bn), narrowing the surplus slightly to EUR 22.1bn. Exports to the US fell by 1.2% to EUR 14.2bn.

- Germany’s manufacturing PMI stood at 45.4 in May (Apr: 42.5), with slower declines in output and new orders (with improved demand from China and the US).

- Unemployment rate in Germany remained unchanged at 5.9% in May, but the number of unemployed increased by 25k versus the 11k gain in Apr.

- Manufacturing PMI in UK, at 51.2 in May, was the highest since Jul 2022 and higher than Apr’s 49.1 reading. Production expanded at the quickest rate since April 2022 and domestic demand strengthened while new export orders fell for the 28th consecutive month. Furthermore, output charge inflation strengthened to its highest level in a year.

- BRC like-for-like retail sales in the UK rebounded in May, rising by 0.4% yoy from the previous month’s 4.4% drop. Food sales and online non-food sales increased by 3.6% yoy and 1.5% yoy over the three months to May while in-store non-food sales declined by 2.7%.

Asia Pacific:

- China’s Caixin manufacturing PMI increased to 51.7 in May (Apr: 51.4) – the most since Jun 2022: while output grew the most in 23 months, employment declined for the ninth month in a row. Services PMI rose for the 17th straight month, rising to 54 in May (Apr: 52.5) as new business and export orders grew on robust demand while employment rose.

- Exports from China grew by 7.6% yoy in May with integrated circuits exports rising by 28.4% and vehicles exports up 16.6%. Imports rose by 1.8%, taking trade surplus wider to USD 82.62bn (Apr: USD 72.35bn).

- Japan manufacturing PMI rose to 50.4 in May (prelim: 50.5, Apr: 49.6), in expansionary territory for the first time in a year. New orders and output were stable though the depreciating yen added pressure on prices of imports.

- Overall household spending in Japan rebounded in Apr, expanding by 0.5% yoy (Mar: -1.2%): this was the first expansion since Feb 2023. Spending on transport, food and recreation & culture fell by 10.2%, 2.7% and 9.2% respectively.

- Labour cash earnings (nominal wages) in Japan increased by 2.1% yoy to JPY 296,884 (USD 1913.28) in Apr (Mar: 1.0%), the fastest pace in 10 months. Real wages fell 0.7% yoy in Apr (Mar: -2.1%), staying down for the 25th month in a row.

- Japan’s leading economic index slipped to a 3-month low of 111.6 in Apr (Mar: 111.7) while the flash estimate of the coincident index rose to 115.2 (Mar: 114.2).

- The Reserve Bank of India left policy rates unchanged for the 8th consecutive time: repo and reverse repo at 6.5% and 3.35% respectively. Growth projection for the financial year 2024-25 was raised to 7.2% from 7% while inflation was retained at 4.5% (though food inflation remains a concern).

- Manufacturing PMI in India edged lower to 57.5 in May (Apr: 58.8), as new orders and output rose at a softer pace; export orders rose at the fastest pace in over 13 years and employment rose to one of the greatest extents since data collection started in March 2005.

- GDP in South Korea grew by 1.3% qoq and 3.3% yoy in Q1 (Q4: 0.6% qoq and 2.2% annualised), thanks to construction activity (5.5%) amid 0.9% uptick in both manufacturing and services.

- Retail sales in Singapore declined by 1.2% yoy in Apr – the largest yoy decline since Feb 2022 as sales dropped across multiple categories including supermarkets & hypermarkets (-3%), recreational goods (-7.3%) and cosmetics & toiletries (-4.6%) among others. In mom terms, sales fell by 2.7%, the largest drop since Jan 2023.

Bottom line: Global PMI data for May indicated the fastest growth in a year – the JP Morgan Global PMI composite output index rose to 53.7 in May (Apr: 52.4) – with forward looking indicators (new orders, future output) highlighting sustained activity though price pressures have increased. Global PMI data also shows that the services sector is performing much better than the manufacturing sector, and that emerging markets are expanding strongly (alongside conditions stabilising in developed markets). Separately, the ECB and Bank of Canada both cut interest rates last week, though the Fed is expected to keep rate steady in the target range of 5.25% to 5.50% later this week and the BoJ governor’s rhetoric has led markets to expect reduction in bond purchases. Election results last week saw (a) Modi return to power in India (but having to rely on alliance partners to form a coalition government), which resulted in a plunge in the share market after exit polls had suggested an emphatic victory; (b) Ms Sheinbaum elected as the first woman president of Mexico – the results saw the peso and the stock market drop sharply after the conversation turned towards a potential constitutional overhaul; and (c) European Parliament elections signalled a shift to the right in Europe’s biggest economies, France and Germany and greater consolidation in Italy. With elections in 40 countries this year, a new, changing political landscape will reshape defence, economic, trade and climate policies.

Regional Developments

- IMF reached a staff-level agreement for USD 820mn loan to Egypt, following the third review of the facility. The IMF highlighted the country’s improving fiscal discipline, tight monetary policy and move to a flexible exchange rate regime as positives while mentioning downside risks including spillovers from the conflict in Gaza and risks from extended trade disruptions related to Suez transport and shipping.

- Egypt’s 2024-25 budget was approved by parliament: revenue estimates were around EGP 2.6trn (+8.5% yoy) and expenditures stood at EGP 3.9trn (29% yoy), taking total deficit to EGP 1.2trn (7.3% of GDP). About EGP 635.9bn was allocated for subsidies, grants, and social benefits (+19.3%). A primary surplus of 3.5% of GDP is targeted in the 2024-25 fiscal year while the country also expects to attract USD 30bn in FDI in the fiscal year.

- Egypt’s PMI rose to 49.6 in May (Apr: 47.4), the highest reading since Aug 2021, but remained contractionary for the 42nd month in a row. There are signs of optimism & recovery: demand increased as prices stabilised, and currency availability improved. Services and construction activity picked up and new orders fell at the slowest pace since Sep 2021. Input cost inflation slowed to a 38-month low though rising wages were still cited as a constraint.

- International reserves in Egypt increased to a record high USD 46.125bn in May (Apr: USD 41.057bn). Foreign currencies rose by USD 5.18bn to USD 36.5bn in May.

- Kuwait received an A+ rating from S&P, with a stable outlook: the firm based the outlook on Kuwait’s potential to pass structural and fiscal reforms (given the suspension of parliament and constitutional review) and the large financial assets (estimated at 418% of GDP in 2024).

- Kuwait PMI touched a 4-year high reading of 52.4 (Apr: 51.5), on record-high new orders (highest since reporting began in Sep 2018).

- Lebanon’s PMI however slipped further to a 16-month low of 47.9 in May (from 48.9). Domestic and overseas demand fell on escalating security tensions. Supply issues continue to affect businesses and both output and input prices rose. While tourism is expected to prop up activity come summer, businesses were pessimistic about the 12-month outlook.

- According to IATA, Lebanon is among the biggest debtors to global airlines, though the total dropped to USD 129mn from USD 175mn in 2021. In Q1 2024, visitors were down by 13.5% yoy, and with “no significant traffic” from Western markets.

- Public debt in Oman slipped to OMR 14.5bn (USD 36.6bn) down from OMR 15.3bn at end-2023, after the country paid off OMR 700mn towards maturing international sukuk bonds. Repayment of foreign debts resulted in a decline in the ratio of external debt to 71% currently (from 74% at end-2023).

- Exports from Oman grew by 17% yoy to OMR 6.5bn in Q1 and imports were up by 5.6% to OMF 3.8bn. This resulted in a widening of surplus to OMR 2.6bn (+35% yoy). Major import partners of Oman were the UAE, India and Saudi Arabia.

- Assets of the Oman Investment Authority climbed by 7.4% yoy to OMR 19.24bn in 2023; return on investment for the sovereign wealth fund stood at 9.95% last year.

- Qatar’s PMI ticked up to an 8-month high of 53.6 in May (from 52 in Apr) was above the long-run trend level (of 52.3, since Apr 2017): employment grew for the 15th straight month while financial services’ business activity and new business indexes rose to 12-and eight-month highs of 60.9 and 59.1, respectively.

- Inflation in Qatar inched up to 1.4% yoy in Apr (Mar: 1.1%). Food prices ticked up (3.2% from 2.6%) as did recreation costs (10% from 8.5%) while transport costs rebounded (1.2% From -0.9%). Housing & utilities and restaurants & hotels continued in deflationary territory (at -2.9% and -1.3% respectively).

- Latest monetary statistics data released by the National Planning Council showed a 6.3% increase in commercial bank deposits in Qatar, driven by public sector deposits (+11.7% yoy and 0.9% mom to QAR 372.9bn); private sector deposits edged down slightly in month-on-month terms (but was up 4% yoy). Money supply growth remained healthy: M2 and M3 were up by 5.7% and 7.2% respectively. Credit growth was up by just 4.9% yoy in Apr, with claims to the private and public sectors up by 5.1% (to QAR 867.2bn) and 3.9%(to QAR 389.1bn) respectively.

- Foreign currency reserves and liquidity of the Qatar Central Bank increased by 3.96% yoy to QAR 249.165bn in May. Office reserves grew by QAR 8.833bn to QAR 190.206bn at end-May while gold reserves were up by 7.276bn to QAR 28.327bn.

- Qatar’s sovereign wealth fund QIA agreed to buy a 10% stake in China Asset Management Co (ChinaAMC), reported Reuters. If the deal is approved, the QIA will become the third largest shareholder in ChinaAMC which manages over CNY 1.8trn of assets.

- QatarEnergy inked a long-term agreement to supply Japan’s Idemitsu Kosan Co. Ltd with up to 6 million tons of naphtha over the next 10 years starting in Jul 2024.

- Tourism in Qatar continued to rise: April alone seeing an inflow of 382.5k tourists, taking the total to more than 2mn visitors in Jan-Apr 2024 (Qatar had clocked in a record-high 4mn visitors in full year 2023). While visitors from the GCC account for close to 50% of the total, the upcoming unified GCC visa will support tourism even further.

Saudi Arabia Focus

- Real GDP in Saudi Arabia fell by 1.7% yoy in Q1 (Q4: -3.7%), according to preliminary estimates, dragged down by oil activities (-11.2%) as non-oil sector grew by 3.4% alongside a 2% uptick in government activity.

- Saudi Arabia PMI slipped to 56.4 in May (Apr: 57), the second lowest reading in 22 months. New orders expanded (59.5 from 61 in Apr), supported by domestic activity alongside modest gains in export orders, though its growth pace was the slowest in 2 years. Output was a robust 60.1, though lower than Apr’s 61.9 reading, while firms offered price markdowns in spite of an increase in input prices.

- Saudi Arabia leads global construction activity in Q1 2024, according to JLL, with a pipeline of USD 1.5trn in unawarded projects. The country accounted for 39% of the total construction projects in MENA, valued at USD 3.9trn.

- The Saudi Ministry of Investment report disclosed that 127 firms had moved regional HQs into the country in Q1 2024, a surge of 477%.

- Over half of the Saudi Aramco share sale was placed with foreign investors, reported Reuters – with US, UK, Hong Kong and Japan the origin of multiple orders. Aramco shares were priced at SAR 27.25 (USD 7.27) after the firm set a price range of SAR 26.7- 29.0.

- Sinopec signed a CNY 7.956bn (USD 1.1bn) deal to build natural gas pipelines for Saudi Aramco. Construction is expected to be completed by end-May 2027.

- Saudi Arabia’s energy minister revealed at a conference that the country’s oil production capacity will be increased from 2025 to 2027, before going back to the current level of 12.3mn barrels per day in 2028.

- The size of the corporate Sukuk and debt capital market in Saudi Arabia grew to SAR 125bn by end-2023 from SAR 95bn at end-2019, according to a report from the Capital Market Authority. Value of trades surged to SAR 2.5bn in 2023 (2019: SAR 0.8bn) and the number of executed transactions jumped to 36,961 (2019: 3722).

- Saudi Arabia will become a “full participant” of Project mBridge (a central bank digital currency cross-border trial that includes China, Hong Kong, Thailand and UAE) disclosed the BIS, as a participant in the “minimum viable product” platform. This is the first global multi wholesale-CBDC platform to reach the MVP phase and is important as it provides an alternative to settle transactions without the use of the USD.

- Saudi Arabia has launched the “National Semiconductor Hub” to develop the sector: about 50 semiconductor design companies will be established in Saudi by 2030, with the supported of a deep tech venture capital fund (exceeding SAR 1bn).

- Riyadh Air, in a bid to build its network, announced partnerships with Singapore Airlines and Air China. It had already signed a cooperation agreement with Turkish Airlines last year.

- Saudi Arabia signed a 92-year contract to establish a logistics zone, spanning an area of 120k sqm in the initial phase, in the port of Djibouti.

UAE Focus![]()

- UAE PMI remained steady at an 8-month low of 55.3 in May: output sub-index slowed to 60.8 (Apr: 63.2), the slowest since Jan 2023 and while new orders expanded (to 58.7 from 56), the uptick was at the second-weakest since Aug 2023. Furthermore, UAE demand was recovering post the flood disruptions, though input costs were the highest since Jul 2022 (on higher wages & fuel costs).

- Bilateral non-oil trade between UAE and Malaysia grew to a record-high USD 4.7bn in 2023, as discussions / negotiations towards a CEPA continues between the 2 countries.

- Abu Dhabi launched a “Unified Economic License” allowing for a more streamlined process for setting up and registering businesses across the emirates and its various free zones.

- Dubai ranked first globally out of 115 cities for FDI capital inflows into cultural and creative industries projects last year, disclosed the Chairperson of Dubai Culture. About 898 announced FDI projects were attracted into the specific sector in 2023, almost double that in 2022 (451 projects). Total FDI capital inflow clocked in at AED 11.8bn (+60% yoy) and new job opportunities rose by 74% to 21,563.

- Abu Dhabi’s Alef Education saw a massive demand, resulting in an oversubscription level of almost 39-times to over AED 74bn. Market cap on listing is expected at USD 2.57bn.

- Real estate transactions in Abu Dhabi touched AED 19.4bn in Q1 from 6,070 transactions: the sector attracted record levels of FDI in the quarter, of AED 1.81bn from 487 individual investors, according to the Abu Dhabi Real Estate Centre.

- Dubai property market touched an all-time high in May 2024: transactions were up 53% yoy to 17,713 while value rose 38% to AED 46.5bn, according to real estate portal PropertyFinder.

- Etihad Airways and China Eastern Airlines entered into a joint venture to boost growth: the airlines will manage flight capacity on chosen routes, coordinate schedules and share revenues but without any equity investment or cost-sharing.

Media Review

Scars of Conflict Are Deeper and Longer Lasting in Middle East and Central Asia

https://www.imf.org/en/Blogs/Articles/2024/06/05/scars-of-conflict-are-deeper-and-longer-lasting-in-middle-east-and-central-asia

“The GCC will benefit from a US-China chill”: Dr. Nasser Saidi’s op-ed in Arabian Gulf Business Insight (in English) & Al Arabiya interview (in Arabic)

https://www.agbi.com/opinion/trade/2024/06/the-gcc-will-benefit-from-a-us-china-chill/

https://nassersaidi.com/2024/06/05/the-gcc-will-benefit-from-a-us-china-chill-op-ed-in-arabian-gulf-business-insight-agbi-4-jun-2024/ (longer version)

Al Arabiya interview: https://nassersaidi.com/2024/06/10/interview-with-al-arabiya-arabic-on-gccs-potential-to-become-middle-powers-9-jun-2024/

Saudi Arabia rises 9 places in global AI talent ranking, LinkedIn data reveals

https://www.arabnews.com/node/2524136/business-economy

Is it the Economy, Stupid? Op-ed on India’s election results

https://indianexpress.com/article/opinion/columns/verdict-2024-economy-puzzle-if-growth-has-been-dynamic-why-have-voters-punished-government-9378852/

Political heat gives central bankers pause for thought on interest rate cuts

https://www.ft.com/content/a645ecf3-eeca-4239-aa4c-17e6a9c271f3

The wiggle room around 2% inflation targets

https://www.reuters.com/markets/wiggle-room-around-2-inflation-targets-mike-dolan-2024-06-07/

Powered by: